Market Overview - Page 14

September 10, 2025

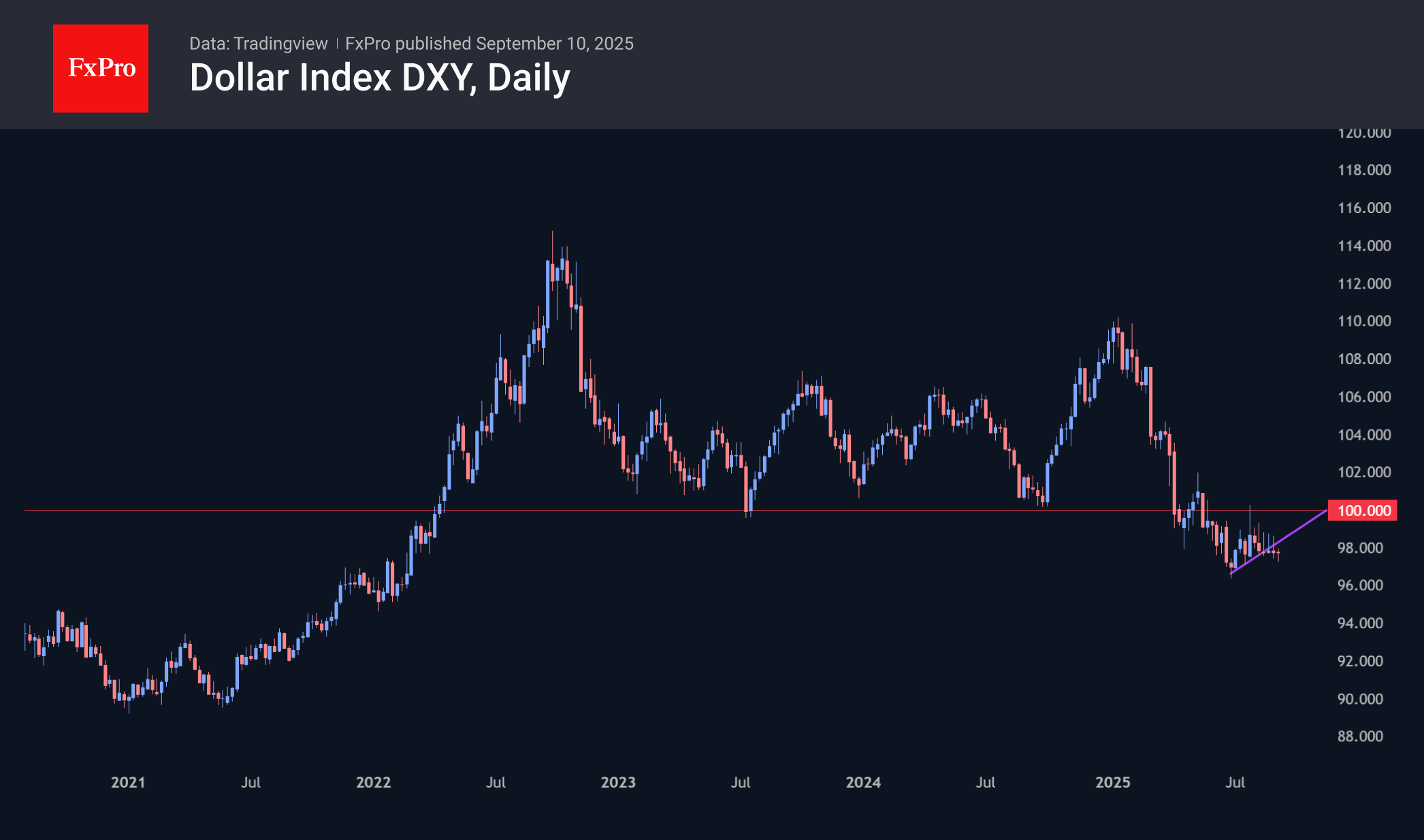

The US dollar finds itself at a crossroads during a rather dangerous season, when markets often form trends for the coming months.

