Market Overview - Page 118

February 16, 2022

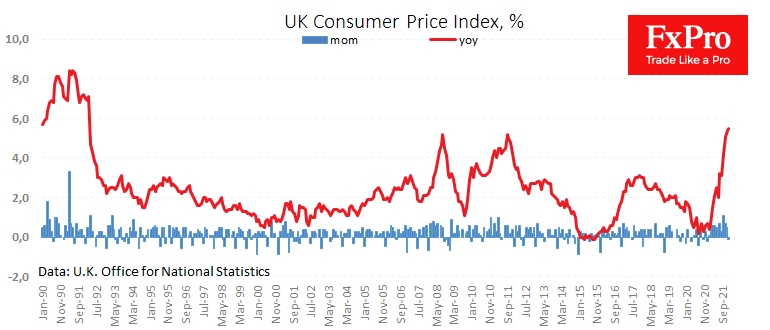

Britain’s consumer price index fell 0.1% in January, not as sharply as analysts had expected; they were expecting an average fall of 0.2%. Year over year inflation reached 5.5%, a new record since March 1992. There are plenty of signs.

February 15, 2022

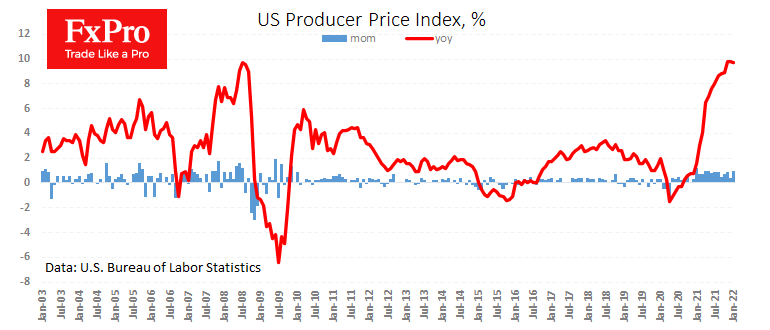

US producer prices rose 1% in January, double analysts’ forecasts. The annual growth rate slowed from 9.8% to 9.7% for the first time after nearly two years of gains, but analysts had been bracing for a sharper decline, expecting to.

