Market Overview - Page 24

May 16, 2025

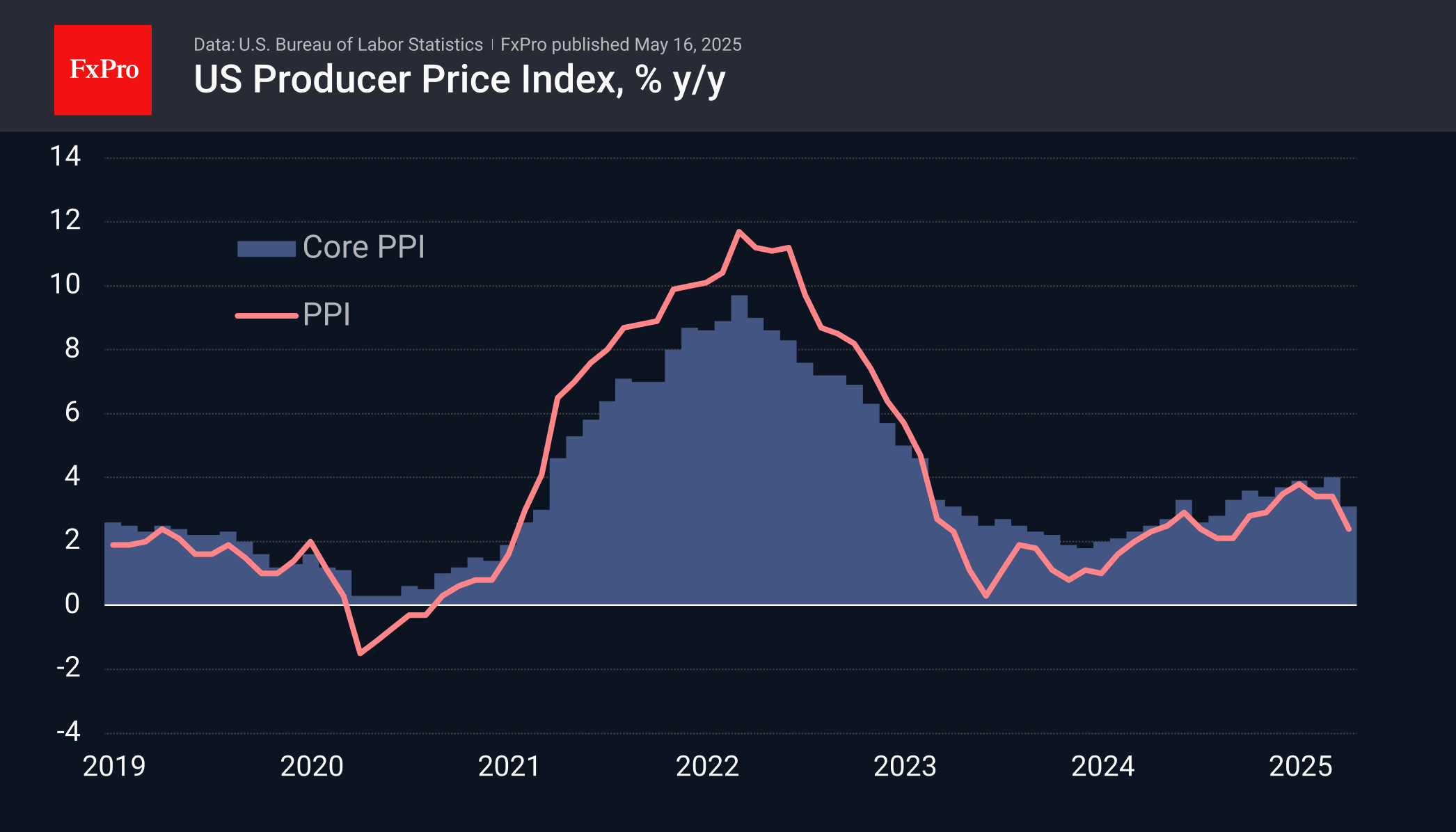

US producer prices unexpectedly fell 0.5% in April, dampening expectations of a strong upward trend due to tariffs. Despite this, the market outlook for rate cuts decreased, leading to a 2.5% rise in the dollar over a month.

