Market Overview - Page 301

August 31, 2020

High-profile COVID-19 vaccines developed in Russia and China share a potential shortcoming: They are based on a common cold virus that many people have been exposed to, potentially limiting their effectiveness, some experts say. CanSino Biologics’ vaccine, approved for military.

August 31, 2020

They say 90 is the new 70, and in Warren Buffett’s case, it may be true.The chairman and CEO of Berkshire Hathaway announced Sunday — his 90th birthday — that his company has acquired a slightly more than 5% stake.

August 31, 2020

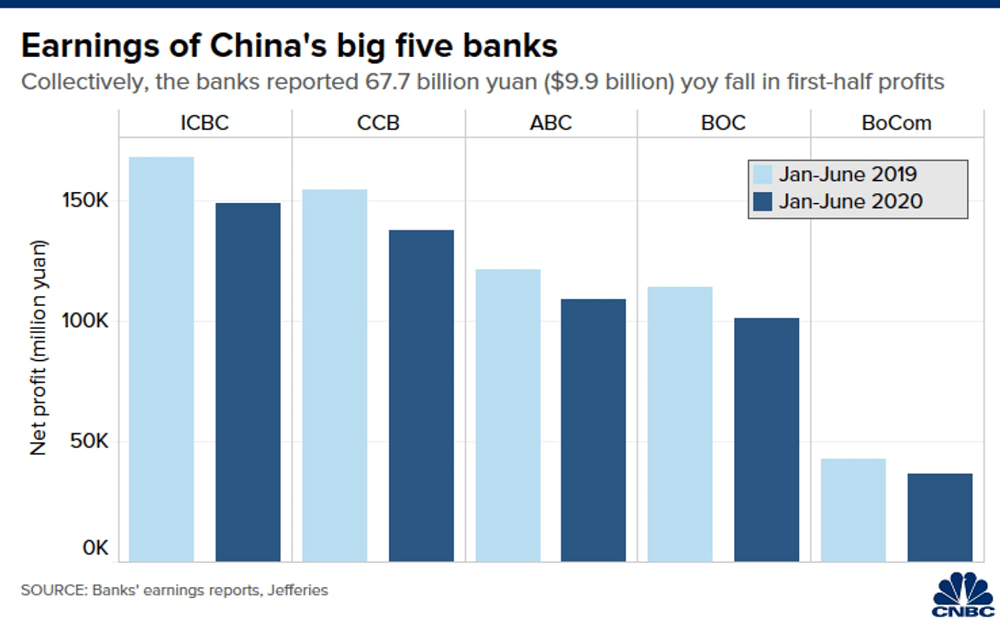

China’s five largest banks reported their biggest profit declines in at least a decade as they brace for further increases in bad loans in an economy weakened by the coronavirus pandemic. The five lenders — Industrial and Commercial Bank of.

