Market Overview - Page 110

April 22, 2022

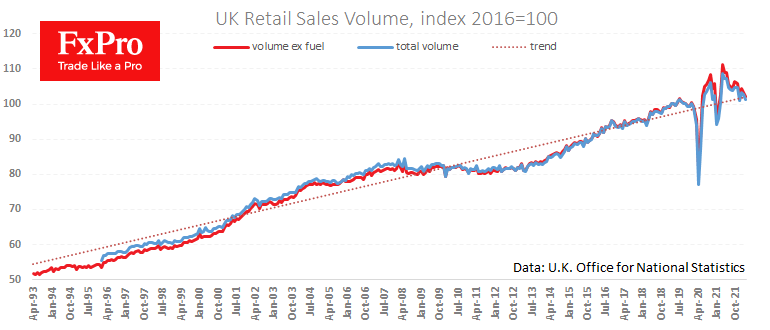

GBPUSD fell below 1.3000 to its lowest level in 17 months due to a weak retail sales report. ONS reports a 1.4% drop in total sales for March after a 0.5% decline a month earlier. Sales excluding fuel fell 1.1%.

April 22, 2022

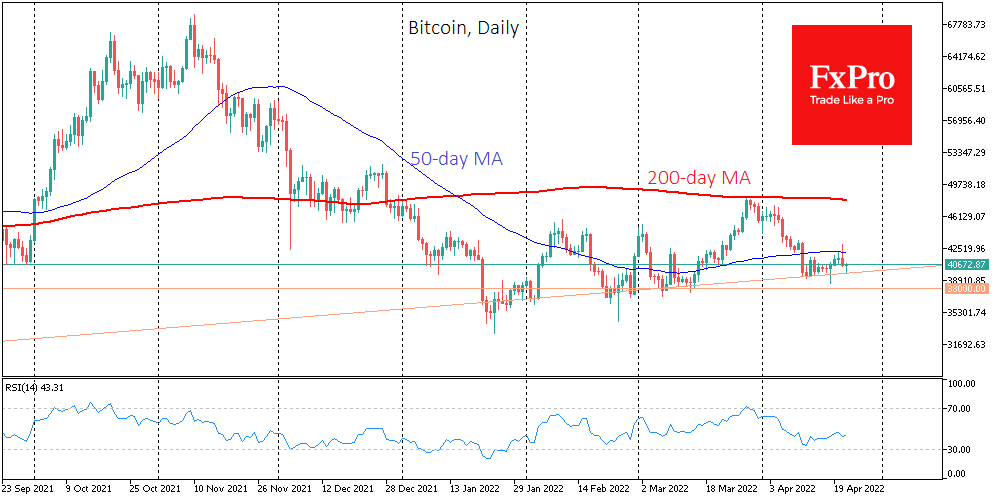

Powell’s speech on Thursday night weighed on US markets and echoed on cryptocurrencies, leaving an emerging breakaway from a critical support line. A decline in US stock indices added to the negative impact amid a speech by Fed Chairman Jerome.

