Market Overview - Page 15

August 29, 2025

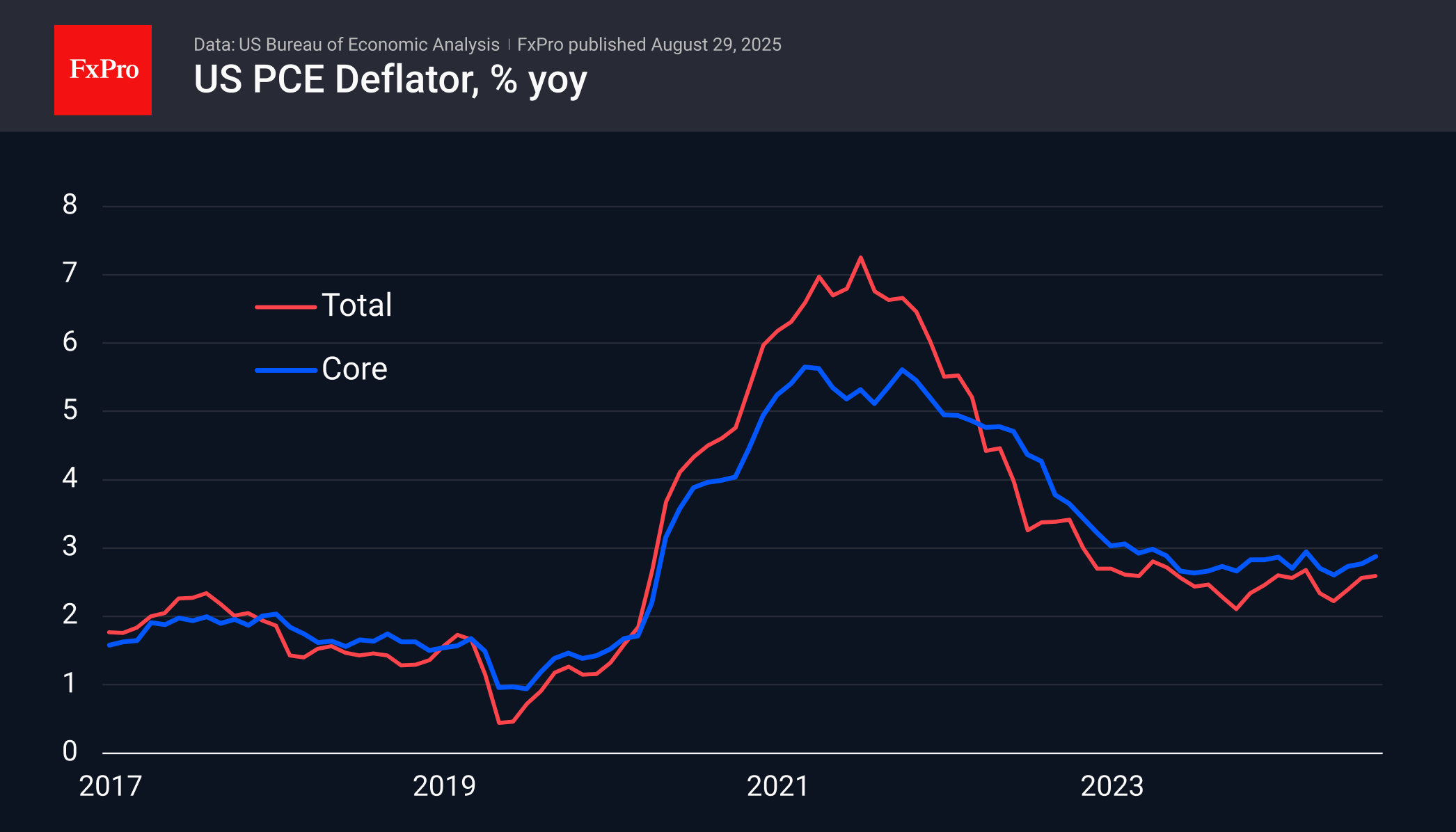

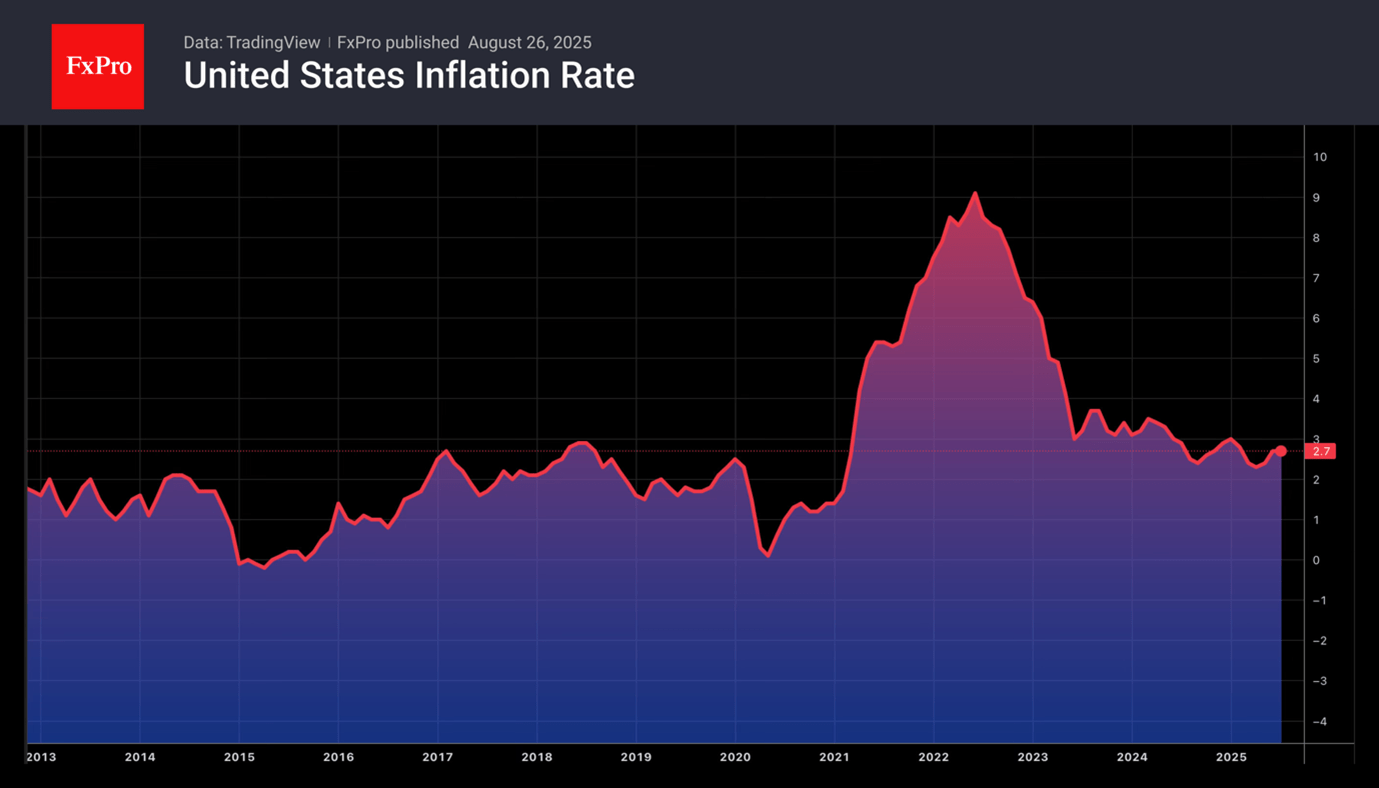

