Market Overview - Page 349

June 9, 2020

Deflation is back on the minds of European Central Bank officials, presaging battles for President Christine Lagarde over whether the euro zone needs yet more monetary stimulus. In sparking the biggest peacetime recession in Europe since the 1930s, the coronavirus.

June 9, 2020

When the U.S. stock market started to rebound after hitting bottom on March 23, many analysts warned of another crash. On May 8, Goldman Sachs said that the S&P 500 would plunge by 18% over the next three months. But.

June 9, 2020

In the past few days, ripple followed a bearish path below the $0.2100 pivot level. XRP price broke the $0.2020 support zone, but it remained well bid above the $0.2000 support level. The price is currently consolidating above the $0.2000.

June 9, 2020

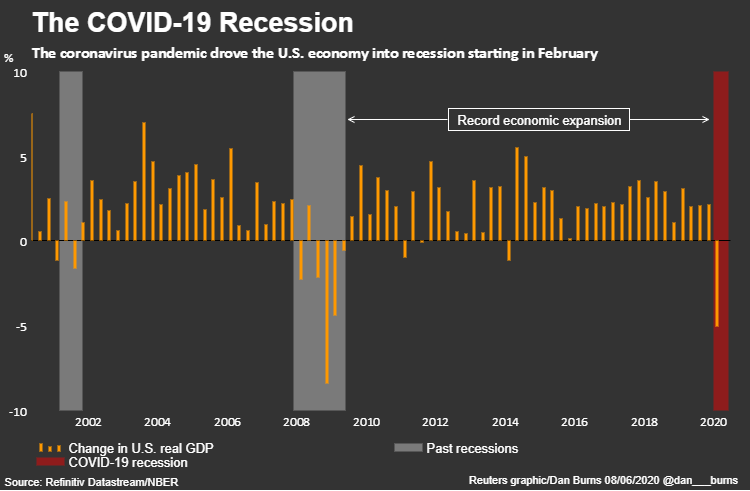

The U.S. economy ended its longest expansion in history in February and entered recession as a result of the coronavirus pandemic, the private economics research group that acts as the arbiter for determining U.S. business cycles said on Monday. The.

June 9, 2020

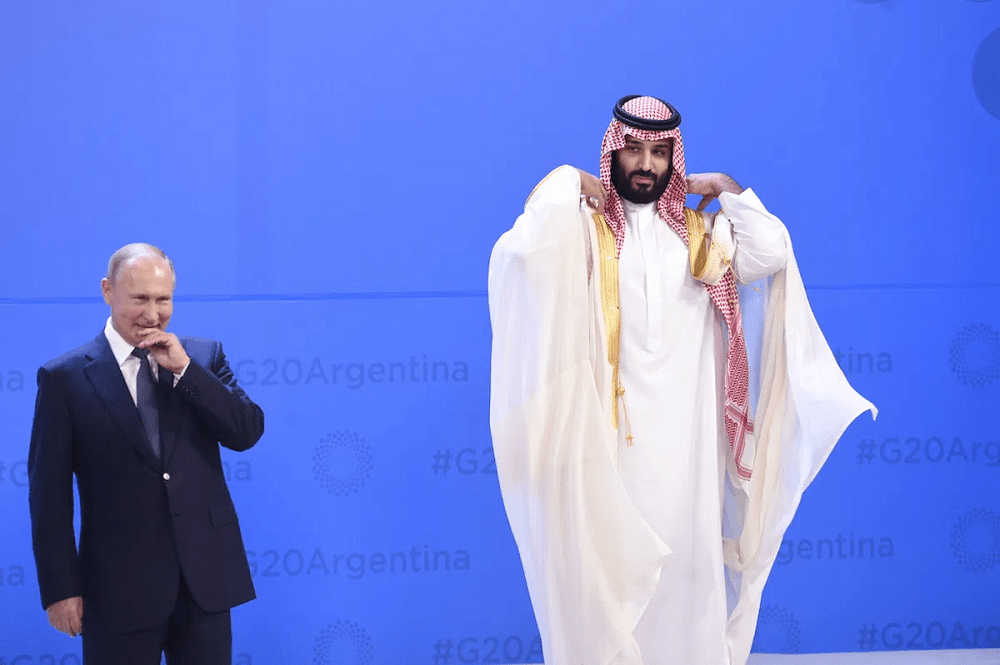

Qatar’s Minister of State for Energy Affairs shared his thoughts on some of the major oil producers’ market moves in recent months, shedding disapproval on the March decision by Saudi Arabia and Russia to launch into a price war, which.

June 9, 2020

From a trade fight to a war of words over the origin of the coronavirus, to greater scrutiny of Chinese firms on Wall Street — relations between the U.S. and China havenosedived in recent years. A new “cold war” is.

