Market Overview - Page 25

May 2, 2025

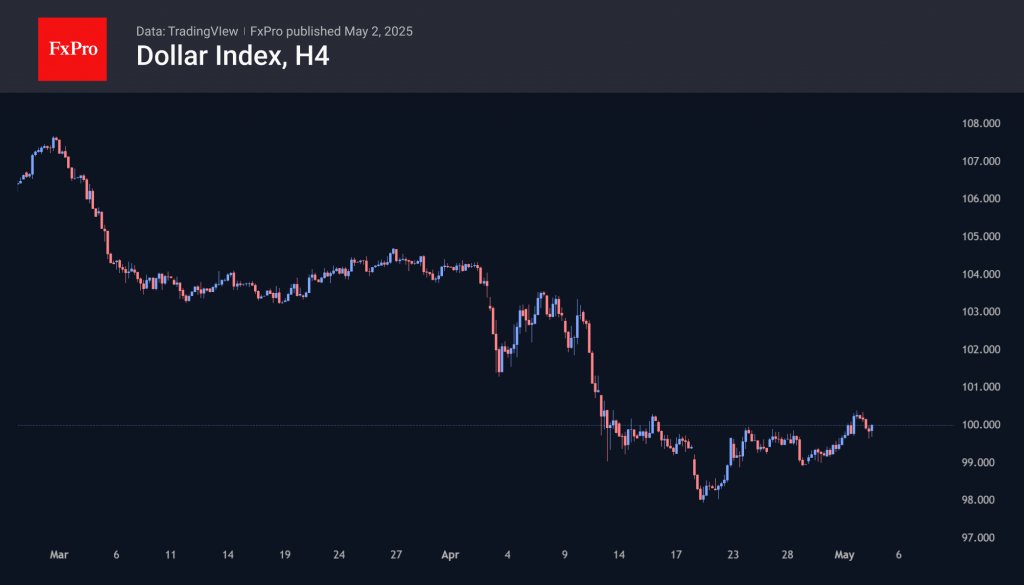

The dollar remains calm with signs of recovery, US and European index prices rise, gold under pressure. Look for divergence in RSI for trading signals. US indices up due to strong company reports and overcoming economic concerns.

