Market Overview - Page 114

March 23, 2022

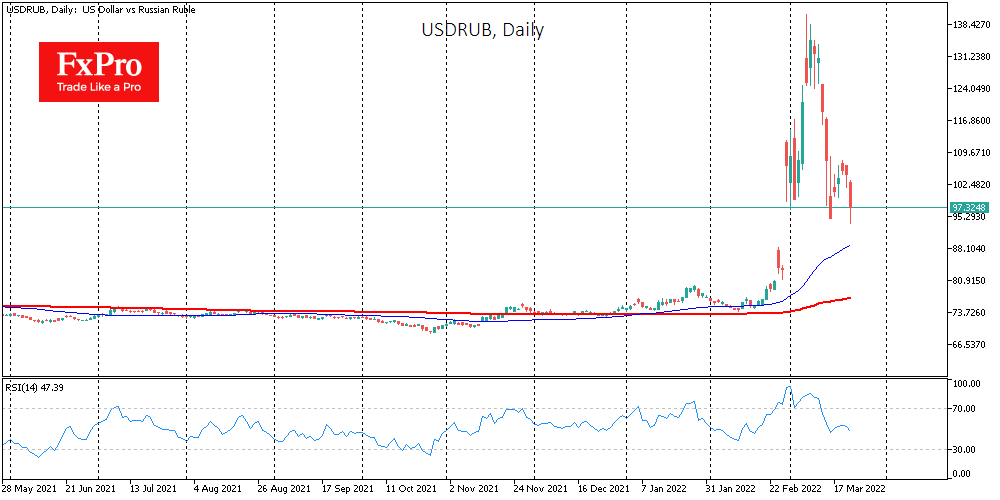

The Russian rubles adds more than 3% to the dollar, trading around 100 on news that “so-called unfriendly countries” will have to pay for gas in rubles. Impulsively (as the Russian currency market remains extremely illiquid), the USDRUB dropped below.

March 23, 2022

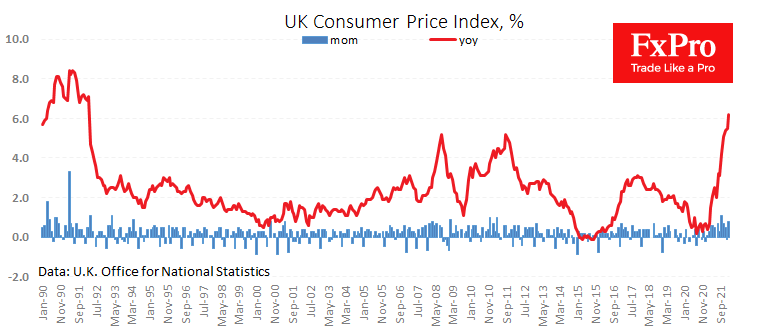

After the traditional January reset, UK consumer prices continued their flight. Morning data showed that CPI rose by 0.8% last month and 6.2% year-over-year. This data is 0.2 percentage points above market expectations, indicating that prices rise faster than initially.