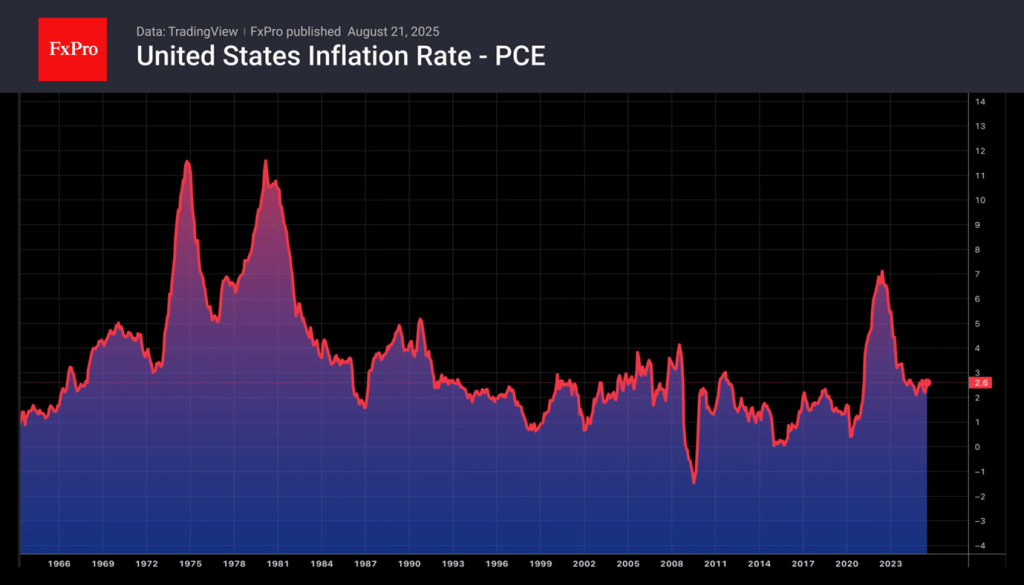

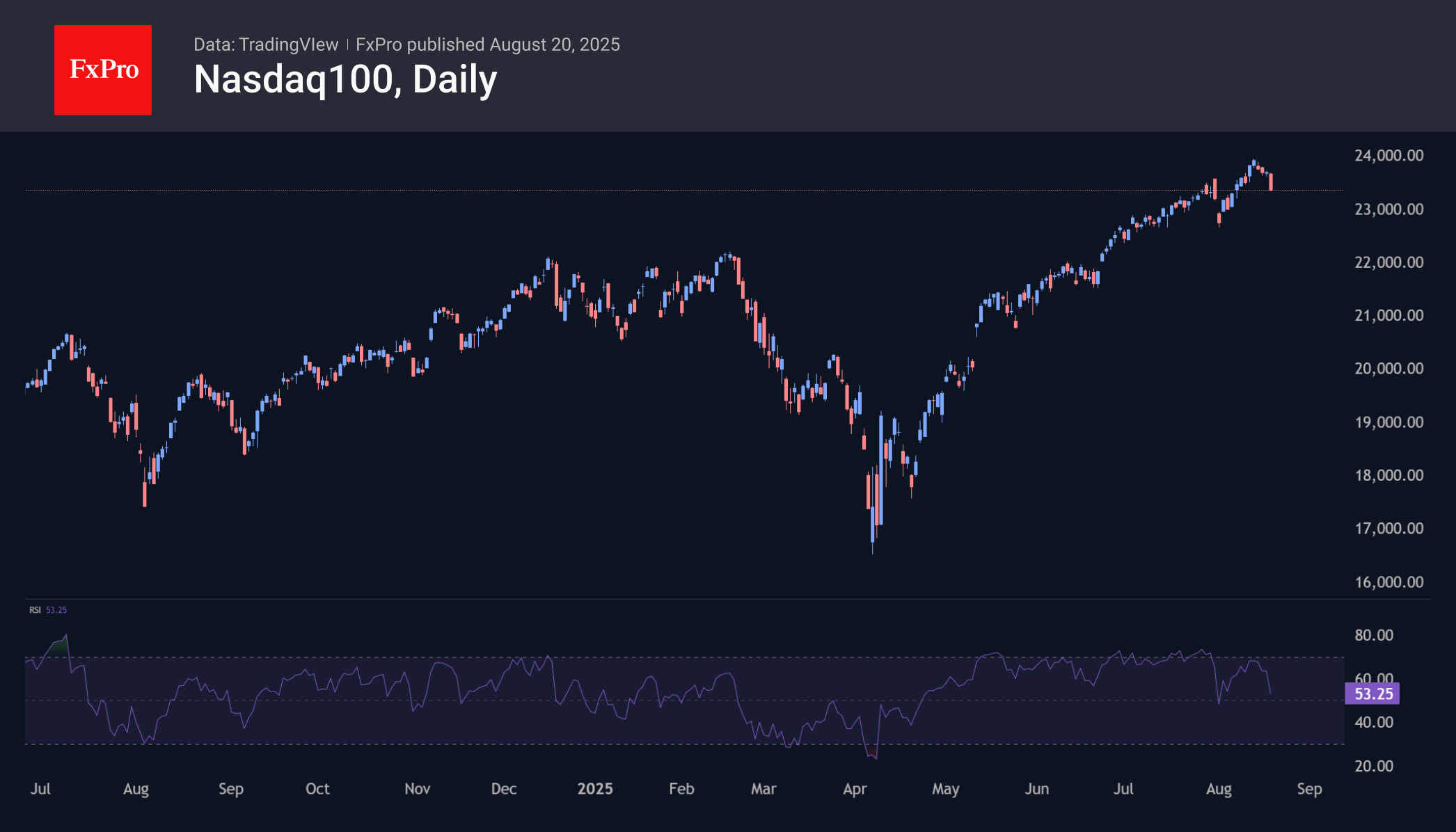

US inflation is rising but matches forecasts; consumer spending and income remain healthy. The Fed may still cut rates in September, pending jobs data.

