Market Overview - Page 116

March 8, 2022

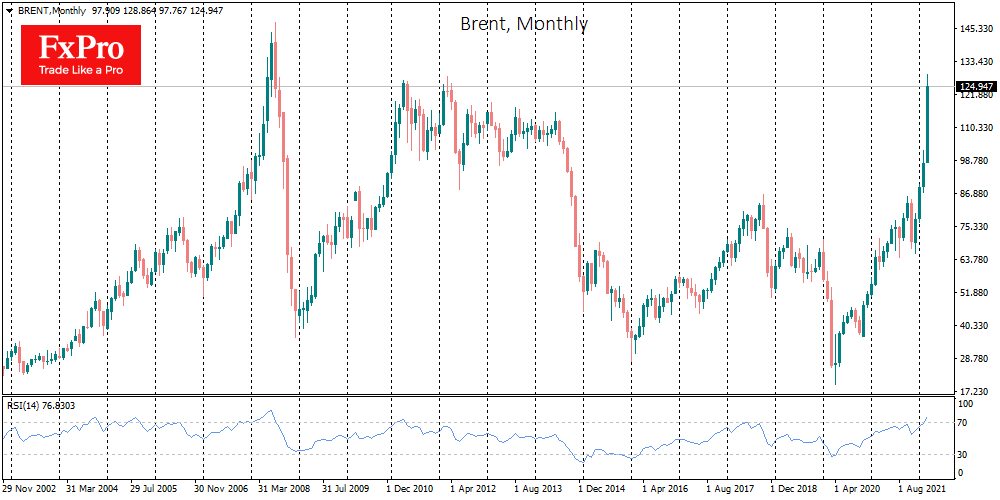

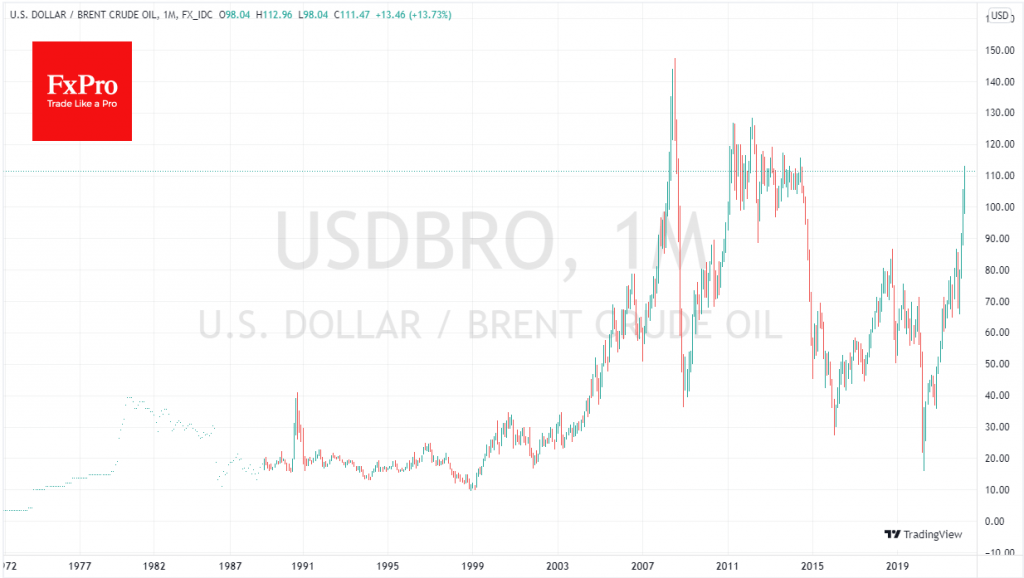

Brent oil is trading near $125 – in the 2011 and 2012 highs area. The market continues to receive bullish comments from politicians and officials. However, traders seemed set to pause to digest current price levels after a frightening rally.

