Market Overview - Page 28

February 28, 2025

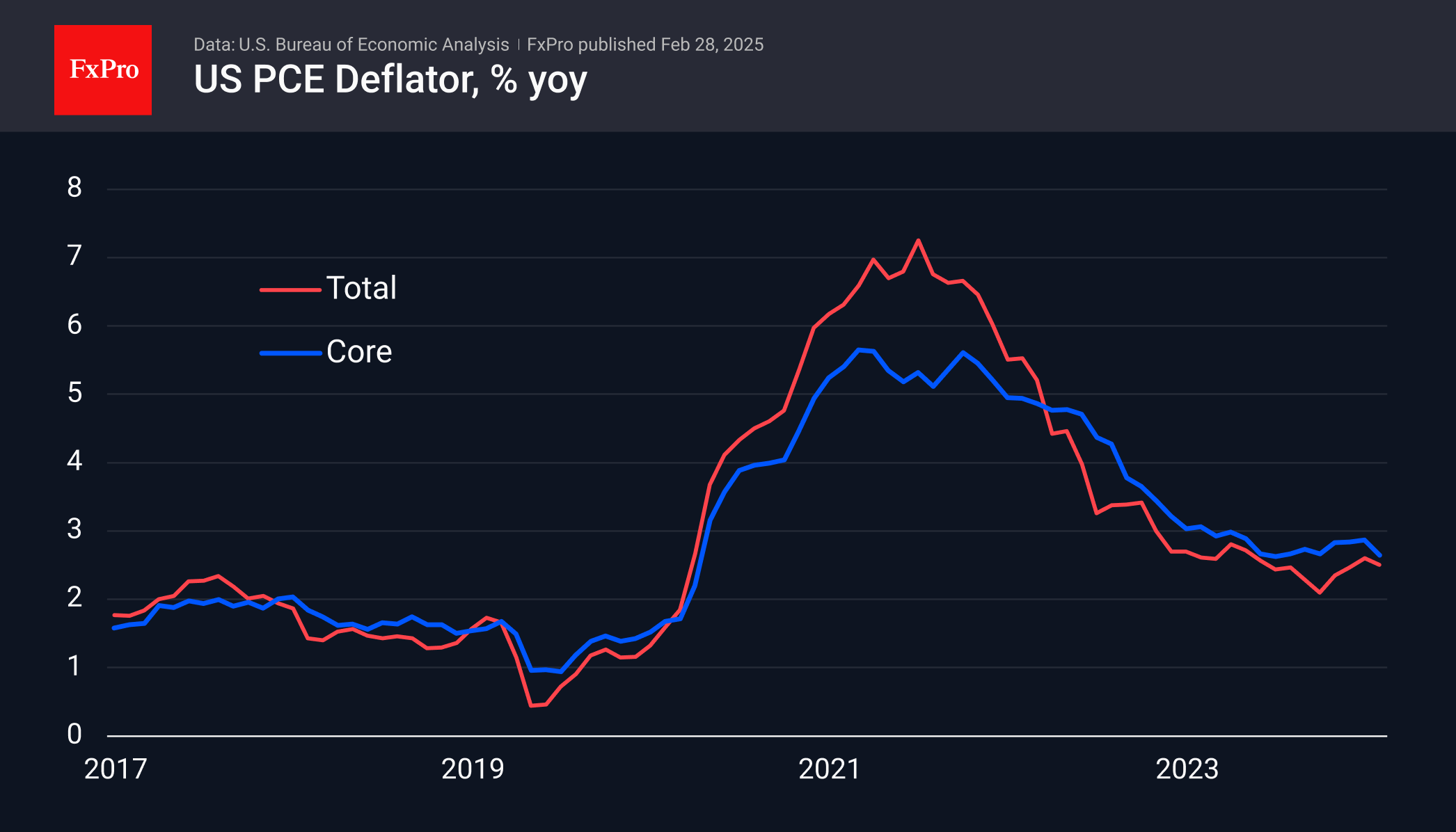

The US PCE Price Index met expectations, indicating potential easing by the Fed later in the year. Personal disposable income increased while spending fell. This is negative for the dollar but positive for stocks and crypto.

