Market Overview - Page 298

September 4, 2020

Wall Street could be headed for correction territory if there is a shift in investor attitude, Allianz’s chief economist Mohamed El-Erian said after the biggest market decline in months. Investors have taken a liquidity approach to the market and buying.

September 3, 2020

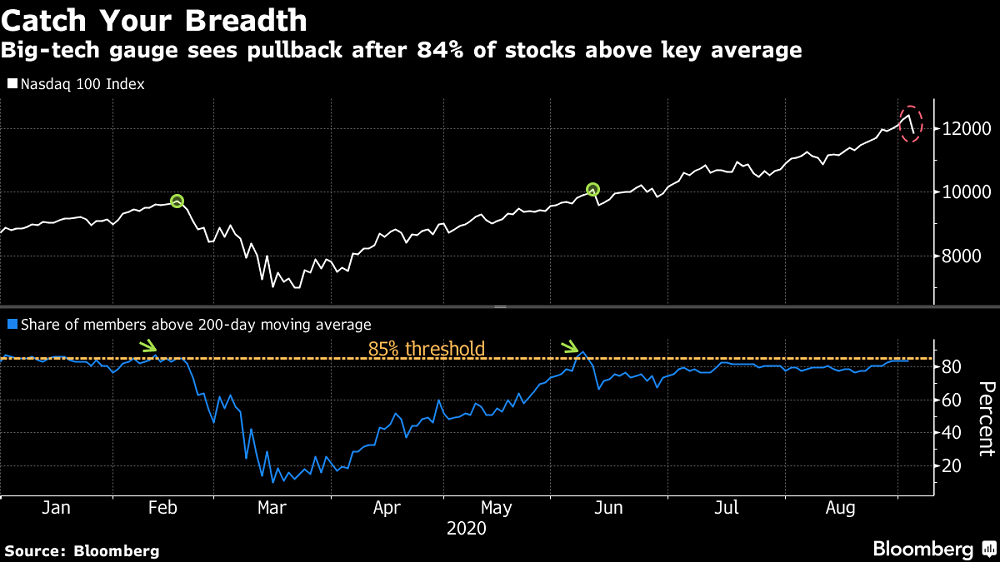

U.S. equities tumbled by the most in almost three months as the rotation away from high-flying tech stocks gained steam, with investors questioning the sustainability of lofty valuations. The S&P 500 Index retreated from a record high and was set.

September 3, 2020

Bitcoin (BTC) tumbled about $403 in an hour early Thursday, deepening a two-day sell-off that pushed the largest cryptocurrency to its lowest point in a month. The price was down 4.9% on the day to $10,838 as of 13:09 coordinated.

September 3, 2020

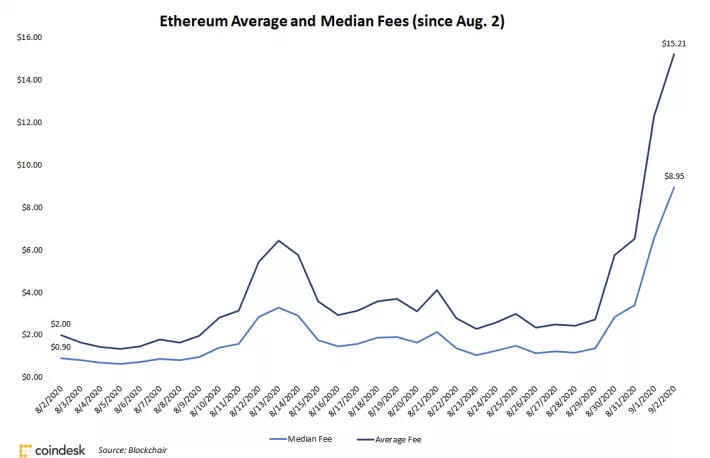

The surge in fees is being driven by the explosive popularity of decentralized finance (DeFi) applications that are predominantly built on Ethereum. Average network fees reached $15.21 on Wednesday, up 660% from $2 a month ago. Ethereum’s median fees also.

September 3, 2020

Stablecoins are a hot commodity. Over $16 billion of them circulate in the wild today, up from $4.8 billion to start the year. Mostly these are issued outside of the U.S., and so are largely unaccountable to financial regulators. If.