May 14, 2025

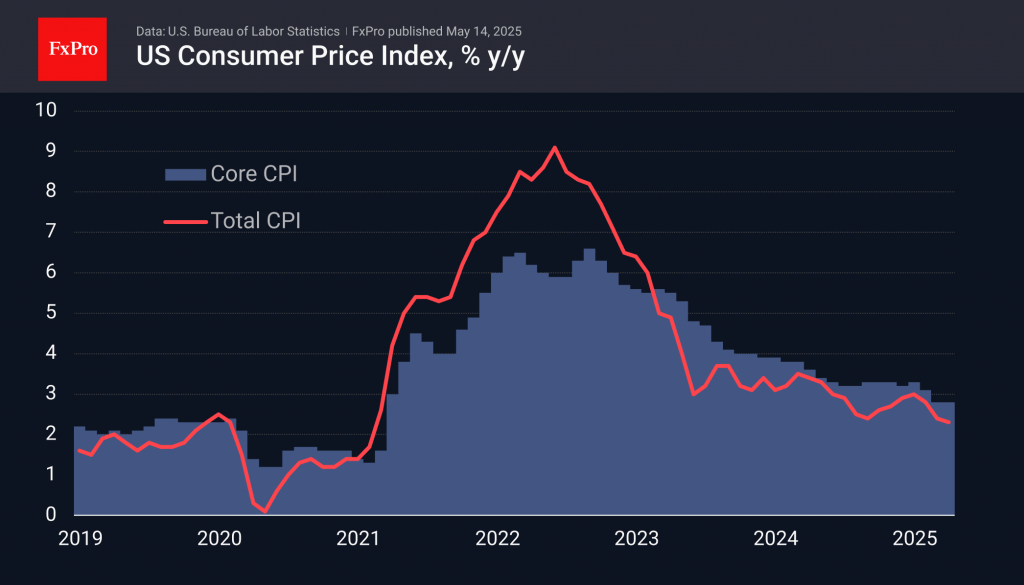

US CPI slowed to 2.3% y/y, slightly below expectations. Core inflation remains at 2.8%, leading to a weaker dollar and lower rate cut expectations.