February 27, 2025

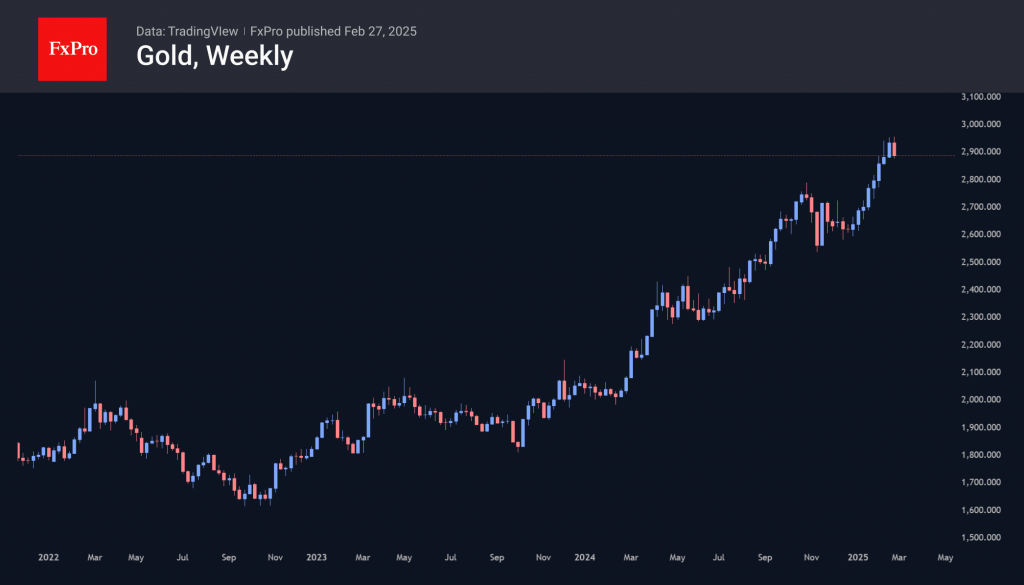

Gold has seen its first decline after eight weeks of gains. After starting the week with an attempt to renew its highs, the precious metal has been hit by a more intense sell-off. We saw a similar dynamic at the.

February 27, 2025

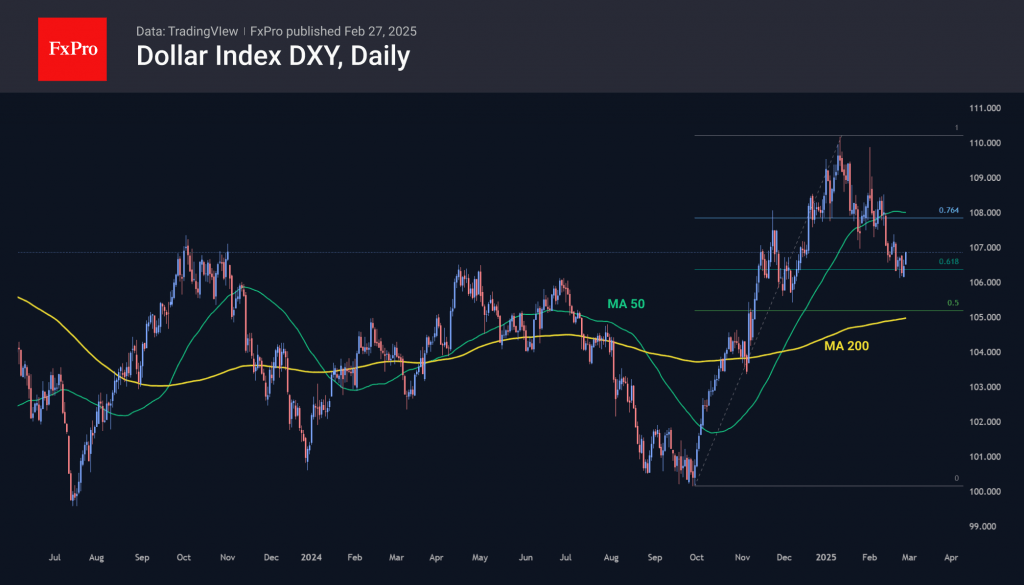

The dollar index fell to 106, retreating from the lows of early December. The momentum against its major rivals was not clear as the Euro stalled, the Pound gained, and the Canadian dollar retreated. Technically, the DXY retreated to the.