May 1, 2025

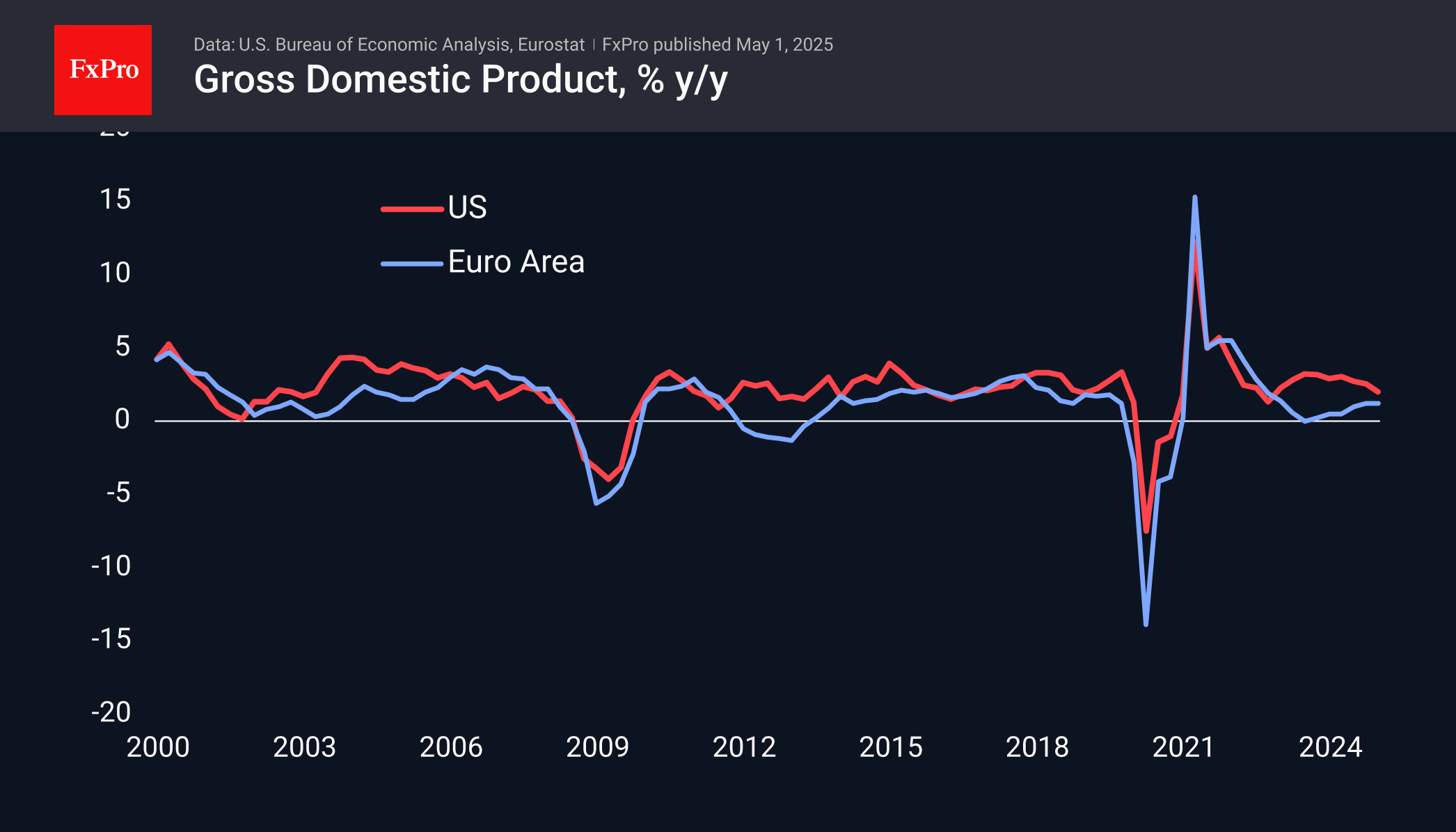

The US GDP contracted by 0.3% in the first quarter, mainly due to a surge in imports. This decline sparked market sell-offs and raised concerns about the impact of tariffs and trade wars on the economy and labour market.

