Market Overview - Page 112

April 8, 2022

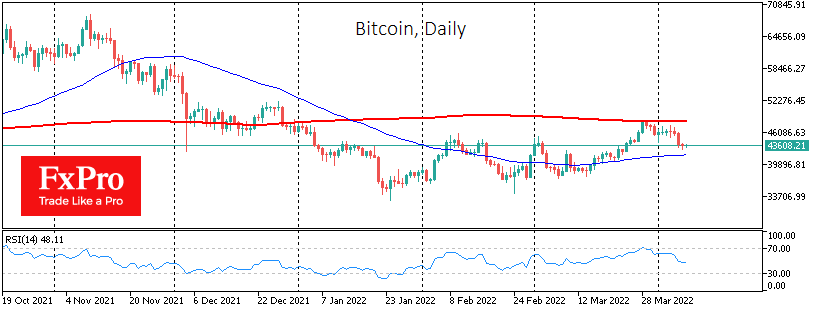

Bitcoin rose slightly, by 0.6%, to $43.6K. Ethereum added 1.6%, while other leading altcoins from the top 10 showed mixed dynamics: a 3% decline (Terra) to 6.2% growth (Solana). Total crypto market capitalisation, according to CoinMarketCap, rose 1.2% to $2.02.

April 7, 2022

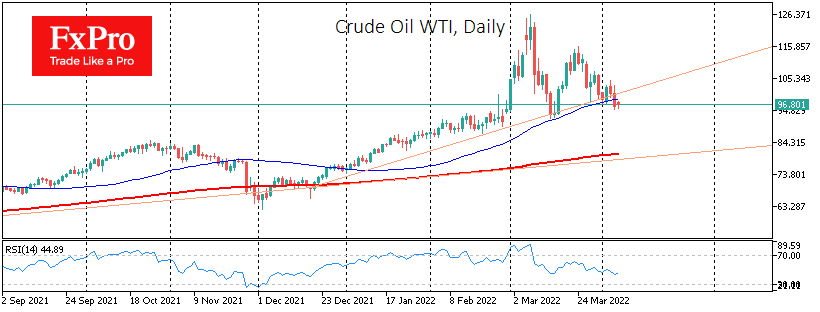

Despite our initial scepticism, there seem to be signs that the latest bullish trend in oil is breaking down. The WTI price ended Wednesday below $100 and below the support line of the rising trend through the lows since December..

