Market Overview - Page 33

December 9, 2024

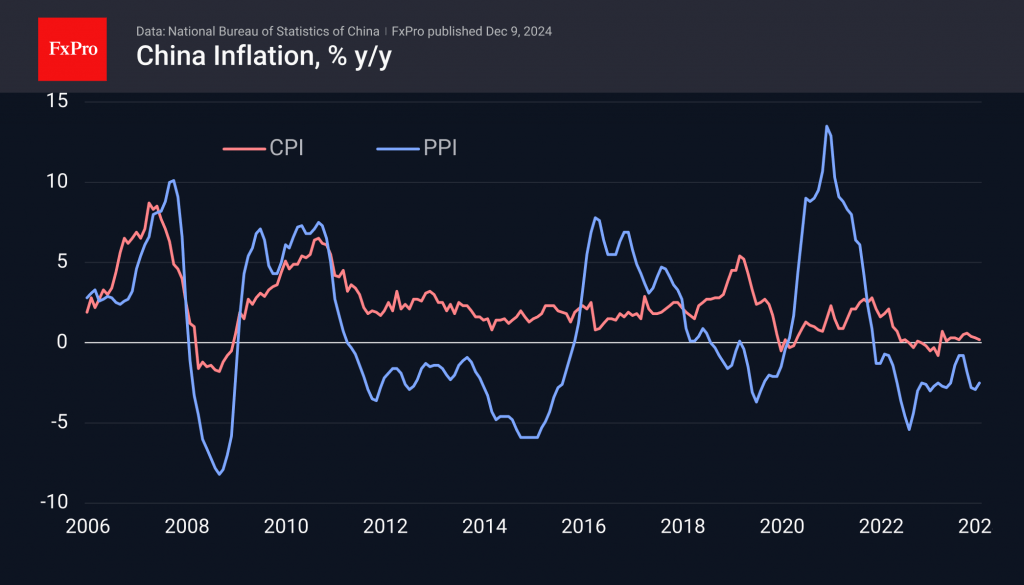

Chinese stock indices soared on Monday as the government announced a shift to a more accommodative monetary policy, in response to lower-than-expected consumer inflation data. The change in policy is expected to put pressure on the local currency.

December 9, 2024

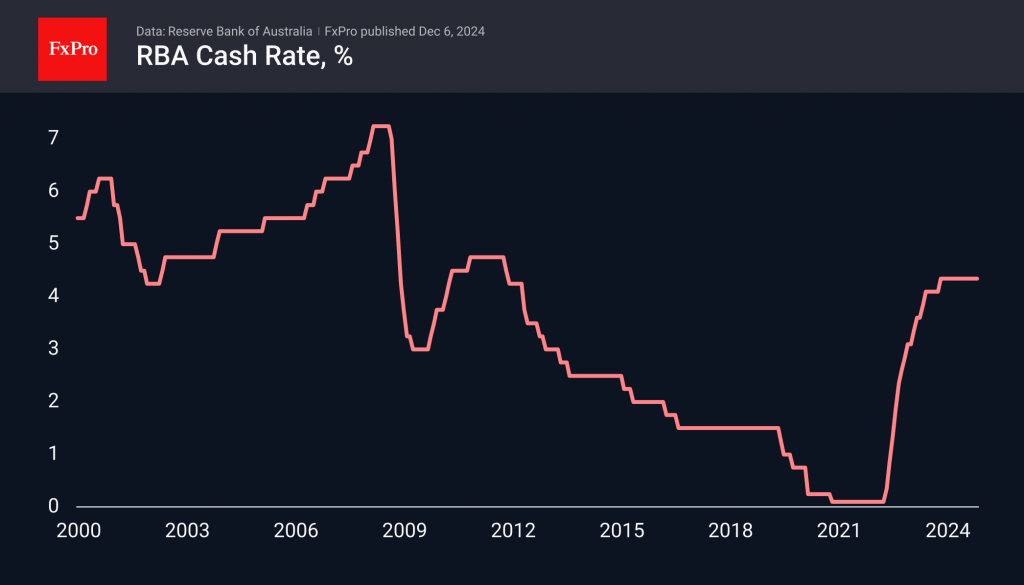

This week will is packed with central bank decisions and economic releases, including CPI from the US, as well as rate decisions from the Reserve Bank of Australia, Bank of Canada, Swiss National Bank and ECB.