March 8, 2022

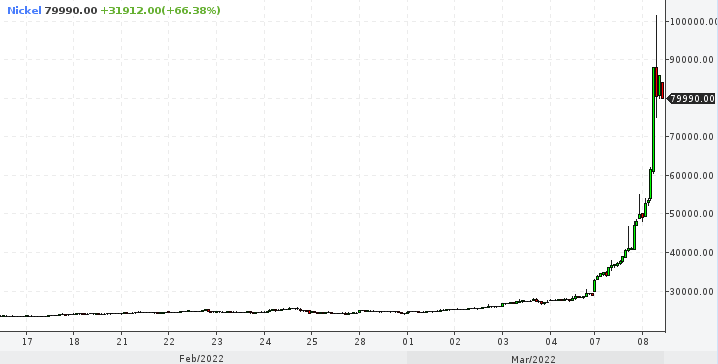

While the world discusses the prospect of an embargo on Russian oil and gas, the absolute madness is in metals. In many of them, Russia has a pretty significant share, and investors fear a ban on exports could be Russia’s.

March 7, 2022

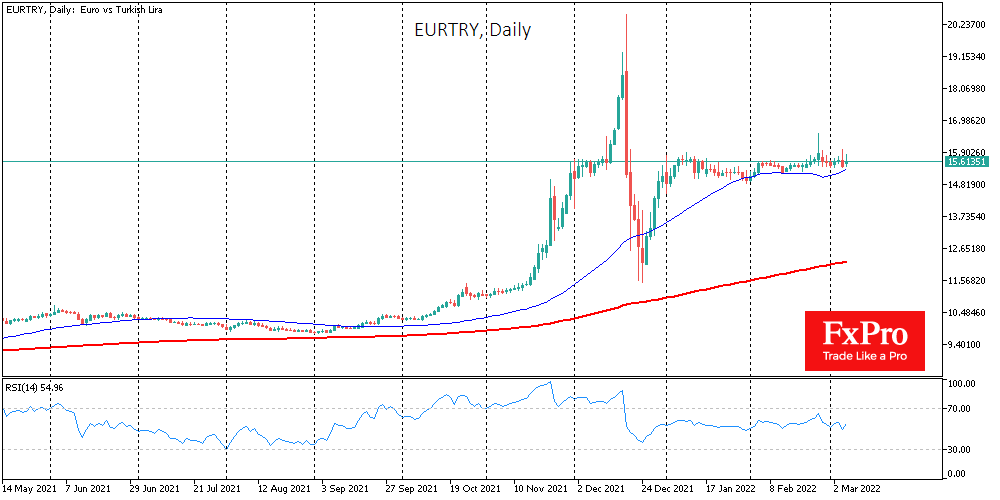

Since the beginning of the year, the Turkish lira has looked like a safe haven, trading in a very tight range against the euro. However, recent events make us look at the economic prospects of this currency with concern. In.

March 7, 2022

The armed conflict in Ukraine continues to have a destabilizing effect on the markets. With no visible signs of de-escalation over the weekend, markets opened the week with impressive gaps. They continued to move in the directions that were set.

