Market Overview - Page 20

June 12, 2025

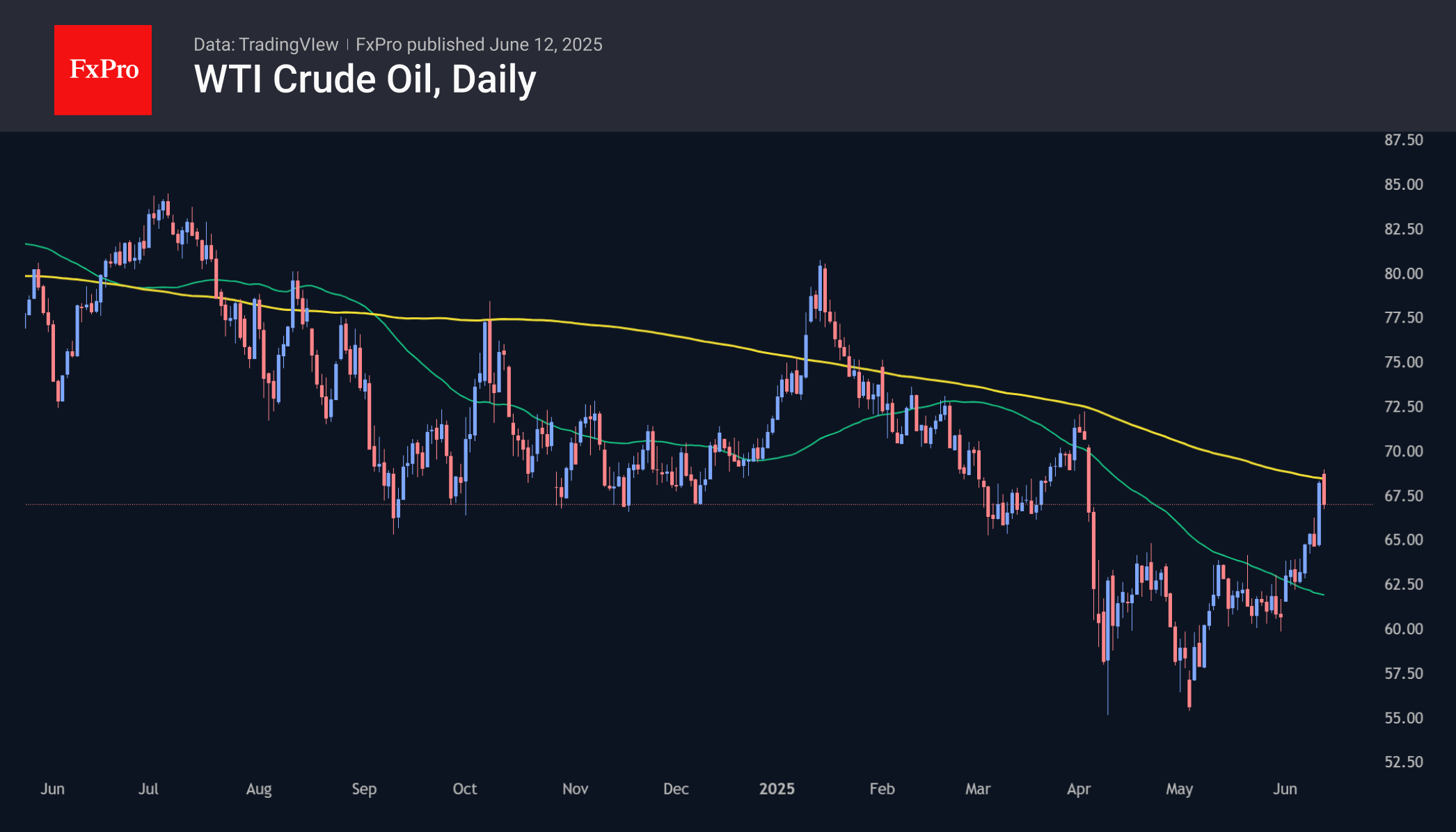

Oil prices surged over 6% due to bullish news, including US embassy evacuation in Iraq, US-China trade agreement, falling crude inventories, and decreased active oil rigs. Oil market bears still have control.