February 26, 2025

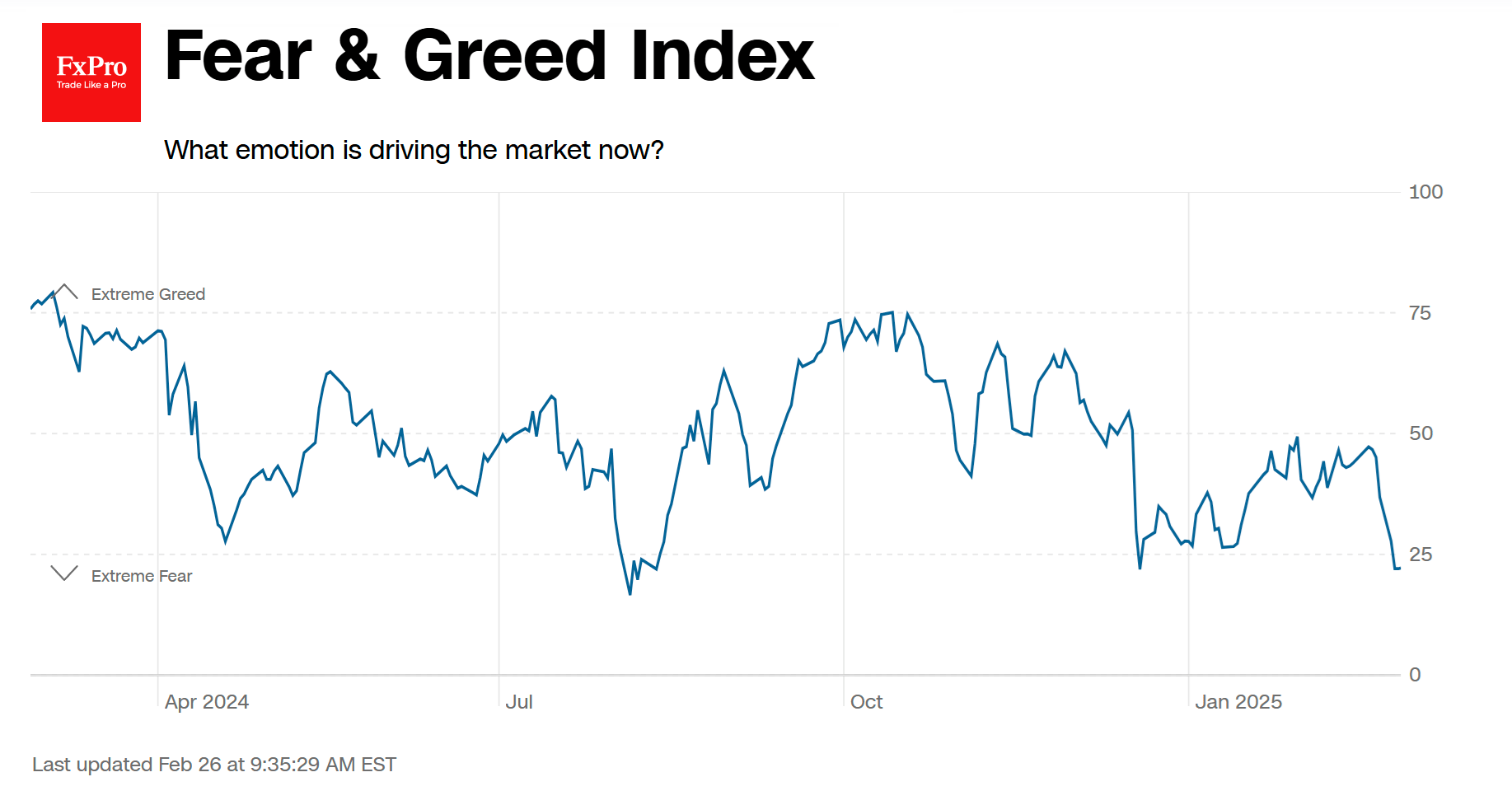

Extreme Fear is driving US stocks now, but it hasn't reached extreme levels yet. Buying during periods of extreme fear may not be the best strategy when considering previous market trends.