March 4, 2022

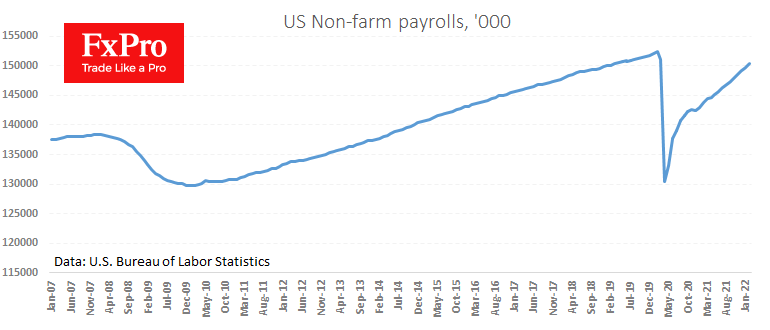

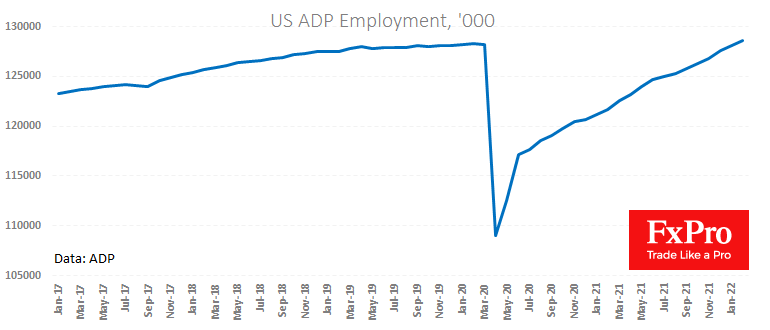

The US labour market added 678K jobs outside the agricultural sector in February. This is higher than the expected 400K. In addition, last month’s estimates were improved, which also adds strength to the fresh data. Hourly earnings were virtually flat.

March 4, 2022

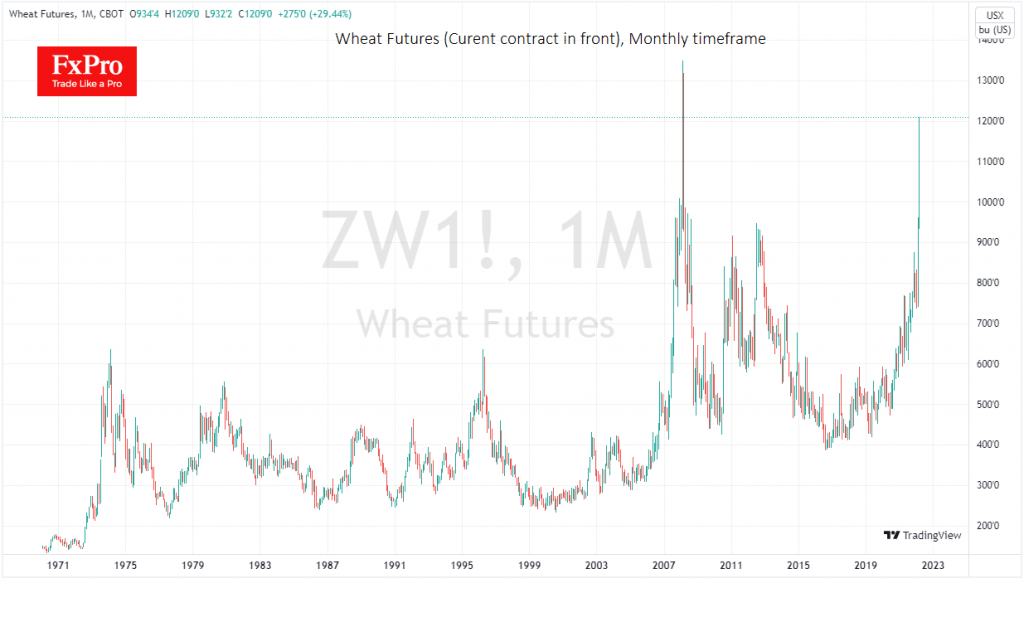

Wheat futures on the US CBOT are trading above $12.09 per bushel, more than 40% surge over the week and 85% over the year. The current price is an area of historical extremes. The world hasn’t seen wheat more expensive.

