Market Overview - Page 23

May 27, 2025

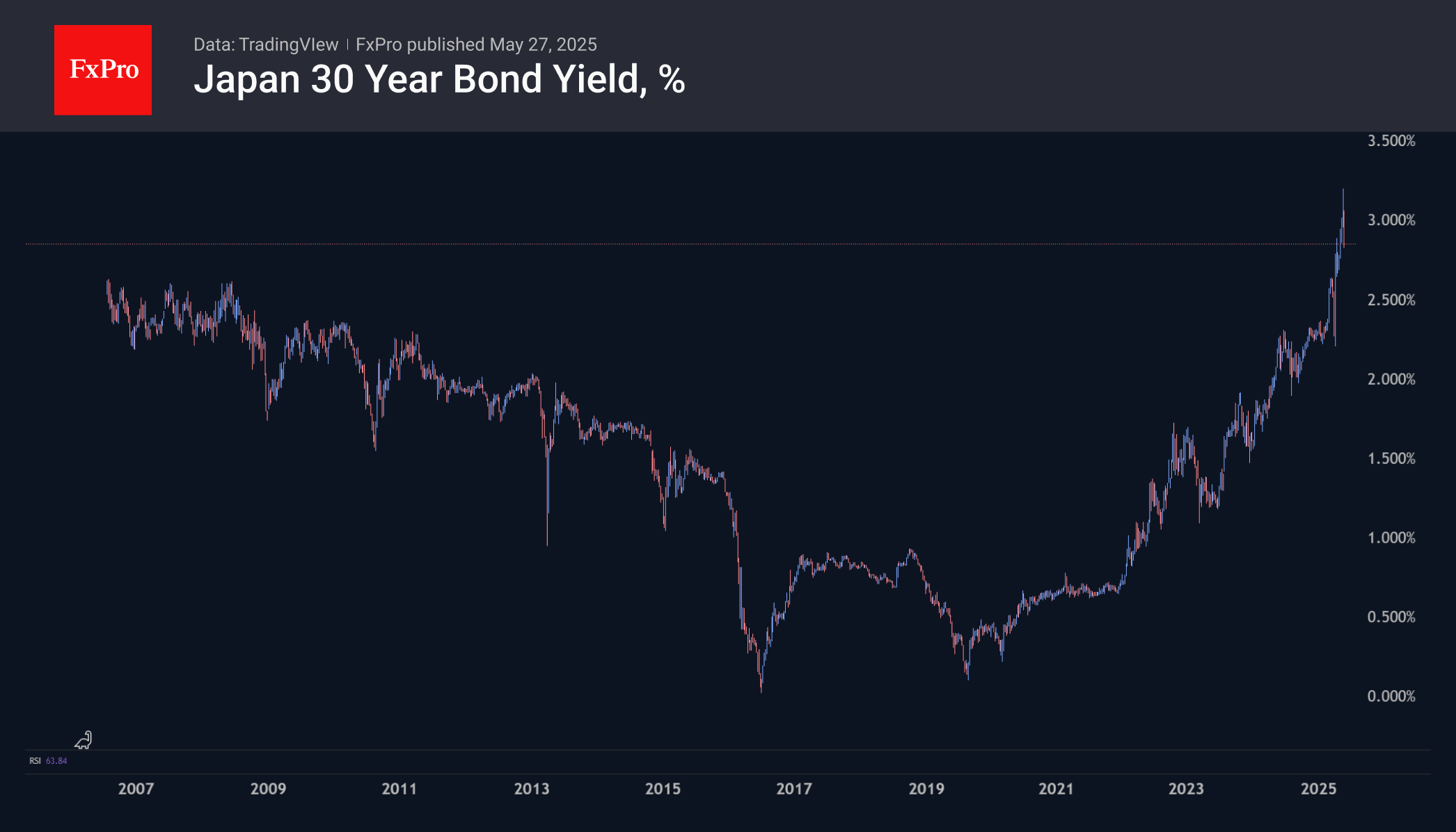

Japan's high debt burden may lead to a reversal in monetary policy to support the bond market and exports. The USDJPY pair is seen to have retreated from long-term support at 140, with the potential to rise to 160 or higher.