February 15, 2022

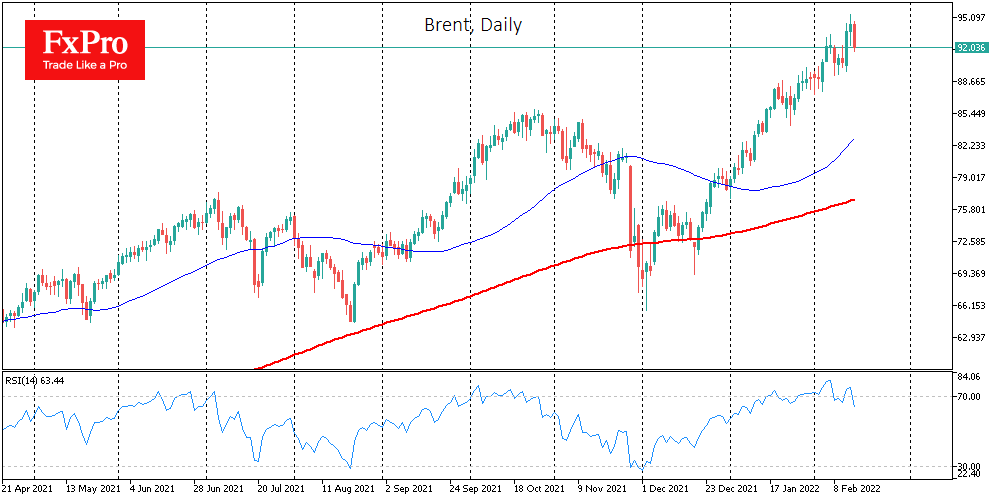

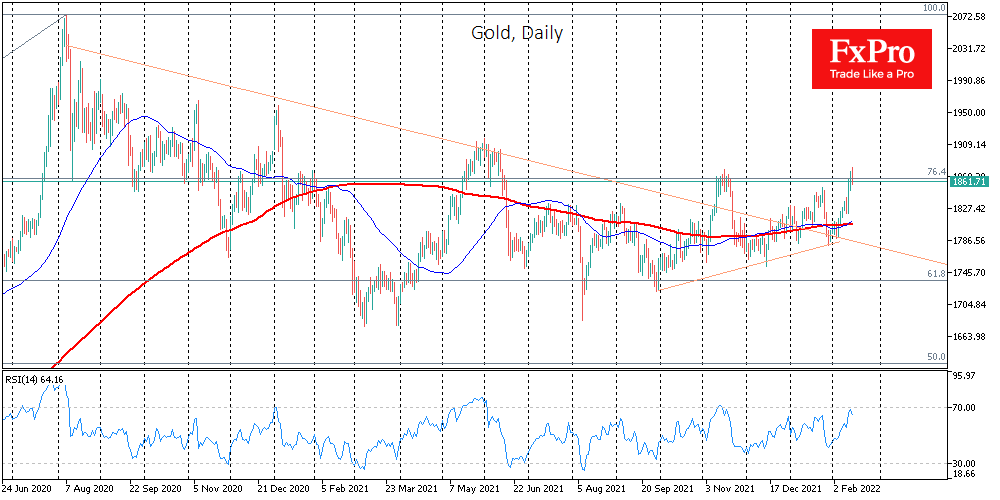

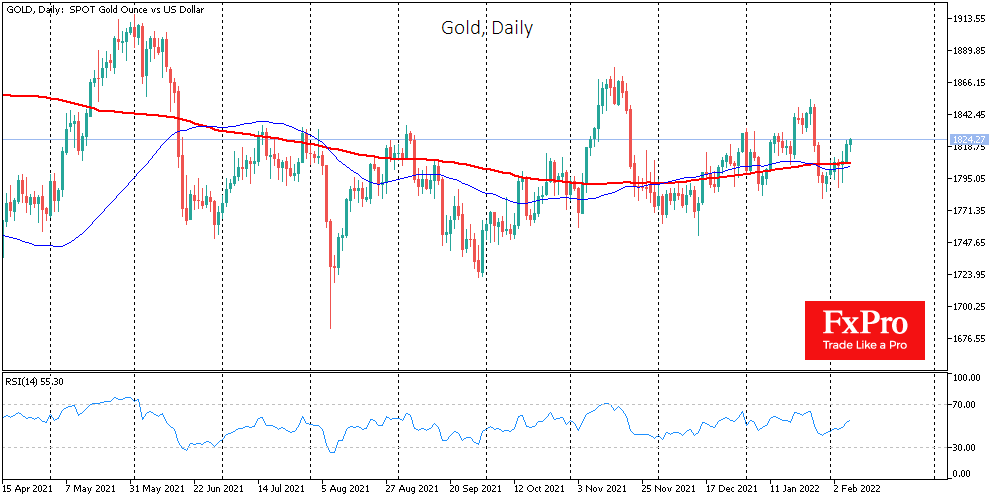

Events in recent weeks have brought back interest in assets that have benefited from tensions in previous decades, with gold rising as insurance against currency destabilisation and oil rising on fears of surging demand and shortages of supply if sanctions.

February 15, 2022

Since the end of last week, the price of gold has risen by more than 3%. With a high of $1879, it was temporarily rose to highs since last June. Biden’s warning that Russia could invade Ukraine “at any moment”.