June 11, 2025

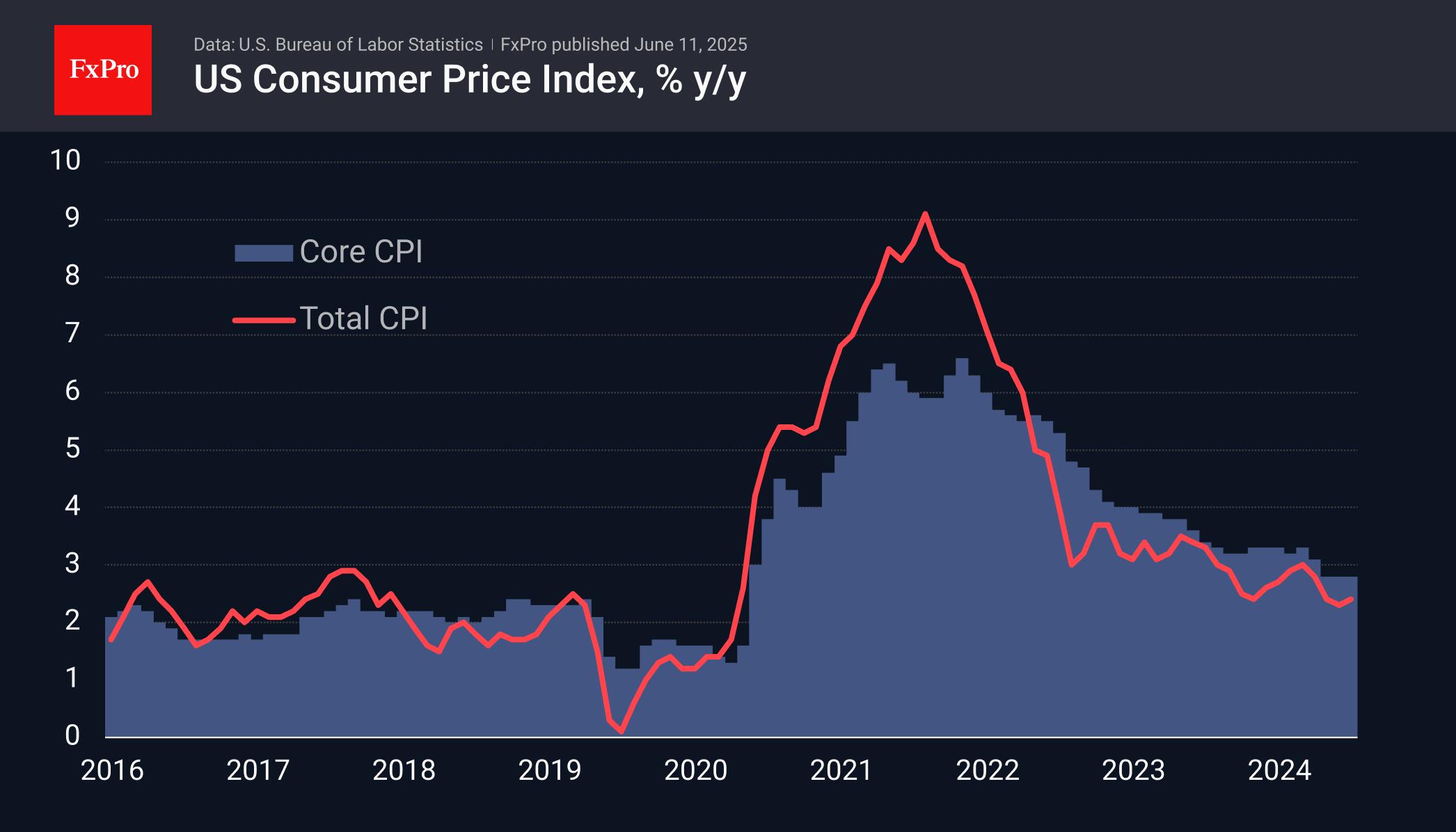

US CPI rose by 0.1% in May, lower than expected, impacting the dollar. Tariff disputes haven't significantly increased inflation, with sellers not rushing to raise prices.

