Market Overview - Page 16

August 19, 2025

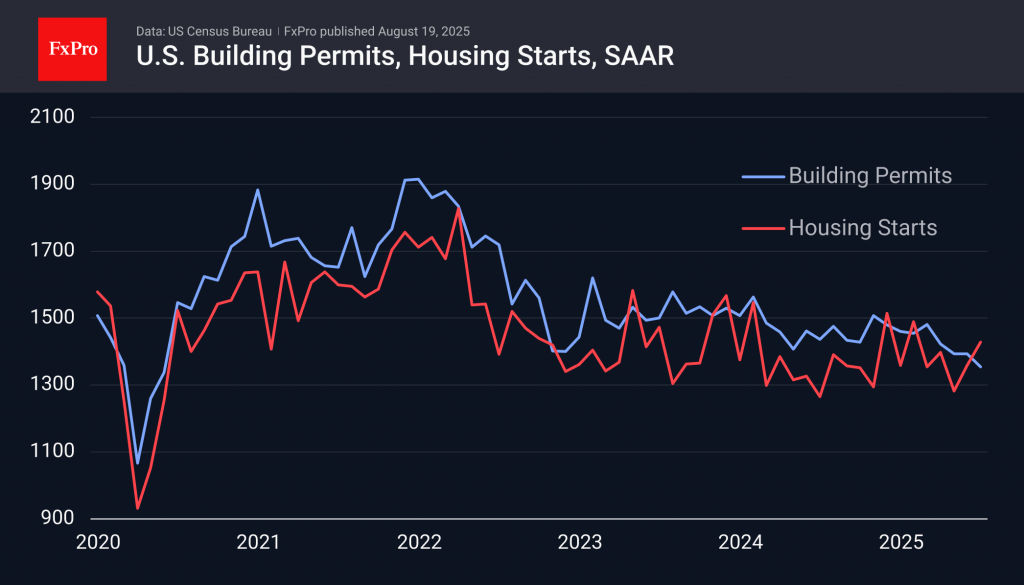

US construction permits fell to a 5-year low, signalling a slowing housing market. Median new home prices dropped to $401,800, highlighting ongoing downward trends.

