Market Overview - Page 26

April 17, 2025

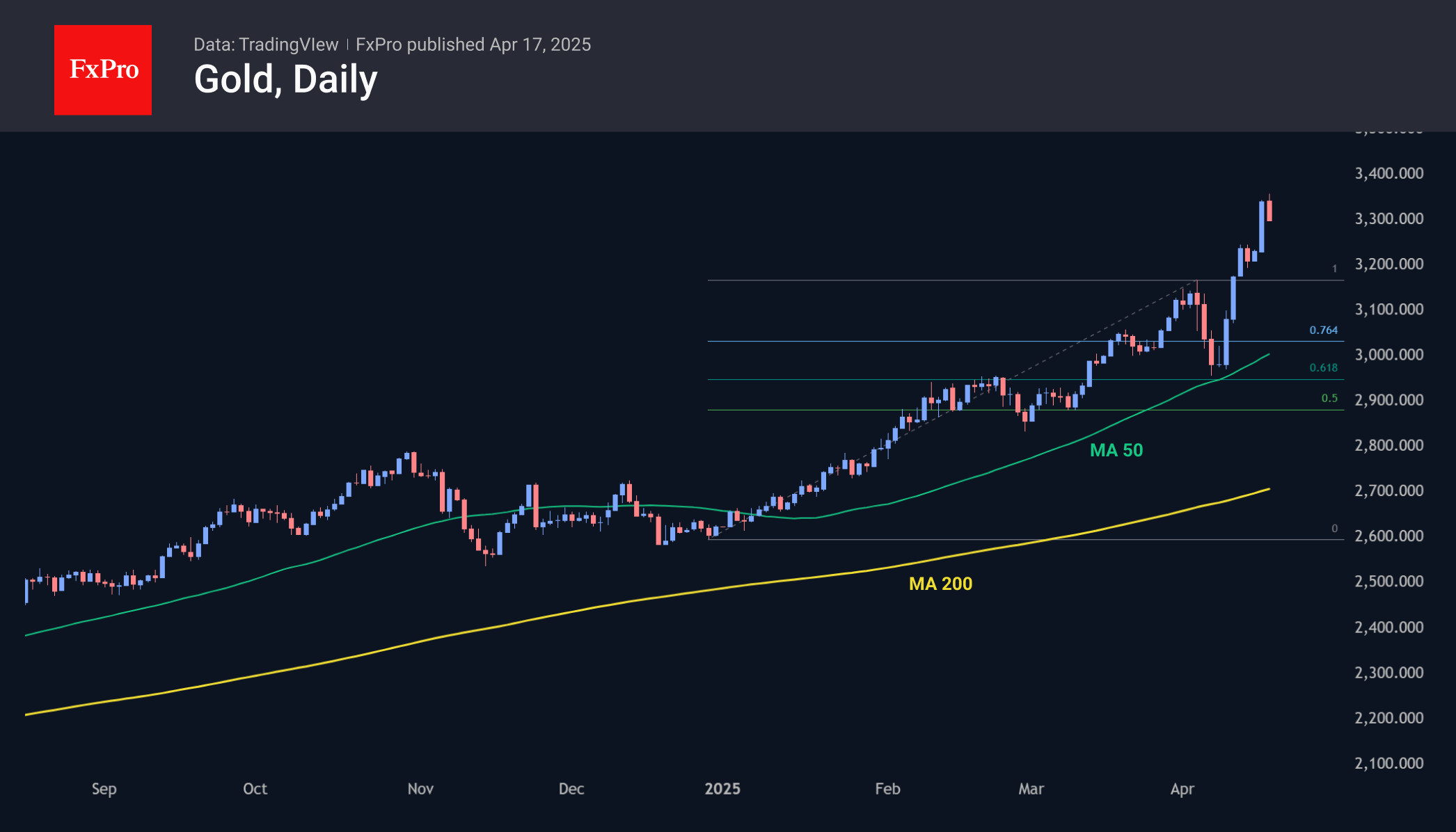

Gold has experienced an epic rally, reaching historical highs above $3350 per troy ounce, with the potential for further gains above $3500.