June 11, 2025

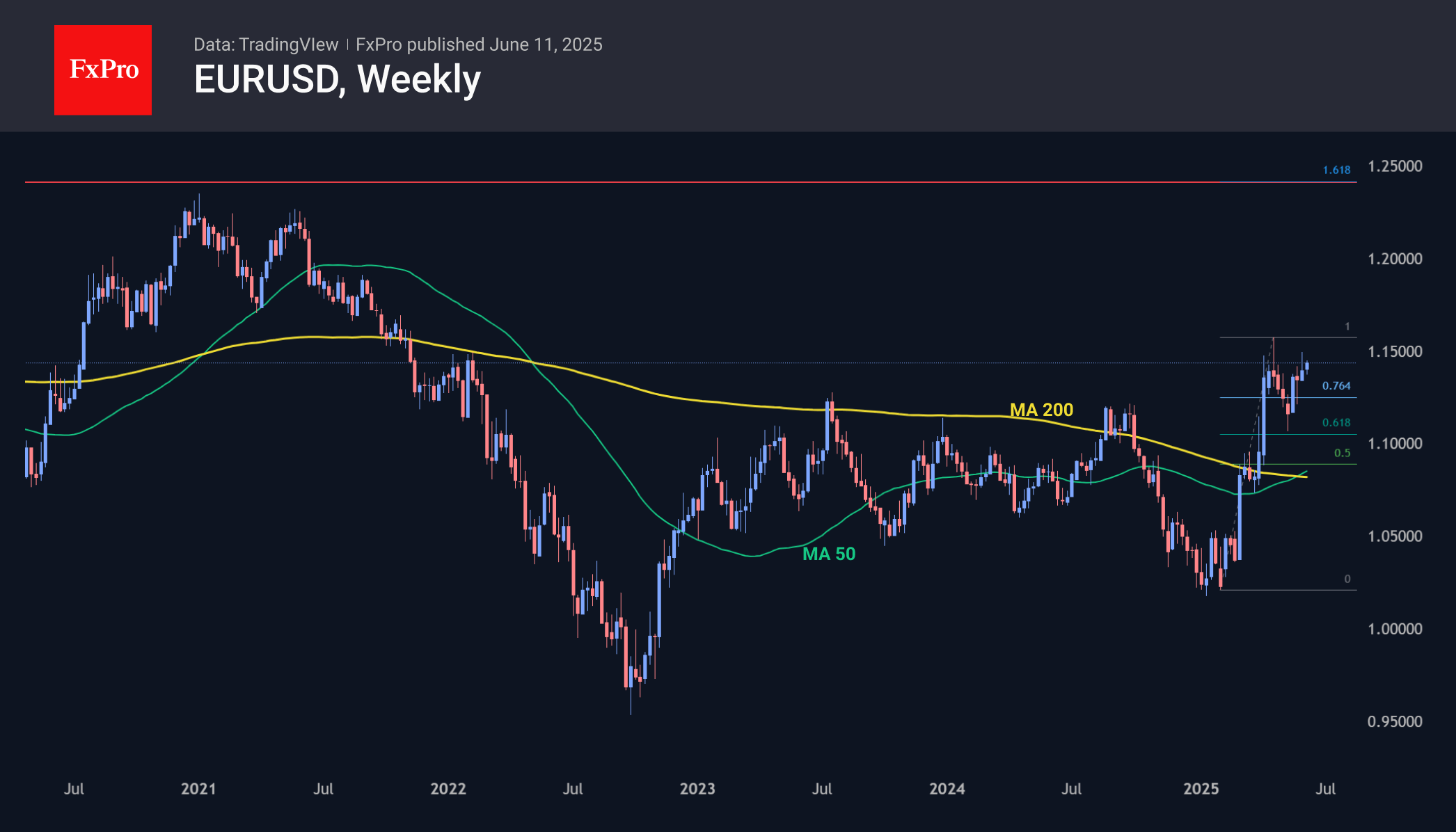

The euro is experiencing an upward trend, supported by political decisions and varying economic factors, with potential for further growth.

June 10, 2025

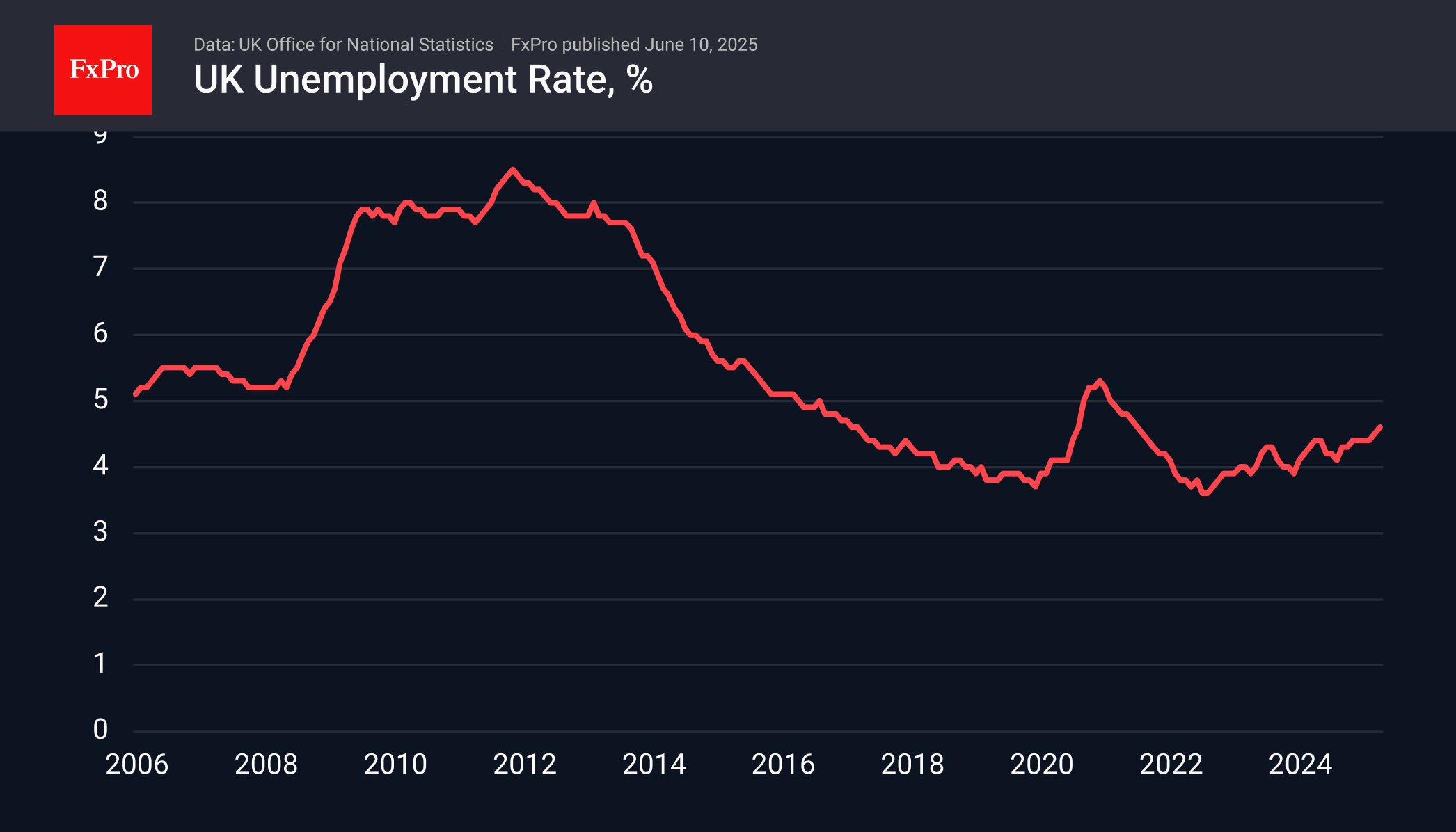

The British labour market deterioration has weakened the pound due to rising unemployment rates and slowing income growth. Bank of England's easing measures have not yet reversed the trend, increasing expectations of further rate cuts.