March 22, 2022

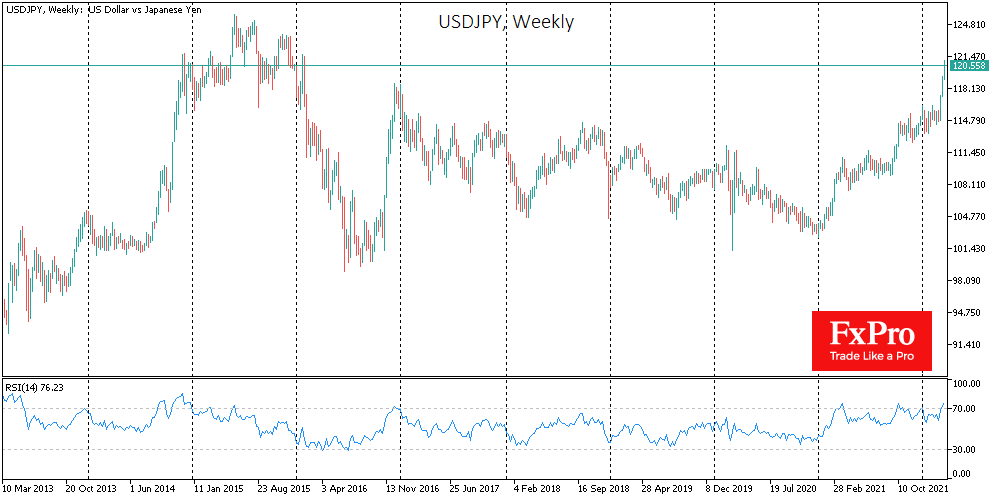

The Japanese yen has fallen for the third week in a row, and the amplitude of this decline has become rather scary on Tuesday. It seems yen traders’ stop-lines have been blown as the markets have become increasingly aware of.

March 22, 2022

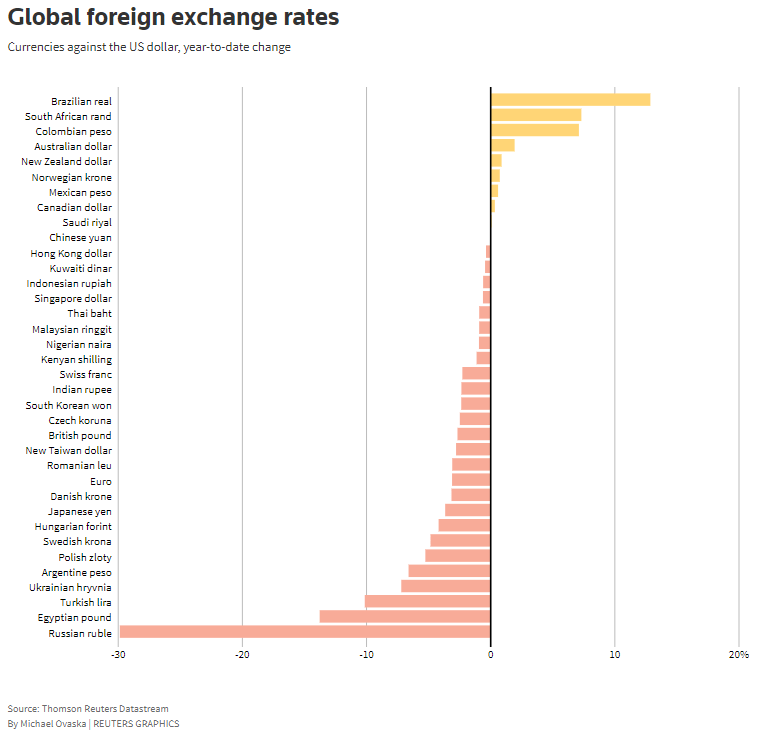

Since the start of the year, the performance of emerging market currencies mirrors what we saw last year, but with more polarisation. The Brazilian real has been the growth leader against the dollar since the start of the year, gaining.