December 4, 2024

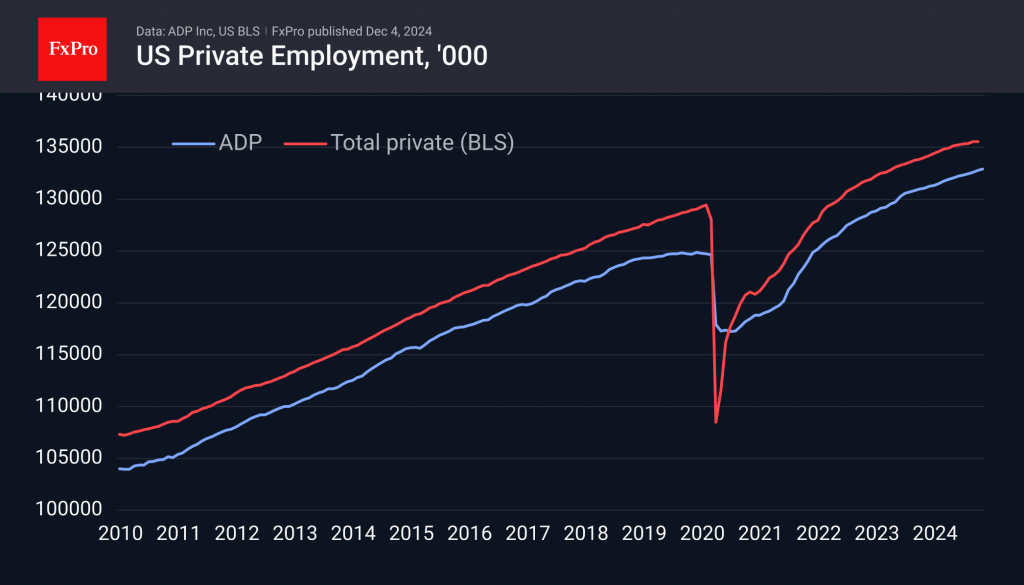

The most important publication in the coming weeks will be Friday’s US employment report. Ahead of that, we are turning our attention to other labour market indicators. Wednesday’s ADP private sector employment report is the closest we have to a.