May 13, 2025

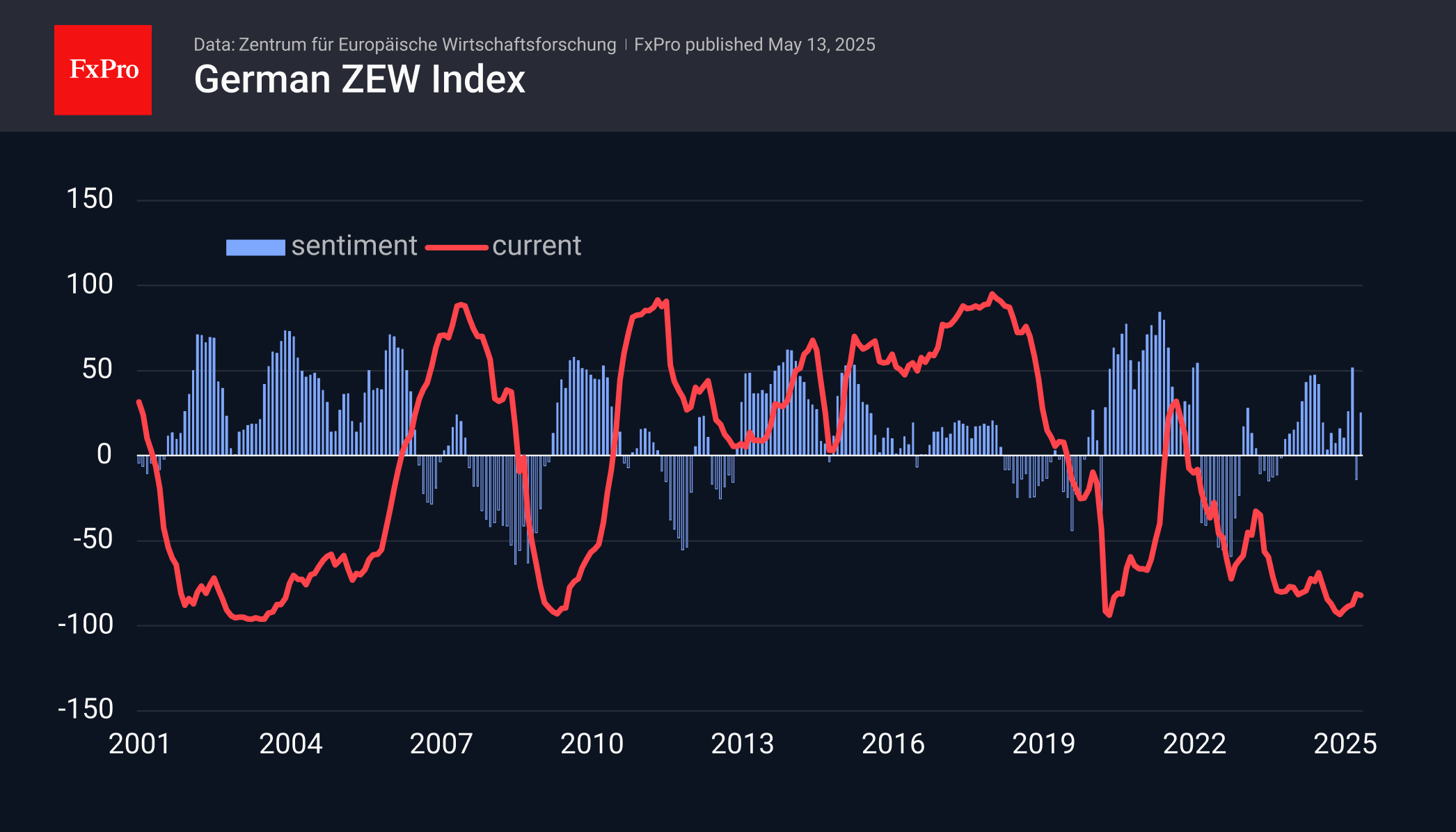

German business sentiment improved in May, with the ZEW index rising significantly to 25.2. Current situation assessment remains low but the positive sentiment supports the EURUSD near its 50-day MA.

