Market Overview - Page 35

November 13, 2024

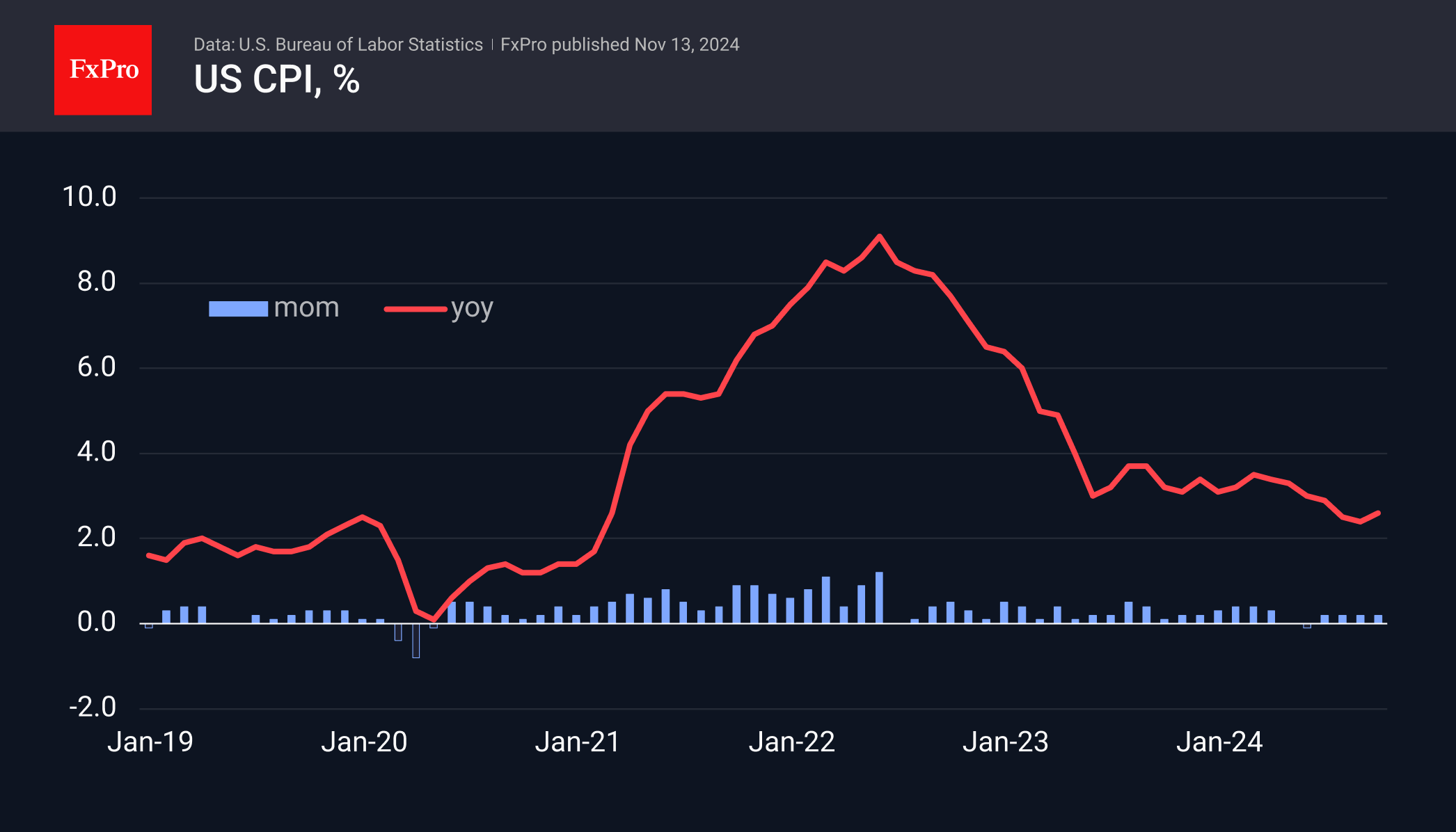

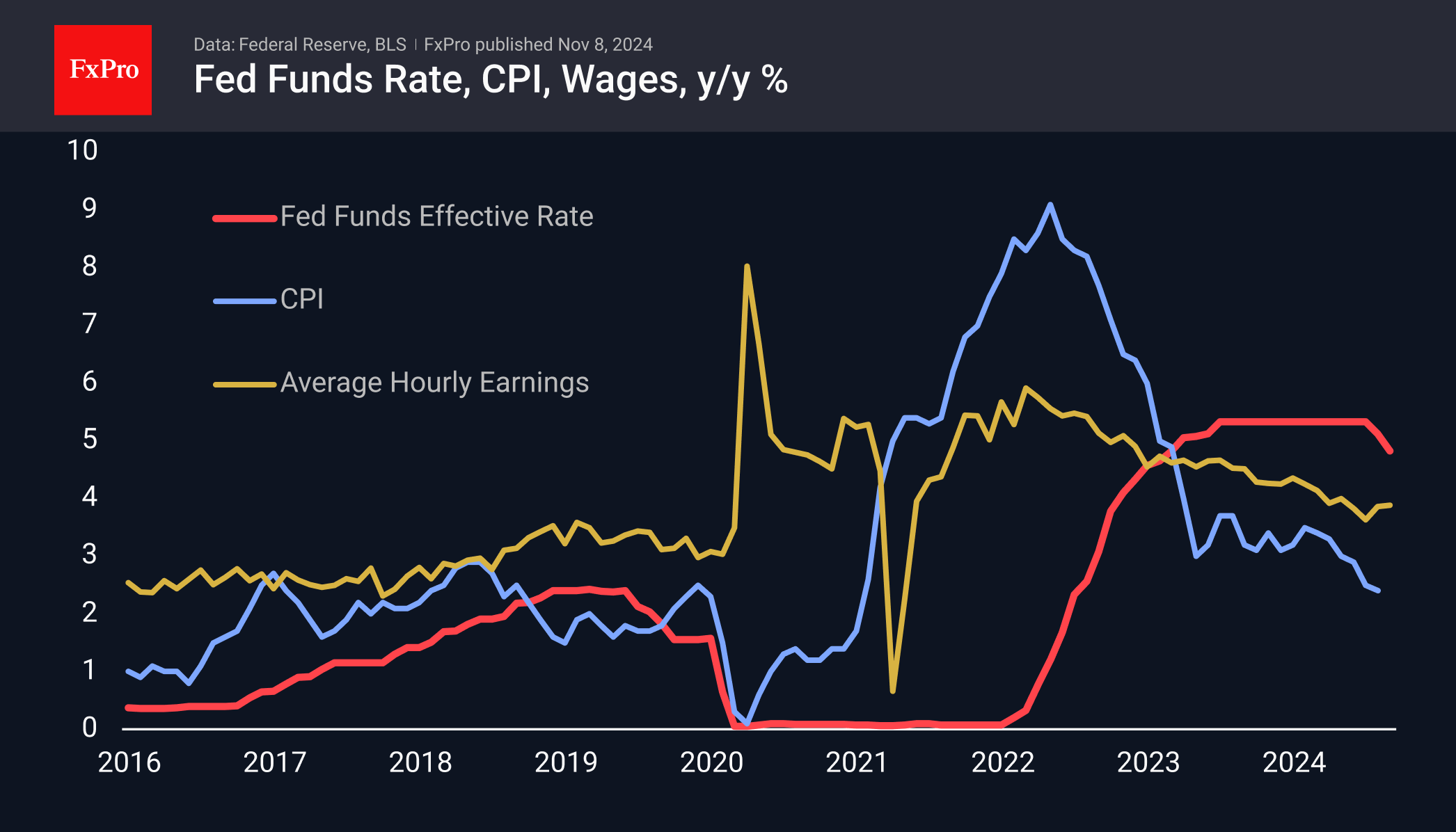

US CPI went in line with expectations, but this hasn't changed the outlook for the Federal Reserve to cut rates in December and possibly further, despite inflation being above the target.

