Market Overview - Page 34

November 22, 2024

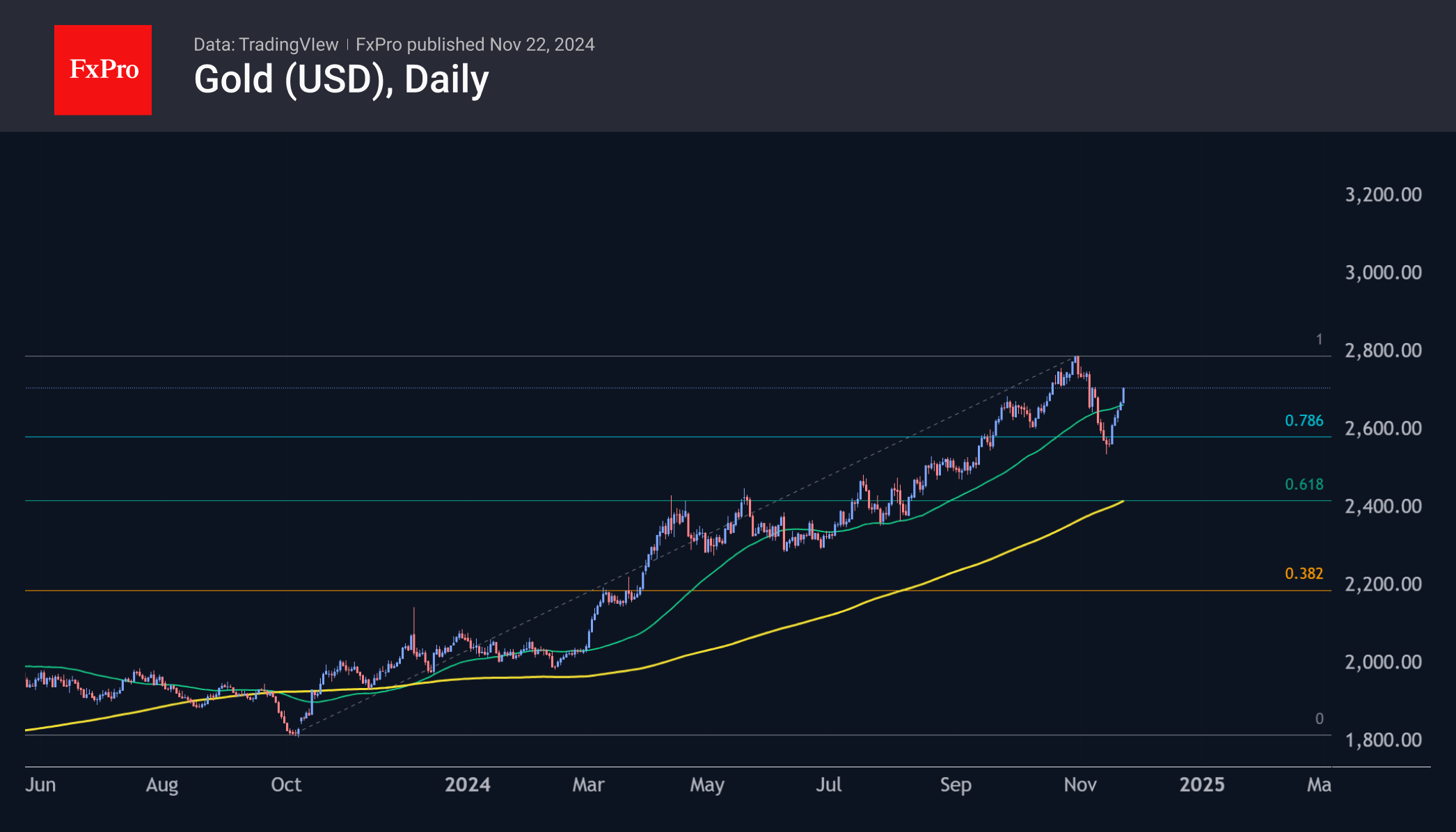

Gold has reached record high in euro above 2600, and growing fast in dollar terms also, possibly reaching $3400.

