Market Overview - Page 17

August 12, 2025

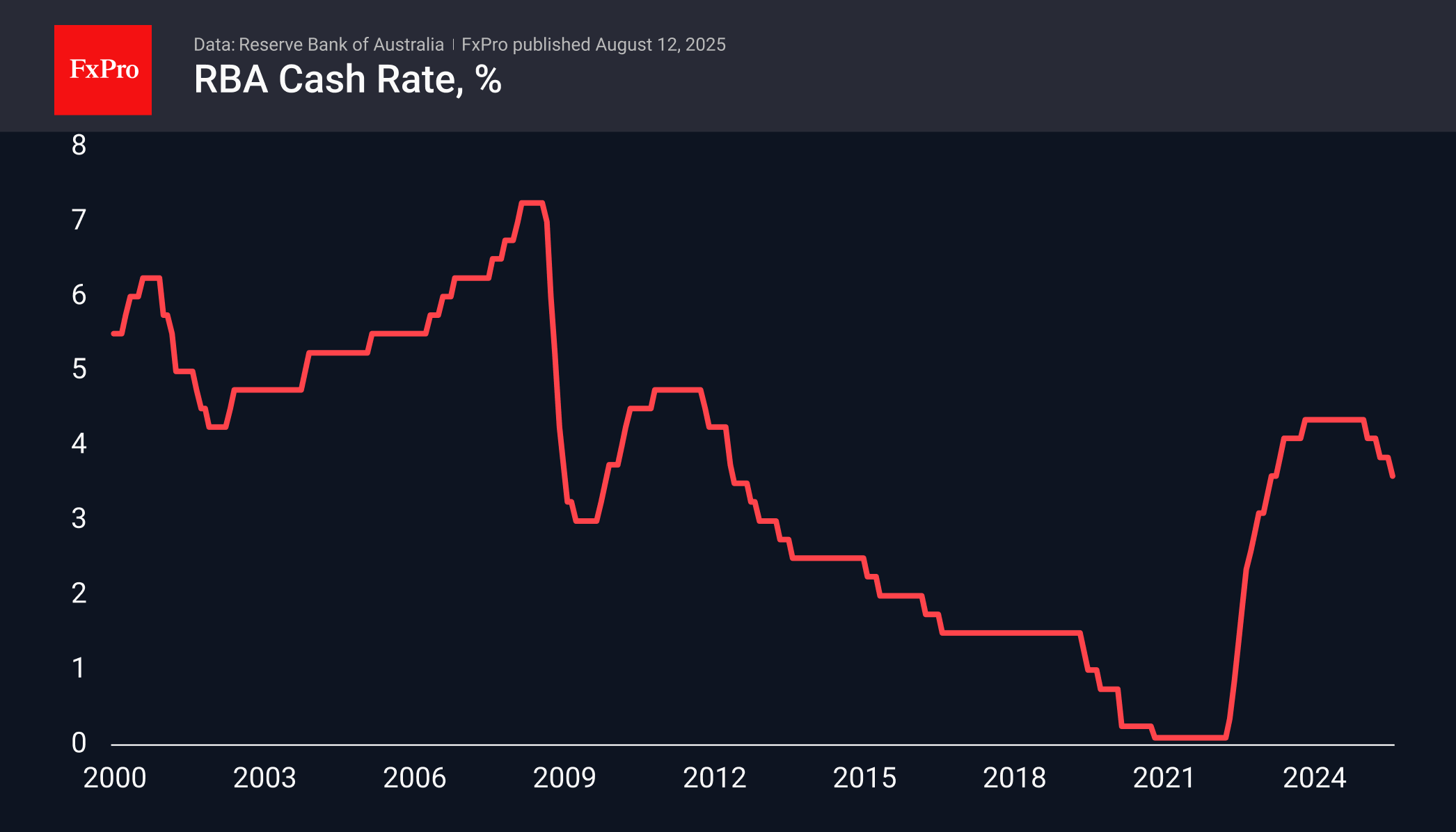

The Reserve Bank of Australia cut rates to 3.60%, citing inflation in line with expectations. This easing led stocks to all-time highs and the Australian Dollar lower.