May 26, 2025

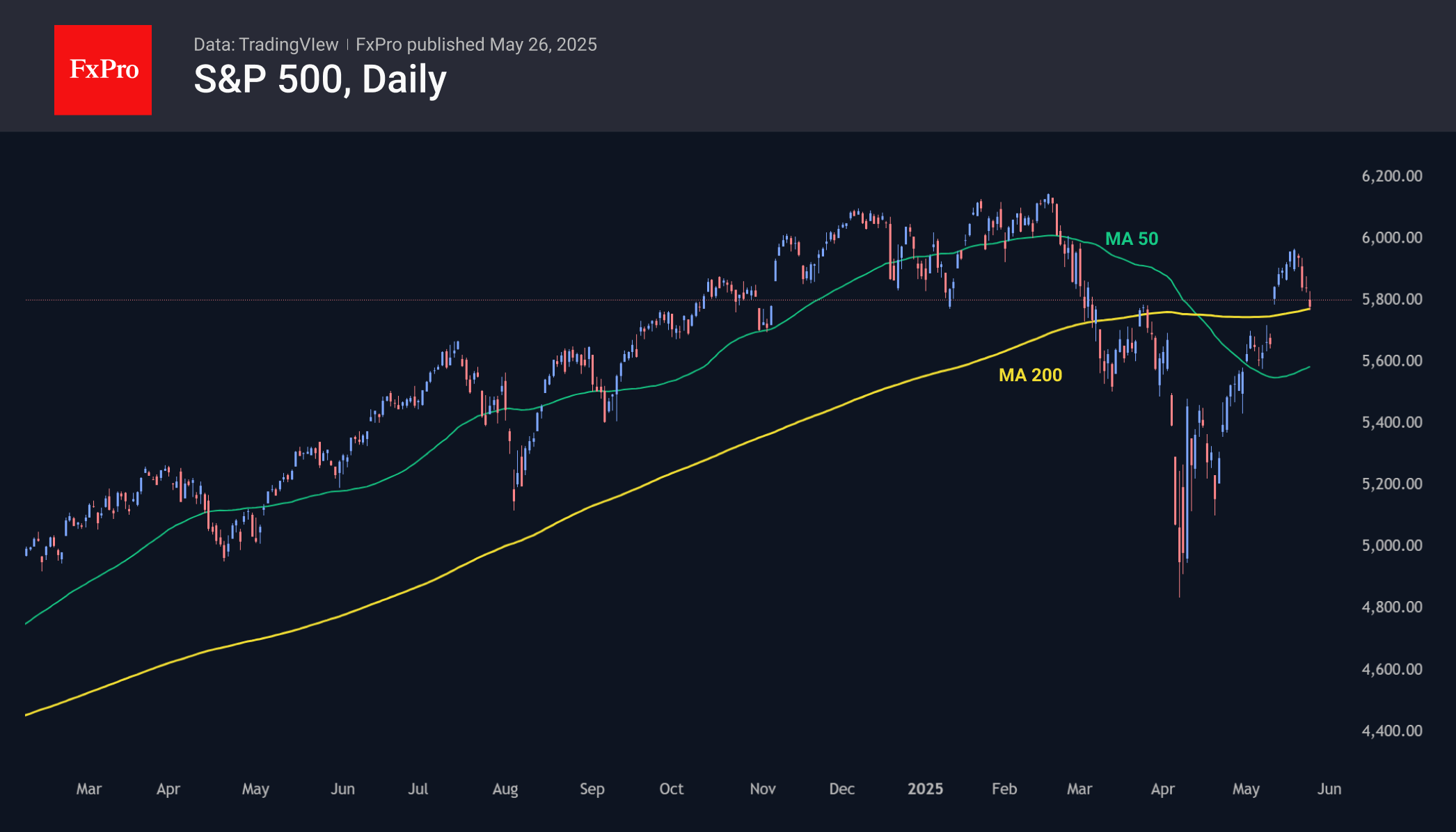

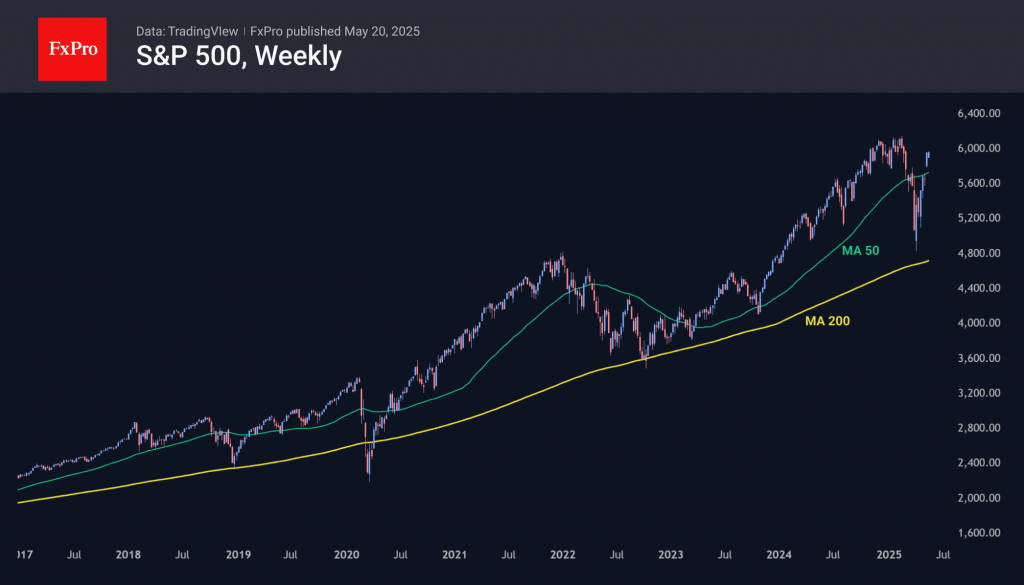

The EU tariff shift led to a bounce in the S&P500 off its 200-day MA after US President delayed imposing tariffs, pushing the index towards potential historical highs.