March 4, 2022

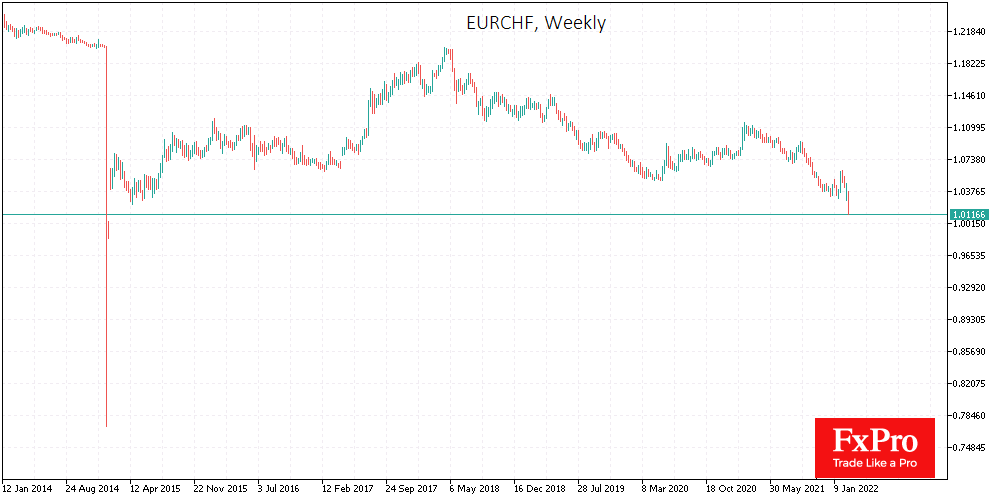

The single currency approached 1.1000 against US Dollar – its lowest since May 2020 – and is close to declining for the fourth week in a row. Investors fleeing into safe havens outside the eurozone continues to gain momentum. The.