April 17, 2025

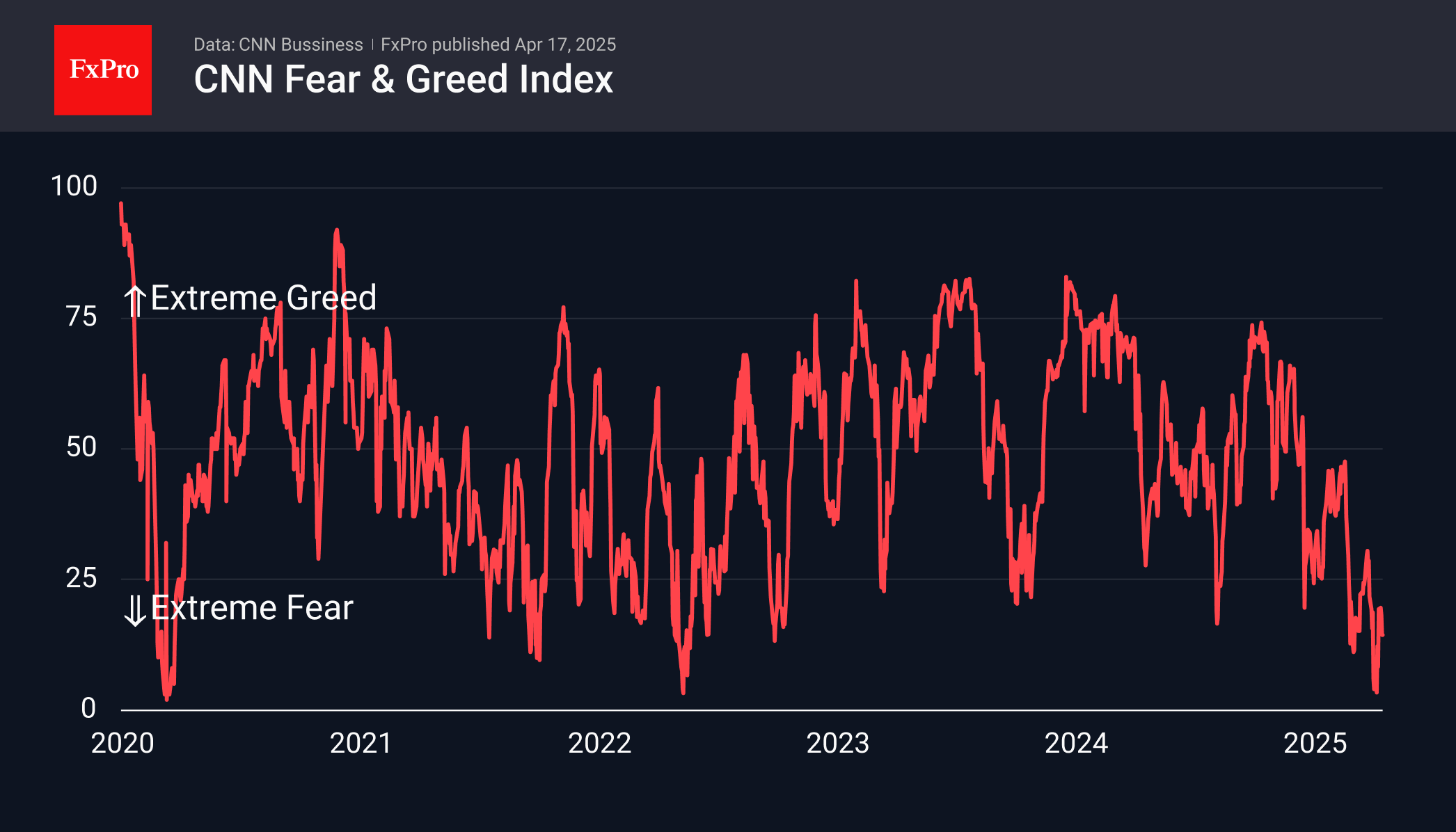

Despite extreme fear in the markets, history shows that buying on downturns can be profitable and provide an upward bias. The S&P500 has held above the 200-week moving average, an important support level, and the RSI index is showing signs of rebounding.