May 26, 2025

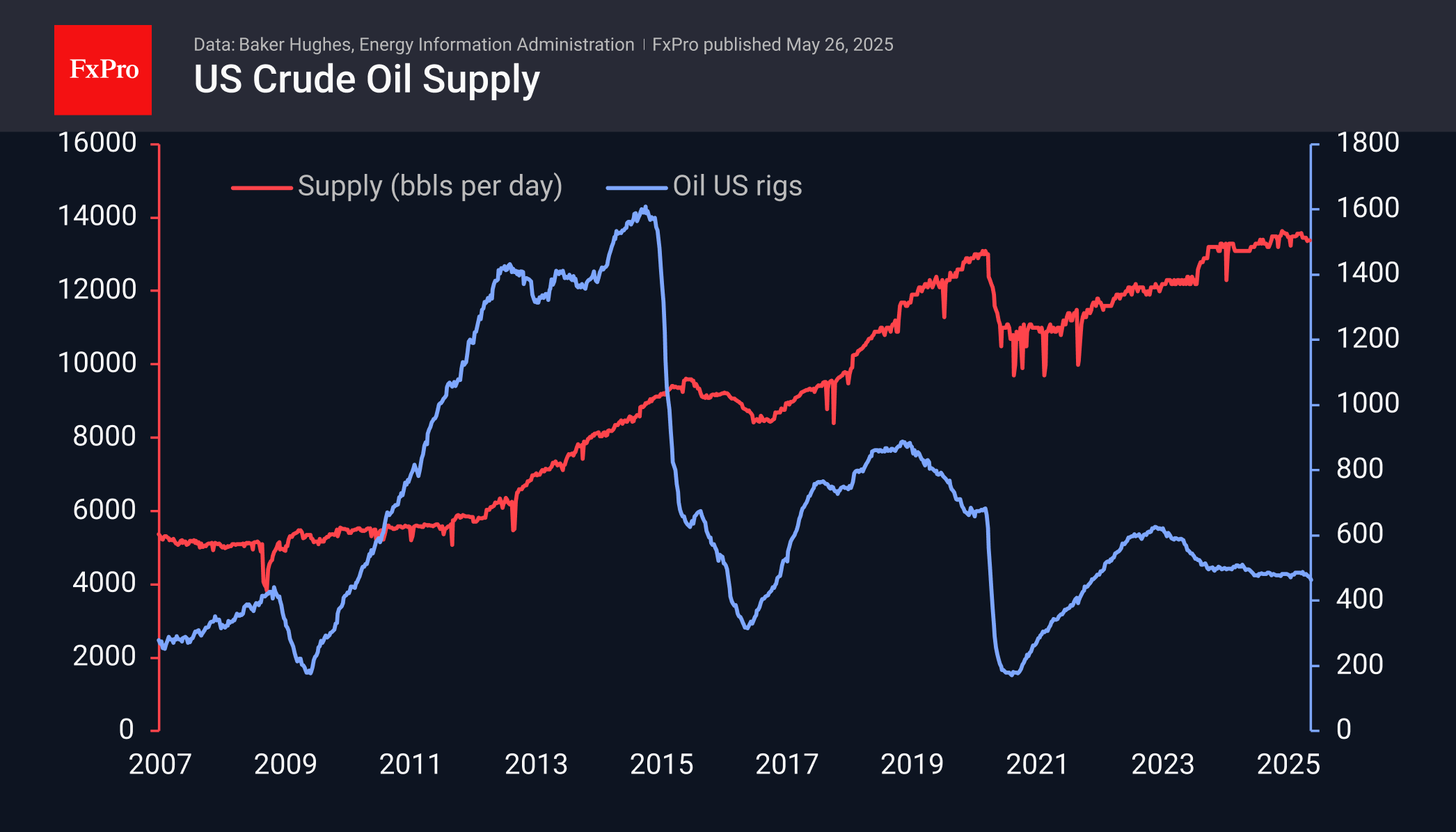

US drilling activity declines due to low oil prices, with rig count dropping to its lowest level in late 2021. Meanwhile, OPEC plans to increase production, affecting oil prices negatively.