August 29, 2025

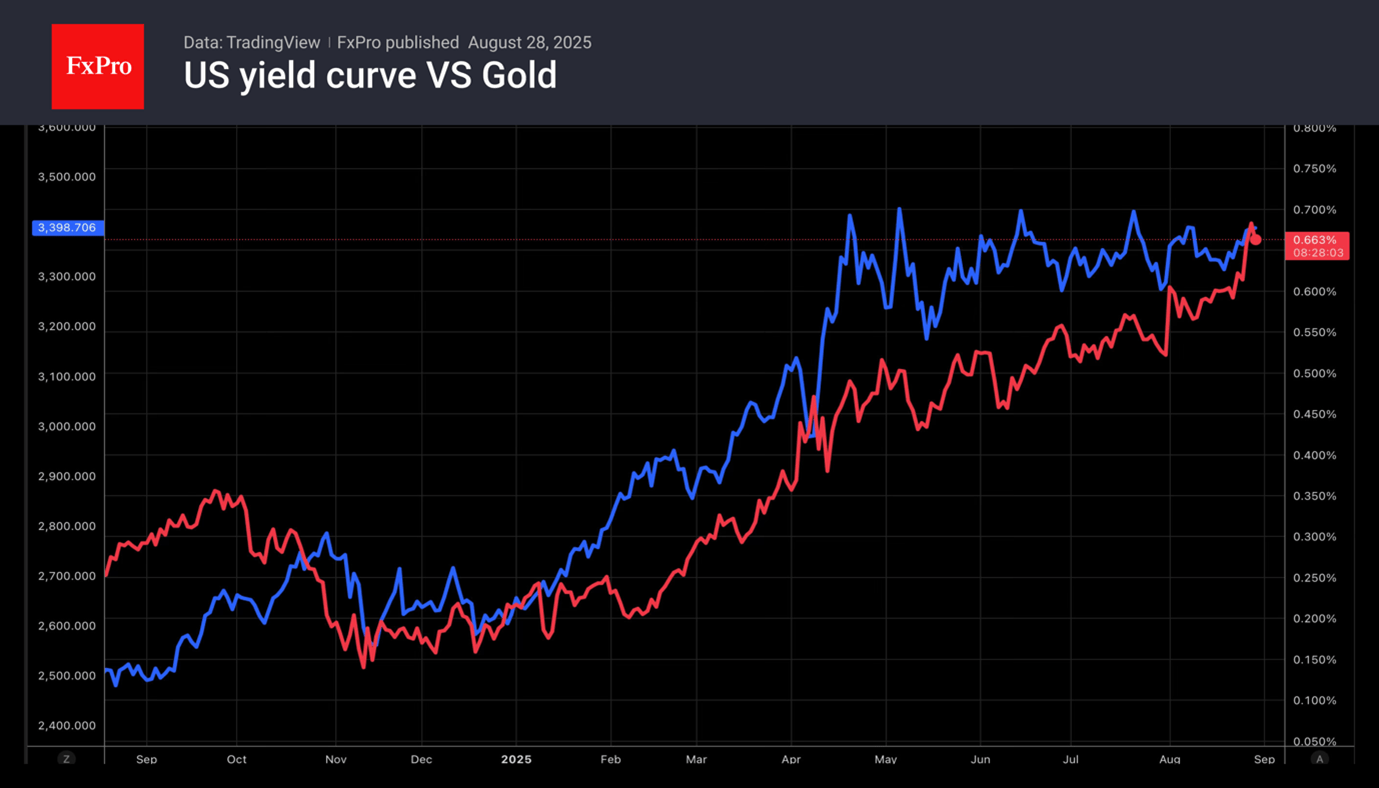

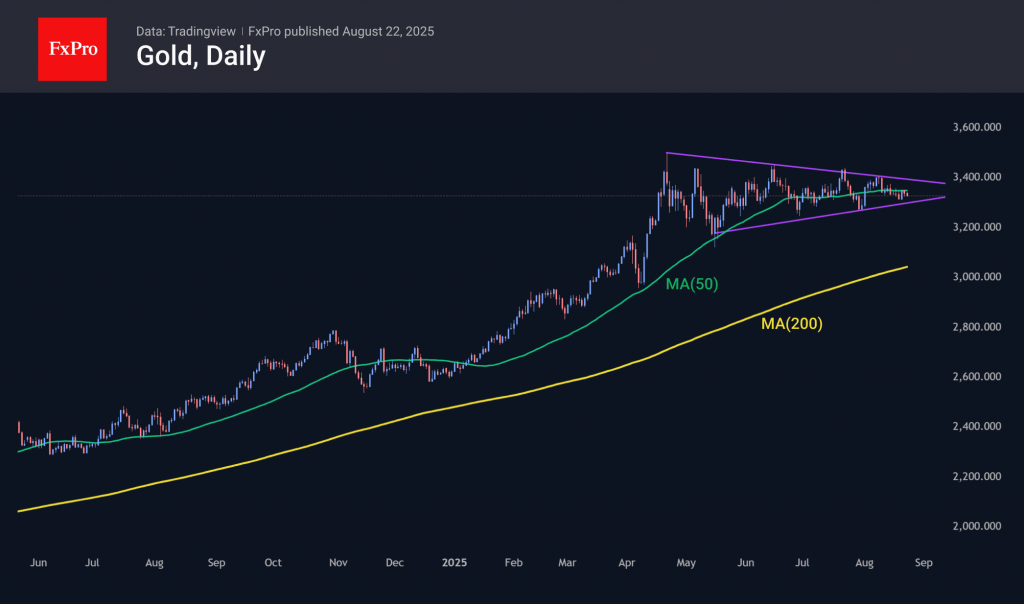

Gold is trading above $3,400 again at the end of the week. The upper limit of the trading range, within which the price has been fluctuating since April, is close to $3,430. Jerome Powell’s signals about a rate cut, unprecedented.