April 29, 2025

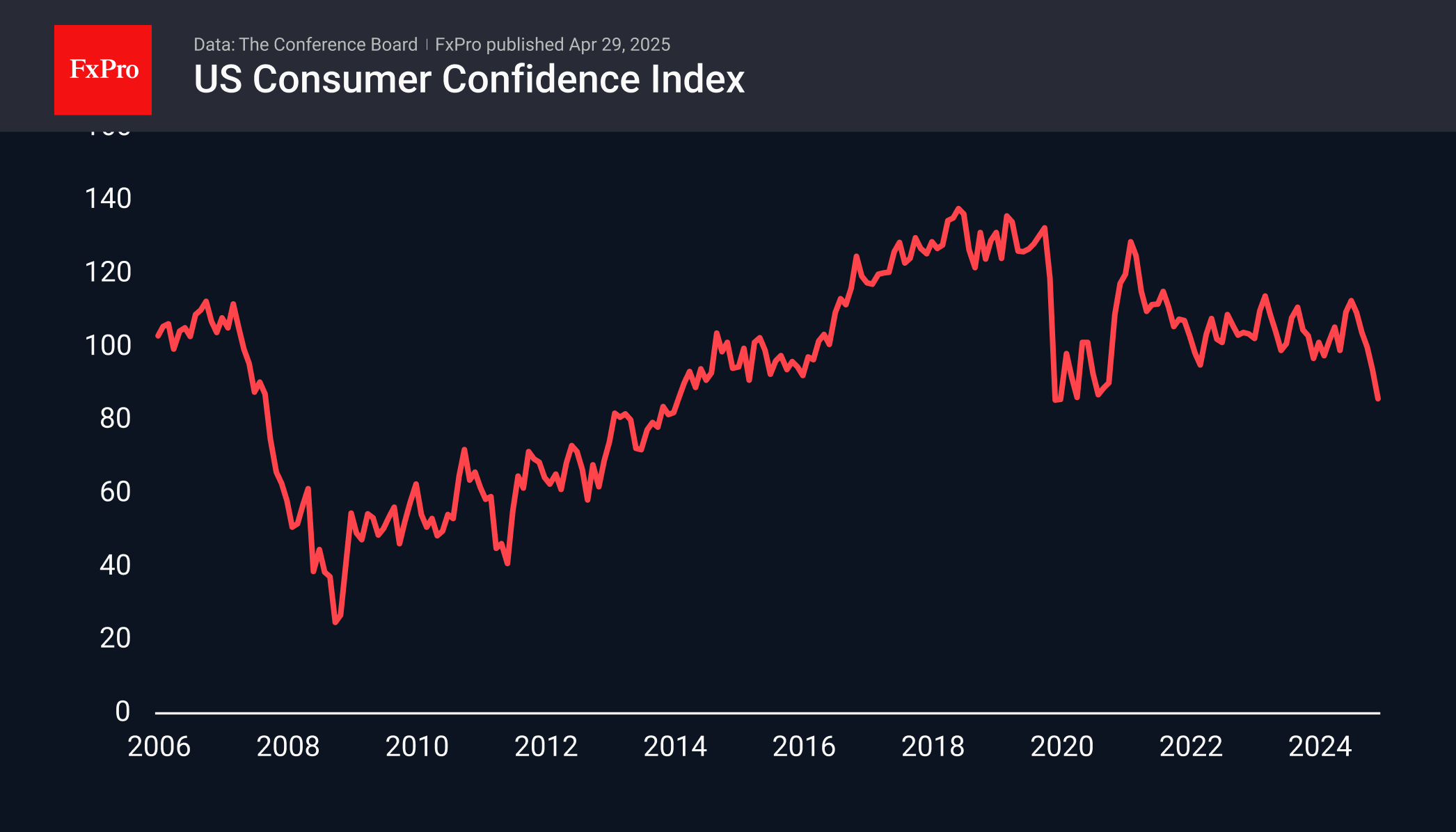

Consumer confidence in the US is declining, particularly regarding future prospects. The overall consumer confidence index published by the Conference Board fell to 86.0, recording its lowest reading since May 2020. Barring covid shocks, the last time the index was.

