Market Overview - Page 32

December 23, 2024

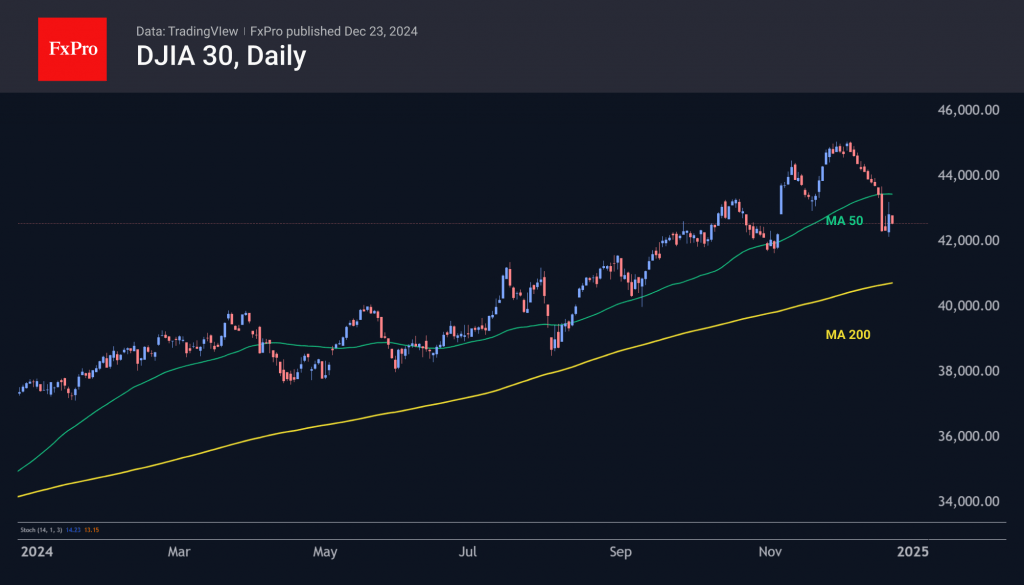

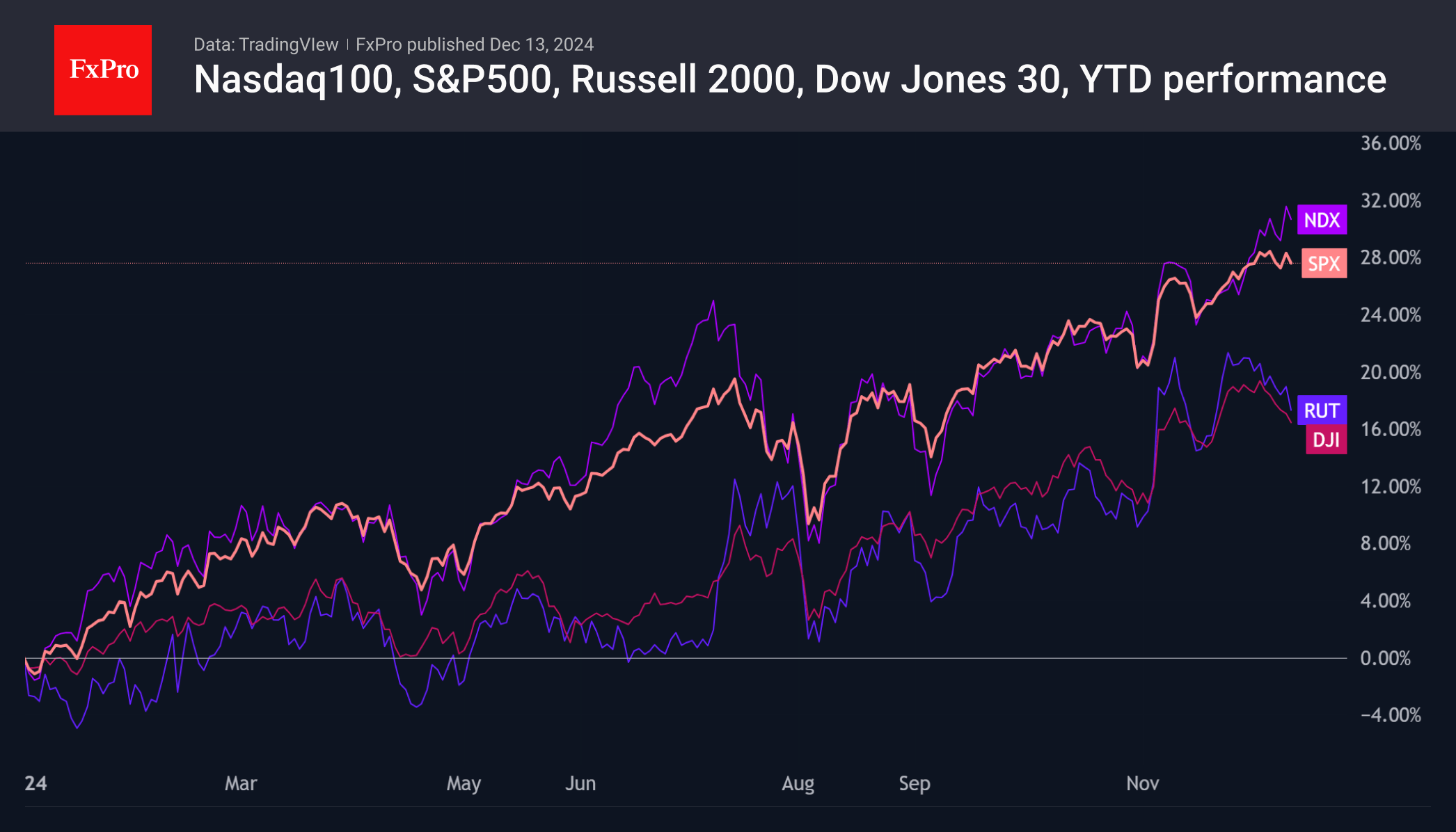

The recent declines in US indices may have broken the bullish trend, indicated by technical signals. The S&P500 and Nasdaq100 are still fighting to maintain their upward trends. The overall outlook will become clearer by the end of the year.

