Market Overview - Page 2

February 11, 2026

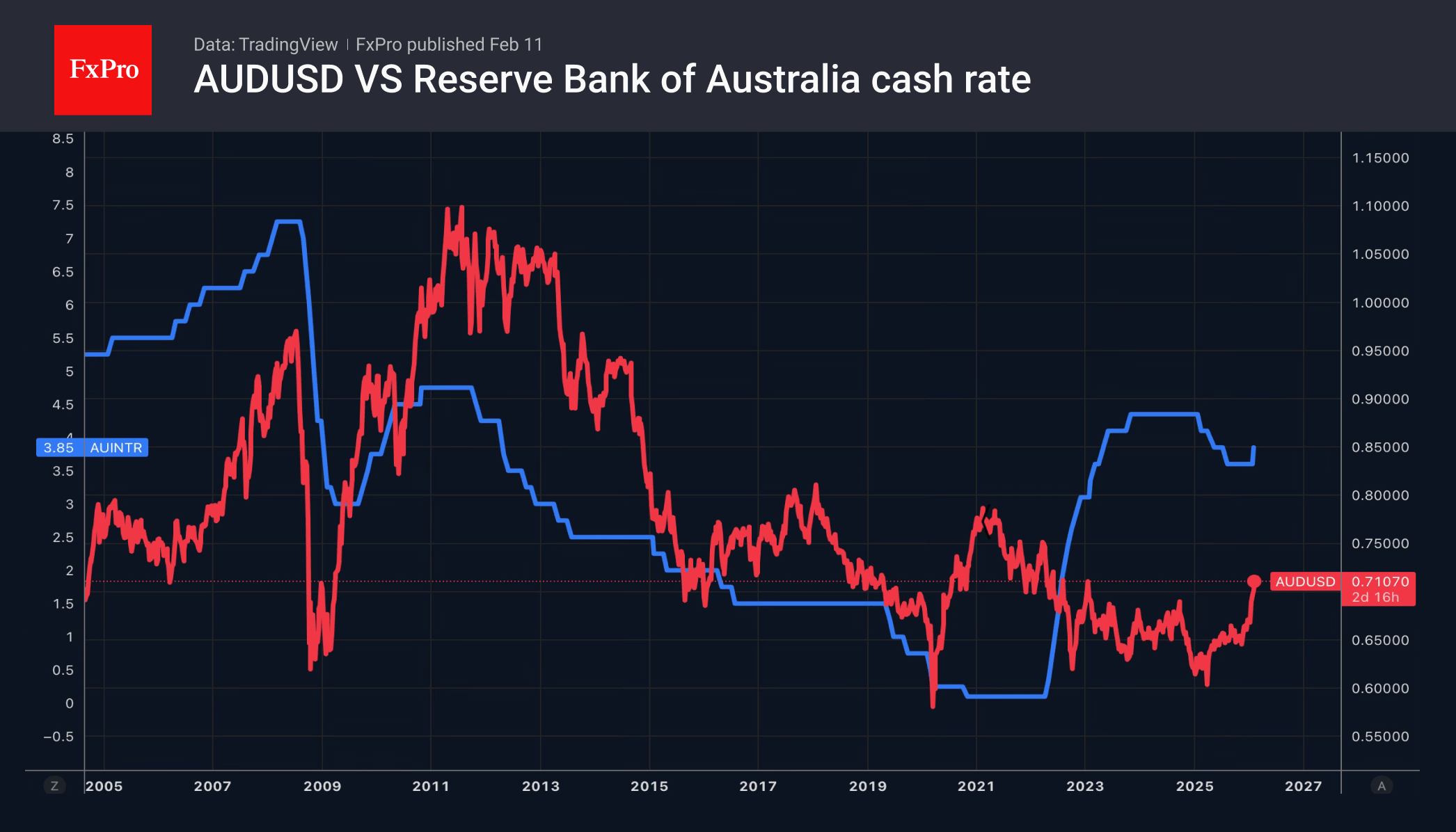

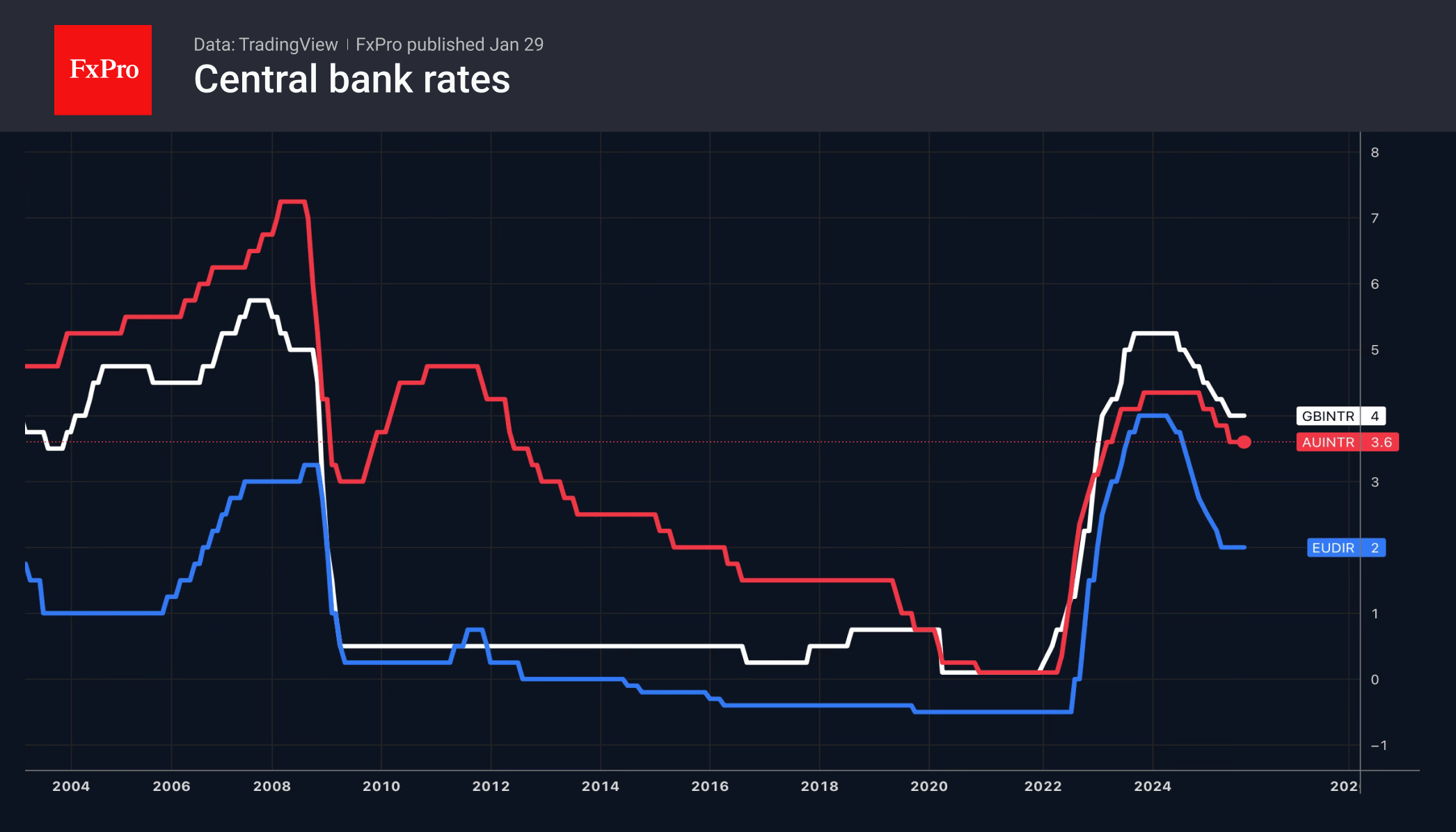

AUD leads Forex; US dollar pressured by jobs, retail sales, and possible rate cuts. JPY strengthens on capital inflows. Gold eyes Fed policy.