August 19, 2025

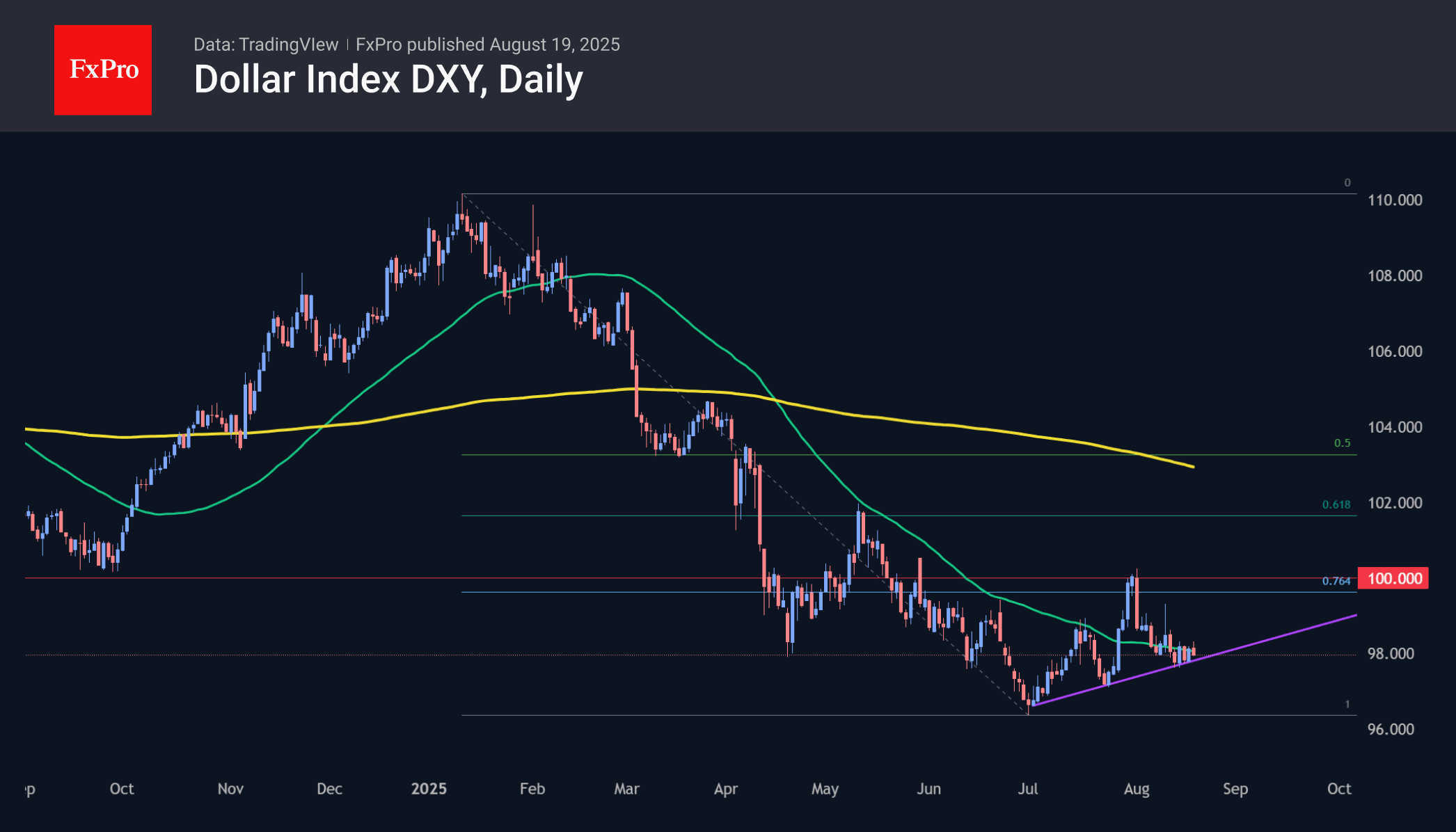

The US dollar is showing signs of recovery due to inflation risks and shifting trade flows, but a lasting uptrend will only be clear if DXY surpasses 100.

August 19, 2025

The crypto market dips as BTC tests $114.7k and ETH $4,200. Capital