November 12, 2024

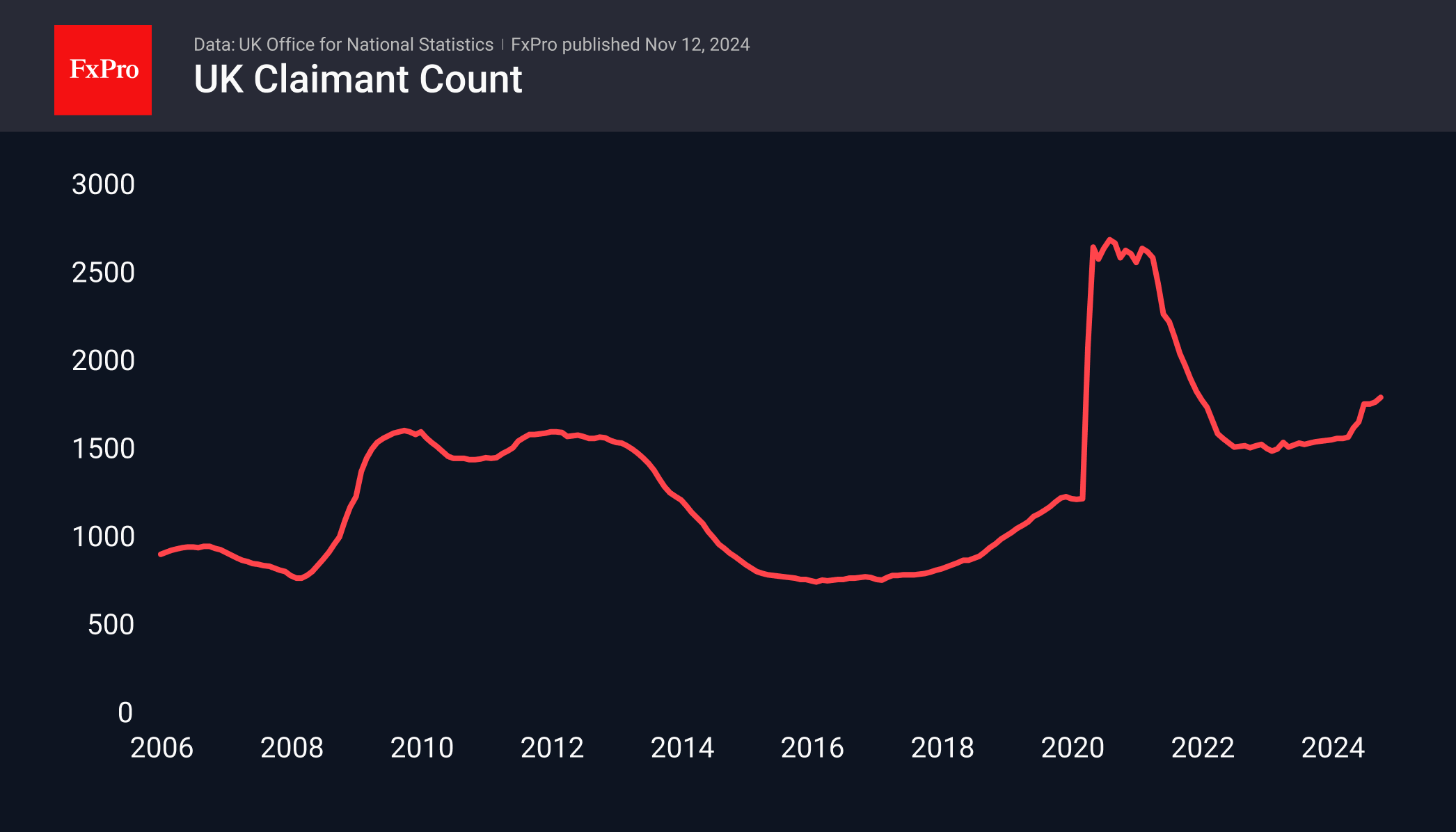

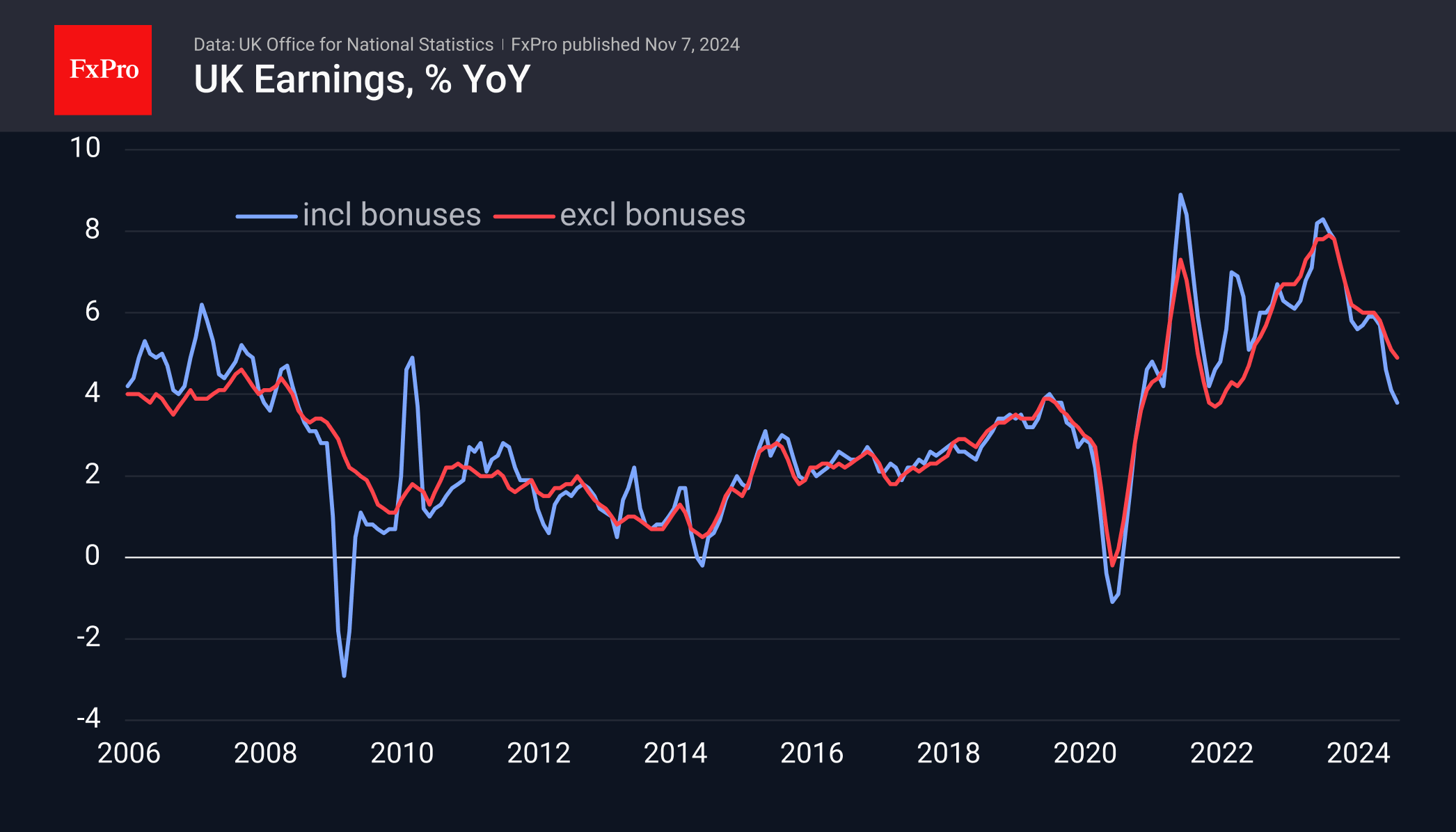

The British pound has been losing ground against the dollar due to weak macroeconomic data, including a rise in unemployment and a slowdown in wage growth. There is potential for further decline, possibly below 1.2000.

November 12, 2024

📈 Since the election, markets are buzzing with movement, bringing exciting trading opportunities! Here’s a quick look at the latest highlights: 🚀 Crypto Surge: Bitcoin is up +30% this week, Ethereum +40%, and Dogecoin is leading with an incredible +154%! 🥇.

