Market Overview - Page 117

February 25, 2022

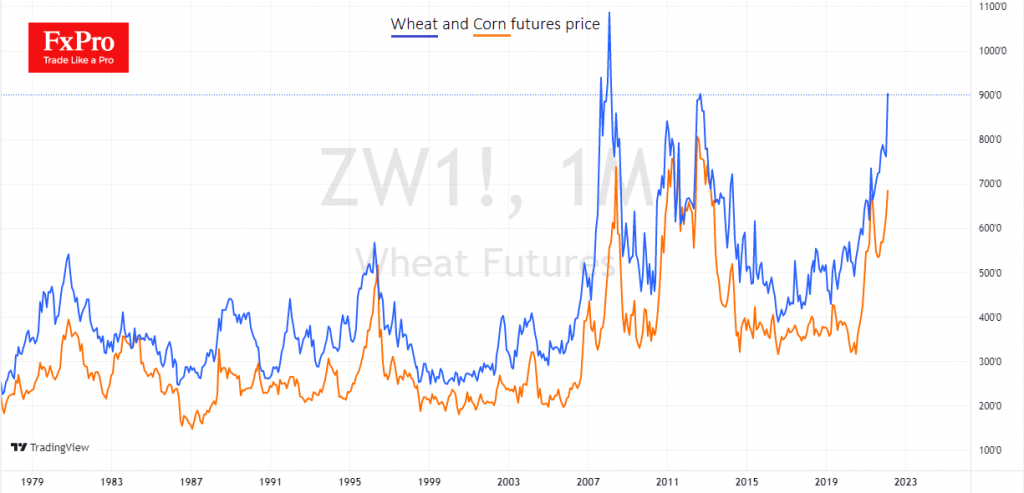

Wheat futures on the CBOE are up 16% since the start of the week, the biggest rally since the poor harvest in 2012. At one point yesterday, the weekly rise was close to 20%. The price level was the highest.

February 24, 2022

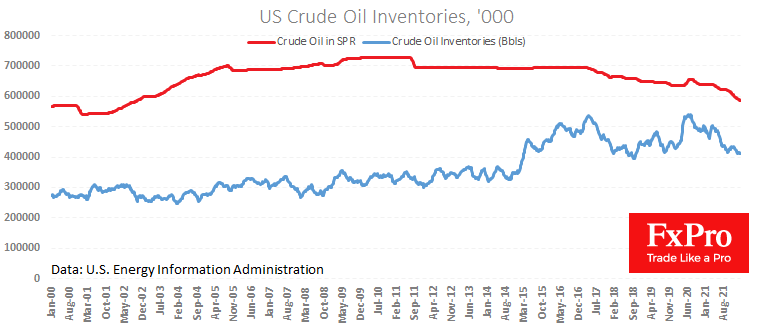

Oil prices are up more than 7.5% so far today, bringing Brent close to $101 a barrel. Futures for gas, which is traded in the US, add more than 5% on a sharp aggravation of the situation around Ukraine. Putin.

February 23, 2022

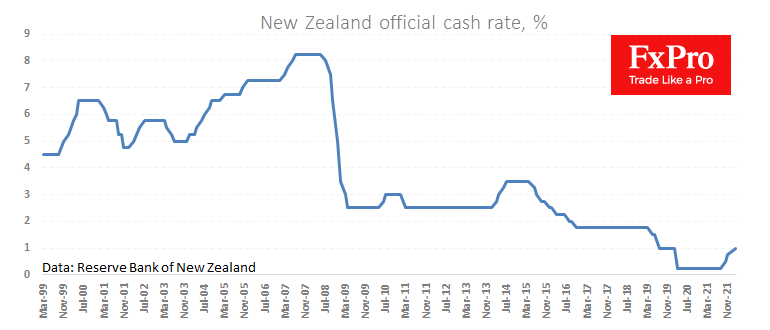

The New Zealand dollar has been adding around 1% since the start of the day following the third key rate hike of 0.25 percentage points to 1.0% and comments from the RBNZ on the need for further policy tightening. Wednesday.

