Market Overview - Page 309

August 17, 2020

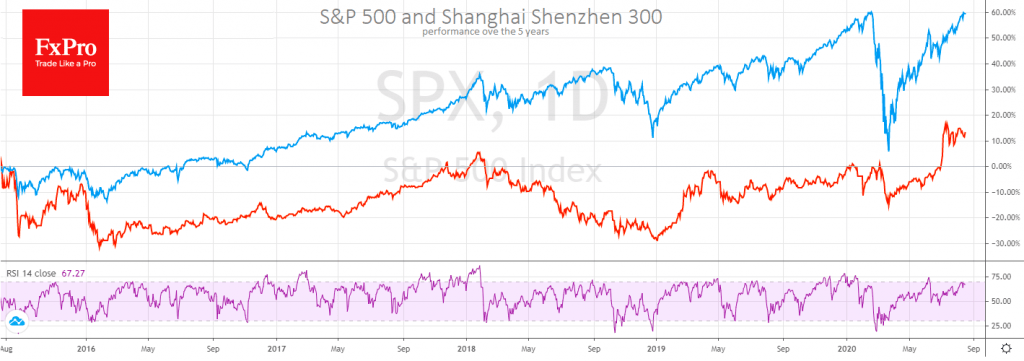

Chinese markets are adding 2-3% on Monday morning after reports that the People’s Bank of China will expand medium-term lending for the financial system. The promise of capital feeds the growth of Chinese markets. For Europe and the US, this.

August 14, 2020

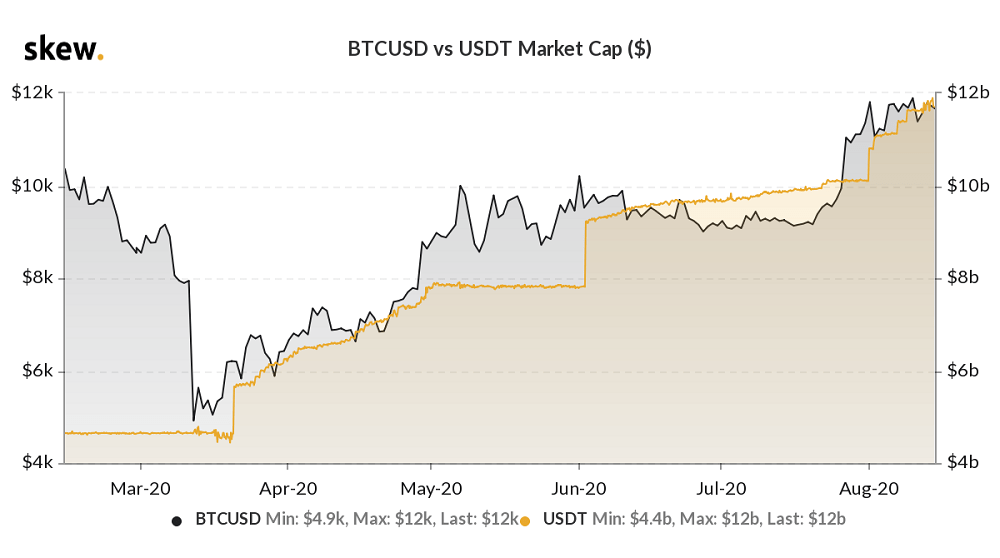

The market capitalization of Tether (USDT) surpassed $12 billion as of Aug. 14, according to cryptocurrency market analytics firm Coinmetrics. Meanwhile, some believe the rapidly-rising valuation of the dominant stablecoin positively benefits Bitcoin (BTC) in the long term. But some.

August 14, 2020

If this summer was supposed to offer hope that coronavirus was under control in Europe, spikes in cases across the continent and ensuing travel chaos have given governments a worrying reality check. From France down to Ukraine, the number of.

August 14, 2020

U.S. futures edged lower ahead of retail sales data for July, while European stocks slumped as fresh quarantine rules took hold in the U.K. Treasury yields declined after rising for five days and the dollar was steady. The Stoxx Europe.

August 14, 2020

The euro zone’s trade surplus with the rest of the world ballooned in June to 21.2 billion euros ($25 billion) as the bloc’s drop in imports of goods outpaced the fall of exports amid a global slide in trade due.