August 29, 2025

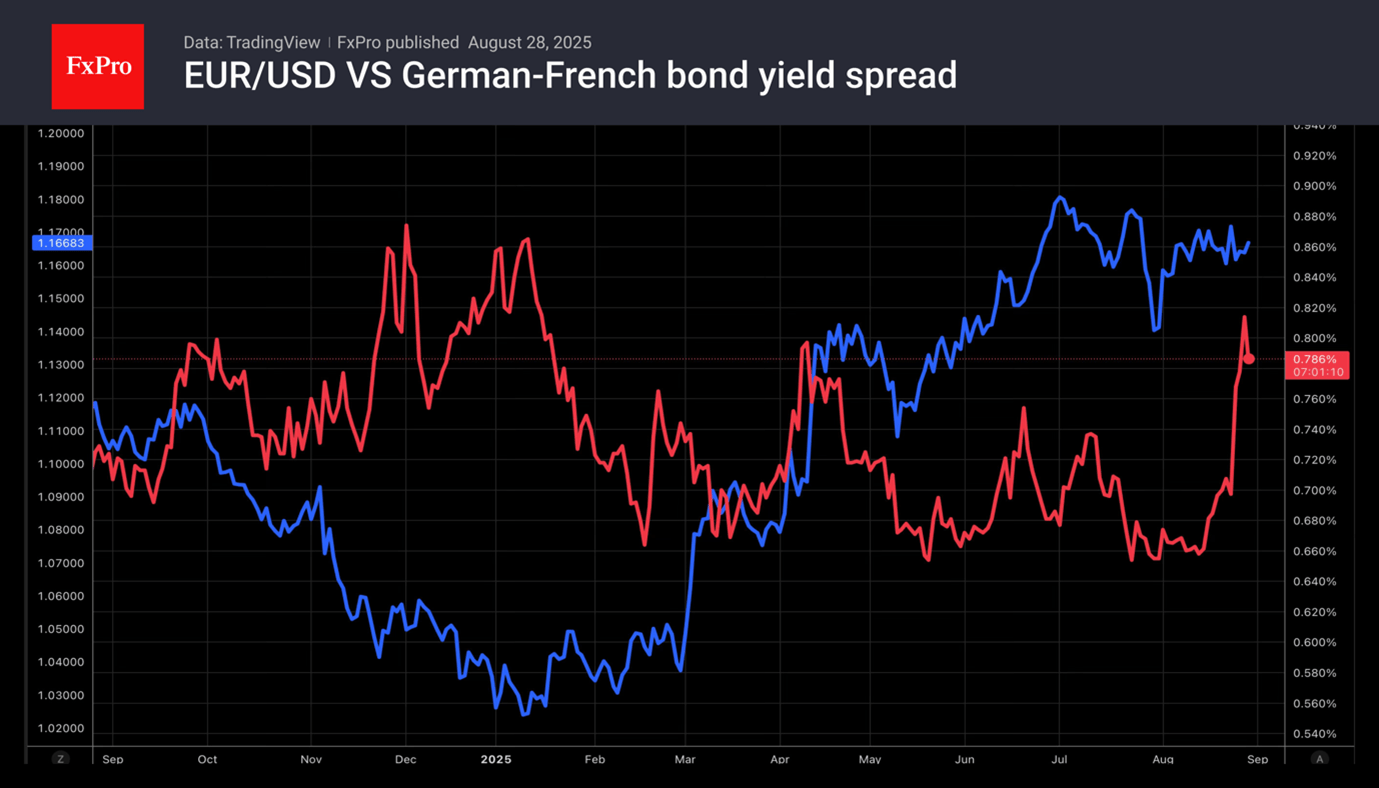

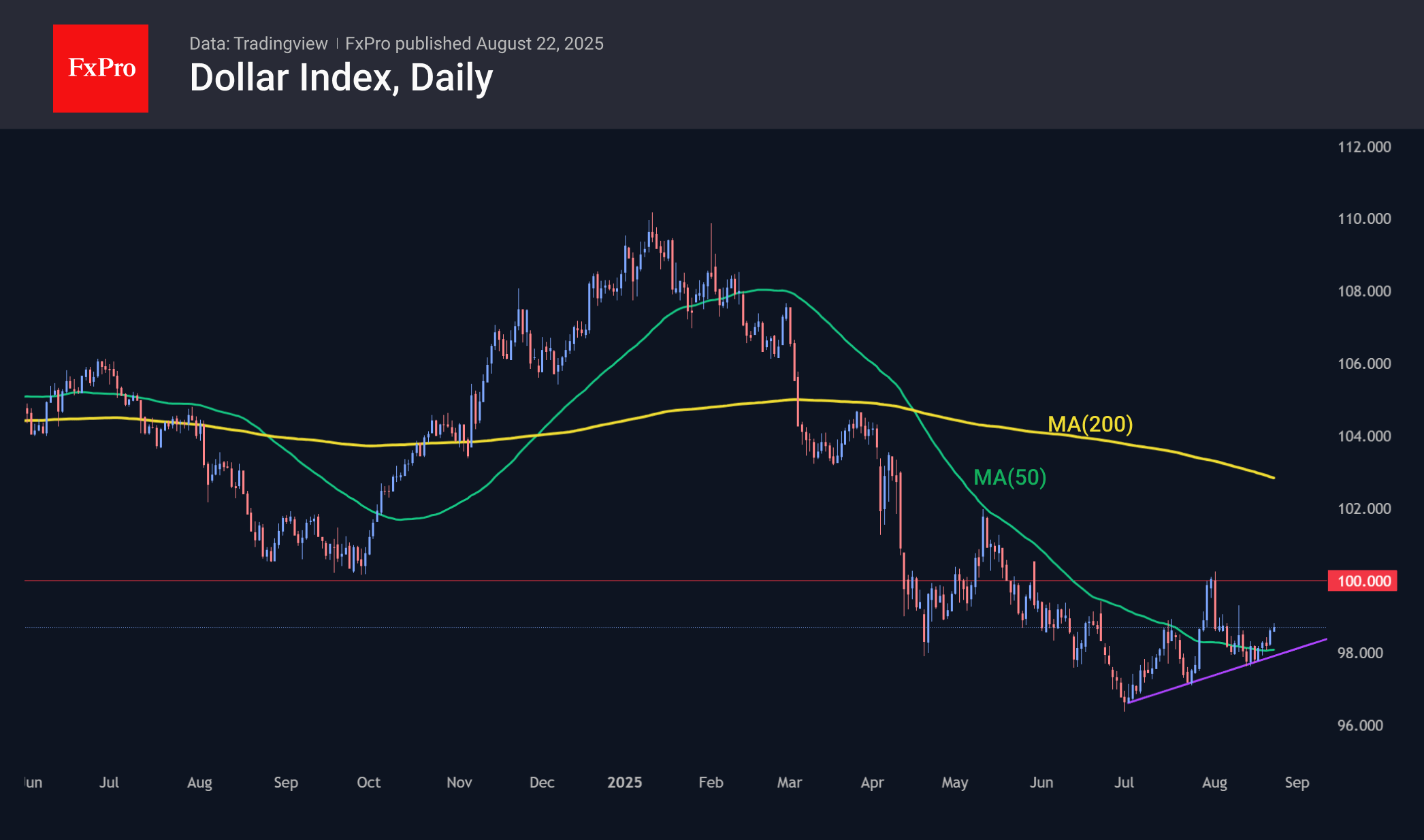

US dollar The US dollar has been consolidating for more than two weeks. Pressure on the USD index is being exerted by the increased likelihood of a Fed rate cut in September, from 69% to 85%, following Jerome Powell’s dovish.