inflows surge, but large holders lock in profits. Solana hits a record TPS in a stress test.

August 18, 2025

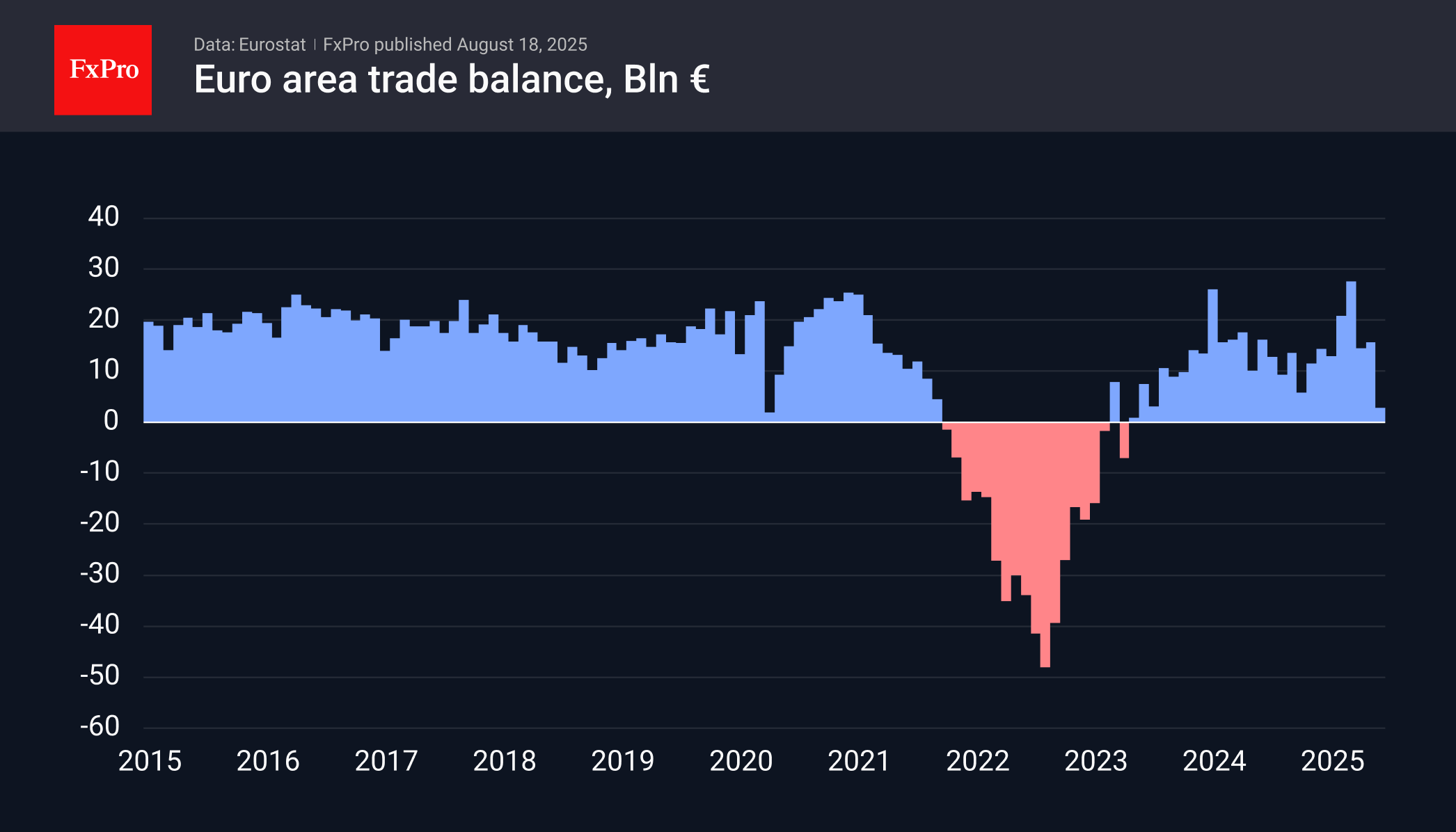

Eurozone trade surplus dropped to lowest since May 2023 as exports fell and imports rose. This may push the ECB to maintain an easier monetary policy.