May 23, 2025

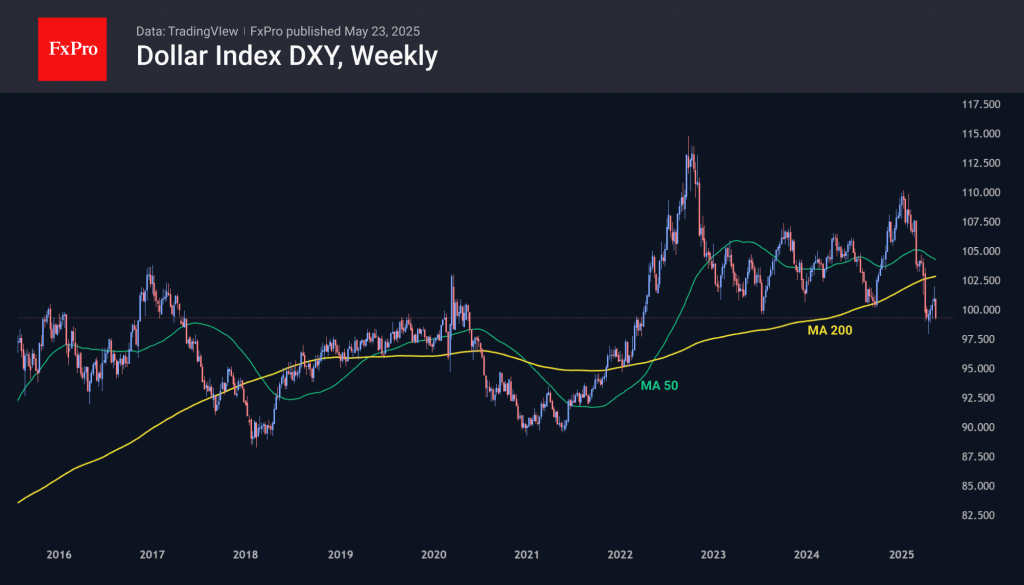

It’s been a wild week in the markets. U.S. stocks are sliding, the dollar’s under pressure, and Bitcoin just hit a new record. What’s behind the chaos?

May 23, 2025

The US dollar faces increasing risks due to trade wars, credit rating downgrade, fiscal problems, and tariffs threats, leading to a decline in confidence and value.