November 29, 2024

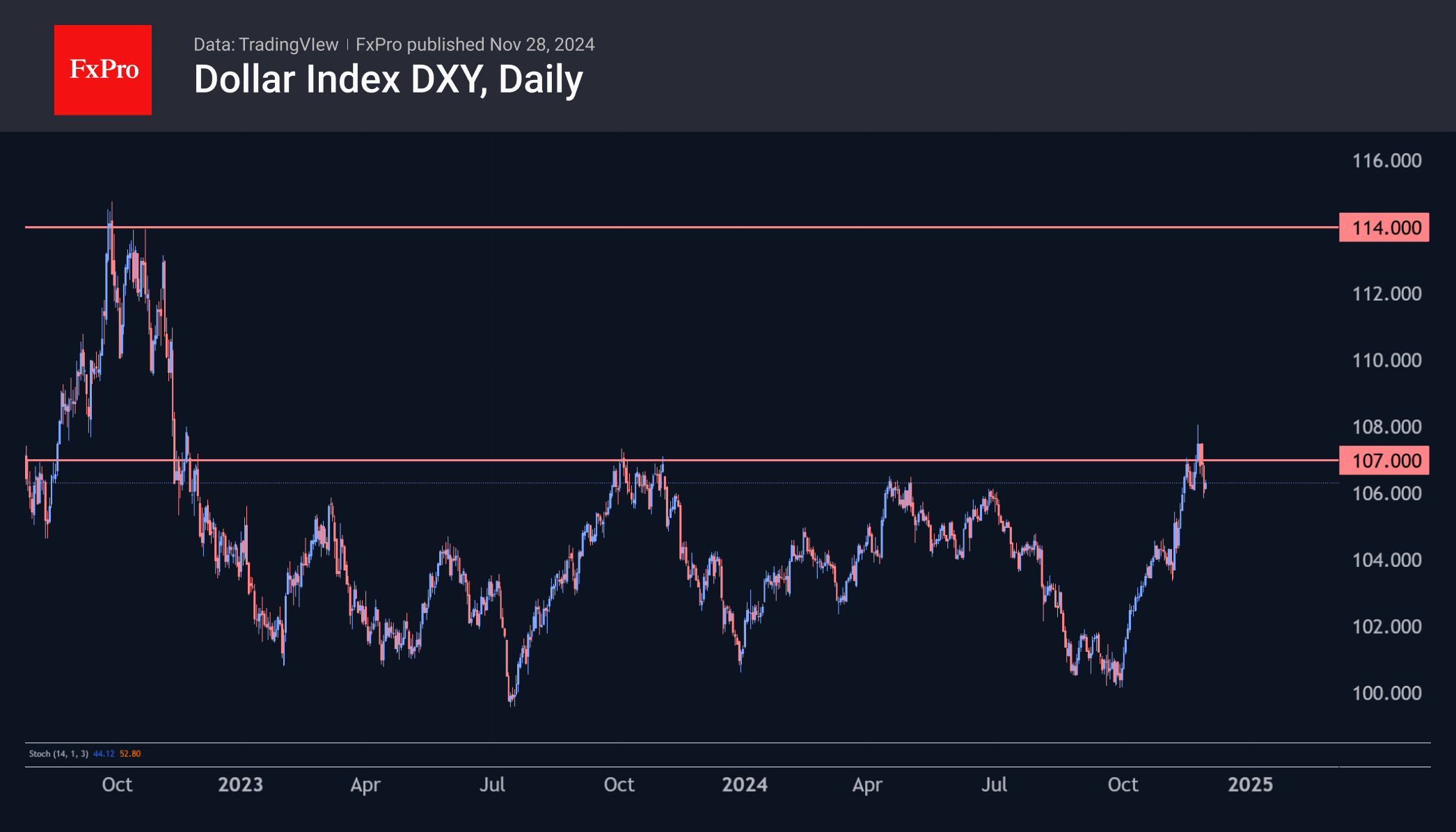

The Dollar Index has retreated from a high, but another attack on the highs is possible. The Fed is revising rate cut expectations, consumer demand and service sector inflation are causing caution.

November 29, 2024

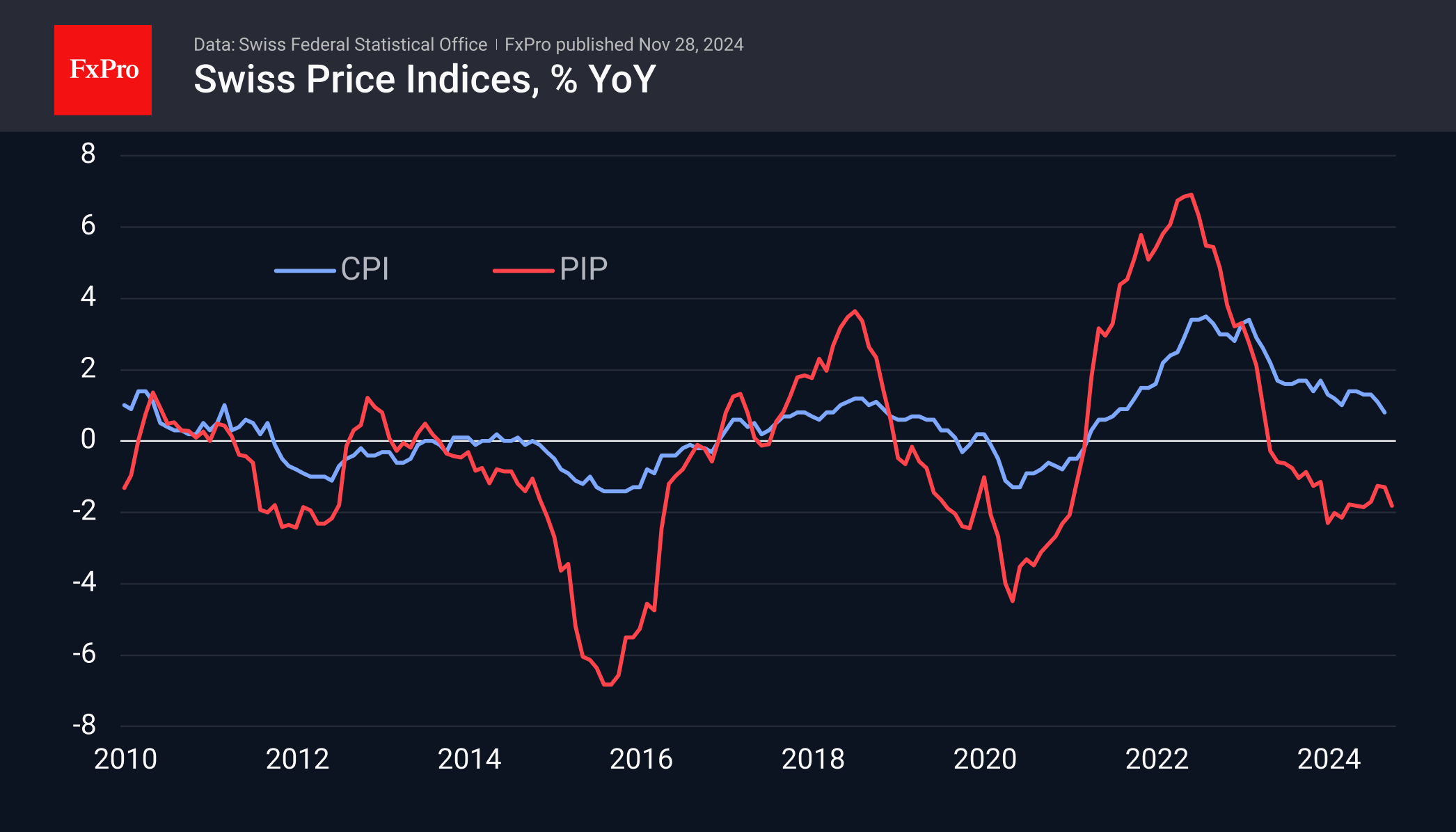

Switzerland is awaiting the release of CPI data, which could lead to further monetary easing. Employment data from the US and Canada will also be closely watched.

