Market Overview - Page 120

January 31, 2022

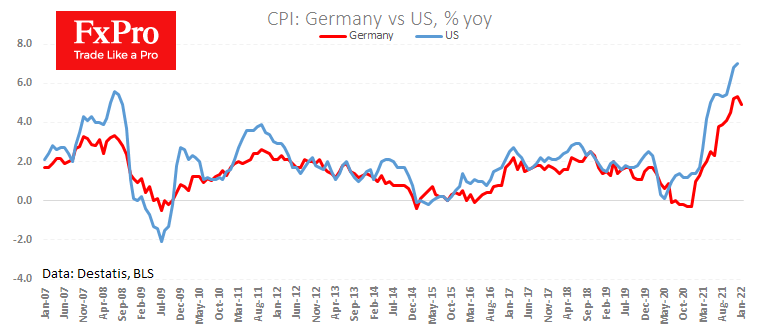

Today we have seen the first slowdown in annual inflation in seven months, but the data is better than expected. In January, consumer prices rose 0.4%, up 4.9% on the same month a year earlier. Analysts, on average, were expecting.

January 31, 2022

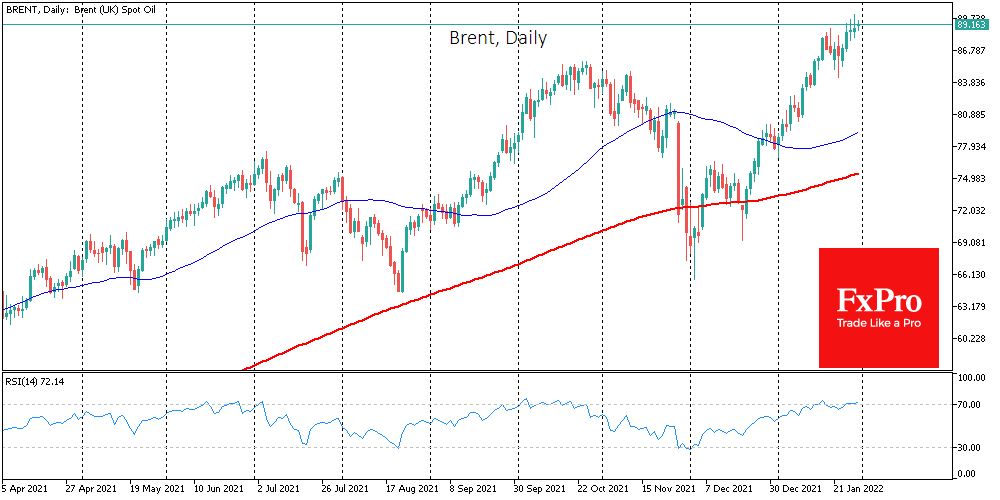

Oil has added more than 14% this month, and Brent spot contracts are trading near $90 a barrel. Steady strengthening has been underway for the past two months after it became clear that the widespread Omicron strain is not leading.