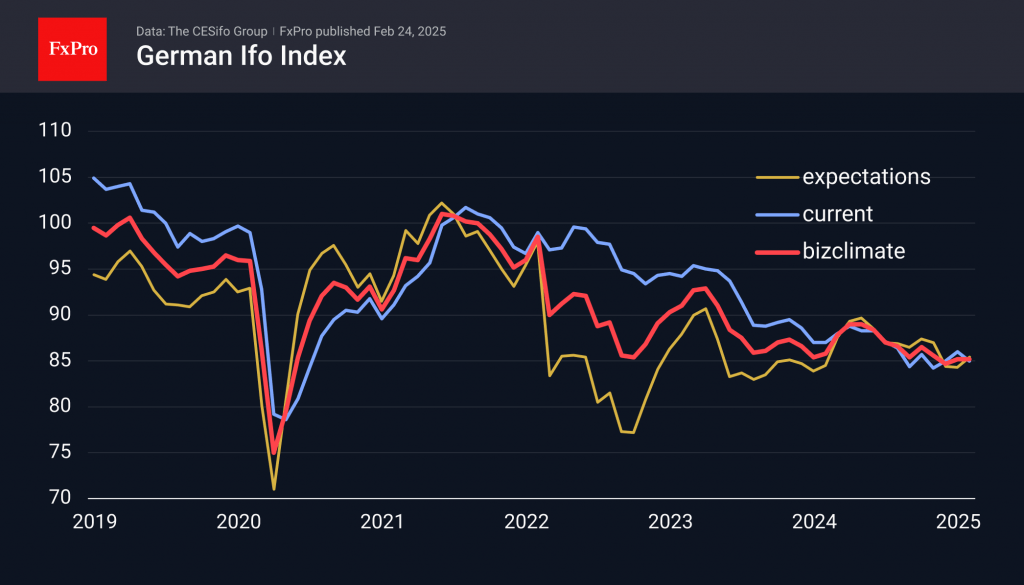

February 24, 2025

Germany's business climate in February remained unchanged, with a decline in the current assessment balanced by an increase in expectations. The disappointing results put pressure on the euro.

February 24, 2025

We're breaking down the latest in the financial markets, from the dollar's ups and downs to gold reaching new highs

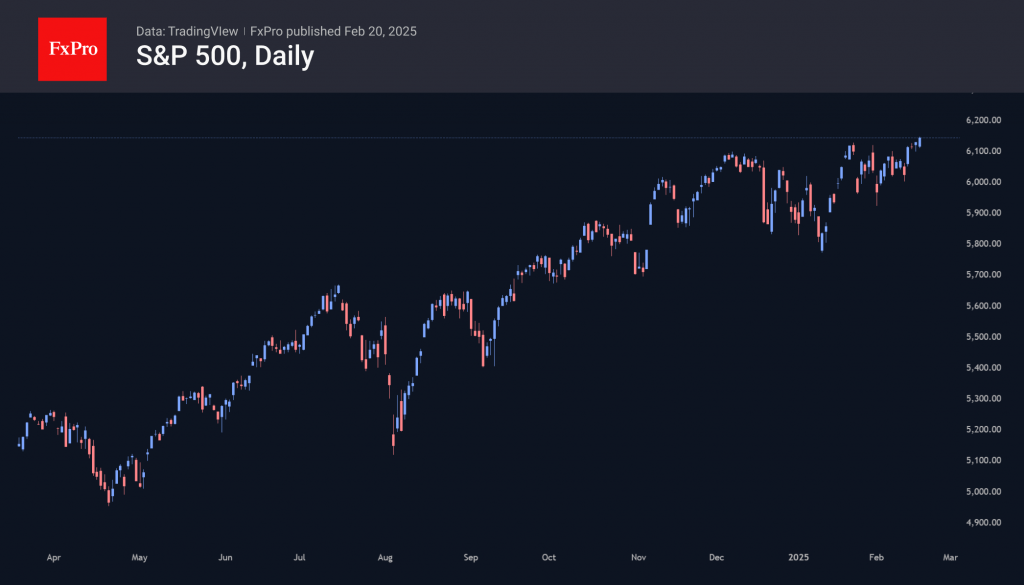

February 21, 2025

Indices This week, the S&P 500 and Nasdaq 100 reached new all-time highs. While the Nasdaq 100 continued to push higher after a strong start following the long weekend, the Dow Jones and S&P 500 traded within a narrowing range..

