Market Overview - Page 339

June 26, 2020

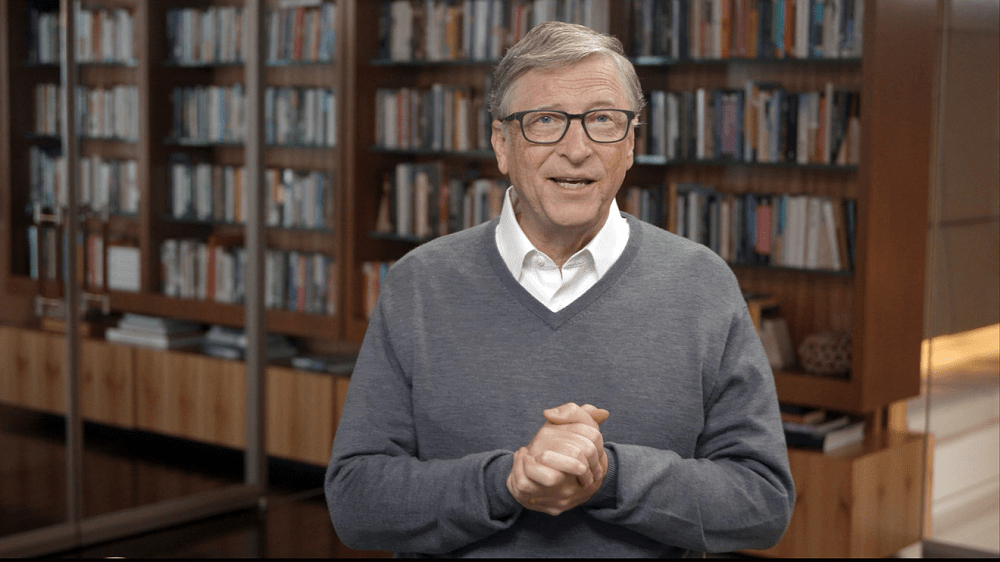

That’s Bill Gates, the Microsoft Corp. co-founder whose philanthropic foundation has long funded the global fight against infectious diseases, speaking about the coronavirus pandemic Thursday night during a virtual town hall on CNN. Appearing with anchor Anderson Cooper and Dr..

June 26, 2020

The governor of Texas temporarily halted the state’s reopening on Thursday as COVID-19 infections and hospitalizations surged and the country set a new record for a one-day increase in cases. Texas, which has been at the forefront of efforts to.

June 26, 2020

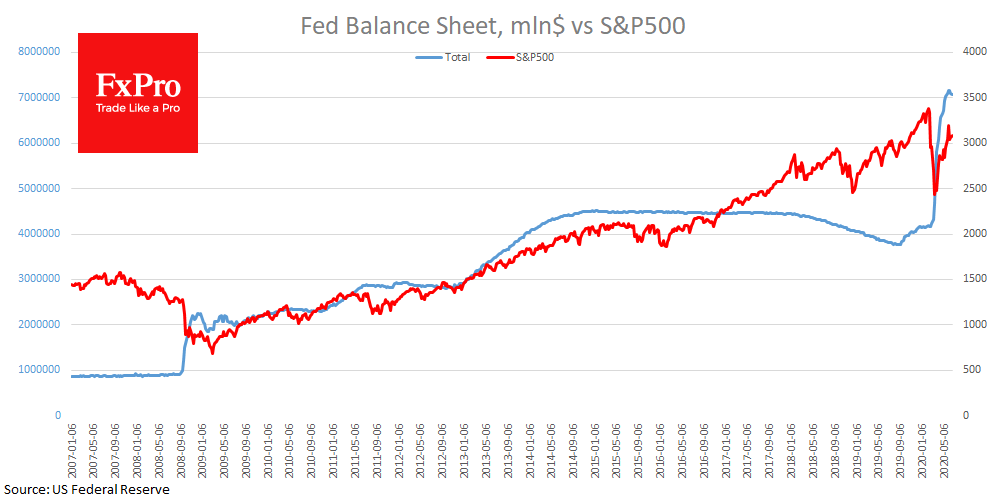

US markets managed to break out in plus at the end of trading on Thursday. The S & P500 added 1.1%, the Dow Jones rose 1.2%, and the Nasdaq managed to stay above 10,000, following an increase in banking sector.