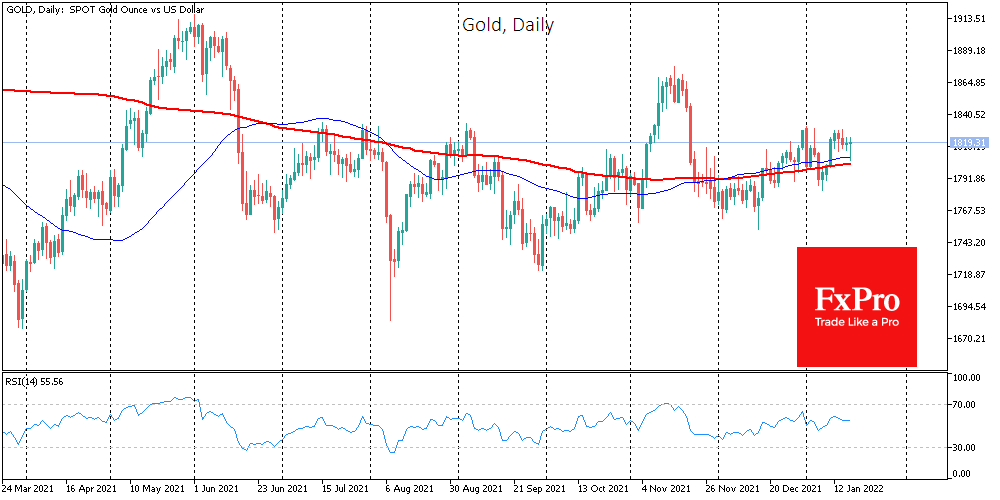

January 25, 2022

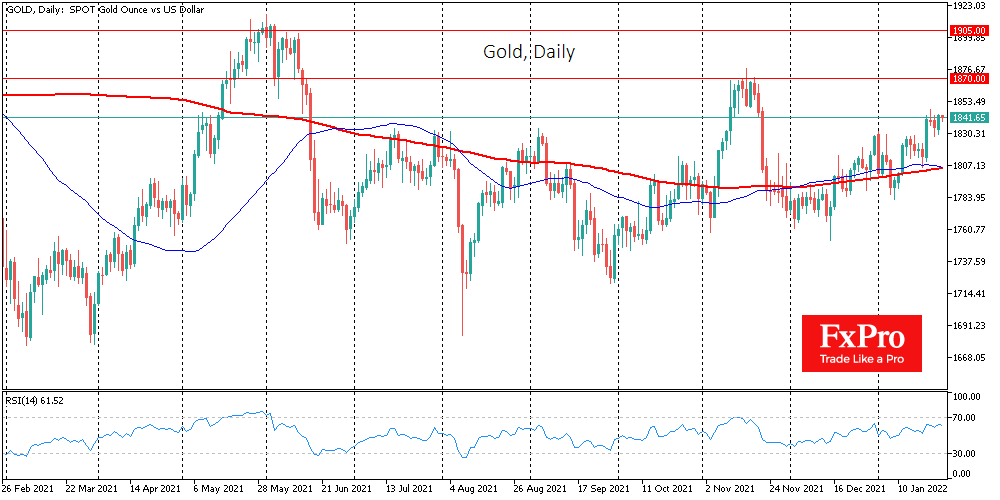

Gold is trading near $1840, adding 3.2% from the Jan 7 lows, as a hedge against increased financial market volatility. By comparison, the S&P500 has experienced its worst start to a year in history, losing more than 12% in that.