May 13, 2025

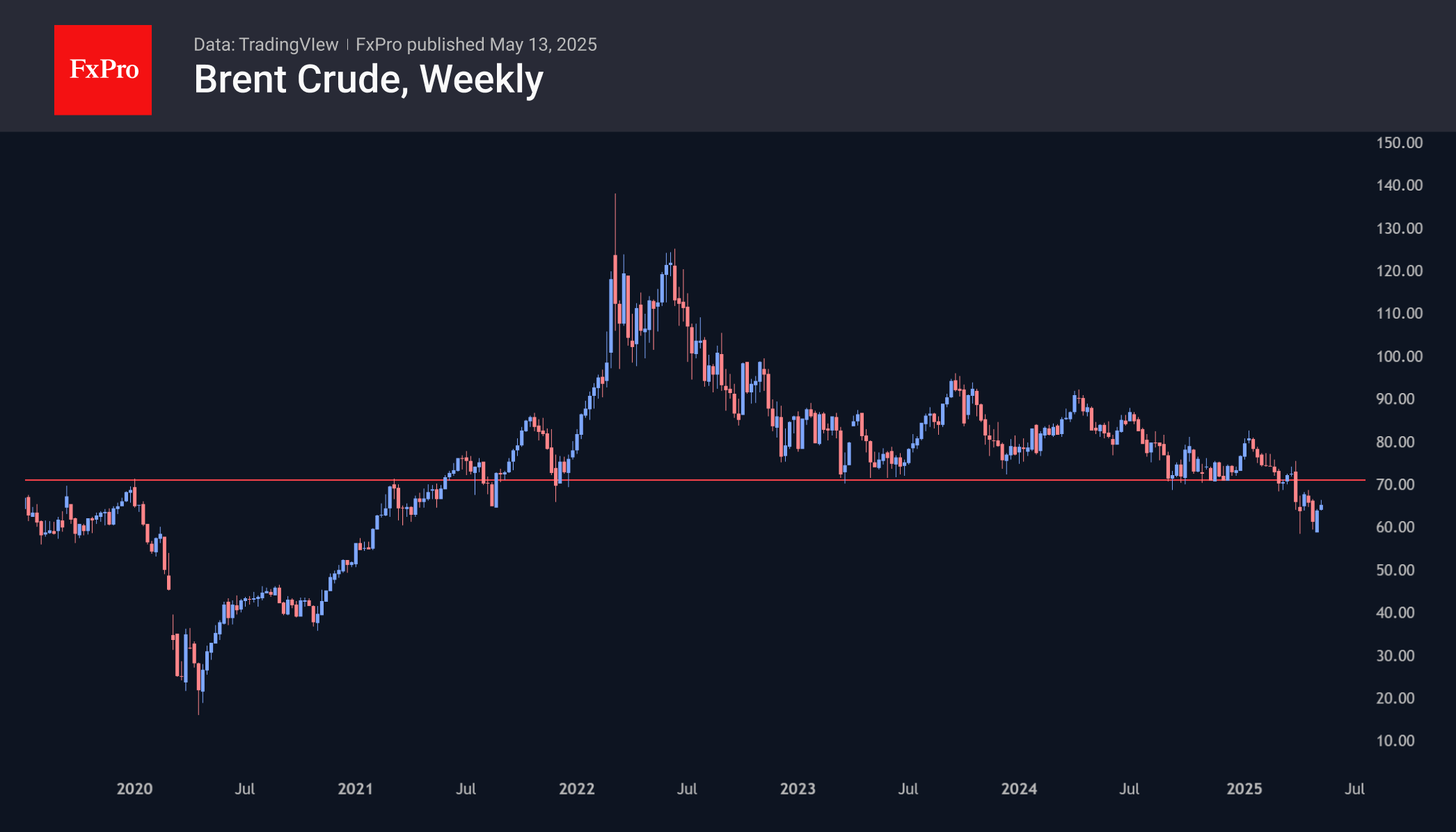

Oil prices have increased by over 12% due to positive news on China-US tariff talks. US oil production has declined, supporting an optimistic market sentiment and leading to falling commercial inventories.