June 8, 2020

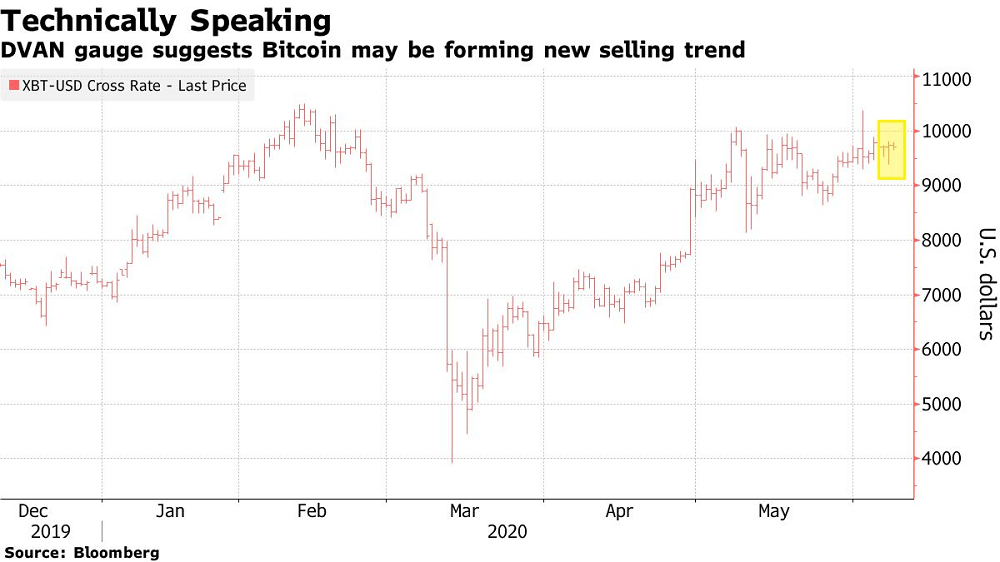

Bitcoin fans have been heartened by its recent rally, but a technical indicator points to a potential slump ahead. Based on the DVAN Buying and Selling Pressure Indicator, which depicts bull/bear trends, Bitcoin fell below the trend line for the.

June 8, 2020

The stock market’s rapid fall and subsequent rise in the wake of the pandemic were enough to give investors whiplash. Now traders are facing a dilemma. They can jump into an increasingly frothy market or stand by and miss out.

June 8, 2020

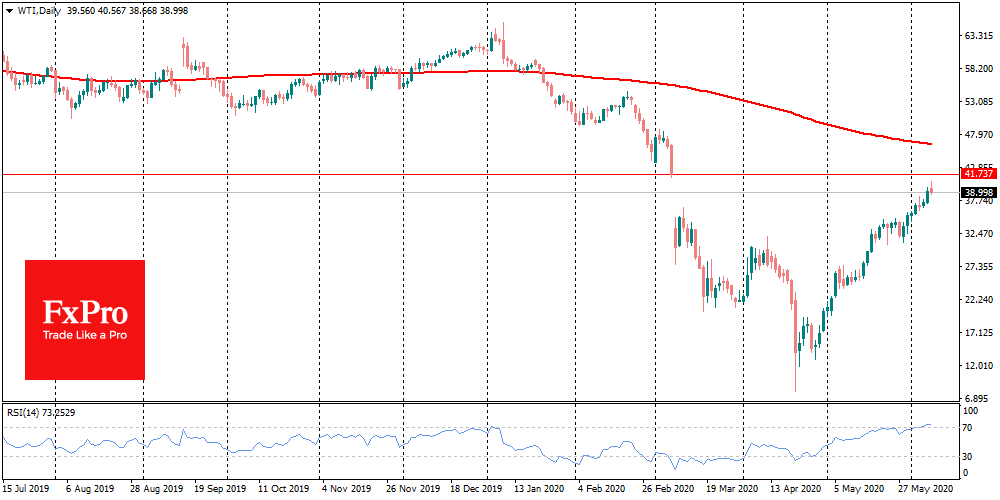

OPEC + over the weekend agreed to extend the period of the lowest quotas for another month. This news pushed Oil price by 3.5% on Monday to $43.30 for Brent, and above $40 for WTI, the highest since March 6..

June 8, 2020

U.S. stocks are set to move higher still on Monday, after rallying sharply at the end of last week in the wake of a surprising jobs boost. The U.S. economy added 2.5 million jobs in May and the unemployment rate.

June 8, 2020

Fierce Competition Is ComingImproving passenger traffic may signal hope for carriers, but it isn’t yet time to pop the champagne yet. Numbers are unlikely to return to pre-pandemic levels anytime soon. To compete for the reduced number of flyers amid.