February 11, 2026

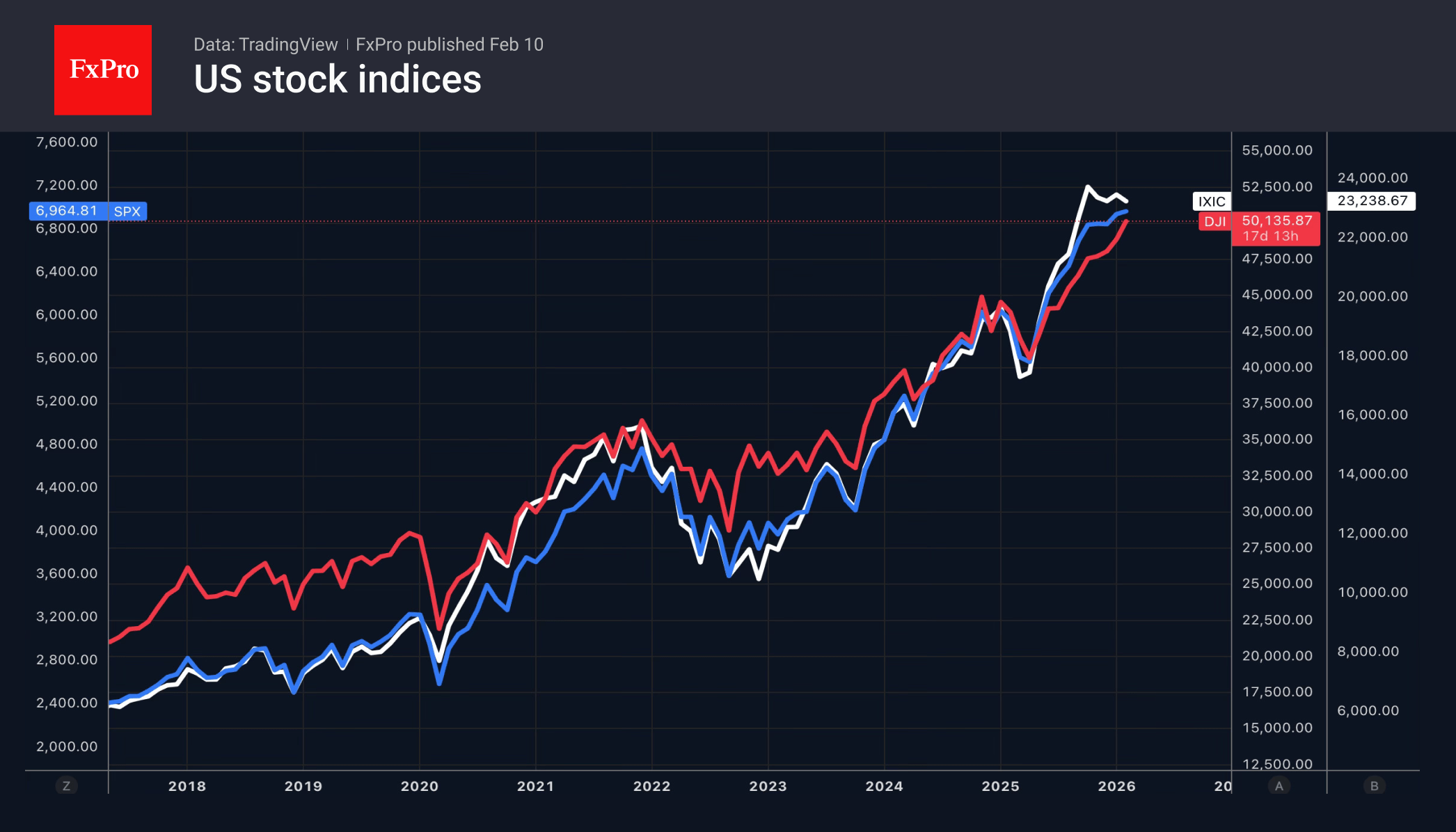

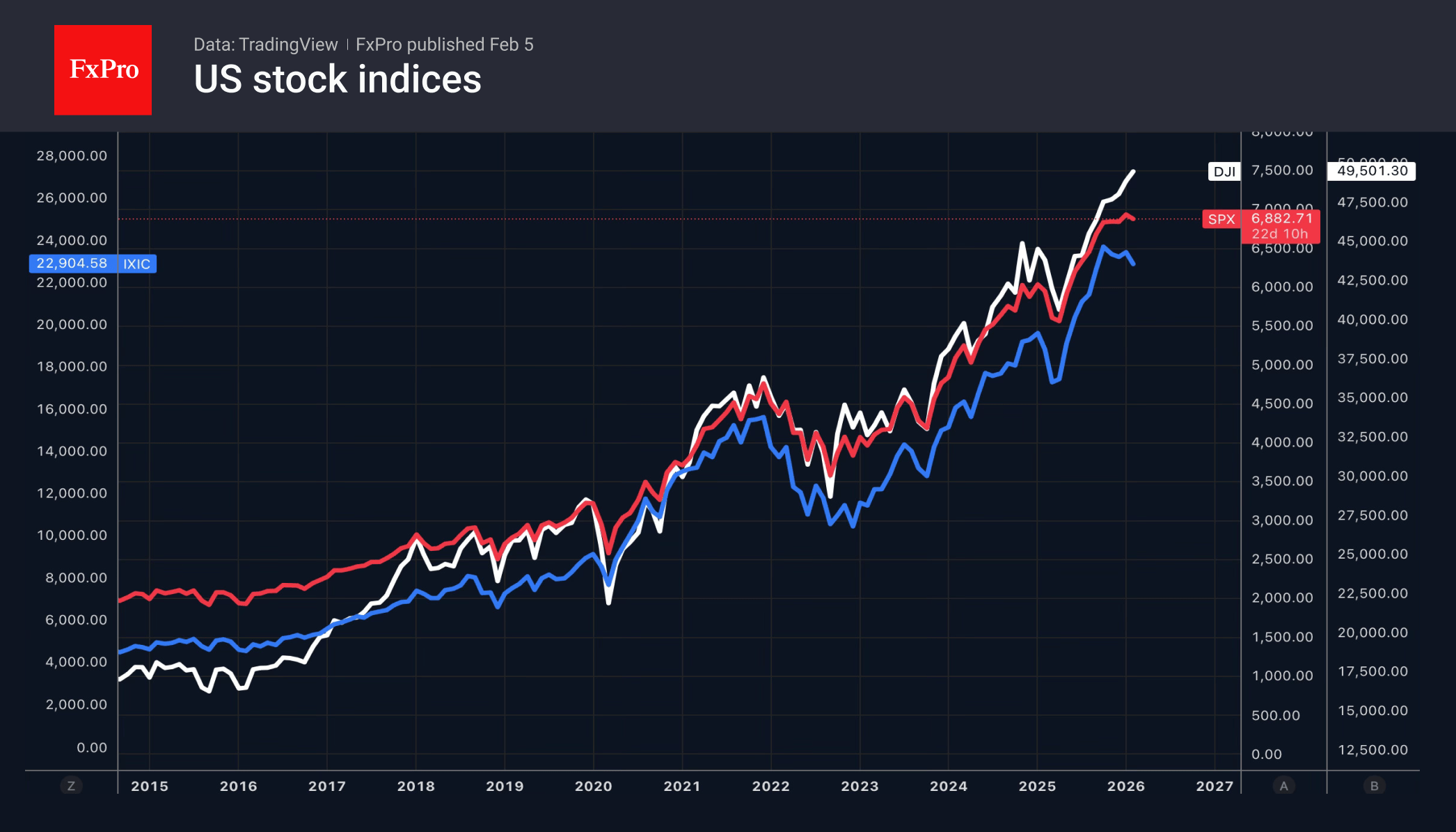

The Dow Jones hit 50,000 for the first time, outperforming other indexes due to investor rotation and economic optimism.

