Market Overview - Page 18

July 11, 2025

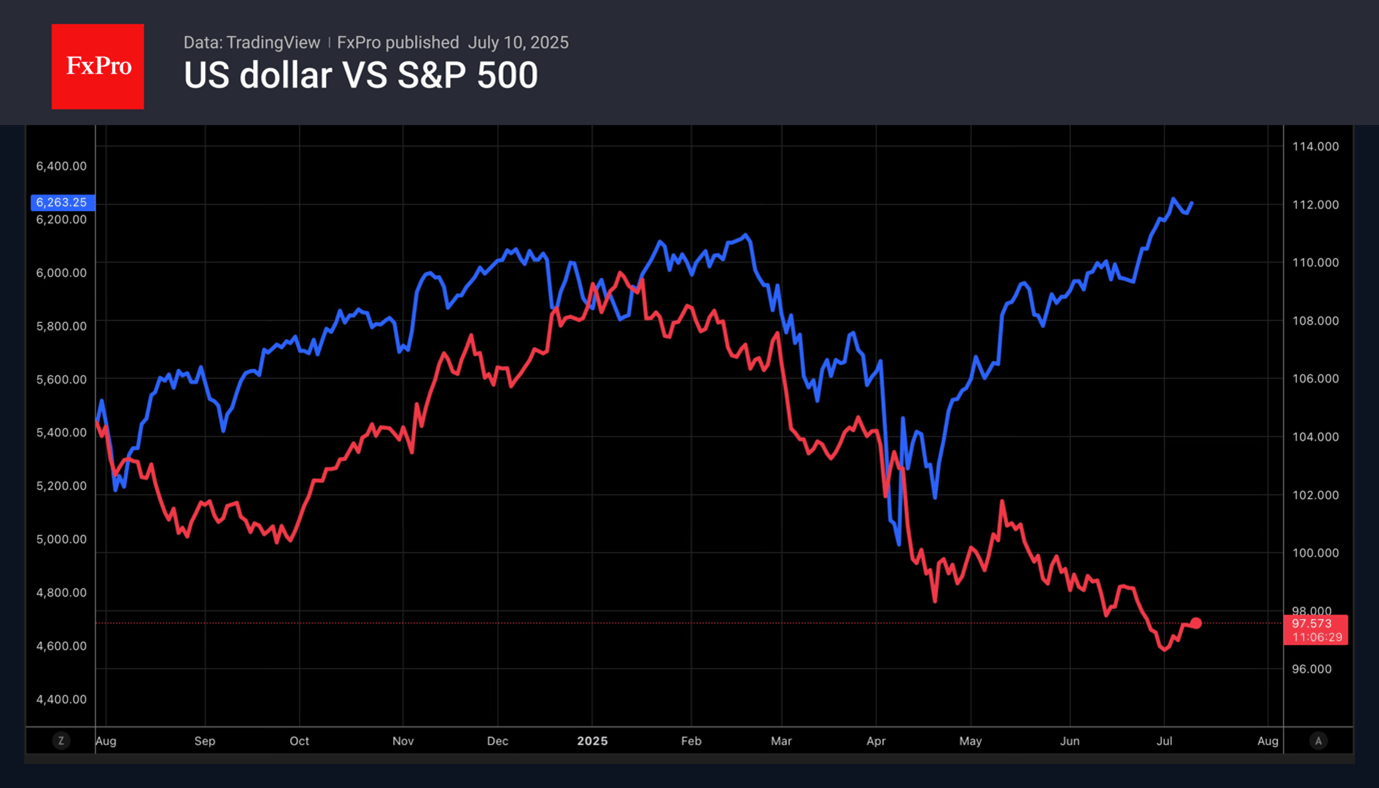

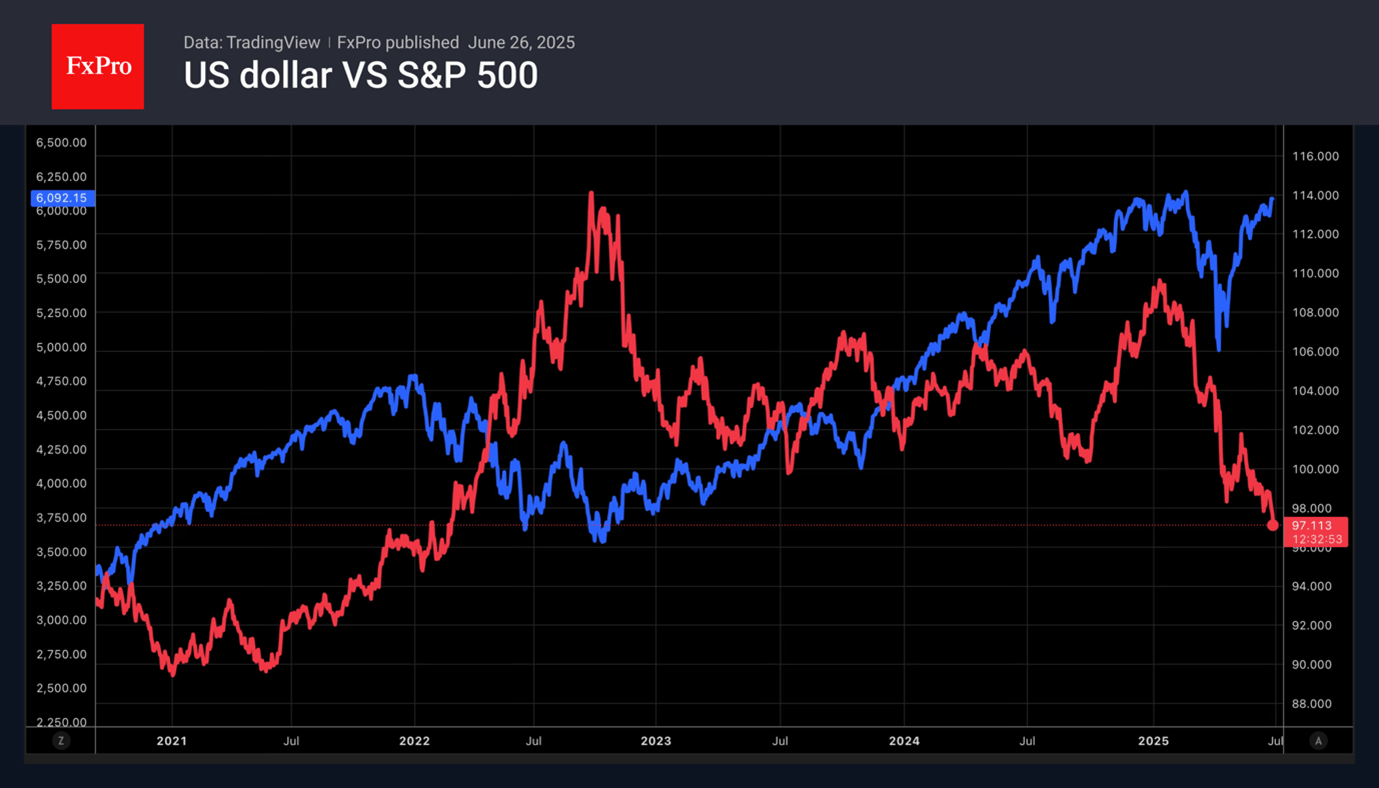

Trade conflicts have impacted the US dollar, tariffs, and trade deal possibilities. Despite risks, the US economy and stock markets are strong and showing resilience and growth.

