Market Overview - Page 354

June 1, 2020

Goldman Sachs has begun to establish short positions on the dollar as the reopening of economies is expected to lure investors out of the traditional safe-haven currency. In a note over the weekend, Goldman strategists said that while they had.

June 1, 2020

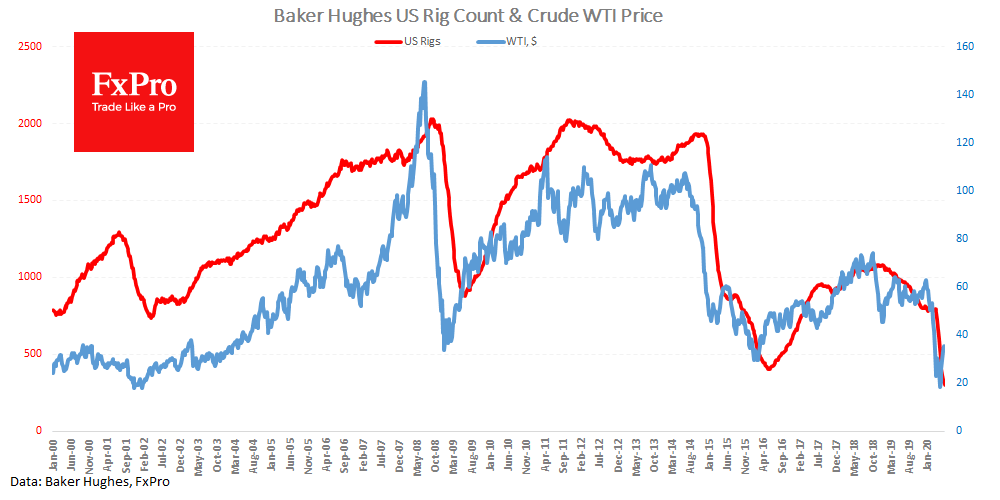

This week, oil may return to investors’ focus, on par with the U.S. labour market. This data promises to shed light on how active the real recovery in consumer demand is in the United States and across the world. The.

May 29, 2020

The dollar extended its slide against a surging euro on Friday, hurt by month-end flows and as the common currency continued to enjoy a boost from the European Union’s recently announced plan to prop up the bloc’s coronavirus-hit economies with.

May 29, 2020

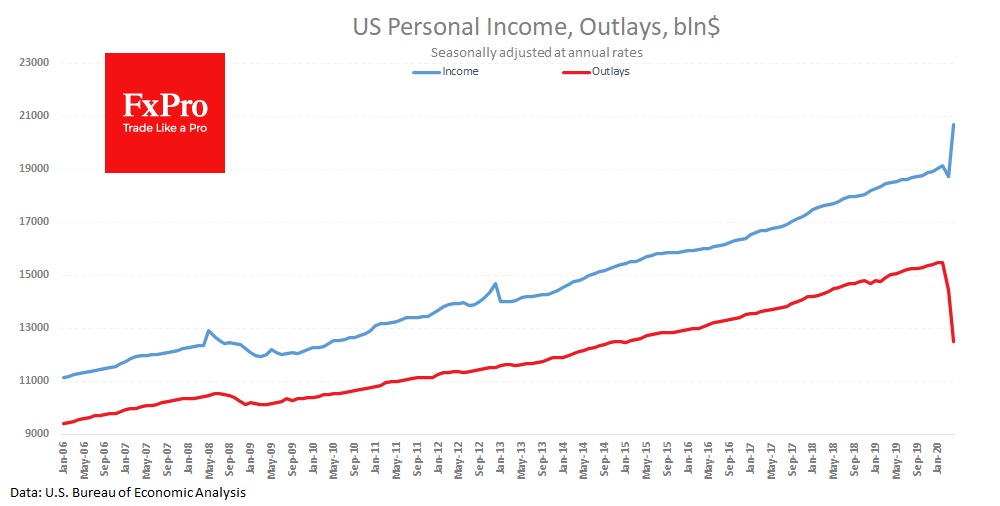

U.S. consumer spending plunged in April by the most on record as widespread government lockdowns largely prevented Americans from spending federal stimulus payments in the month. Household outlays fell 13.6% from the prior month, the sharpest drop in more than.

May 29, 2020

April data on personal spending and income in the United States showed a very wary mood of the Americans. A recent publication notes revenue growth of 10.5% in April (vs -7% expected) after a decrease of 2.2% in March. But.

May 29, 2020

Biden losing economic argument to Trump as U.S. begins to re-open U.S. President Donald Trump is trusted more than Democratic nominee Joe Biden to handle the economy, polls show, even with more than 40 million Americans filing jobless claims and.

May 29, 2020

The Swedish economy expanded at a far superior rate than many of its European counterparts over the first three months of the year, data published Friday showed, following the government’s decision not to impose a full lockdown to contain the.

May 29, 2020

As the world turns more digital, crypto’s pioneer asset Bitcoin (BTC) could take on gold’s store of value role, according to the CEO and co-founder of Digital Assets Data, an analytics firm. “I see Bitcoin replacing gold as the hardest.

May 29, 2020

Stocks slipped and U.S. futures edged lower on Friday as President Donald Trump’s planned press conference on China threatened to further stoke tensions between the world’s two largest economies. Treasuries gained along with most European bonds. The Stoxx 600 Index.

May 29, 2020

Key economic indicators may be skewed, and perhaps less accurate, as a result of the coronavirus pandemic, according to the International Monetary Fund. “Accurate and timely economic data are crucial for informing policy decisions, especially during a crisis. But the.

May 29, 2020

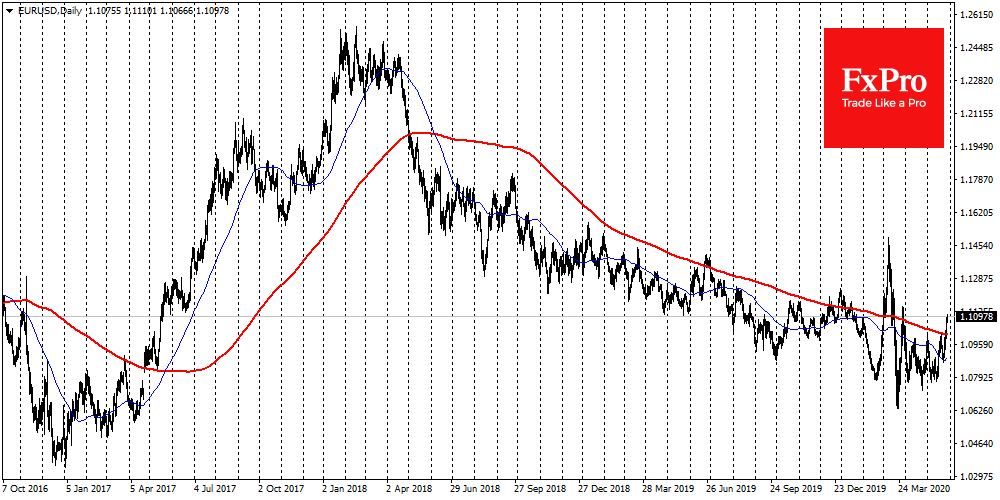

The dollar is going down, and it is bullish for the markets. The two most closely monitored instruments of the world markets, EURUSD and S&P500, signal a breakthrough of their downtrends. The dollar not only declines against the euro but.