November 29, 2024

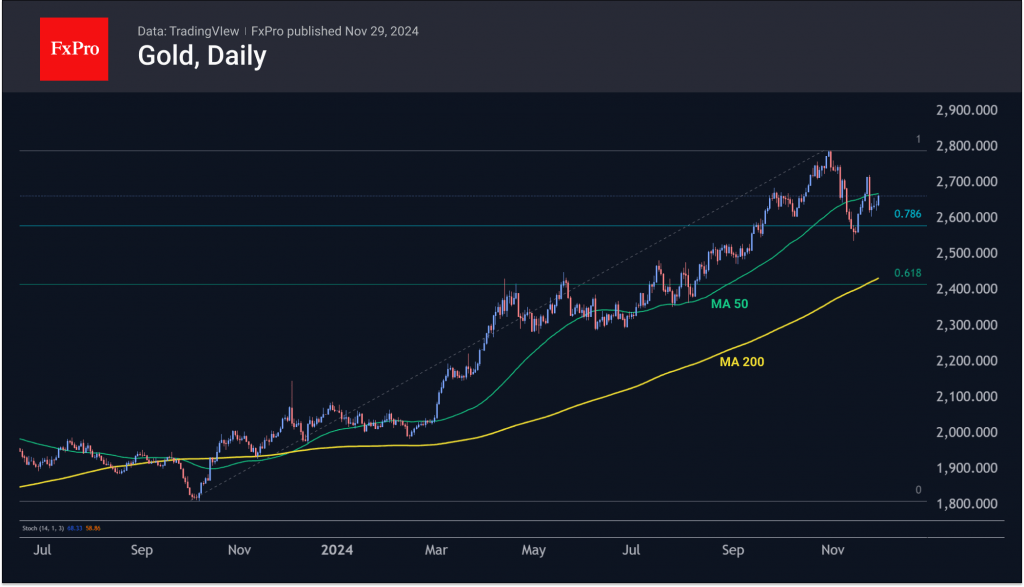

The price of gold fell 4% but then rebounded, finding support at $2,600 per troy ounce. Further drops could lead to sellers targeting $2,540, with a long-term target of $2,000 per ounce. Small steps are now more reasonable.

November 29, 2024

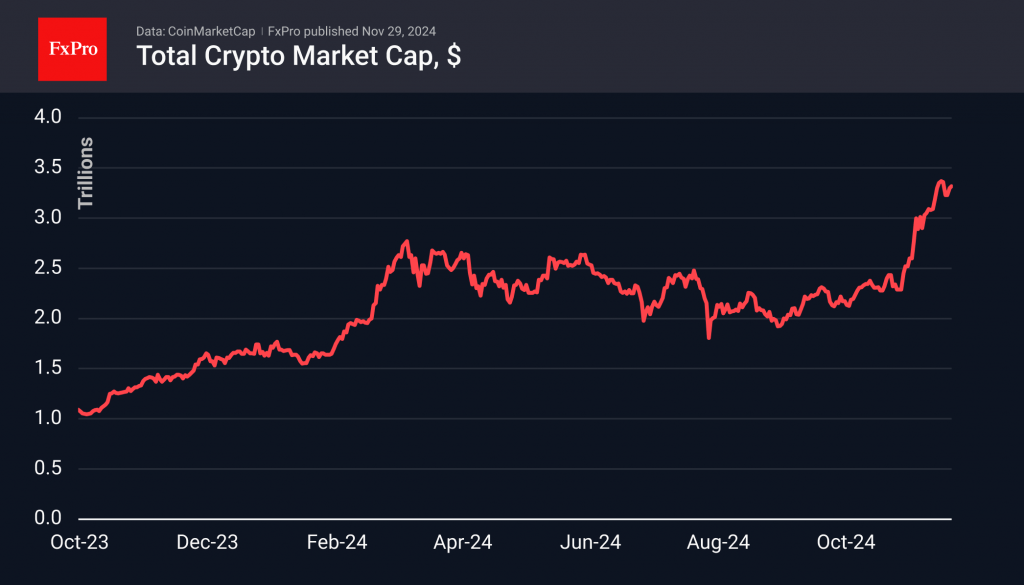

XRP is experiencing an increase in value while Ethereum is facing selling pressure. The overall market is growing, but bitcoin's rise is limited.