May 23, 2025

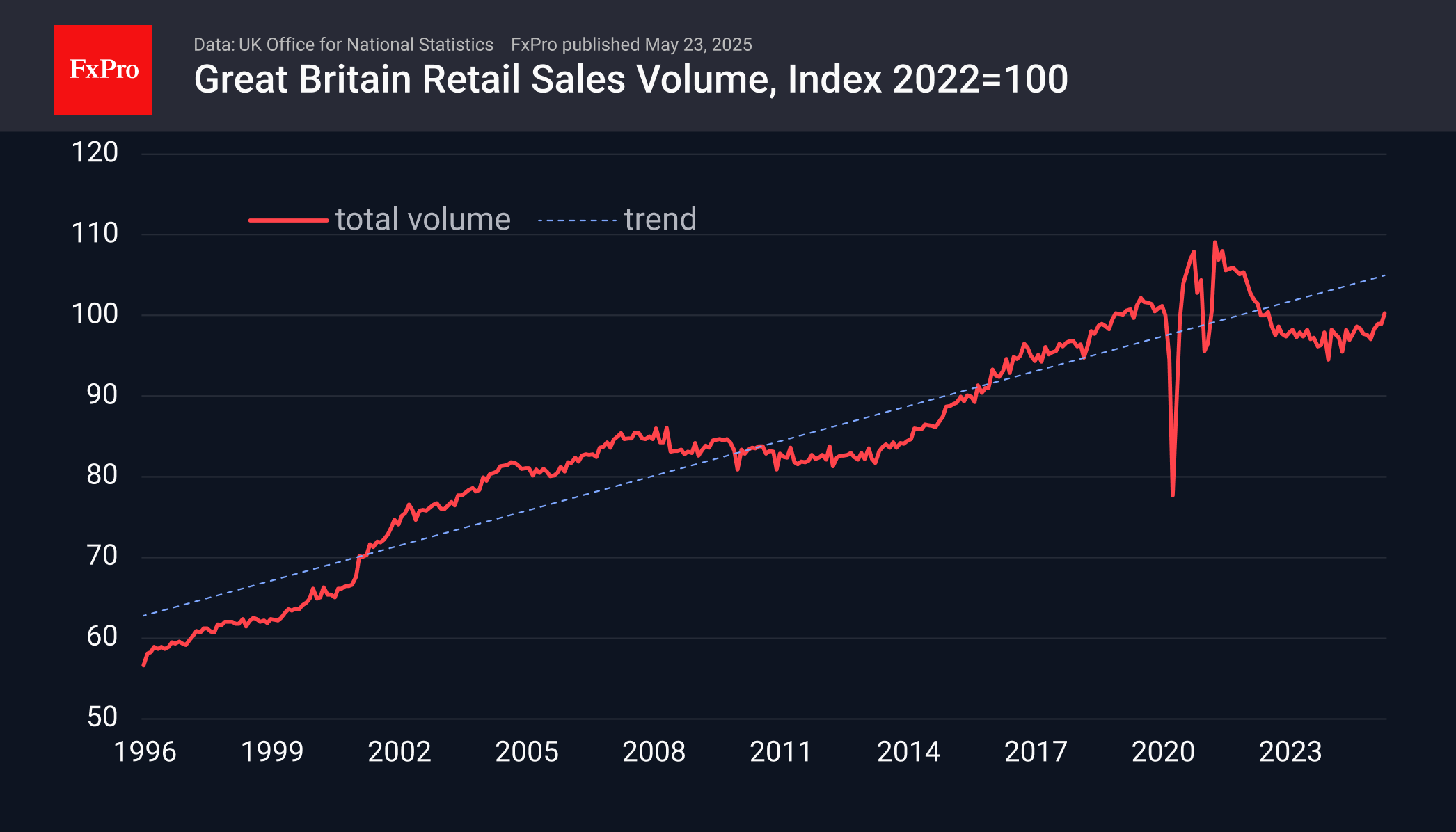

Strong retail sector data and accelerating consumer inflation in Britain limit room for Bank of England rate cuts. This news boosts the pound, hitting 39-month highs, supported by strong retail sales figures exceeding expectations.