April 17, 2025

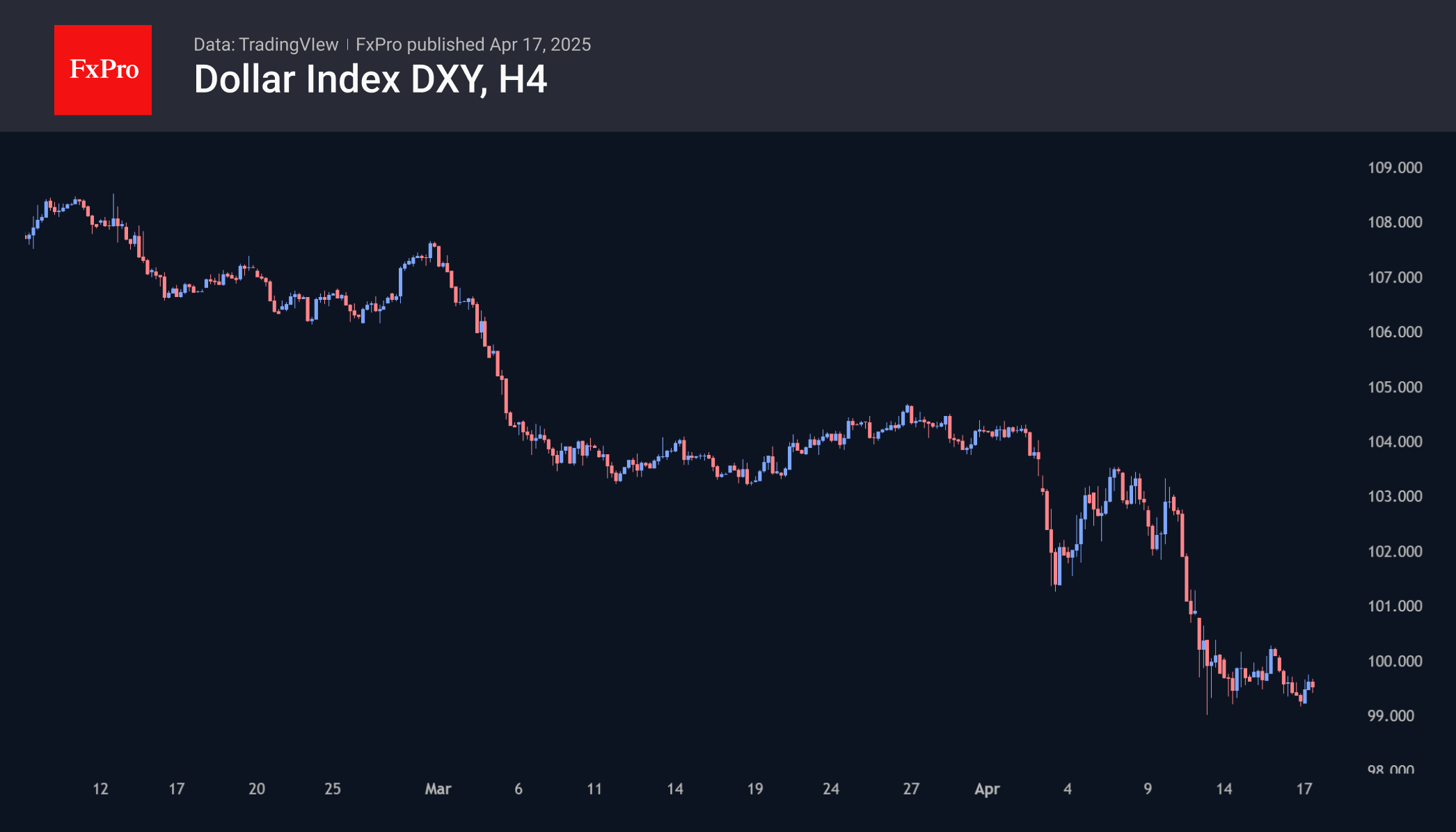

The correlation between the dollar and promised tariffs is evident, as trade barriers lead to a sell-off in the US currency. This decline in the dollar is a clear signal that trade wars are negatively impacting the US' privileged position in the global economy.

