Market Overview - Page 311

August 11, 2020

And as the bits settle, the proof-of-work blockchain’s future remains in question more than ever. The first attack occurred on Aug. 1, the network’s second ever. Five days later, a second 51% attack followed the news that the first had.

August 11, 2020

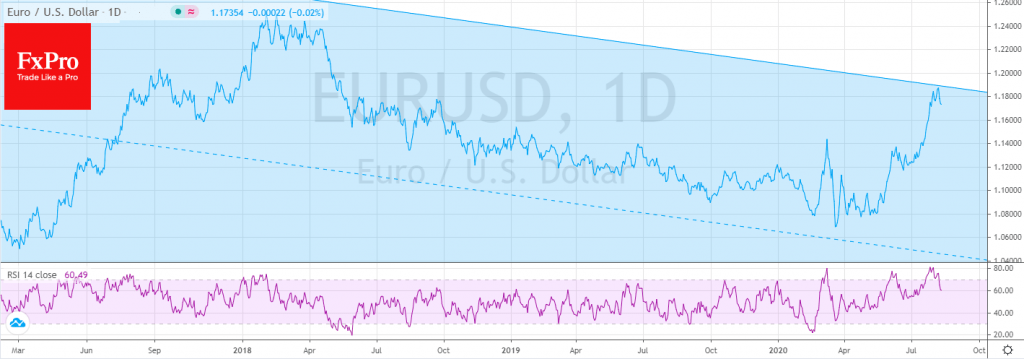

Cautious optimism prevails in the markets at the beginning of the week, if we exclude a couple of worrying signs for investors. A wave of purchases continues in the stock markets. Risk-sensitive GBP and AUD on Tuesday morning added about.

August 11, 2020

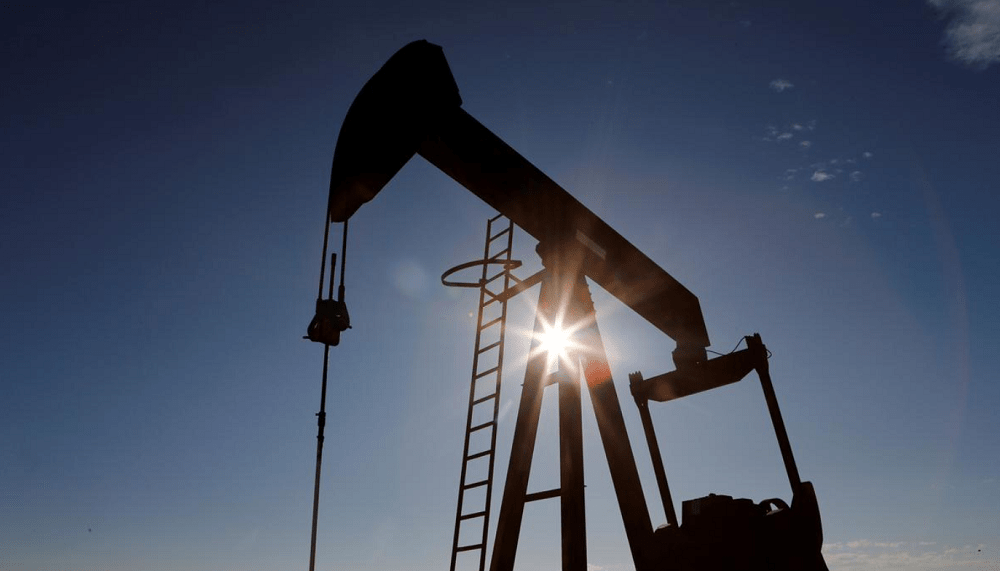

Crude oil gained more ground on Tuesday, with prices underpinned by expectations of U.S. stimulus and a rebound in Asian demand as economies reopen. Brent crude added 22 cents, or 0.5%, to $45.21 a barrel, as of 0441 GMT. West.

August 11, 2020

The number of people in work in Britain fell by the most since 2009 in the three months through June as the coronavirus crisis took a heavy toll on the labour market, even with the government’s huge jobs protection scheme.

August 11, 2020

China has unveiled a slew of policies to help boost its domestic semiconductor industry as tensions with the U.S. continue to rise, but analysts have cast doubt over whether they will have a major impact. A large part of the.