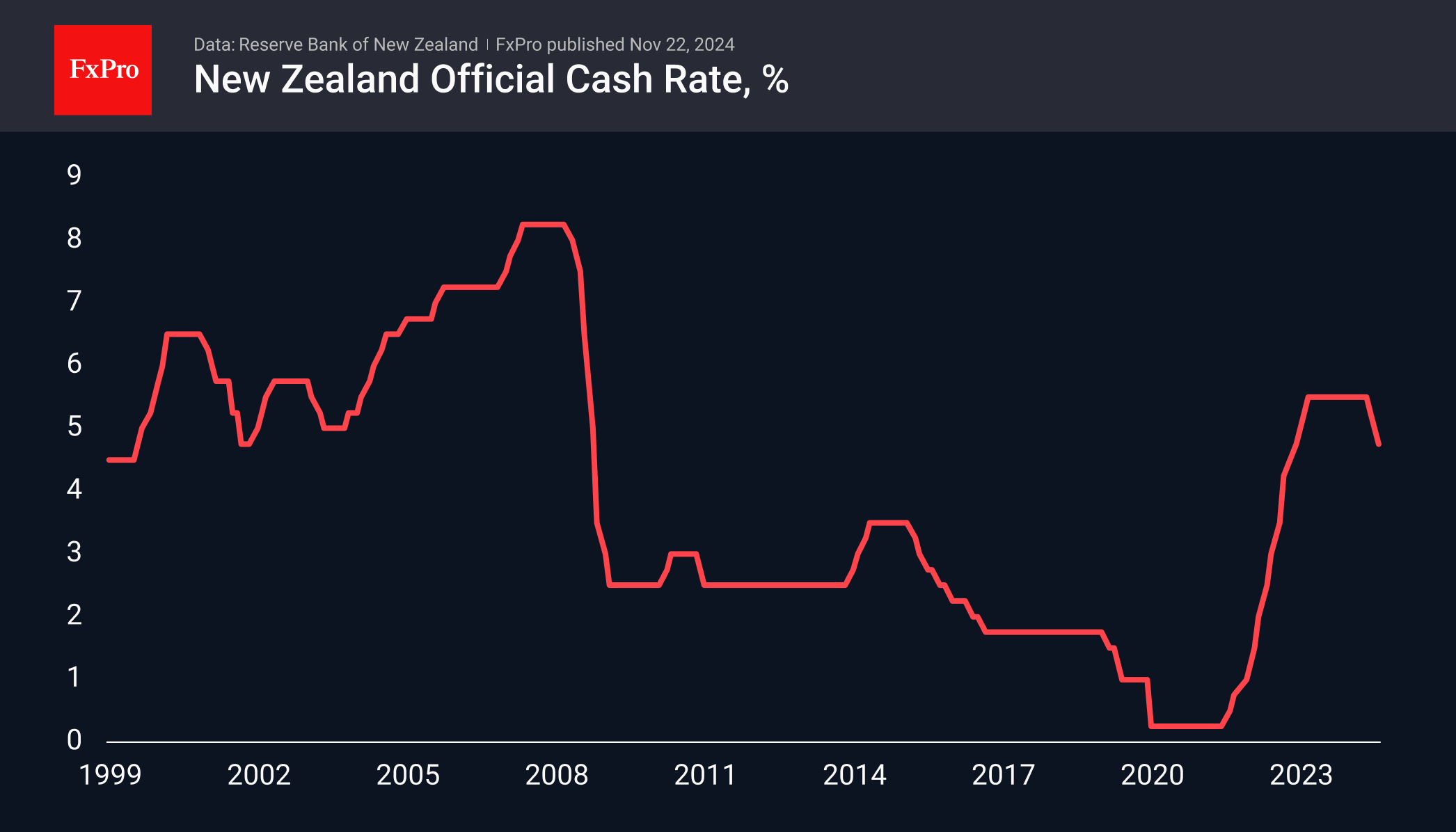

November 27, 2024

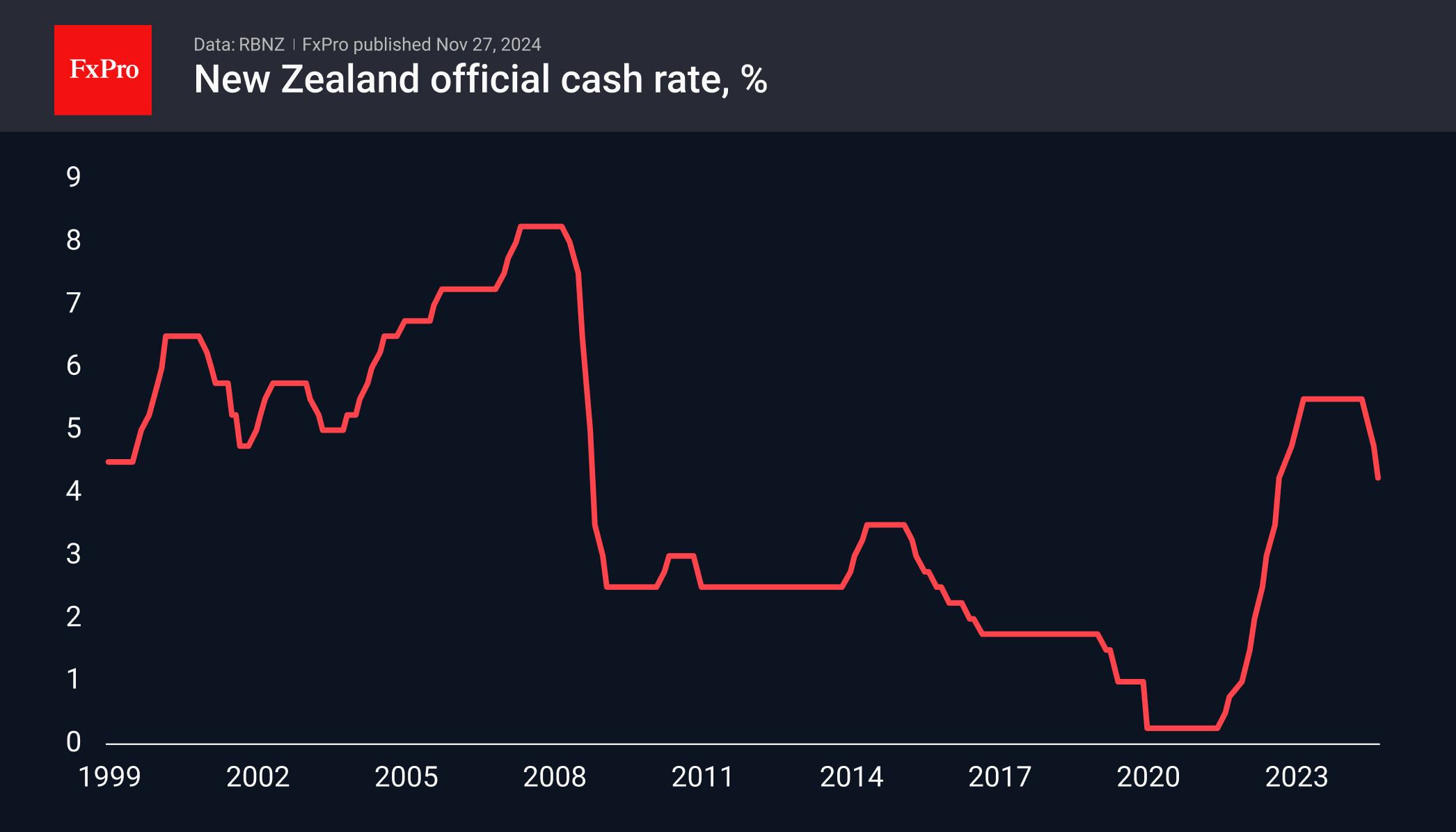

The RBNZ cutting its key rate by 50 b. p. suggests a faster pace of normalisation. NZDUSD rebounded, but it may only be temporary, as the Fed's monetary policy tone diverges in favour of the USD.