August 18, 2025

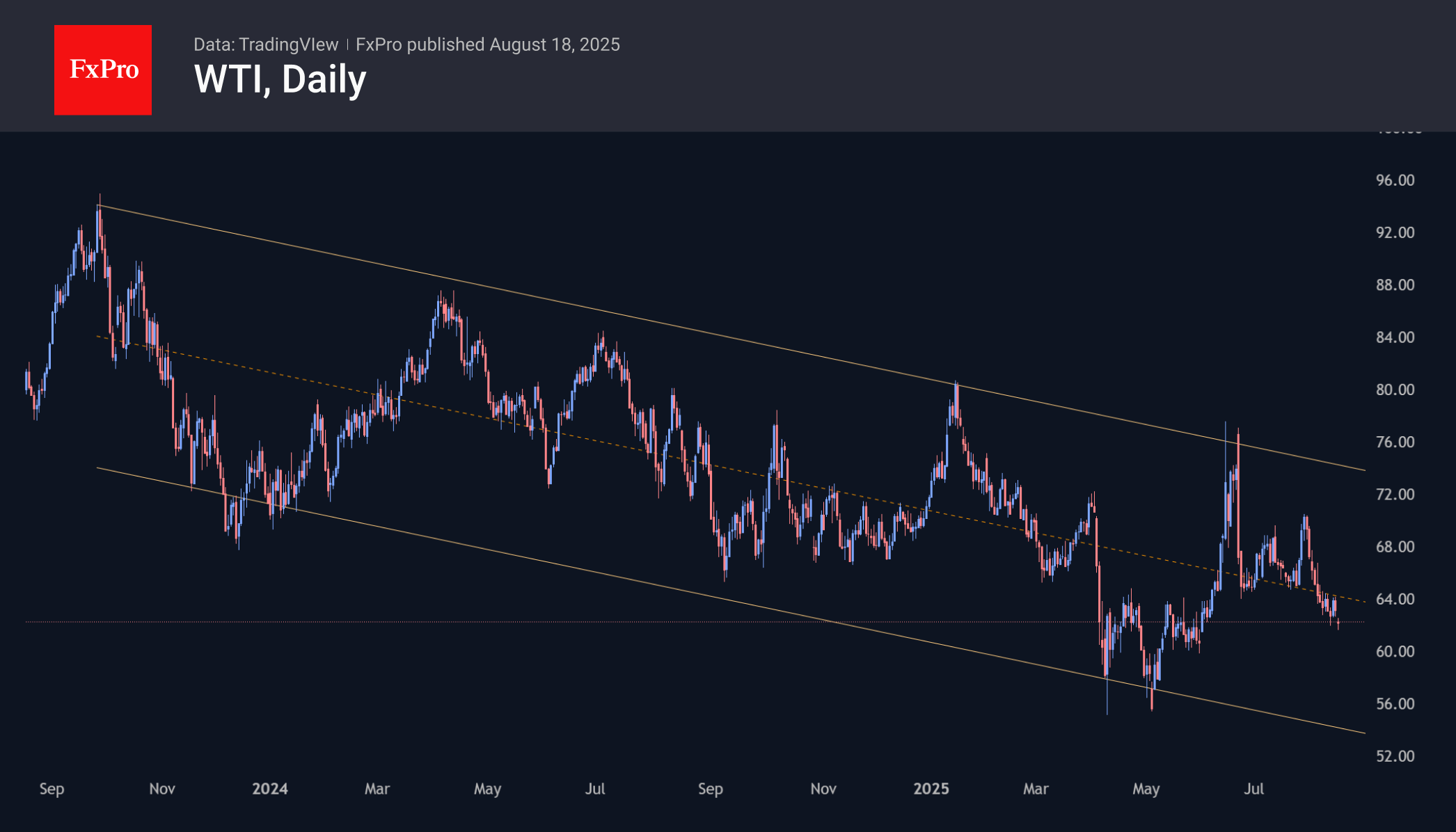

There are signs that oil prices are attempting to bottom out at around $61 per barrel for WTI and $65 per barrel for Brent. In the middle of last week and at the start of trading on Monday, local lows.