April 24, 2025

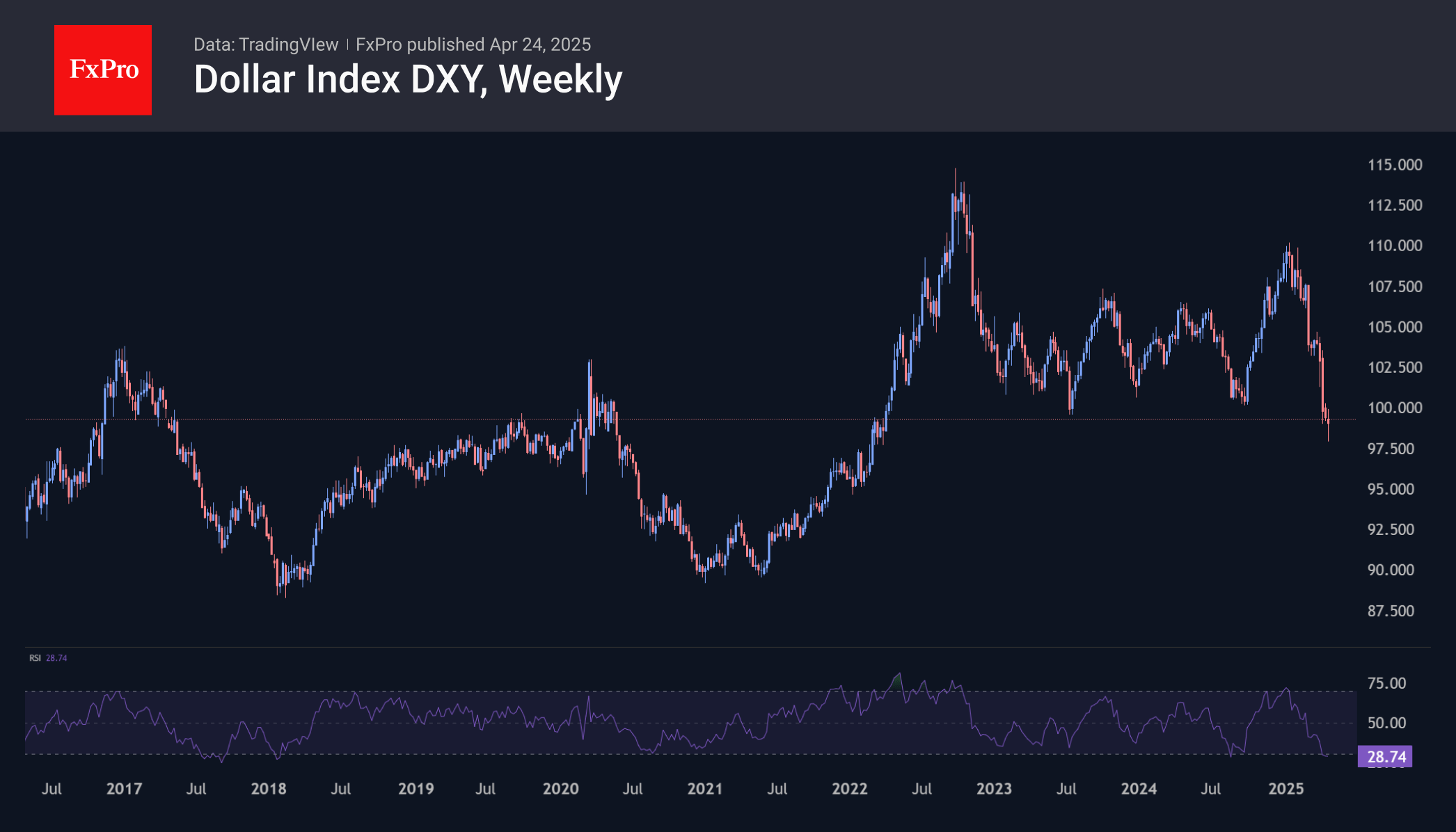

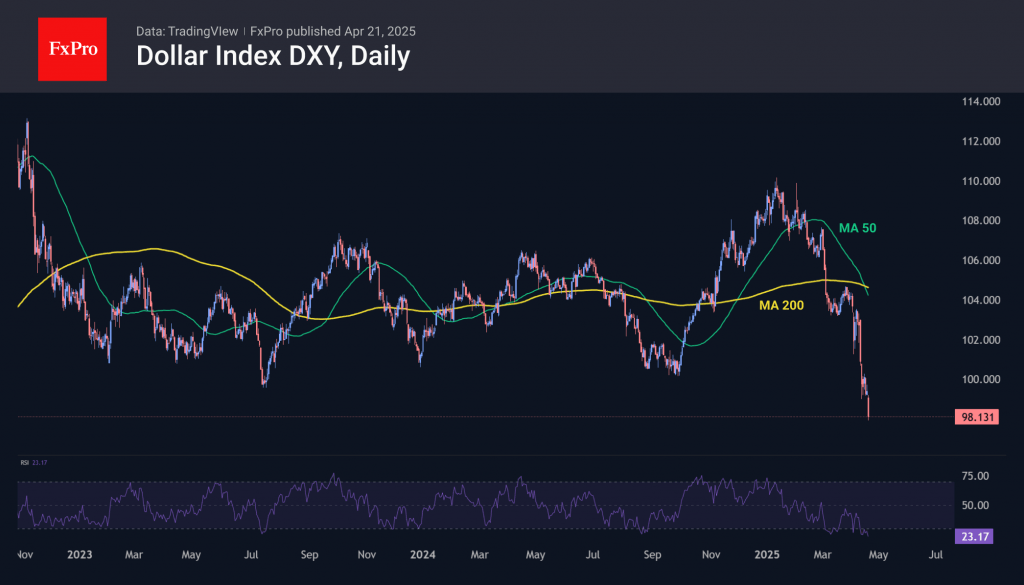

The U.S. currency started the week by hitting three-year lows against a basket of key currencies, but soon closed the gap on DXY, rising from 97.7 to 99.7. However, the upward trend has not yet developed. Unresolved trade disputes between.