March 3, 2022

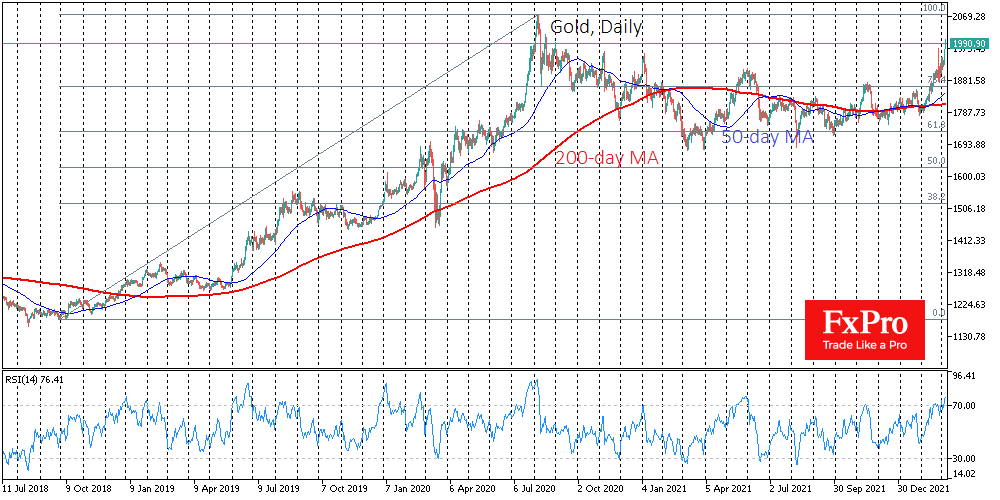

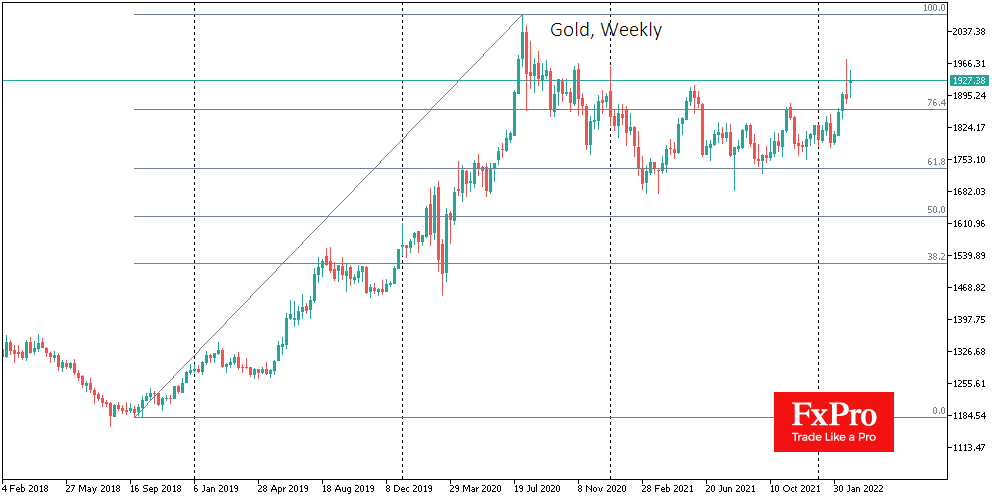

The inflow of capital into gold as a safe haven was evident throughout February, reaching its climax last Thursday when the price was approaching $1975. Since then, the uptrend has remained in place, but the price has moved away from.

March 3, 2022

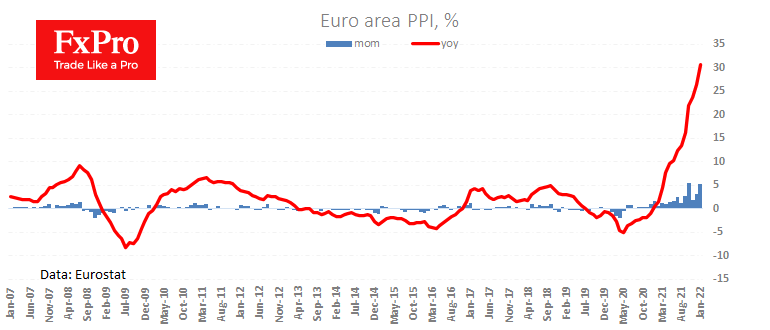

Euro area producer prices accelerated their rise in January – a significant early signal of a further increase in consumer inflation. A fresh Eurostat report showed that PPI rose by 5.2% in the first month of the year, twice as.

March 3, 2022

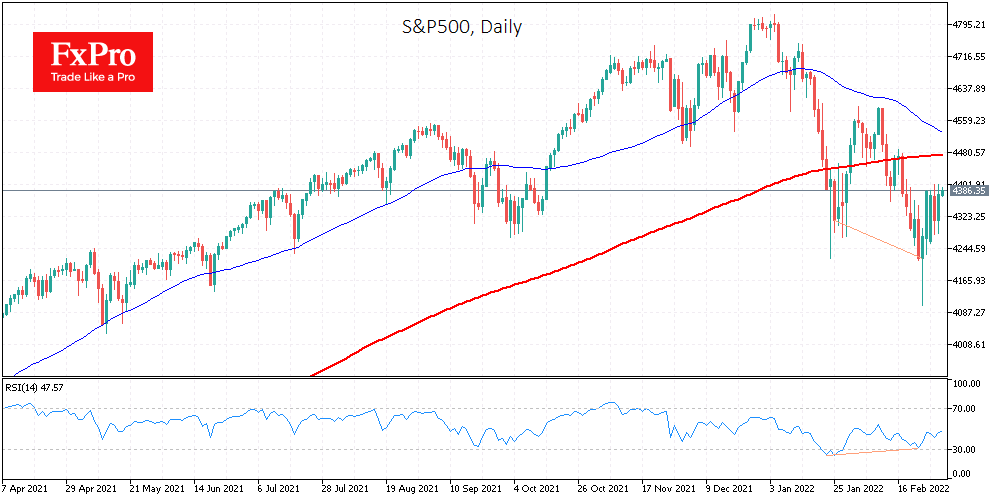

In times of crisis, after initial chaos and sell-off around the globe, the market quickly calculates the winners: both in February-March 2020 and last month, the market decline was general, but very soon the markets diverged in their dynamics. Events.

March 2, 2022

The US private sector created 475K jobs in February, compared to 509K and 780K in the previous two months. The growth is significantly above expectations (378K) and indicates the labour market’s strength, potentially clearing the way for the Fed to.