August 15, 2025

The central event of the week leading up to the 22nd of August will be the meeting of central bank governors in Jackson Hole. In the past, regulators have occasionally signalled changes in monetary policy. Now something similar is expected.

August 15, 2025

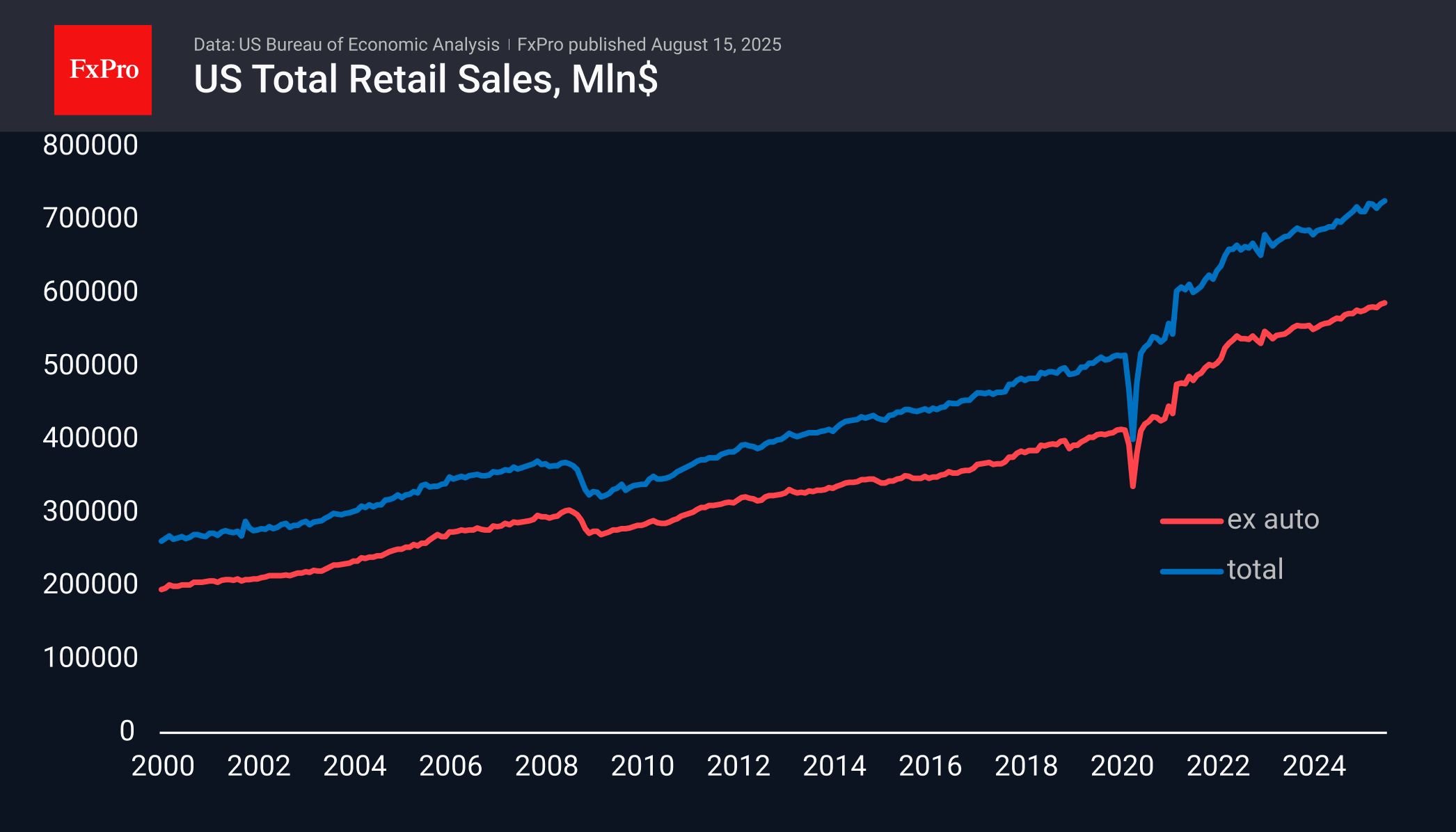

US retail sales show steady growth, outpacing inflation. Construction sales decline, but fears of a repeat mortgage crisis are eased as prices rise while volumes fall.

