Market Overview - Page 31

January 20, 2025

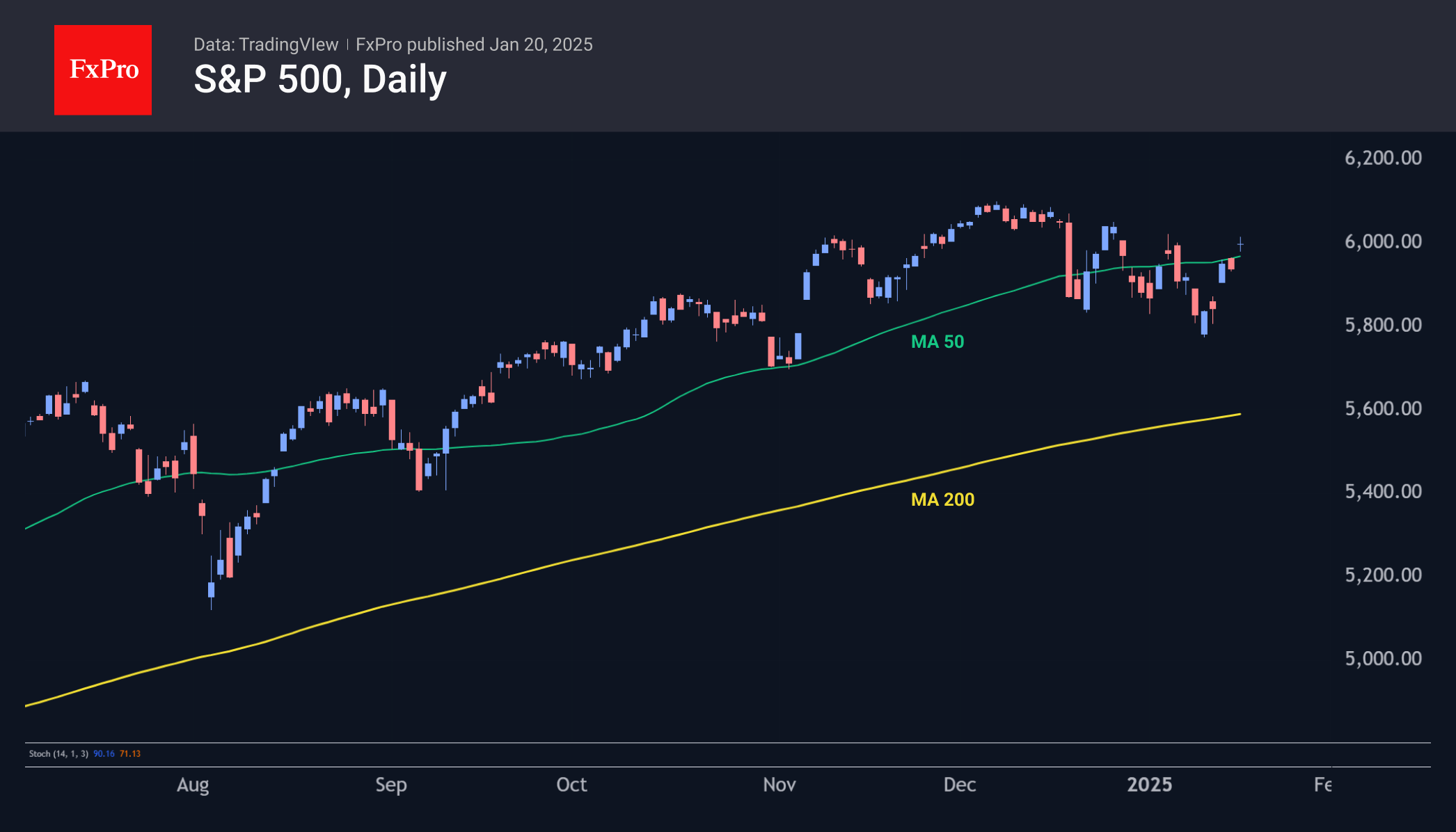

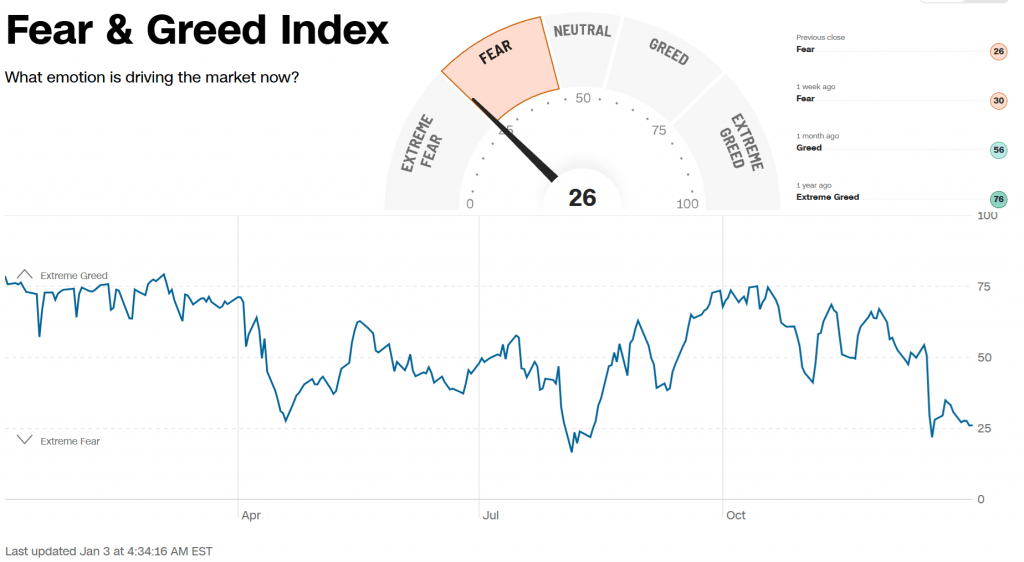

Despite fear driving stock markets recently, the sentiment index suggests further upside potential for stocks. Stronger stocks could lead to broader market gains.

January 17, 2025