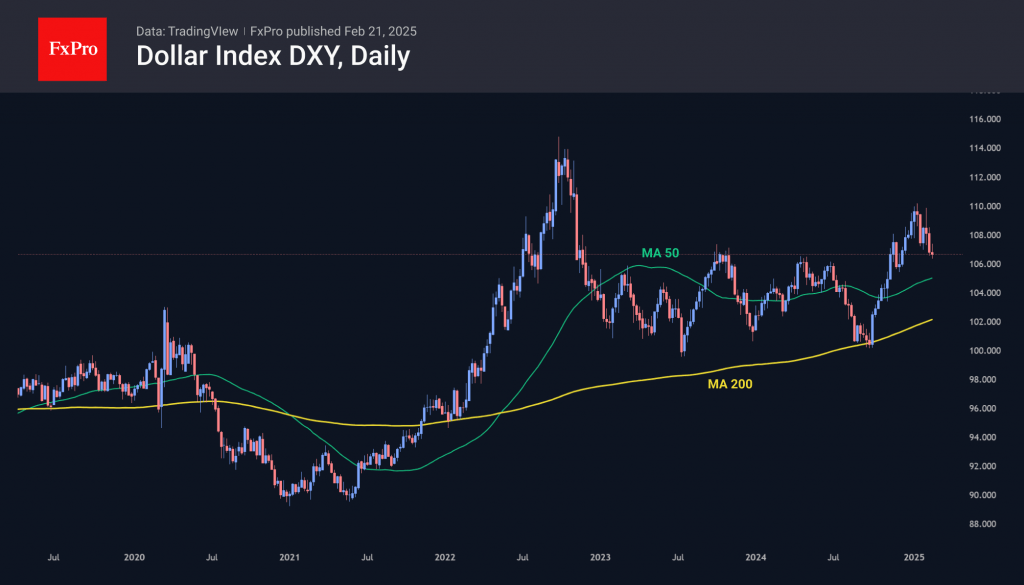

February 21, 2025

USD struggled to gain momentum despite positive fundamentals. Softening rate expectations and the influence of other major central banks put pressure on the dollar.

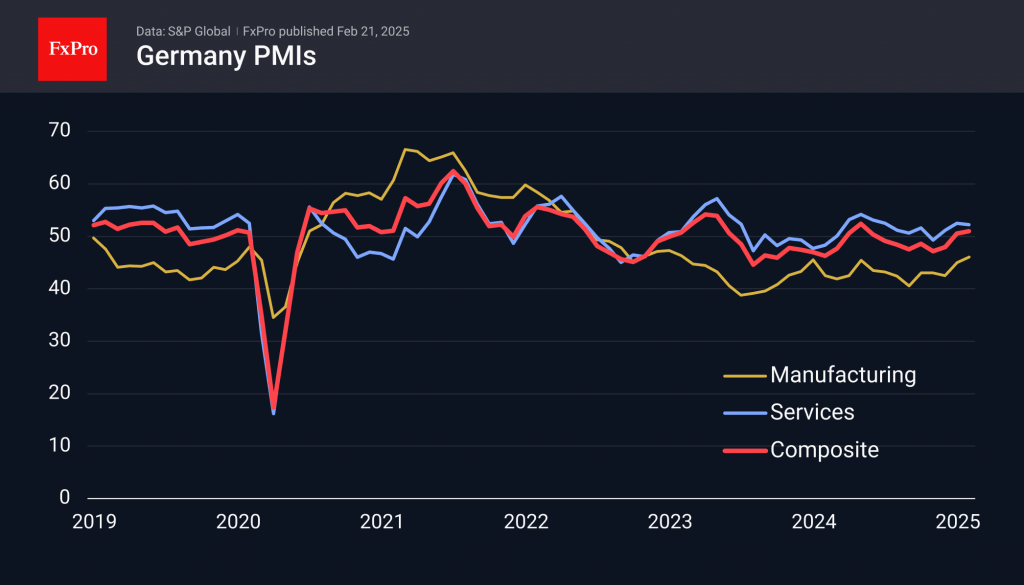

February 21, 2025

Flash manufacturing PMI figures for the Eurozone are better than expected, suggesting economic acceleration in the coming months. However, the services sector was disappointing, indicating a room for further rate cuts.