April 21, 2022

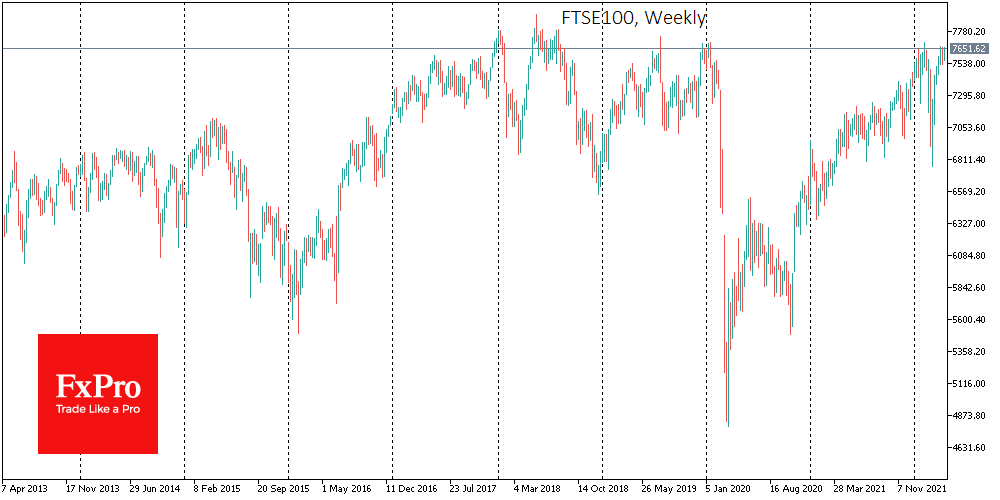

The UK stock market is closer5 to a full recovery from the recent slump than its counterparts in the US or continental Europe. The FTSE100 at 7640 is now only 0.7% below its peak in February. By comparison, S&P500 at.

April 21, 2022

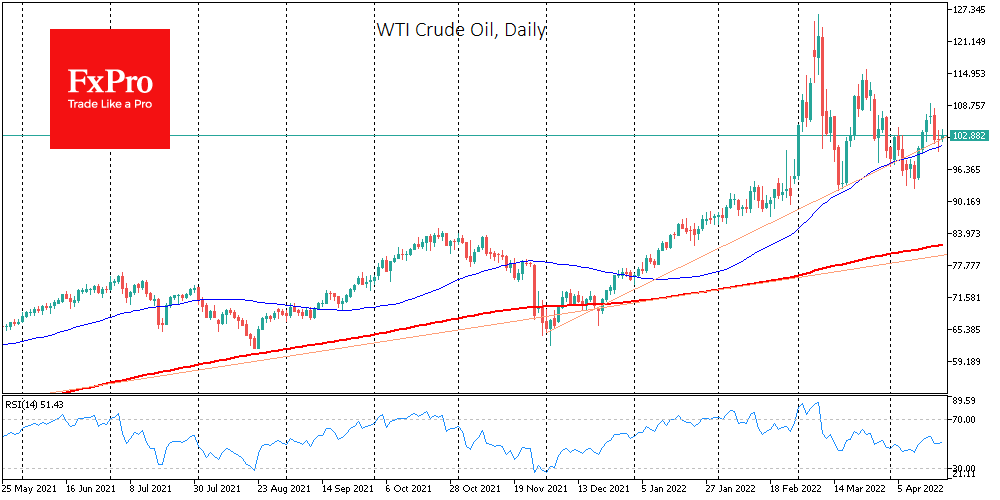

Oil gained 1.5% on Thursday morning to $103.75 per barrel for WTI and $108.2 for Brent, continuing to cling to the uptrend since December. Over the past six weeks, oil price movements are no longer unidirectional, but the market remains.

April 20, 2022

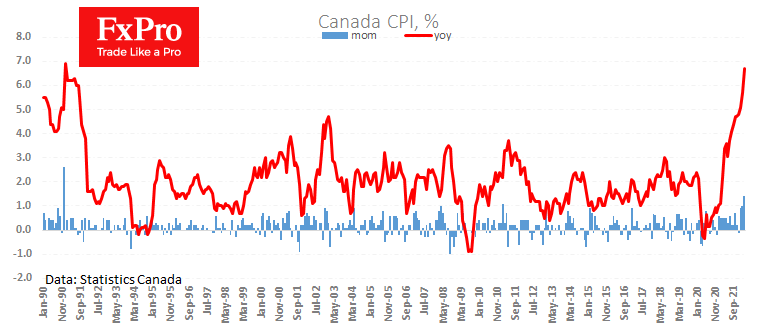

Canadian consumer inflation rose stronger than expected, adding 1.4% for March and accelerating to 6.7% y/y from 5.7% a month earlier and the forecasted 6.1%. The Bank of Canada last week raised its key rate by 50 points and announced.