August 14, 2020

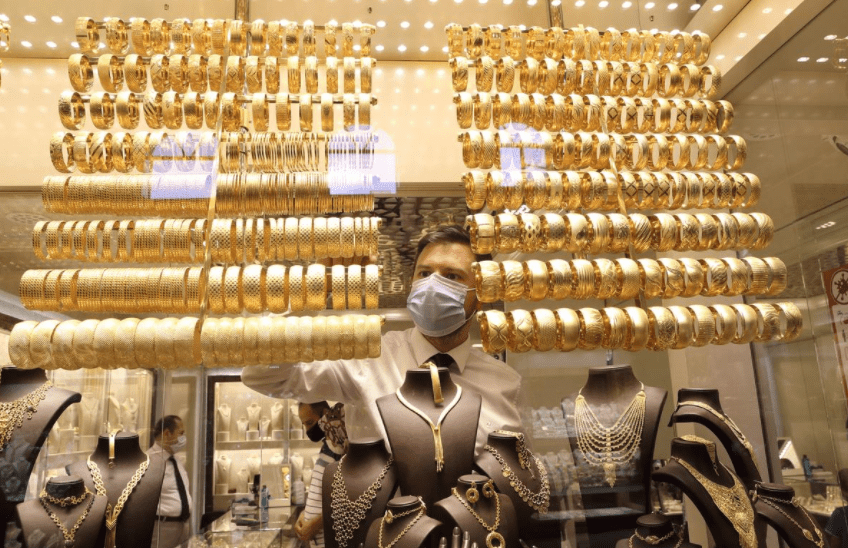

Hasan Ayhan followed his wife’s instructions last week and took their savings to buy gold at Istanbul’s Grand Bazaar as Turks scooped up bullion worth $7 billion in a just a fortnight. With memories of a currency crisis which rocked.

August 14, 2020

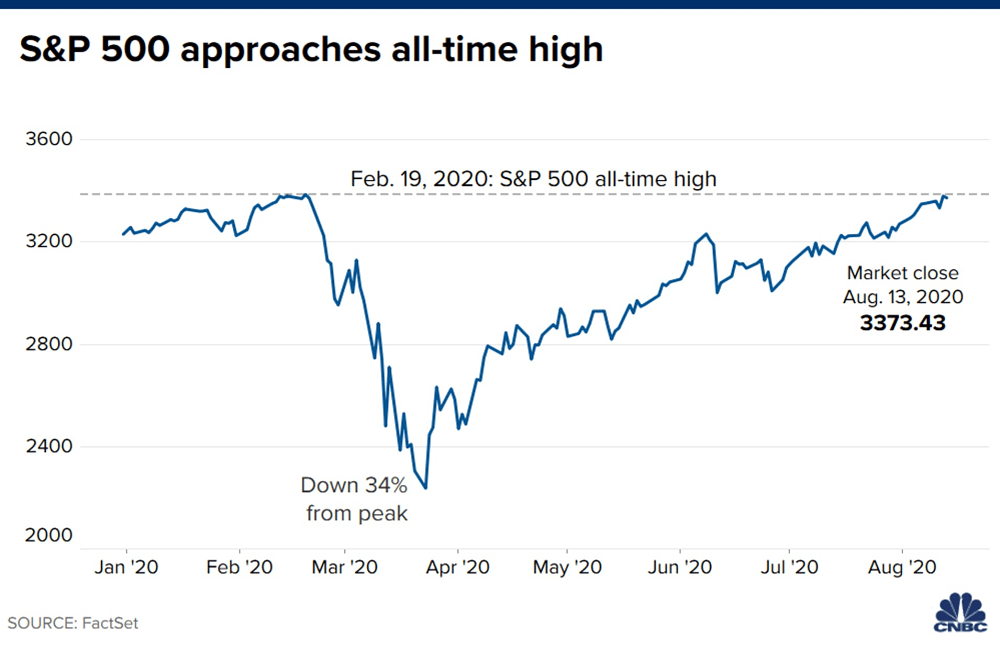

U.S. stock futures retreated early Friday morning as the S&P 500 struggles to break past its record high from February. Dow Jones Industrial Average futures fell 119 points, or 0.4%. S&P 500 futures lost 0.2%. Nasdaq 100 futures were flat..