November 20, 2024

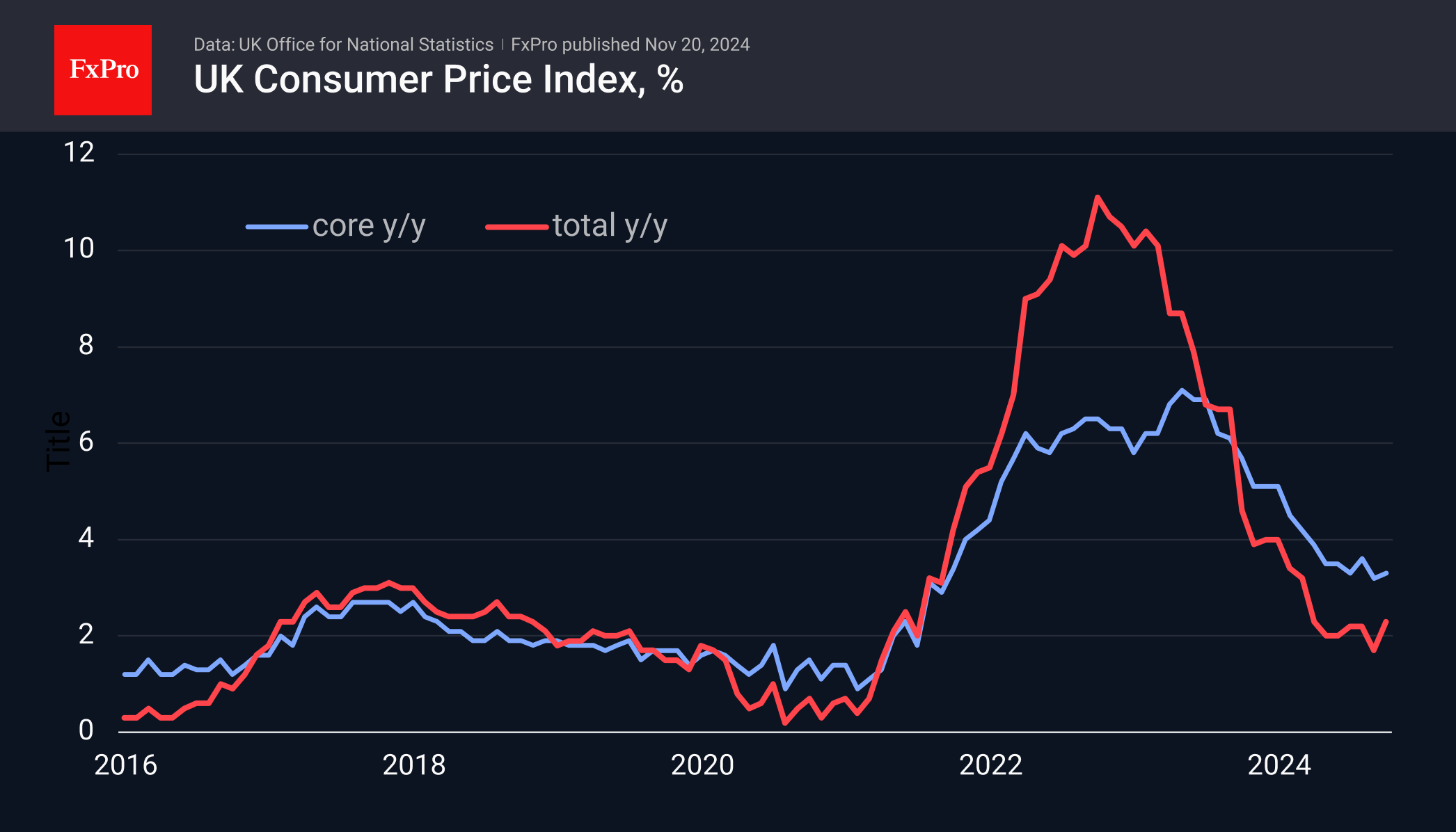

UK inflation accelerated to 2.3%, its highest level since March, but this did not boost the Pound significantly. Producer prices also exceeded expectations, but remain disinflationary. The Pound's failure to hold above 1.2700 suggests a bearish outlook with a potential target near 1.23.