August 11, 2020

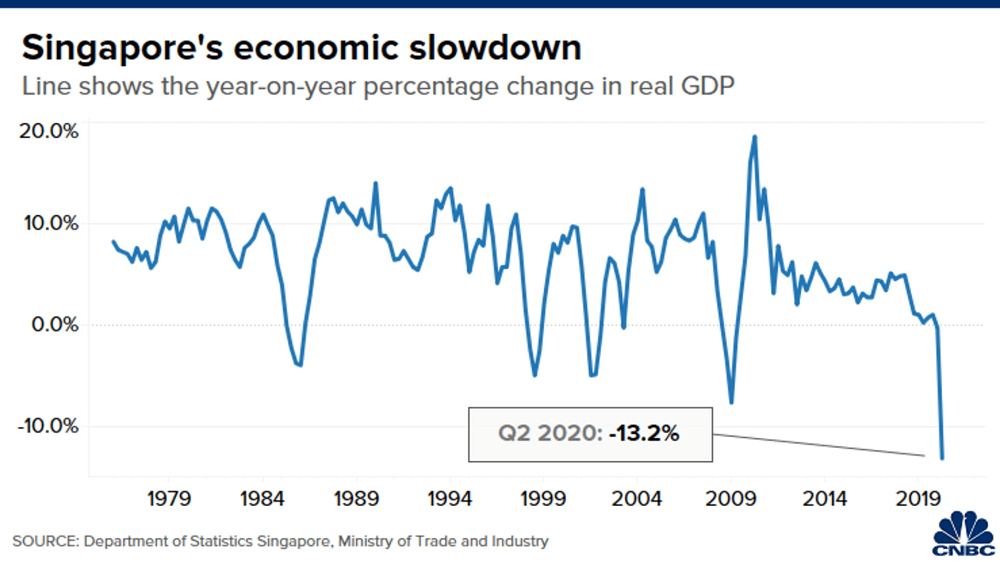

Singapore on Tuesday reported that its economy contracted more than initially expected and narrowed its economic forecast for the full year of 2020. The Singapore economy contracted by 42.9% in the second quarter of 2020 compared to the previous quarter.

August 10, 2020

Although over two months have passed since the halving happened on the Bitcoin network, the crypto mining industry is still heaving from the frantic pace of events that have followed suit. The rollercoaster of hash rates has left Bitcoin (BTC).

August 10, 2020

The Dow climbed 3.8% last week to end with its best weekly performance since June. We kick things off on Monday with more of the same on Wall Street. The Dow Jones Industrial Average (DJIA) rocketed more than 200 points.

August 10, 2020

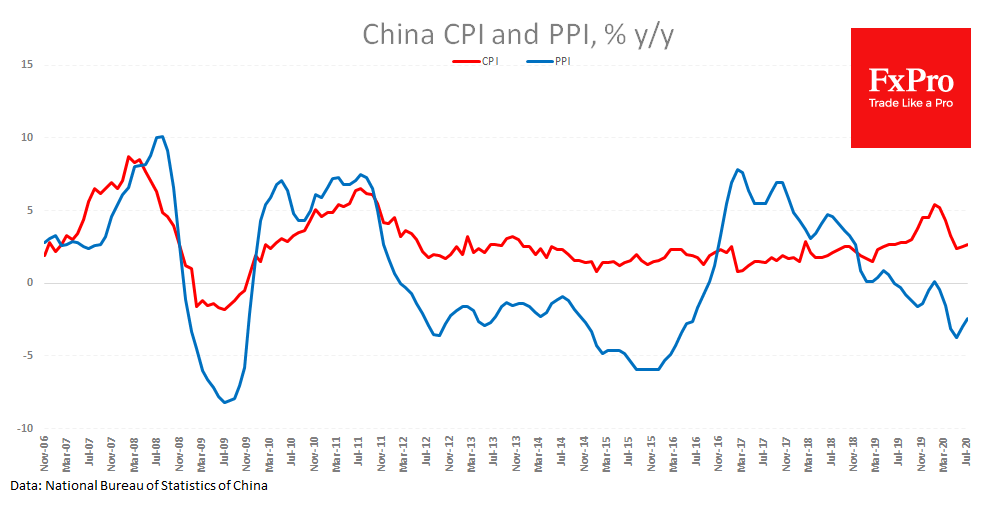

We continue to see a rapid recovery in inflation across the Globe. This factor could severely restrict the actions of the Central Bank in the coming months, thus delaying recovery. This time, the data from China has exceeded expectations. CPI.

August 10, 2020

It’s shaping up to be another rough day for Turkish markets. The lira, which sank to a record low last week as the central bank abandoned some of the policies that had underpinned it for much of this year, extended.

August 10, 2020

Microsoft Corp. founder and billionaire philanthropist Bill Gates said it’s “mind-blowing” that the US government hasn’t improved Covid-19 testing that he described as slow and lacking fair access. “You’re paying billions of dollars in this very inequitable way to get.