Market Overview - Page 337

July 1, 2020

European travel and leisure stocks have rebounded in recent weeks but still have a long way to go before returning to pre-crisis levels. The Stoxx 600 travel and leisure sector, which covers 16 companies, sank 42% in the first quarter.

July 1, 2020

Asia’s economy is expected to shrink this year “for the first time in living memory,” the International Monetary Fund said, warning that the region could take several years to recover. The fund said in a blog post published Tuesday that.

June 30, 2020

Ether (ETH) options implied volatility, a measure of the expected price swings as per the options markets premium, has dropped below Bitcoin’s (BTC) for the first time ever. This could signal that investors have given up expectations of a price.

June 30, 2020

Travelers from a list of 15 nations will be allowed entry to the European Union starting Wednesday, but the United States is not on the list. Thirty countries in Europe (26 of which are members of the EU) closed their.

June 30, 2020

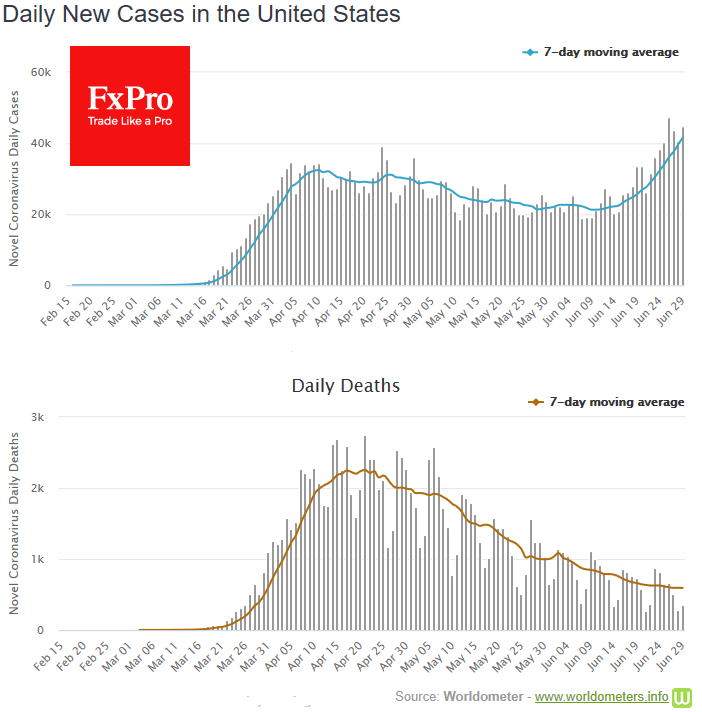

Markets show growth on Tuesday morning after indications of a stronger recovery. In addition, the U.S. indices rose more than 1% on Monday. Interestingly, the growth of the U.S. indexes is taking place on the background of a more significant.

June 30, 2020

The dollar held on to modest gains on Tuesday as upbeat U.S. home sales and Chinese factory data left traders torn between optimism about global growth rebounding and fears a surge in new COVID-19 cases could jeopardise a swift V-shaped.

June 30, 2020

Bitcoin (BTC) price showed a bit of strength by briefly pushing to $9,235 as the daily close occurred but at the time of writing the top-ranked digital asset on CoinMarketCap is trading below the $9,200 resistance. As discussed in the.

June 30, 2020

2020 has seen a 1929-style stock market meltdown, a retail investor-fueled 1999-style rally, and even Zimbabwe is having a repeat of its 2008 hyperinflationary collapse. And that’s just in the first half of the year! Who knows what craziness we’ll.

June 30, 2020

Britain’s economy shrank by the most since 1979 in early 2020 as households slashed their spending, according to official data that included the first few days of the coronavirus lockdown. Gross domestic product dropped by a quarterly 2.2% between January.

June 30, 2020

The top decision-making body in China’s parliament has passed the contentious national security law for Hong Kong, according to a member of the Standing Committee of China’s National People’s Congress. Tam Yiu Chung, the sole Hong Kong delegate to the.

June 30, 2020

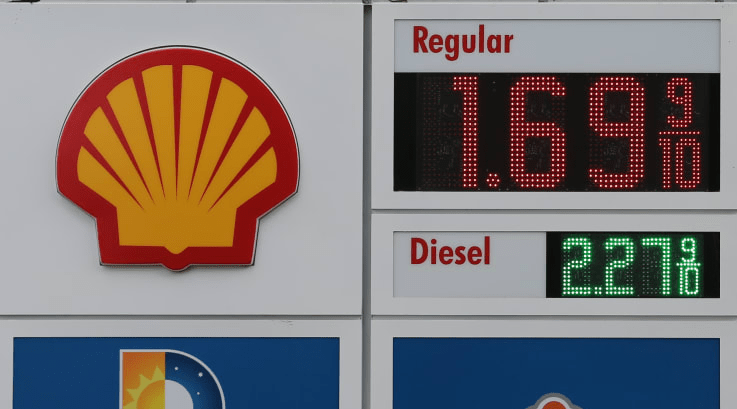

Oil giant Royal Dutch Shell said on Tuesday it will write down the value of its assets by up to $22 billion in the second quarter, after revising down its long-term outlook for oil and gas prices. It comes after.