July 4, 2025

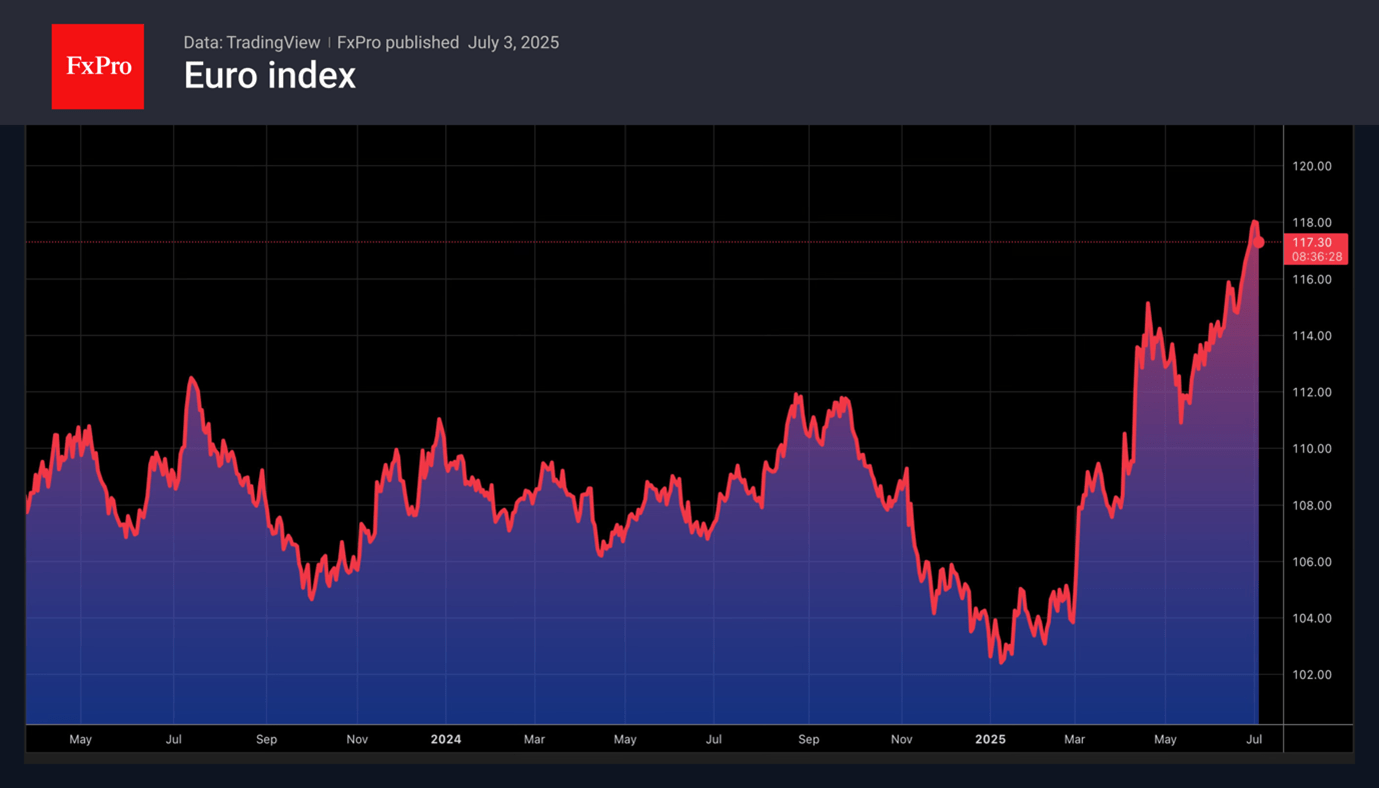

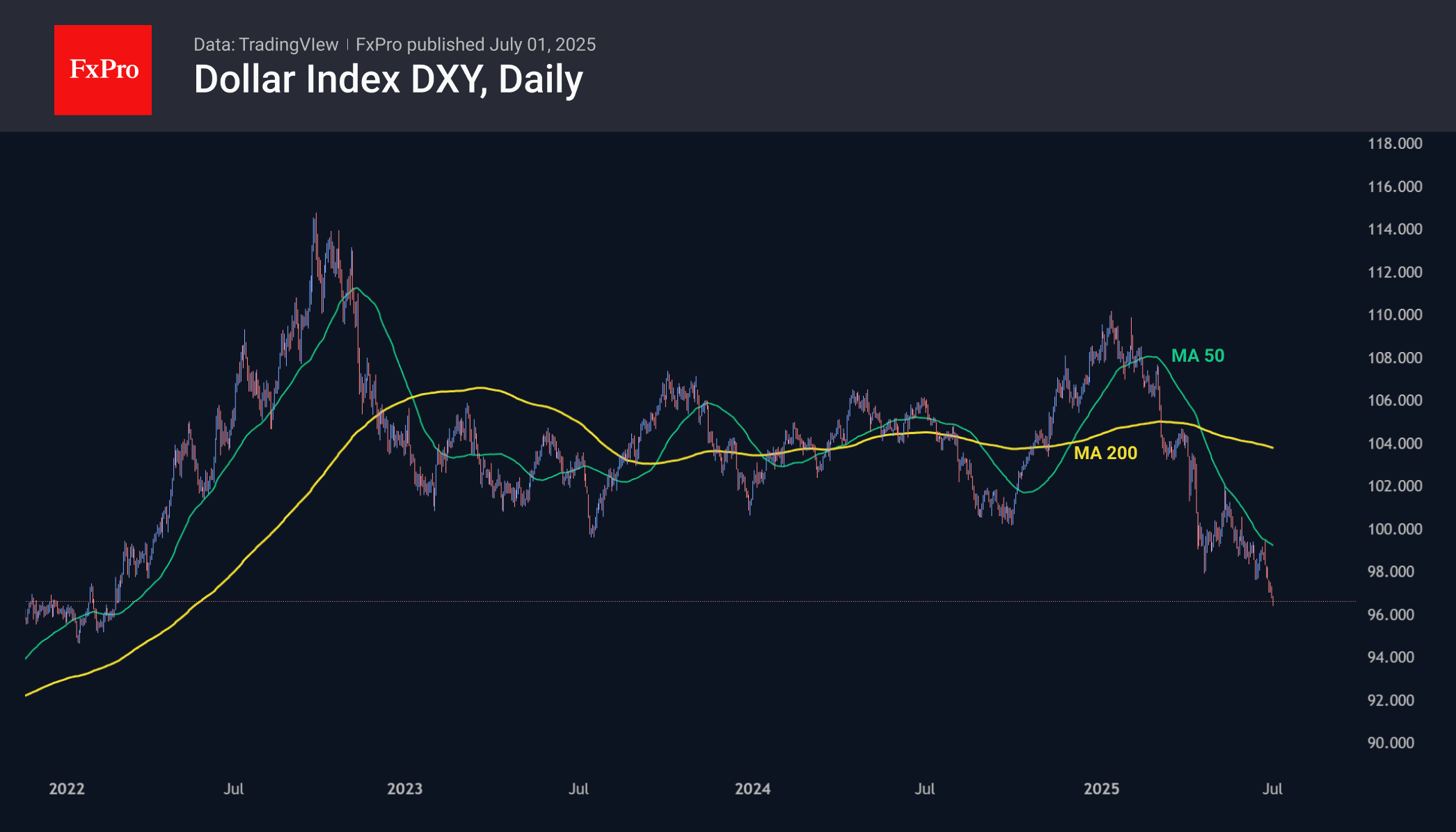

US Dollar The US dollar is losing ground. Its index is being pressured by more than just White House policy, a cooling economy and rising expectations of an upcoming Fed rate cut. The dollar’s main rival is gaining strength. The.