November 11, 2024

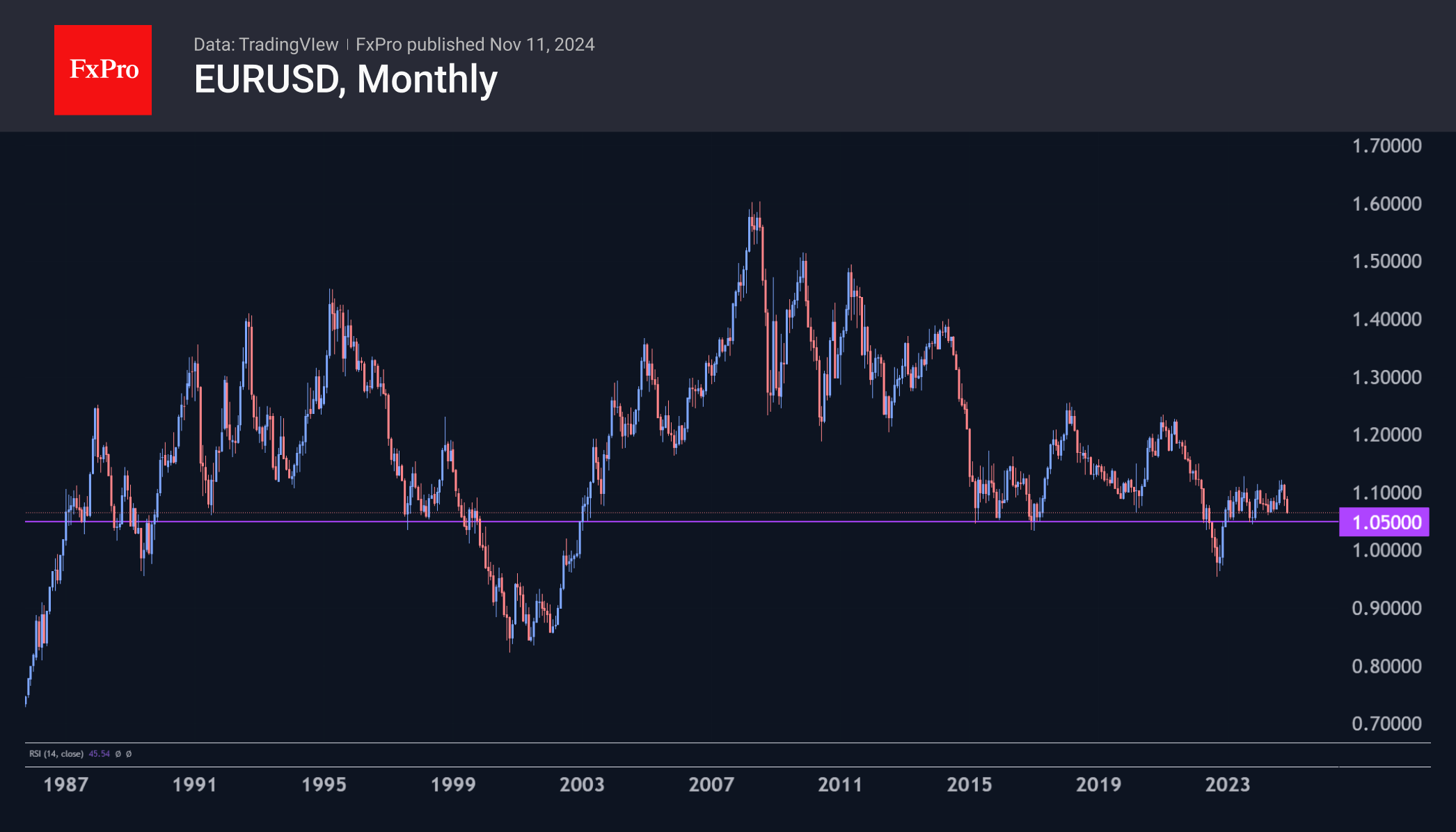

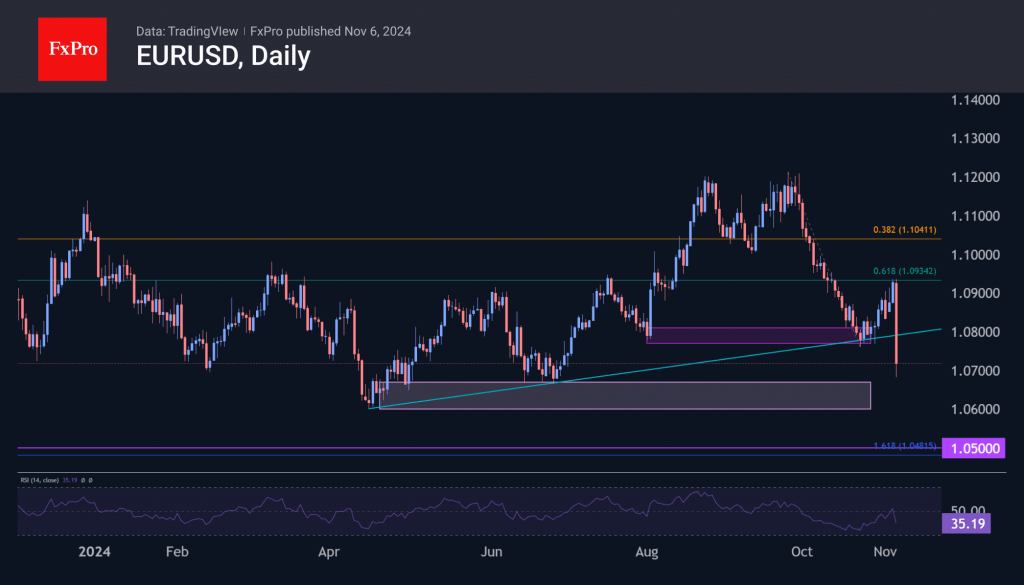

The US dollar continues to strengthen, reaching its highest level in months, fueled by policy changes and concerns over protectionist measures. The euro and Japanese yen have weakened, and further declines are expected if support levels are broken.