February 10, 2026

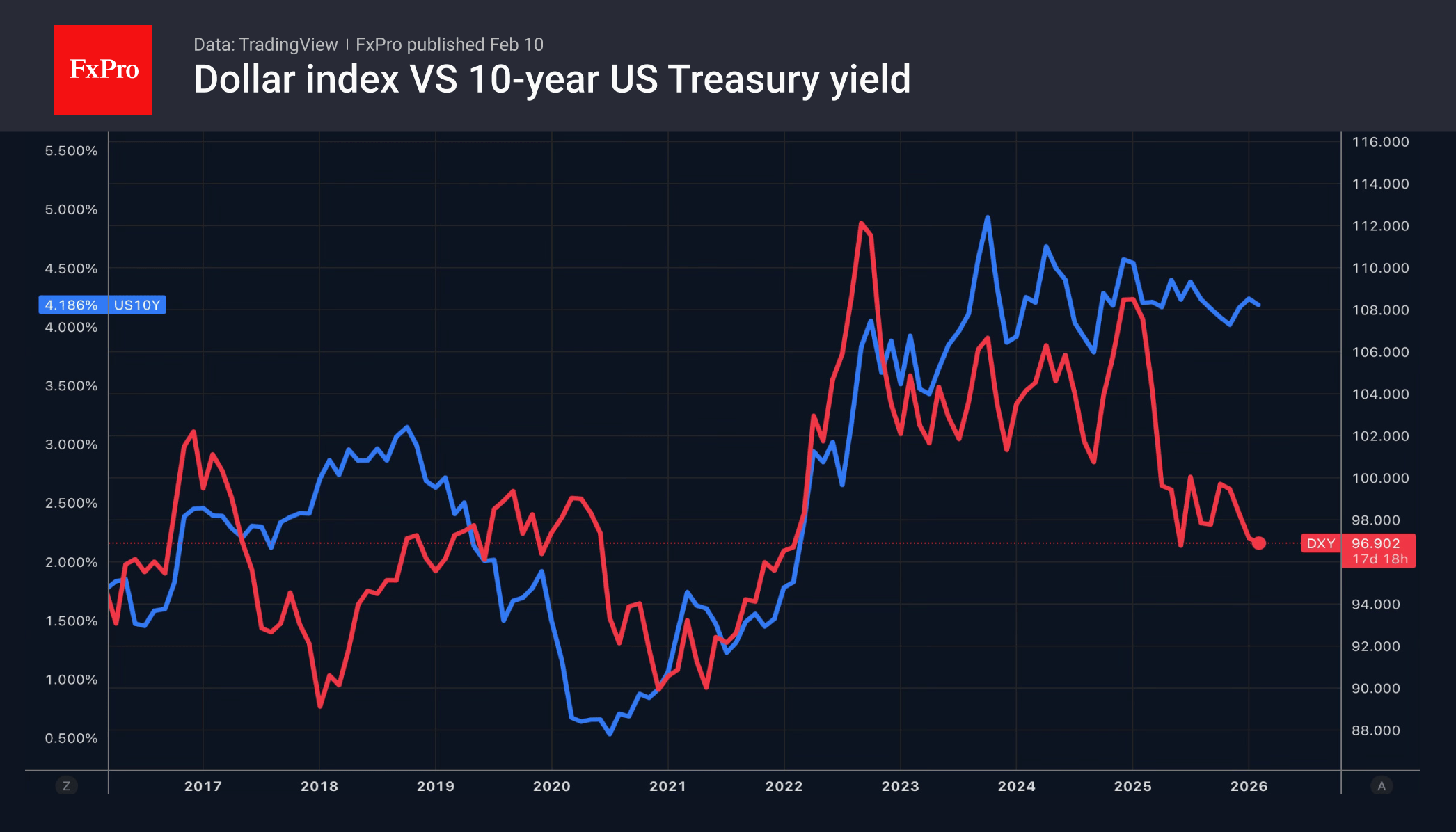

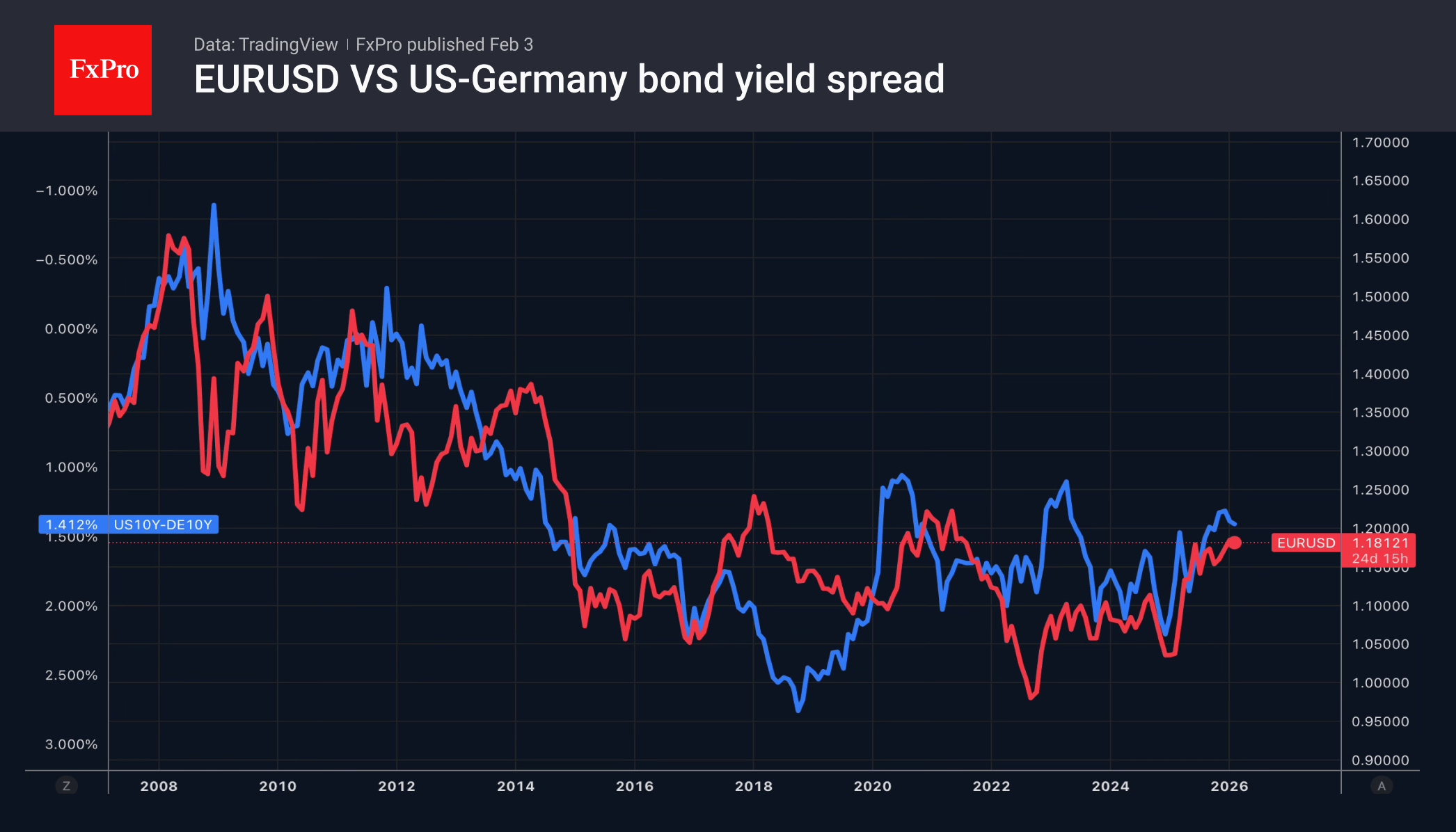

While the IMF is urging investors not to focus on the dollar’s short-term weakness, EURUSD is posting its best daily gain since the end of January. According to the International Monetary Fund, the greenback will retain its power on the.