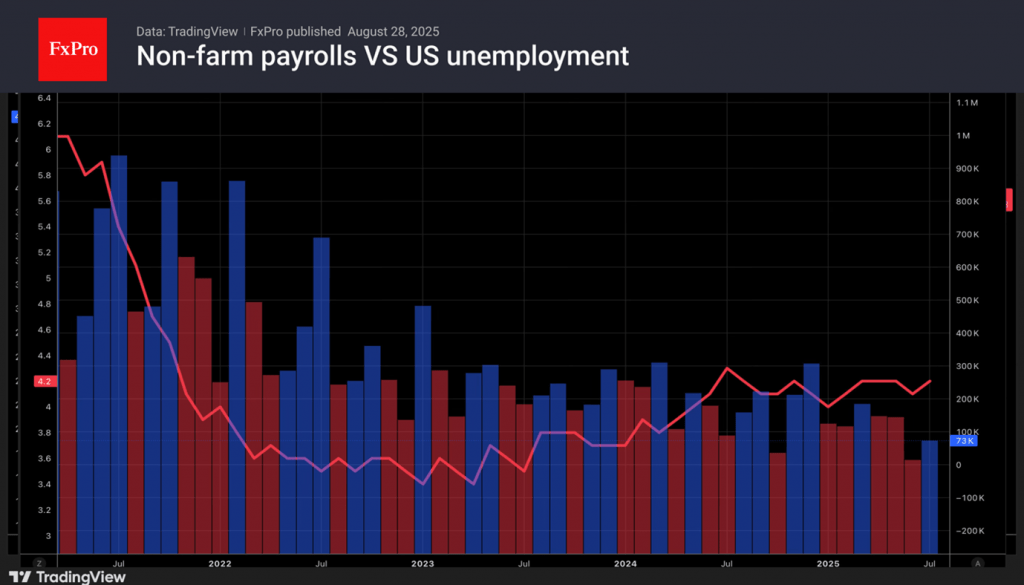

September 8, 2025

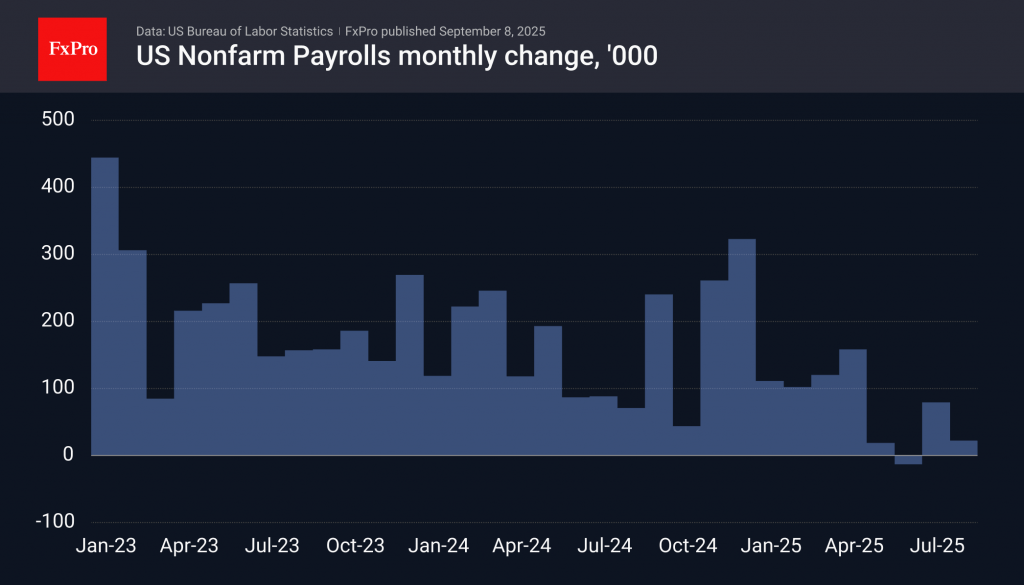

US job growth slows, market expects Fed rate cuts, but high inflation and Fed caution may limit the pace. Volatility in equities and FX could impact further decisions.