April 6, 2022

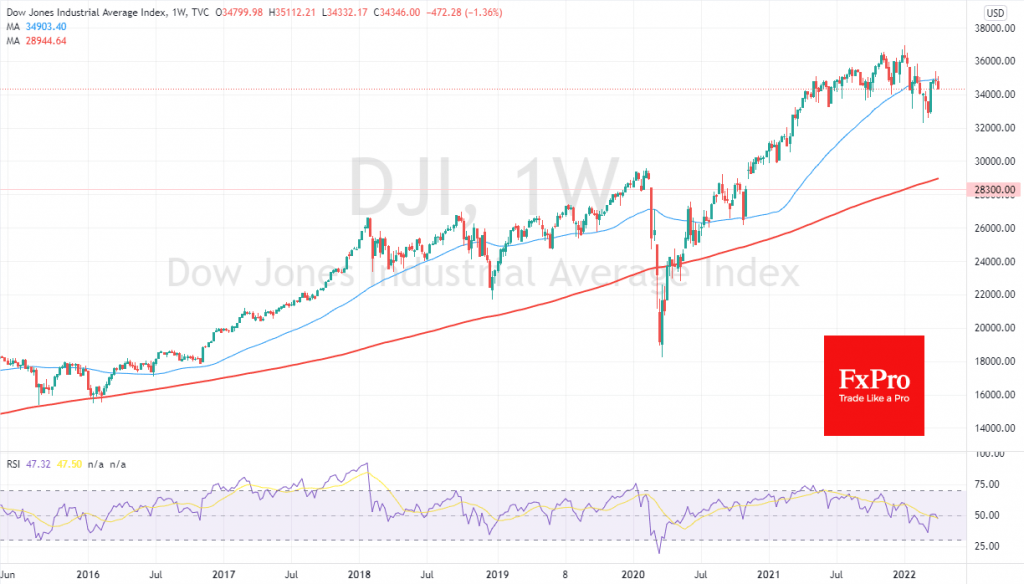

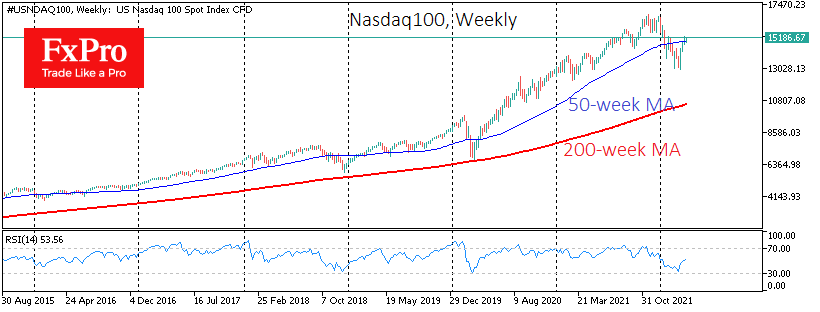

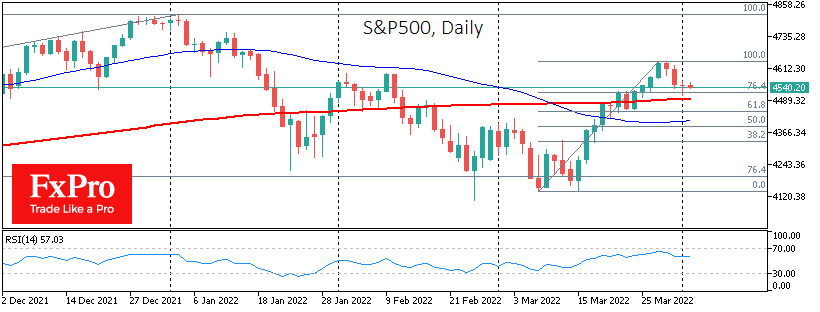

Stock market indices have reversed downwards as sustained dollar strength with tightening financial and trading conditions worldwide worsens the outlook for companies. From the technical analysis perspective, the Dow Jones and Nasdaq100 fail to consolidate above their 200-day moving averages.

April 6, 2022

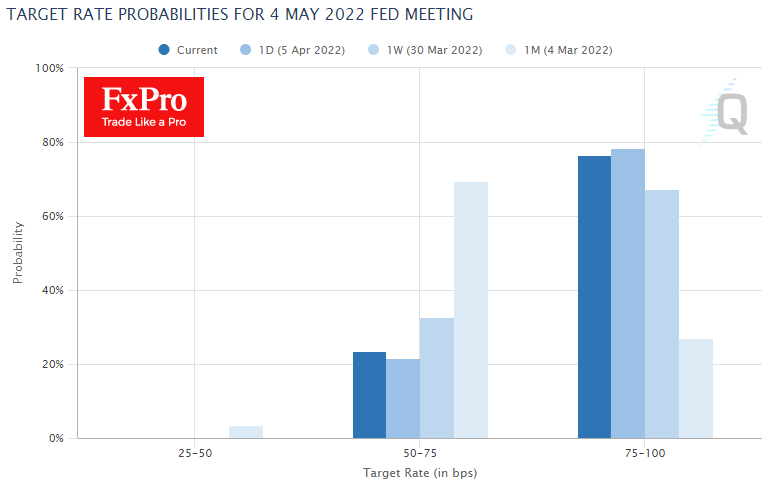

The dollar is rising against most of its major rivals on the latest hawkish comments from the Fed. The futures market lays a 77% chance of a 50-point rate hike at the next meeting in a month from 27% a.

April 5, 2022

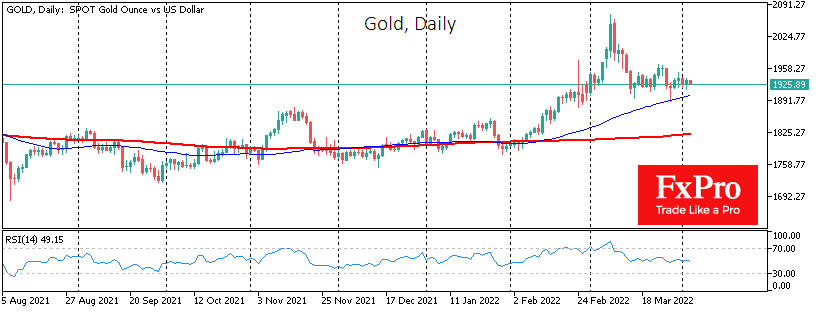

Gold has found a balance, stabilising at around $1930. The pullback in gold from the highs reached on the 8th of March was in unison with the rebound in stock indices, i.e., reflecting capital flow from the safe harbour into.

April 5, 2022

Nasdaq100 has added over 2% on Monday, in contrast with a more modest gain of 0.8% for the S&P500 and a barely notable 0.3% rise for the Dow Jones. But this is not a signal of general optimism from market.

April 4, 2022

Financial markets are clinging to positivity on Monday morning after a modest rise on Friday. Robust US labour market data reinforced expectations that the Fed will press the monetary policy brake harder. However, this news is countered by optimism that.