February 11, 2022

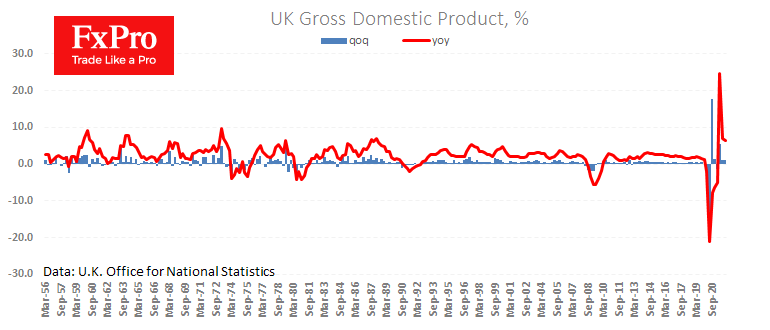

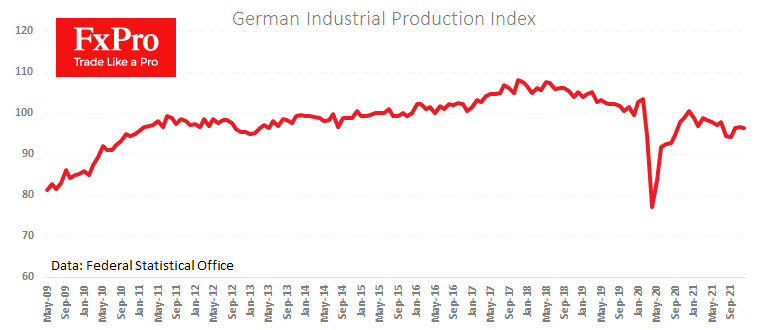

The UK economy added 1% in the fourth quarter last year and is 6.5% higher than a year ago. The annual growth rate is declining as the low base effect fades away. In December, industrial production added 0.3% and moved.

February 10, 2022

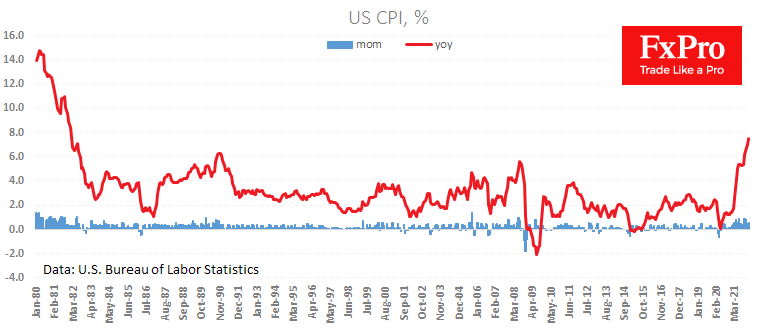

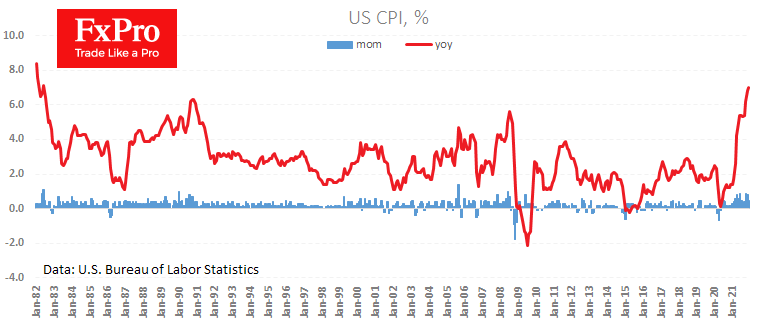

The US inflation report noted higher-than-expected price rises, triggering a boost to the dollar and a pullback in US major index futures. The price index for January rose 0.6% to an annual rate of 7.5%. The report dashed hopes that.

February 10, 2022

US inflation data for January is in the spotlight in the markets today. The annual growth rate is expected to break 40-year records, reaching 7.3% compared with 7.0% in December. Higher oil prices in recent weeks will reinforce the general.

February 10, 2022

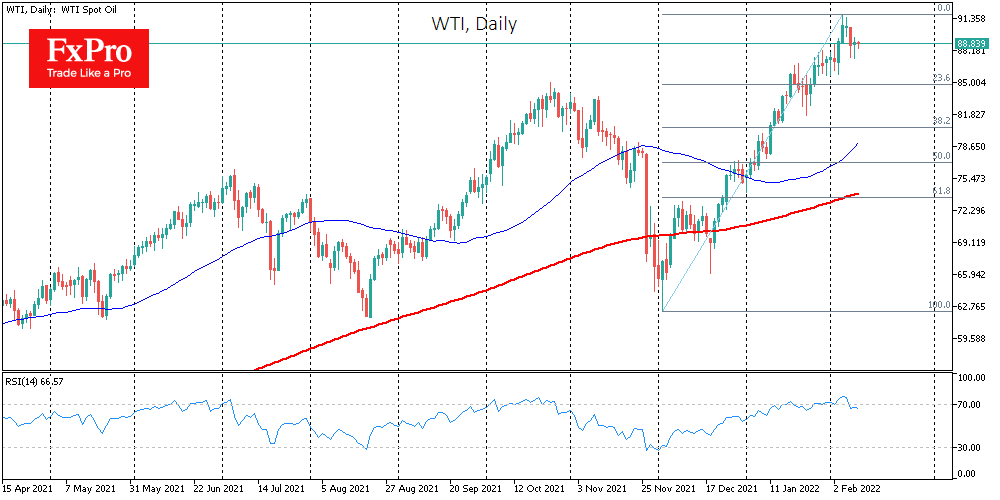

WTI crude oil has lost around 3% since the start of the week, bouncing back to $88.4 from $91.2 at the beginning of the week. The observed pullback looks like a technical correction to remove local overheating. This correction comes.