May 9, 2025

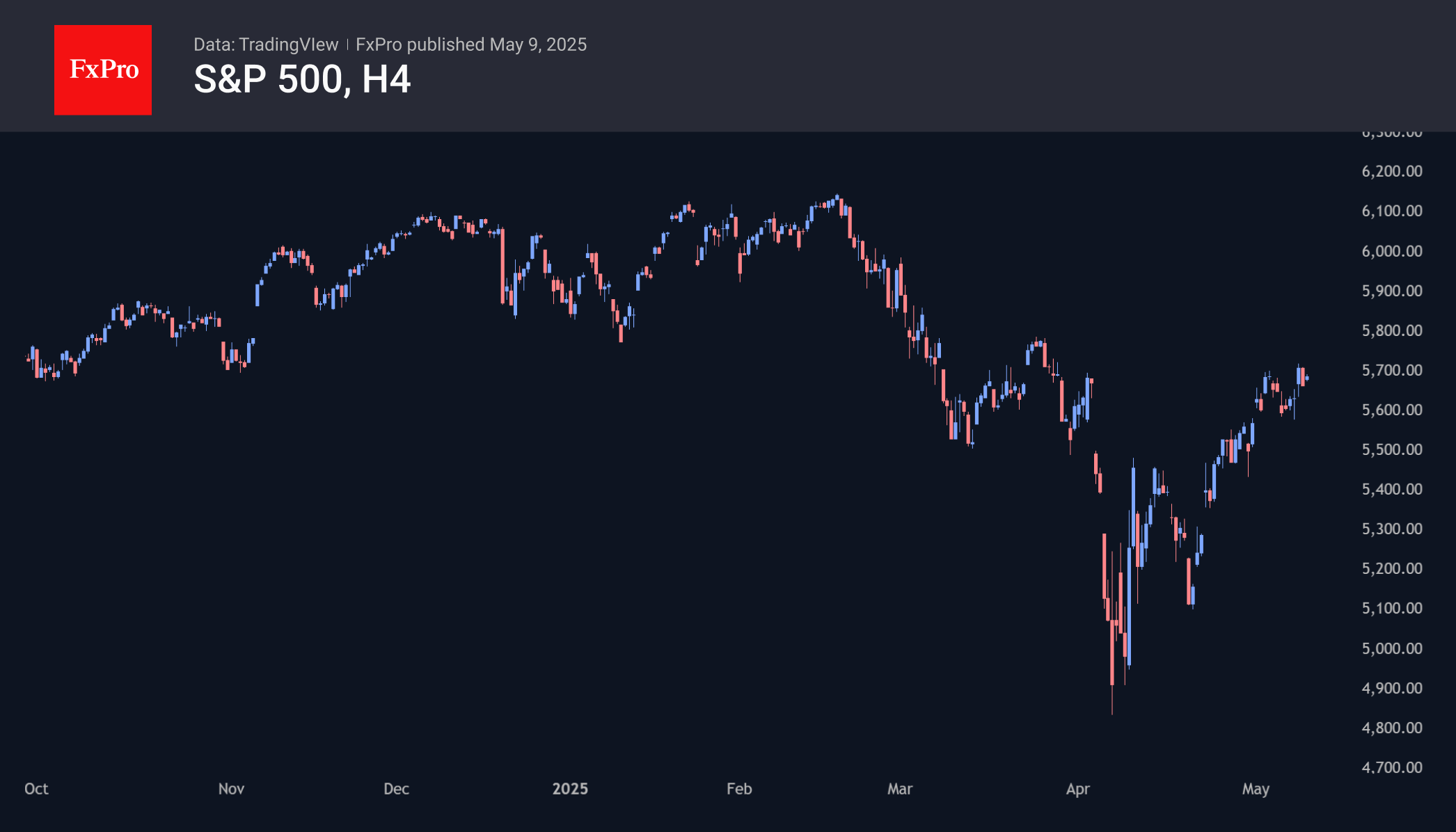

The S&P 500's rally raises concerns of overvaluation, but financial institutions advise holding US securities. Trade tensions easing, positive sentiments, and strong corporate reports drive the index up.