January 24, 2022

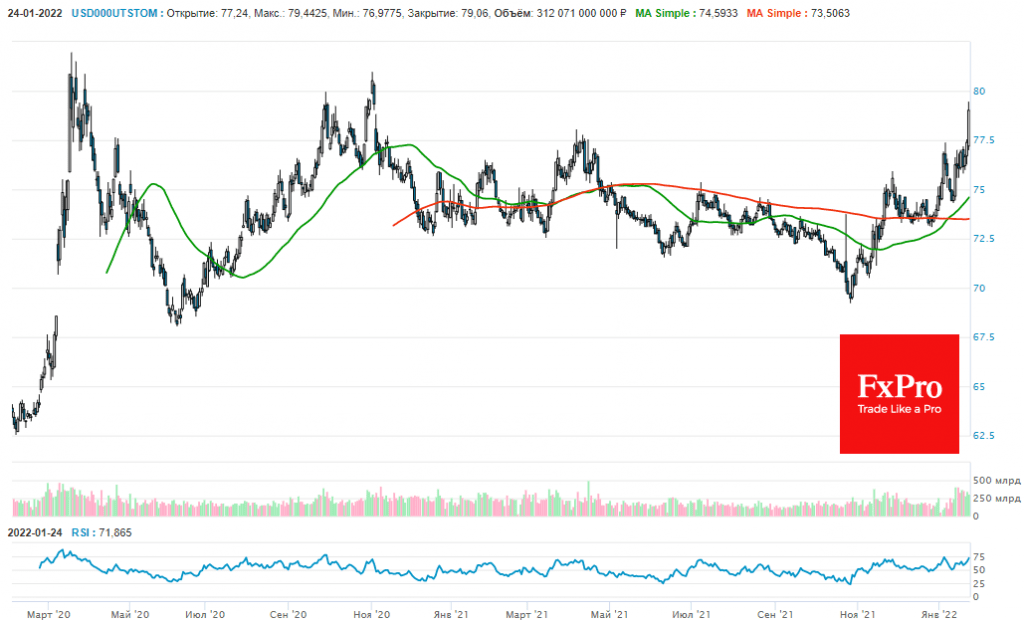

The ruble remains under pressure on Monday after four weeks of decline. The USDRUB is above 77.7 and approaching the area of last year’s highs. Technically, the situation looks like a moment of truth for the ruble. An easing of.

January 21, 2022

• NZDUSD reversed from support level 0.6700 • Likely to rise to resistance level 0.6800 NZDUSD recently reversed up from the key support level 0.6700 (previous monthly low from December), strengthened by the lower daily Bollinger Band. The upward reversal.

January 21, 2022

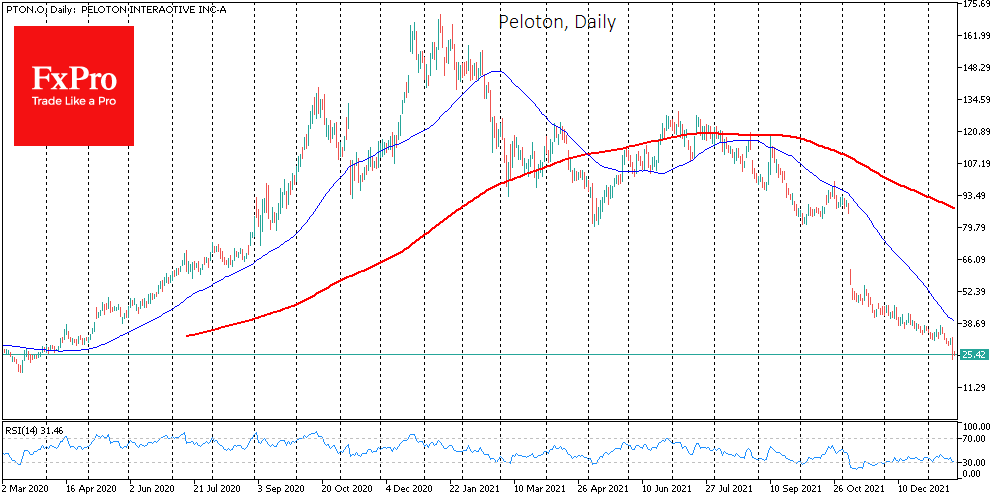

This corporate earnings season, gaining momentum this week, has so far caused more worries and disappointments than pleasant surprises. Judging by market dynamics, investors are getting rid of shares of pandemic favourites. However, we can’t say yet that they are.

January 21, 2022

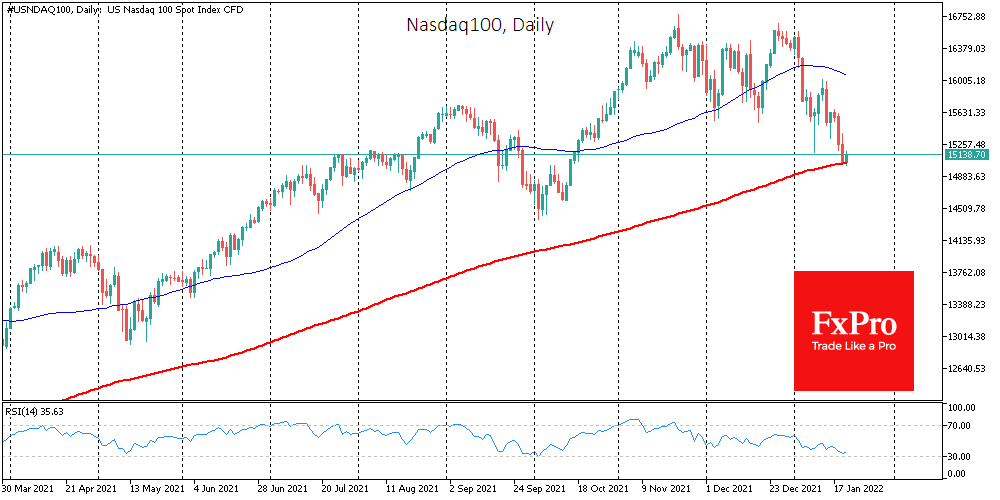

The buying reflex on drawdowns can provide a false start for short-term investors. In the previous two years, markets fell on fears of pandemic effects, but central bankers and governments gave a supporting hand to the economy and pulled the.