April 24, 2025

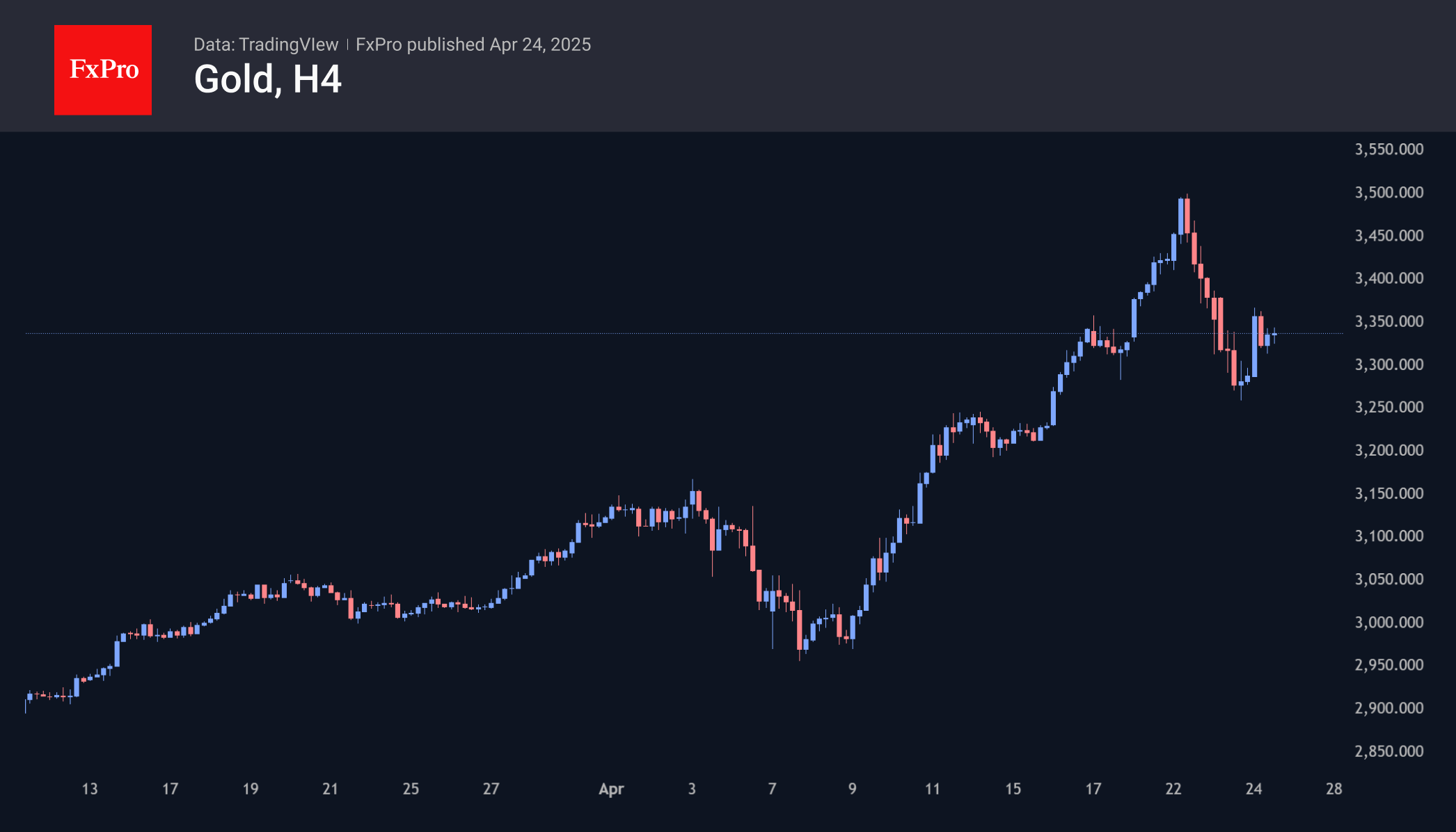

Gold’s 5% rally in the first 30 hours of the trading week, and touching the important round level of $3500, was followed by a steep fall to $3260 in the next 30 hours. After that, the price stabilised at $3340,.