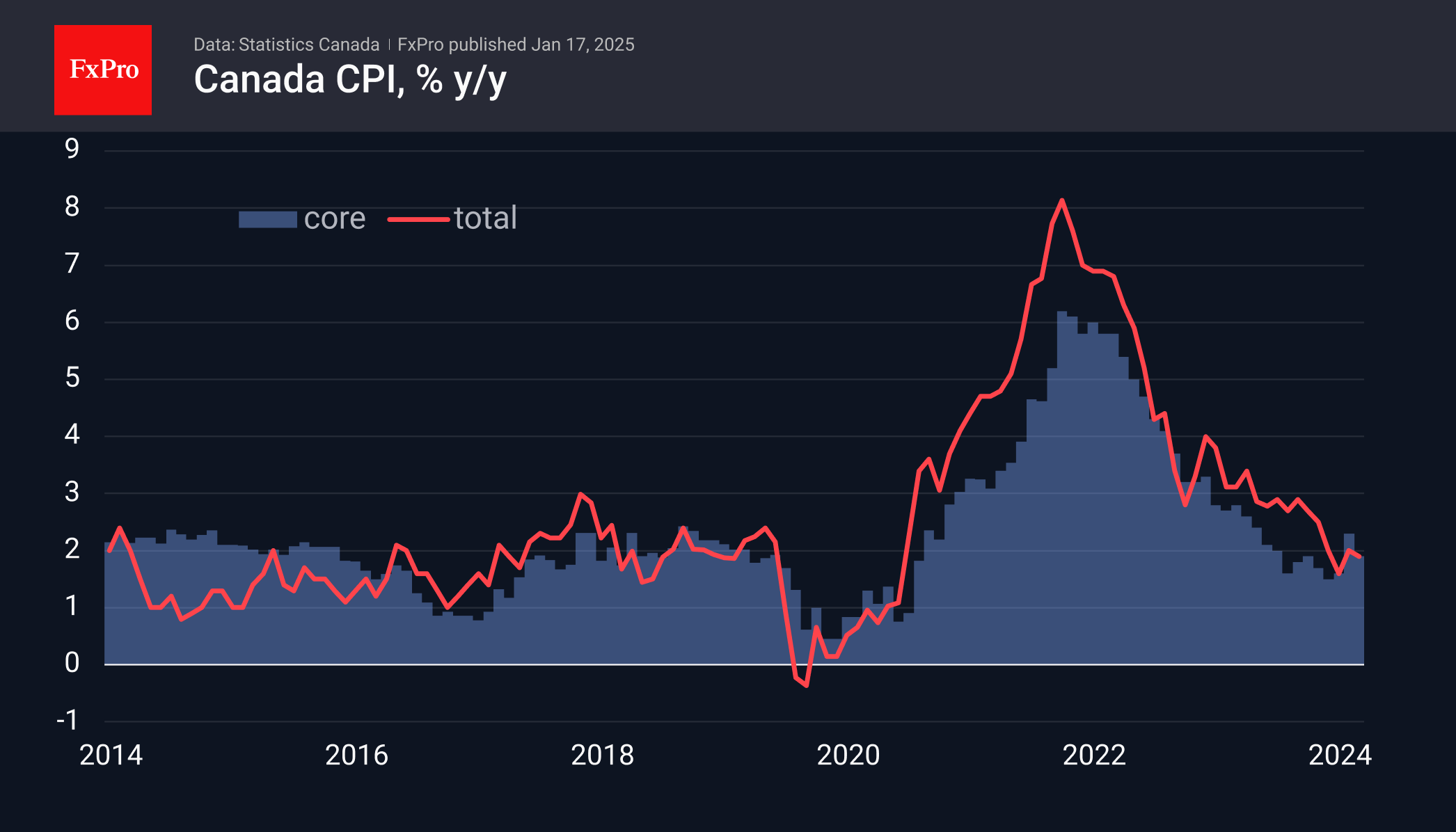

US markets will be closed on Monday for Martin Luther King Day, affecting trading hours. Trump's inauguration may influence FX and global stocks. On Tuesday, the CAD may be influenced by CPI data. On Friday worth noting BoJ rate decision and EU PMI Flash releases.