August 14, 2020

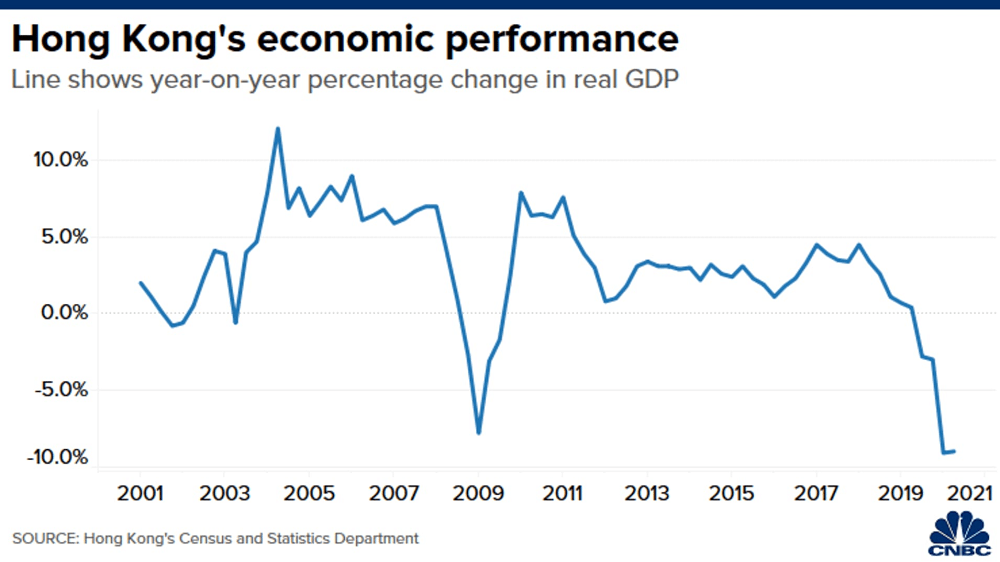

Hong Kong’s government downgraded its full-year economic forecast on Friday after a recent flare up in coronavirus cases threatened to further derail the city’s economy. The government now expects the city’s economy to shrink by between 6% and 8% in.

August 14, 2020

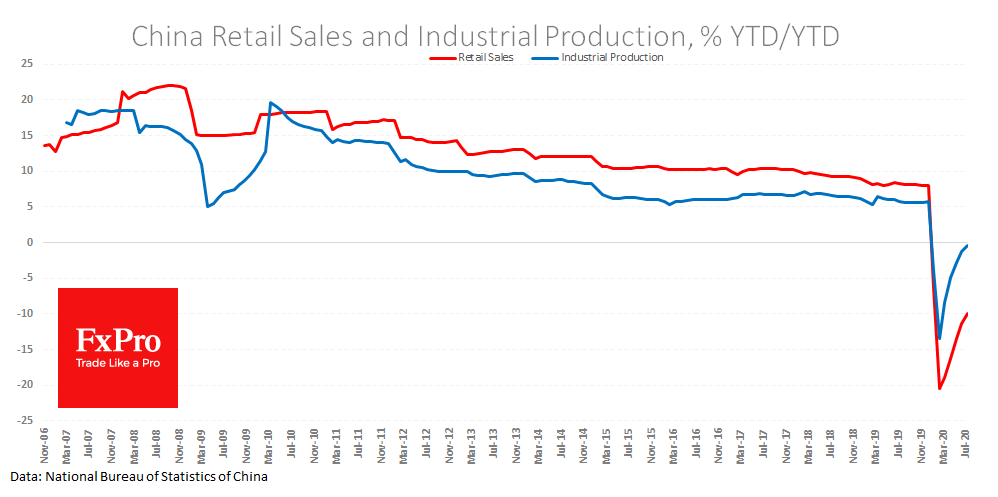

The markets returned to caution Friday, which can be explained by the frustration with new Chinese data, but also by the caution of investors after unsuccessful attempts to develop growth in certain markets. Overall, the recovery of the economy and.

August 13, 2020

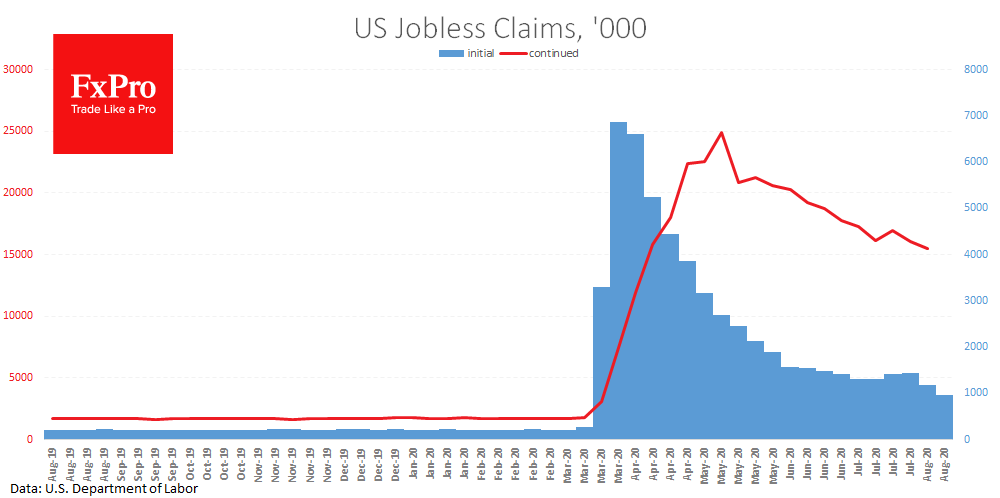

First-time claims for unemployment insurance last week fell below 1 million for the first time since March 21 in a sign that the labor market is continuing its recovery from the coronavirus pandemic. The total claims of 963,000 for the.

August 13, 2020

The Turkish lira has depreciated rapidly since the turn of the year, recently notching its weakest ever level against the dollar, but analysts suggest the risks are still skewed to the downside. Only two years after its last currency crisis,.