August 11, 2025

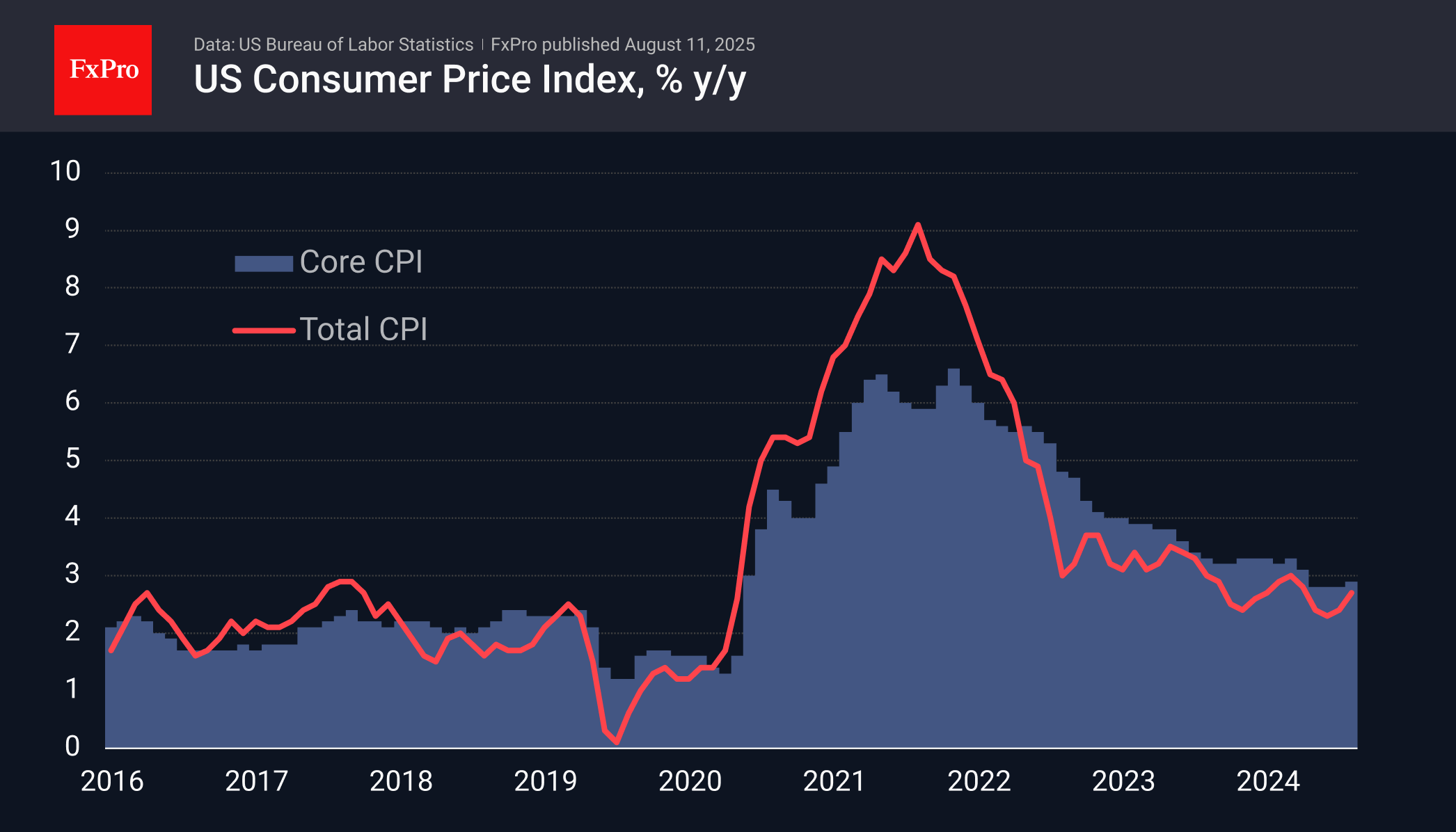

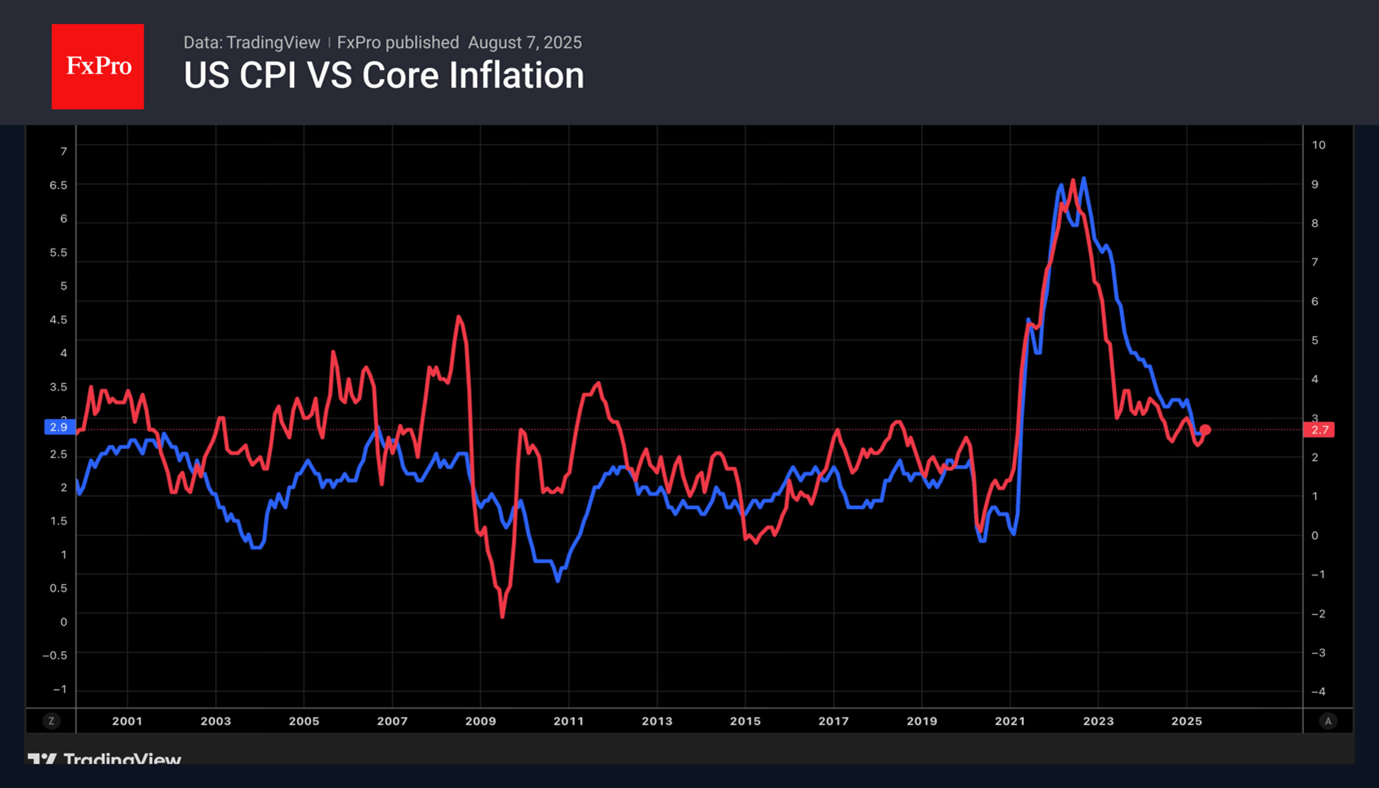

US consumer inflation data for July will be key in determining a potential rate cut in September.