April 20, 2022

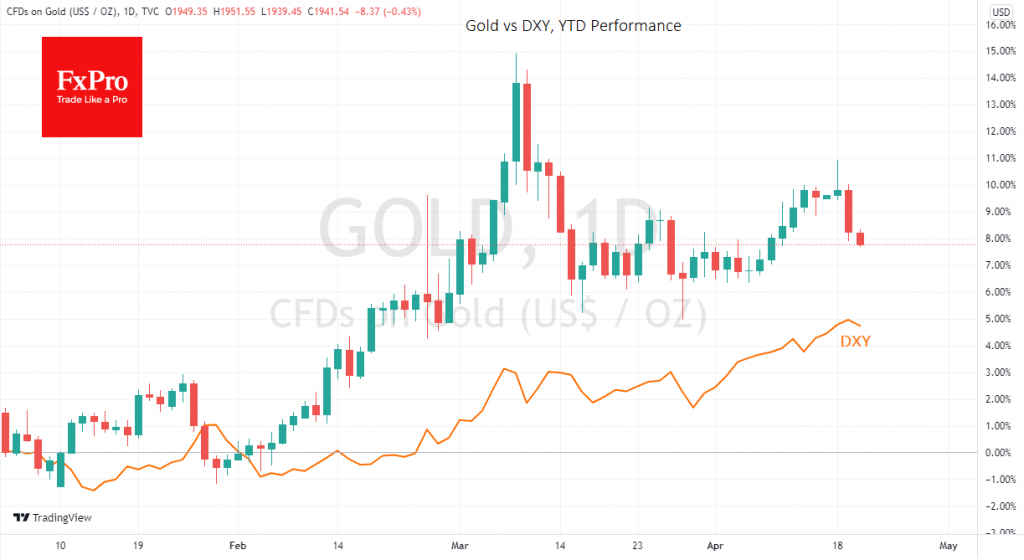

Gold is falling fast, having lost about 3% to $1940 from Monday’s peak. On Monday, the bulls are locally capitulating after an unsuccessful attempt to push the price above $2000. It would be a mistake to attribute gold’s fall to.

April 19, 2022

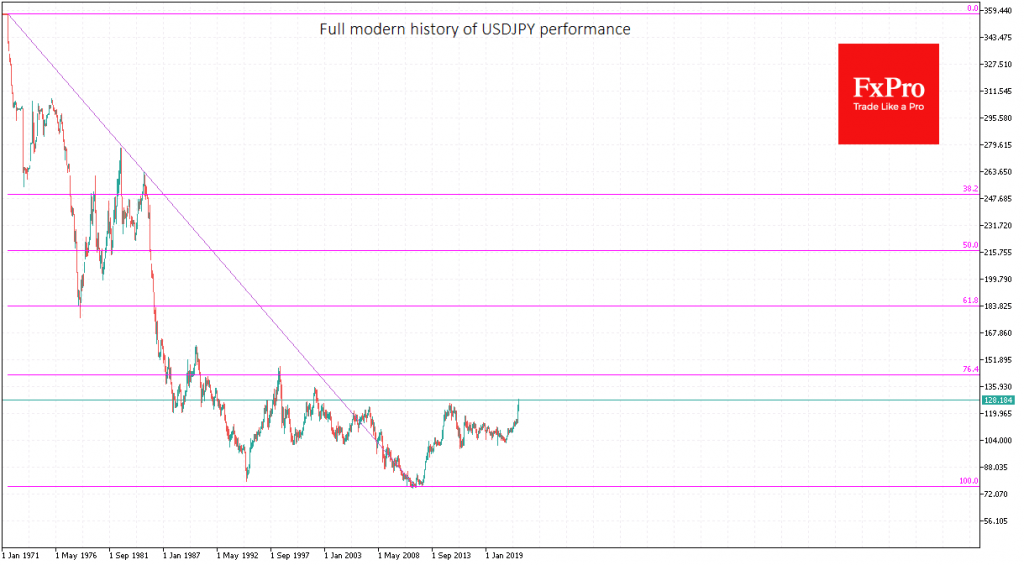

The pressure on the Japanese yen persists in the markets. The USDJPY has been hitting 20-year highs almost daily since last week, rising 11.8% to 128.40 since early March. Since the beginning of the year, the yield spread between the.