July 3, 2025

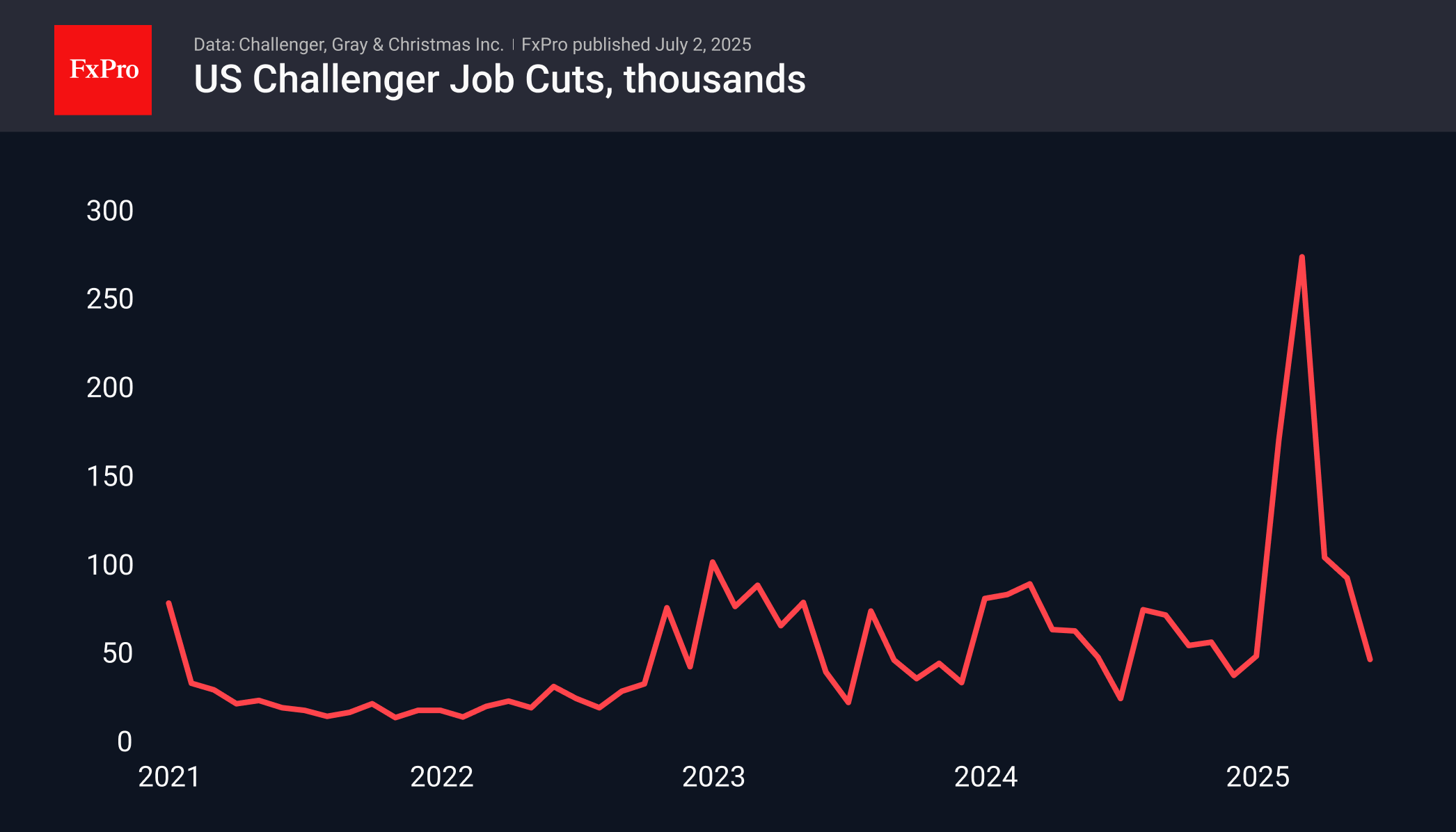

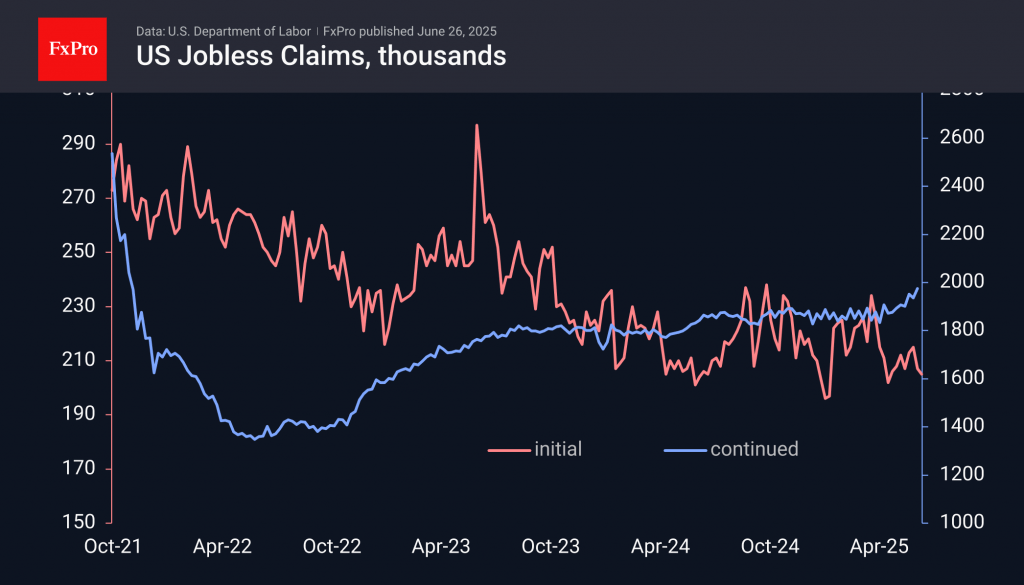

US labour market data presents mixed signals: a decline in private sector employment but reduced planned layoffs and some increase in job offering activity

July 2, 2025

The US dollar's recent decline is attributed to geopolitical factors, market sentiment, and expectations of interest rate cuts. Politicians' decisions will play a crucial role in determining the dollar's future trajectory.

June 27, 2025

As June turns to July, investors’ attention will shift from geopolitics to trade wars. The expiration date of the White House’s 90-day tariff delay is approaching. Countries are rushing to conclude trade agreements with the US to limit themselves to.

June 27, 2025

The truce between Israel and Iran has dampened the demand for gold as a safe-haven asset. The recent test of the 50-day MA suggests a potential trend reversal, with the uncertainty whether it will lead to a significant correction like 2020.