January 17, 2025

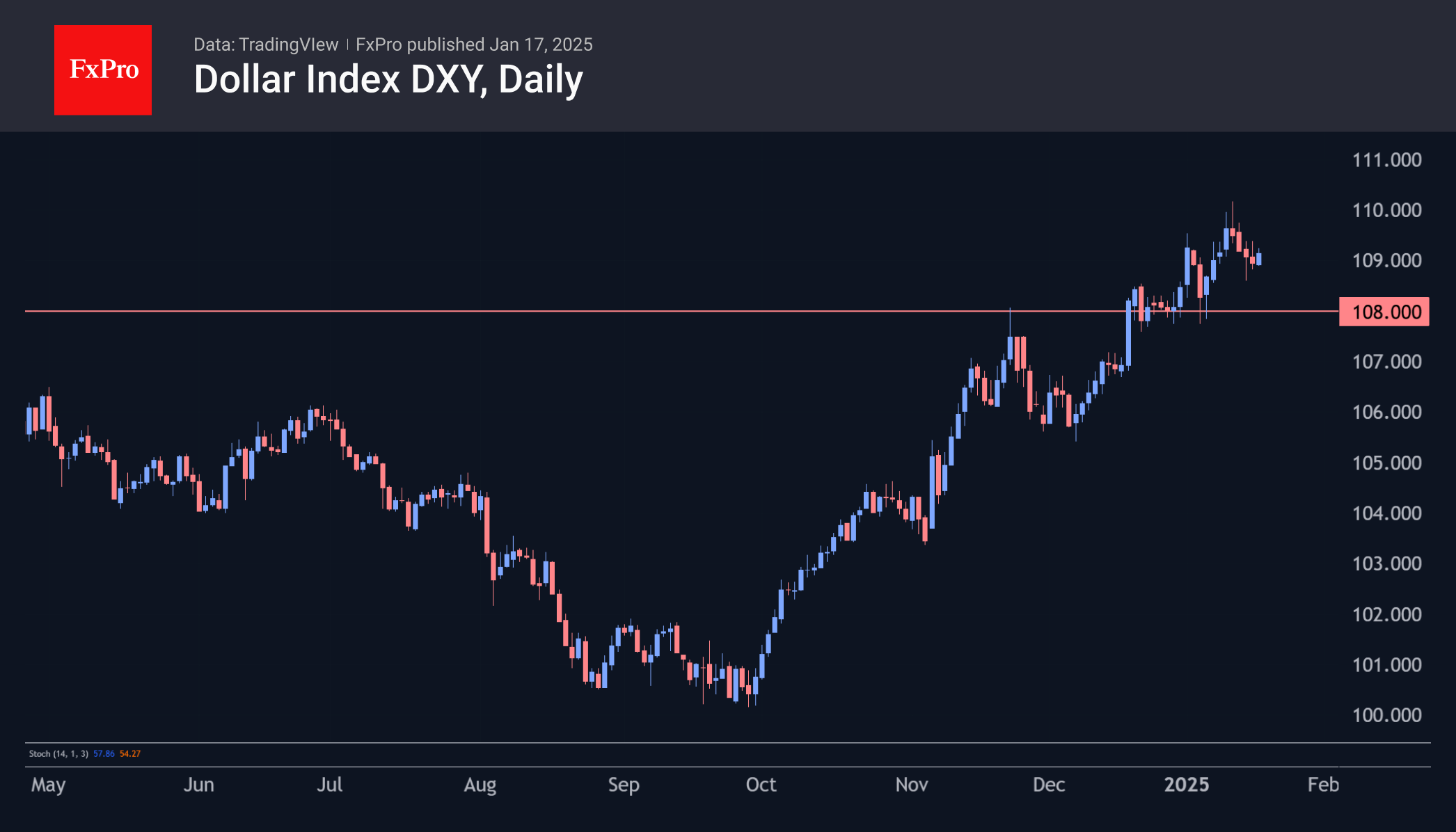

The US dollar initially rose but came under pressure throughout the week. Chances that Fed will not cut rate this year has decreased. US indices experienced a correction but have since grown due to softer inflation figures.

