Market Overview - Page 333

July 8, 2020

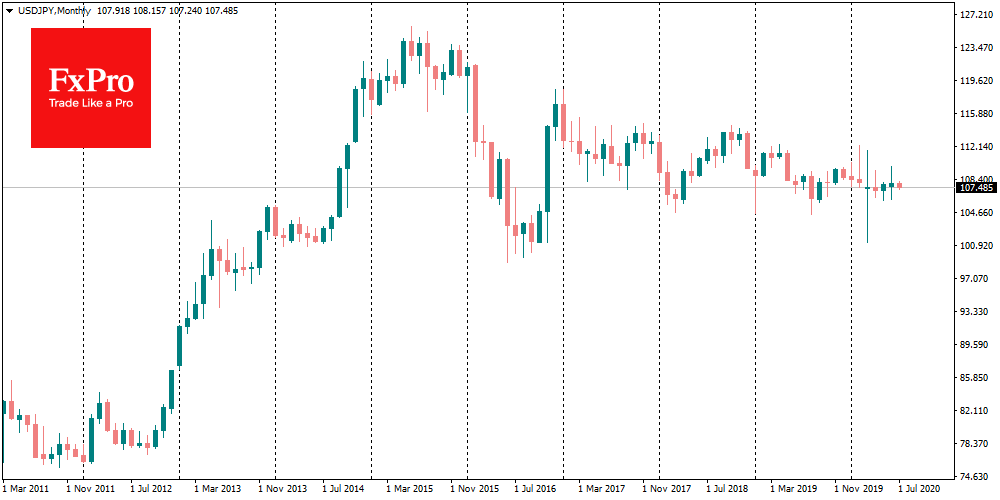

The growth of financial markets has stalled, with American indexes losing more than 1% on Tuesday. On Wednesday morning, most Asian markets were at a small minus (about 0.2%). Currency markets confirm these sentiments, showing a slight slope towards the.