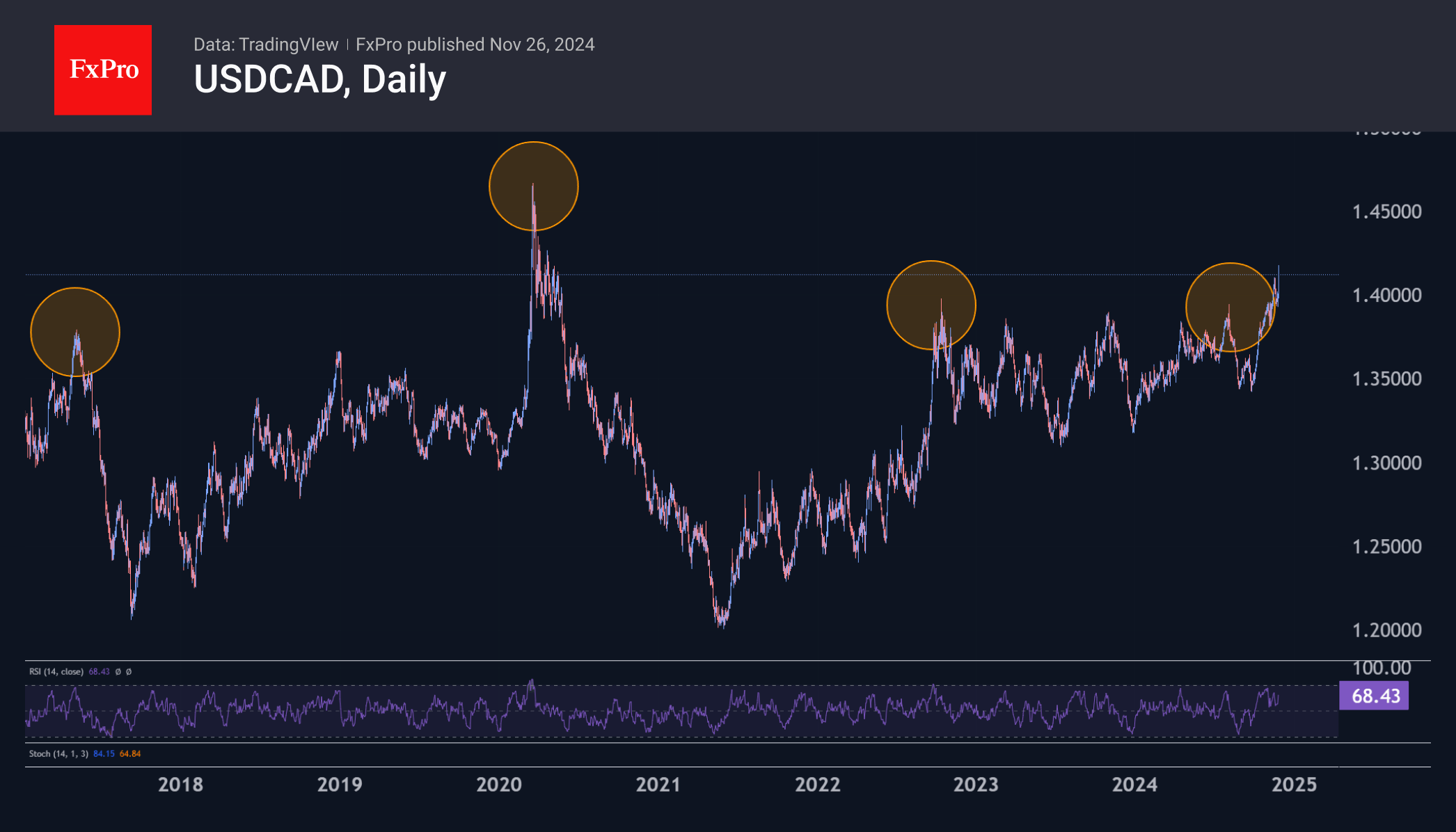

November 26, 2024

The period of currency turbulence may continue, but there is potential for the Canadian dollar to strengthen in the long term if oil prices increase.