January 15, 2025

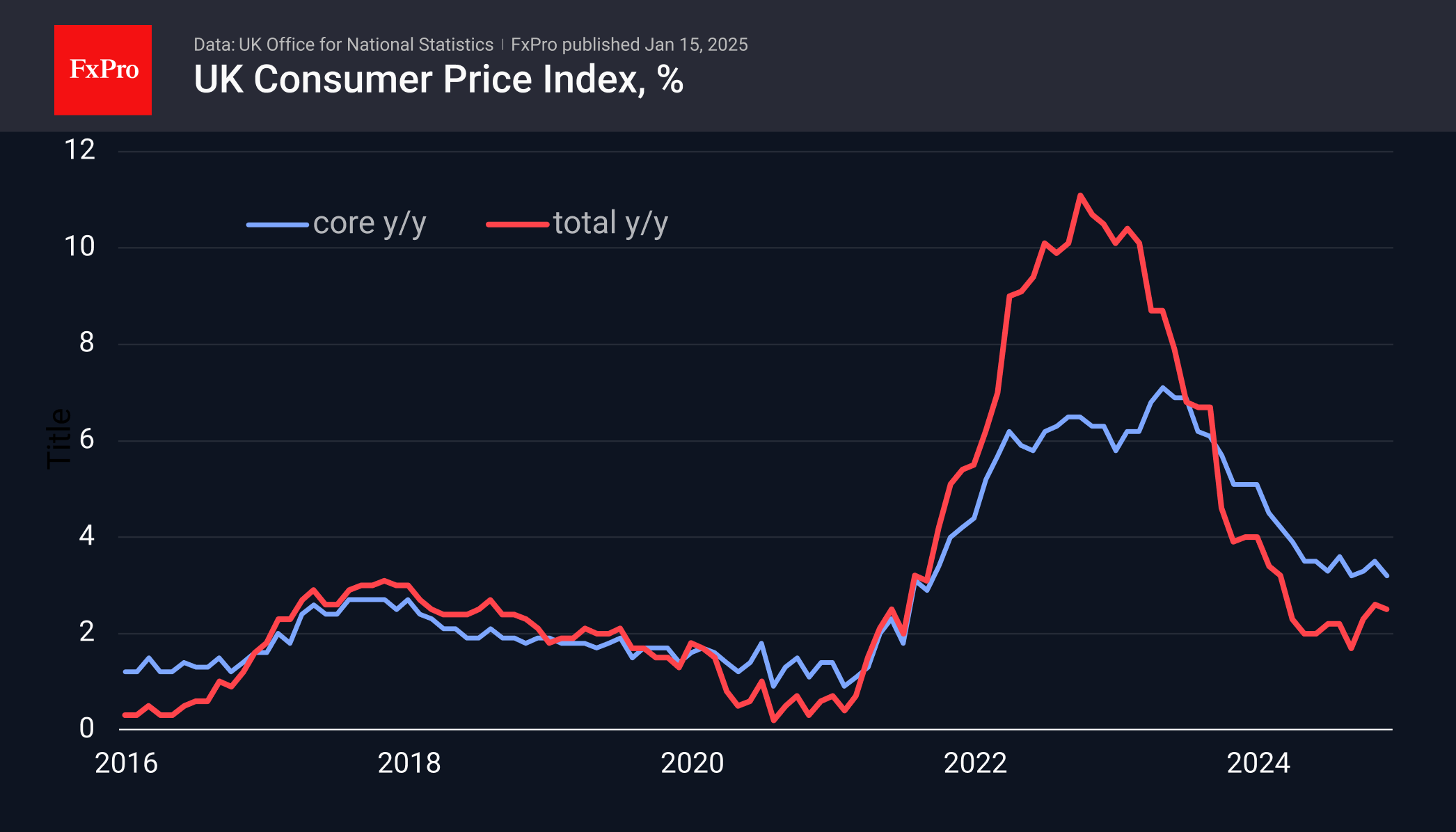

UK inflation in December was slightly below expectations at 0.3%, but still remained above the target range at 2.5% annually. Core consumer inflation also remained high at 3.2%, indicating a lack of downward trend.