February 9, 2022

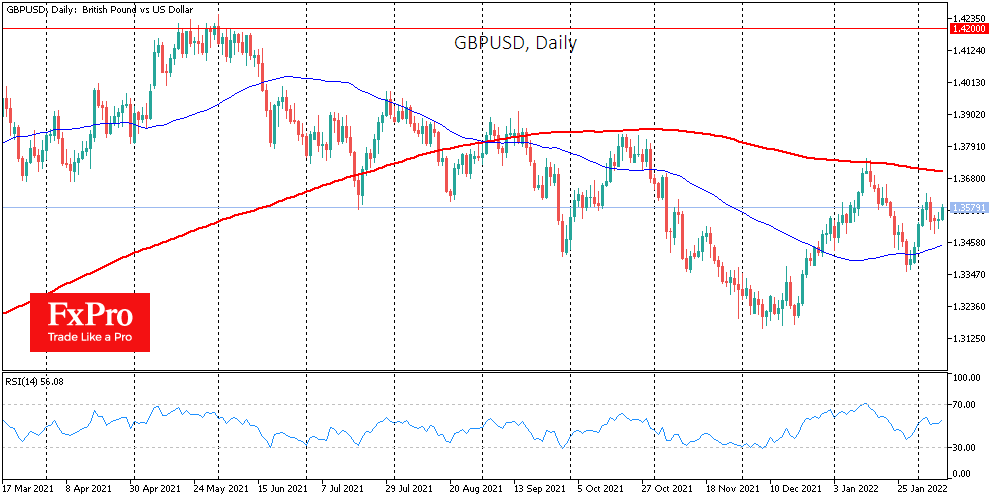

GBPUSD is gaining 0.35% on Wednesday, surpassing 1.3585, not far from the month’s highs of 1.3620. The British pound is closely correlated with equity market dynamics, and the latest upward momentum in major global indices supports GBP buyers. Also noteworthy.

February 9, 2022

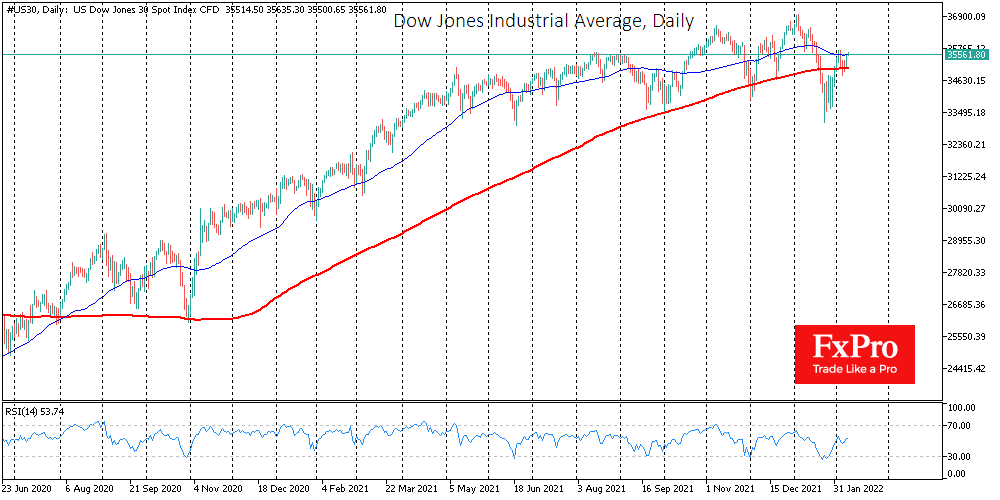

Stock markets continue their shaky recovery. On Tuesday, intraday trading patterns in US equities point to a buying trend on declines. The S&P500 and Dow Jones indices rebounded from their 200-day simple moving average. Both indices were below those levels.

February 8, 2022

Tightening monetary conditions in developed countries are not hurting gold so far, and investors’ switch from buying risky stocks generates demand for the safe-haven. The daily charts also clearly show gold being repurchased in downturns. Since late last year, impulsive.