June 27, 2025

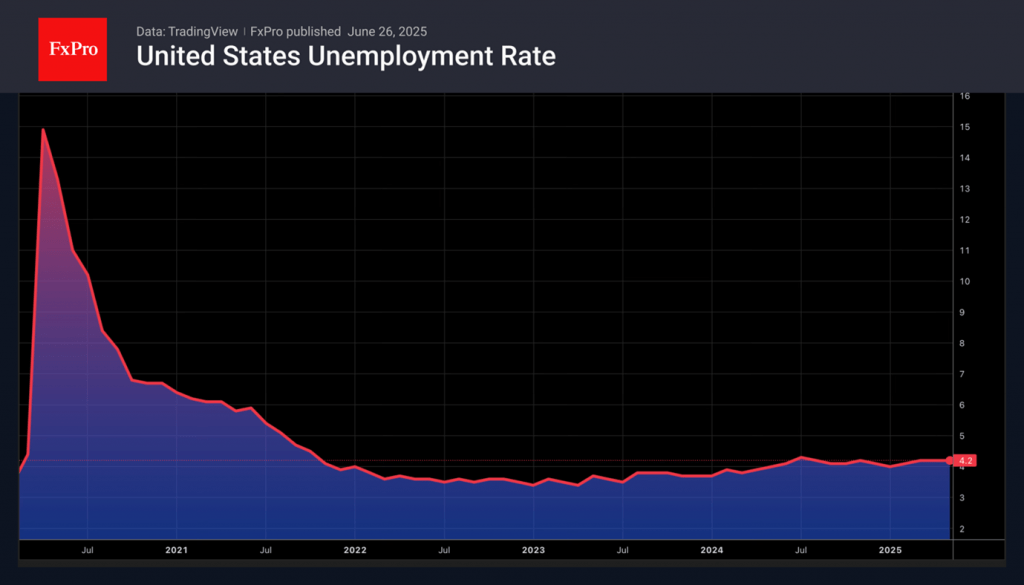

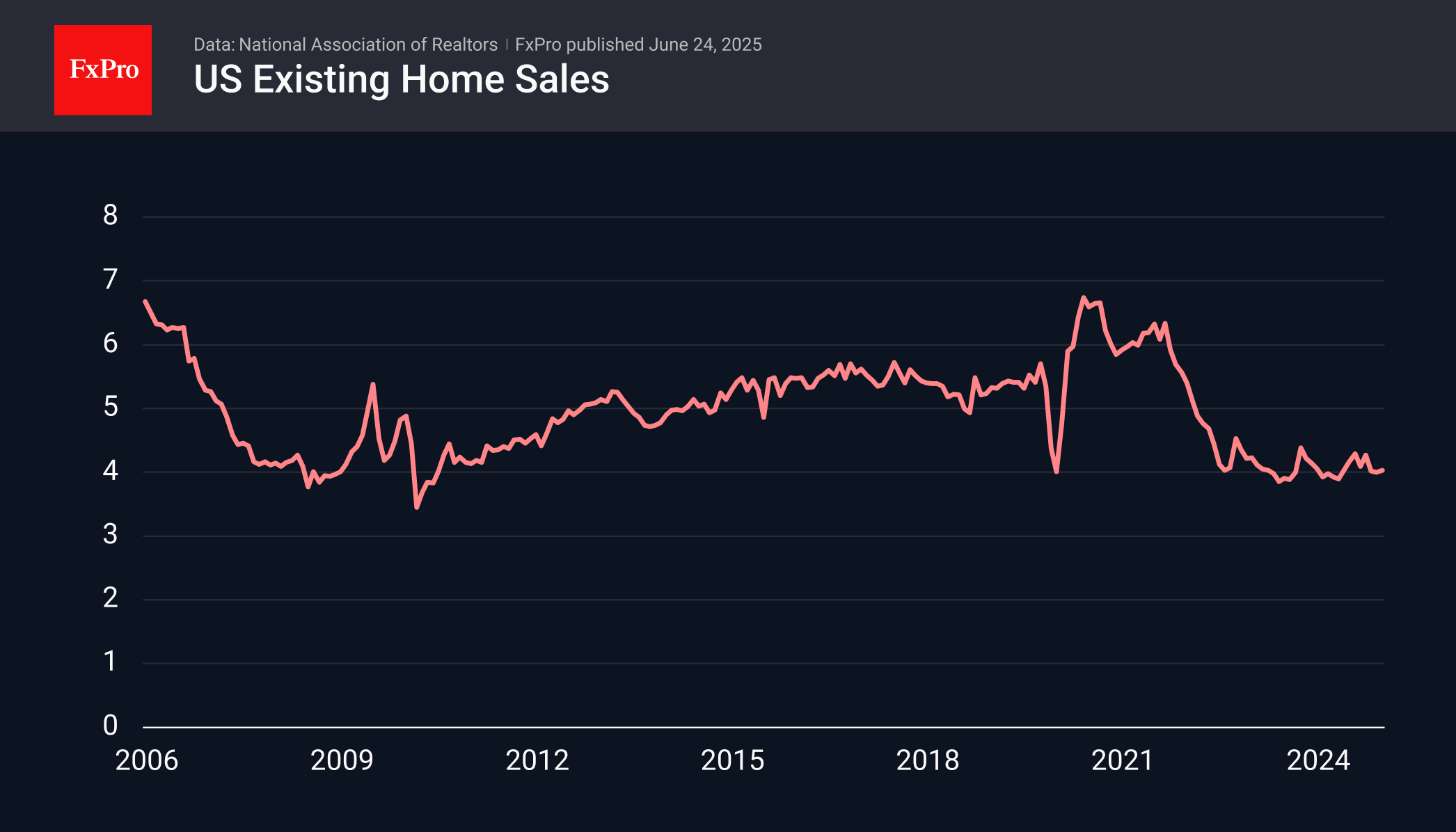

Weekly unemployment benefit claims increased by 37K, reaching 1.974 million, the highest since November 2021. Other indicators like real estate and consumer confidence also suggest economic slowdown.