September 8, 2025

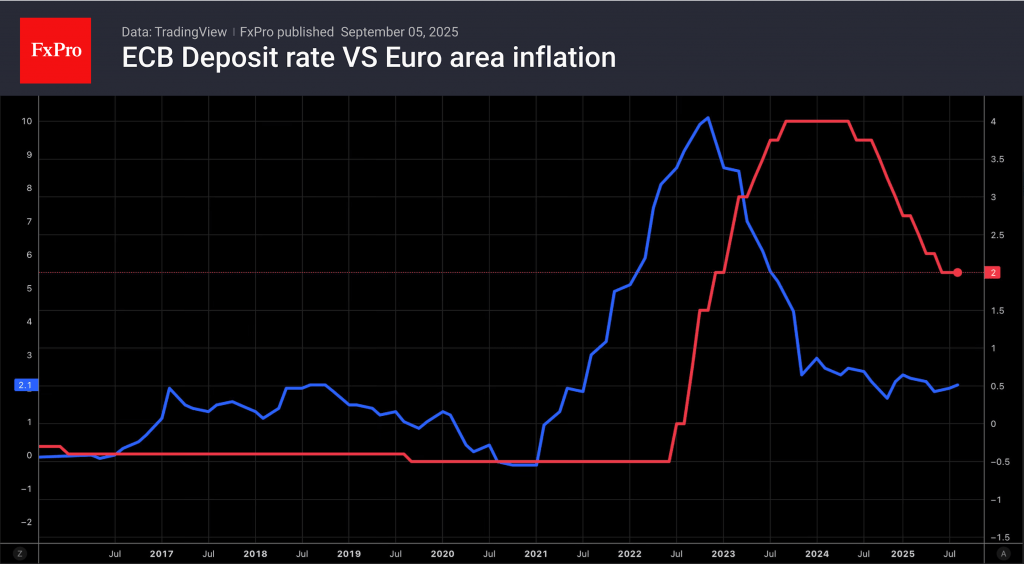

The ECB likely will hold at 2%, and the US CPI may rise to 2.8%. Rate cuts depend on inflation data; a slowdown could weaken the USD and boost stocks. Investors will watch Lagarde's remarks.

September 5, 2025

The dollar remains a safe haven amid global debt fears and political