June 10, 2025

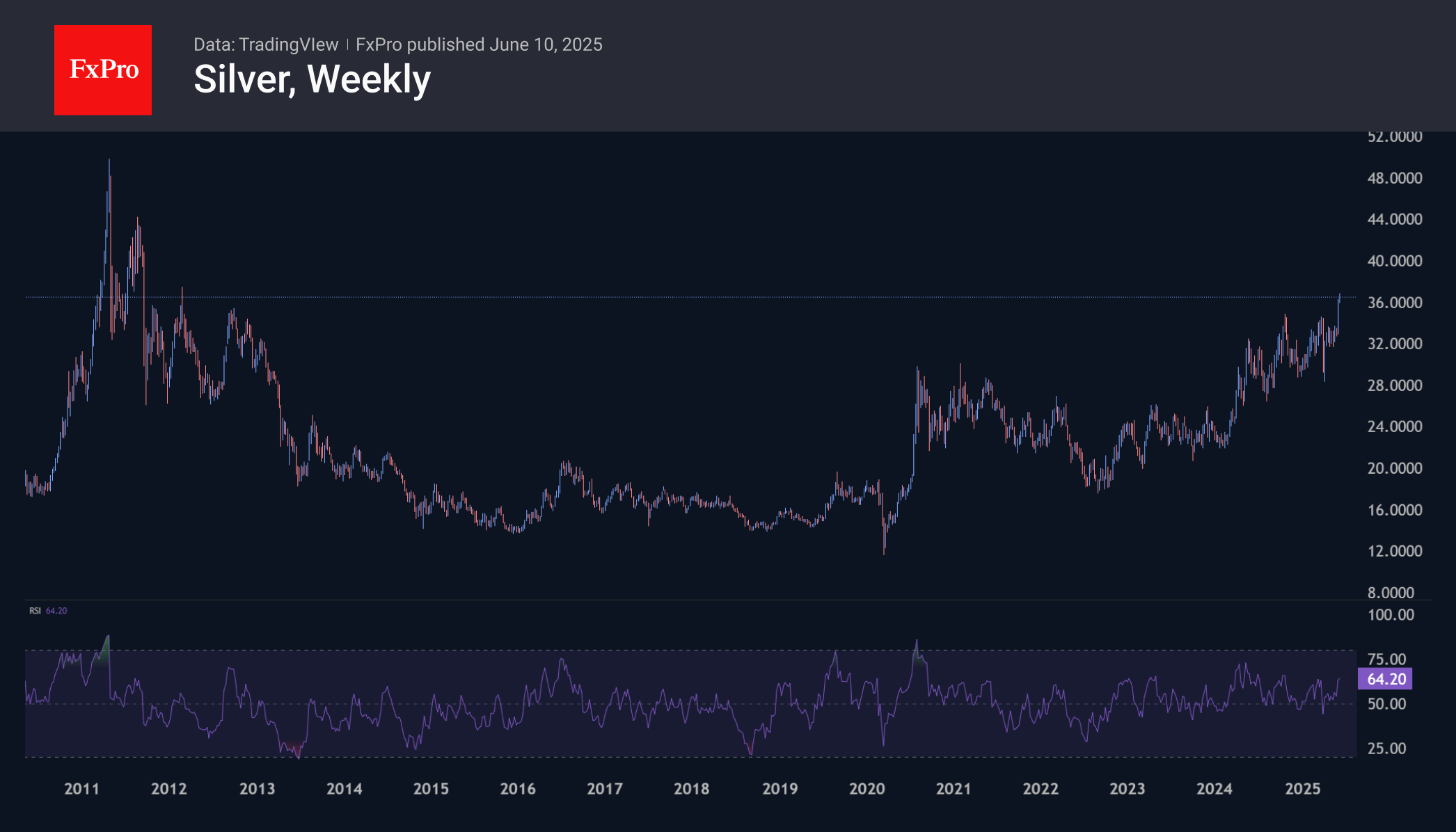

Silver and platinum are experiencing strong rallies and attracting bullish investors as gold faces turbulence. Platinum has surged 35% to $1,225, while silver has risen 27% to $36.9, with both metals showing potential for further growth.