September 3, 2020

Thursday is a bad day for U.S. equity markets. Stocks fell sharply after the recent rally hit all-time highs. The tech sector, the market leader since the rebound began in late March, is dragging down the whole stock market. The.

September 3, 2020

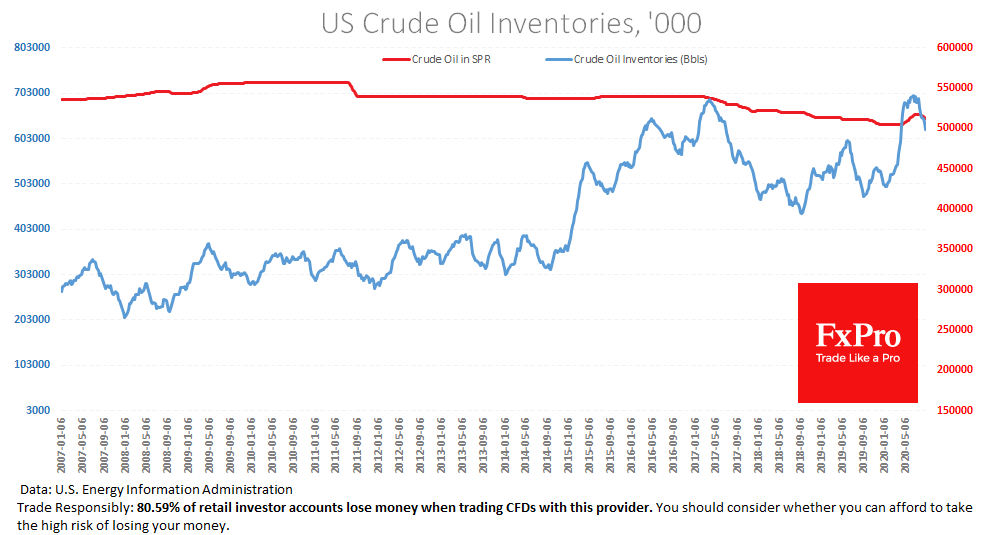

Oil prices tumbled on Thursday to their lowest point since early August as Wall Street sold off following U.S. unemployment data that fed fears of a slow recovery for the economy and fuel demand a day after weak U.S. gasoline.

