Market Overview - Page 124

November 4, 2021

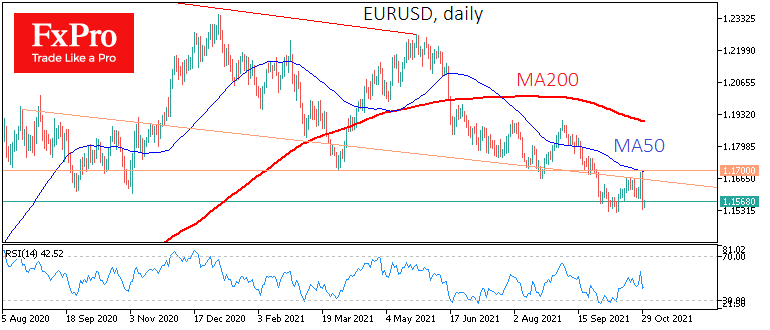

The pressure on the single currency remains high on the foreign exchange market. Much of the credit goes to ECB head Lagarde, who yesterday once again pointed out that it hasn’t met conditions for a key rate hike before the.

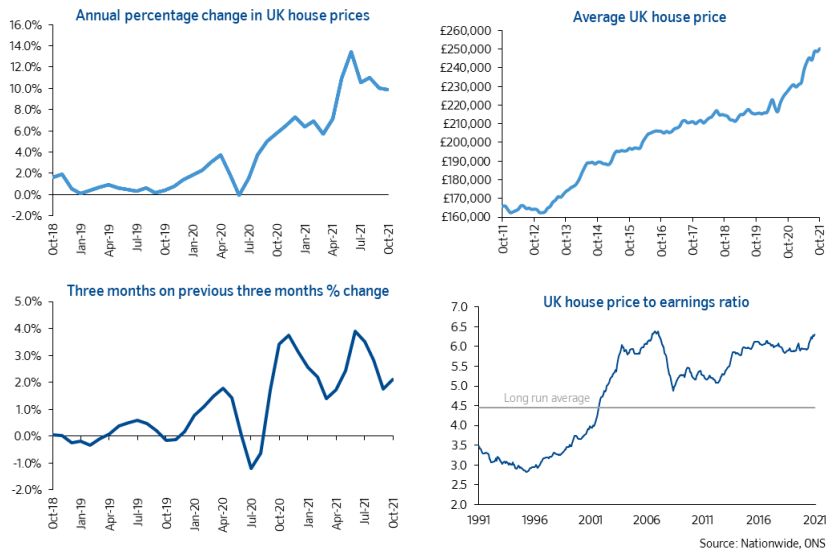

November 3, 2021

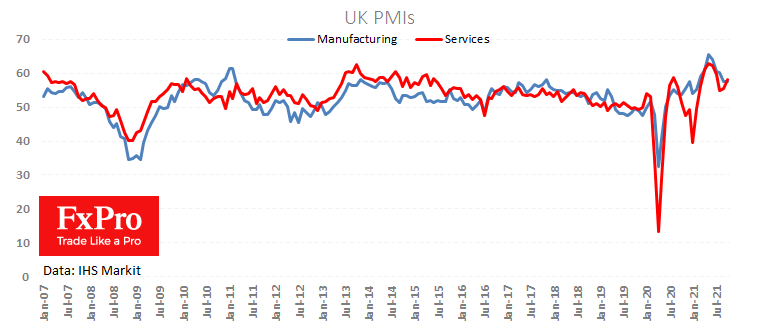

The annual growth rate in UK house prices fell to 9.9%, returning to the single-digit territory after five months. At the same time, a 0.7% jump in prices in October signalled increased buyer’s demand. Buyer interest is based both on.