February 9, 2026

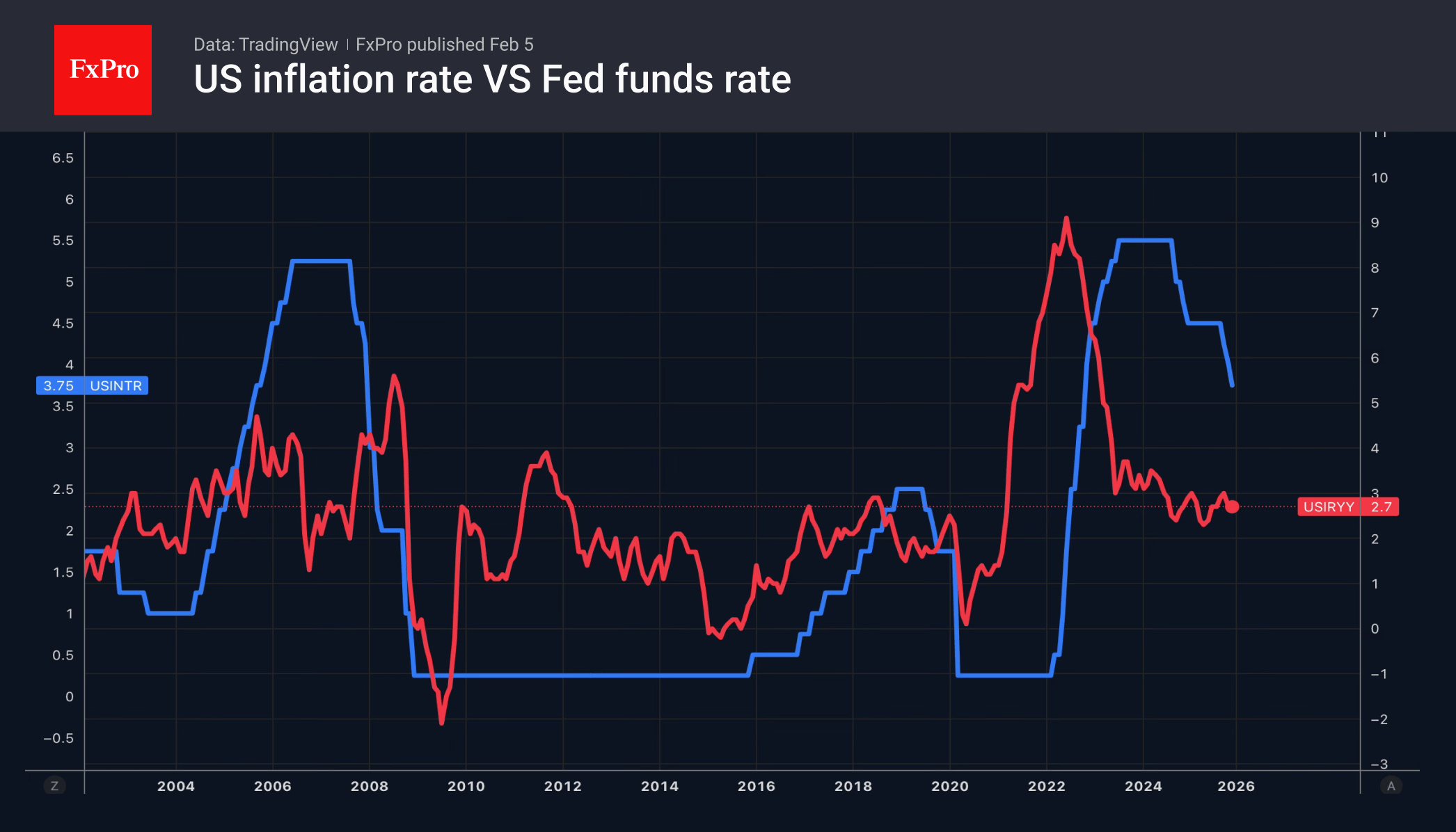

Key events: delayed US jobs and inflation data may affect rate decisions; Middle East tensions and rising oil boost the US dollar as a safe haven.