August 11, 2025

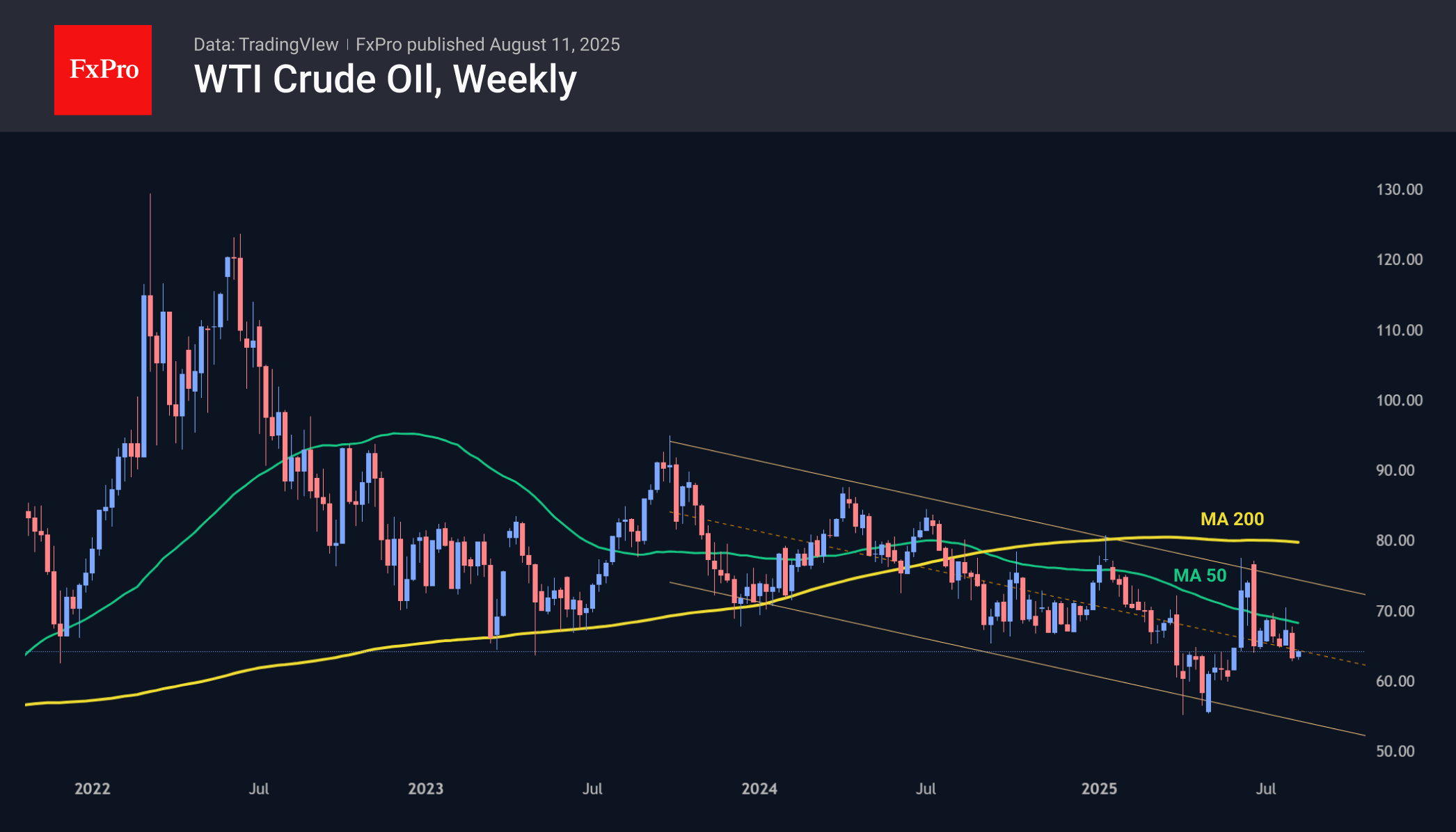

Oil prices rebounded by 1.3% to $63.5 per barrel of WTI following a recent 11% decline due to weak US labour market data and increased OPEC+ quotas, reflecting market focus on negative news.