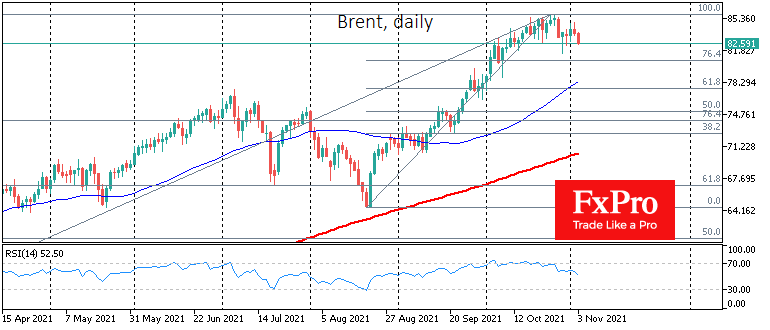

November 3, 2021

Oil has lost its upside momentum. Despite reports of record gasoline prices in the UK and the US, crude prices are losing around 0.6% on Wednesday morning on speculation that the supply-demand balance point is approaching. The price of Brent.

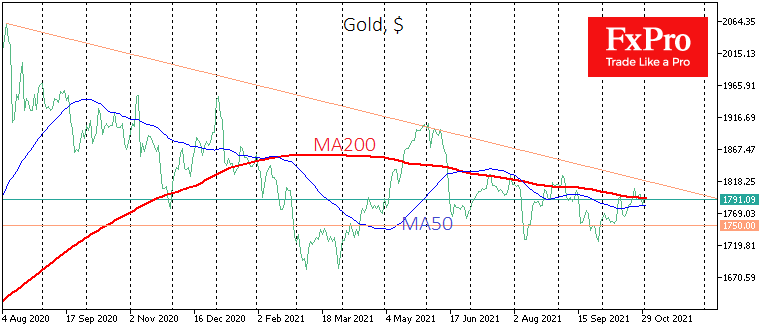

November 2, 2021

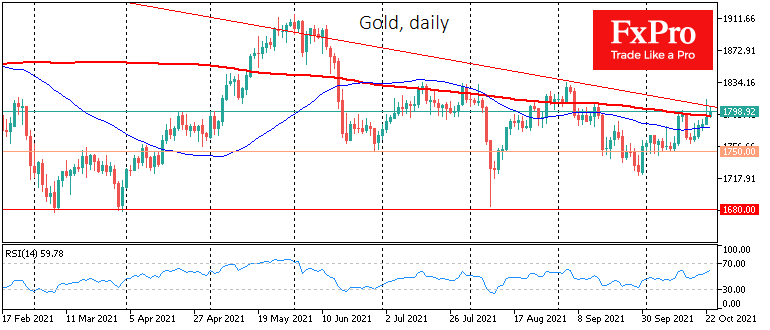

Gold added 1.5% during October, closing the month at $1783. In the last couple of weeks, it has been frequently above its 200-day moving average. So far, it is hard to talk about a bulls’ victory, but there are increasing.

November 1, 2021

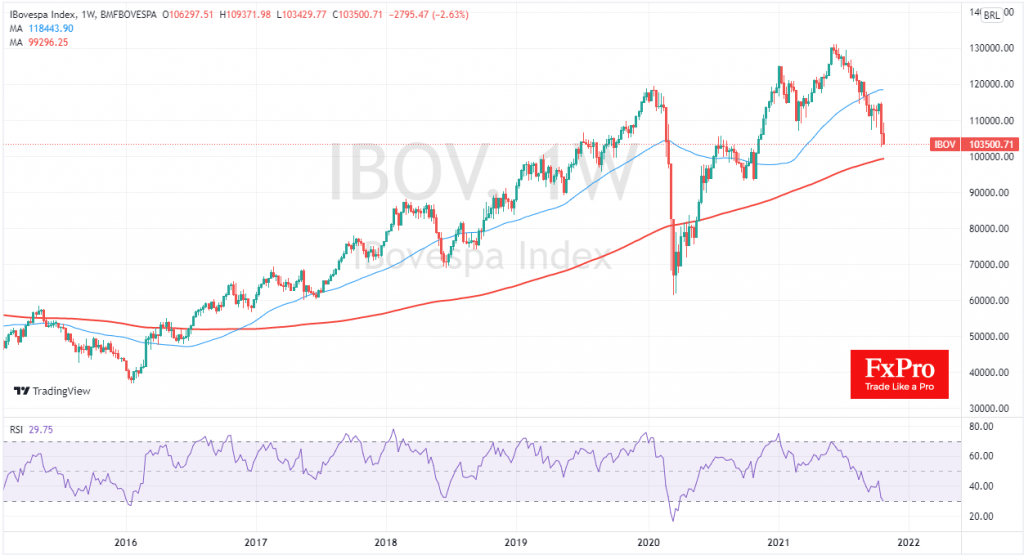

The Brazilian stock market developed its decline last week, losing 2.6%, closing at lows since mid-November last year. Since June this year, the Brazilian market has remained under sustained pressure, following a reversal in metal prices. In that time, the.