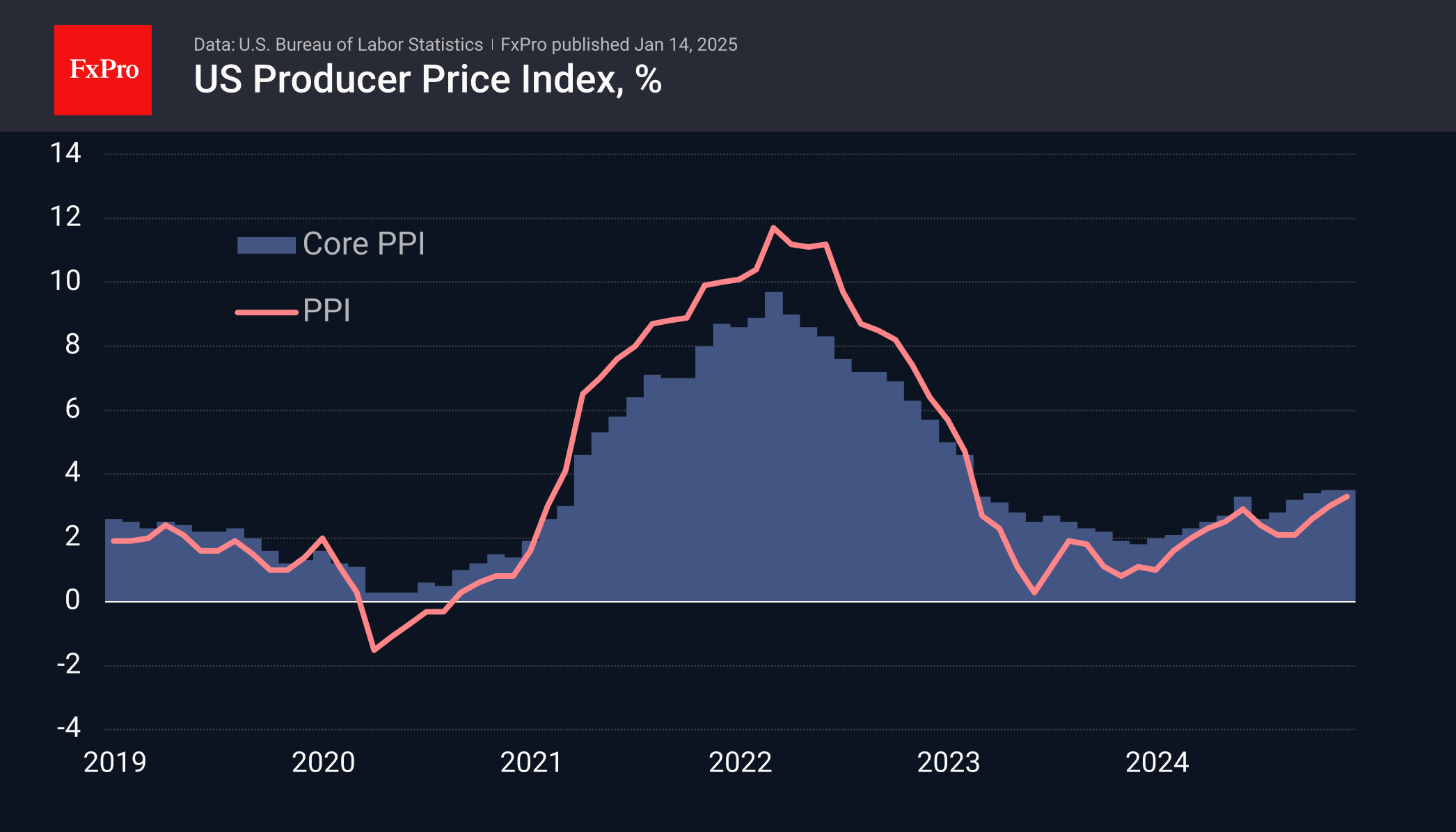

January 14, 2025

US producer prices rose at a slower pace in December, easing fears of tight monetary policy. The softer report may indicate the beginning of a reversal in Fed policy, potentially impacting the dollar.