November 19, 2024

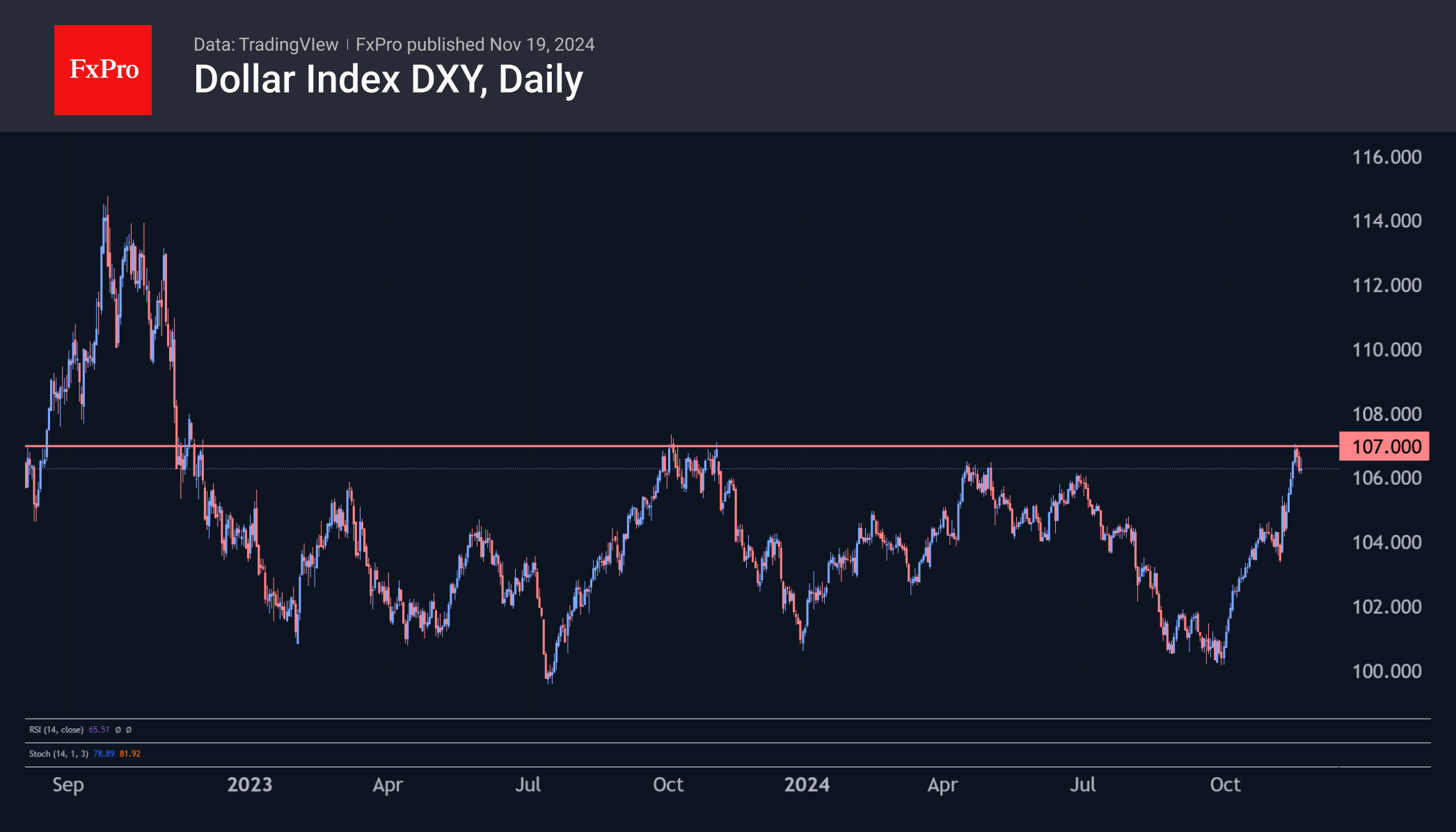

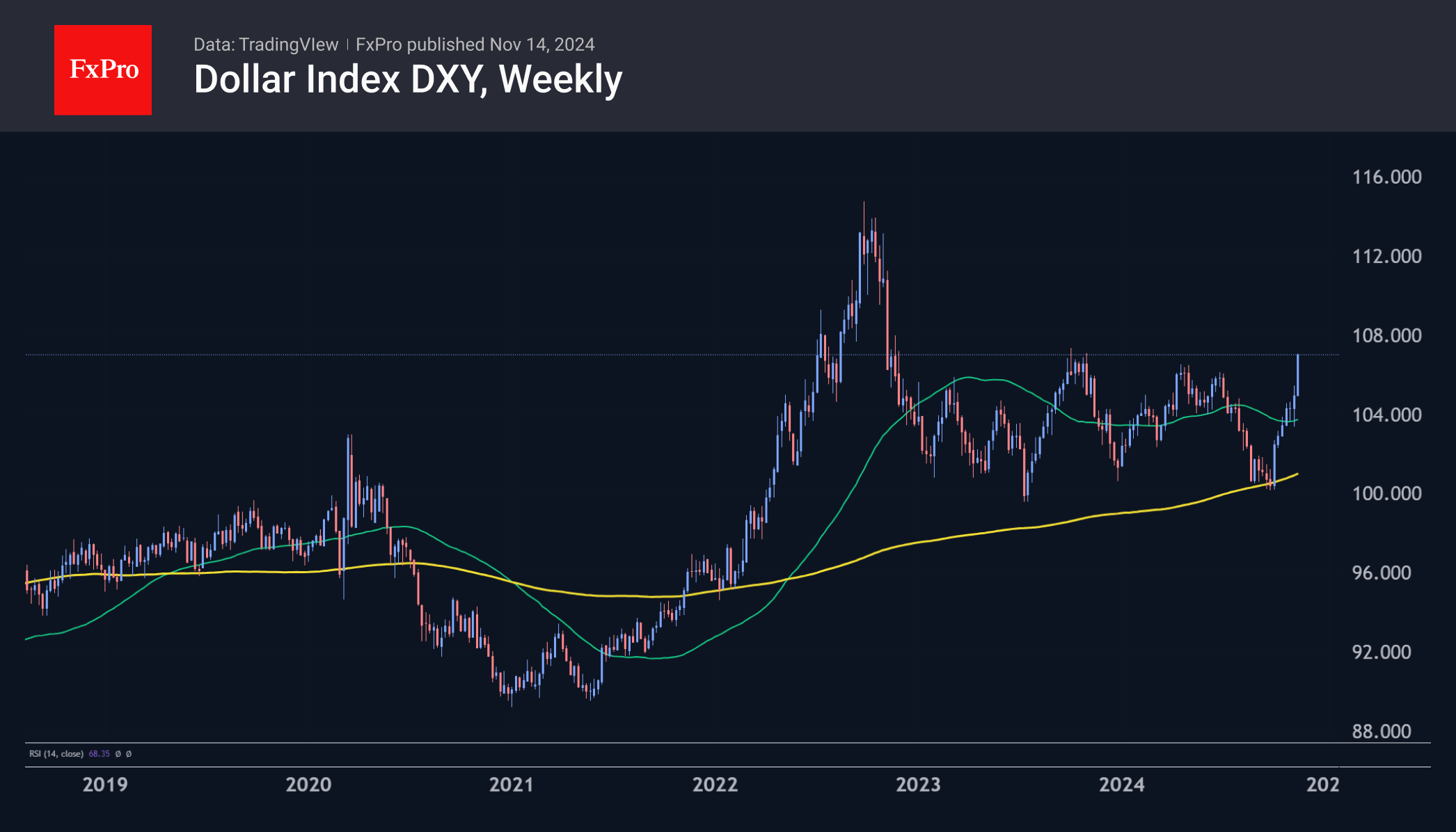

The dollar index is pulling back, potentially indicating the end of its range or a shakeout after a prolonged rally. The battle between bulls and bears may determine the trend in the coming weeks.