June 4, 2025

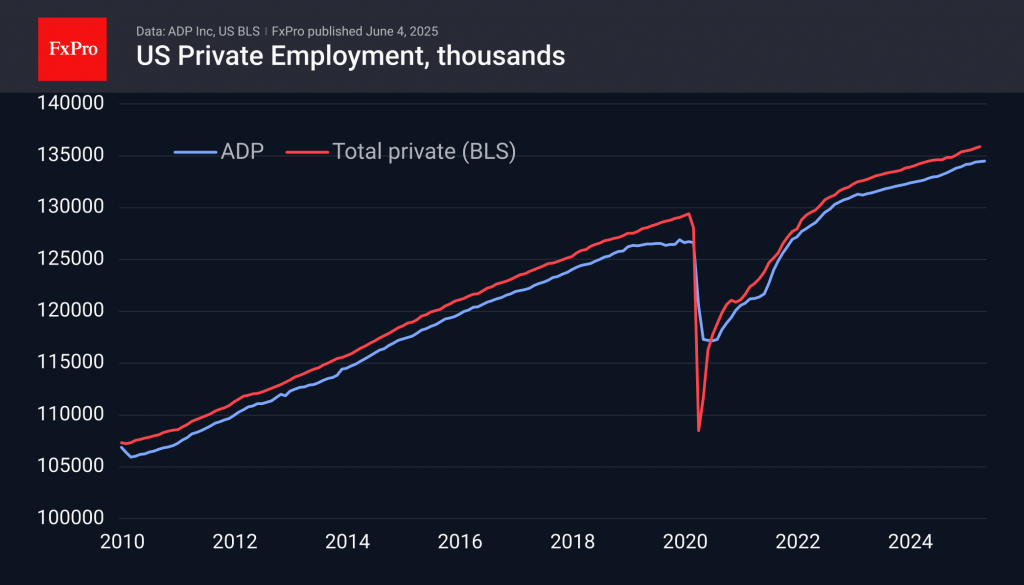

ADP employment data suggests a significant slowdown in the US labour market, with private sector employment growth at a low of 37K. But this unlikely brings Fed closer to rate cut because of accelerating price pressure