April 16, 2025

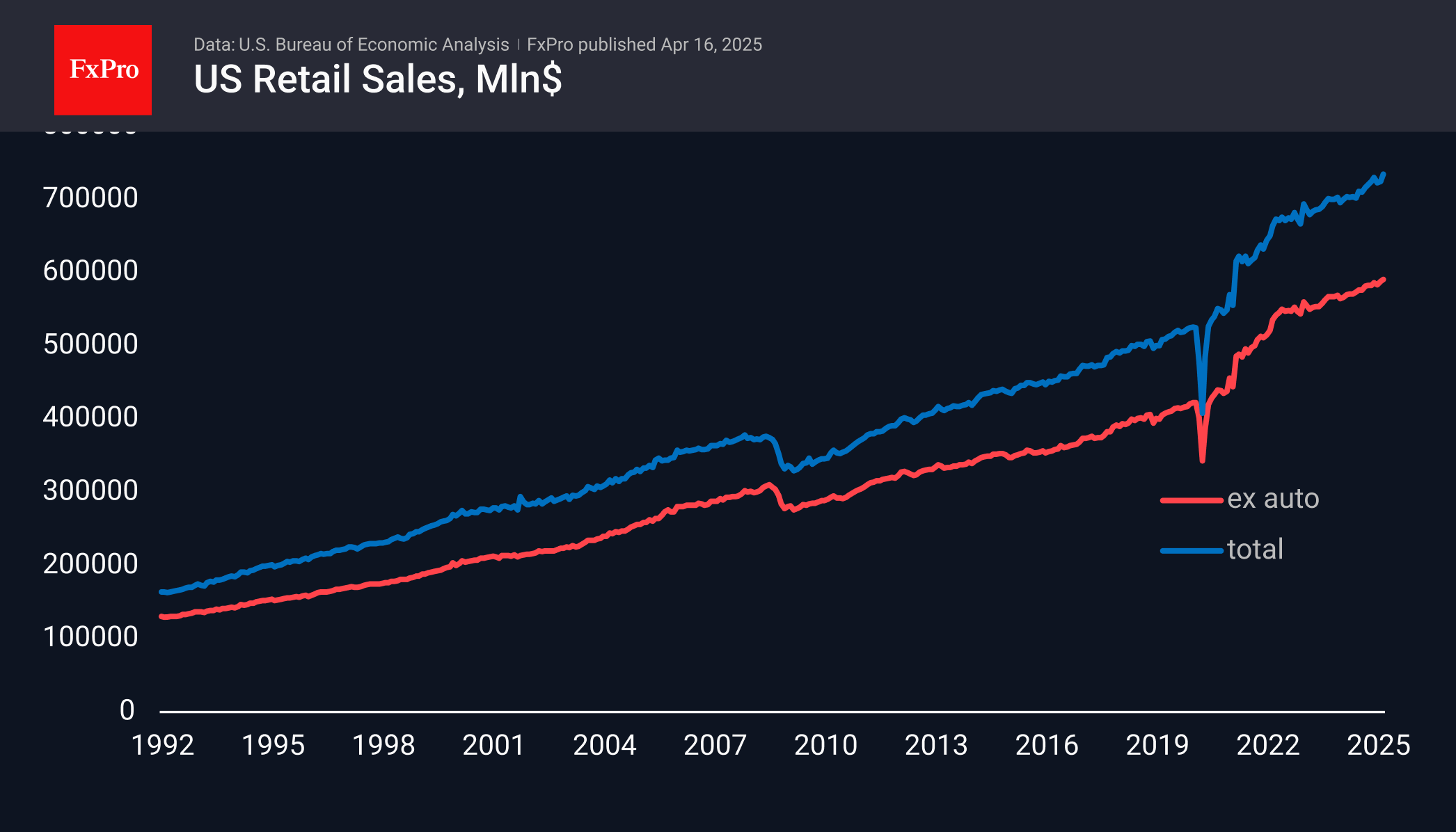

US Total retail sales rose 1.4% in March, beating the expected 1.3% after rising 0.2% a month earlier. On an annualised basis, sales rose 4.4%, the fastest pace since December 2023, which contrasted with the slowdown in inflation to 2.4%.

April 14, 2025

In the week ahead, trade tariffs are set to dominate global attention around the clock, though key scheduled events will still remain important. On Wednesday, the US retail sales data is worth watching. The last three reports have come in.

April 11, 2025

We break down one of the most dramatic weeks in the markets — including a record-breaking S&P500 surge, the dollar index slipping below a critical 3-year support line, and gold closing the week at all-time highs.

April 11, 2025

The US dollar is suffering due to weaker than expected inflation data and a surge in Americans' inflation expectations.

April 10, 2025

The dollar index returned to the lows of September last year after a brief surge at the start of the week. The rebound of the US currency was only sufficient to close the gap created by the announcement of tariffs..

April 10, 2025

This week saw one of the most epic reversals in the US indices. On Wednesday, the S&P500 added about 9.5% for the day, posting the third largest gain in its 75-year history and rebounding nine-tenths of the decline caused by.

April 9, 2025

The selling pressure on the US dollar is due to the sell-off in equities and long-term bonds. The current situation is reminiscent of the uncertainty seen in March 2020.

April 7, 2025

Sentiment in financial markets is at a five-year low, with the Fear and Greed Index falling to 3. Waiting for a reversal in sentiment and a change in politicians' rhetoric can be more reliable indicators for investors.