May 22, 2025

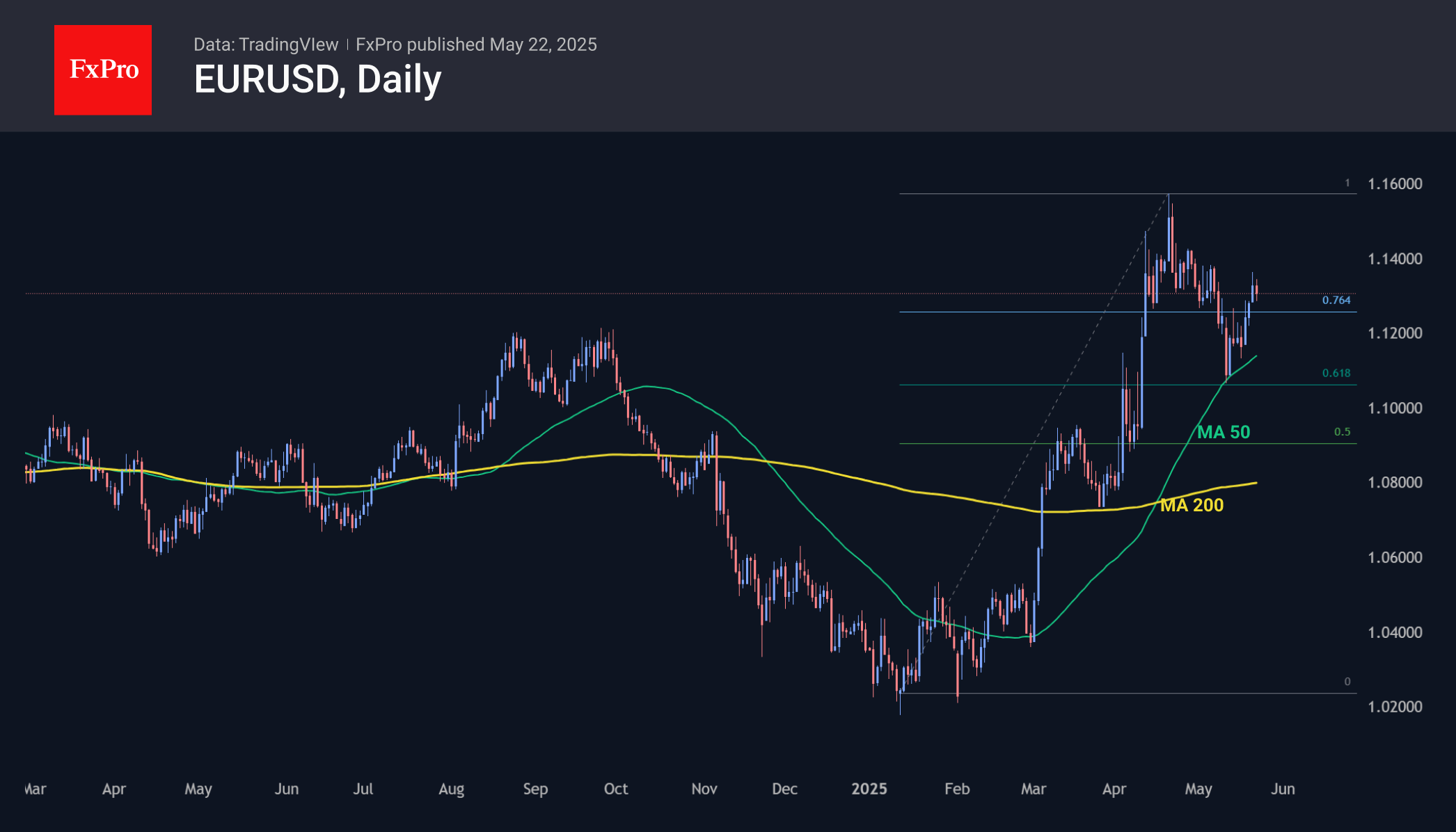

EURUSD is seeing a tactical retreat towards 1.13 after a rapid rise. The 1.12-1.15 area is a key pivot, with a longer-term uptrend targeting 1.20-1.25.