May 9, 2025

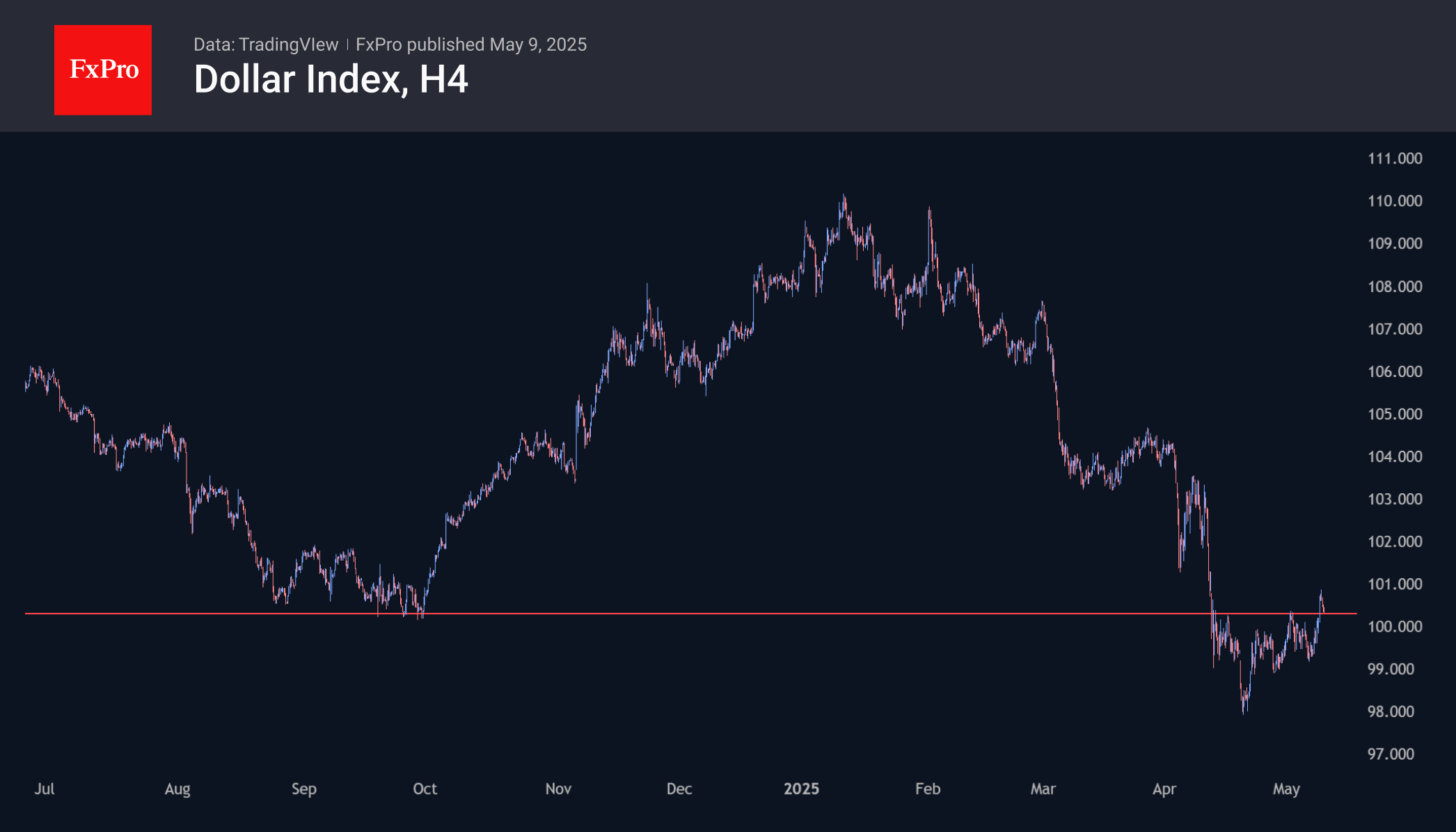

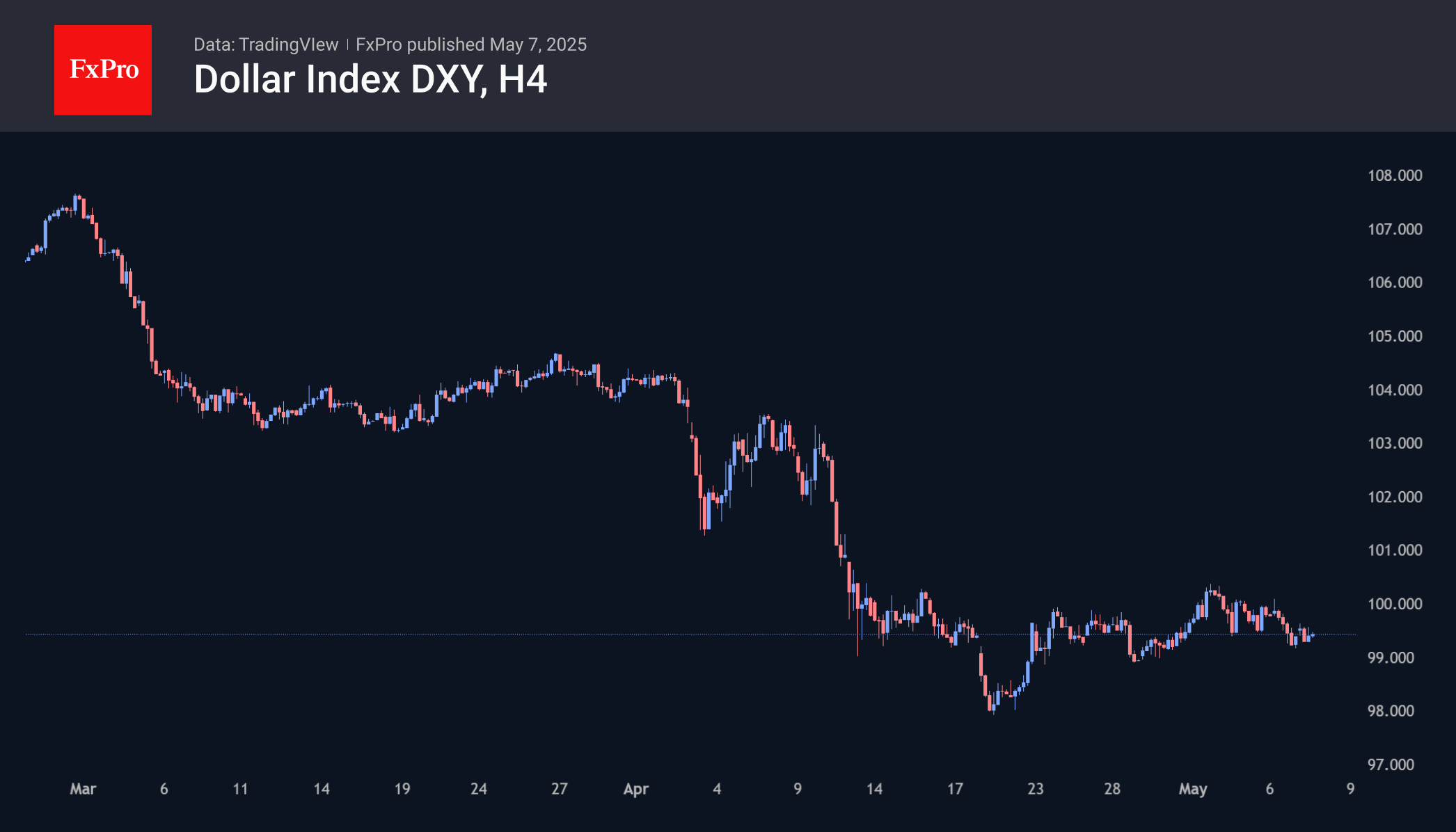

The US dollar gains strength due to the Fed's stance on rates, support from the White House, and upcoming trade talks with China.