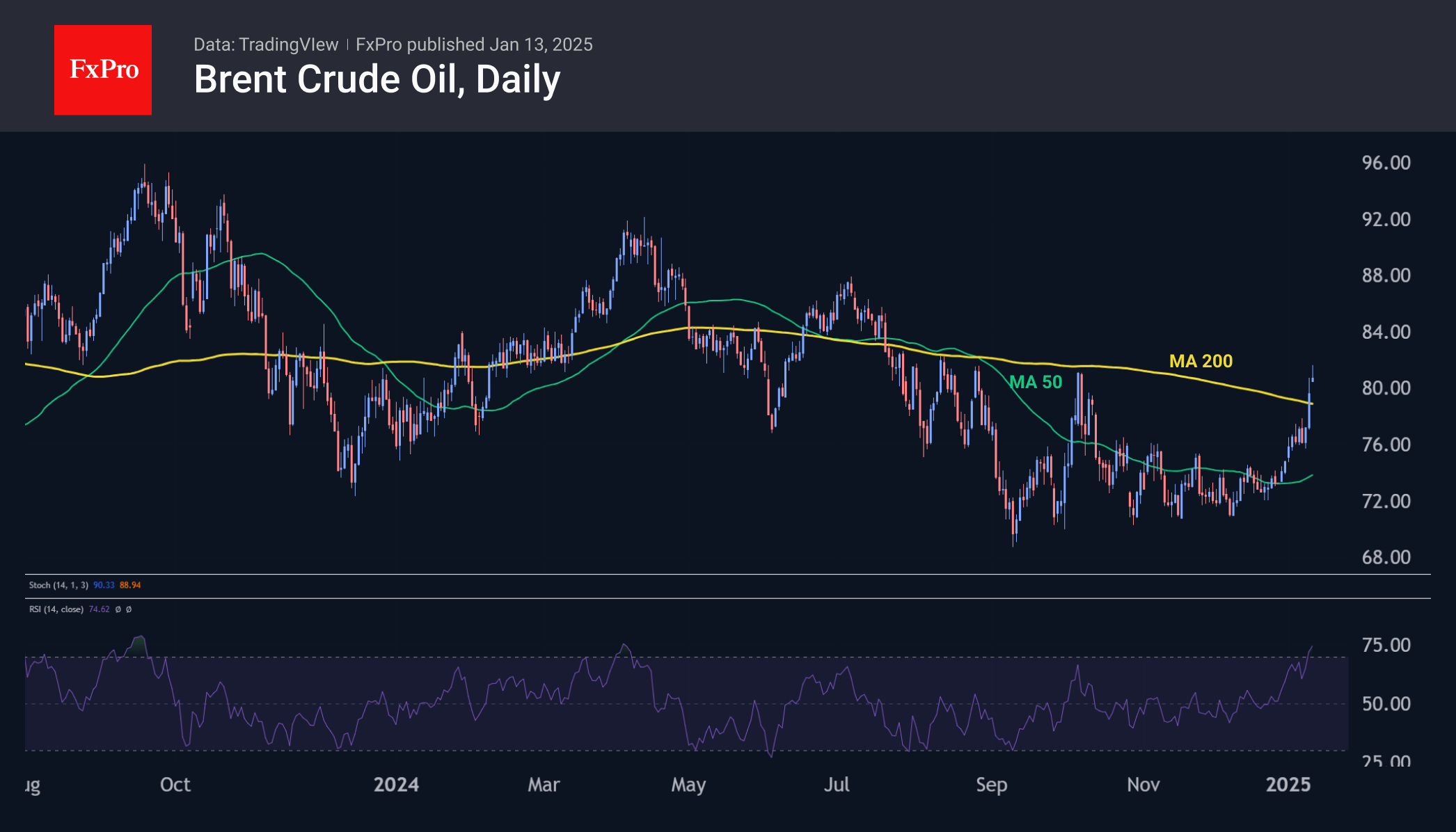

January 13, 2025

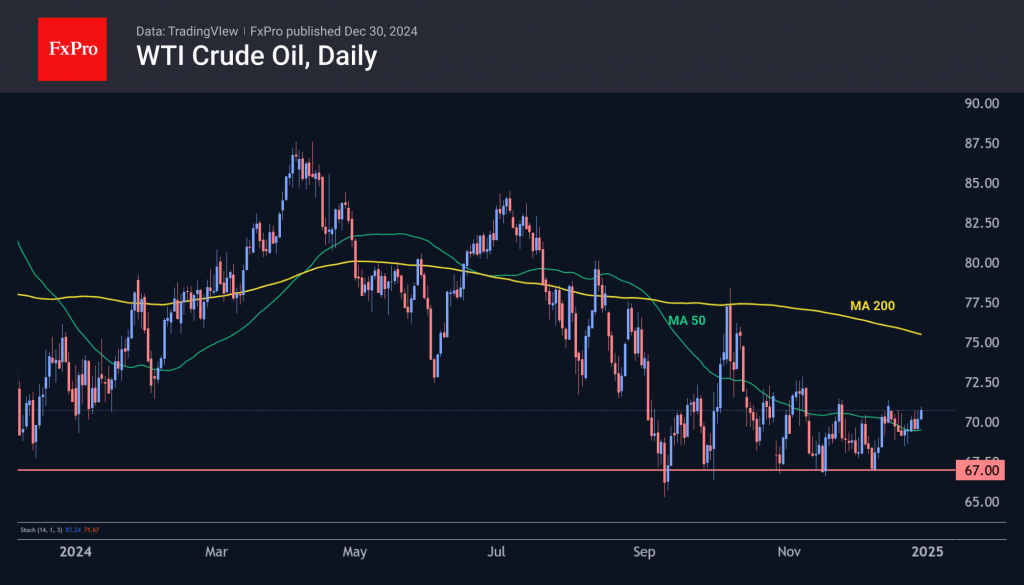

Oil prices are rising due to various temporary bullish factors, including tightening sanctions on Russia's oil sector, adverse weather impacting supply, and declining inventories in the US. Brent oil is approaching the 200-week MA, a significant test for bulls