December 23, 2024

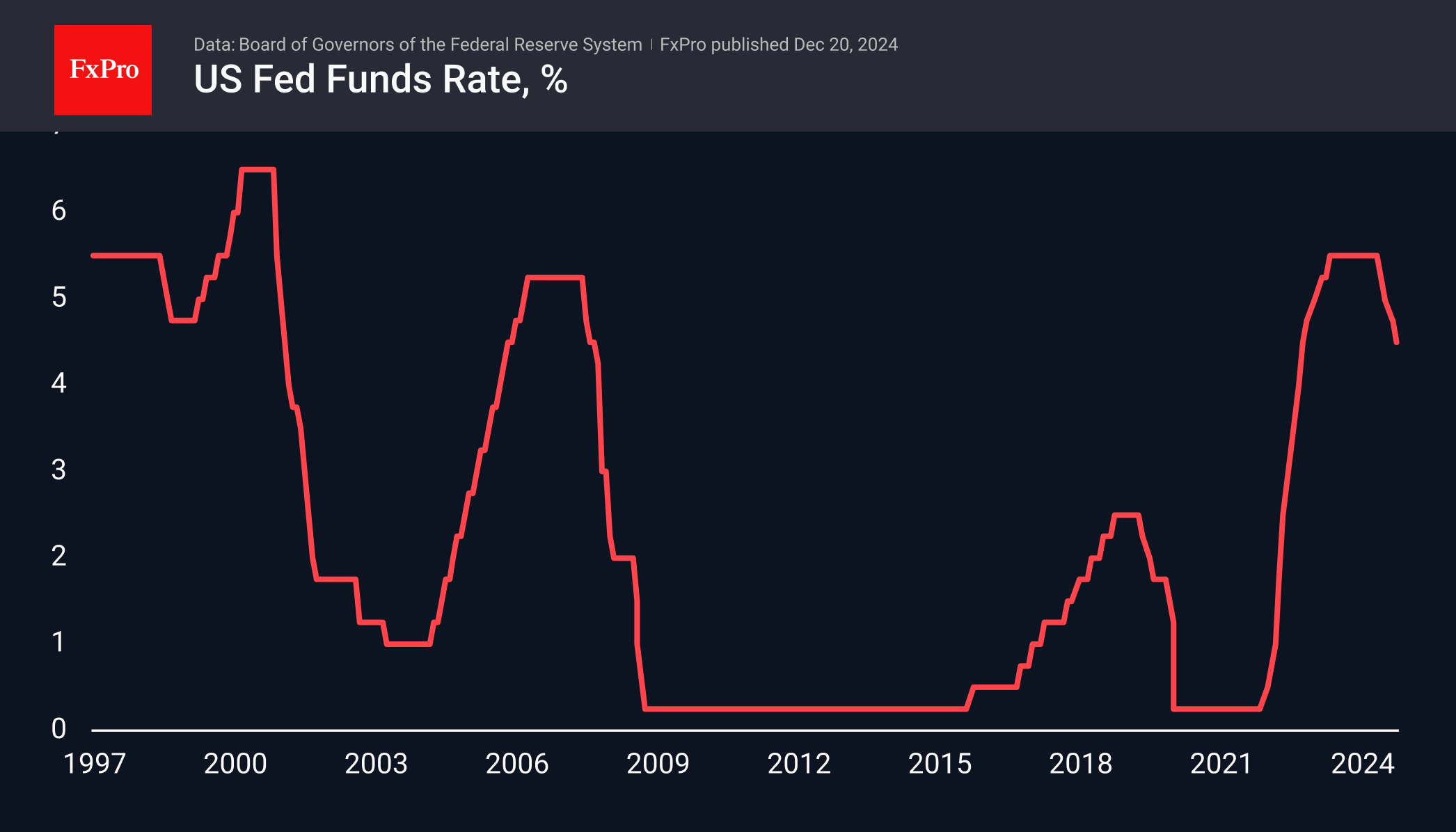

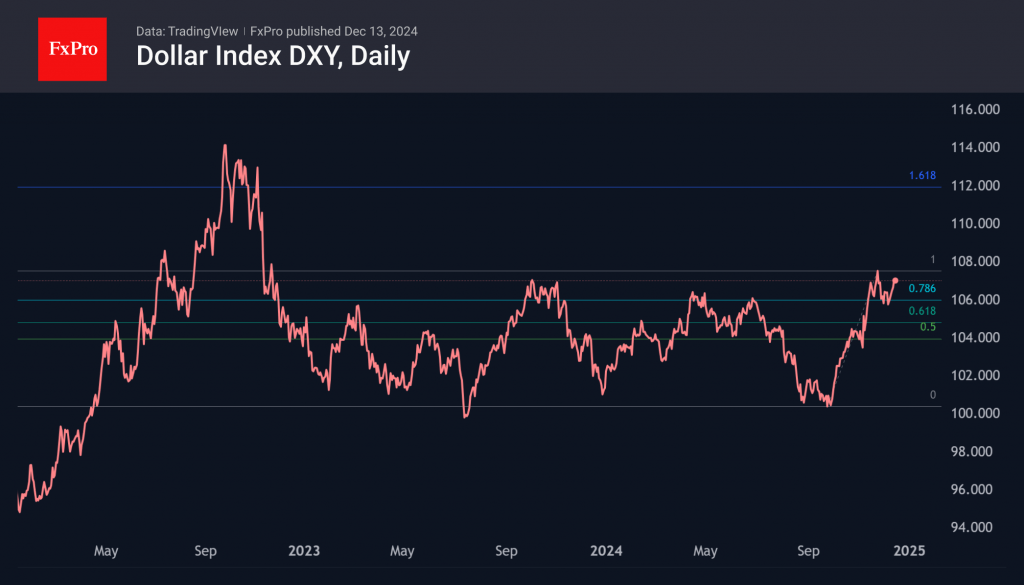

The dollar has paused its strengthening, as weaker-than-expected inflation data reduces fear of future Fed monetary policy. This short-term effect is unlikely to change the direction of the dollar's trend.

December 20, 2024

The US dollar is at two-year highs. Factors such as changes in the Fed's monetary policy and market speculation are driving its rise. The dollar's strength is also impacting EURUSD, which may continue to decline.