February 23, 2022

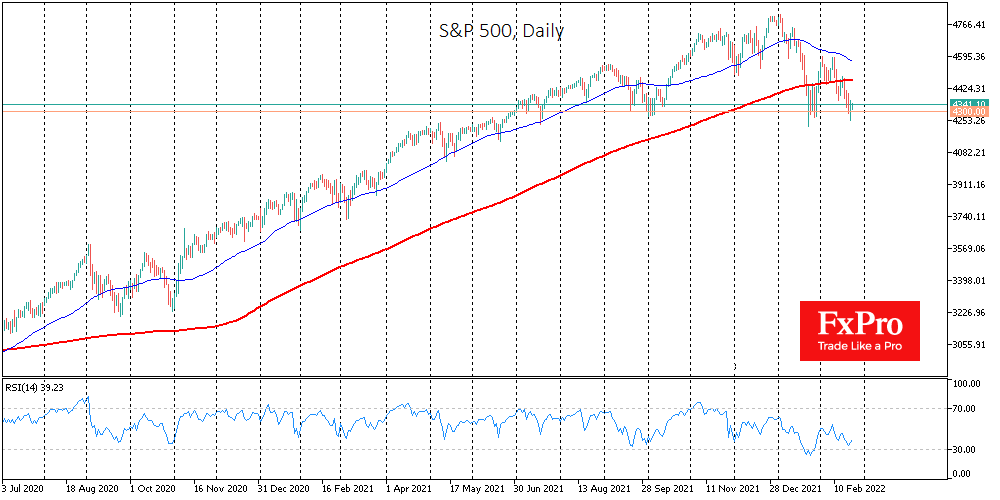

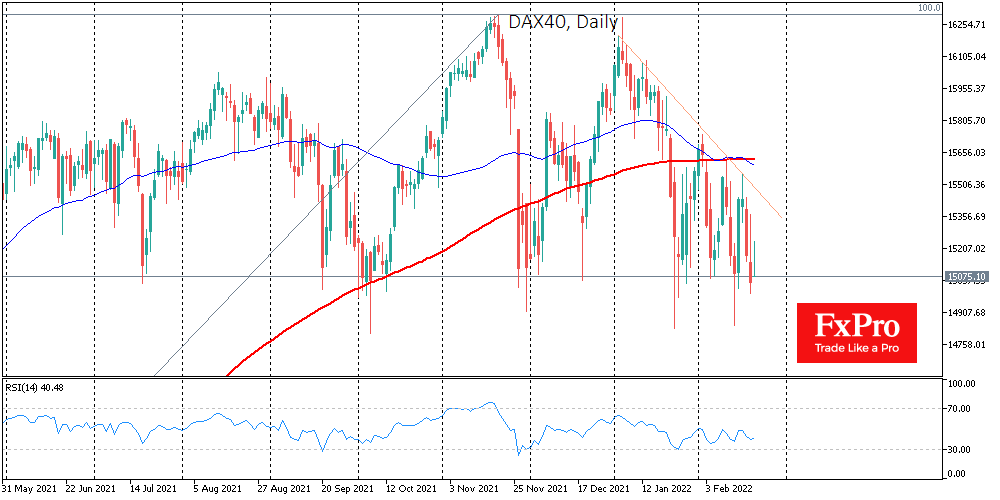

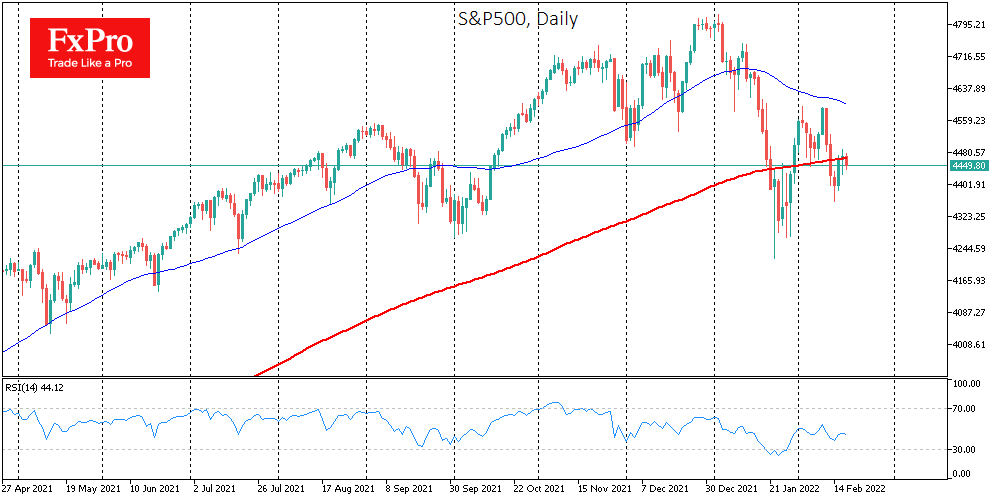

The S&P500 futures are trading on Wednesday morning with a slight gain of 0.3% after rising 0.5% on Tuesday. Meanwhile, the main index lost about 1%, taking back the downward momentum in world markets on Monday, when there was no.