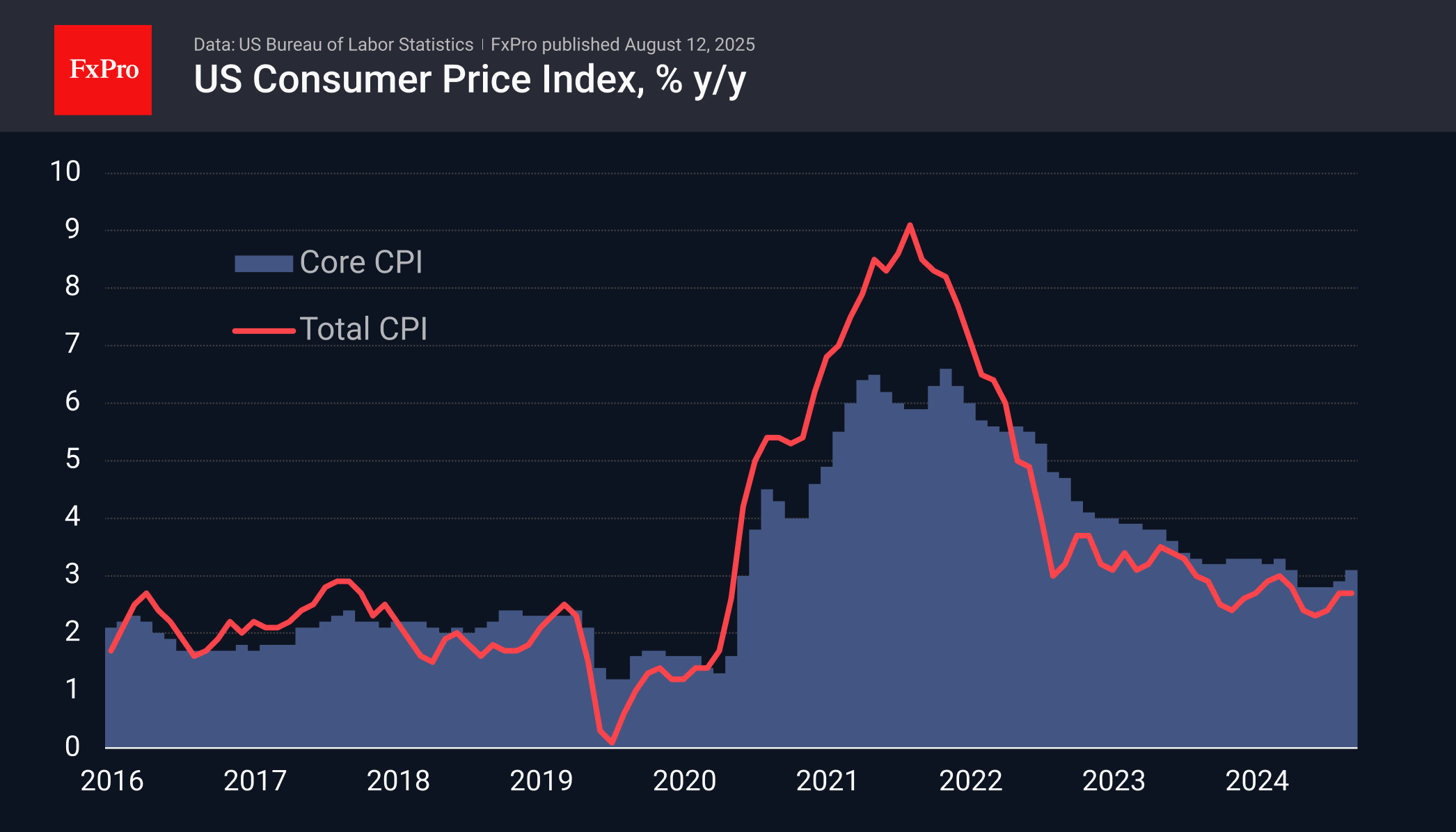

August 15, 2025

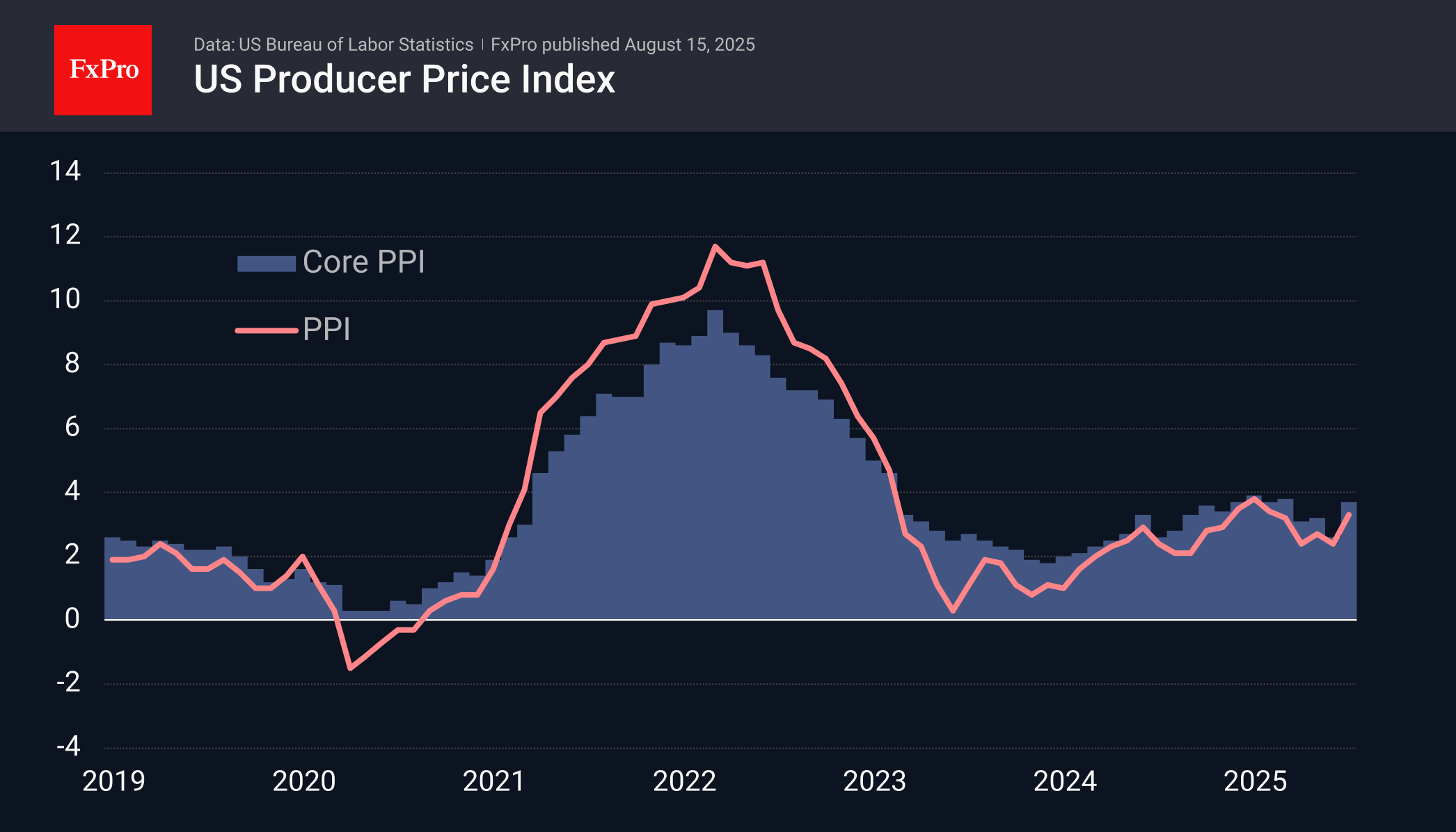

US PPI and core inflation jumped, shaking markets and reducing the chances of aggressive Fed rate cuts. Confidence in multiple cuts fell as focus shifted to Powell’s upcoming Jackson Hole speech