August 31, 2020

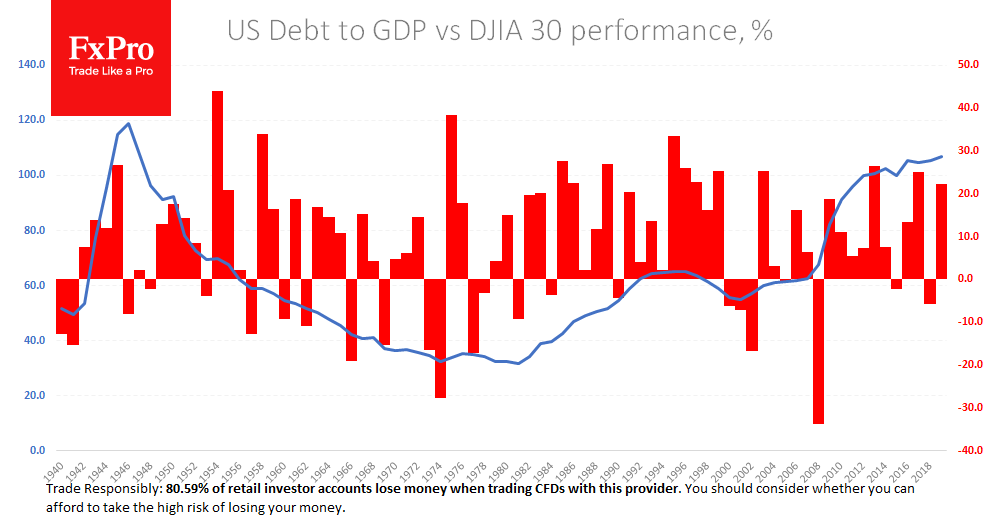

Stock markets continue to move upwards, spurred by a combination of positive data and central banks actions. Macroeconomic indicators include higher than expected US personal income and outlay growth, rapid GDP recovery in Canada and an increase in China Services.

August 28, 2020

Two key stocks metrics have soared to levels unseen since the dot-com bubble in the 1990s. It raises the risk of an S&P 500 pullback, coming off a 55.7% rally since March 23. The Buffett Indicator and the number of.