November 18, 2024

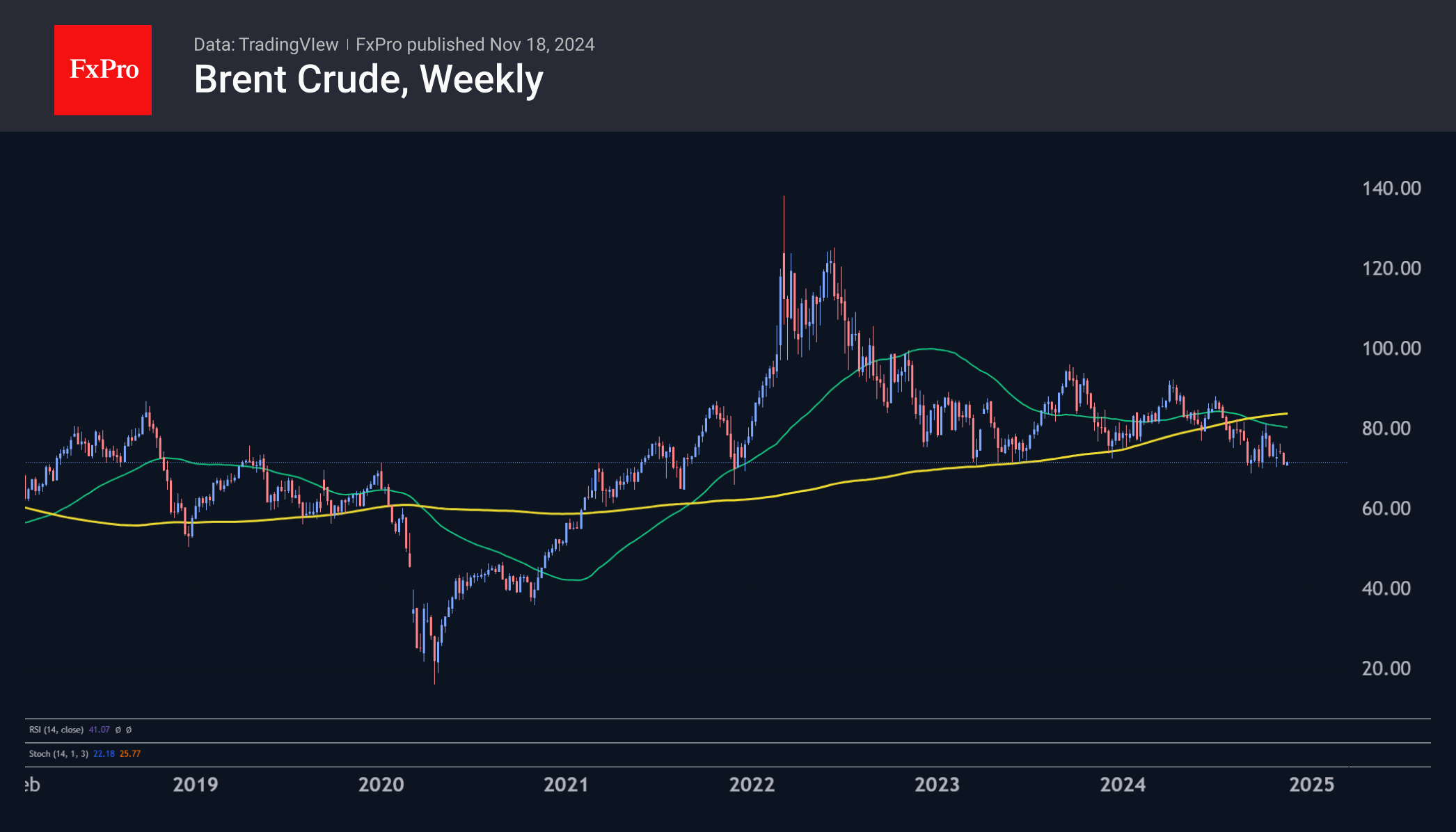

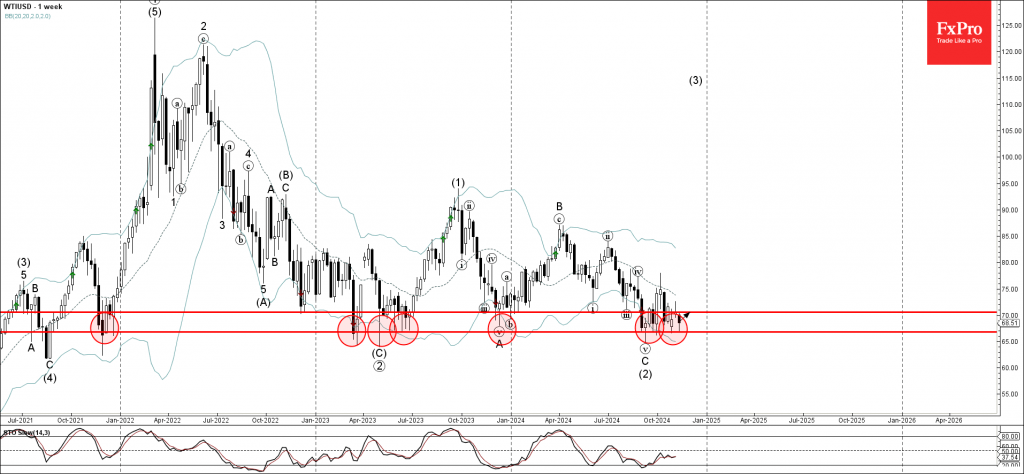

Oil prices have started the week at the lower end of the trading range, potentially leading to a sharp decline or rebound. Natural gas prices started the week near upper boundary of this year training range.

