Market Overview - Page 121

January 17, 2022

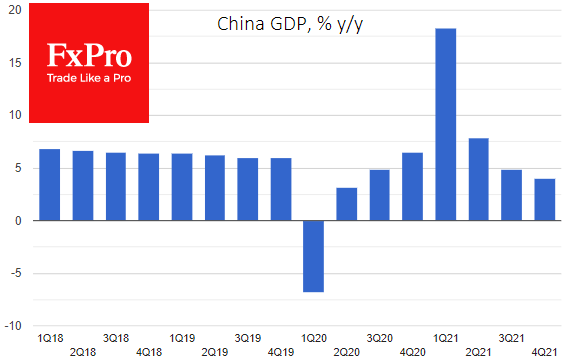

China published mixed economic data noting a slowdown in a year-over-year comparison, but some of the data exceeded expectations. The Chinese renminbi has been on the offensive against the US dollar for the past week, bringing USDCNH back to test.

January 17, 2022

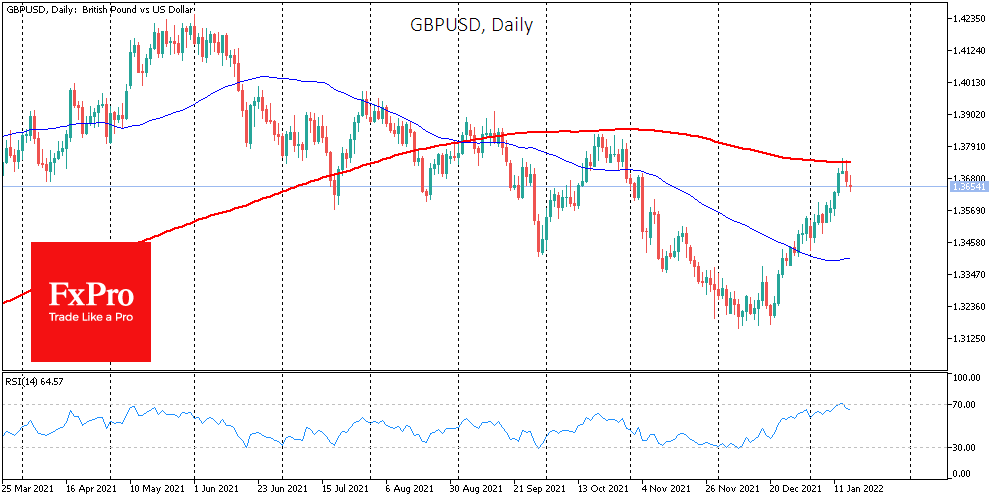

After nearly a month of strengthening against the dollar, the British pound is encountering strong resistance. Speculative interest in the British currency is shrinking as more hawkish Fed rhetoric is being put into the GBPUSD quotes in recent weeks as.

January 14, 2022

On Thursday, the Russian ruble lost more than 2% against the dollar and euro, as both sides’ hawkish comments followed the Russia-NATO meeting. In early trading on Friday, the dollar was above 76.6, and the euro was 87.8 on the.

January 13, 2022

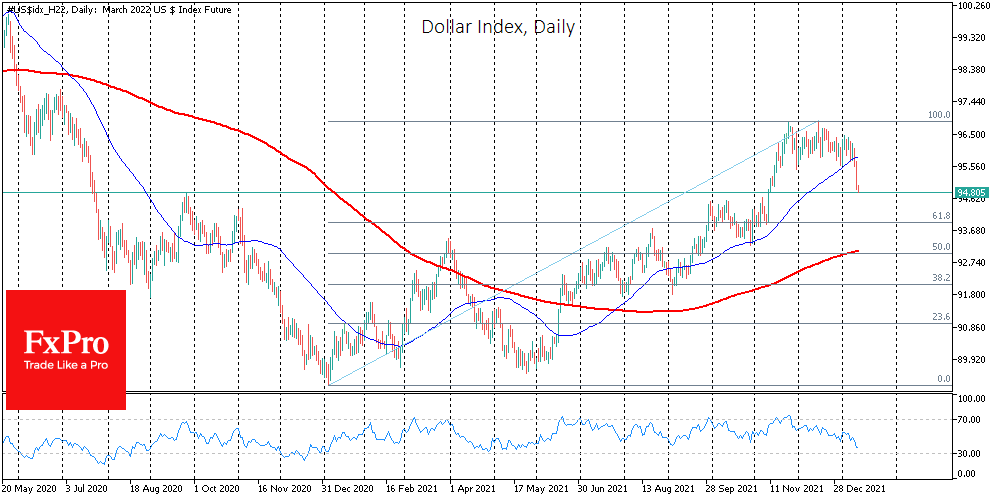

Fundamental and technical factors on the dollar locally give opposite signals. However, after a long period of strengthening the American currency, a corrective DXY pullback looks like a logical short-term prospect. On Wednesday, the US dollar came under pressure, the.