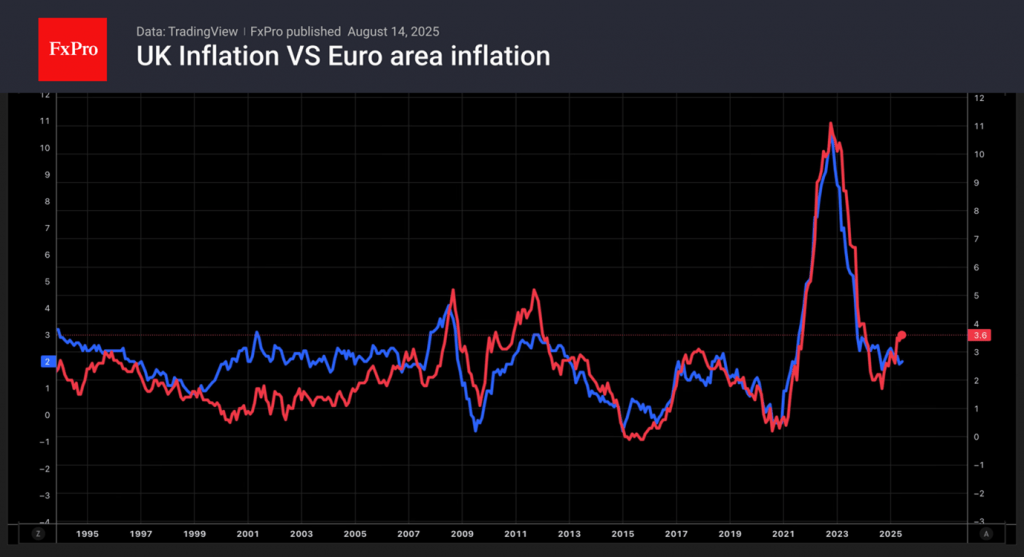

August 14, 2025

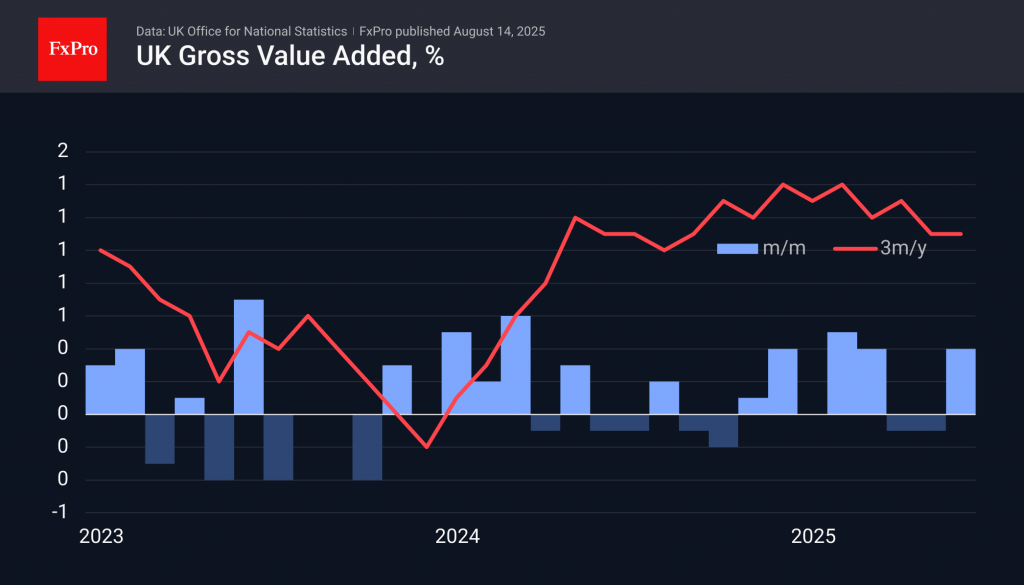

UK data shows positive economic growth in June, mostly surpassing expectations. Pound faces resistance despite strong fundamentals, showing signs of exhaustion following recent growth.