November 15, 2024

This week, we’re tracking the US Dollar’s powerful climb following Trump’s victory, hitting a crucial resistance level. Meanwhile, the British Pound and Euro face fresh challenges amid economic shifts. On the crypto scene, Bitcoin and altcoins are pushing the market.

November 15, 2024

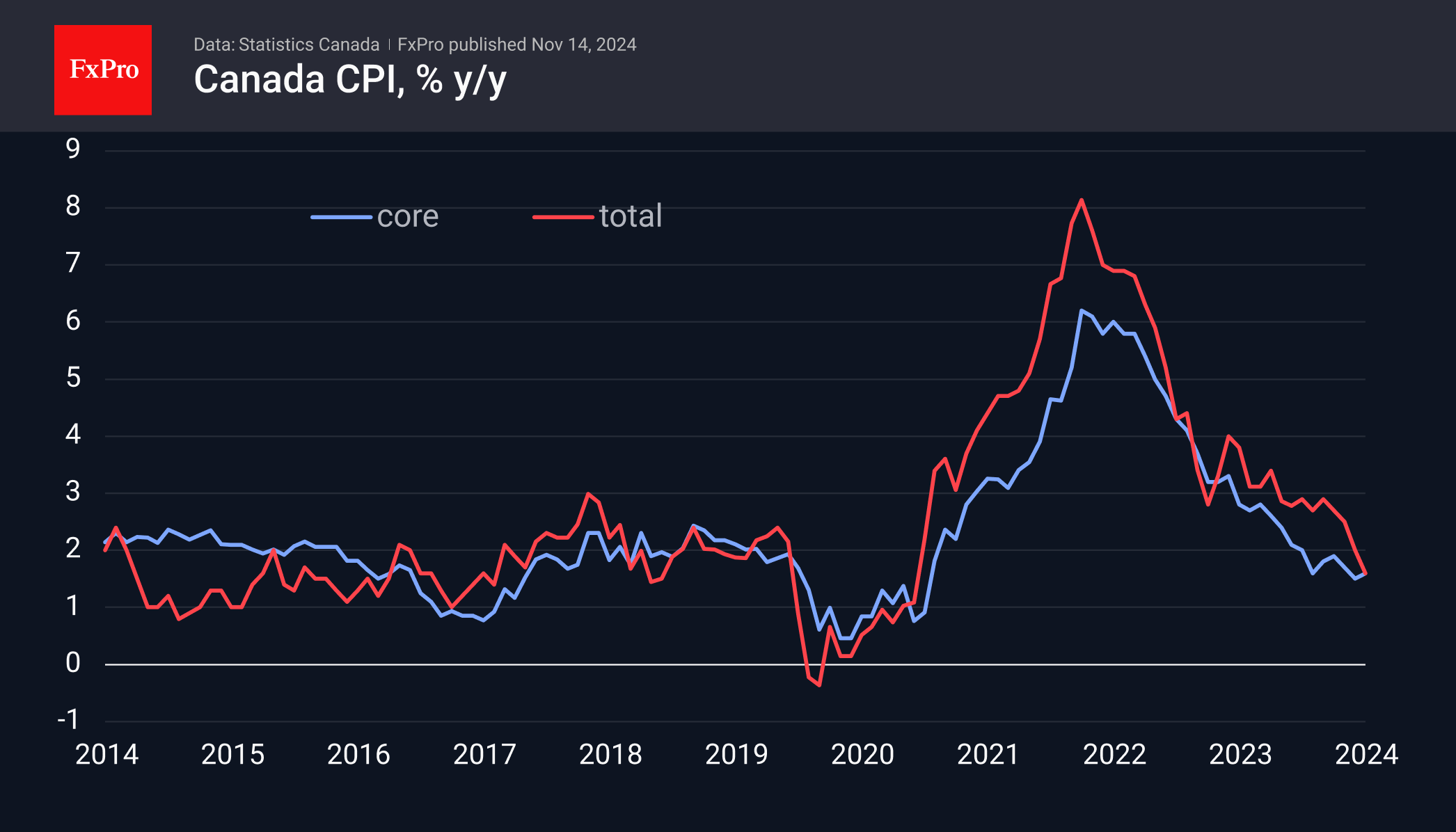

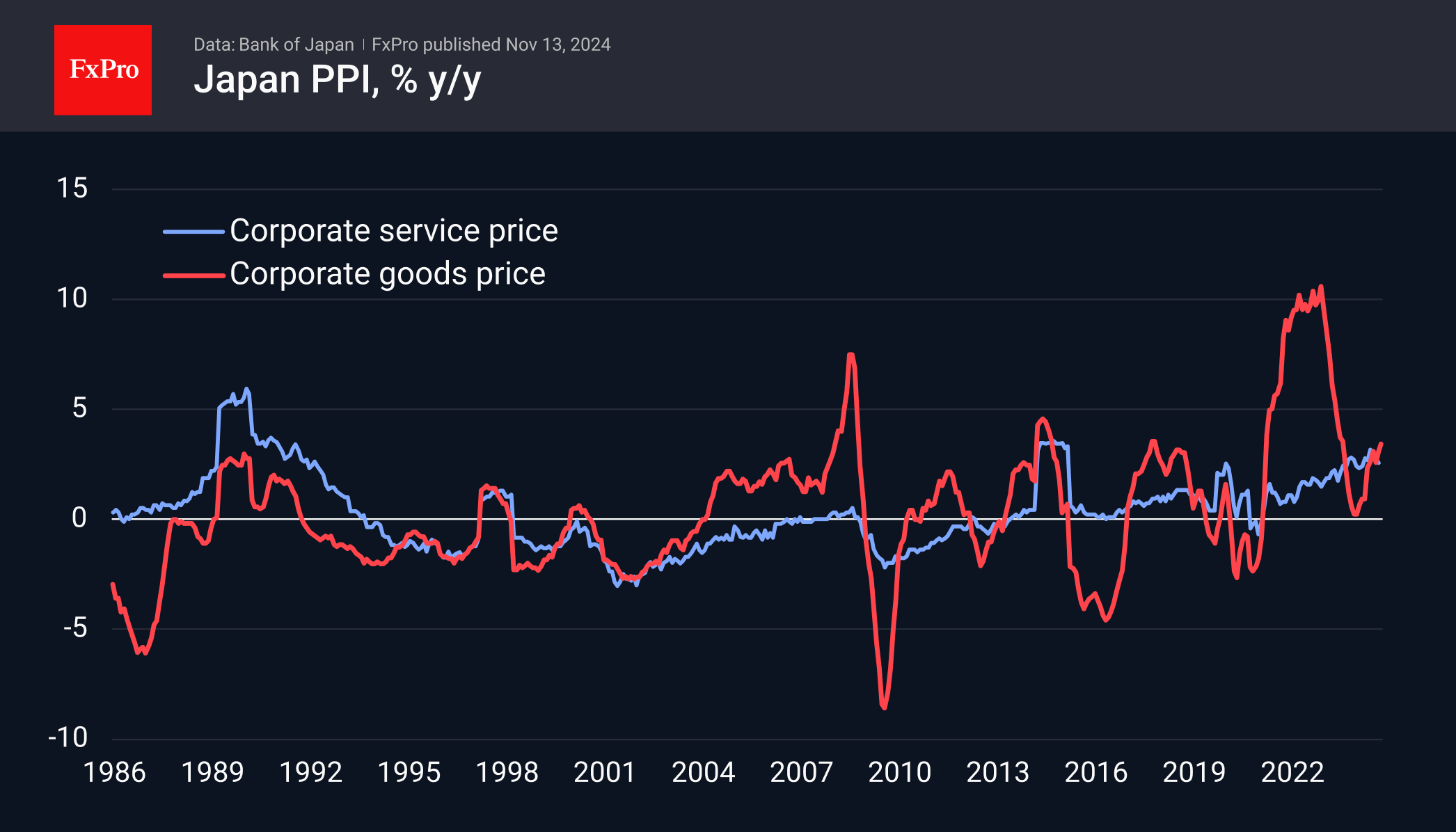

Next week, several countries including Canada, the UK, and Japan will release their estimates of consumer inflation. Additionally, Flash PMI reading may determine the fate of the euro in the coming month.