December 16, 2024

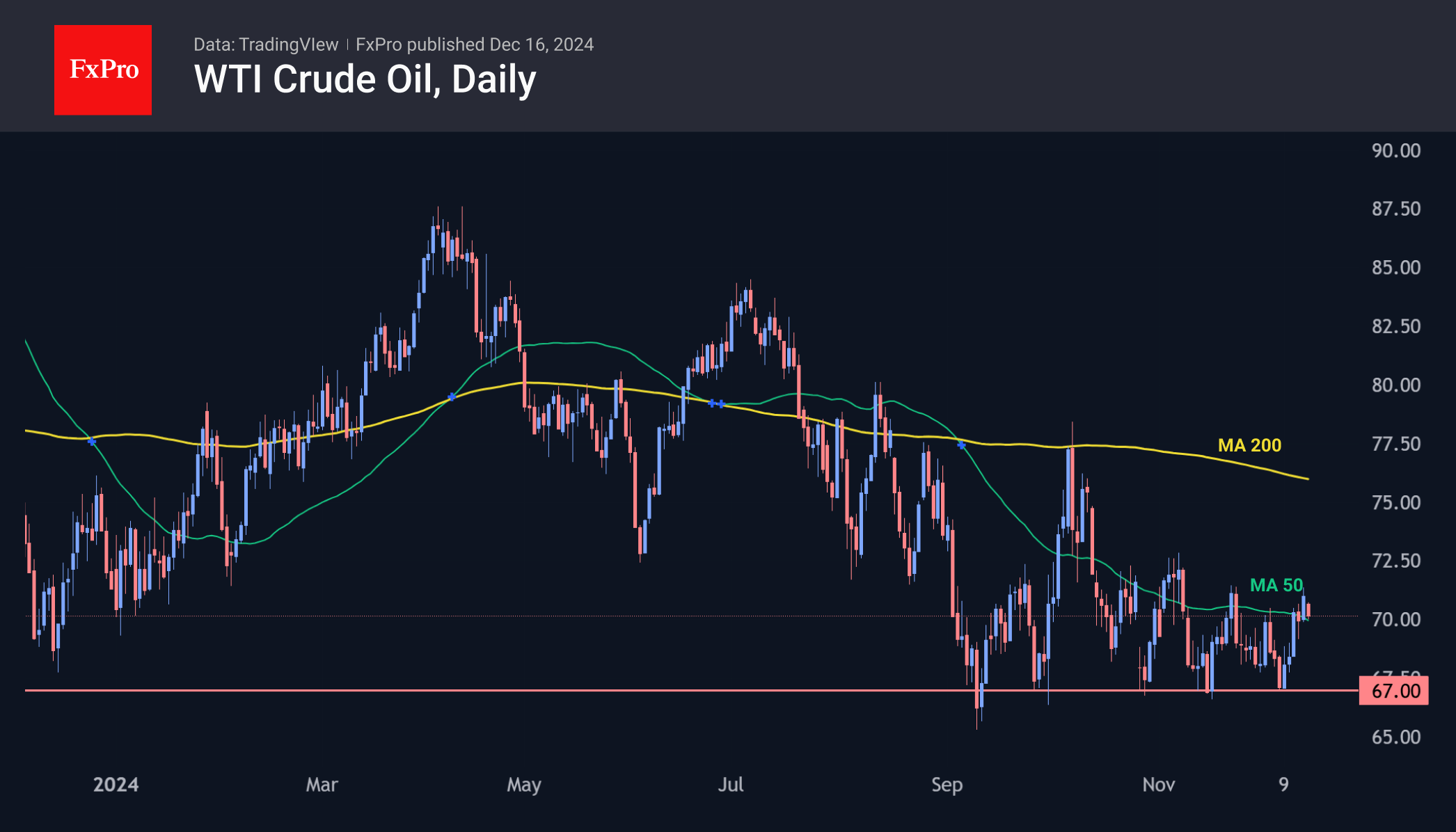

The price of WTI crude oil is at risk of falling below $70, despite OPEC+ postpones a production increase. US production has reached a new record, making it difficult for OPEC+ to regain market share.