March 21, 2022

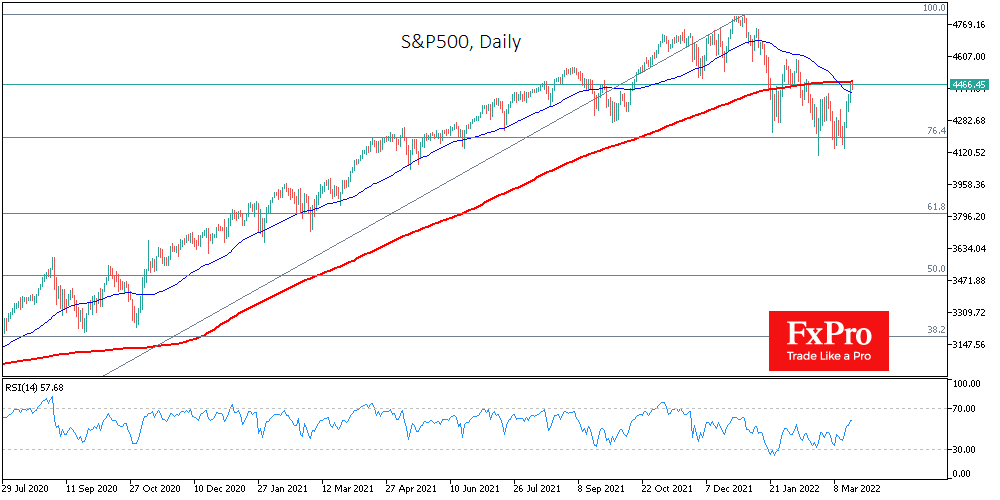

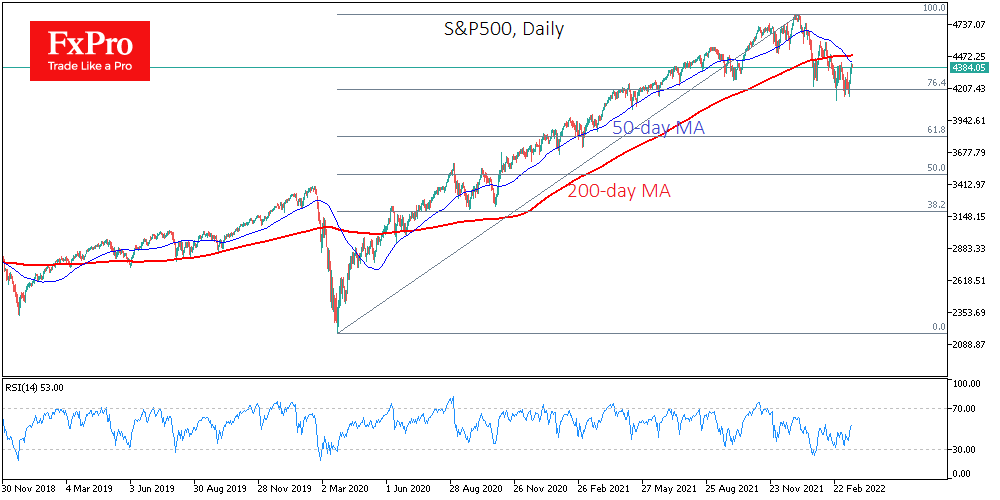

Having added more than 8.2% to Tuesday’s lows last week through Friday, S&P500 futures have surpassed the 50-day moving average and are testing the 200-day average by the start of US trading. We mentioned last week that the “death cross”.