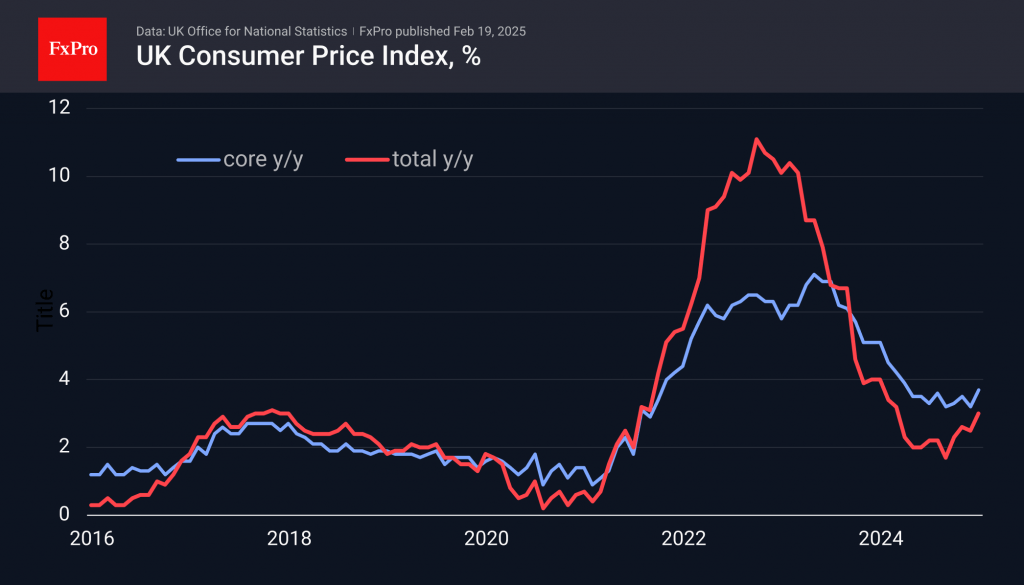

February 19, 2025

UK inflation is rising, but it did not have a positive impact on the pound. The Bank of England may be limited in its ability to support economic growth.

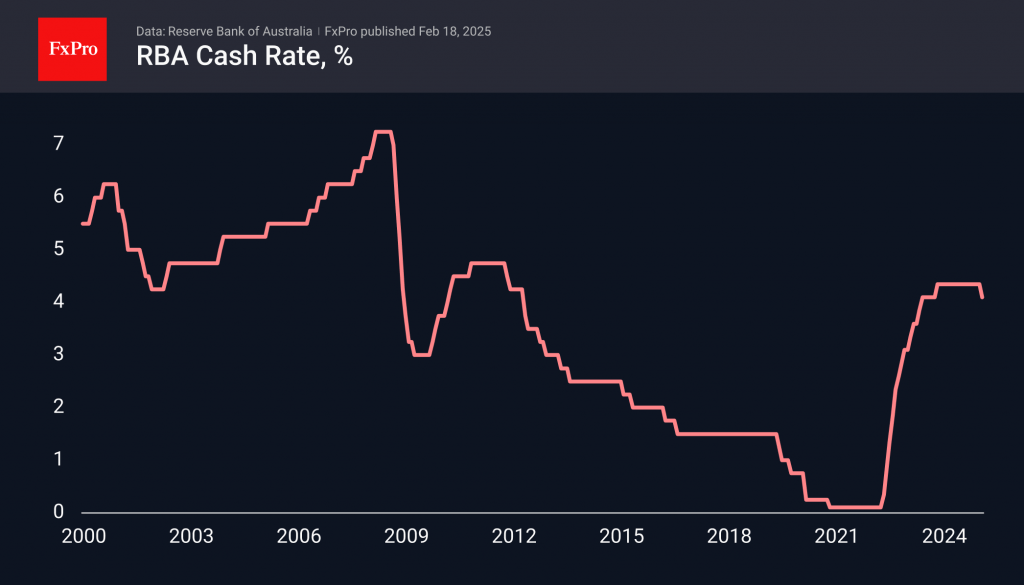

February 18, 2025

The RBA has cut its key rate to 4.1%, signaling a more hawkish approach than expected. This has supported the Australian dollar against its competitors.