August 11, 2025

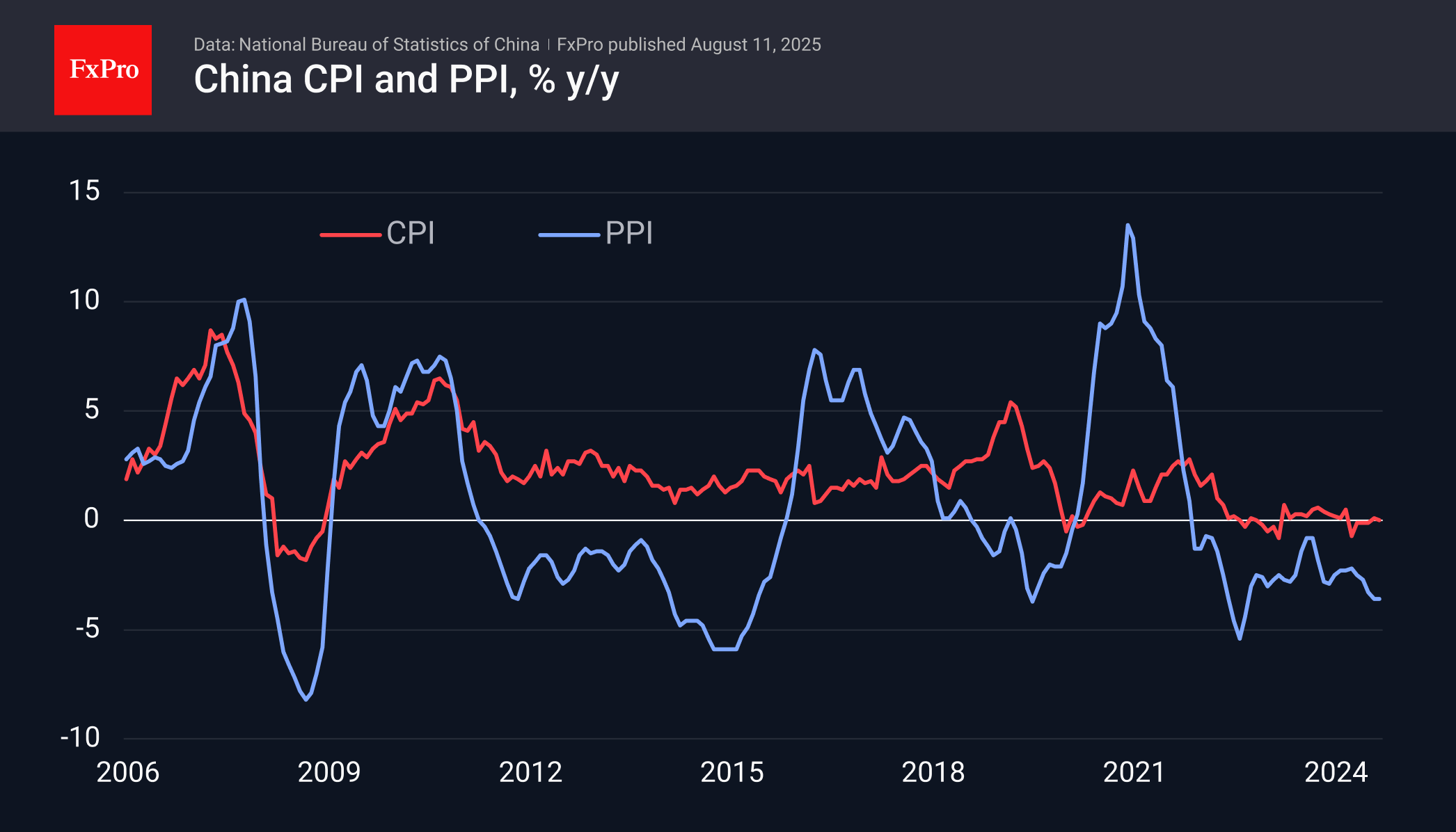

China's falling PPI have contributed to a prolonged period of deflation, prompting potential stimulus measures. Factors include subdued economic growth, low consumer inflation, reduced demand from US tariffs, and global economic slowdown.

August 8, 2025

Key events for the week include the release of US CPI and US negotiations with Russia. Also, be aware of RBA meeting, UK Jobs and GDP stats.