April 24, 2025

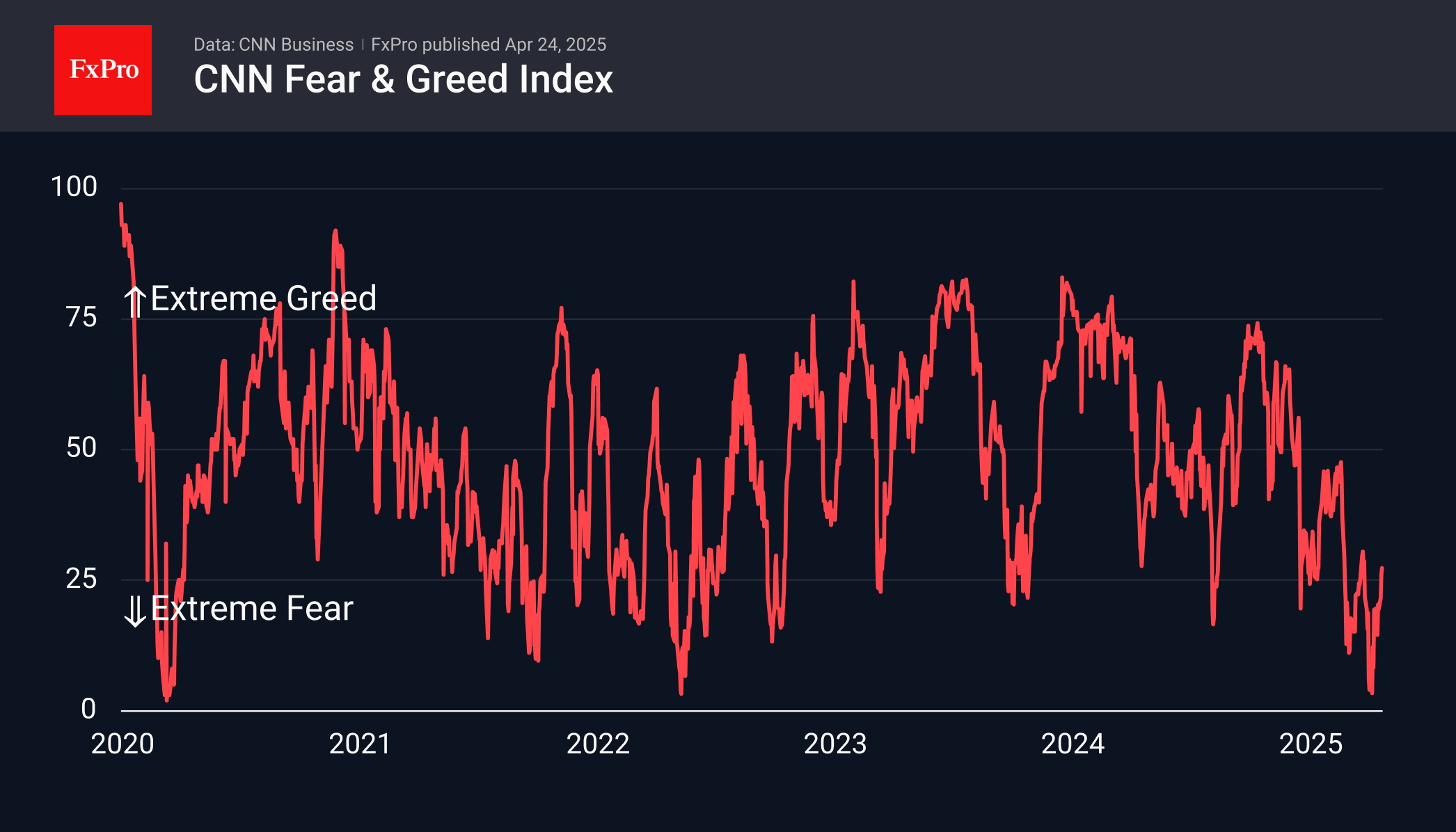

Financial markets are gradually recovering from recent shocks, indicating that the extreme fear has subsided. Market participants are realizing that uncertainty has peaked.