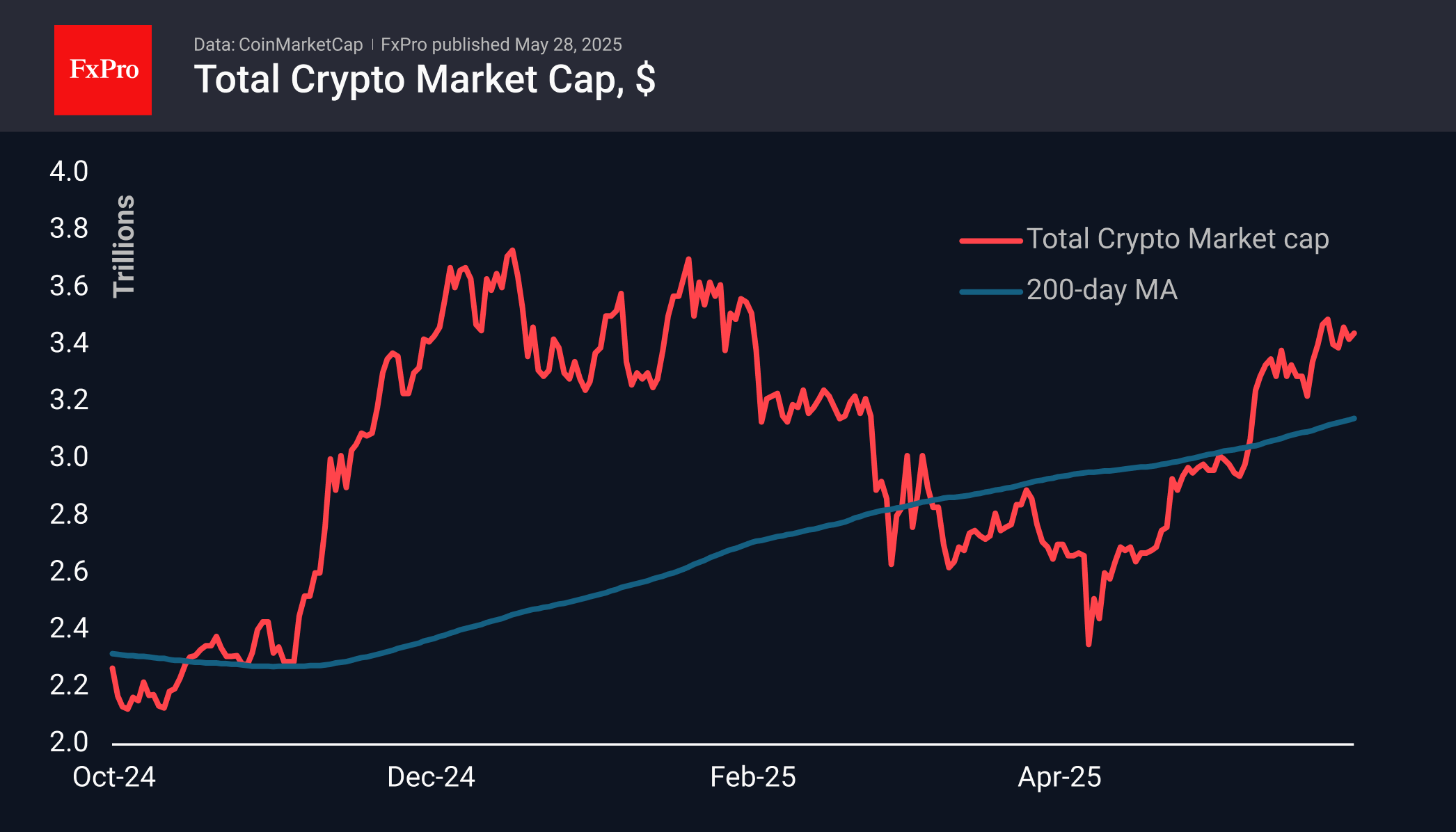

May 30, 2025

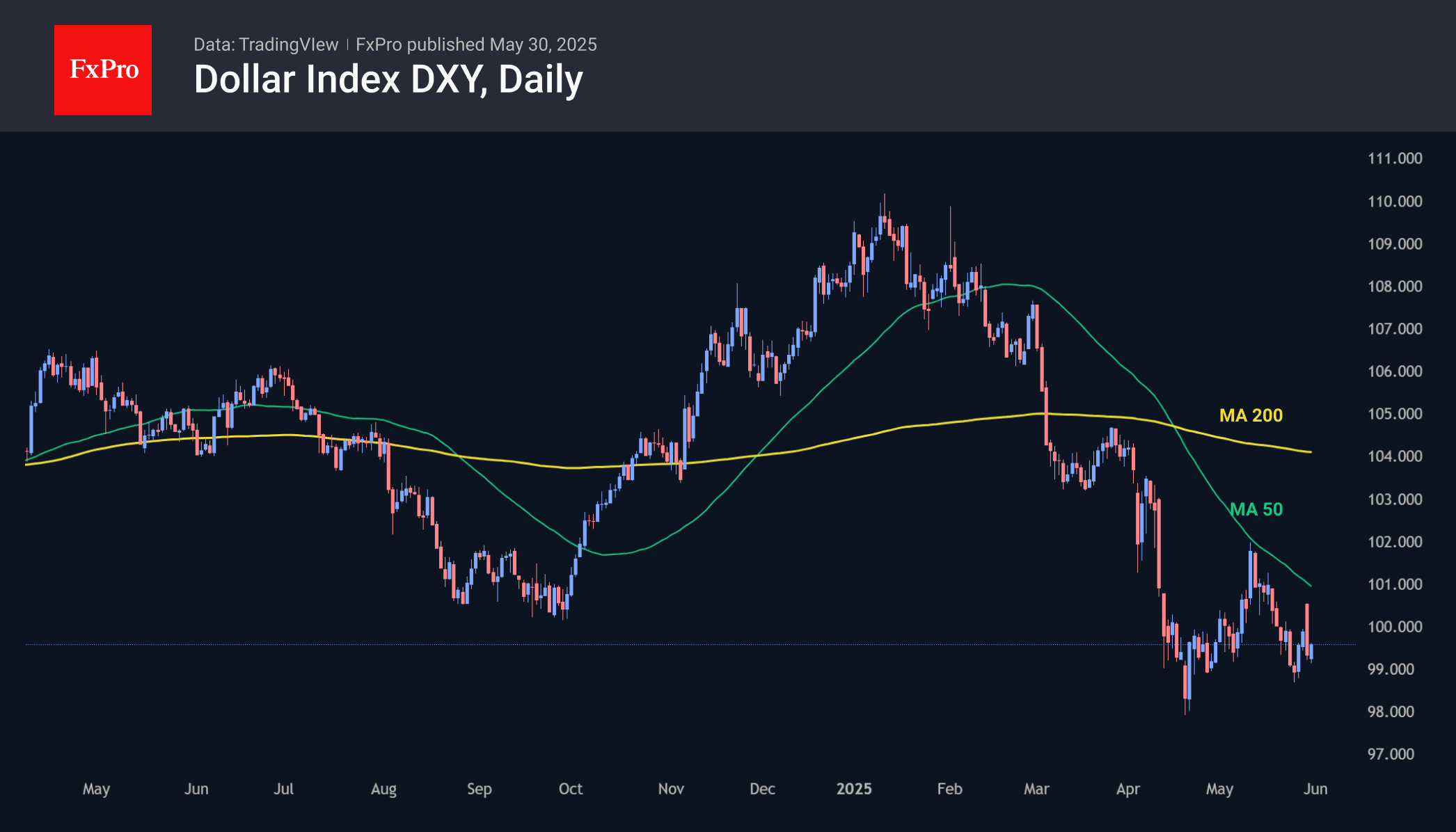

The US dollar is on the rise, gold is losing its safe-haven status, and Bitcoin is cooling off after a record-breaking run.