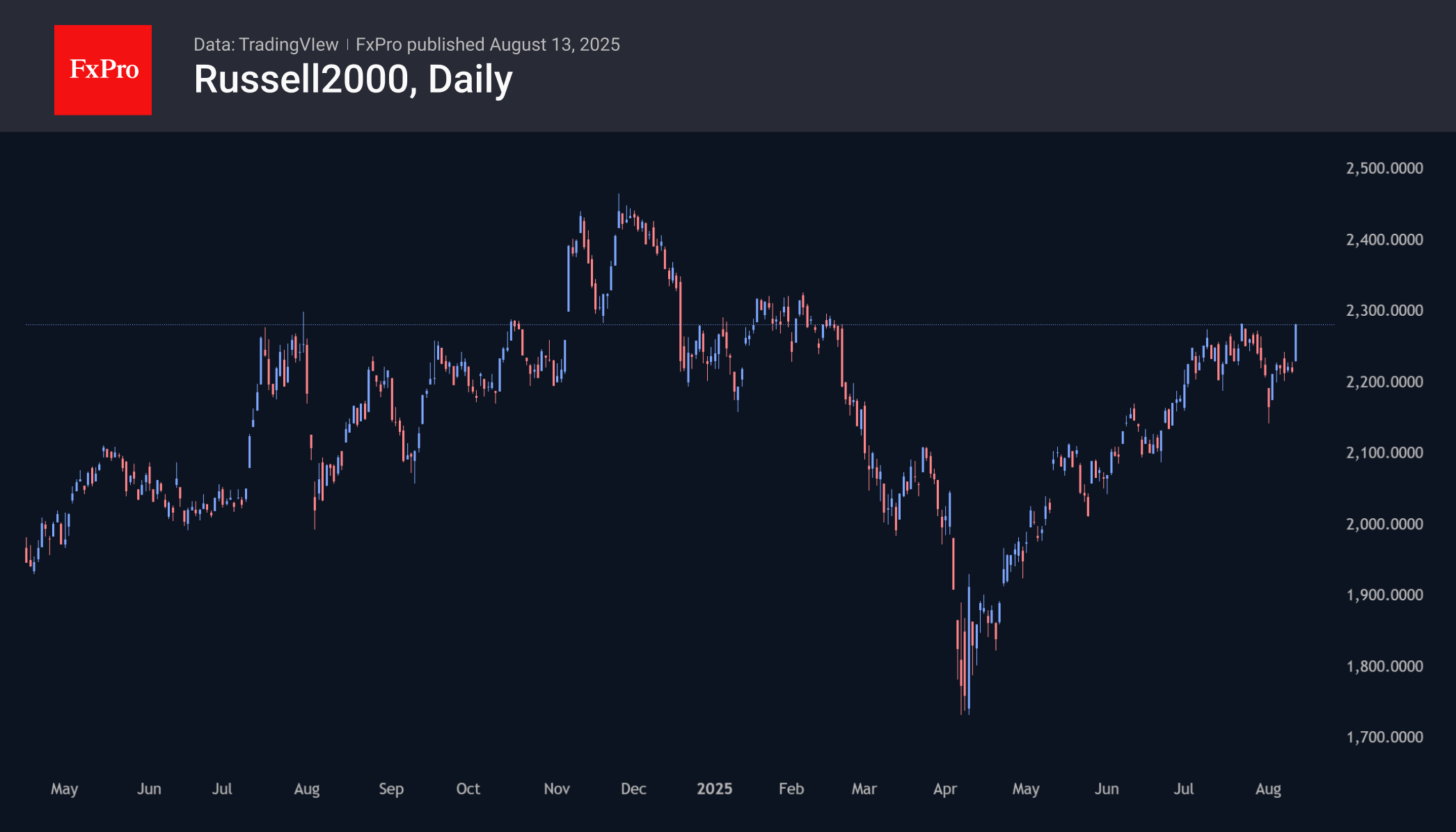

August 13, 2025

The US small-cap index Russell 2000 surged by almost 8%, outperforming S&P 500 and Nasdaq100, driven by expectations of a Fed rate cuts.

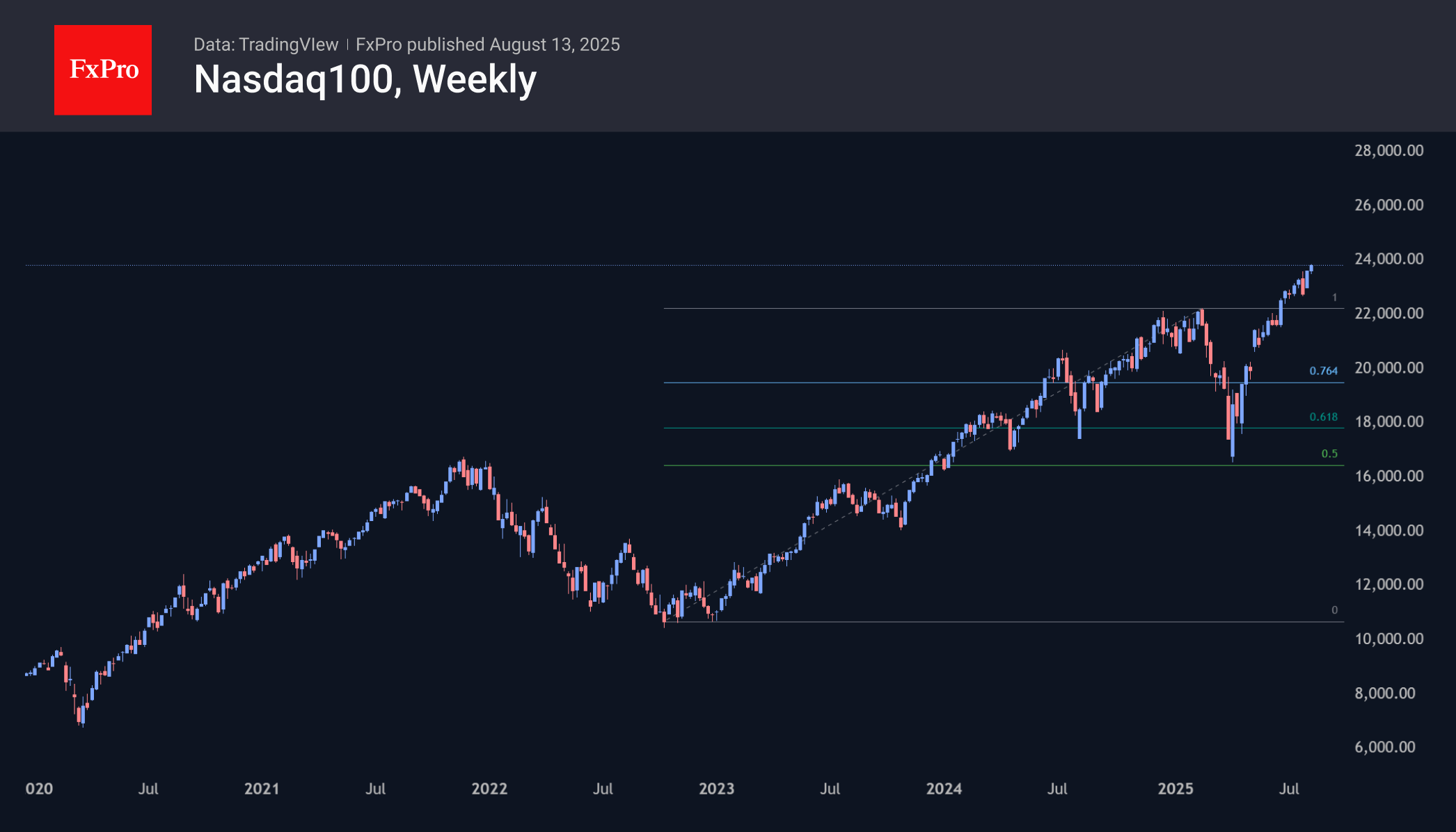

August 13, 2025

The stock market indices are reaching new highs driven by expectations of multiple interest rate cuts. Nasdaq100 targets 30,000, S&P 500 7800, while Nikkei225 aims for 50,000.