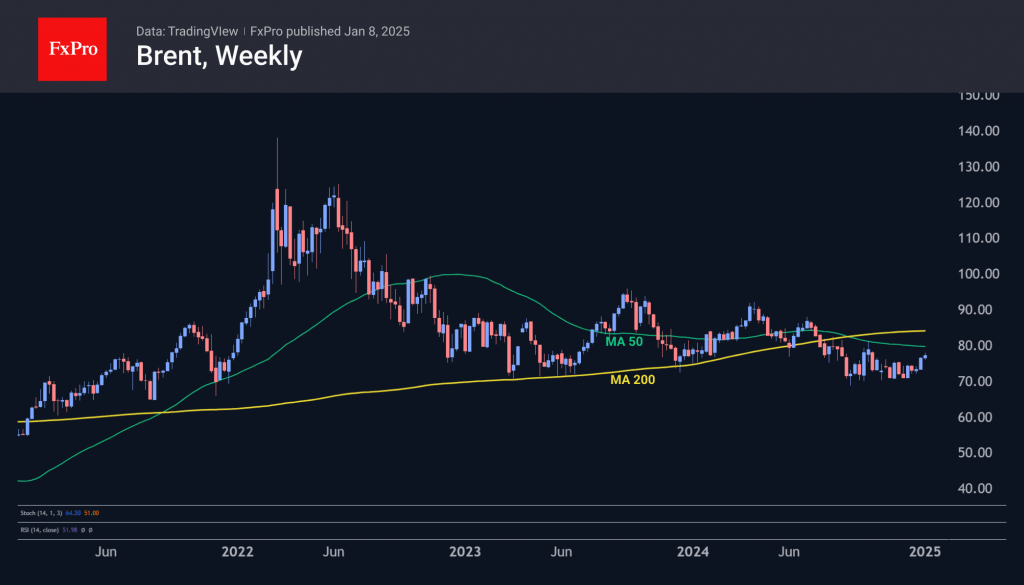

January 8, 2025

Oil prices are rising due to stronger than expected economic data from the US, the ban on offshore oil drilling, and a decline in commercial inventories. If prices surpass certain levels, it could signal a reversal to sustained growth.

January 6, 2025

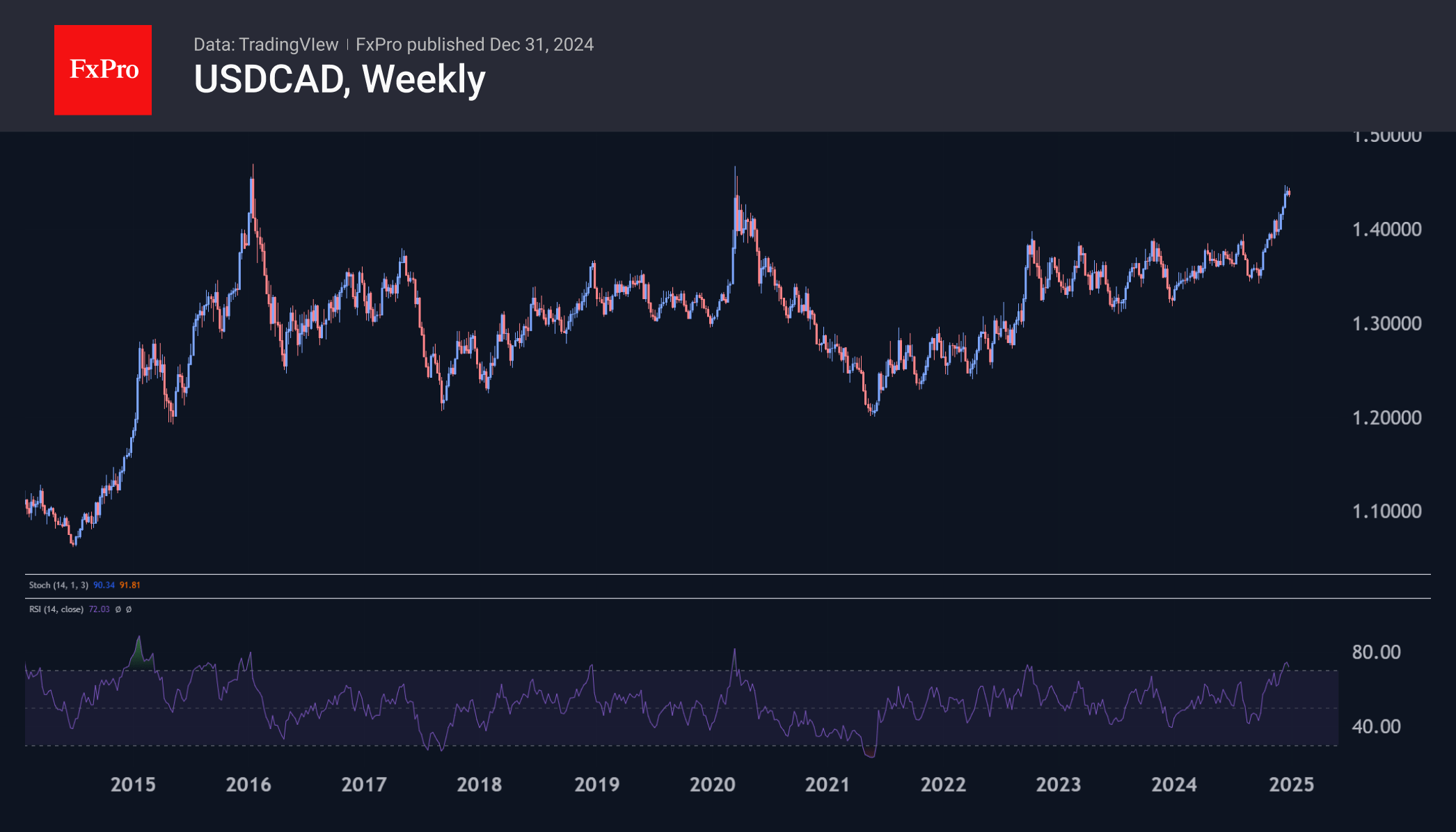

The CAD is increasing against the USD due to reports of Canadian Prime Minister Justin Trudeau possibly resigning, leading to optimism for economic growth under new leadership.