August 29, 2025

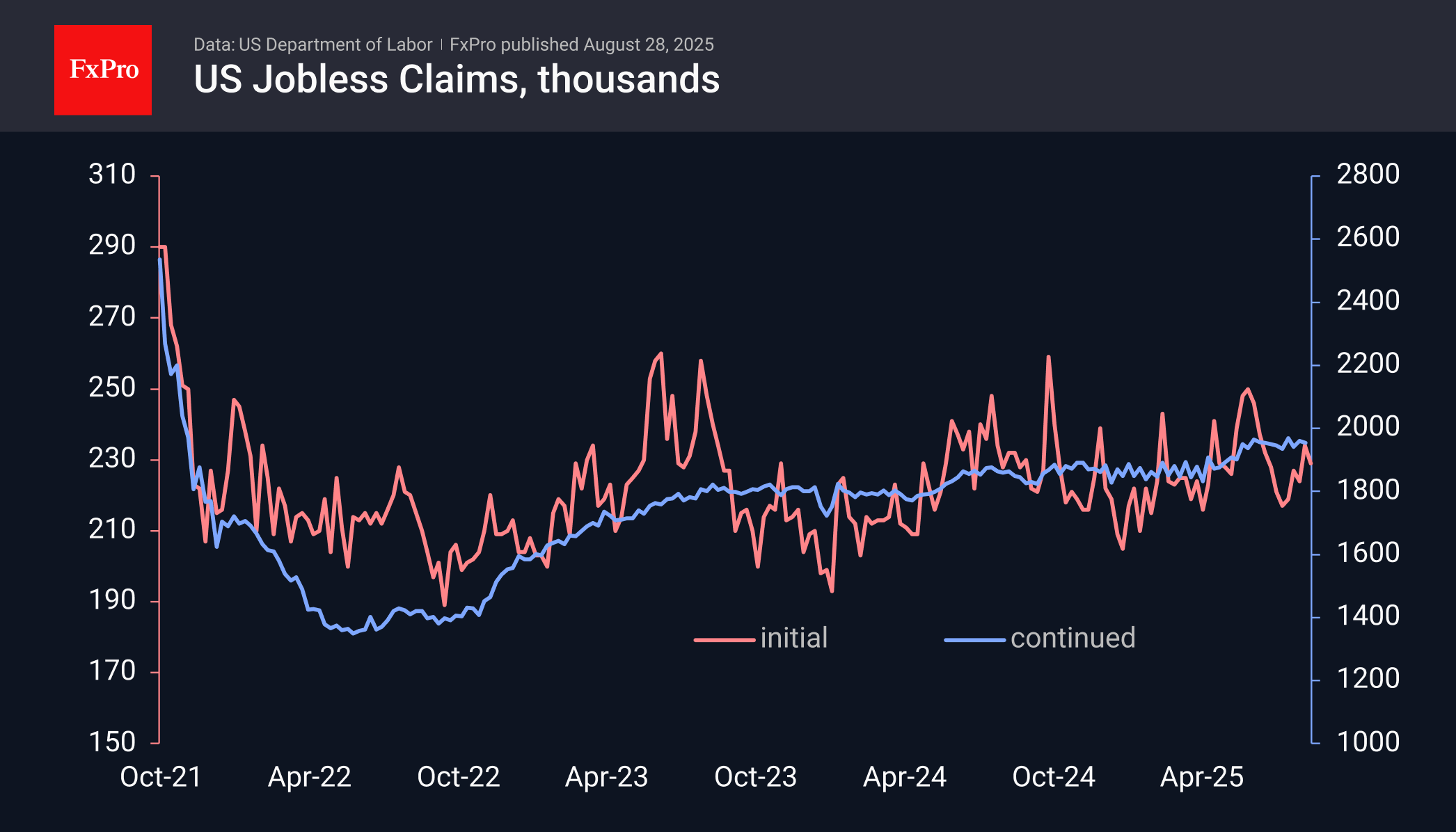

US labour market cools as unemployment claims rise, signalling slowing economic activity and hinting at possible need for monetary policy easing

August 27, 2025