unrest. US job data and Fed rate cut expectations weigh on markets, and the S&P 500 remains volatile.

September 4, 2025

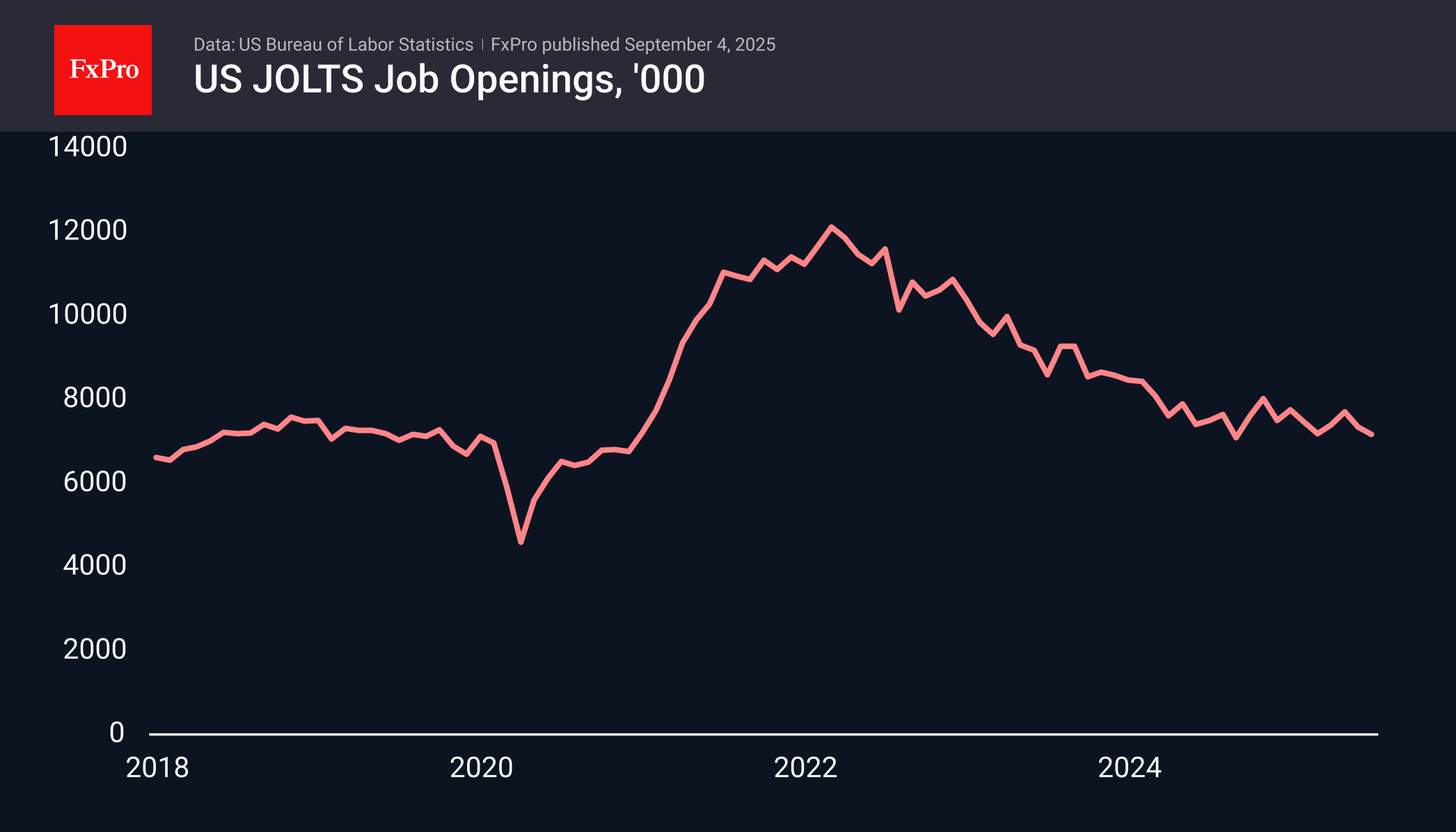

The US job market shows a slowdown: fewer openings, planned layoffs near 900,000 YTD, private jobs up 54k, and analysts expect NFP around 75–130k; Fed rate cuts are possible.