April 24, 2025

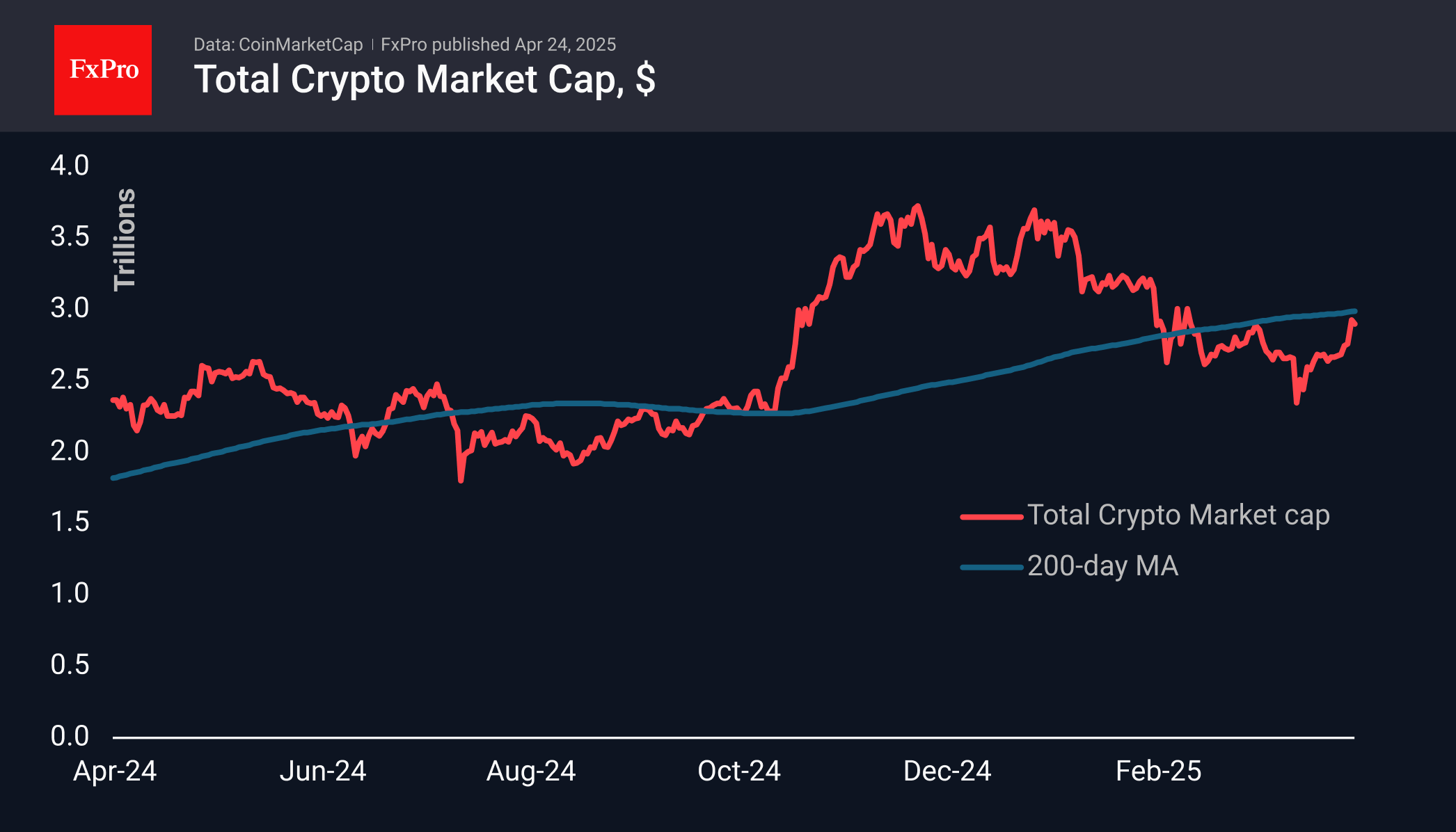

The crypto market has corrected about 1.3% to $2.9 trillion from Wednesday's peak but has been steadily adding over 8.5% over the past 7 days. The technical target for a potential new BTC rise is at 106,000

April 23, 2025

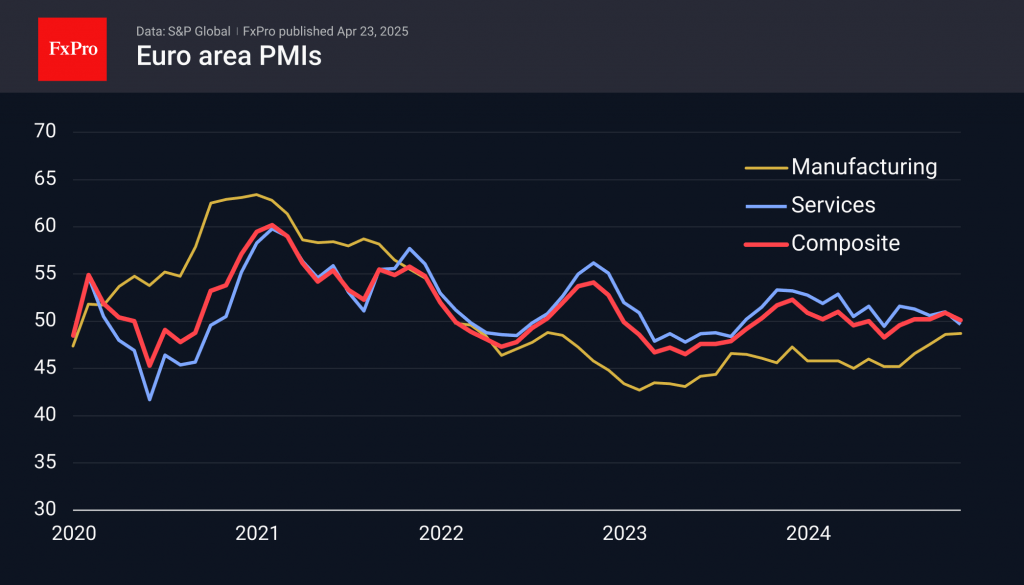

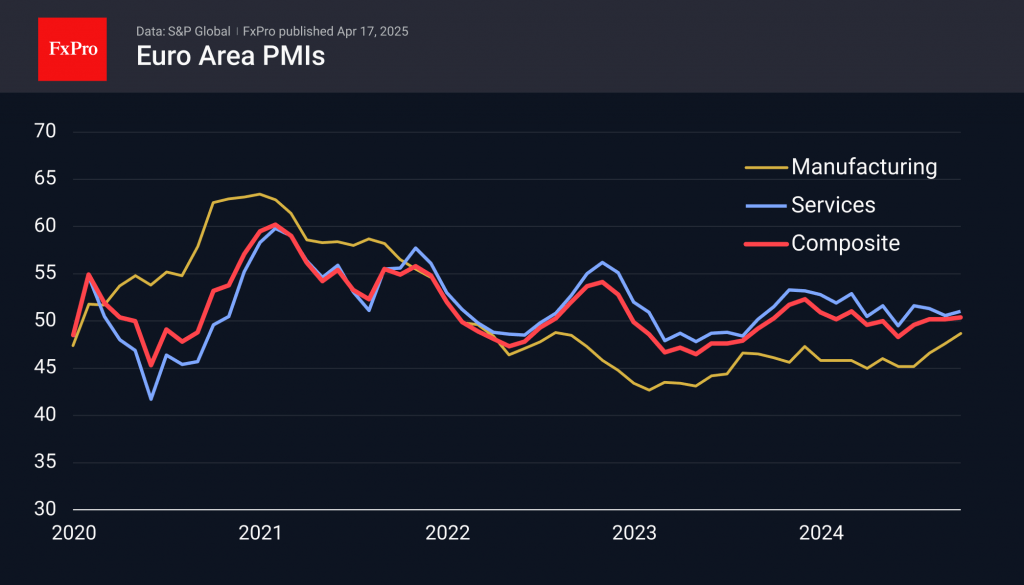

Eurozone business activity slows as falling orders and declining confidence impact growth. Manufacturing PMI remains in contraction, with tariff wars threatening further negative impact. Euro correction observed.