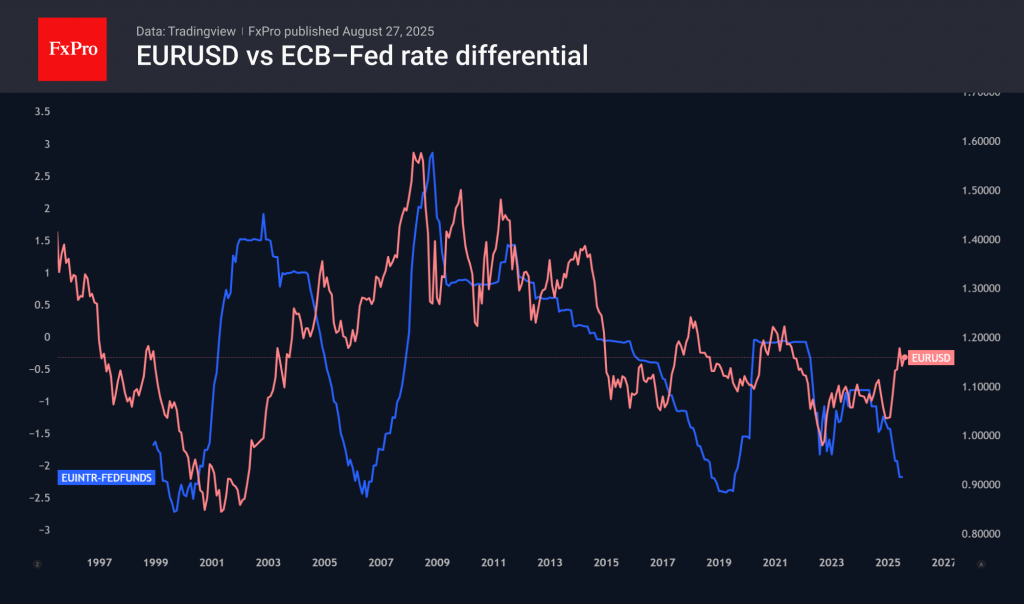

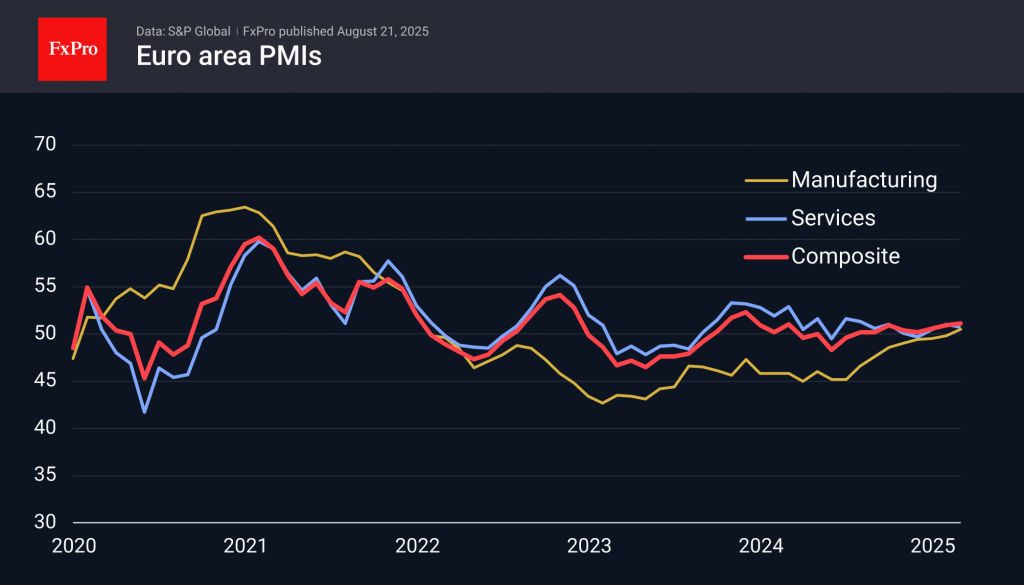

Falling EURUSD reflects trade flows, tariffs, and weak EU fundamentals despite the Fed’s easing prospects; parity or new lows are possible if trends persist.