August 28, 2020

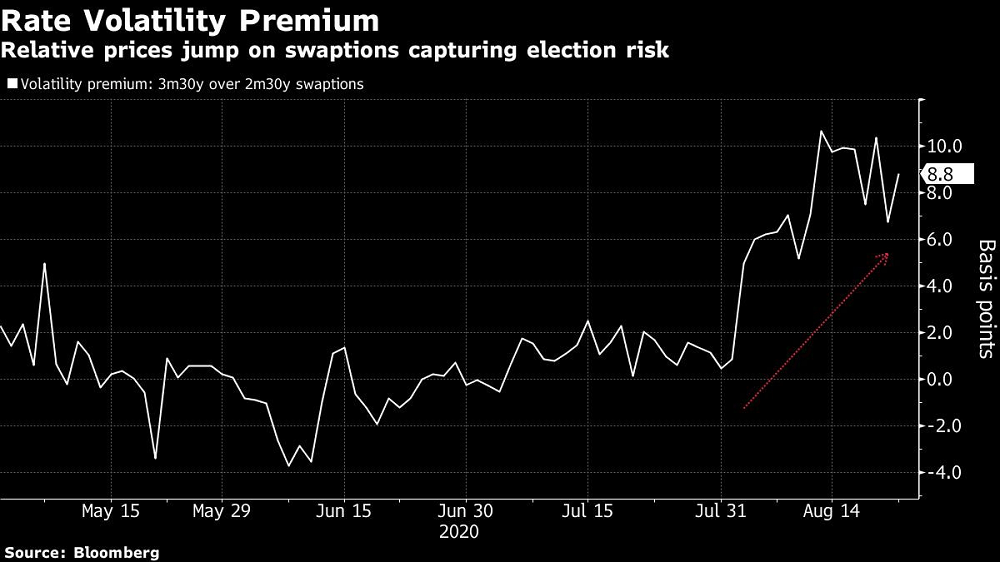

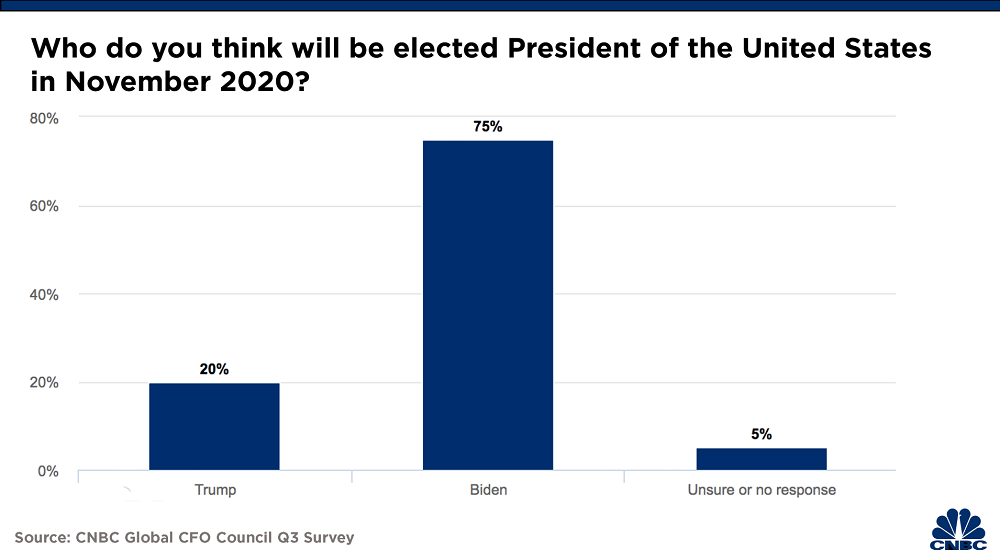

Traders across major asset classes are sending the same message: Prepare for what could be the most-contentious U.S. presidential elections in decades. One measure of hedging in the stock market is higher than at any point in the past three.

August 28, 2020

The price of Bitcoin (BTC) has declined by more than 6% in the last three days and with the $276 million CME Bitcoin futures expiry approaching on Aug. 28, traders are nervous that additional downside could be in store. Following.

August 28, 2020

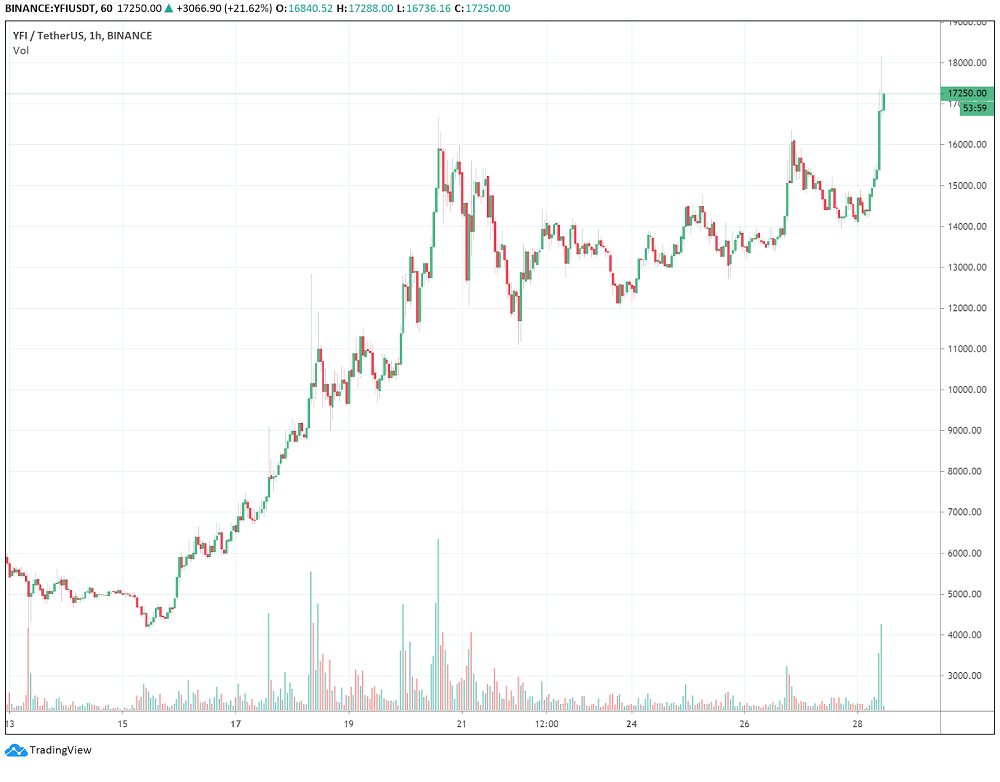

YFI, the native token of the Decentralized Finance (DeFi) giant yearn.finance, achieved a new all-time high. It soared by 30% in the last 12 hours from $14,017 to $18,169, entering price discovery. The term price discovery refers to when an.

August 28, 2020

U.S. technology giants are increasingly dominating the stock market in the midst of the coronavirus pandemic, even as they draw accusations of unfair business practices, and some investors fear the pump is primed for a tech-fueled sell-off. The combined value.