May 22, 2025

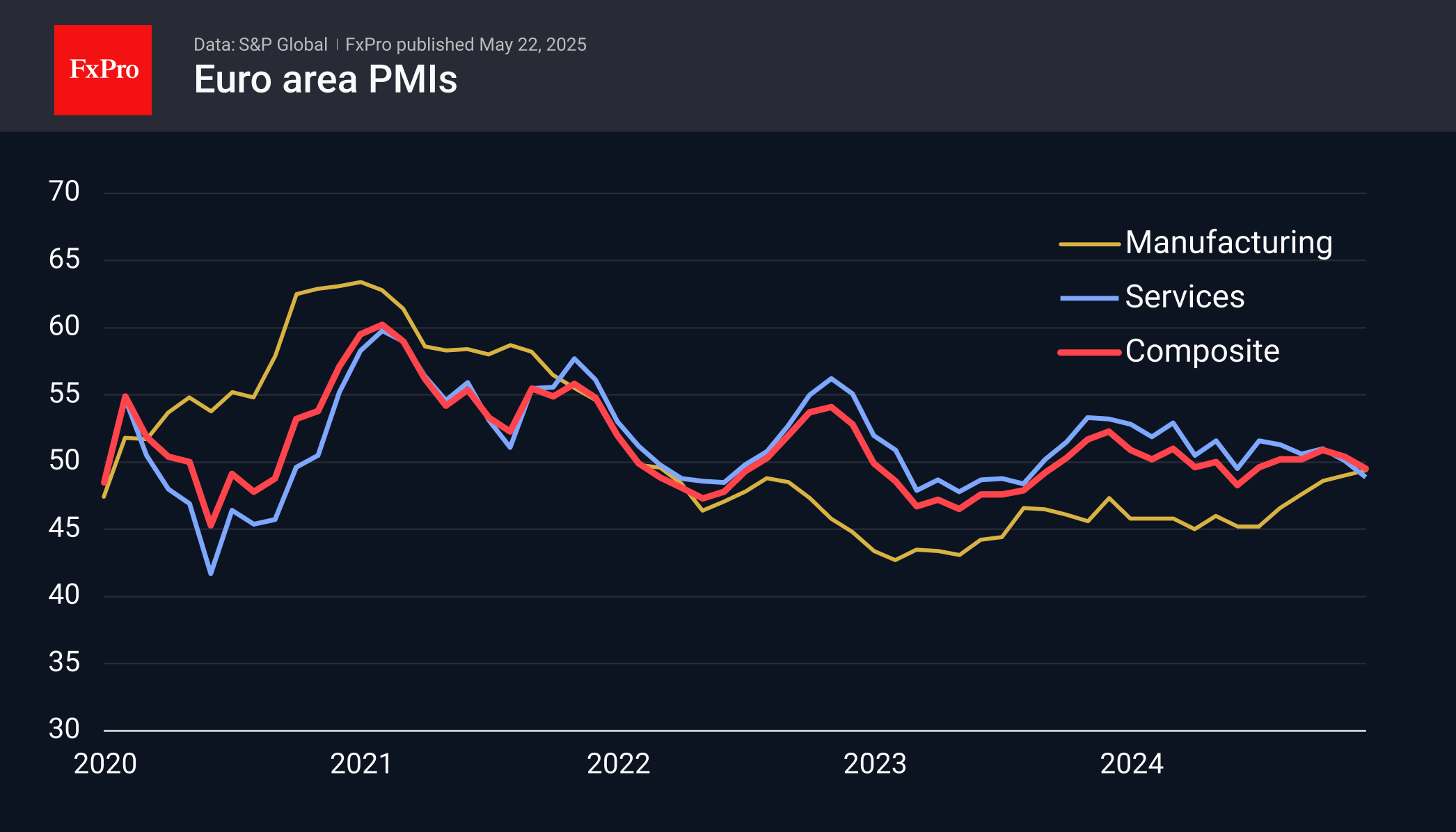

Eurozone PMI data showed a contraction in business activity, with services sector weakening while manufacturing improved. The strengthening euro did not hinder manufacturers.

May 21, 2025

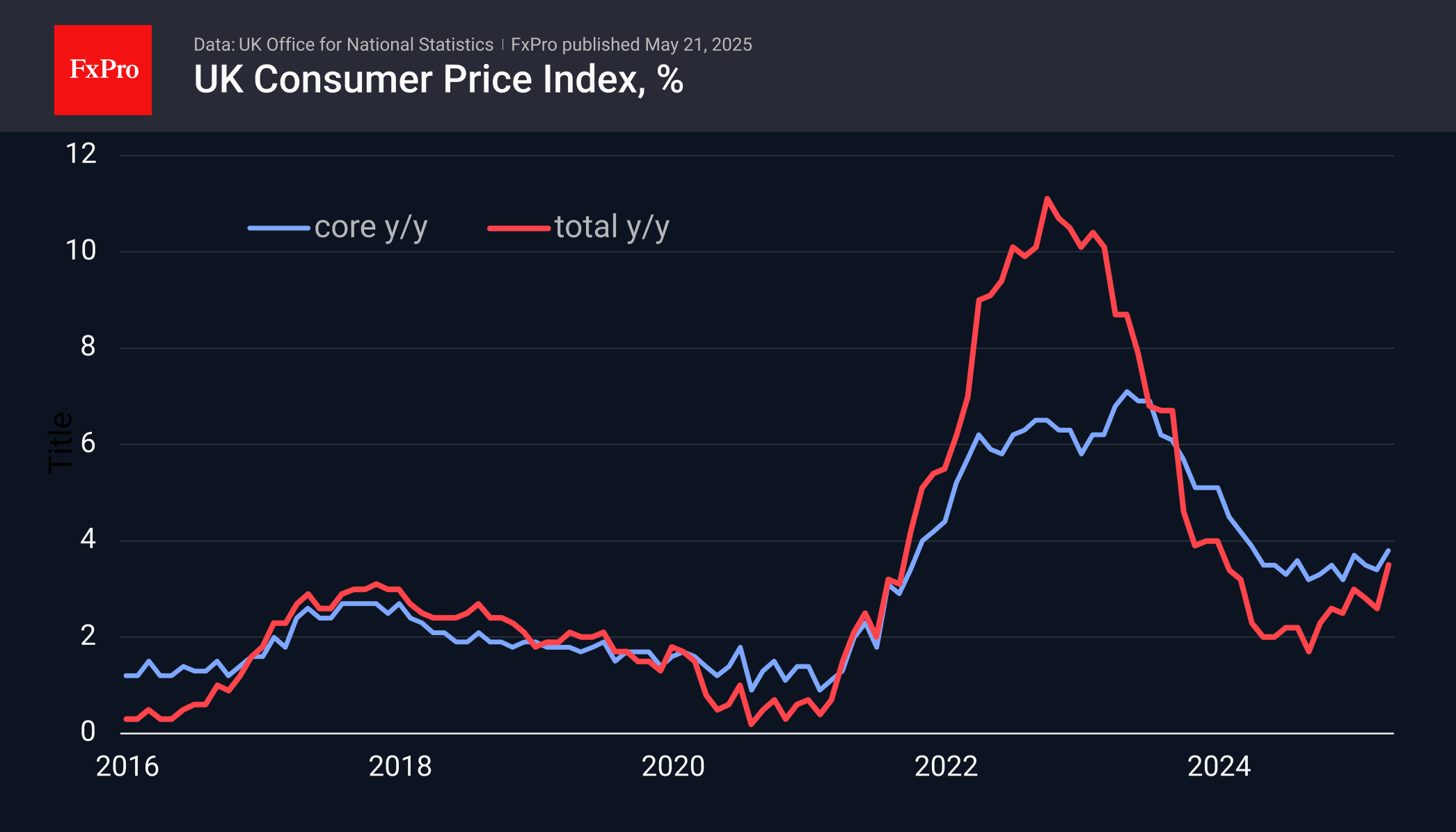

UK inflation surged unexpectedly, raising concerns about a potential Bank of England rate cut. The rise was driven by increases in housing, household services, and leisure, challenging monetary policy.