February 22, 2022

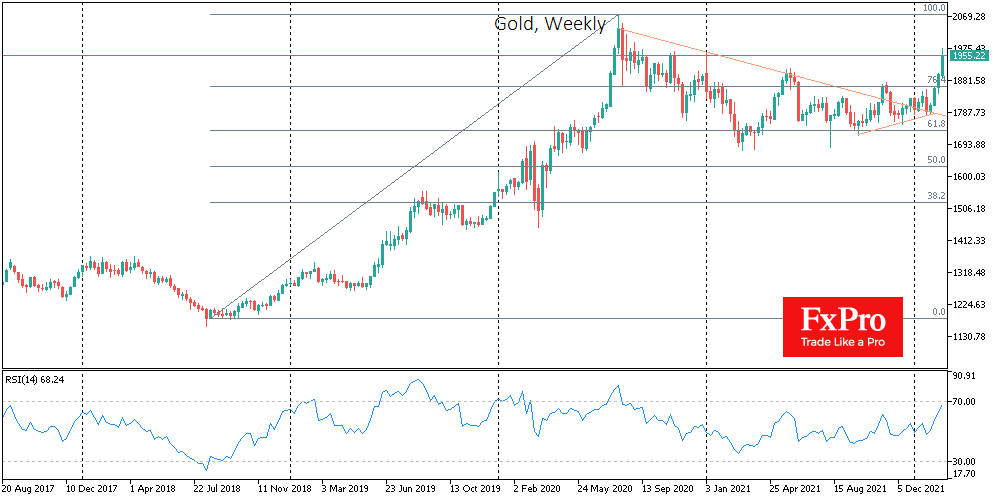

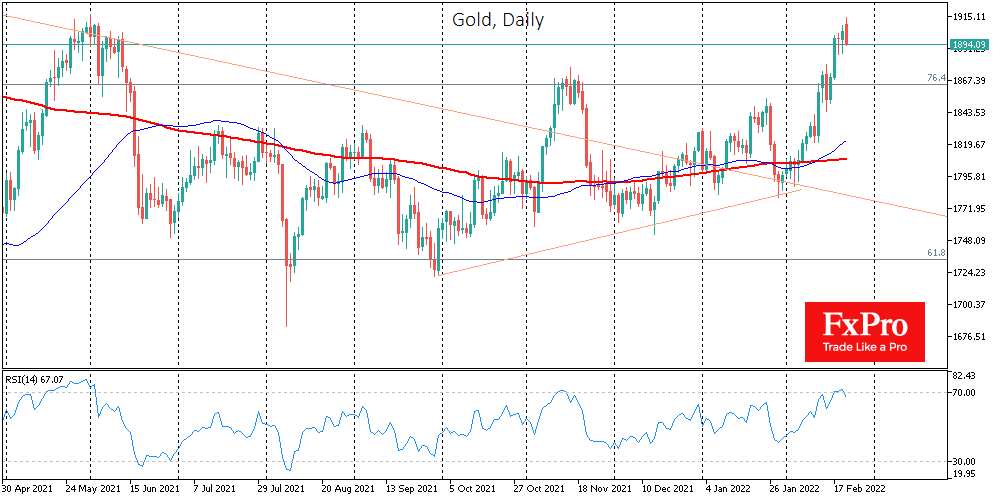

At the start of Tuesday’s trading, gold was close to $1914, its highest level since June last year. However, we already saw a pullback under $1895 and a 0.45% drop. Interestingly, today’s opening gold rally seems more like a knee-jerk.

February 21, 2022

The geopolitical momentum of the escalation/truce situation around Ukraine strikingly has its weekly cycles. Harsh rhetoric seems to peak at the end of the week, followed by the weekend’s relief when the sides look for ways to negotiate, giving a.

February 18, 2022

Gold and oil, former beneficiaries of geopolitical tensions late last week, have gone their separate ways, with the former rising 2.4% and the latter losing 5% since the start of this week. Brent crude rolled back below $90 and, at.