November 11, 2024

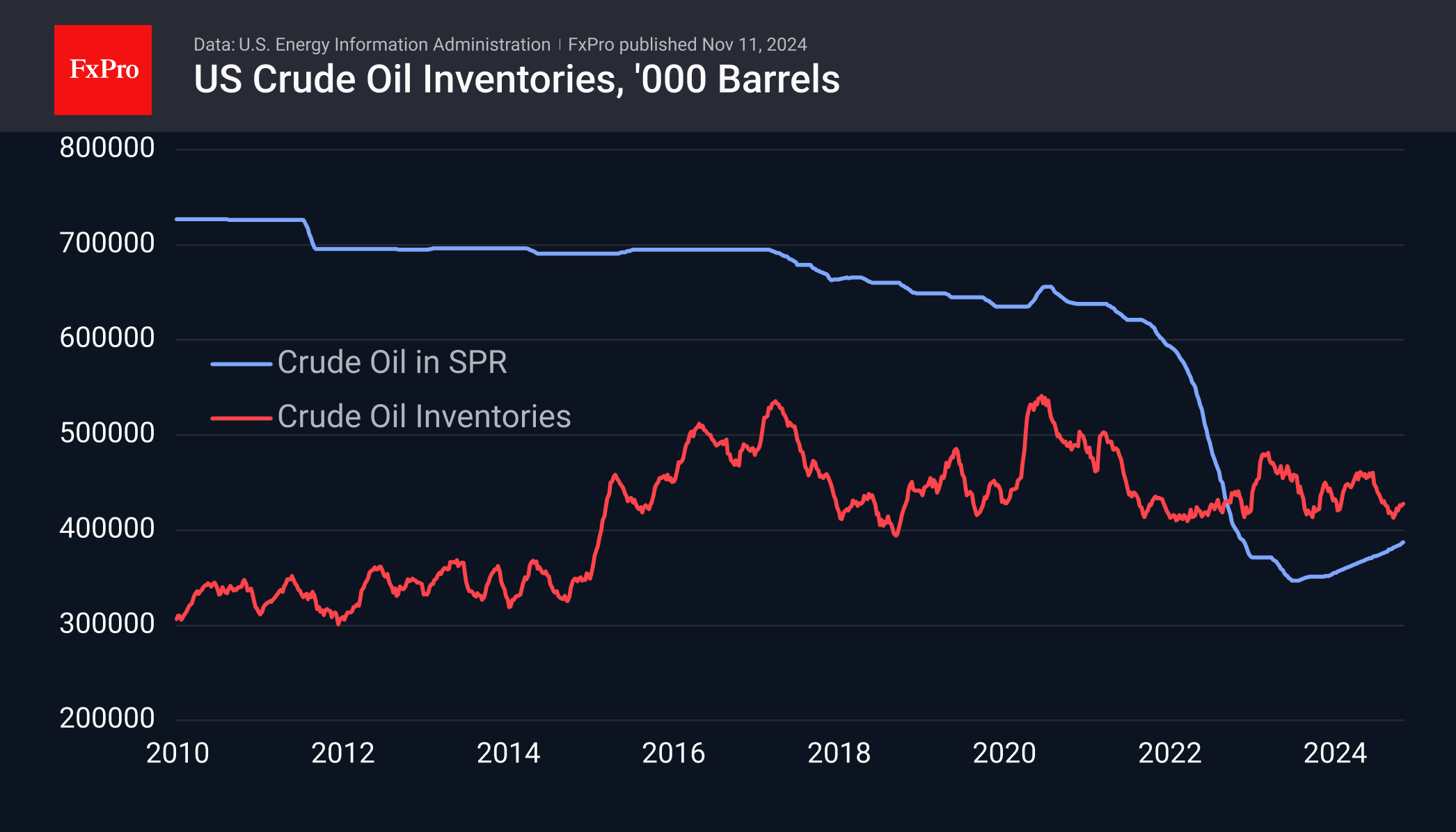

The oil market has a bearish outlook due to factors such as reduced supply risks and disappointing demand. Oil inventories in the US are increasing. Natural gas prices have increased due to a temporary shutdown in production, but high inventories suggest a likely downward momentum.

November 8, 2024

Political developments will impact financial markets, with the focus on policies from Trump's administration and influential Republicans. Key events include UK employment data, US consumer inflation, and China's October statistics. US retail sales and industrial production will also be monitored.

November 8, 2024

The Federal Reserve cut the key rate, causing minimal market reaction. The market predicts a decline in rates next year, making the dollar more attractive. Inflation and retail sales reports will provide further insight.