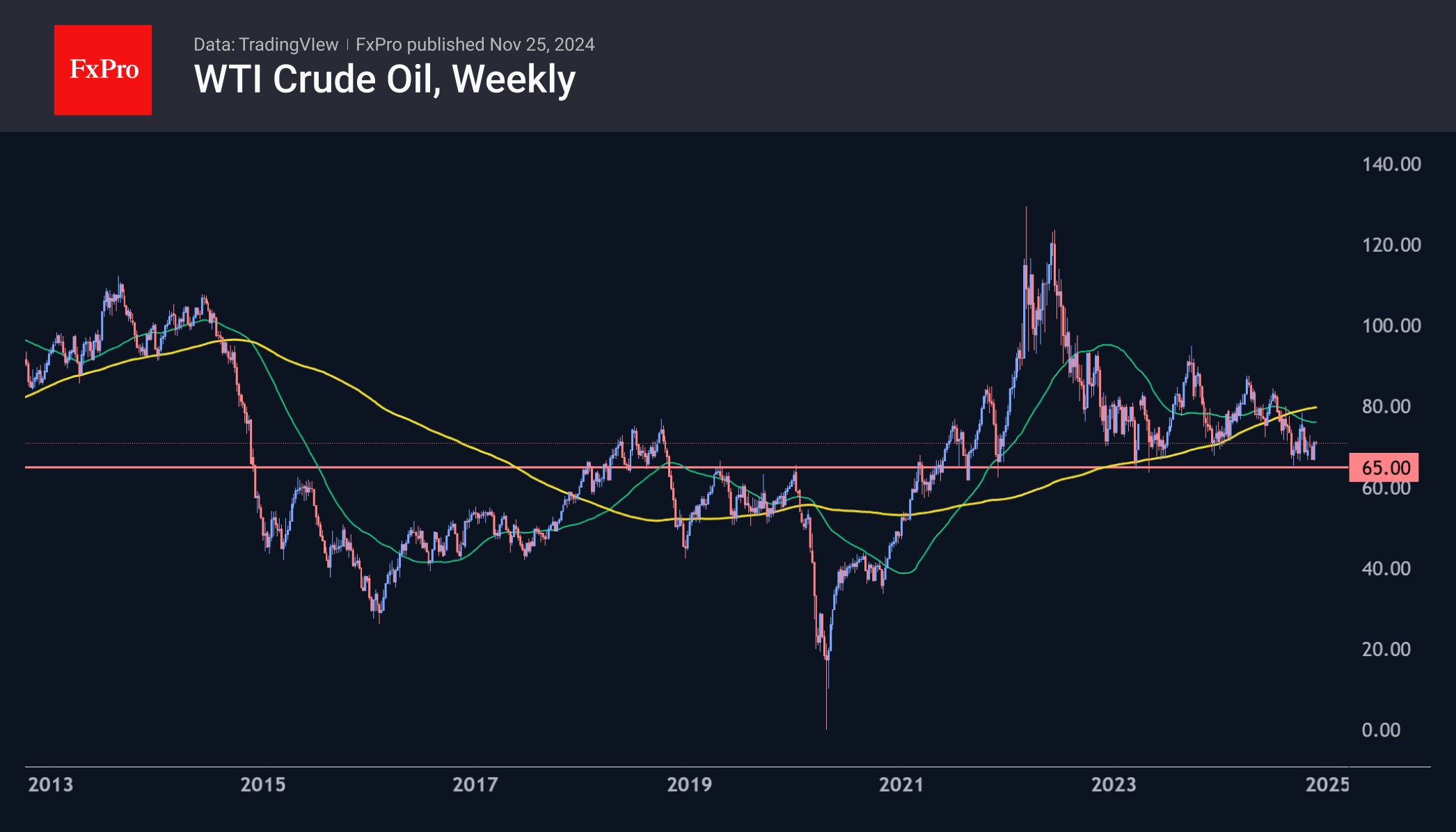

November 25, 2024

Oil prices rose by over 7% in the past week, reaching above $70 per barrel. Factors driving the increase include the Russia-Ukraine conflict, speculation about the US returning its focus to oil and gas, and rumours of OPEC+ postponing production cuts.