November 1, 2021

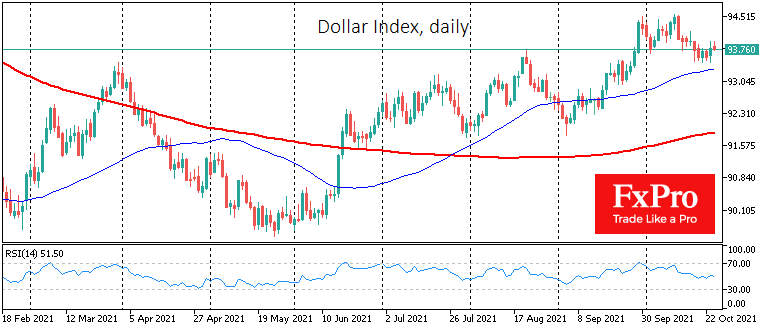

On Friday, the currency market ensured that the dollar bulls were far from giving up important ground and only made a tactical retreat. The Dollar’s 1% strengthening in one day against the euro, its main rival, was a clear demonstration.

October 29, 2021

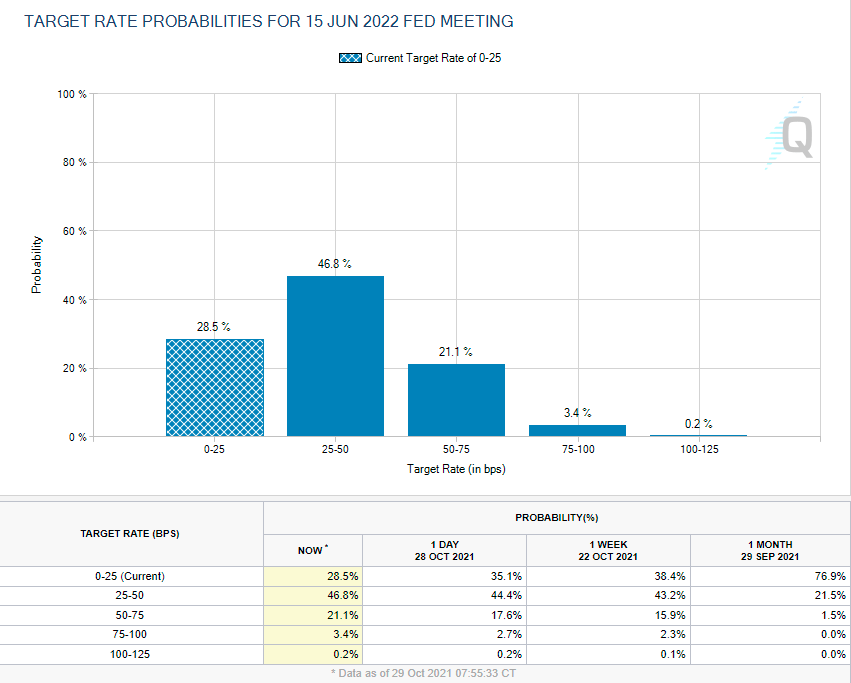

The US dollar came under pressure on Thursday, rewriting monthly lows on the DXY index. The pressure on the US currency was triggered by weak GDP data, which showed the economy growing worse than expected while inflation continued to rise.