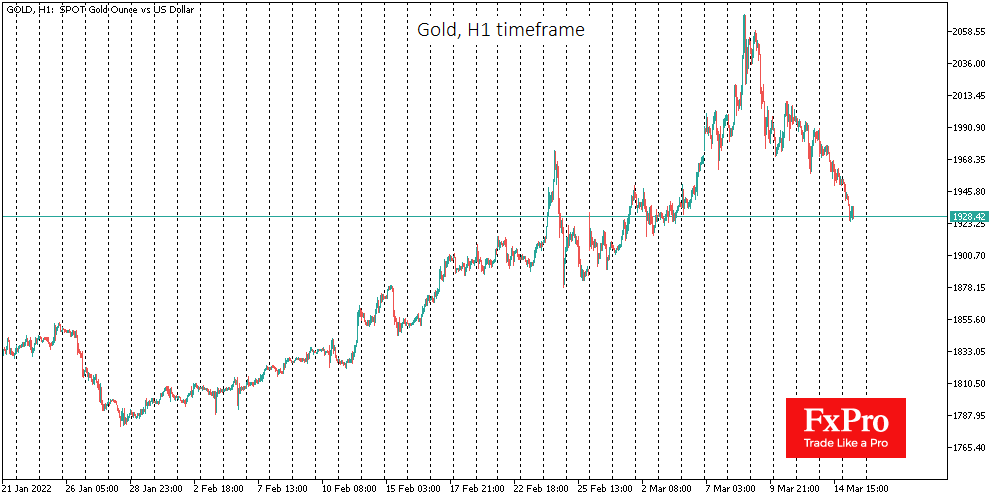

March 21, 2022

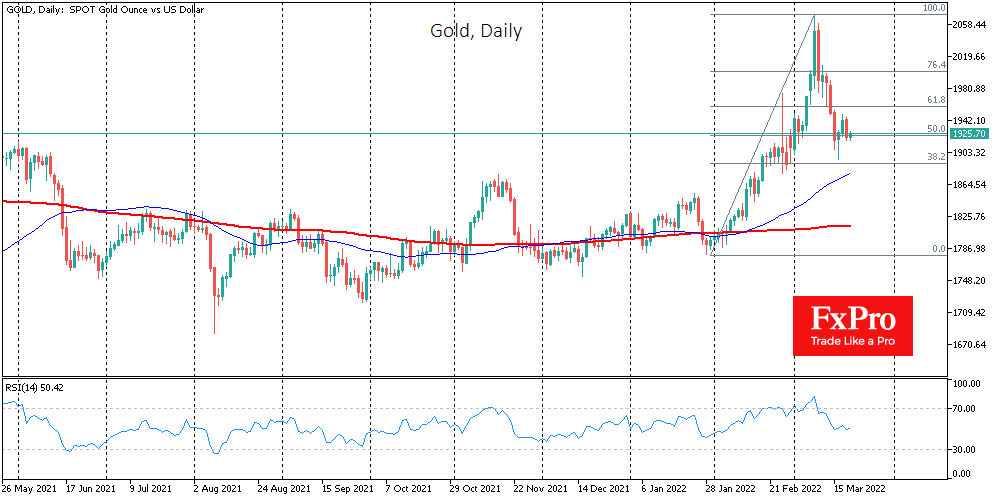

Gold has remained in a one-and-a-half per cent range since last Thursday. The correction from a peak of $2070 to values below $1900 caused a brief aftershock, but it was not sustained. Gold has now stabilised above the peaks of.

March 18, 2022

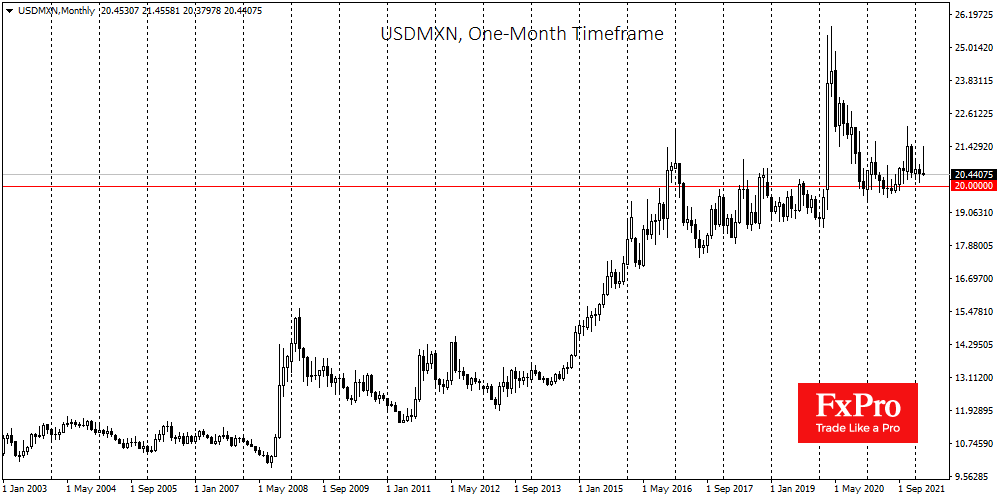

The Mexican dollar has added more than 4% over the last nine days against the US dollar. The upward momentum in this rally is followed by a brief correction but without any noticeable pullback. At first glance, this rally does.

March 18, 2022

The global equity market also continues to thaw after a pronounced decline since the start of the year. Initial reports of progress on the peace talks were later supported by indications that the US and China are looking to reduce.