December 16, 2024

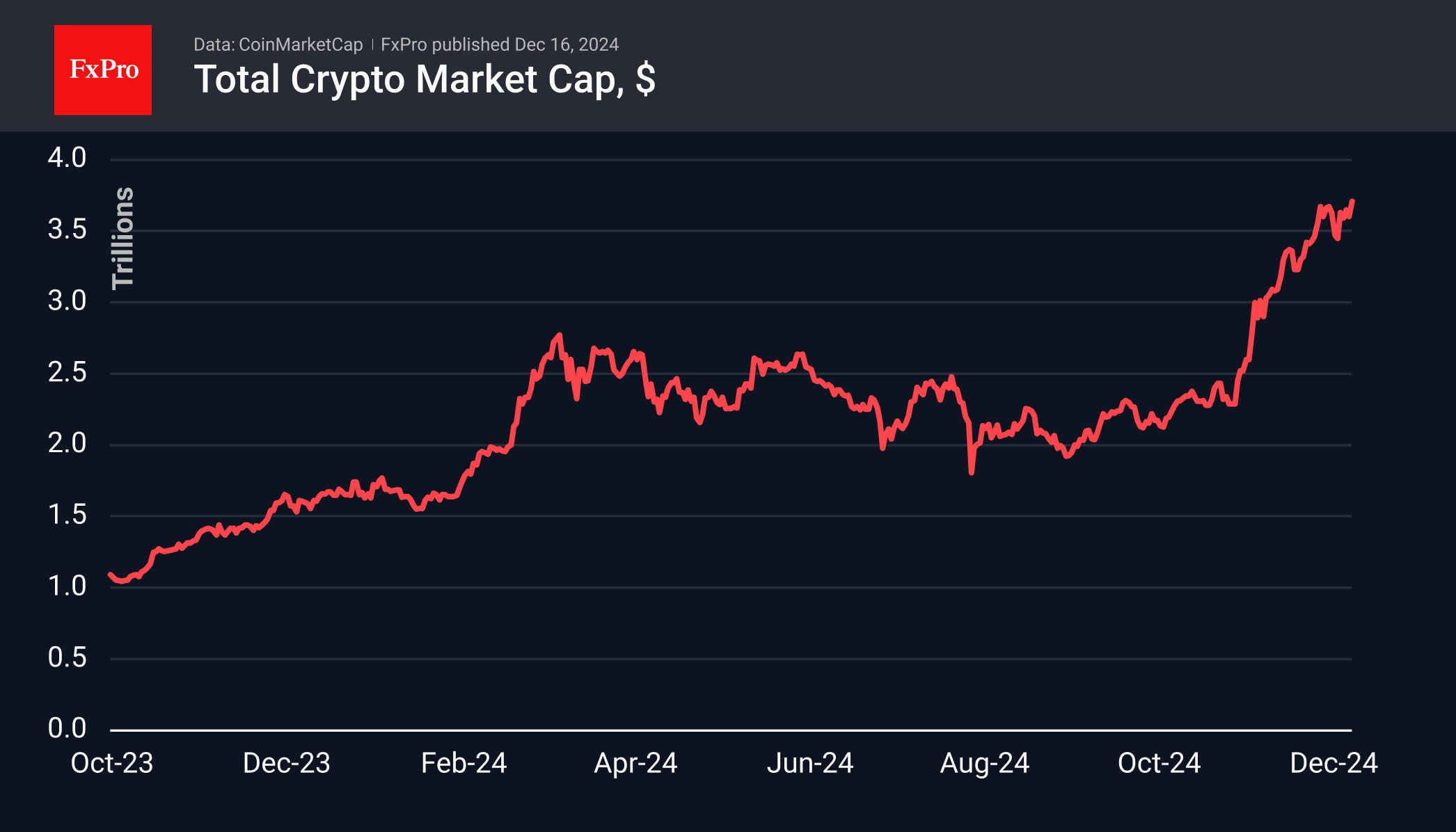

Bitcoin has surpassed resistance from sellers and the cryptocurrency market's capitalization reached $3.71 trillion. Institutional interest in Bitcoin is growing, with states in the US considering creating strategic Bitcoin reserves.