November 15, 2024

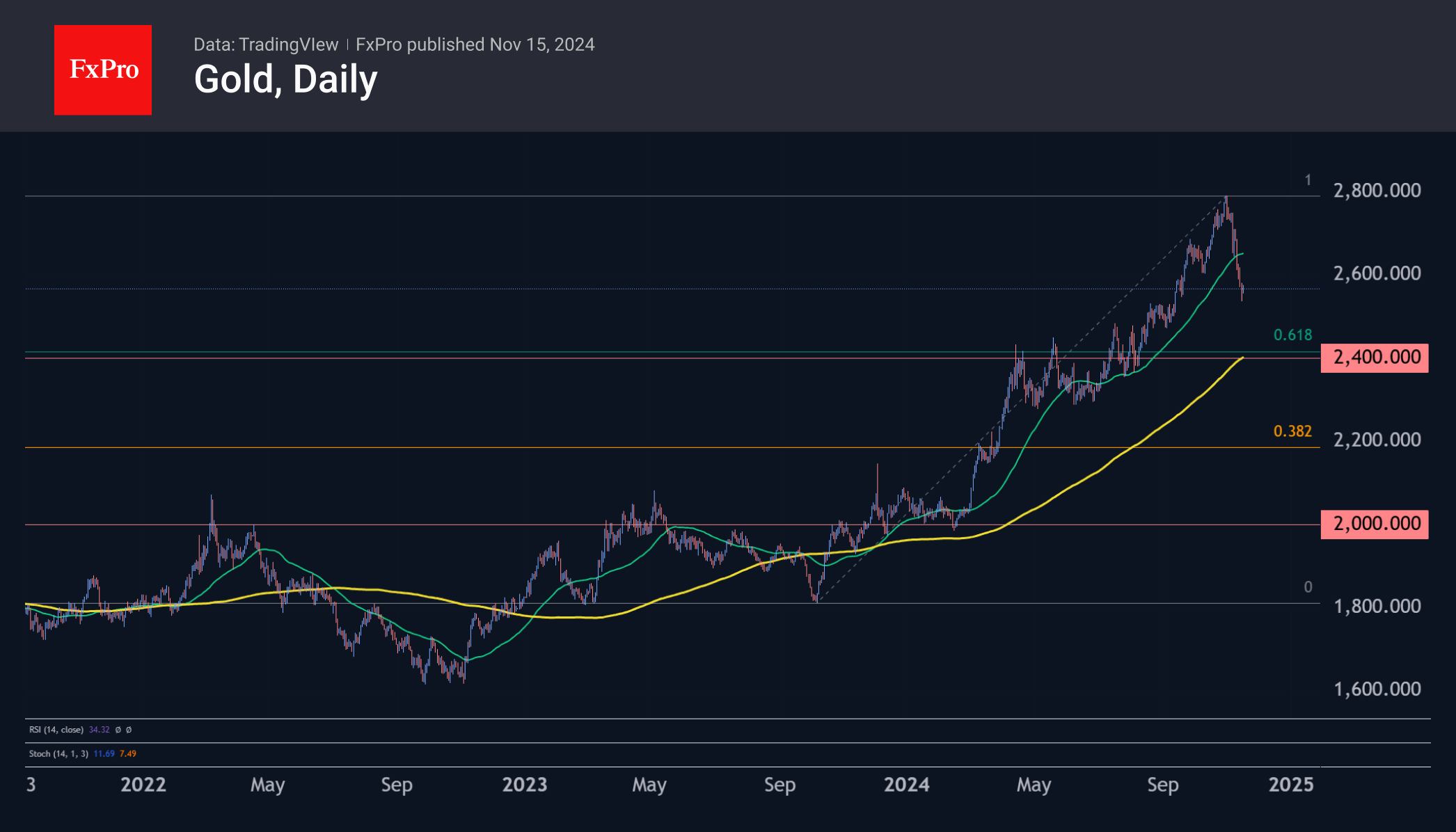

Investors have been selling off gold, with this week's drop being the largest in three years. The decline could continue, with a potential pullback to $2,400 by the end of the year. If the price falls below the 50-week moving average, it could trigger further losses.

