Market Overview - Page 346

June 15, 2020

Fears that a second wave of COVID-19 infections is under way sent jitters across global markets on Monday with stocks and oil under pressure while investors bought into safe havens such as German government debt. Beijing reported its second consecutive.

June 15, 2020

A second wave of coronavirus has started in the U.S. — and people need to remain careful or risk stressing out the health-care system again, said William Schaffner, a professor at the Vanderbilt University School of Medicine. “The second wave.

June 15, 2020

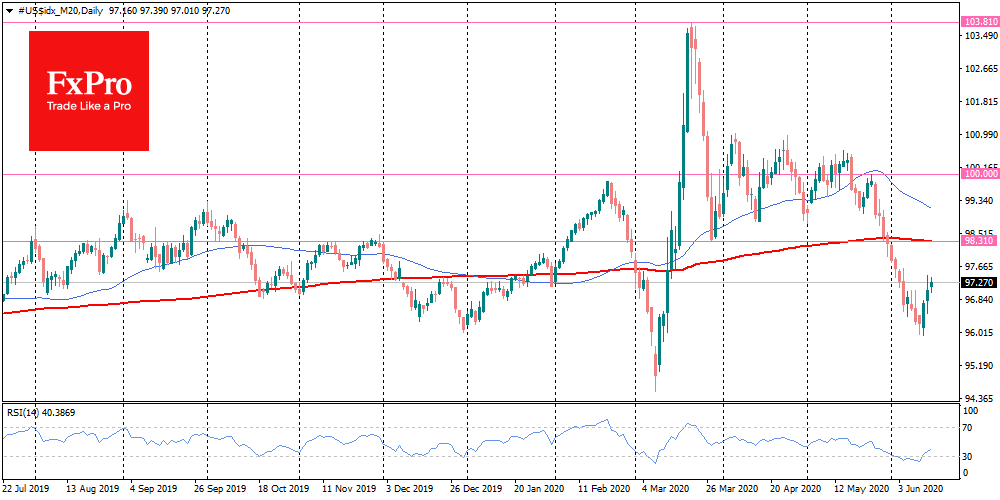

As the dollar was declining in previous weeks, there were more and more apocalyptic forecasts about its prospects. For the most part, such forecasts are based on the mention of huge government debt, as well as high budget and payment.

June 15, 2020

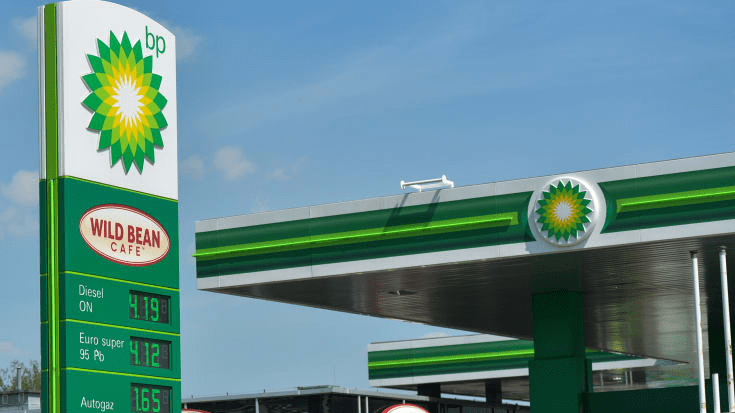

Energy giant BP announced Monday it had lowered its oil price expectations through to 2050, saying the aftermath of the coronavirus pandemic was likely to accelerate the transition to a lower carbon economy and energy system. The U.K.-headquartered oil and.

June 12, 2020

Here’s why the U.S. stock market plunged on Thursday: Too many bulls. You’ll hear other explanations, such as the risk of a second wave of COVID-19 infections and the Fed’s grim outlook for the U.S. economy. But such factors can’t.

June 12, 2020

A new study has suggested that the compulsory use of face masks can slow the spread of Covid-19 cases by as much as 40%. The German report, published as a discussion paper for the Institute of Labour Economics, determined that.

June 12, 2020

Oil prices edged higher on Friday but were on track for their first weekly fall in seven as new U.S. coronavirus cases spiked, raising the prospect of a second wave hitting demand. Brent was up 27 cents, or 0.7%, at.

June 12, 2020

The price of Bitcoin (BTC) is still struggling to break out above $10,000 following three failed attempts over a 36-day period. Traders remain mixed on the short-term price trend of BTC as macro indicators suggest varying trends. Many traders believe.

June 12, 2020

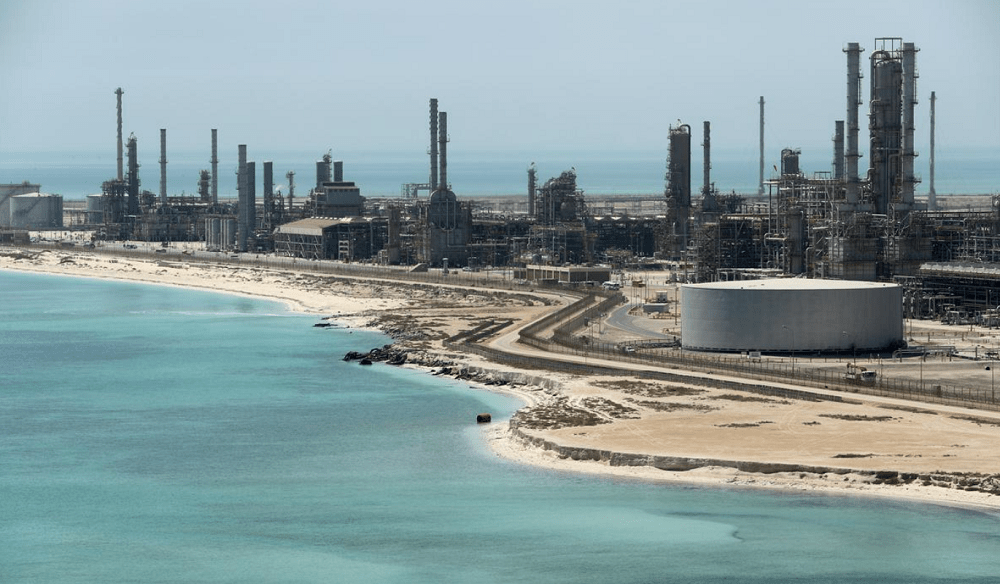

Saudi Arabia’s share of the oil market is set to rise this decade to its highest since the 1980s as investment in production elsewhere dries up in the wake of the coronavirus crisis, J.P. Morgan said in a report. Oil.

June 12, 2020

Tesla hit a milestone Wednesday by surpassing Toyota’s market share to become the world’s most valuable company. The company’s market cap swelled to $190 billion after its stock price soared above the $1,000 mark. Although Toyota’s market cap is around.

June 12, 2020

U.S. stock futures rebounded Friday morning after a resurgence in coronavirus cases in many states sent equity prices plunging a day earlier. Dow Jones Industrial Average futures implied an opening gain of about 600 points. S&P 500 and Nasdaq-100 futures.