December 13, 2024

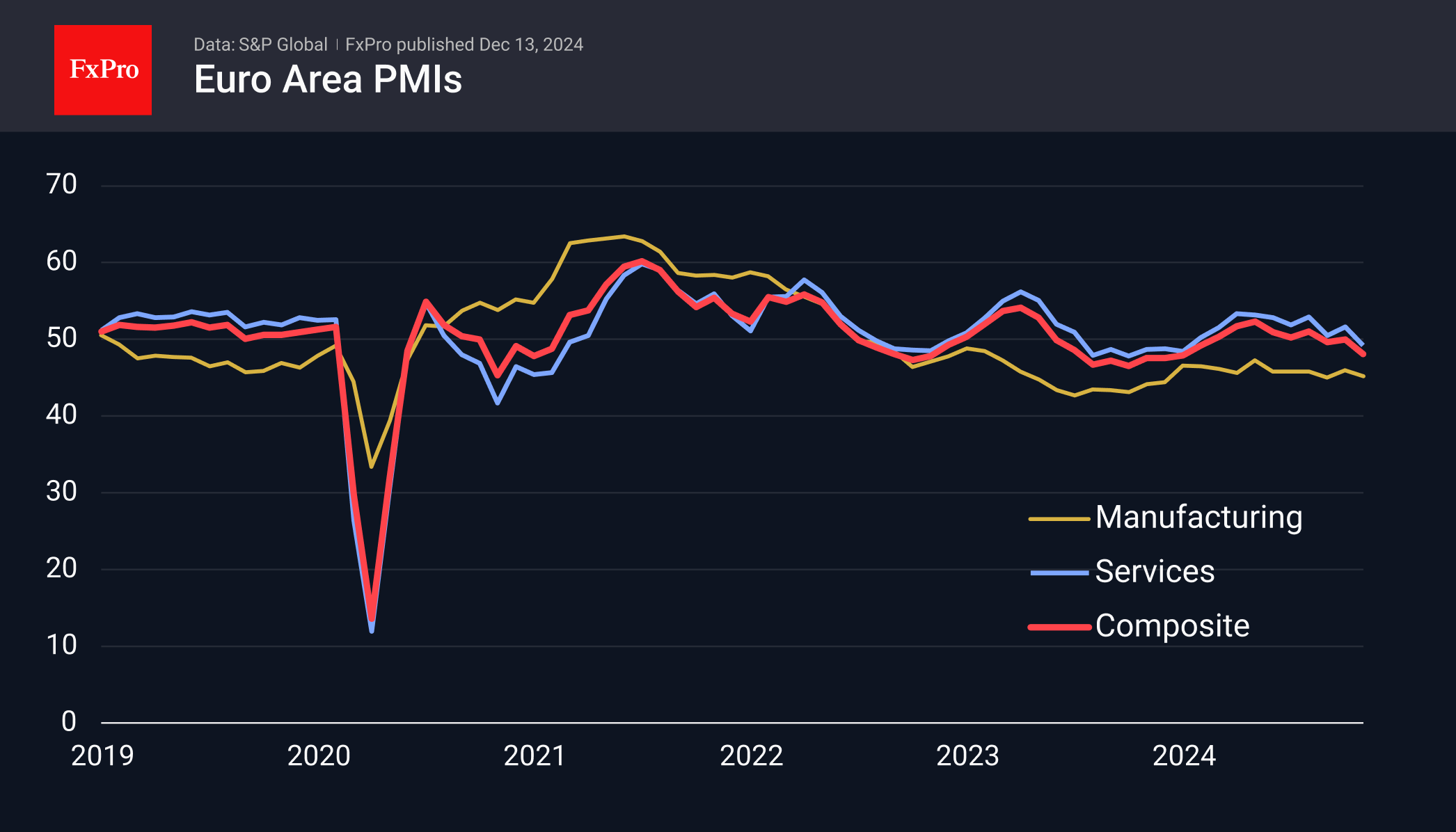

Key events include PMI business activity estimates for Europe, US retail sales and industrial production figures, Canadian inflation data, and the much-anticipated decisions by the Fed and the BoE.

December 13, 2024

he dollar's rise in the latest week weighed on the Dow Jones and Russell 2000 indices, but not hurt Nasdaq100

December 13, 2024

The US dollar is experiencing a new surge of growth, driven by positive macroeconomic data and expectations of a Fed rate cut. However, uncertainty over trade wars and inflation risks remain.

