Market Overview - Page 391

March 30, 2020

The top cryptocurrency by market value picked up bids near $5,850 during the Asian trading hours and rose around $500 to $6,344 at 07:14 UTC. At press time, the global average price, as calculated by CoinDesk’s Bitcoin Price Index, was.

March 30, 2020

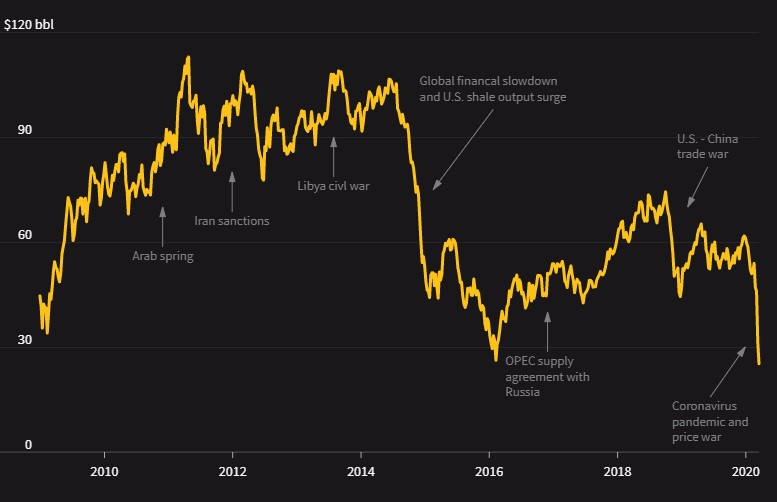

Oil prices fell sharply on Monday, with U.S. crude briefly dropping below $20 and Brent hitting its lowest level in 18 years, on heightened fears that the global coronavirus shutdown could last months and demand for fuel could decline further..

March 30, 2020

The Federal Reserve has offered more than $3 trillion in loans and asset purchases in recent weeks to stop the U.S. financial system from seizing up, but it has not yet directly helped large swaths of the real economy: companies,.

March 30, 2020

The U.S. is all but guaranteed to lose its hard-earned spot as the world’s number one oil producer this year amid the recent price crash, vanishing demand and a plunge in capital investment, energy experts say. That could mean potentially.

March 30, 2020

While the rest of Europe imposes severe restrictions on public life and closes borders and businesses, Sweden is taking a more relaxed approach to the coronavirus outbreak. Unlike its immediate neighbors Denmark, Finland and Norway Sweden has not closed its.

March 30, 2020

World central banks continue to pump liquidity in the financial system to lessen the negative impact on business from strict isolation measures across the globe. The latest example was the People’s Bank of China, which on Monday announced a 20.

March 28, 2020

After trading in the $6,450 to $6,850 range for the past eight days, Bitcoin (BTC) price finally made a larger move, this time to the downside, as the digital asset dropped 8.72% to a daily low at $6,068. The move.

March 28, 2020

President Donald Trump signed a $2 trillion coronavirus relief bill on Friday, as Washington tries to blunt economic destruction from the pandemic ripping through the United States. The House earlier passed the stimulus package, believed to be the largest in.