June 27, 2025

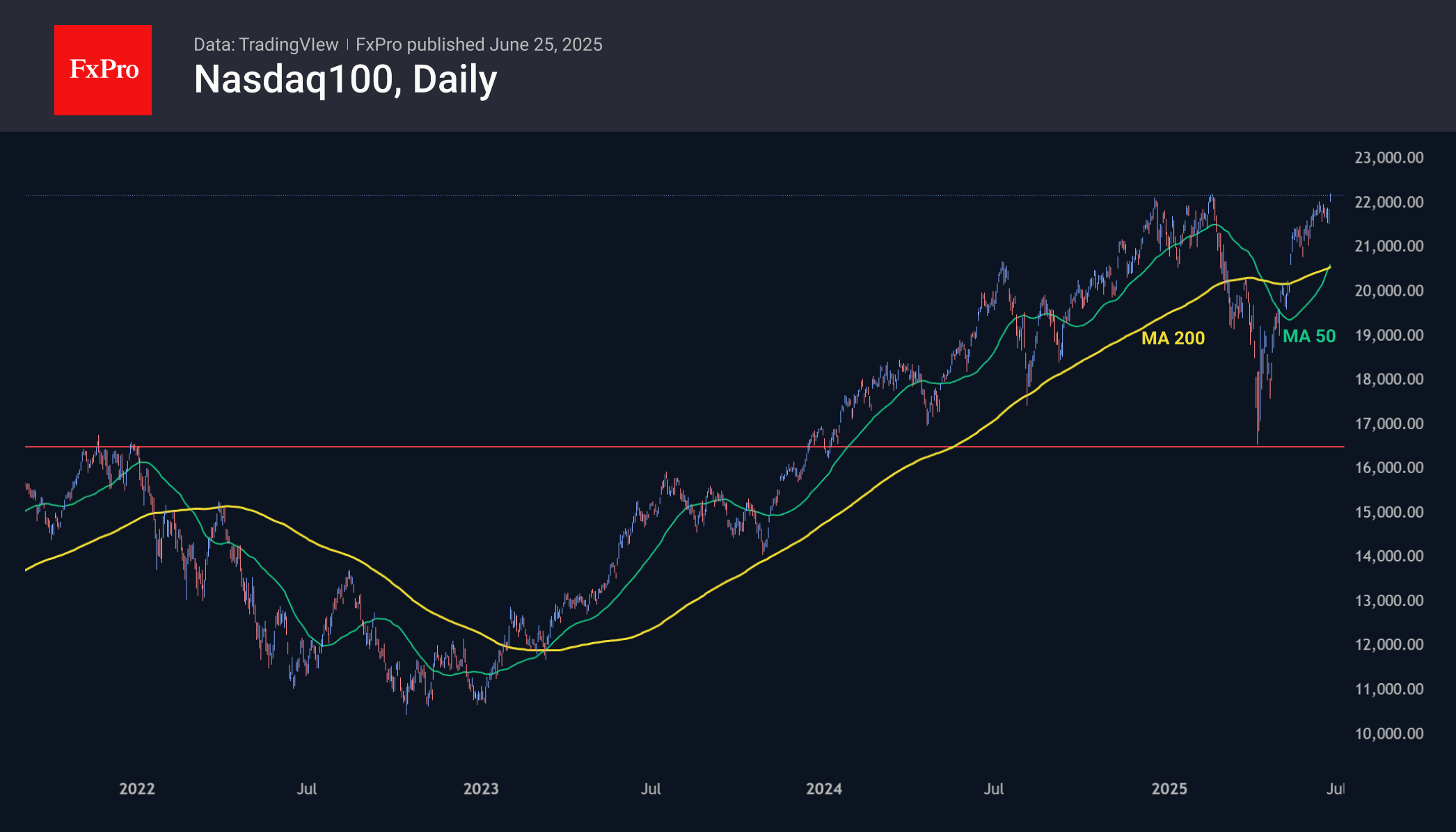

The de-escalation of the Middle East conflict led to increased risk appetite, impacting the US dollar negatively. US stock indices rose, fuelled by tech giants' rally and optimism around trade policies.

June 25, 2025

The Nasdaq100 has returned to updating its highs, indicating the strength of Big Tech and positive market sentiment, with investors preferring technology companies for growth over other sectors.