December 13, 2024

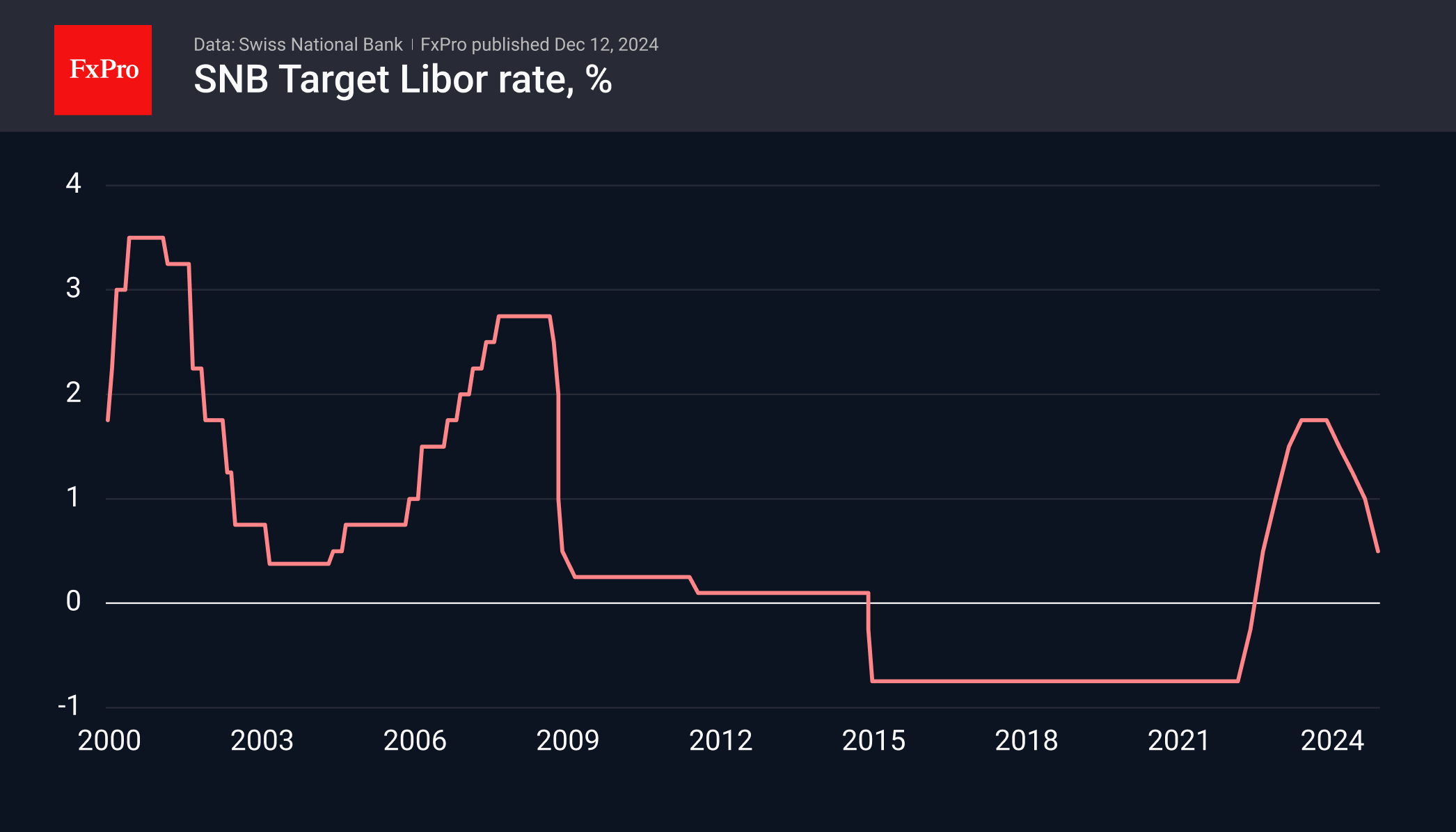

The Swiss National Bank has cut its key rate to 0.5% and is cautious in its actions due to subdued inflation. The franc's strength is evident in crosses, and FX intervention may be the next option. Active traders should monitor EURCHF for possible rate hikes.