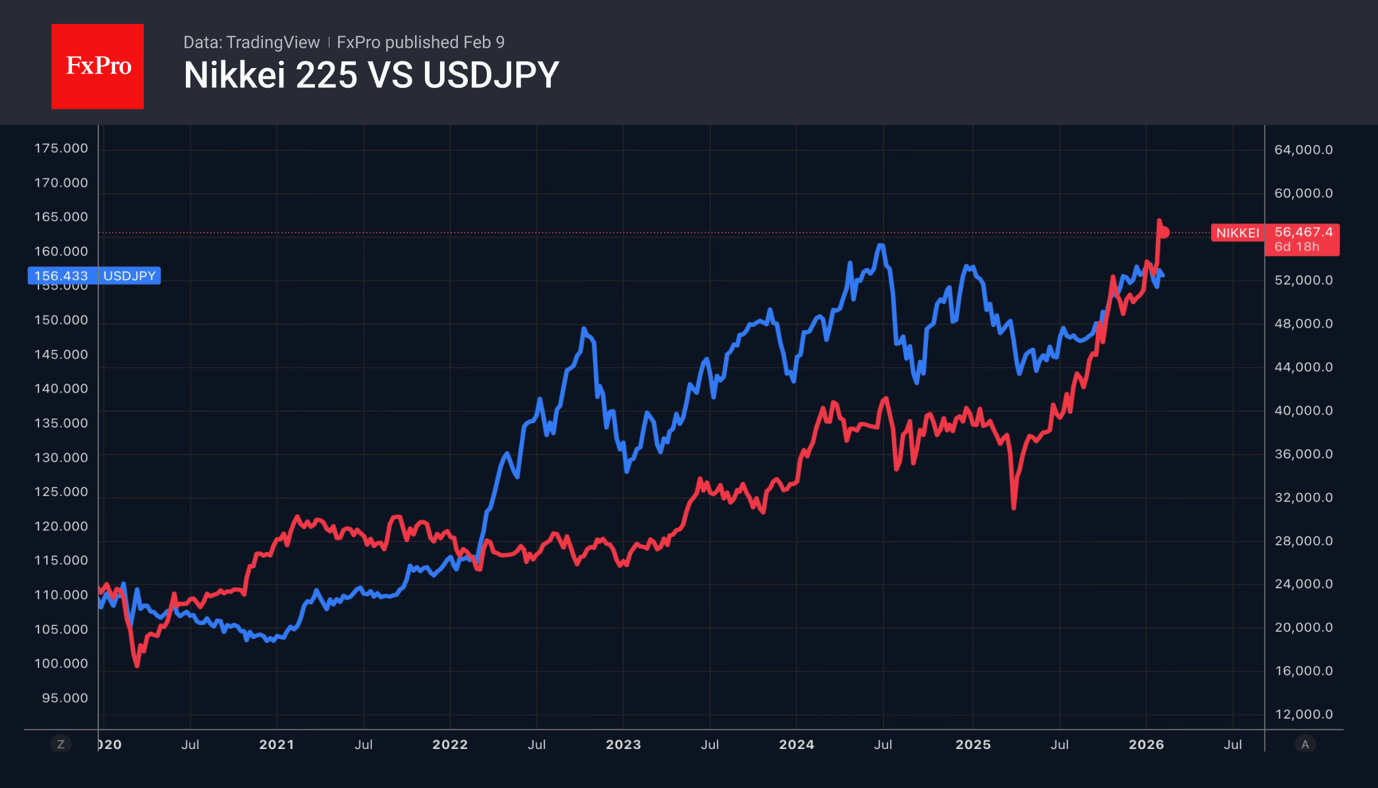

February 9, 2026

The yen strengthened post-LDP win, China boosts gold prices, US dollar weakens as global risk appetite improves.

February 6, 2026

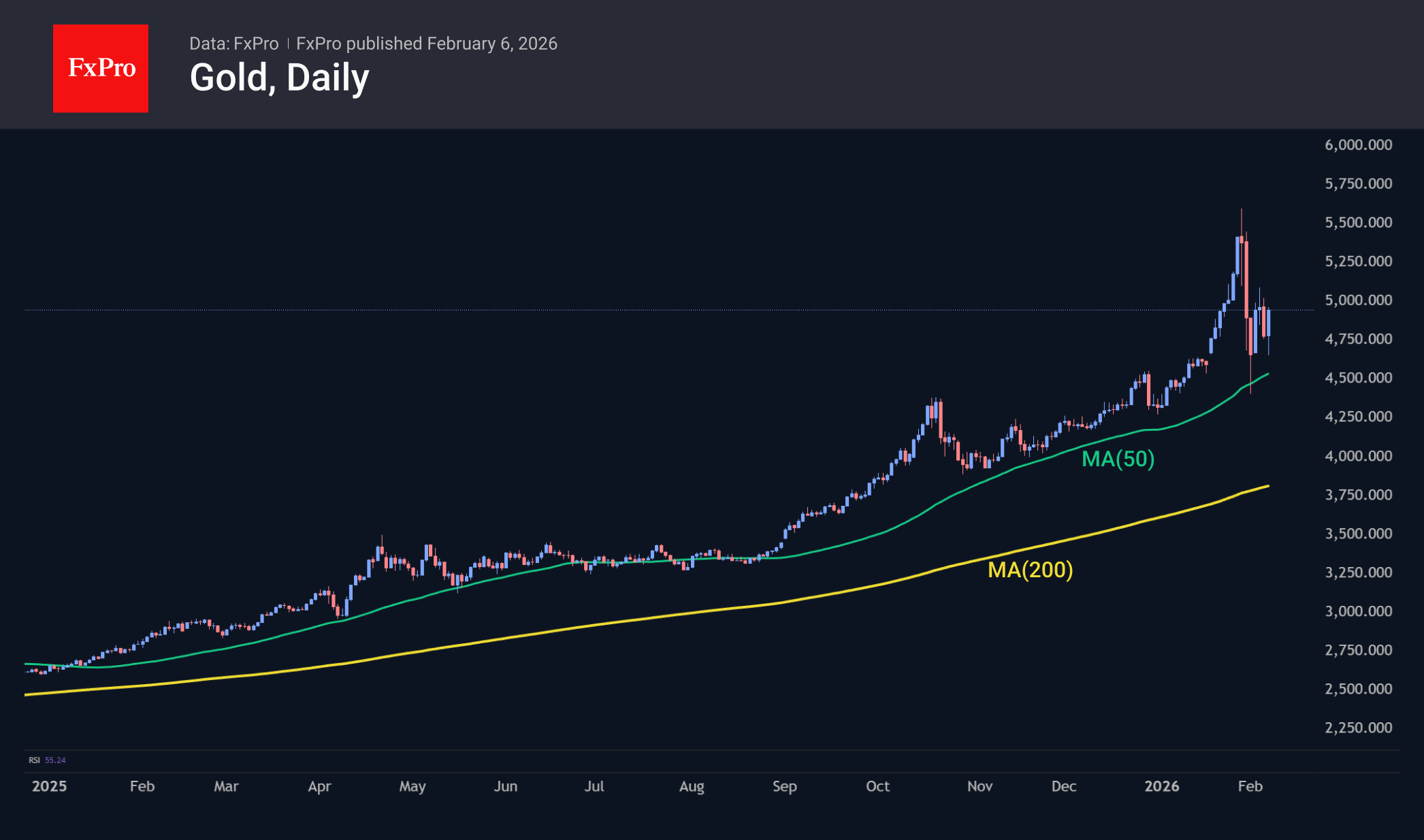

After the most significant sell-off since 1980, gold is attempting to stabilise. Bears argue that the bubble has burst and events will unfold as they did in 2011. Back then, after falling from record highs, the precious metal entered a.