November 8, 2024

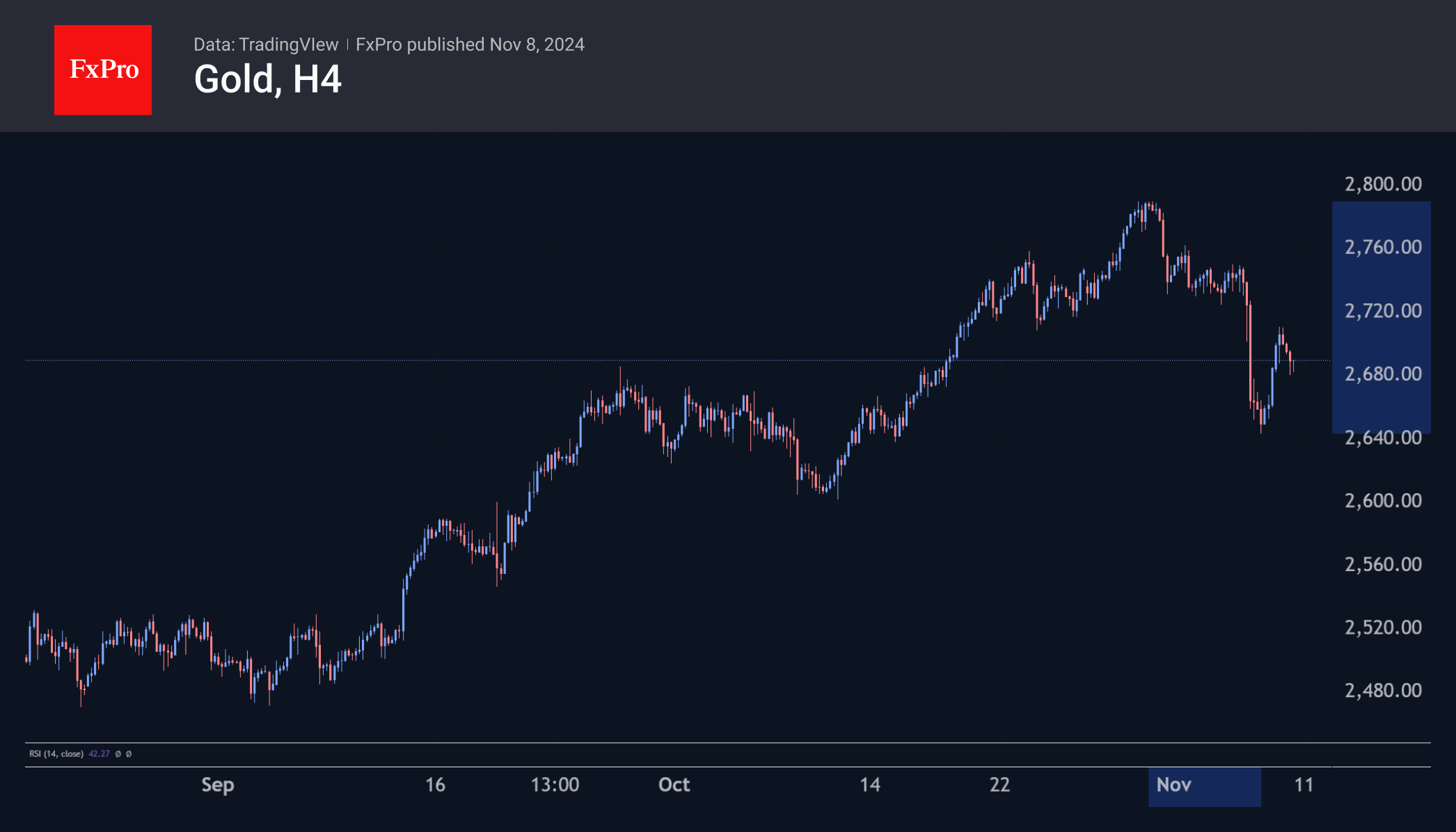

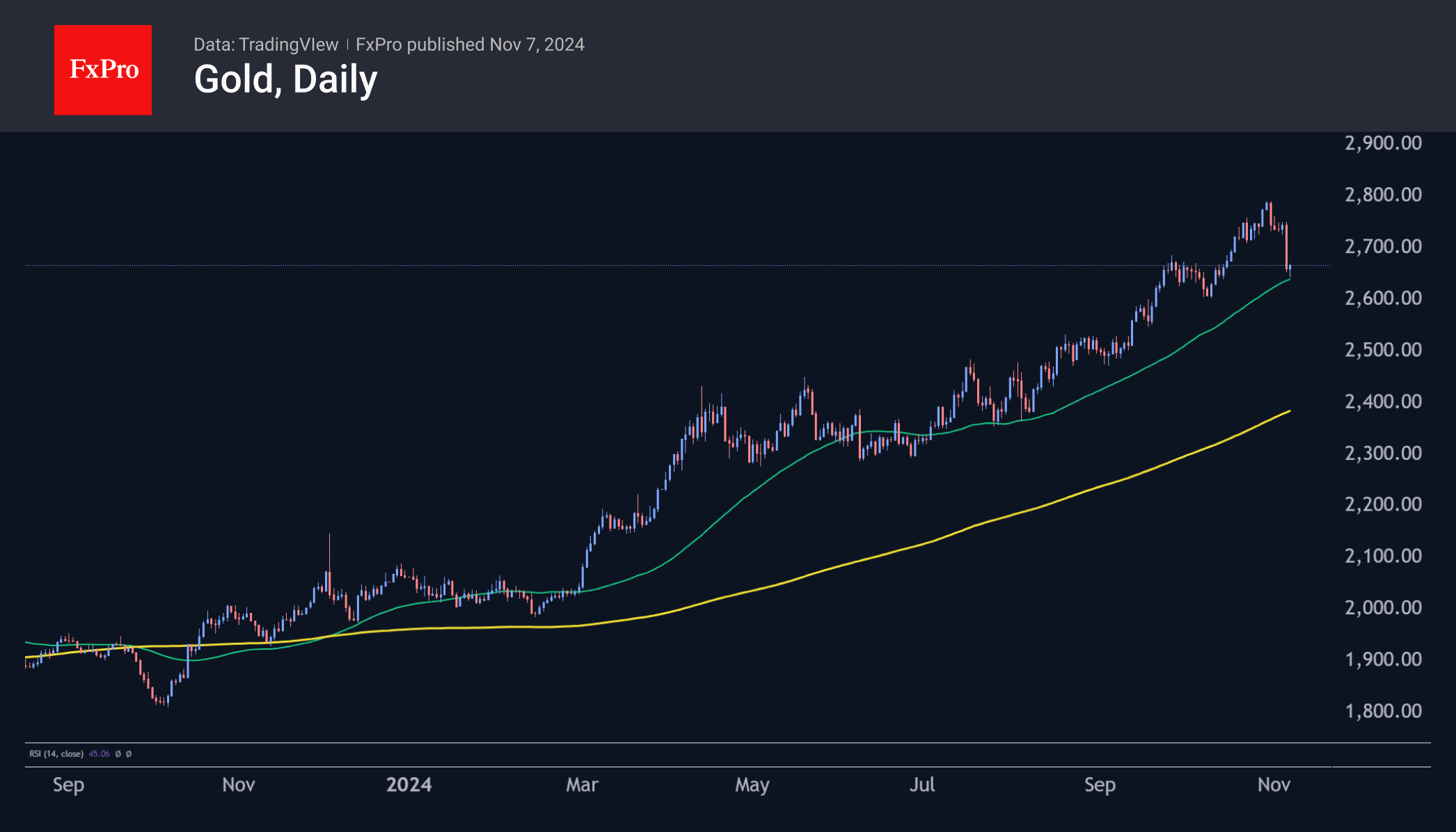

Gold has experienced a correction, losing over 5% since late October. Further declines are expected, with potential support at $2400 and a possibility of a pullback to $2000.