August 8, 2025

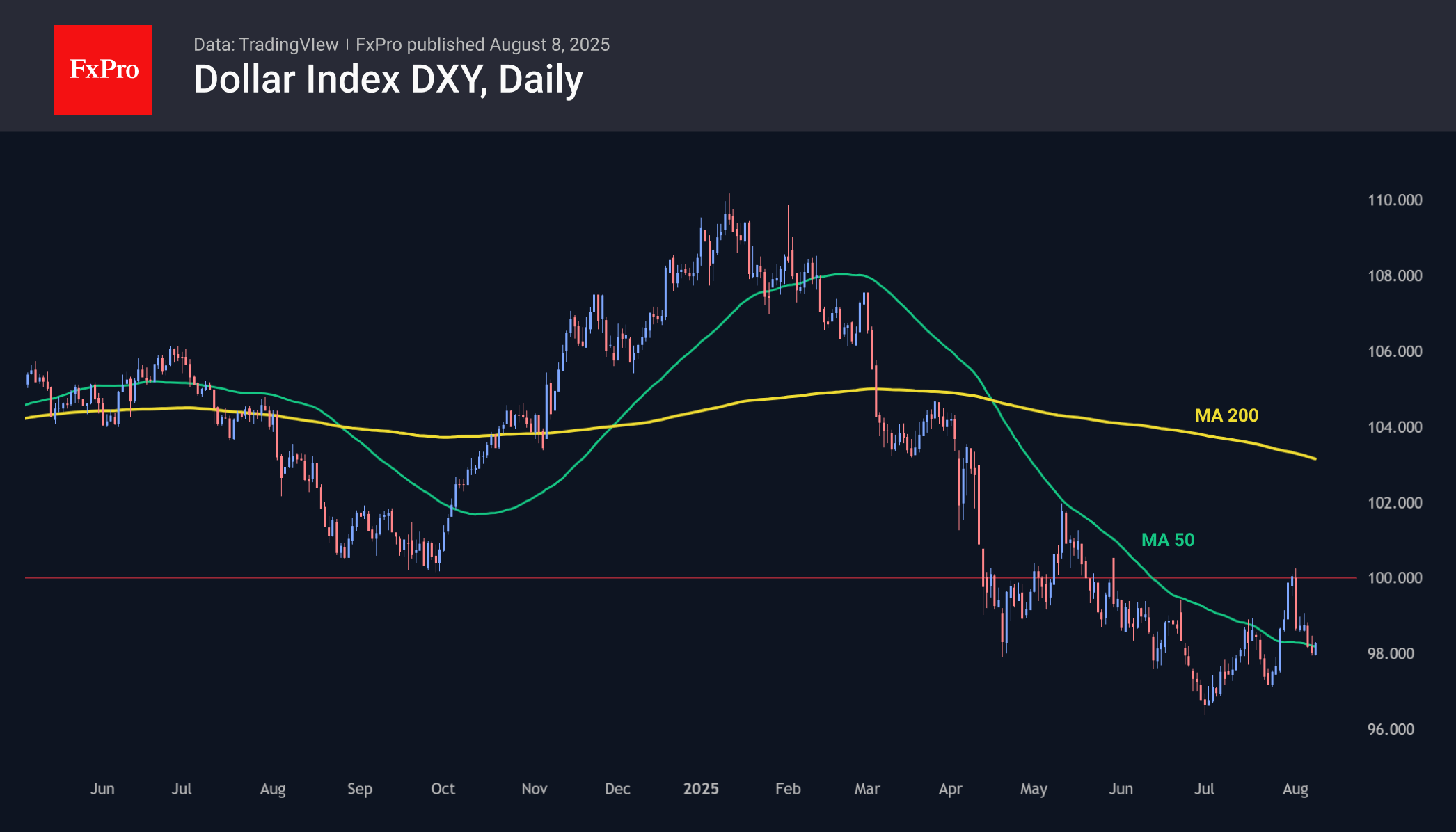

The dollar initially rose but weakened due to labour market data, increasing Fed rate cut expectations. Political appointments and technical indicators signal potential further dollar weakness.

August 8, 2025

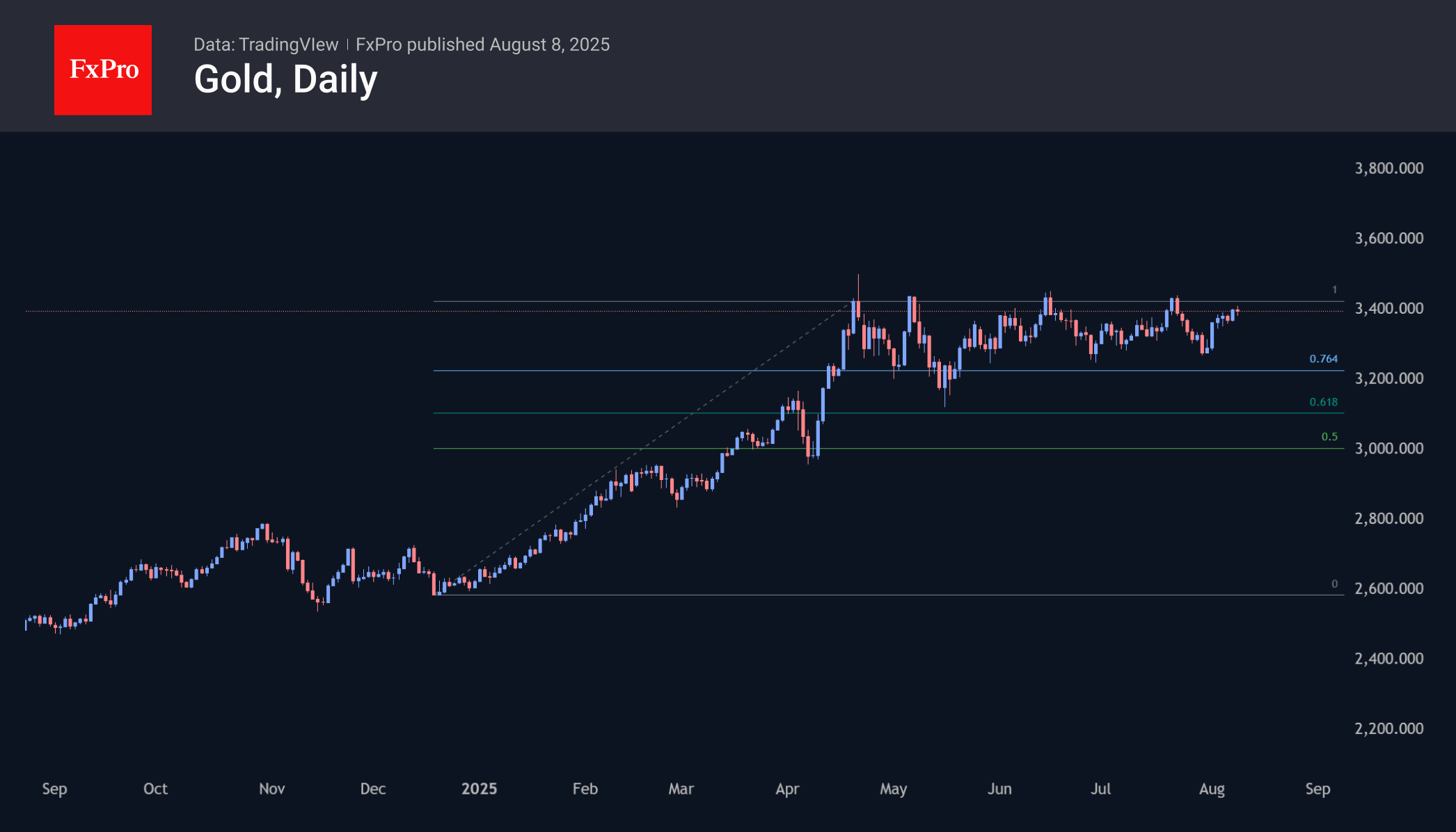

Gold is rebounding due to factors such as stagflation concerns, potential Fed rate cuts, and high demand in China, with a positive outlook ahead. Potential for a rally to reach $3950-4000 if the upper price limit is broken.