May 30, 2025

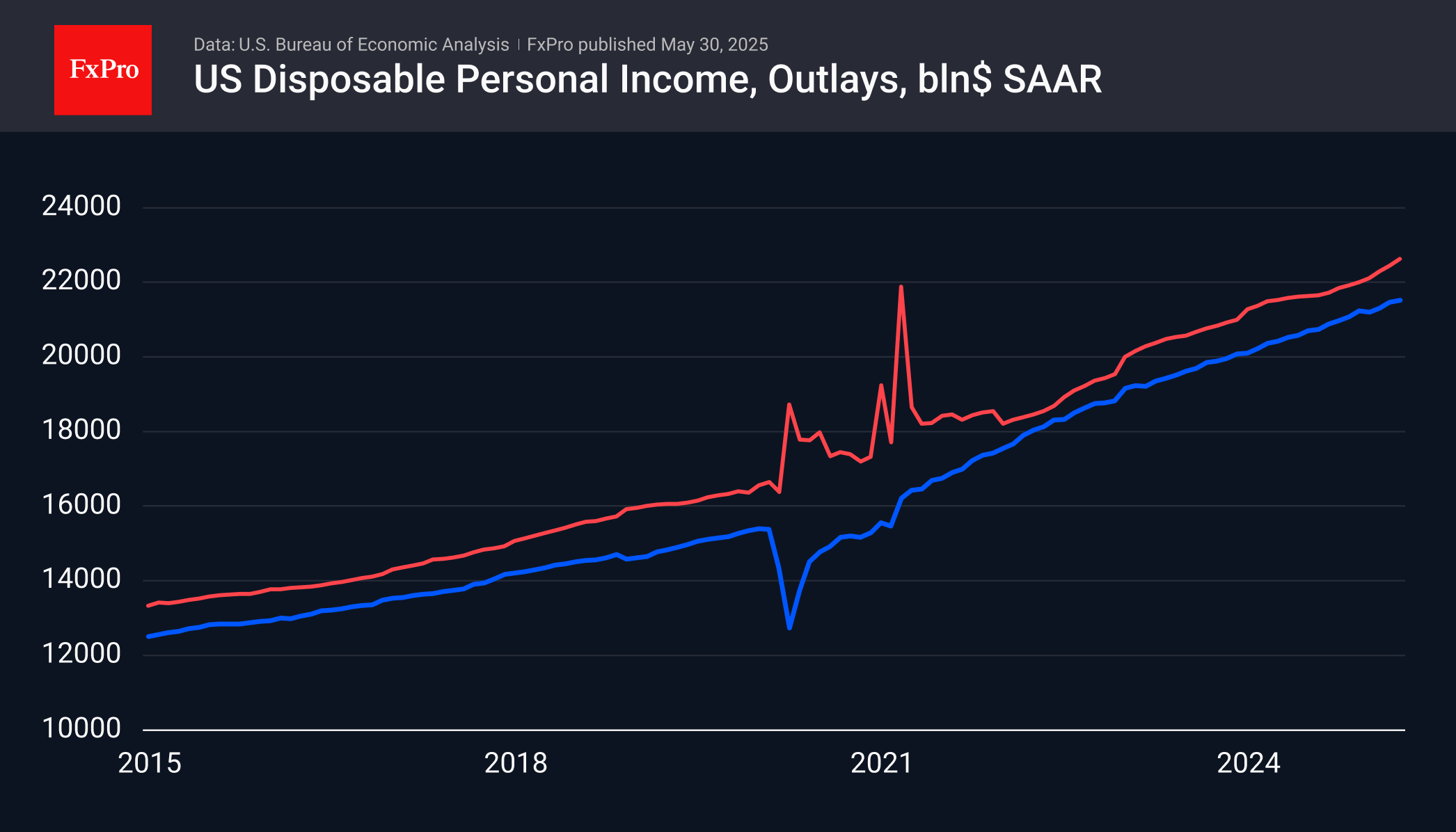

US personal income grew by 0.8% in April, exceeding analyst expectations, leading to higher savings rates due to modest spending increases, with inflation slowing to a four-year low of 2.5%. Fed's dovish stance may bring forward the next rate cut.