September 3, 2025

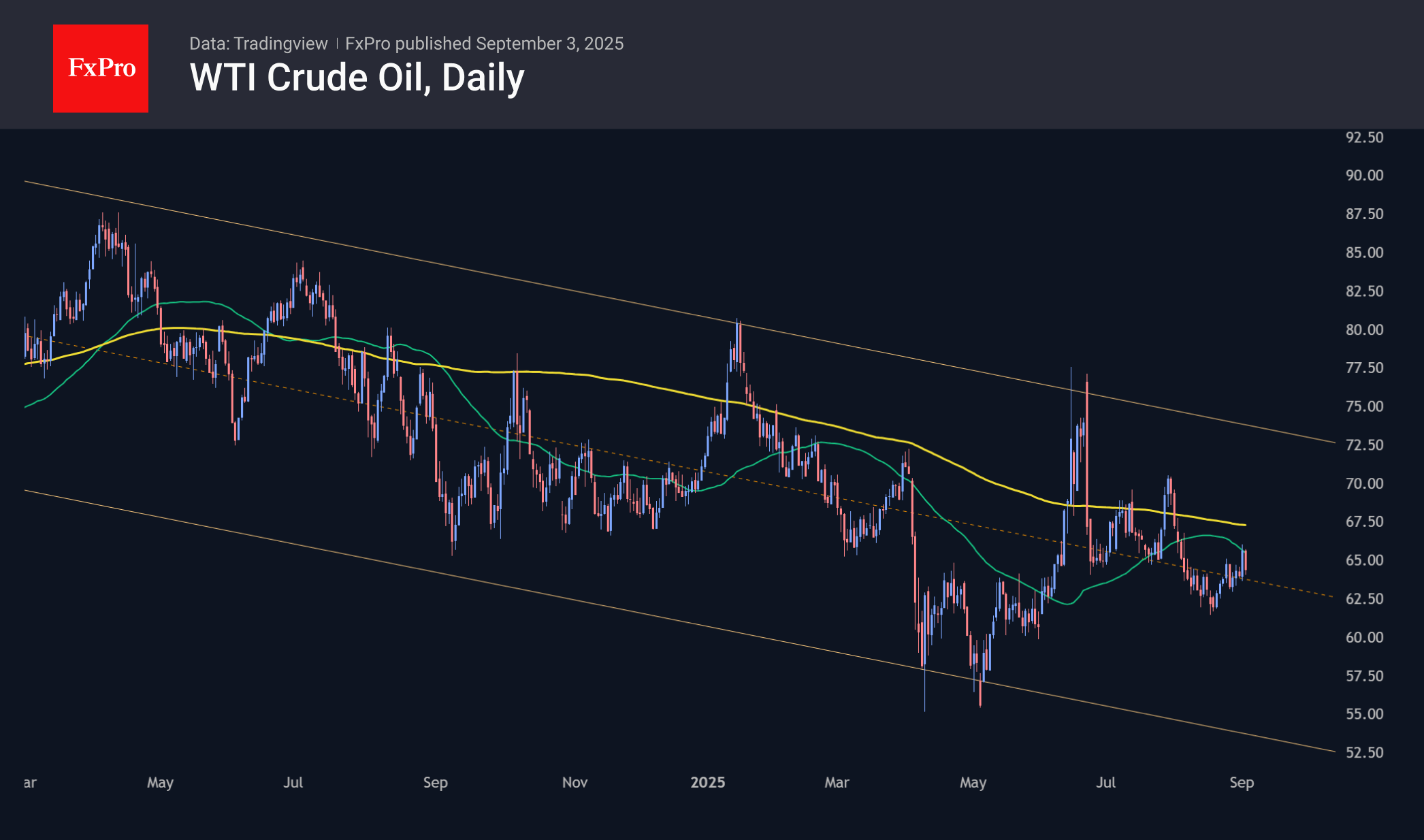

Oil came under pressure on Wednesday, losing more than 2% on reports by Bloomberg that OPEC+ plans to raise quotas again at its next meeting. Last month, the cartel removed all additional self-imposed restrictions that major producers such as Saudi.