December 11, 2024

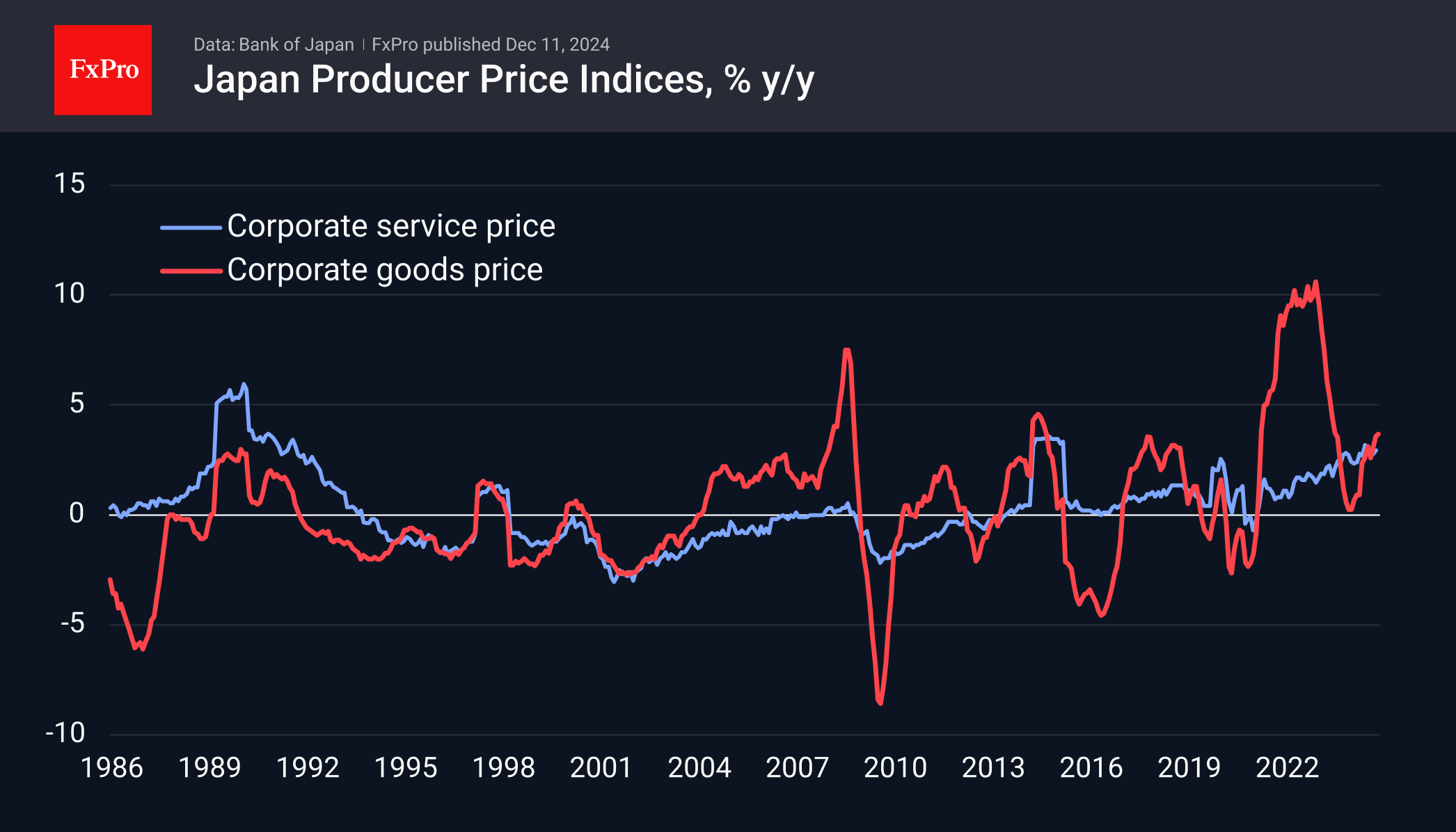

USDJPY is rising due to changing rate expectations, as investors doubt rate hikes in Japan and expect fewer rate cuts from the Fed. Accelerating inflation in Japan is not supporting the yen.

December 10, 2024