September 3, 2020

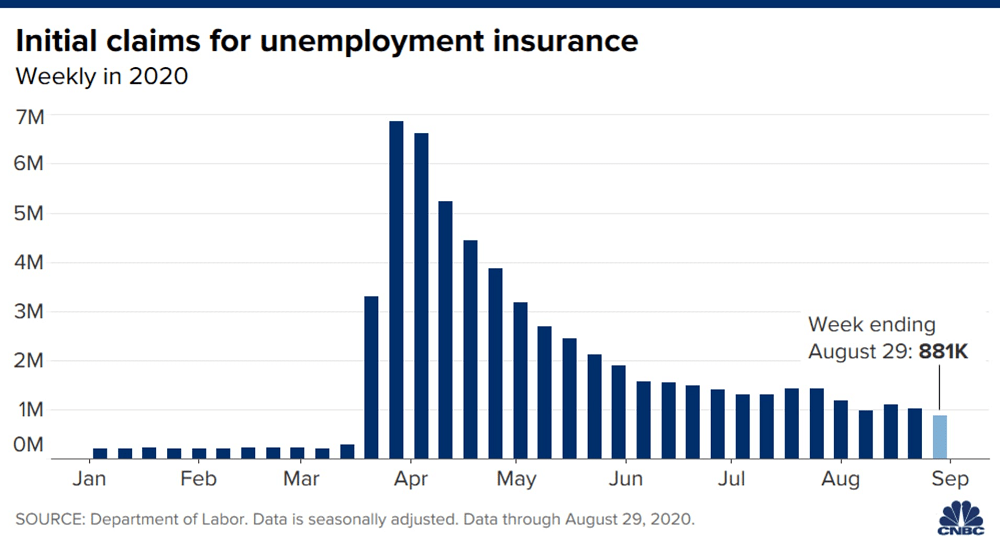

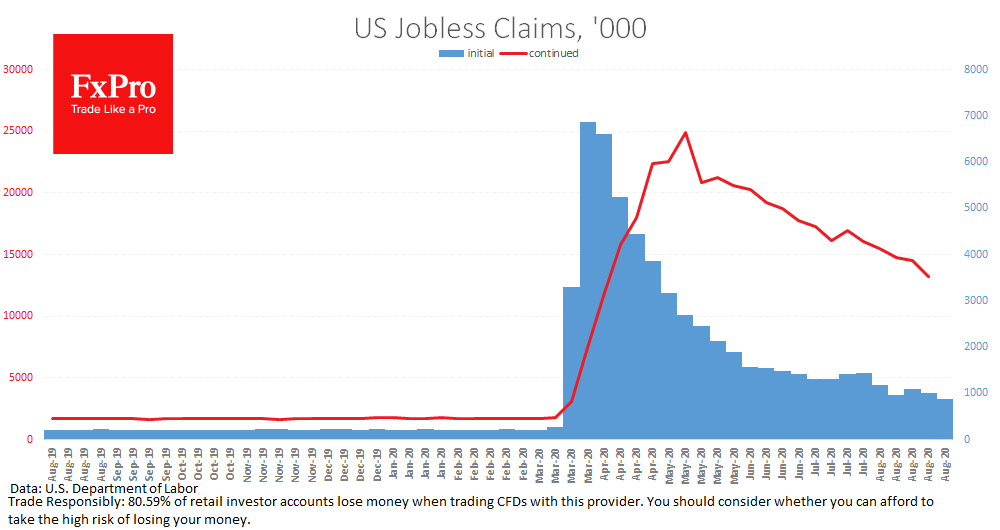

New filings for jobless claims totaled 881,000 last week, better than estimates as the employment market continued its gradual progress during the coronavirus pandemic recovery. Economists surveyed by Dow Jones had been looking for a total of 950,000. The number.

September 3, 2020

Stocks fell sharply on Thursday as investors paused in the wake of a recent rally to all-time highs. Tech, the market leader since the rebound began in late March, was the biggest laggard. The Dow Jones Industrial Average dropped 801.

September 3, 2020

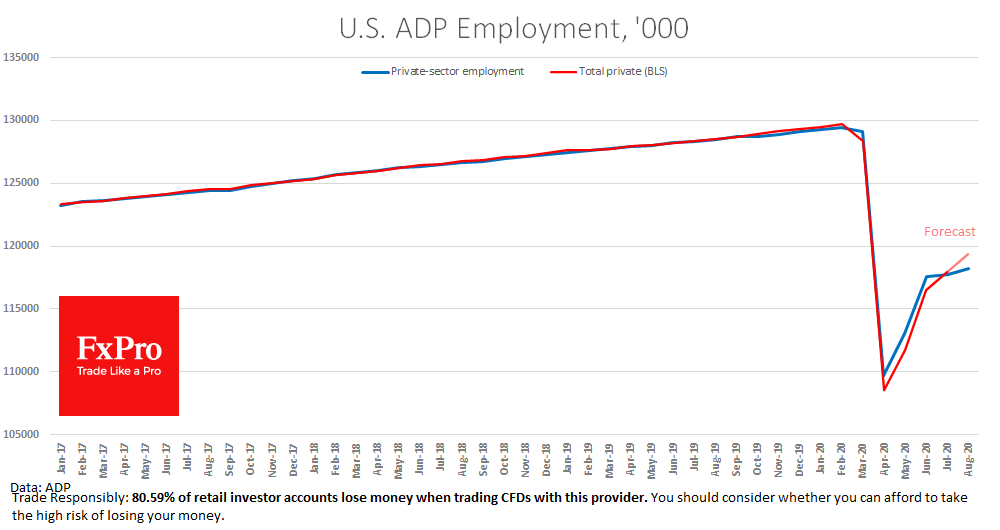

Weekly data on US unemployment claims have markedly exceeded expectations, slightly alleviating concerns before tomorrow’s NFP release. Initial claims fell to 881K last week, better than the expected 955K. Continued claims were 13.2 million, 1.2 million below the previous week’s.

September 3, 2020

There was no shortage of strong movements in the markets on Wednesday. However, a short-lived dip on the stock market was quickly bought back. In contrast, moves on the currency and commodities markets were one-sided. Brent and WTI prices lost.