March 27, 2020

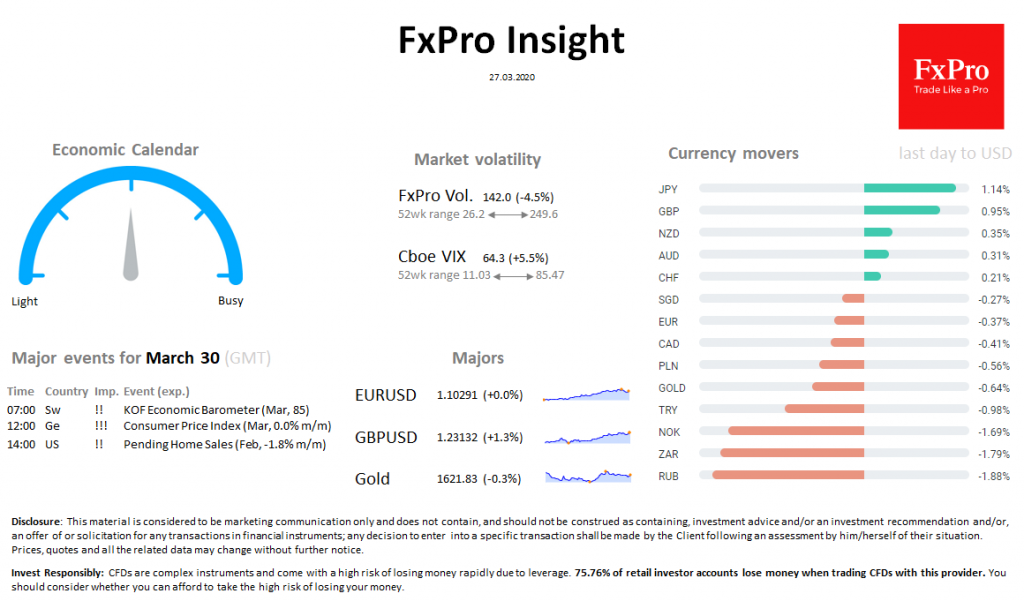

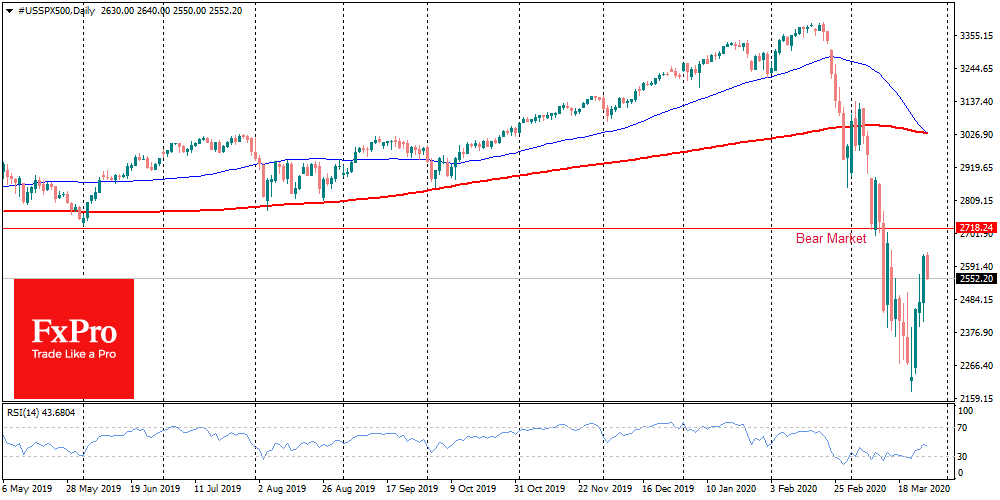

Market overview US indices are losing 3.5% on Friday after 6.4% growth a day earlier. The market rebound due to injections of liquidity from the Central Bank and massive incentives stalls amid signals of a weakening economy. DXY loses the.

March 27, 2020

American indices rose by more than 6% at the end of trading on Thursday. On Friday, Asian indices supported the growth after some fluctuations. Expectations of government stimulus intensified investors’ purchases. $2.2 trillion from the U.S. government was complemented by.

March 27, 2020

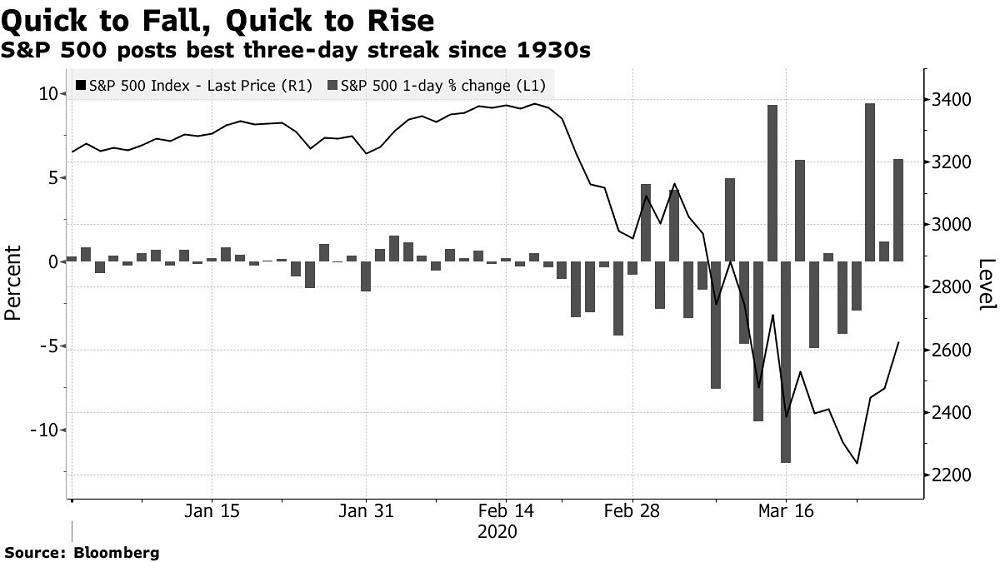

In the stock market lately, only one thing is constant: speed. After falling into a bear market at the fastest rate ever, the S&P 500 just recorded its quickest three-day advance in nine decades. As absurd as it may seem,.