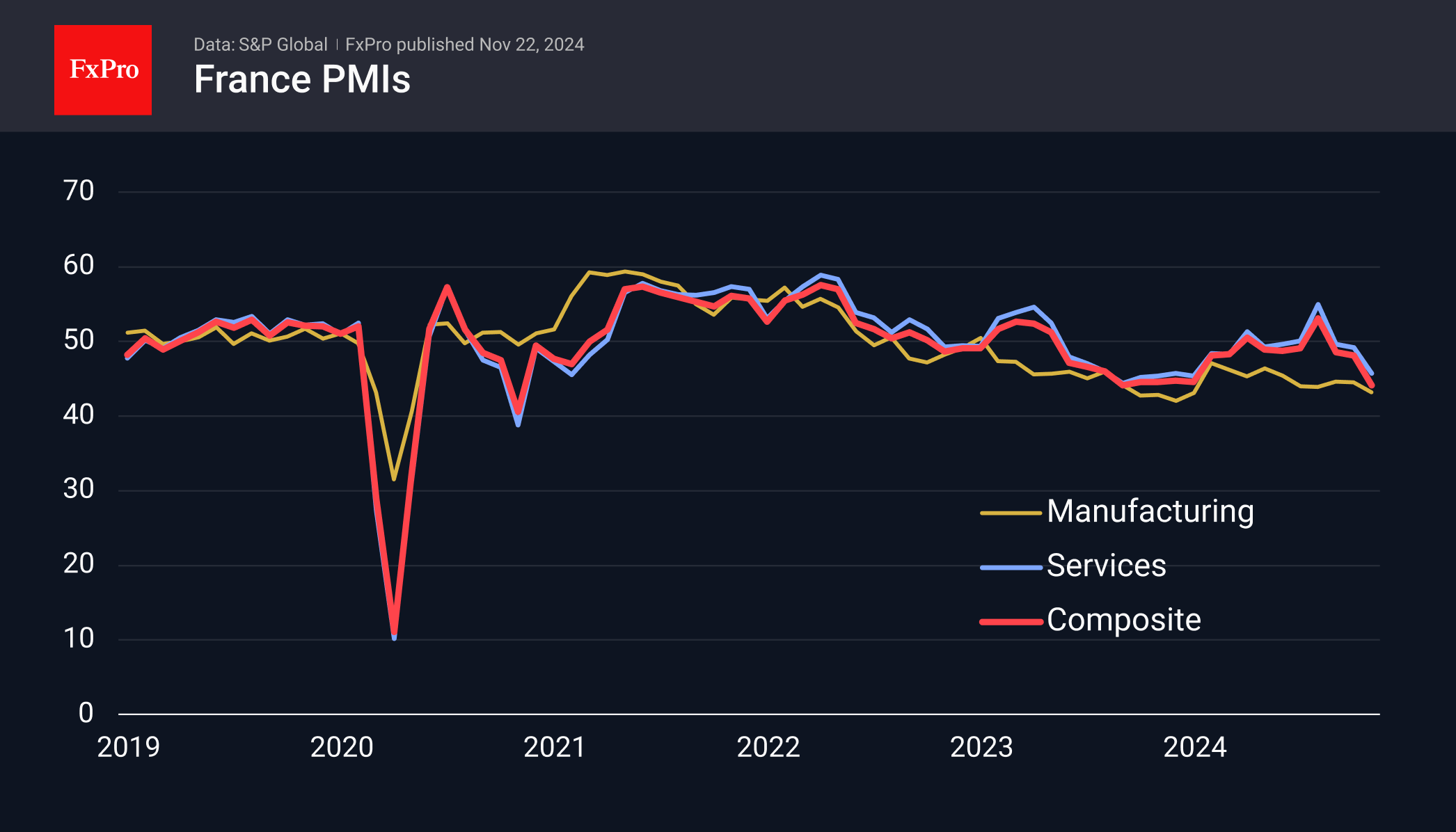

November 25, 2024

The RBNZ's key rate decision, the release of the FOMC meeting minutes, and inflation estimates in Germany and the Eurozone will be important economic events to watch in the new week.