November 7, 2024

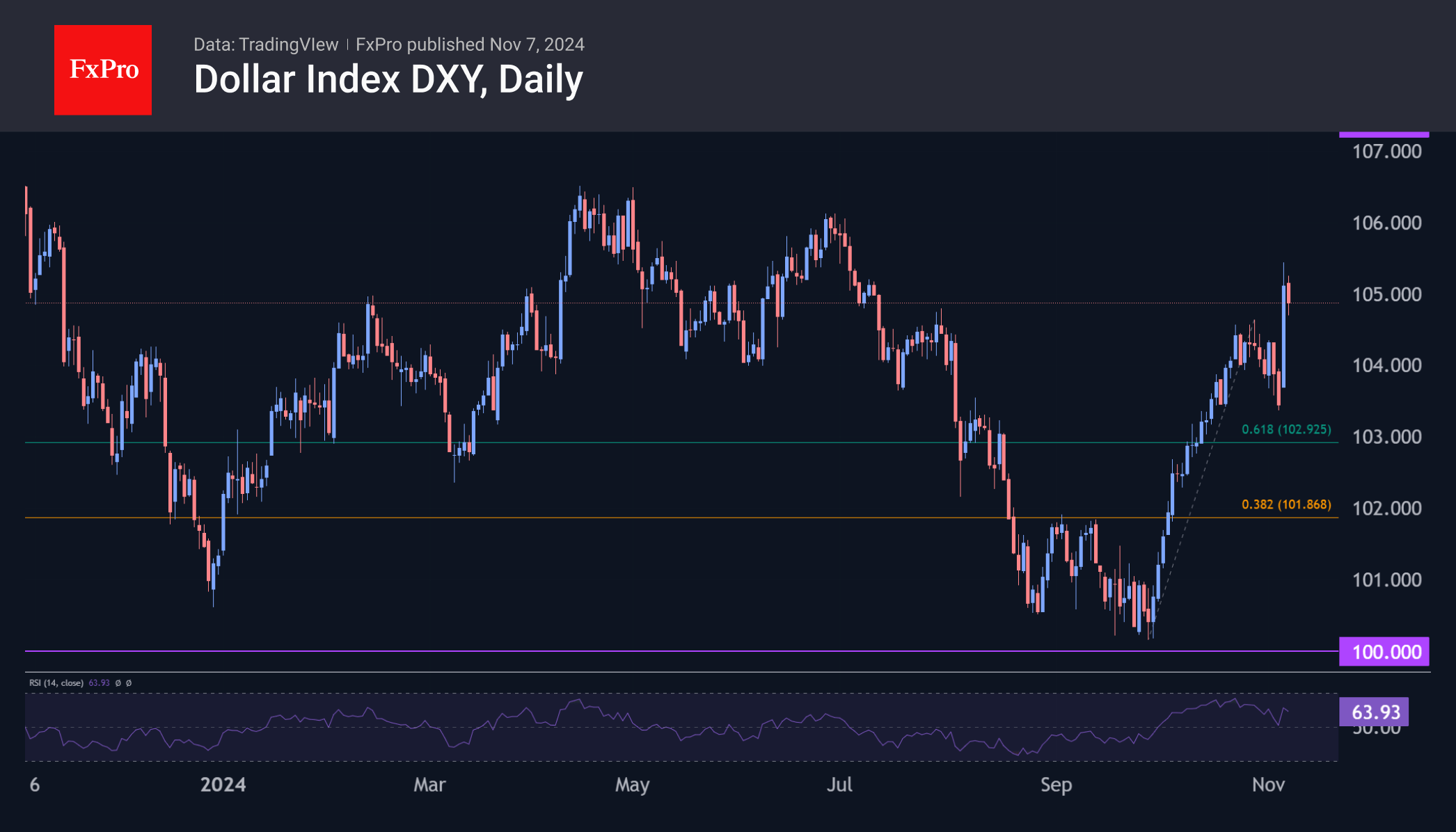

The dollar index rallied on the US presidential election results, picking its way up after consolidation and correction in recent weeks

November 7, 2024

Gold lost over 3% on Wednesday and now evaluating an important support line at the 50-day moving average of $2,640.