August 26, 2025

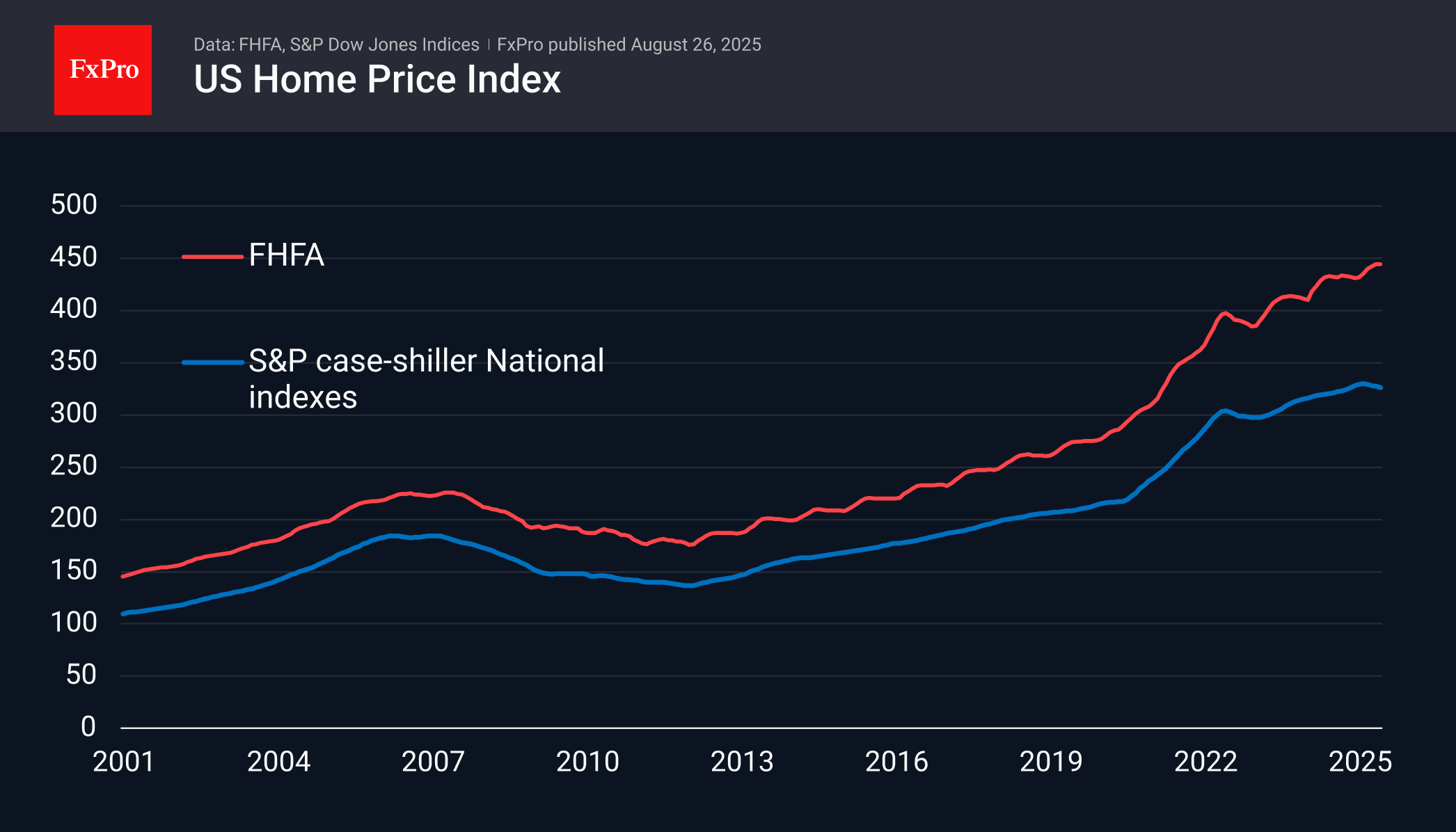

US home prices have declined for three months, signalling market cooling. This trend pressures the Fed to lower rates and is negative for the dollar in the current cycle.

August 26, 2025

In Jackson Hole last week, the Fed chairman said that a weak labour market would slow down inflation, which is rising due to tariffs. The central bank could now throw the US economy a lifeline in the form of monetary.

August 22, 2025

The main economic calendar events for the last week of August will be the release of data on US GDP for the second quarter, the personal consumption expenditure index, and the trade balance for July. Investors will be interested in.

August 22, 2025

Gold is consolidating; Fed policy, central bank demand, and geopolitics will decide the next trend. August could spark a breakout.

August 22, 2025

The US dollar gained amid decreased chances of a Fed Rate cut in September, but much depends on Powell & Co.'s comments and how they interpret the recent data.

August 21, 2025

Eurozone PMI boosted EURUSD above its 50-day MA. Market awaits Powell’s speech; EURUSD likely stays near 1.1650.