April 4, 2022

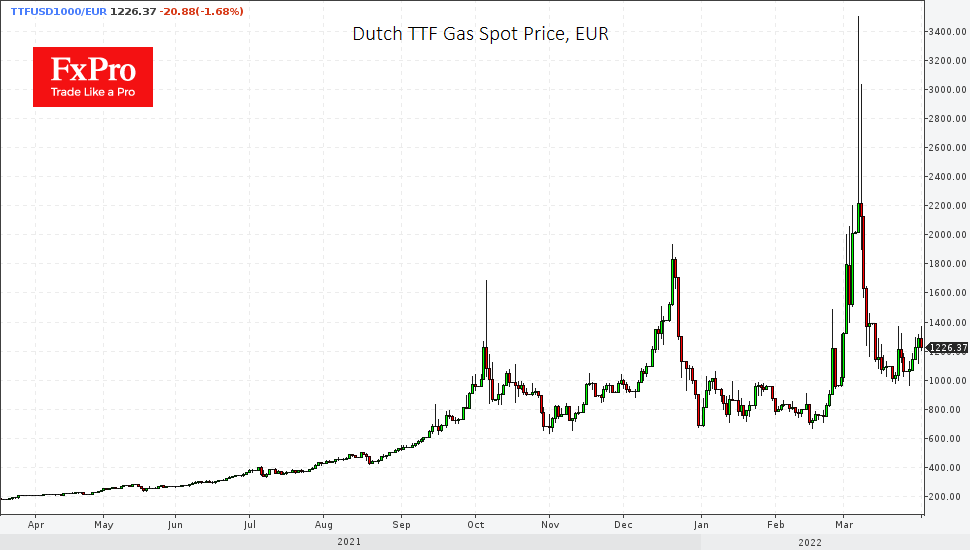

The energy sector has retreated markedly from its highs in the first days of March but remains a hot topic for markets. Europe’s gas market survived several bouts of fear that it would be without Russian gas. However, we only.

April 1, 2022

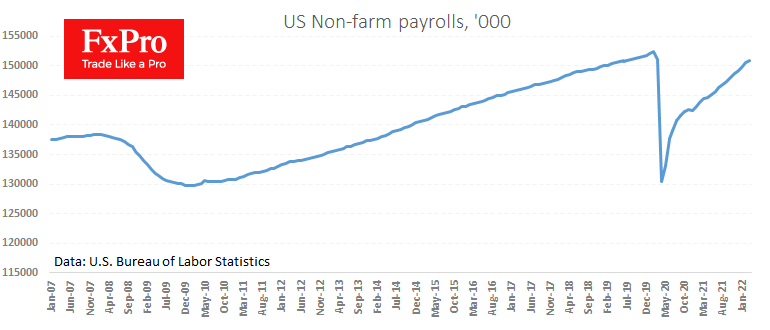

In March, the US economy created 431K new jobs, less than the expected 500K. However, a substantial upward revision of the February data (750K instead of the initially reported 678K) shows that the labour market is still recovering ahead of.

March 31, 2022

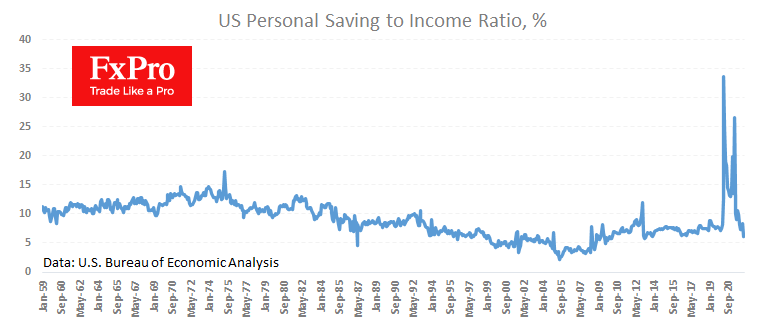

American households increased spending by 0.2% in February, compared with a 0.5% rise in income. But this data only looks optimistic at first glance. Americans saved 6.3% of disposable income compared to 6.1% in January. In other words, we are.

March 31, 2022

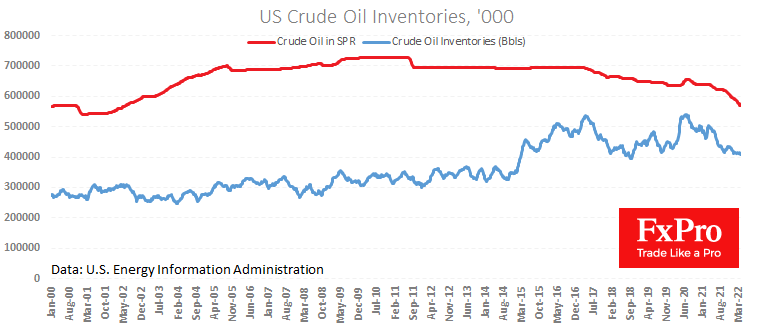

Biden’s team has announced that it is considering releasing up to 180 million barrels of Oil from Strategic Petroleum Reserves over the next 180 days. According to the latest weekly estimate, about one-third of the existing Strategic Petroleum Reserve of.