November 7, 2024

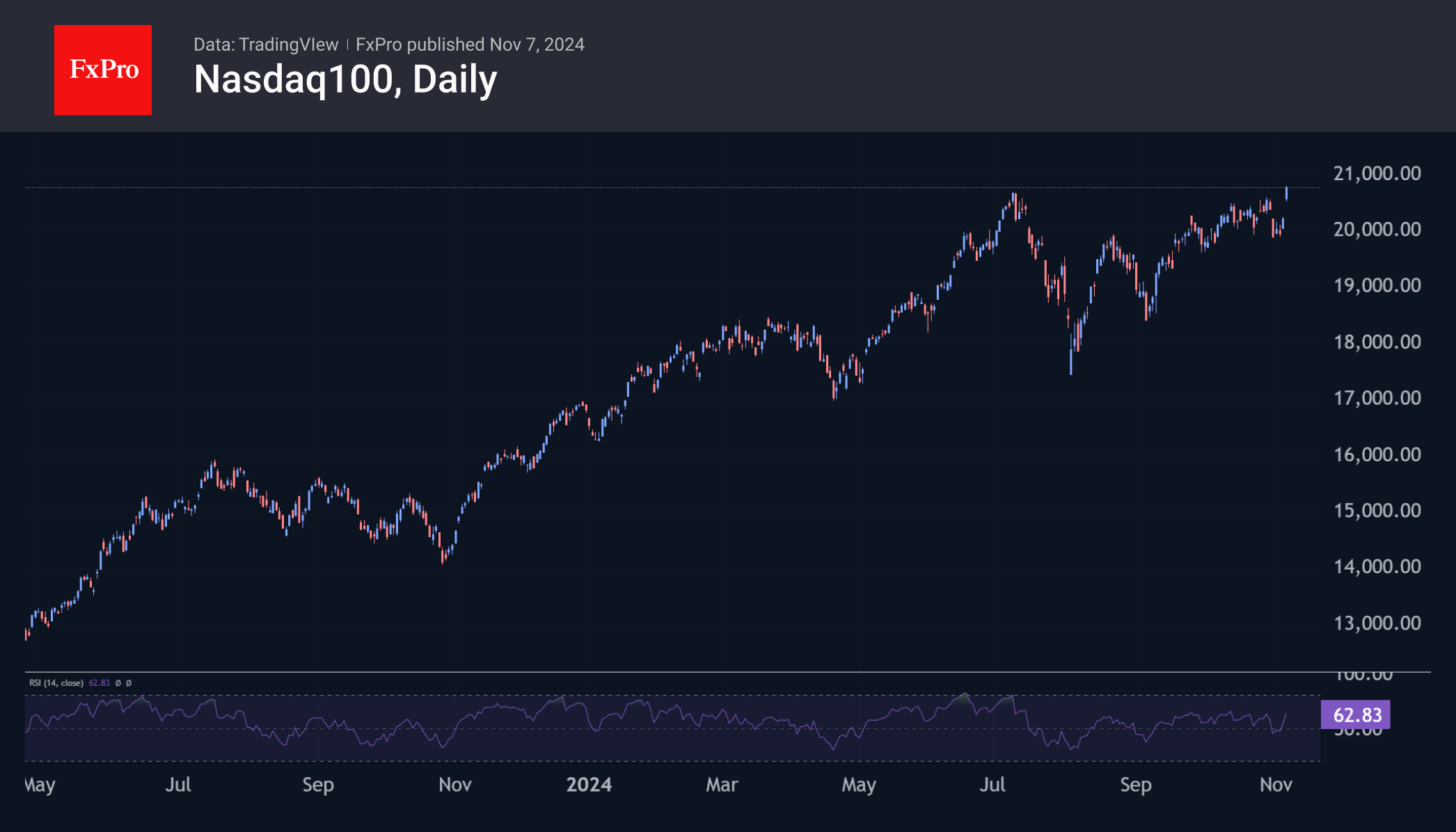

The US stock market experienced a rally after the presidential election results, with several key indices reaching all-time highs. Investors are paying attention to Tesla and Amazon. The oil industry, associated with the Republican Party, has seen increased stock prices.