February 6, 2026

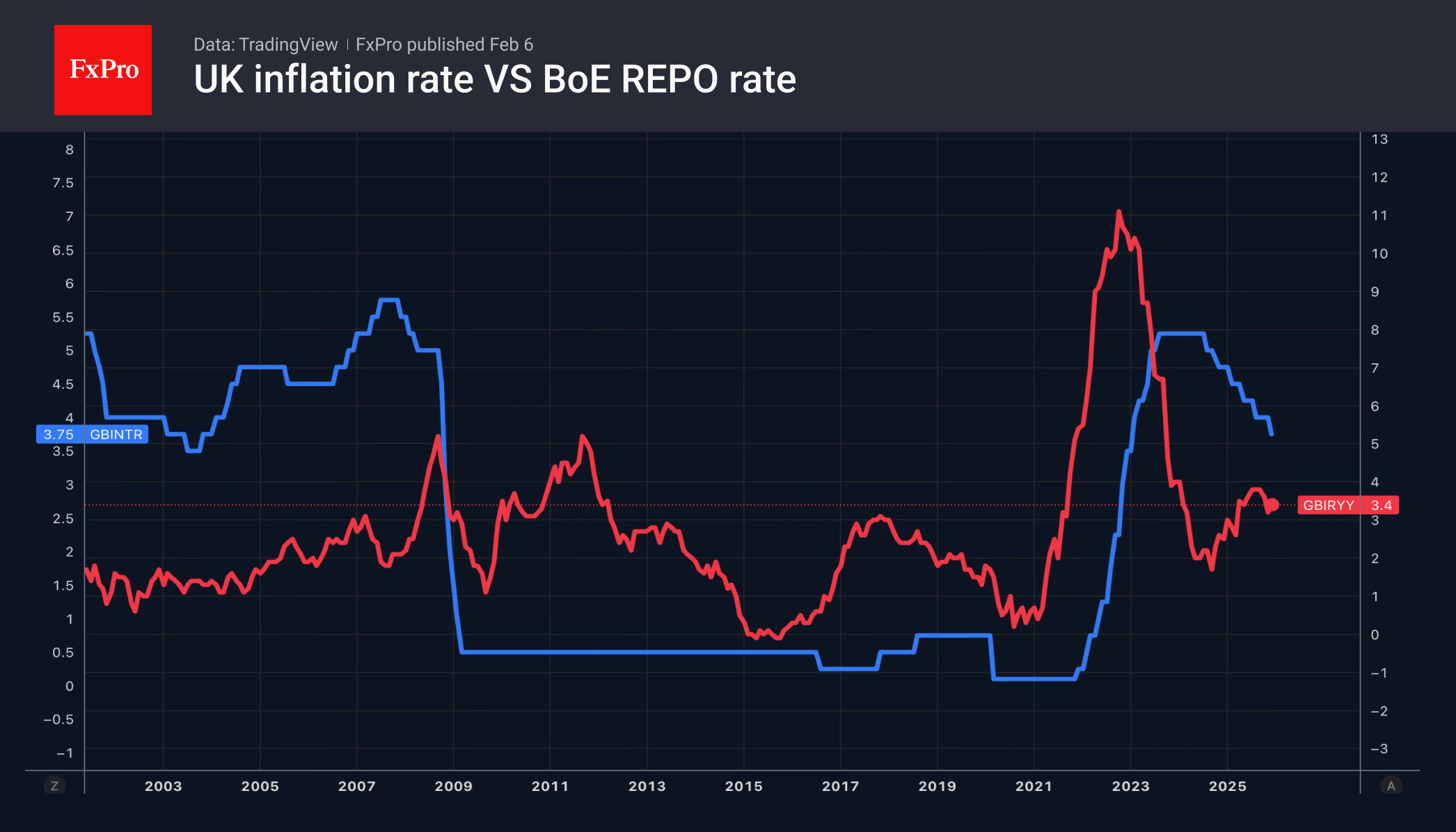

The Bank of England signalled rate cuts, weakening the pound, while the ECB supported the euro. US economic weakness fuels Fed rate cut expectations.