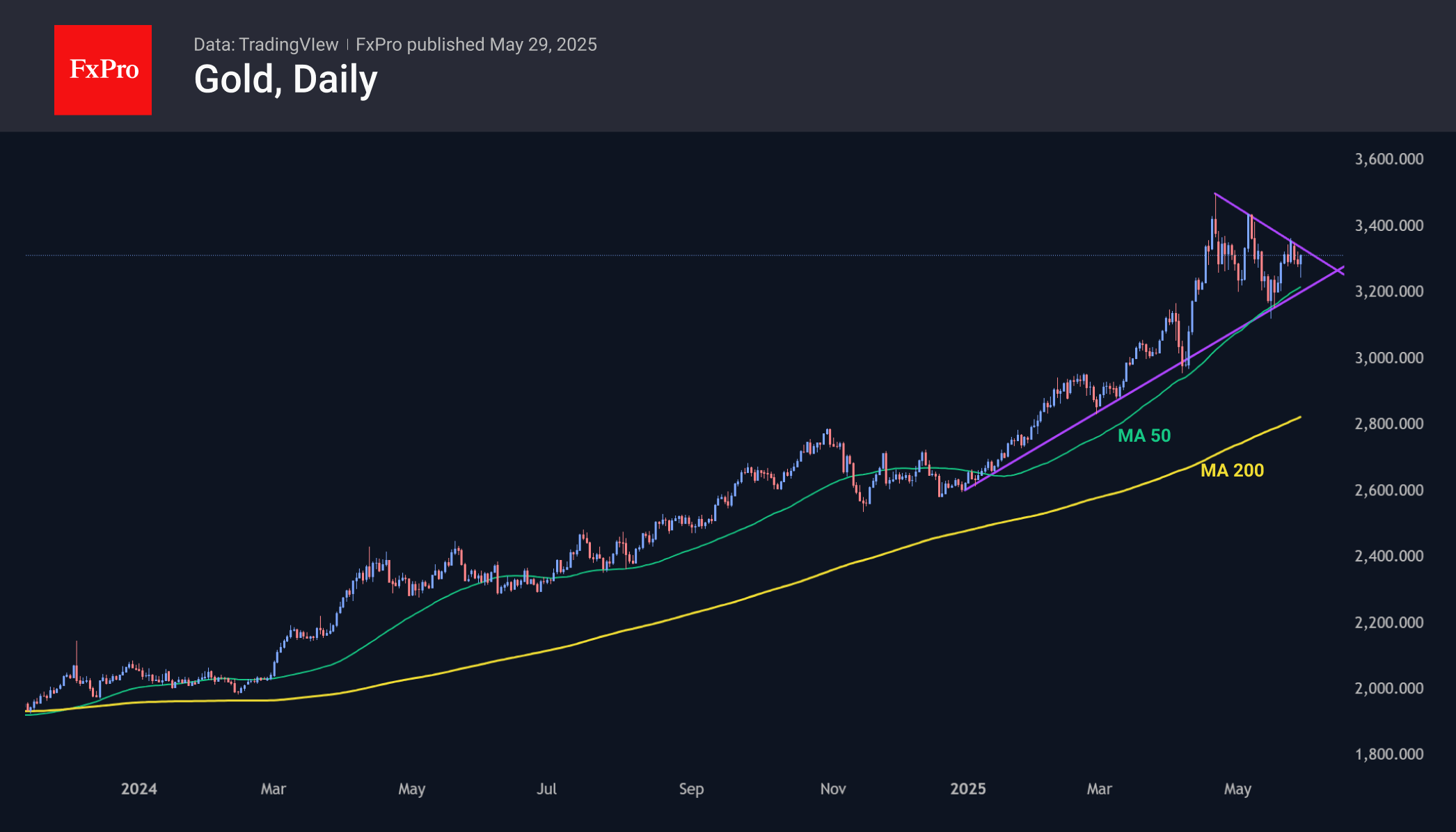

May 29, 2025

Gold experienced a downturn but rebounded after being bought back during an intraday dip. The price increased, testing a downward resistance line with potential for growth.

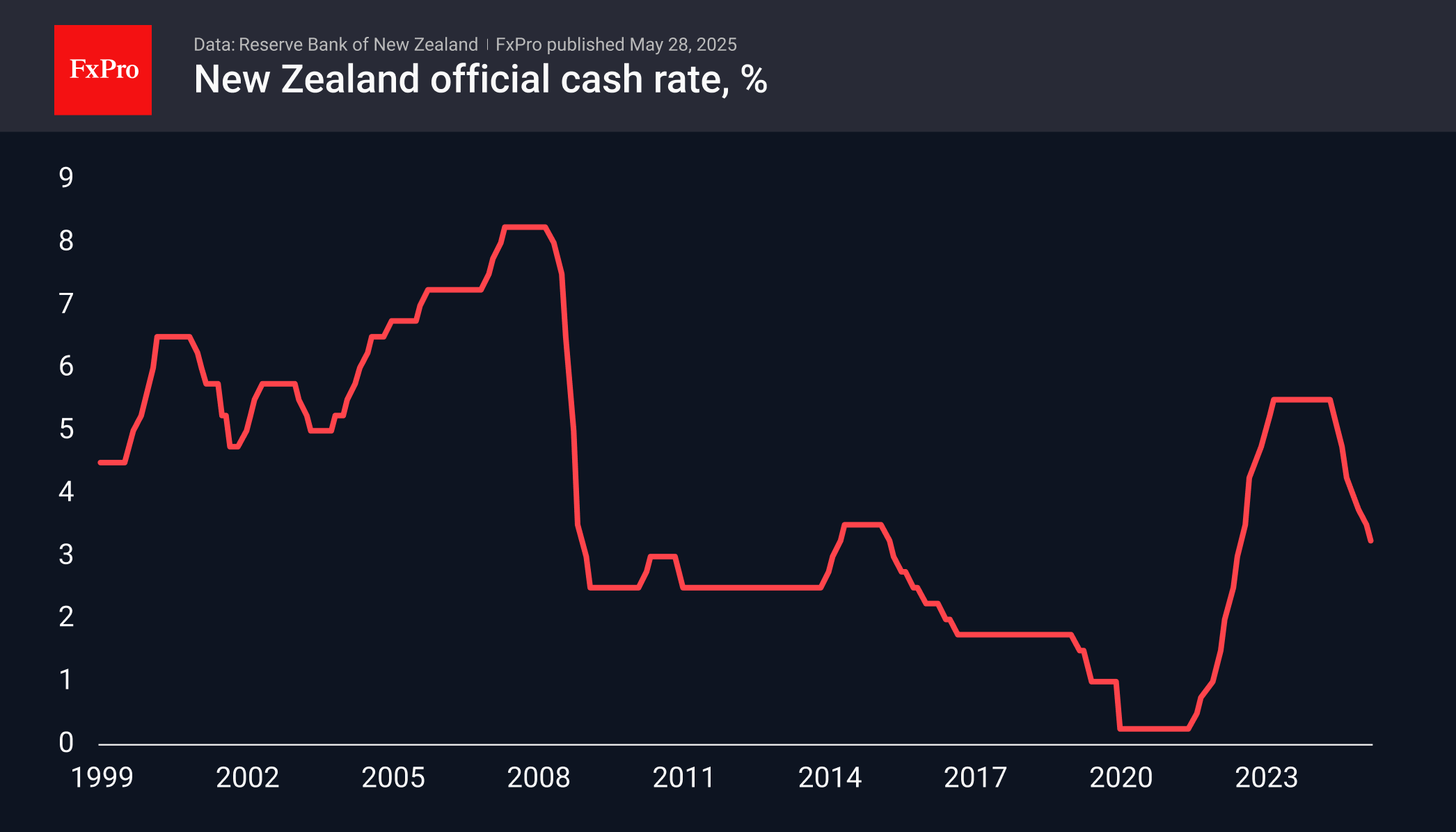

May 28, 2025

The Reserve Bank of New Zealand cuts key rate by 25 basis points to 3.25% to stimulate economic recovery. Bullish news supports New Zealand dollar against US dollar despite interest rate spread.