May 8, 2025

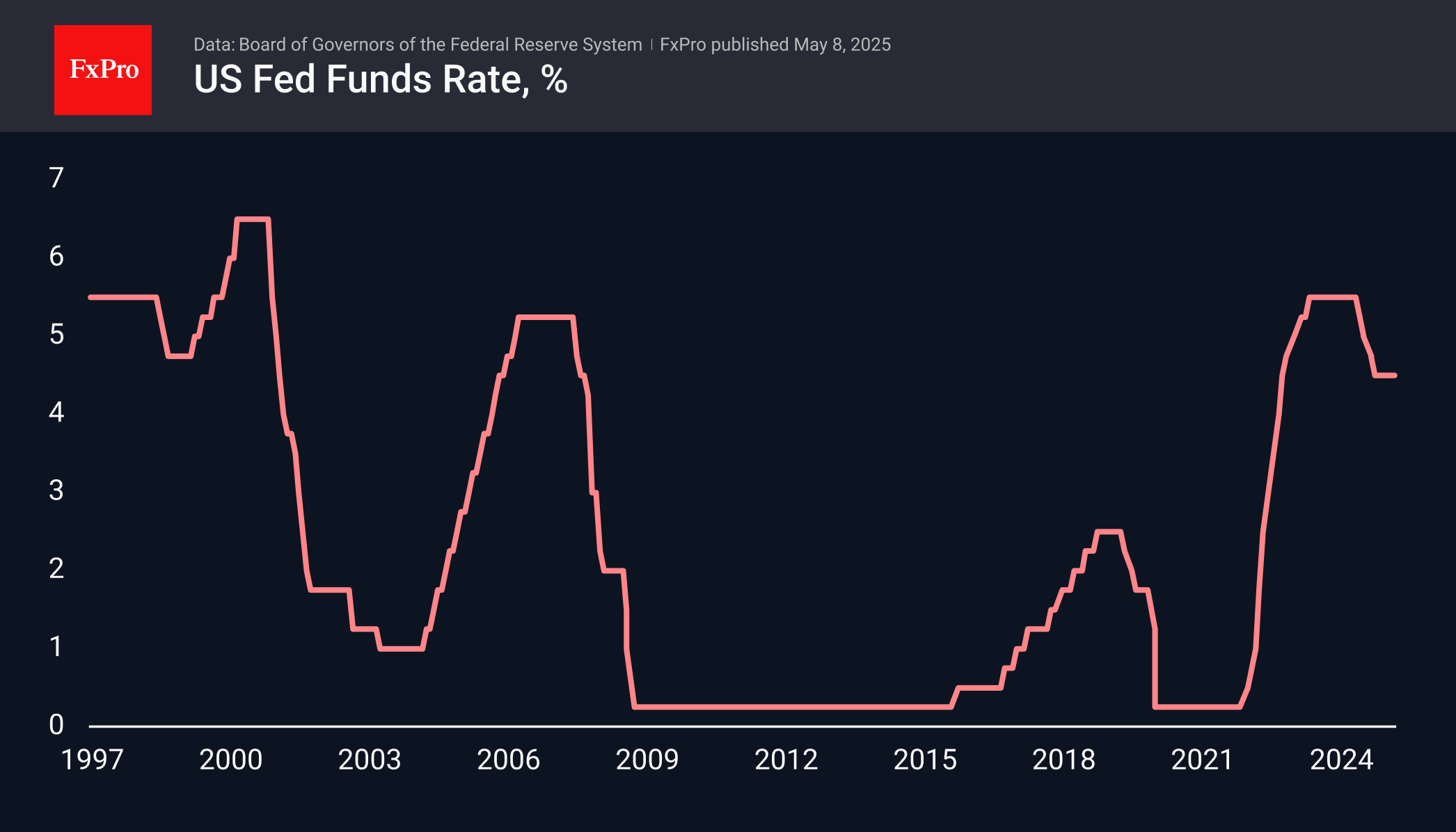

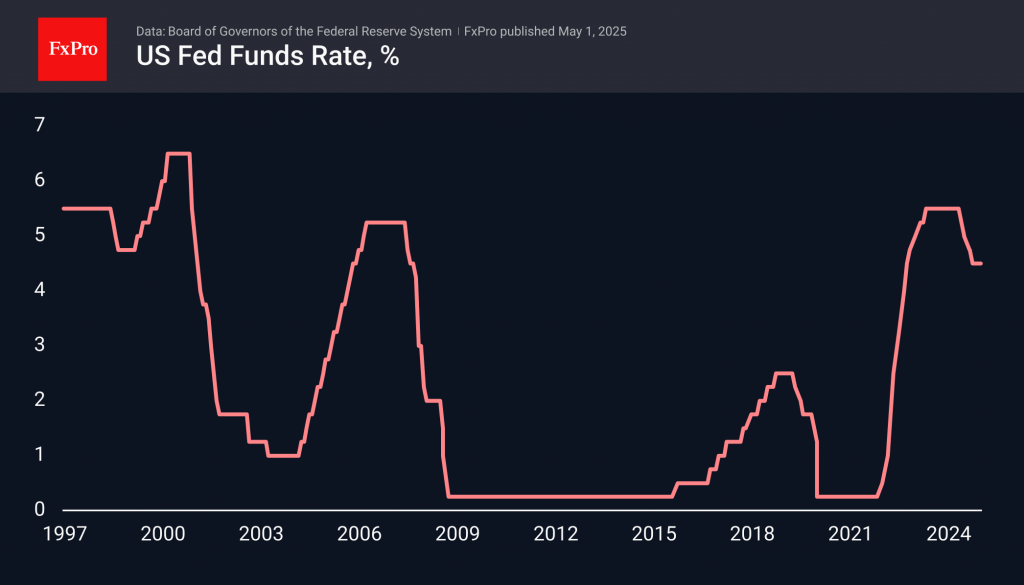

The Federal Reserve, under Powell's leadership, maintained the key rate and indicated a cautious approach to reducing it. Powell's comments contributed to supporting the dollar amidst market uncertainties.