January 12, 2022

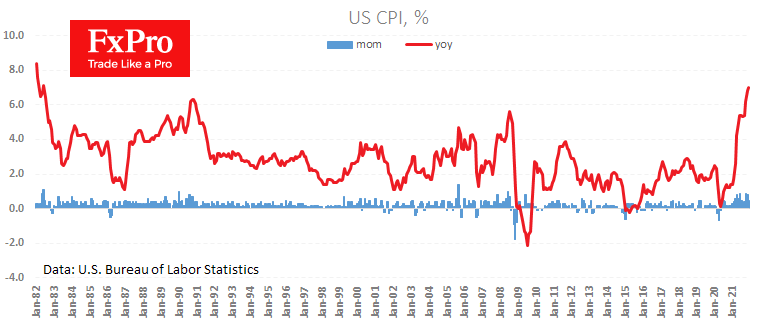

US consumer prices rose 0.5% in December, accelerating to 7.0% y/y. The core index added 0.6% on the month and 5.5% y/y. Prices excluding food and energy added more than 1.7% in the last three months, noting that inflation is.

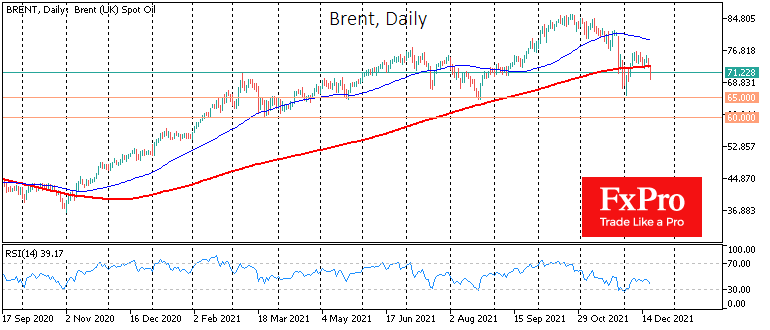

January 12, 2022

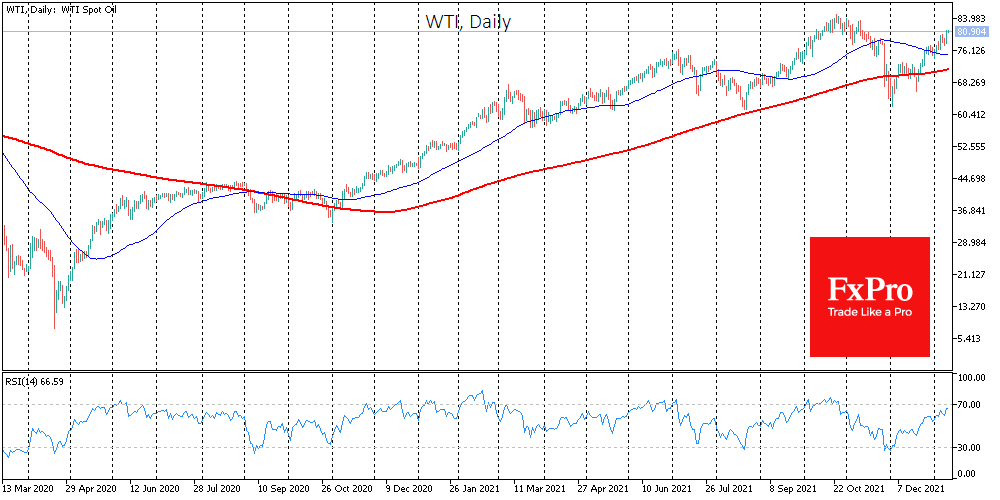

WTI crude oil surpassed the $80 mark in Tuesday’s trading, near two-month highs and solidly above the 2018-2021 pivot levels near $75. Oil’s fall in November-December by more than a quarter from a peak in late October probably served as.