July 7, 2020

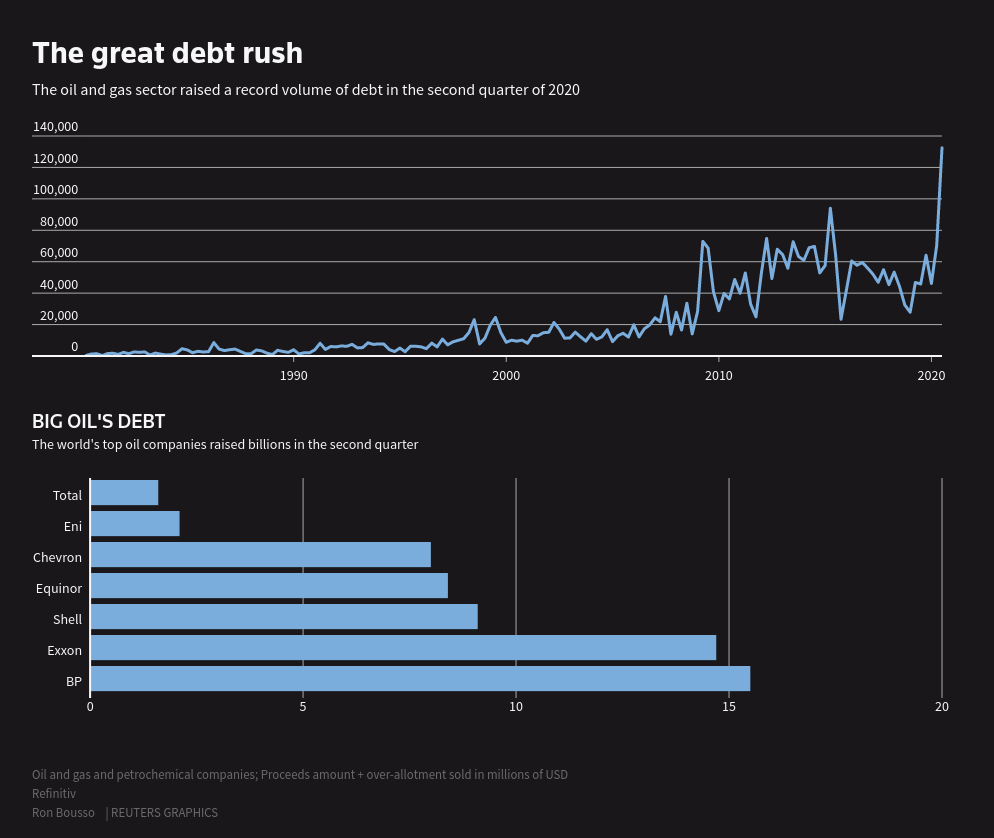

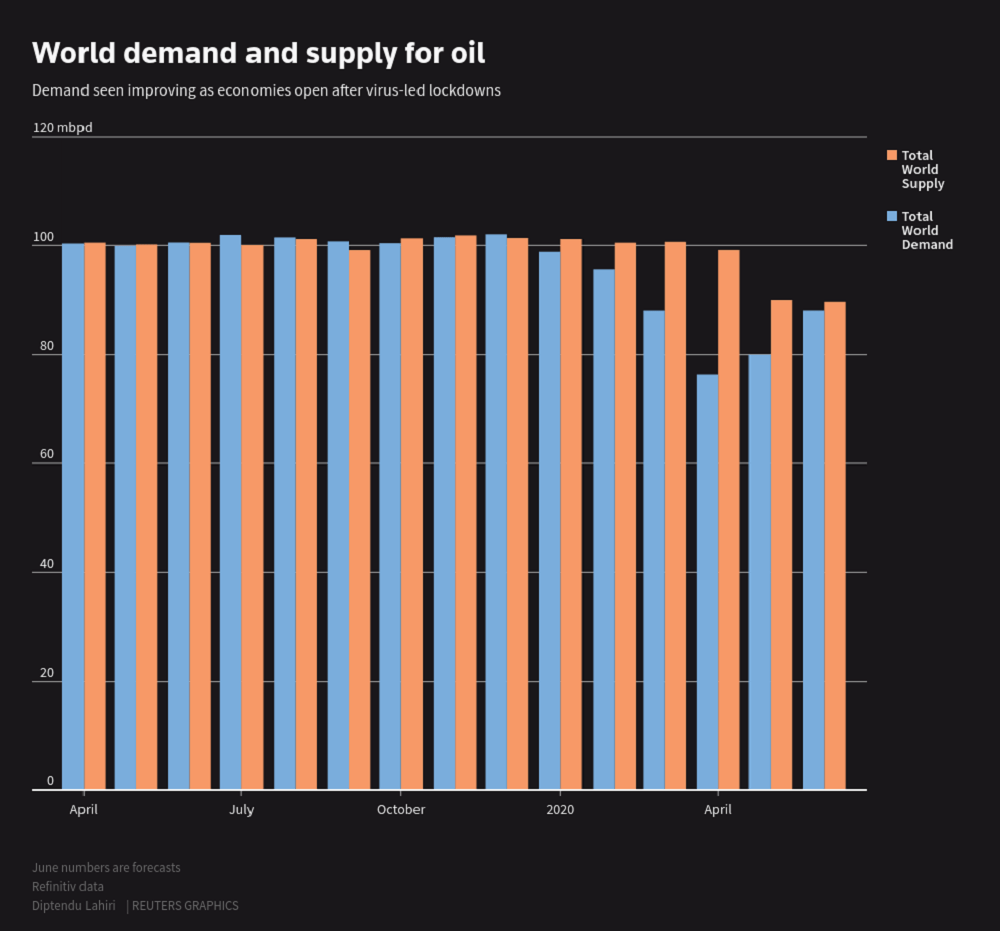

The world’s top oil and gas companies locked in cheap borrowing rates to raise a record amount of debt in the second quarter of 2020 and boost cash reserves as a buffer against a collapse in revenues because of COVID-19..

July 7, 2020

U.K. Chancellor of the Exchequer Rishi Sunak will deliver a fresh set of policy initiatives on Wednesday as Britain looks to spark an economic recovery from the coronavirus pandemic. In his March budget, Sunak announced a £30 billion ($39 billion).

July 7, 2020

Judging by the craziness 2020 has brought us so far, one might think nothing could surprise us anymore. Well, think again. Bubonic plague, the one that killed half of Europe back in the 13th century, has just made a comeback.

July 7, 2020

British house prices fell for a fourth month in a row in June as COVID-19 restrictions continued to depress the market, the longest run of monthly declines since 2010, mortgage lender Halifax said on Tuesday. Halifax said average house prices.