May 7, 2025

Market analysts are anticipating the Federal Reserve's upcoming meeting outcome, predicting no rate changes. Uncertainty prevails due to trade tensions and potential dollar shifts following Trump's demands on rate cuts.

May 6, 2025

The US faced a record trade deficit in March due to a surge in imports before tariffs were implemented, with even worse numbers expected for April. Tariffs are influencing trade dynamics, causing fluctuating figures that may change over time.

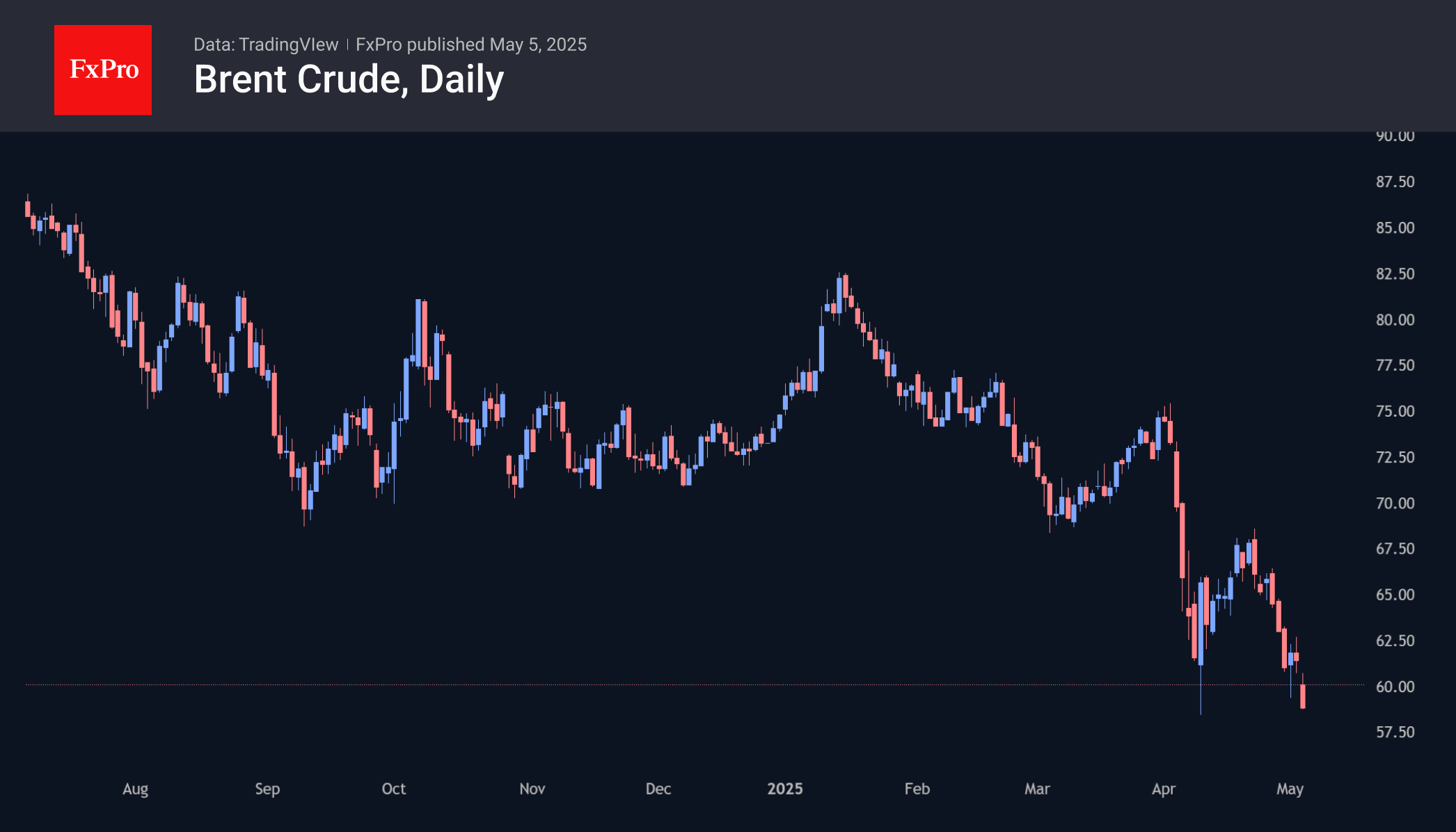

May 5, 2025

Oil opened this week down 4% after OPEC+ said it would increase production by 411K bpd in June, lifting previous voluntary cuts faster than forecasted.

May 2, 2025

In the upcoming week, focus will shift back to monetary policy, with key interest rate decisions expected from both the Federal Reserve and the Bank of England. On Wednesday, Powell and Сo are expected to keep the key rate unchanged,.