May 20, 2025

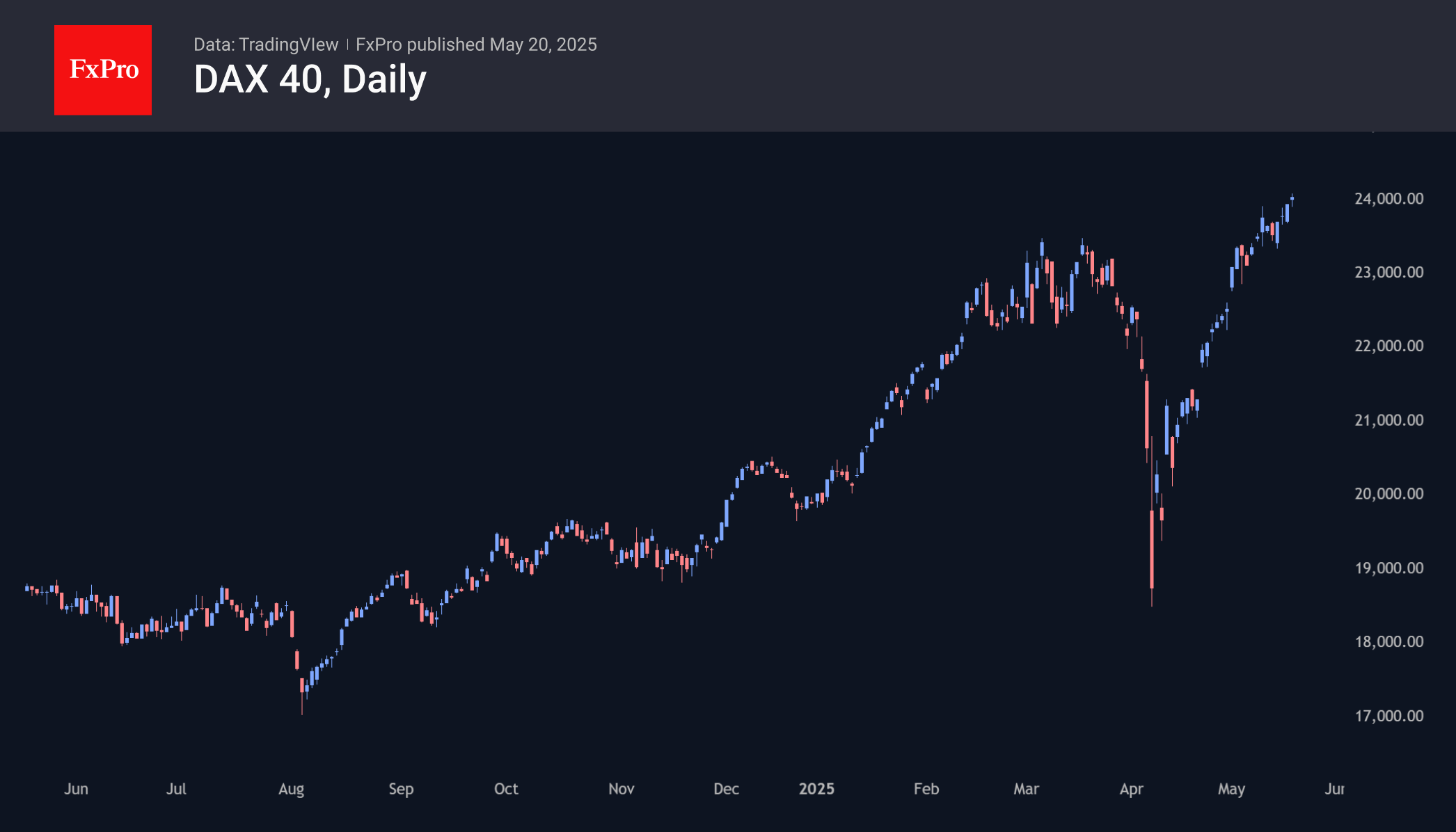

Germany's DAX40 and UK's FTSE100 outperform S&P500, showing strength against economists' pessimism. Stimulus measures from Europe and China boost equities, with potential for positive impacts globally.

May 20, 2025

US markets were not afraid of the downgrade in the country's credit rating by Moody's, as investors quickly recovered from the 1.5% drawdown. Despite positive technical analysis, there are concerns about higher stock valuations and potential market corrections in the future.