February 18, 2022

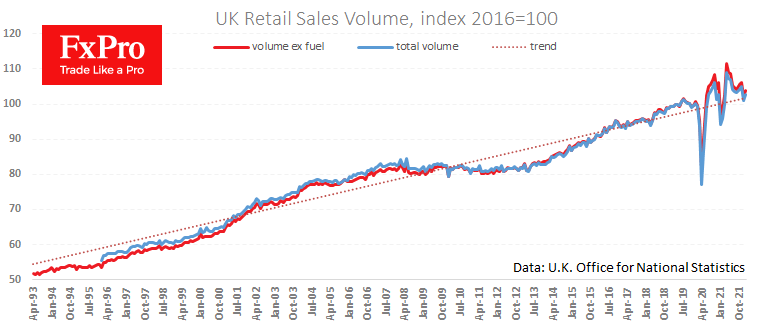

UK retail sales added 1.9% in January, following a dip of 4.0% a month earlier. By the same month a year earlier, the increase was 9.1%, as January 2021 saw a sharp tightening of the lockdown and the vaccination campaign.

February 18, 2022

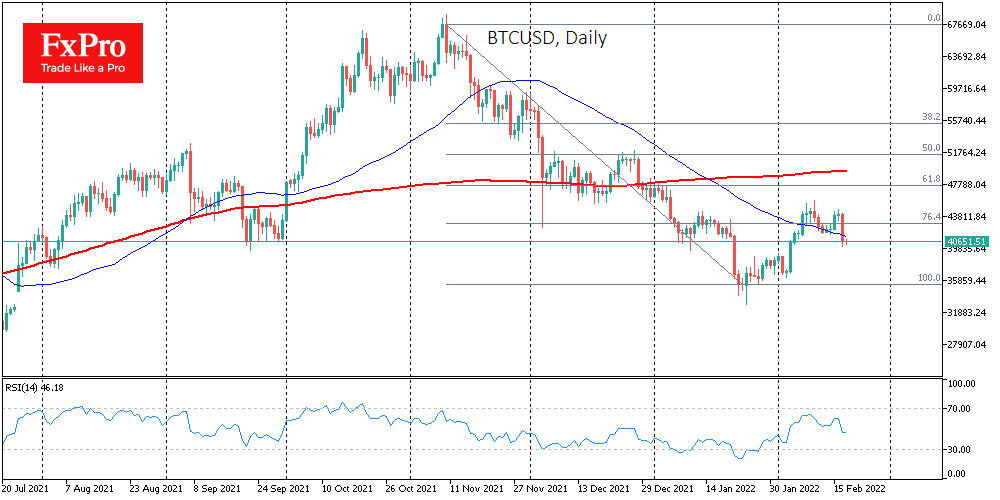

Bitcoin collapsed on Thursday, the most in almost a month amid sales of risky assets. BTC lost 7.7%, ending the day near $40,700. Ethereum fell 7.7%, while other leading altcoins from the top ten also fell, from 5.4% (Binance Coin).

February 17, 2022

The Ukrainian crisis is not likely to recede into the background anytime soon. Promising Russian statements about the withdrawal of troops are refuted by the West and Ukraine, near where the exercises are taking place. There was also a series.

February 16, 2022

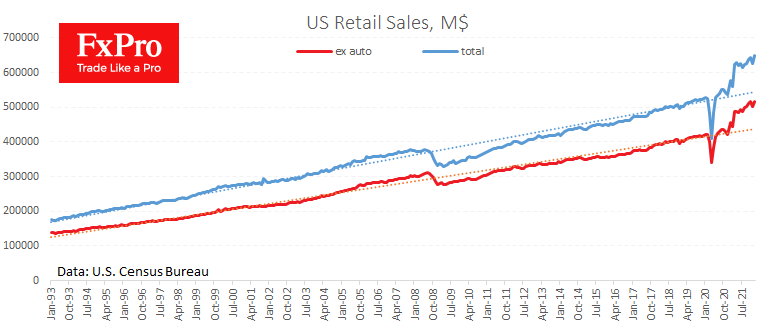

Total US retail sales rose by 3.8% in January and by 3.3% ex auto and fuel vs expected 2.1% and 1.0%, respectively. Both figures confirm a favourable environment in the world’s largest economy for a tighter monetary policy. The nominal.