June 26, 2020

The dollar held firm on Friday as caution over rapid rises in U.S. coronavirus cases cast doubt over the reopening of the economy, keeping demand for the safe-haven currency intact. The dollar index stood at 97.360, having pared a large.

June 26, 2020

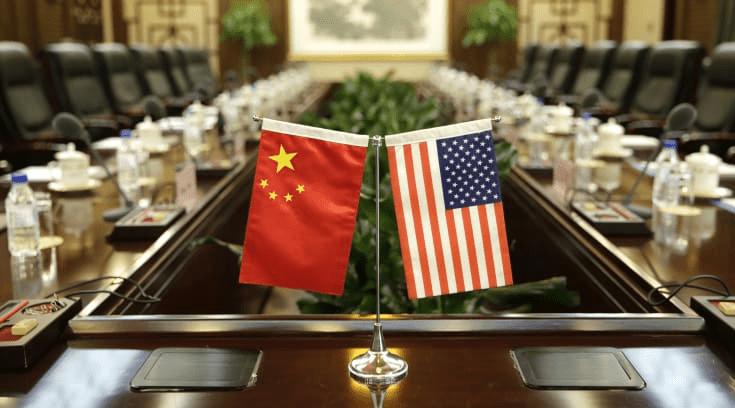

The U.S. and China are heading into a new “cold war” that could be more damaging to the world compared to the geopolitical contest between the U.S. and Soviet Union at the end of World War II, a consultant said.

June 25, 2020

Markets for stocks and other risky assets could suffer a second swoon if the coronavirus spreads more widely, lockdowns are reimposed or trade tensions surge again, the International Monetary Fund warned on Thursday. Equity markets tailspinned into bear market territory.

June 25, 2020

Gold has continued to rise of late as a resurgence of coronavirus cases, particularly in the U.S., has dented some of the investor optimism about the speed of a post-pandemic recovery. Spot gold edged up slightly to $1,763 per troy.

June 25, 2020

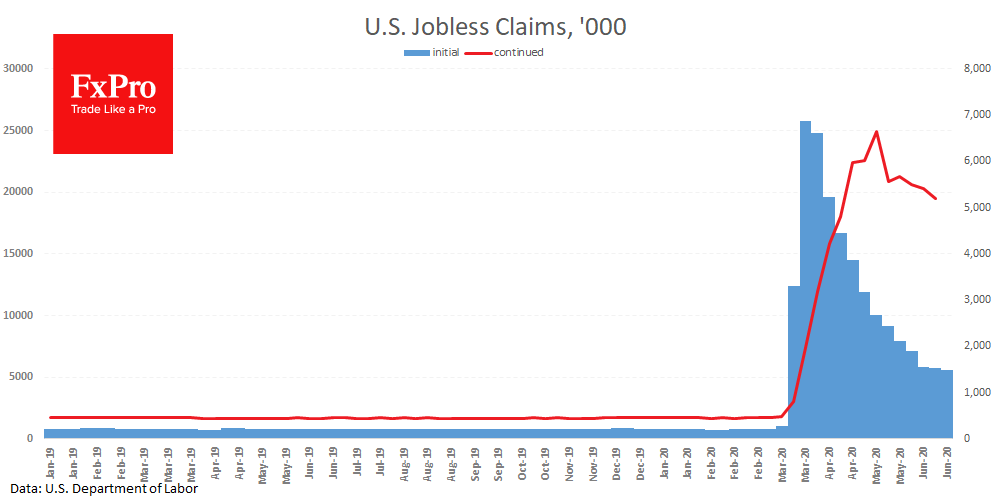

Recent data on weekly applications for unemployment benefits in the US came out mixed. There were 1.48M of the initial claims last week. Once again, it is showing a decrease in noticeably slighter than median expectations (1.32 million). A week.

June 25, 2020

U.S. equity futures fell on Thursday as investors struggled to look past a global resurgence in coronavirus infections that sapped risk appetite yesterday. Treasuries rose with the dollar. S&P 500 and Dow Industrials contracts pointed to another day of losses,.

June 25, 2020

The price of Bitcoin dropped below $9,000 as several factors put pressure on BTC/USD, including correlation with global stock markets. The price of Bitcoin (BTC) dropped below $9,000 from $9,660 within seven hours. The 7% plunge comes as $55 million.

June 25, 2020

Yandex has doubled the size of its new share offering to $400 million, the Russian internet giant said on Thursday, which combined with private placements will raise $1 billion to finance acquisitions and growth. Yandex, co-founded by its Chief Executive.