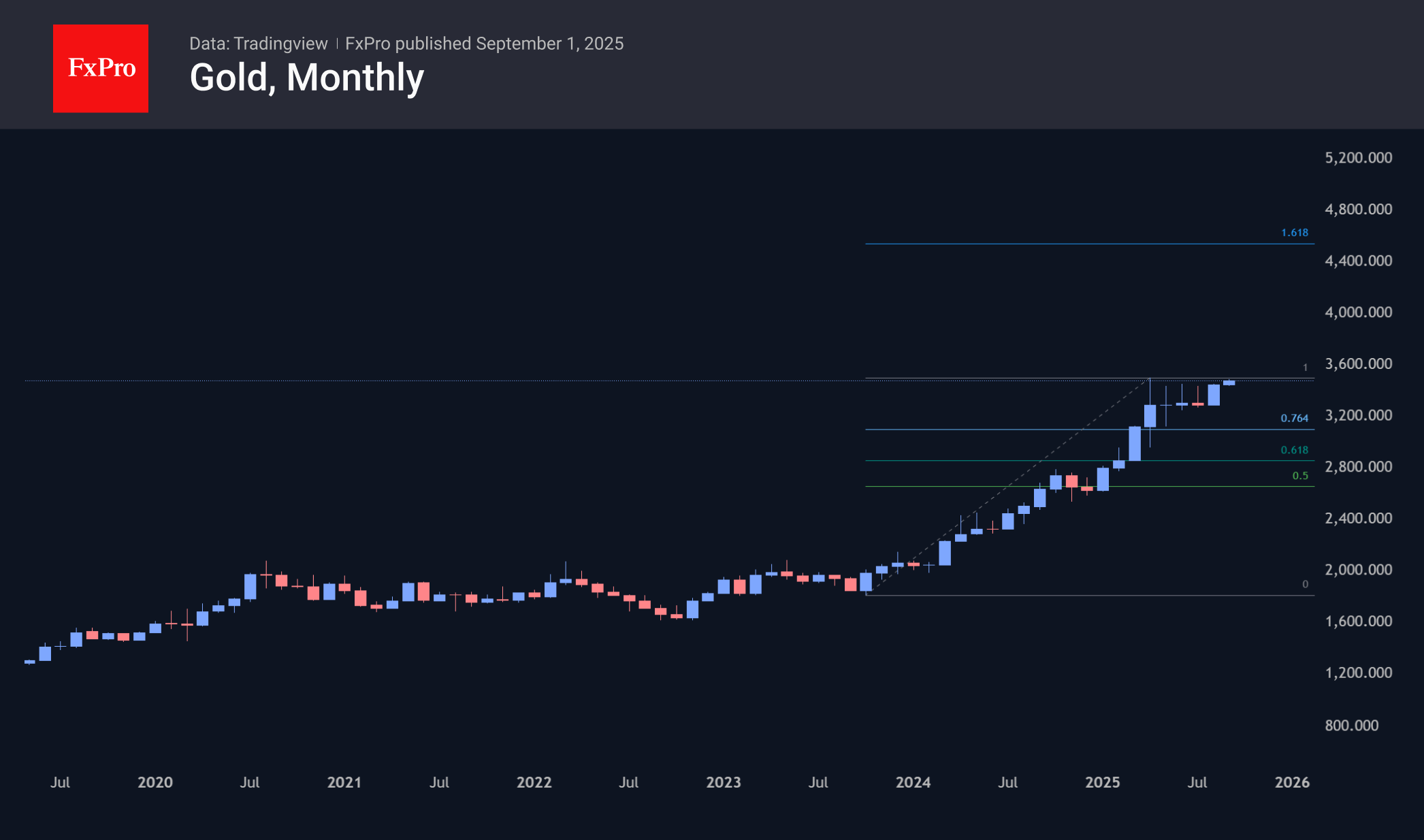

September 2, 2025

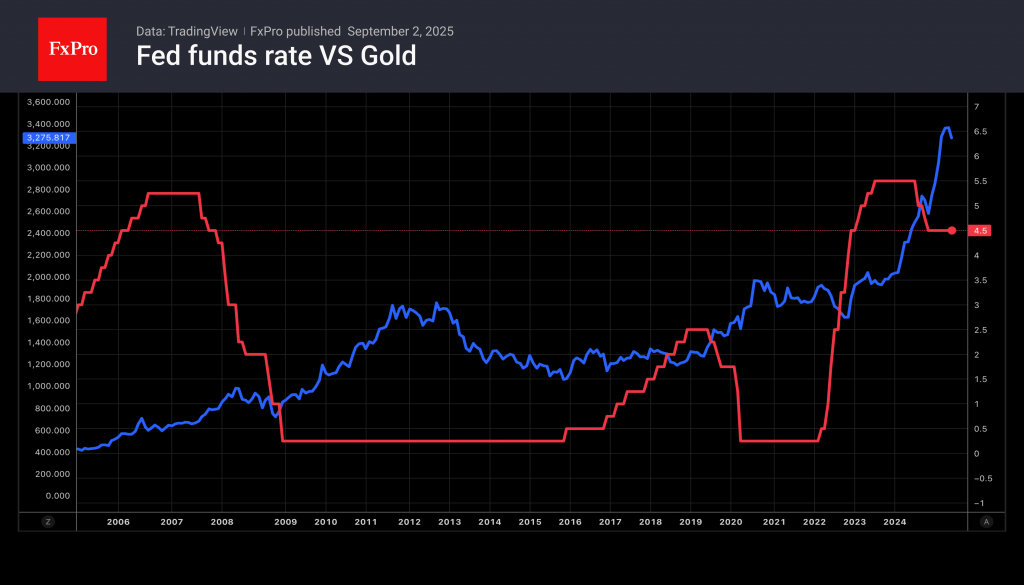

Gold has hit a new high due to trade uncertainty, the Fed's rate cuts, and central banks' bullion purchases. The Federal Appeals Court's ruling on tariffs and geopolitical tensions have also boosted demand for gold