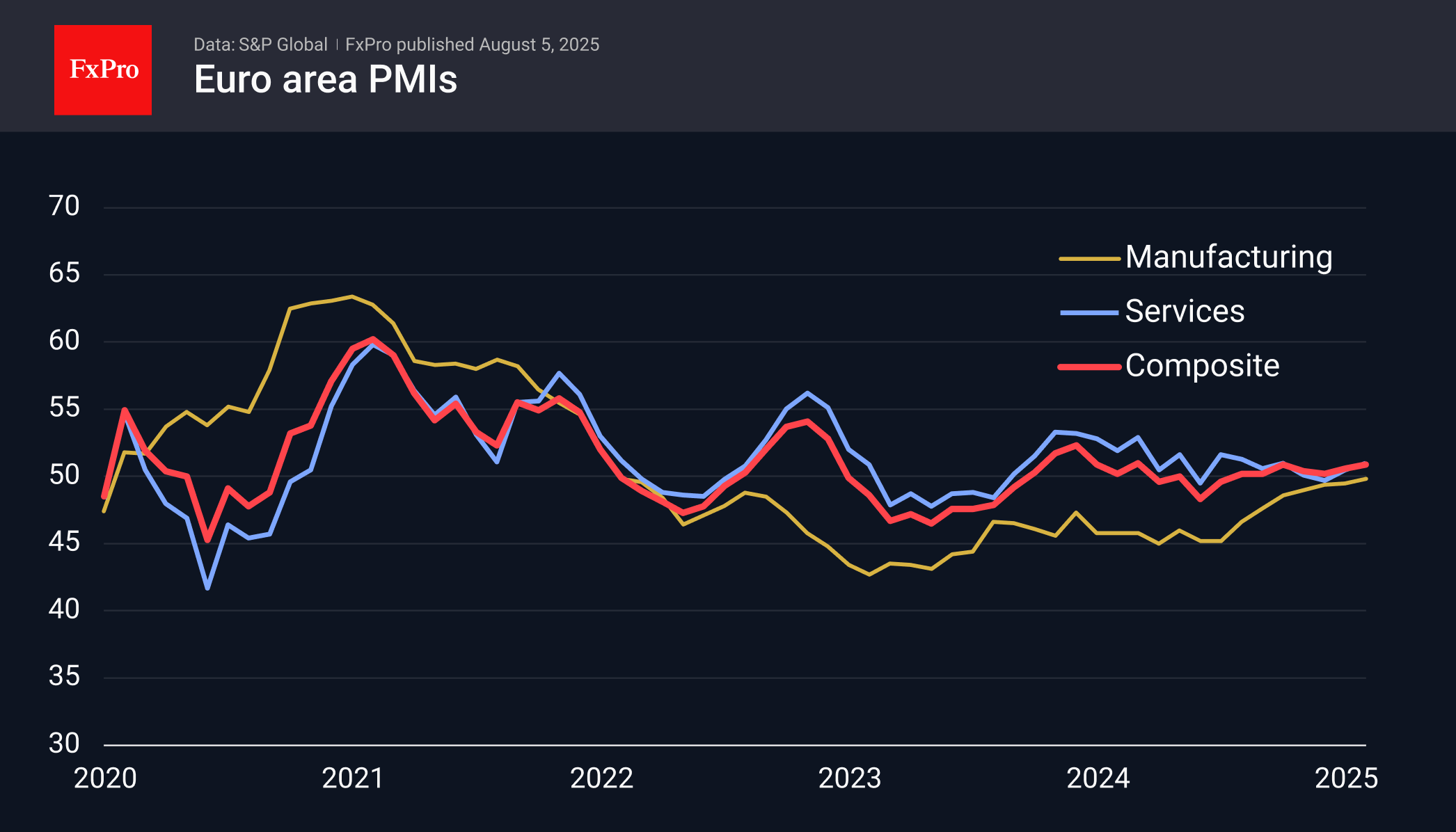

August 7, 2025

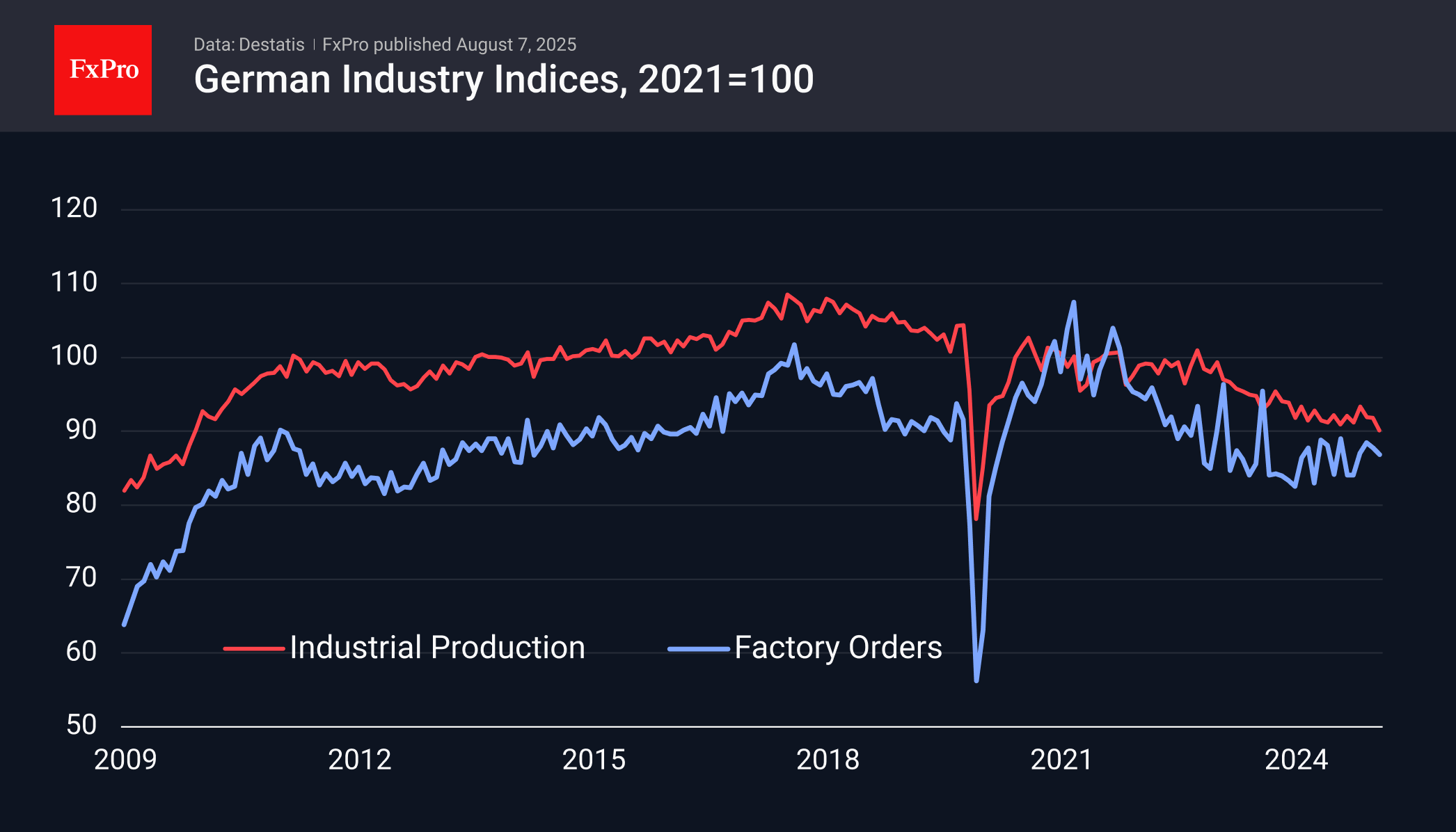

German industrial production has declined sharply in recent months, with the industrial production index at its lowest since April 2010. Stagnant exports and declining industrial orders may lead to a further reduction in the ECB rate, impacting the euro.