June 24, 2025

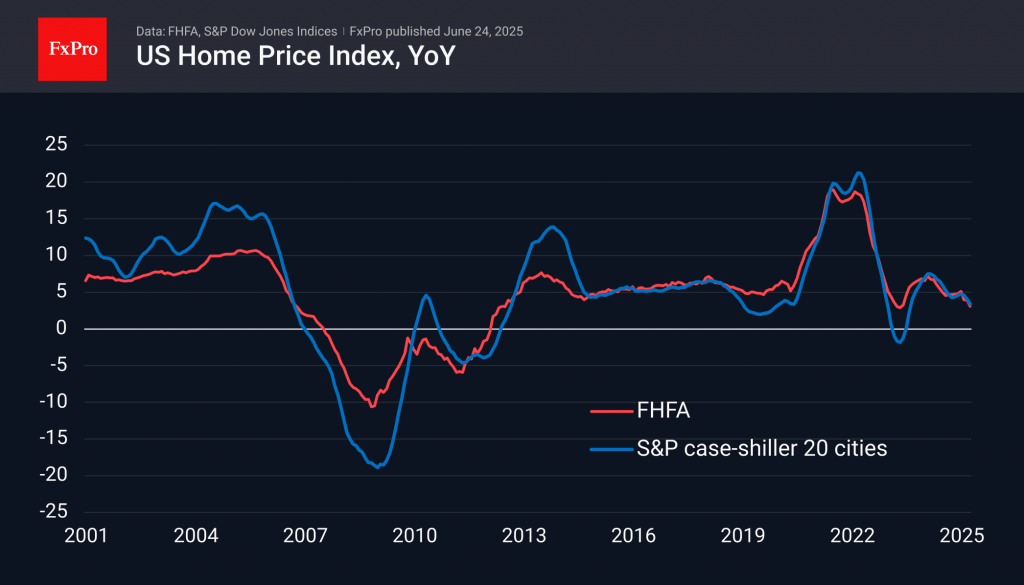

According to lagging but broad data from S&P Global, the pace of housing price growth in the US slowed in April. Annual price growth slowed to 3.4% y/y, the lowest in nearly two years. More importantly, the last two months.

June 24, 2025

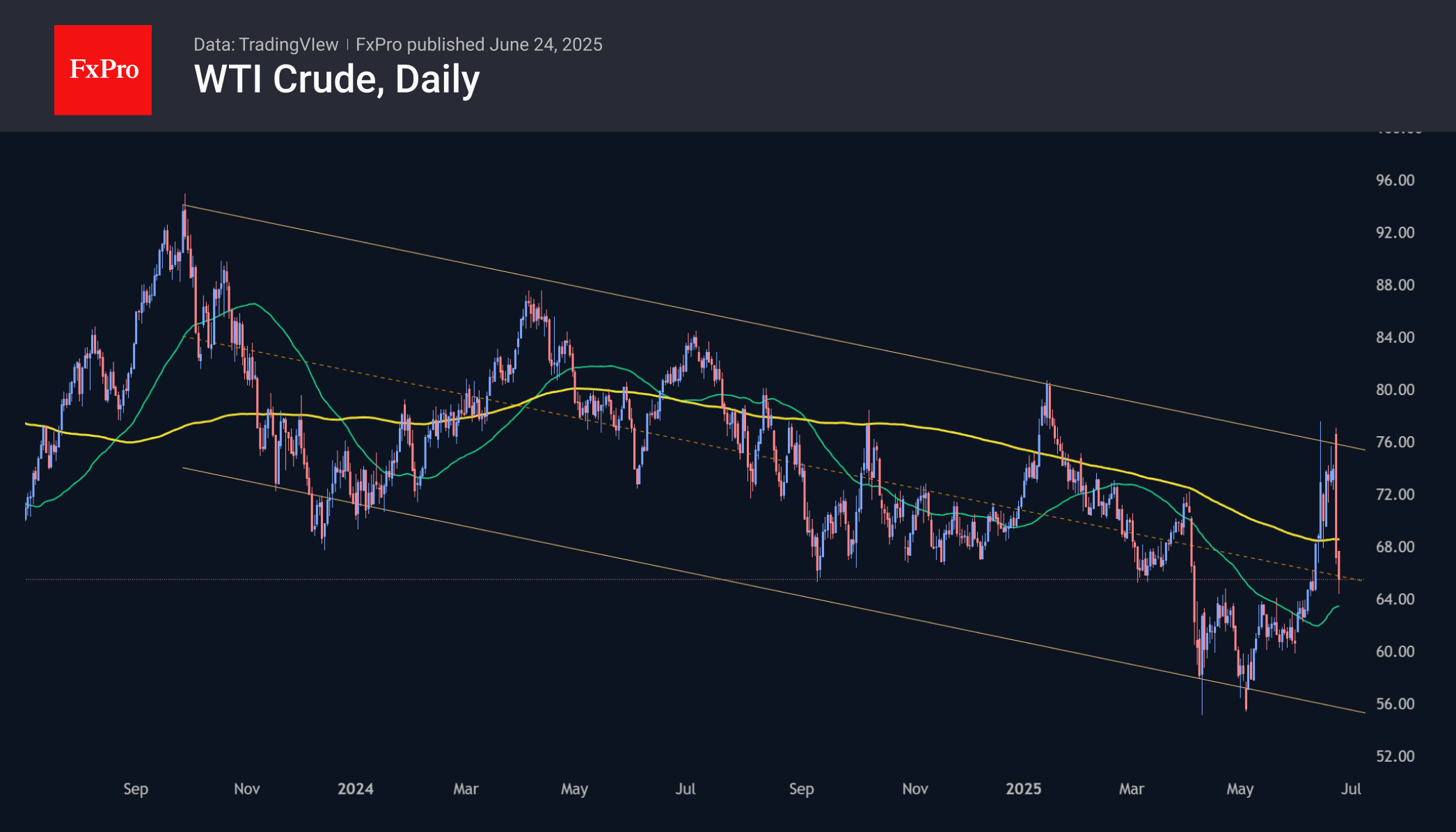

Oil broke downward trend resistance but failed to sustain offensive. Prices predicted to decline to $47 for WTI and $50.50 for Brent by year-end.