September 2, 2025

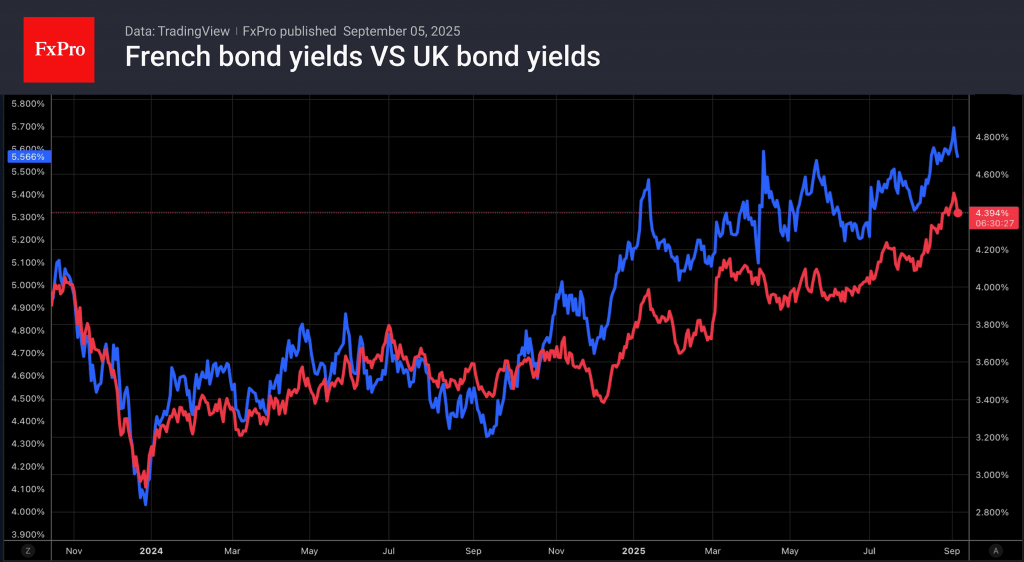

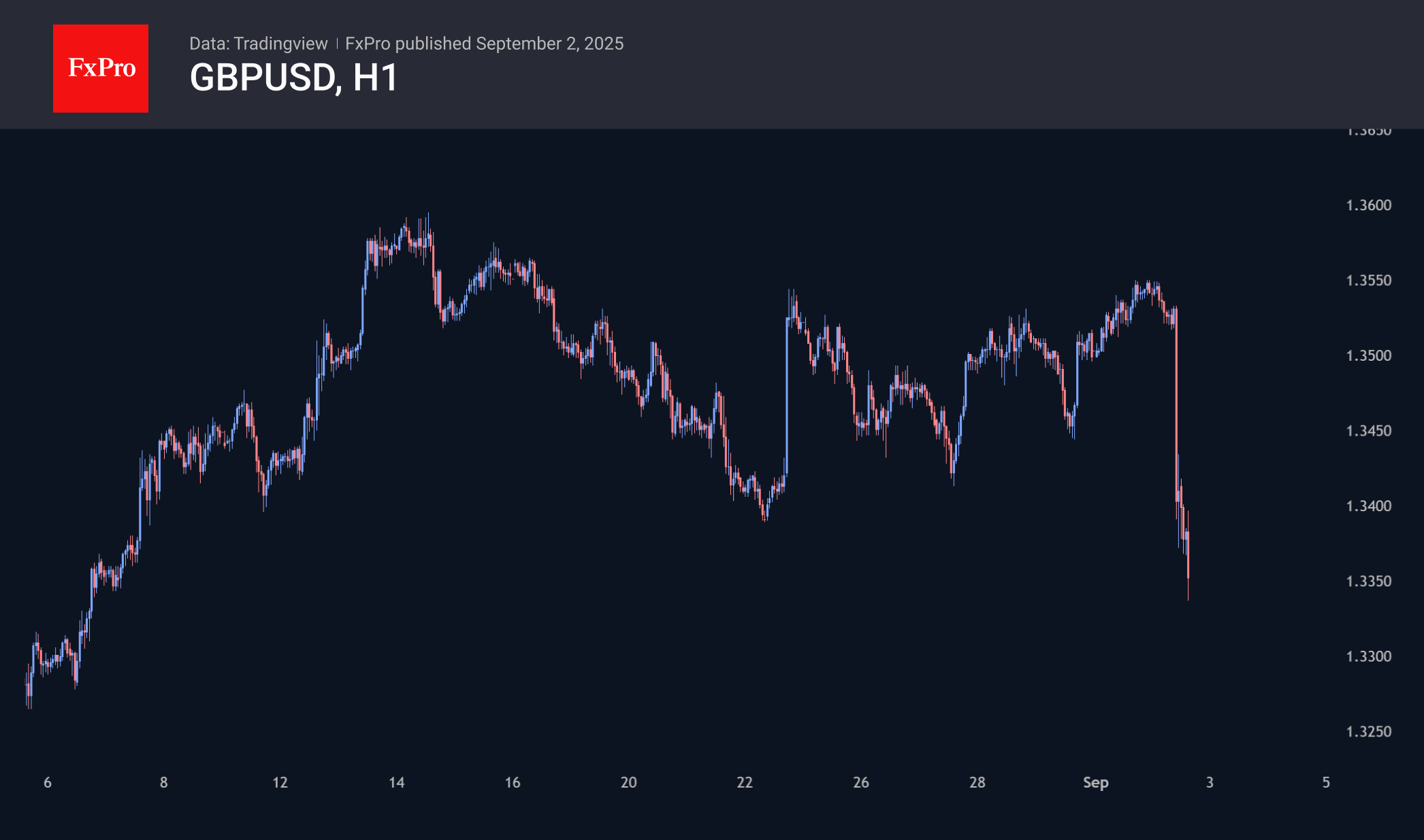

Britain’s pound and FTSE100 fell as rising bond yields fuel fiscal concerns; investor flight boosts the dollar’s strength as a safe haven.