August 28, 2020

According to the most recent CNBC/Change Research Poll, fear over coronavirus has fallen in several key six swing states while at the same time President Donald Trump’s approval rating has seen an uptick. In Arizona, Florida, Michigan, North Carolina, Pennsylvania.

August 28, 2020

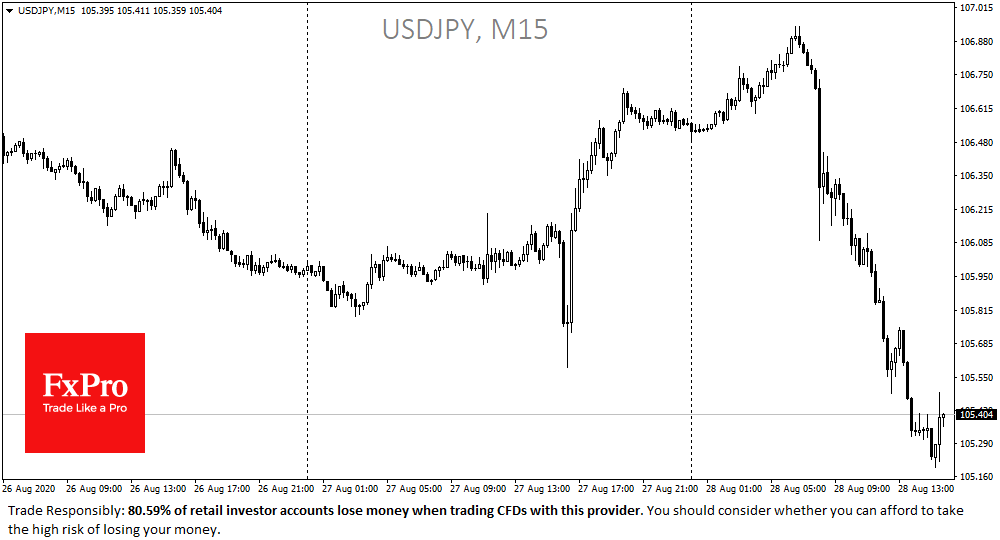

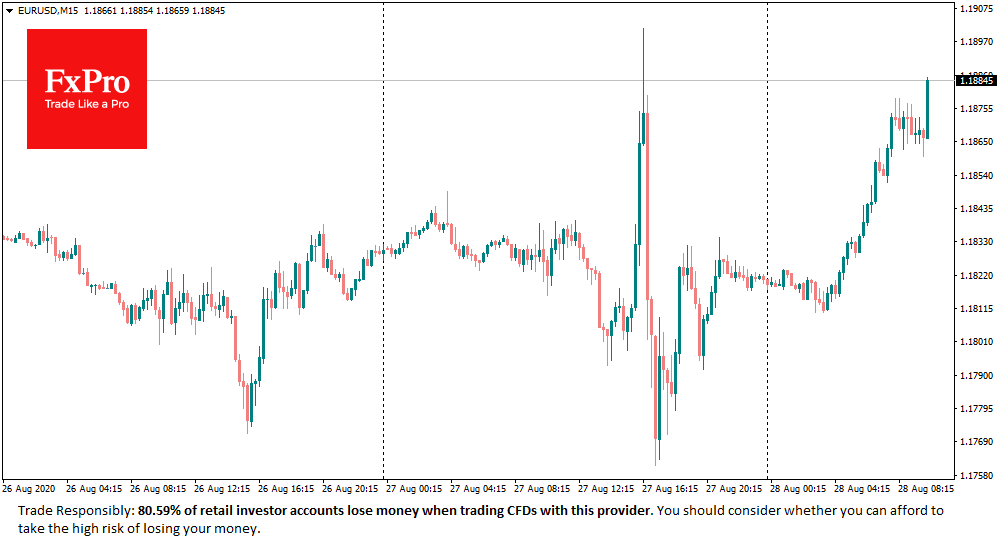

The Japanese yen is leading the FX growth on Friday after news of resigning Prime Minister Shinzo Abe. The appreciation of the yen is a sign that investors are curtailing their foreign exchange carry-trade positions, selling stocks and entering into.