January 11, 2022

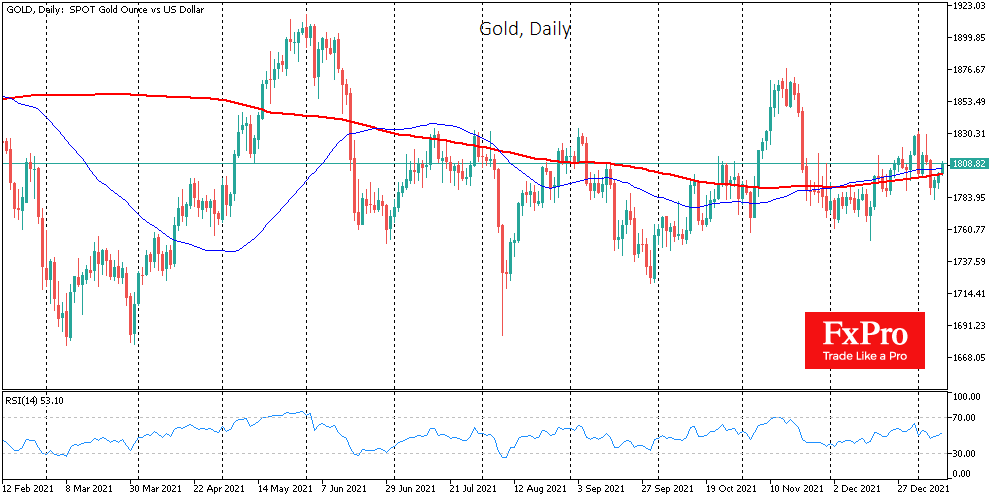

An active reassessment of the outlook for monetary policy continues in the financial markets, but these changes have so far not moved gold from its position near $1800. The latest gold performance shows that it remains a portfolio diversification instrument,.

January 10, 2022

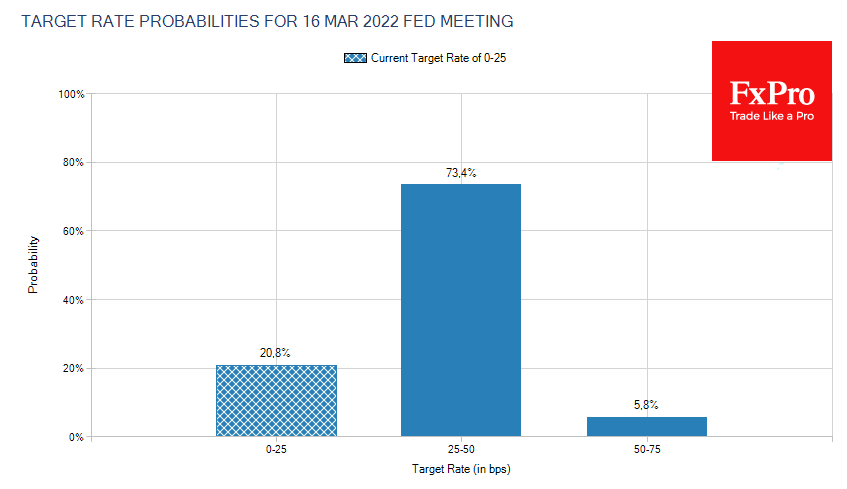

The Fed continued to surprise markets at the start of the year with hawkish rhetoric by unexpectedly raising discussions on balance sheet shrinking. Investors are noticing that the issue has been on the table much earlier than it was before..

December 22, 2021

The main currency market pair, EURUSD, is trading in a sideways pattern of around 100 pips, rarely breaking out of it for long. The observed balance is very fragile. The news backdrop from Europe and the US has been very.

December 21, 2021

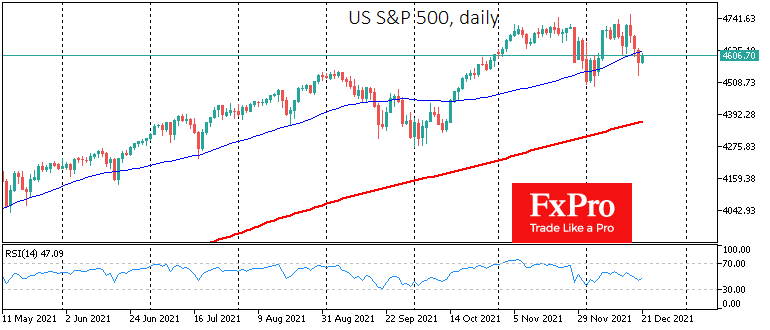

Most stock indices seem to have managed to get that much-needed support from buyers yesterday, which opens the possibility of a Santa rally in the coming days. Earlier this year, some commentators, including us, have repeatedly pointed out that this.

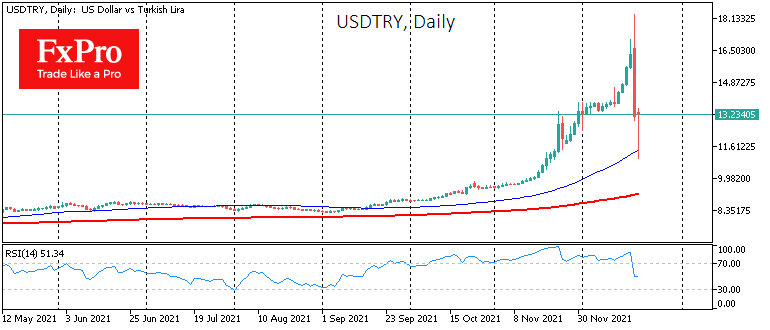

December 21, 2021

The Turkish lira gained 40% in the past 13 hours, sending USDTRY from 18.3 to 11. Despite the impressive amplitude, the exchange rate is only back to levels of a month ago. There is no doubt that behind such a.