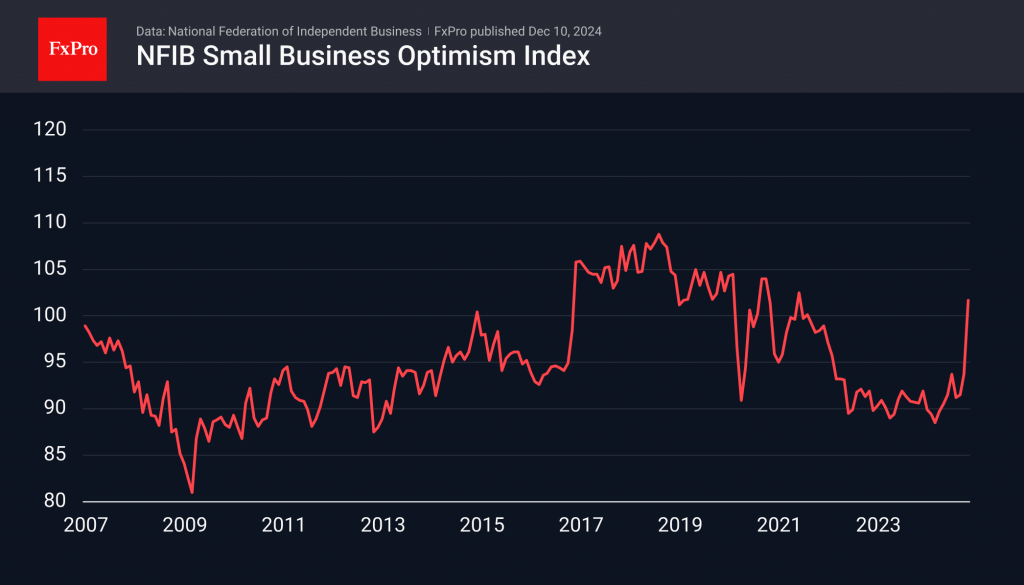

Since the last US election, small businesses have become more optimistic, with the Small Business Optimism Index rising by eight points. This optimism is due to the expected improvement in the economy and promises of protectionist policies and tax relief.