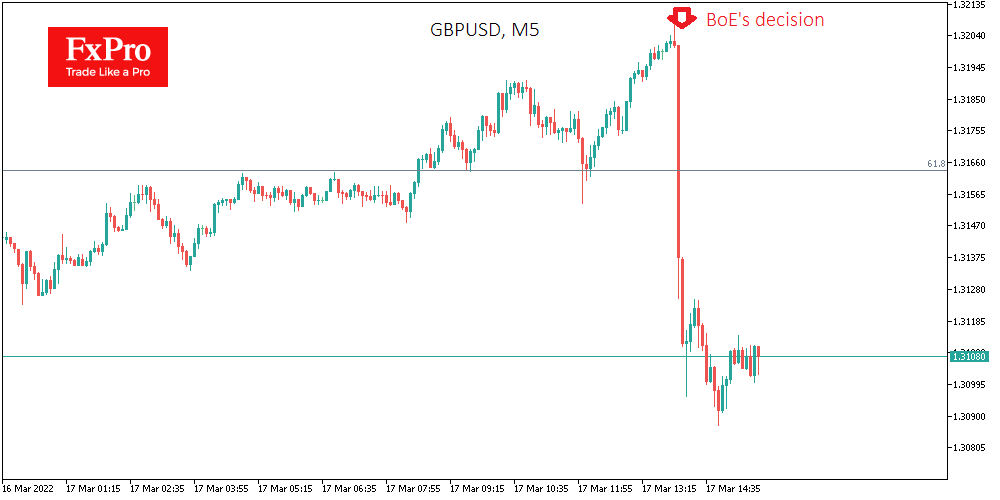

March 17, 2022

The Bank of England raised the rate by 25 points to 0.75%. Such a move was, on average, predicted by market analysts. However, reports that one member of the Bank of England voted to maintain the rate was seen as.

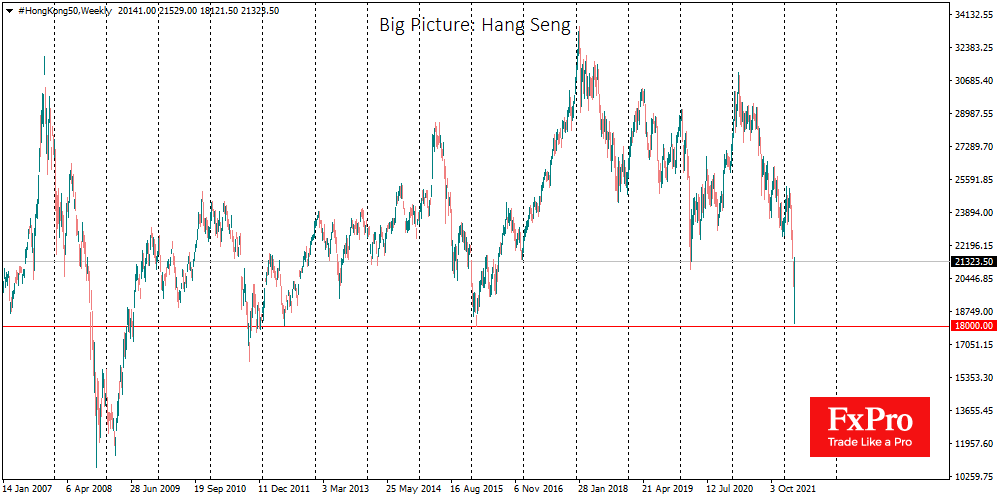

March 17, 2022

Chinese indices are experiencing their sharpest rally yet on Wednesday amid reassurances from officials that the stock market is going to be supported. Hong Kong’s Hang Seng jumped 12%, China’s China A50 is gaining more than 8.5%, while China H-shar.

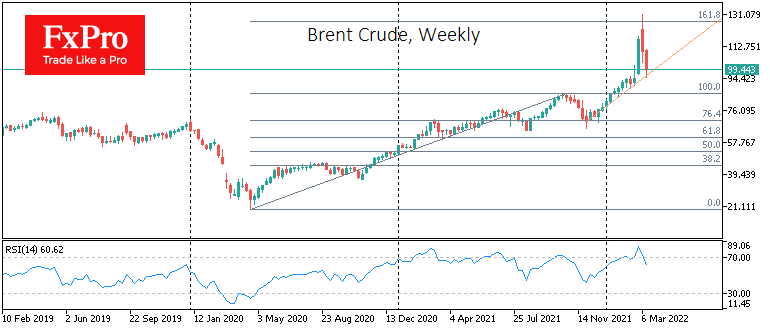

March 17, 2022

The price of oil has stabilised at $93 per barrel for WTI and $95 for Brent, after falling by more than a quarter from March 8th. Buyers’ support came on a correction to levels at the beginning of this month,.