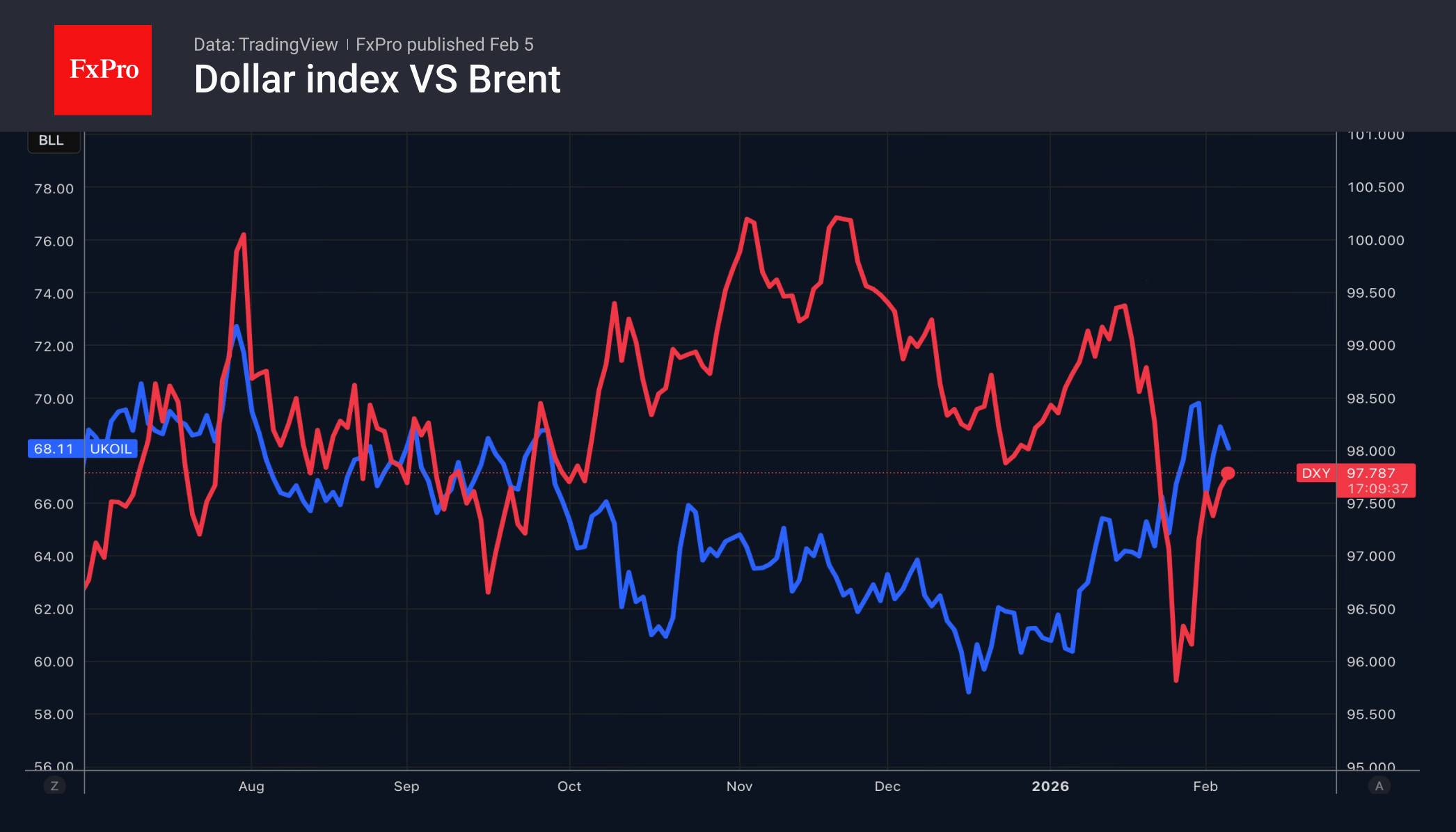

February 5, 2026

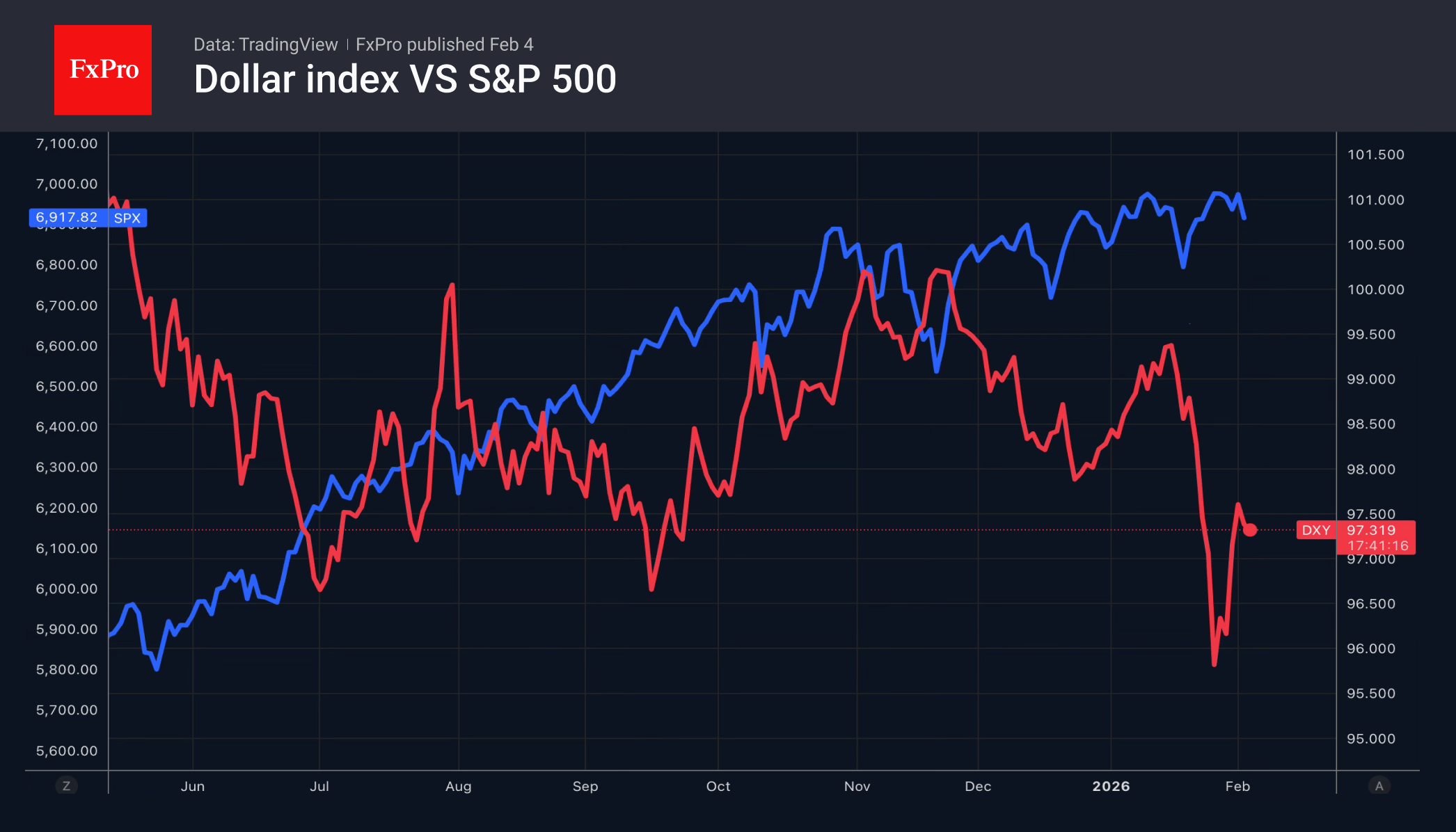

AI innovation hit tech stocks, but economy-sensitive shares soared, with record S&P500 highs in manufacturing, finance, and energy sectors.

February 5, 2026

The dollar benefits from S&P 500 selloffs. The ECB and Bank of England verdicts will affect the euro and pound.

February 4, 2026

Gold volatility stays high as the US dollar weakens, fuelling gold demand and bubble risks amid shifting Fed policy and global tensions.