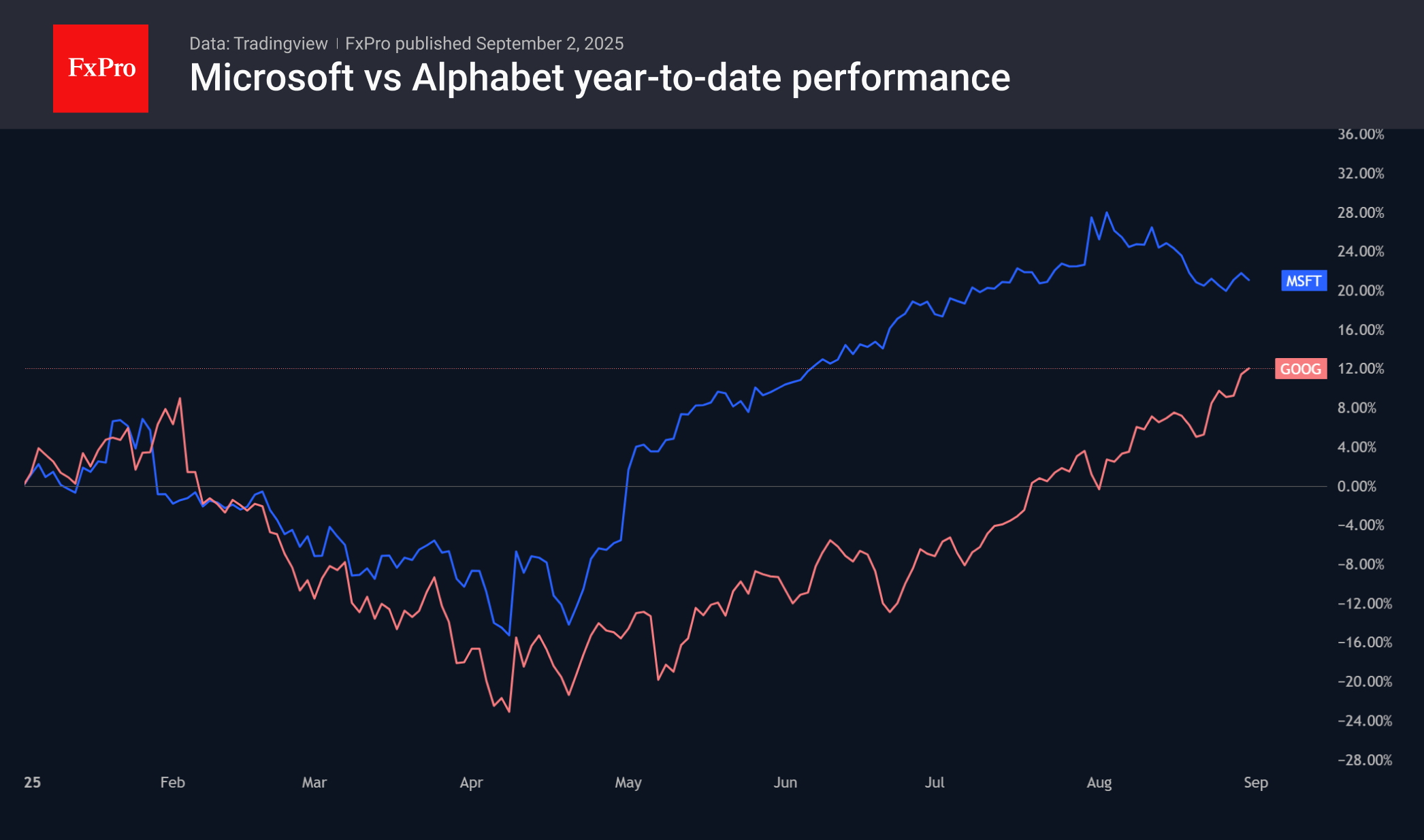

September 2, 2025

There was a notable market shift during August, as Microsoft went down 7.5% while Alphabet went up 13%. Both stocks face possible short-term corrections, but this could make it attractive to buy on a dip.

September 1, 2025

Gold eyes $4,500, silver targets $50 as traders show confidence, and platinum is poised for growth. However, caution is urged as historic highs may trigger profit-taking.

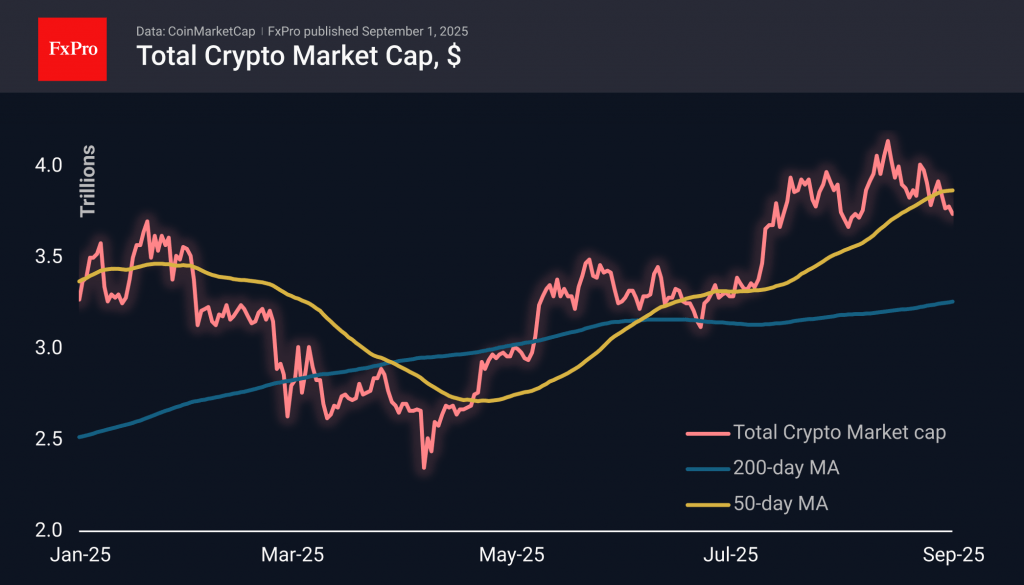

September 1, 2025

Crypto sentiment weakens, BTC nears key support, ETF inflows rise, and TRON cuts fees as Tether dominance drops below 60%.