April 21, 2025

The following economic data events are worth paying attention to in the new week. Wednesday will see the release of preliminary PMI estimates for April, which could have a noticeable impact on sentiment on the Euro and European equities. A.

April 21, 2025

The dollar index is experiencing a decline that resembles patterns seen in the 1980s and 2000s, which may lead to a long-term decline. A more immediate target for the decline is the 90 area.

April 18, 2025

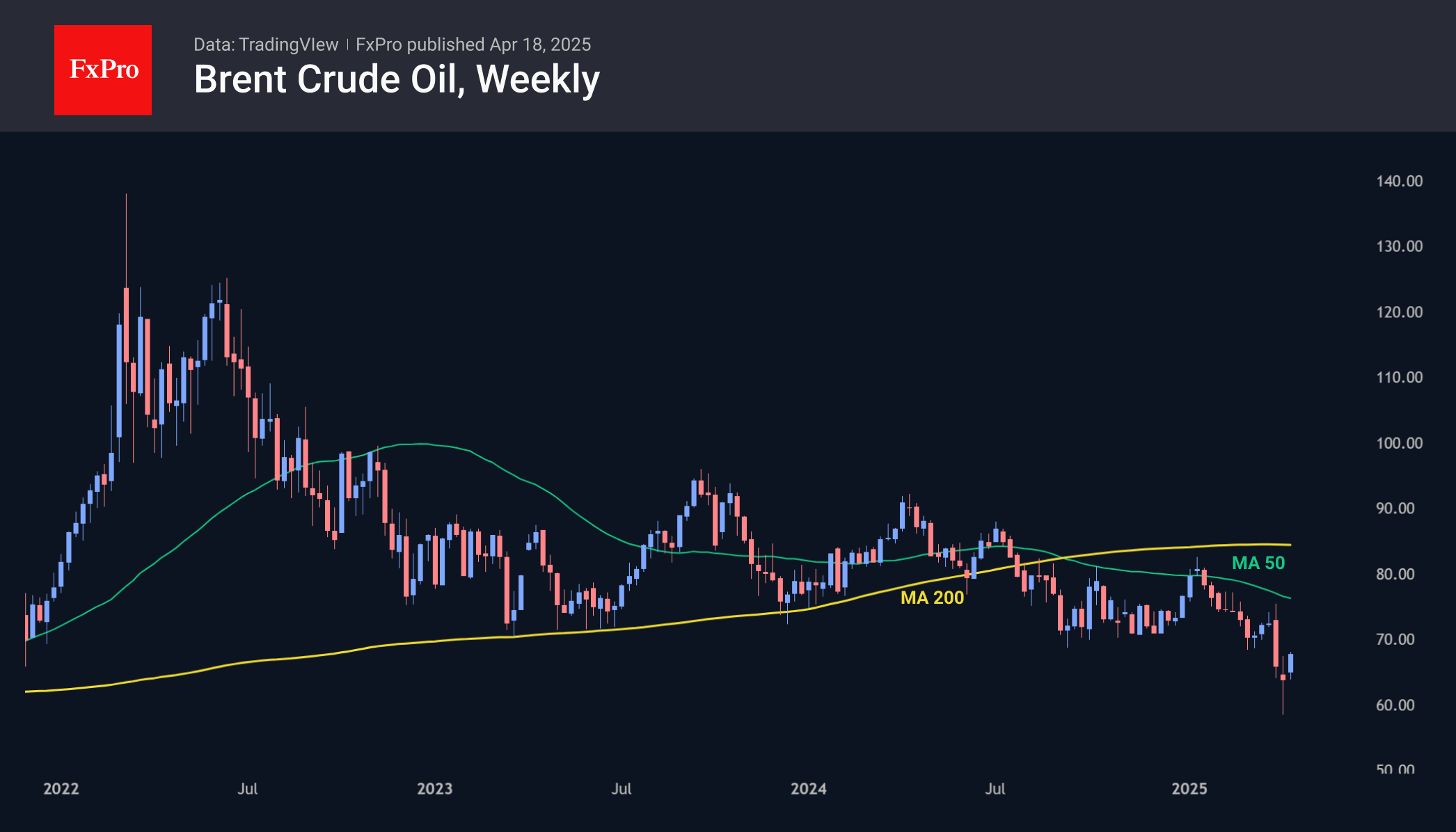

Markets are on edge: gold is smashing through all-time highs, the dollar is teetering under the weight of trade tensions, and crypto is losing steam just shy of a breakout. In this week’s Pro News Weekly, we break down the.