January 20, 2022

• Natural gas reversed from resistance area • Likely to fall to support level 3.525 Natural gas recently reversed down from the resistance area set between the resistance level 4.4, upper daily Bollinger Band and the 50% Fibonacci correction of.

January 20, 2022

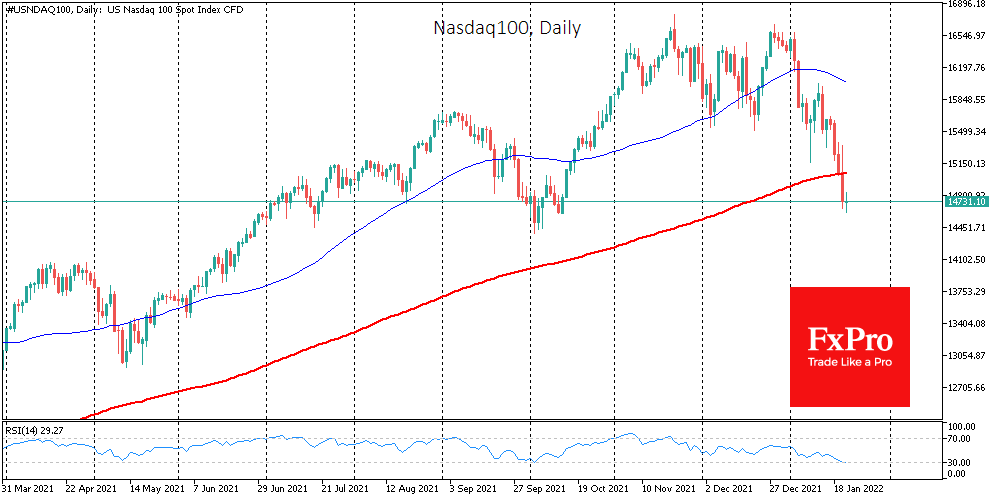

Financial markets rebounded on Thursday after crucial US indices fell about 1% a day earlier. The Nasdaq 100 index closed 1.3% lower and moved into a correction phase, completing more than 10% below the peak. However, this is still a.

January 19, 2022

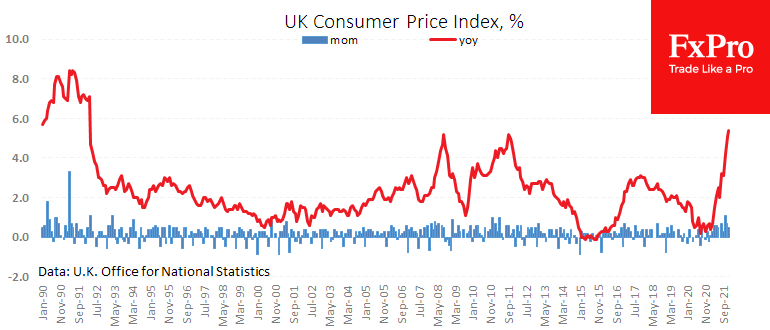

Consumer inflation in Britain continues to accelerate, but producer prices show the first signs of cooling. CPI rose to 5.4 y/y in December, with a 0.5% monthly increase after 0.7% in November. Current figures are above 2008 and 2011 peaks.

January 18, 2022

Gold is trading near $1819 an ounce, unable to take advantage of a spike in geopolitical risks due to an environment of rising interest rates. Two-year US government bond yields have reached 1.06%, pre-pandemic levels. Rising yields on expectations of.