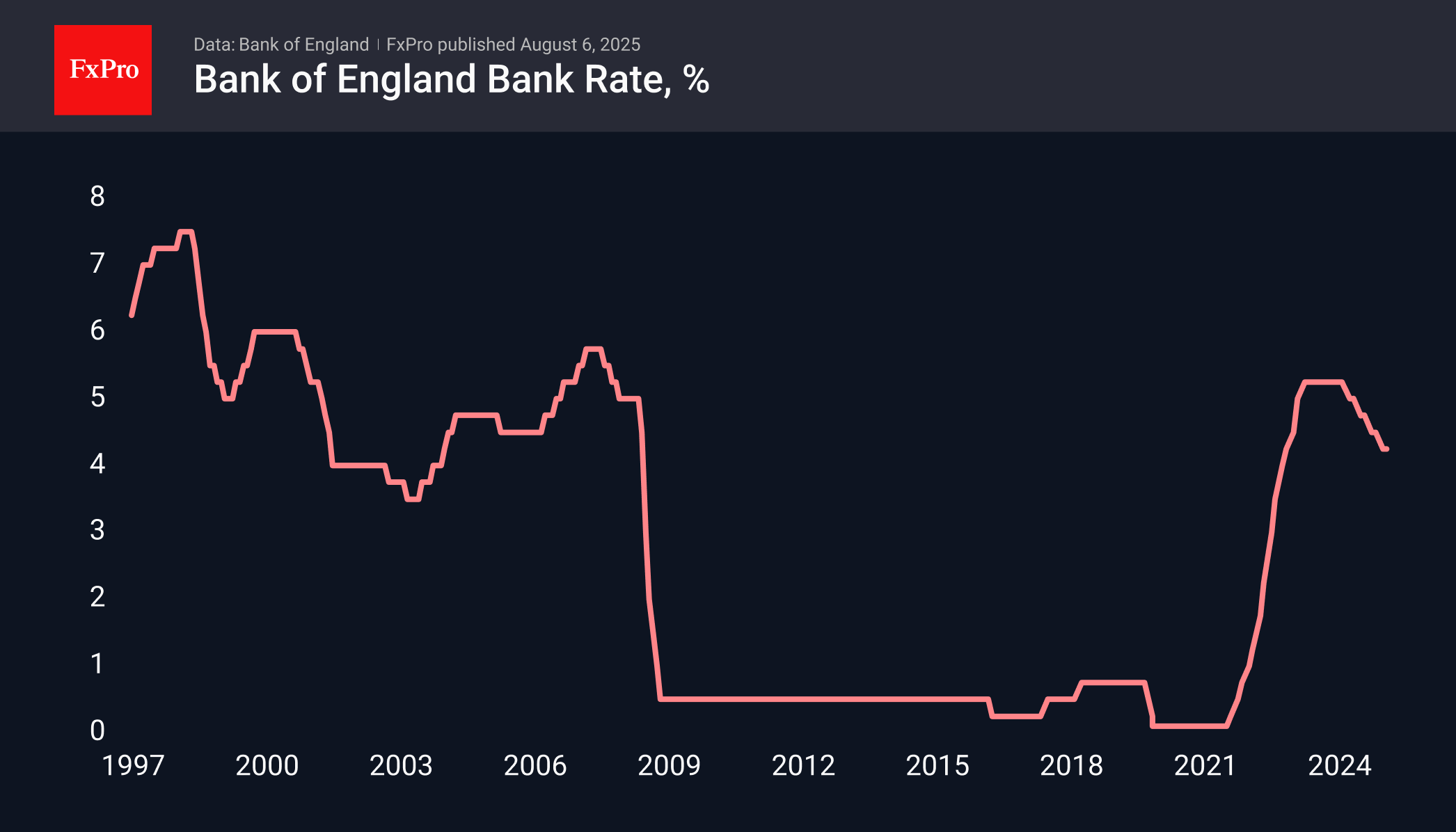

August 6, 2025

The Bank of England is expected to cut its bank rate on Thursday. This decision could impact the EURGBP pair, which is nearing a breakout point towards 0.92 or a drop to 0.8250.

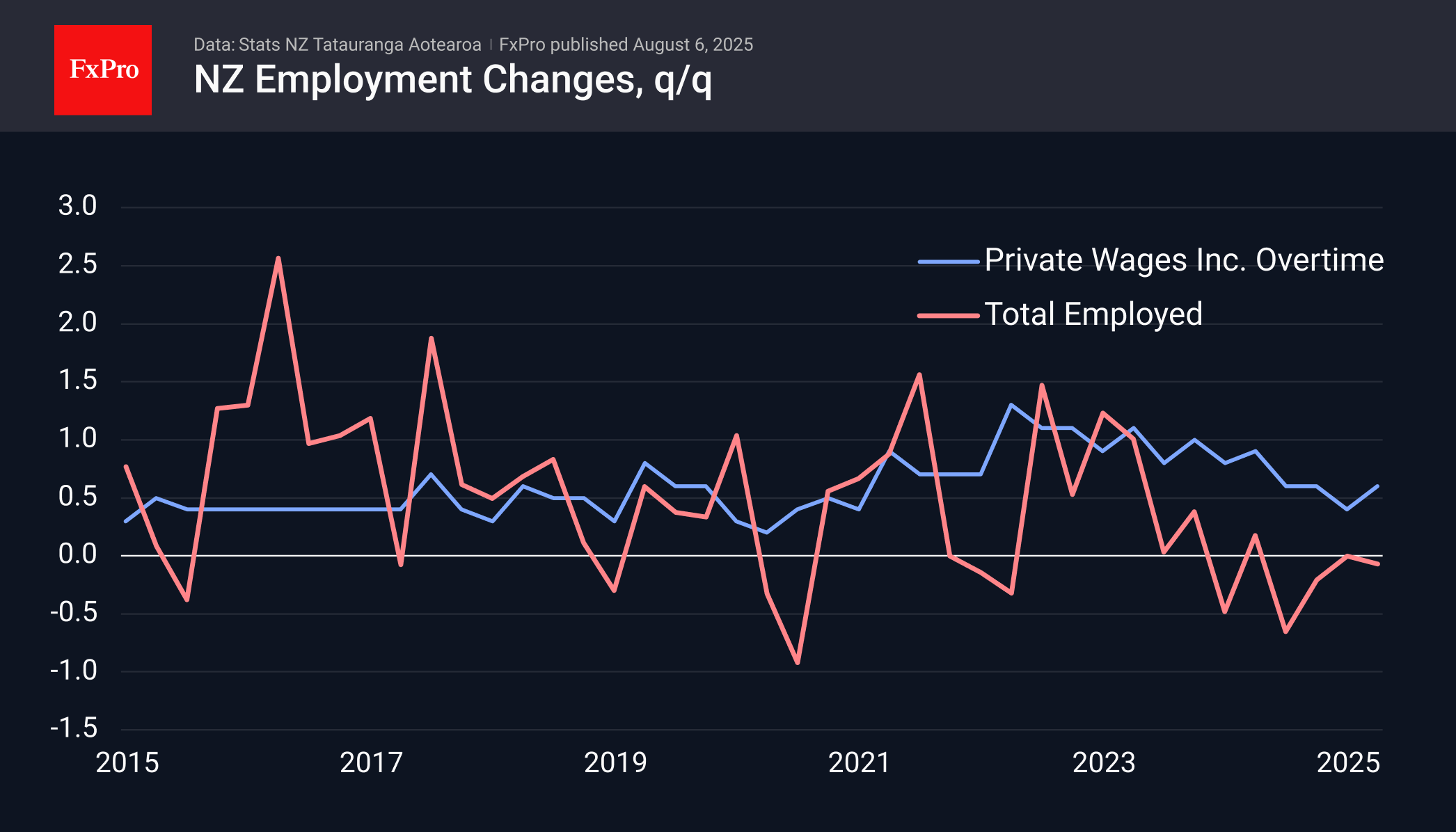

August 6, 2025

The New Zealand dollar was able to swim against the tide on Wednesday, strengthening against the dollar more than its other competitors on positive labour market statistics. NZDUSD has gained 0.6% since the start of the day to 0.5930, hitting.