November 15, 2024

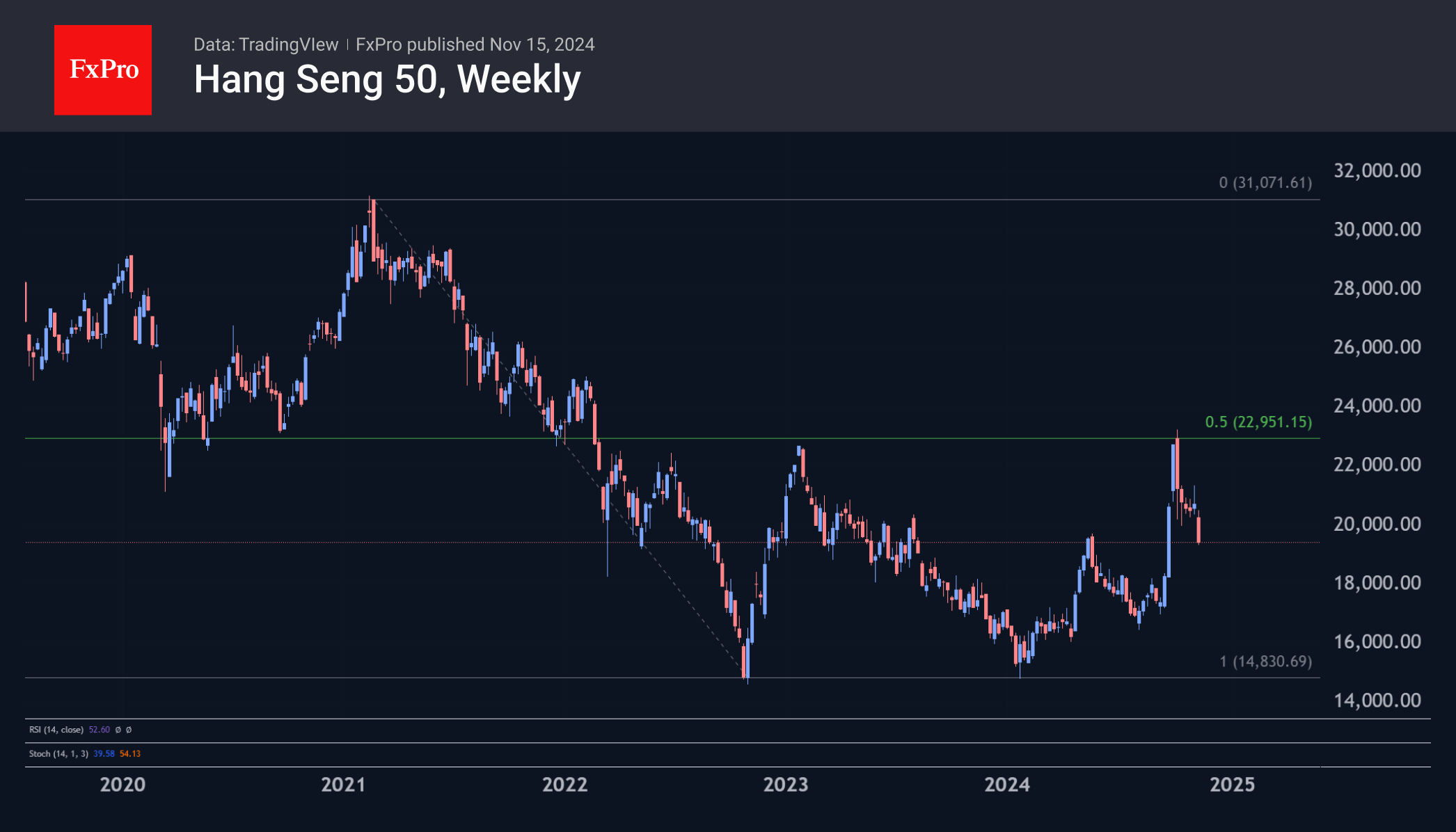

The Hang Seng Index has fallen 20% from its peak, marking the start of a bear market. The index has two peaks in the same area, indicating the possibility of further declines in the medium term.

November 15, 2024

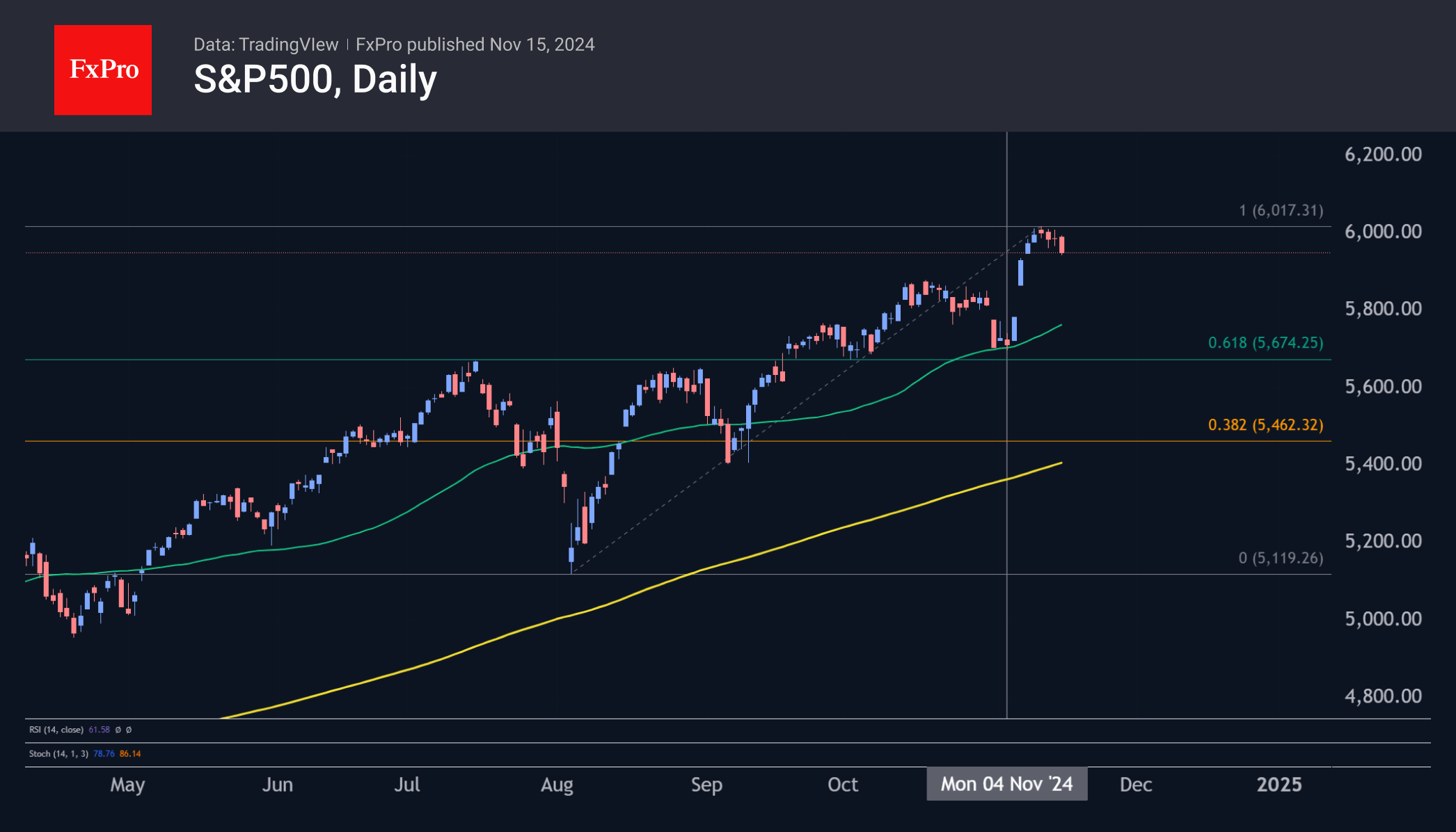

The S&P500 reached the 6000 mark but faced resistance due to fatigue and dollar appreciation. A pullback in US indices occurred, possibly due to profit-taking, with potential correction targets at 5900 and 5670-5700.

November 14, 2024

The US dollar has strengthened, reaching the upper boundary of its trading range. The British pound has fallen, and the euro has been selling off, with EURUSD falling to 1.05.

November 13, 2024

– WTI crude oil reversed from the multi-year support level 66.70 – Likely to rise to resistance level 70.00 WTI crude oil recently reversed up from the powerful multi-year support level 66.70 (which has been repeatedly reversing WTI from the.