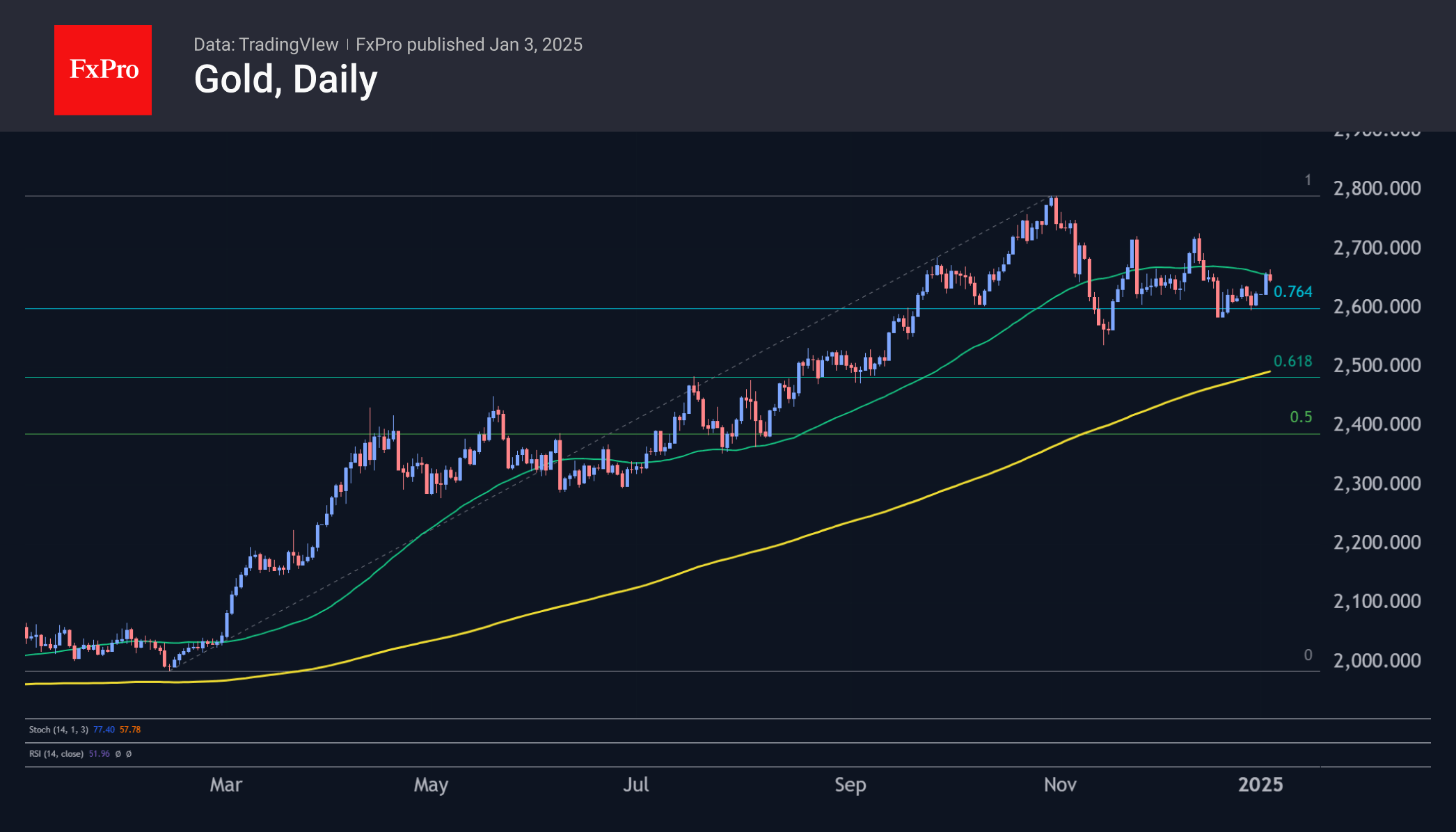

January 3, 2025

The technical picture for gold is mixed, but a dip below the 50-day moving average suggests a bearish signal. However, a longer-term view suggests a potential growth to $3400 if $2800 highs are overcome.

January 3, 2025

The US stock market is starting the year in a state of fear, as reflected by the sentiment index. The reversal of Fed rhetoric and low probability of policy easing have contributed to a decline in the S&P500.

December 31, 2024

The Canadian dollar may strengthen as the extended rally in USDCAD loses momentum. A corrective pullback of around 2% is expected, with potential for a long-term trend reversal.