July 7, 2020

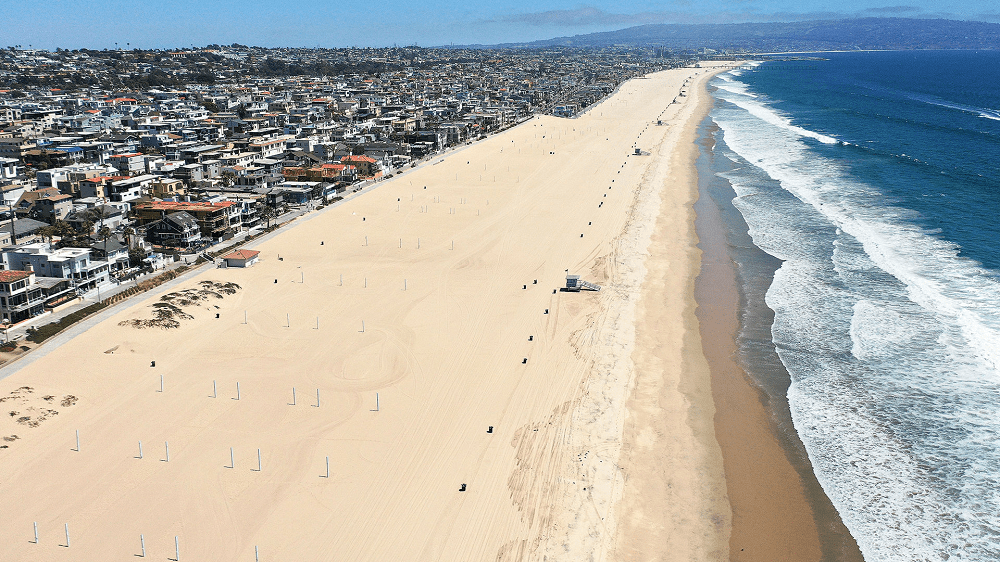

New coronavirus cases soared in California over the July Fourth weekend, stressing some hospital systems and leading to the temporary closure of the state capitol building in Sacramento for deep cleaning, officials said on Monday. The number of people hospitalized.

July 7, 2020

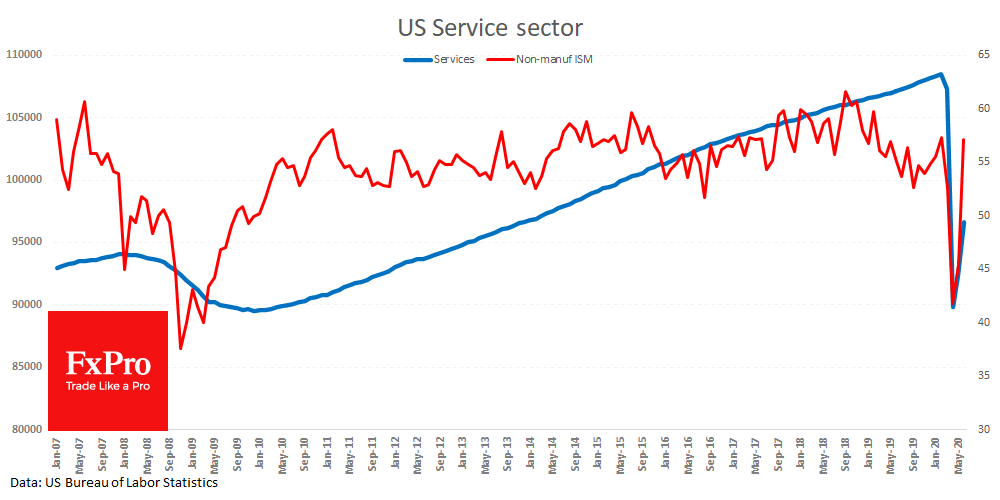

Economic indicators one after another are exceeding expectations, fuelling market growth after a series of strong macro reports were supported by the United States on Monday. The ISM Non-Manufacturing Index rose to 57.1 in June, which is much stronger than.

July 7, 2020

Stock futures were lower in early Tuesday trading after a solid rally on Wall Street to start the week. Futures on the Dow Jones Industrial Average fell 176 points, while S&P 500 futures and Nasdaq 100 futures also traded in.

July 7, 2020

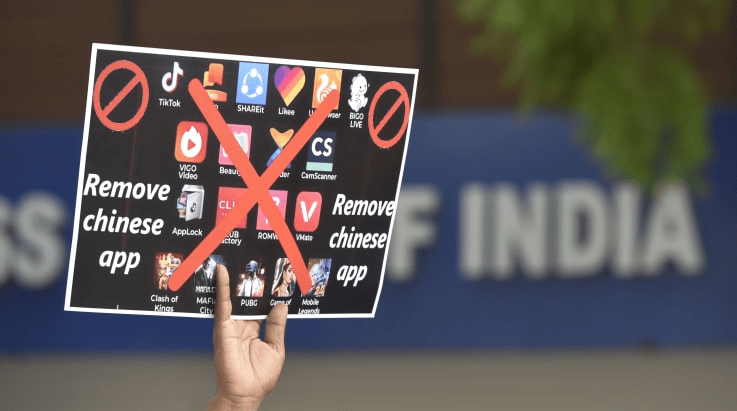

A border clash with China in the Himalayas left 20 Indian soldiers dead and soured public sentiment, with many in India, including some local politicians, calling for a boycott of Chinese products. It exerted pressure on Prime Minister Narendra Modi’s.

July 7, 2020

The U.S. is “looking at” banning TikTok and other Chinese social media apps, Secretary of State Mike Pompeo told Fox News on Monday. His comments come amid rising tensions between the U.S. and China and as scrutiny on TikTok and.

July 6, 2020

Oil rose slightly on Monday as positive economic data supported prices, while a spike in coronavirus cases that could curb fuel demand in the United States limited gains. Brent crude was up 47 cents to $43.26 per barrel by 1:52.