October 28, 2021

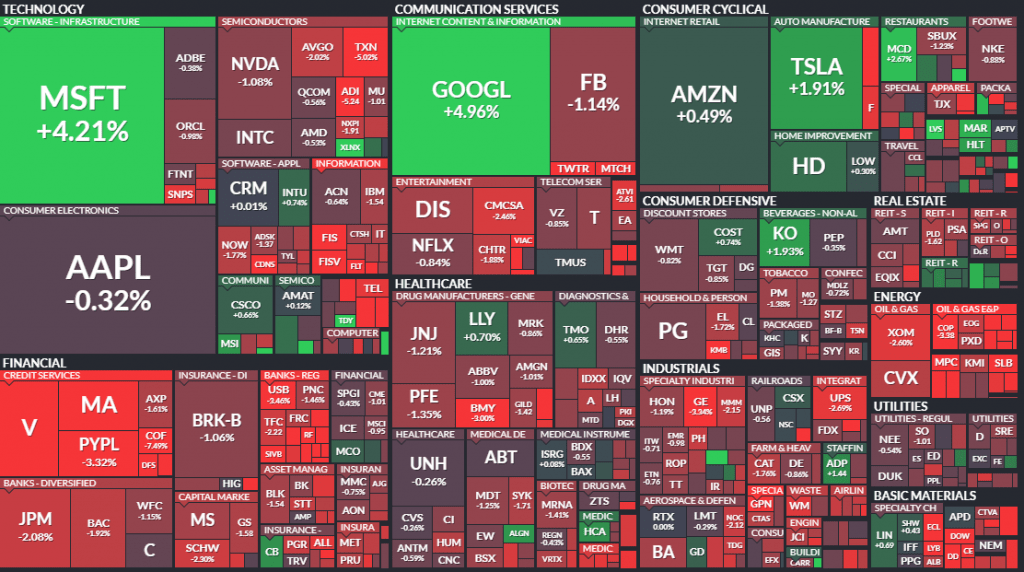

The US Dow Jones lost 0.74% yesterday, the S&P500 was down 0.5%, and the tech-rich Nasdaq closed the day virtually unchanged after hitting an all-time intraday high. Key indices are cruising near the top, but this was only achieved by.

October 26, 2021

The US Dollar has been losing ground for the past two weeks, but it looks more like a tactical retreat before a new surge, while significant near-term factors are playing on the Dollar’s side. US central bank officials are bolstering.

October 25, 2021

Gold rose for the fifth consecutive trading session, coming close to testing a critical technical and psychological level near $1800. The bears are in no hurry to give up, foiling attempts by Gold and other precious metals to accelerate their.

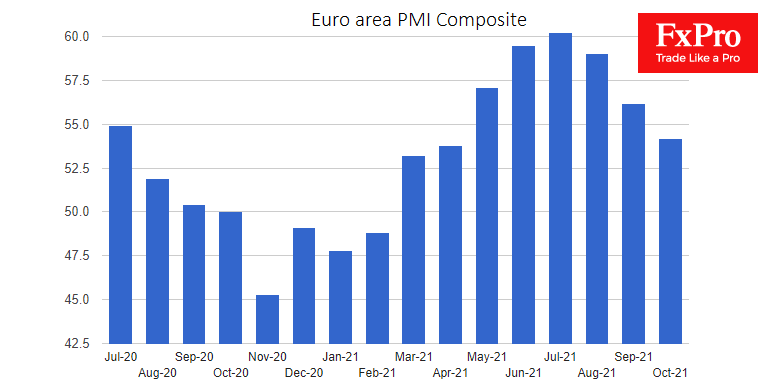

October 22, 2021

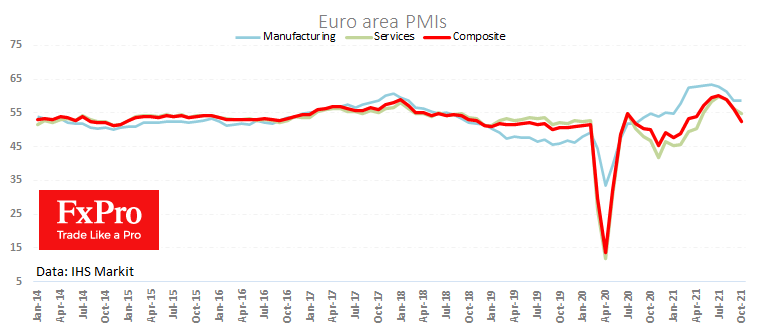

Business activity in the eurozone avoided a sharp decline despite a surge in energy prices in September and October. As a result, the euro is developing a rebound from multi-month lows against the franc and pound. There is also a.