April 19, 2022

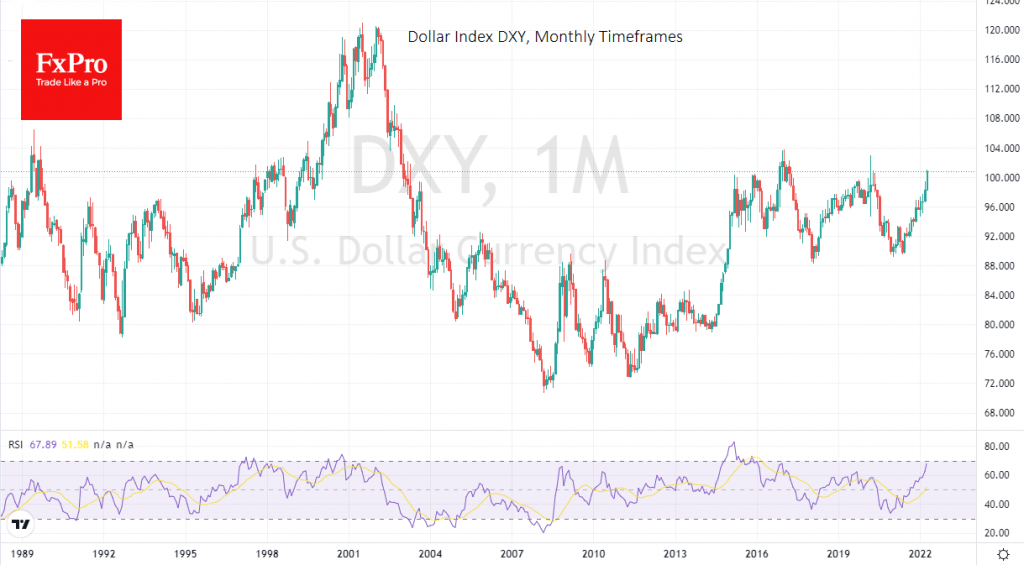

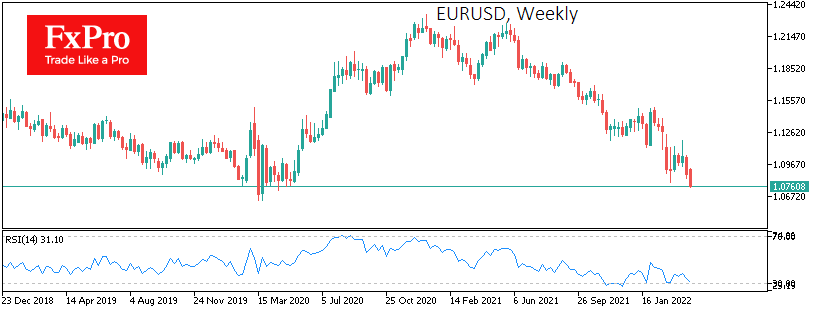

The dollar index passed 101, which we last saw for just over a week at the height of the lockdowns. But history suggests that this rally has roughly passed the halfway point. Except for a brief period of stock market.

April 18, 2022

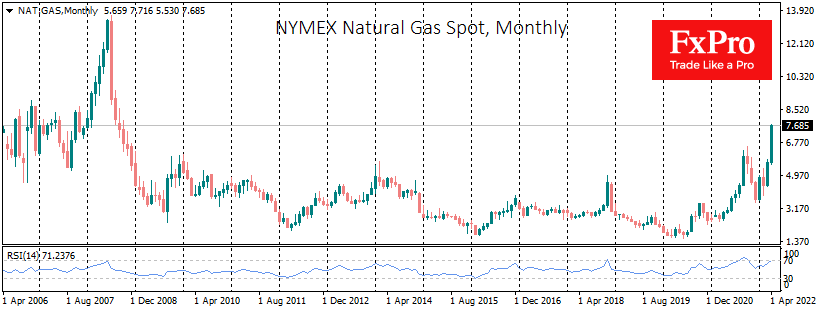

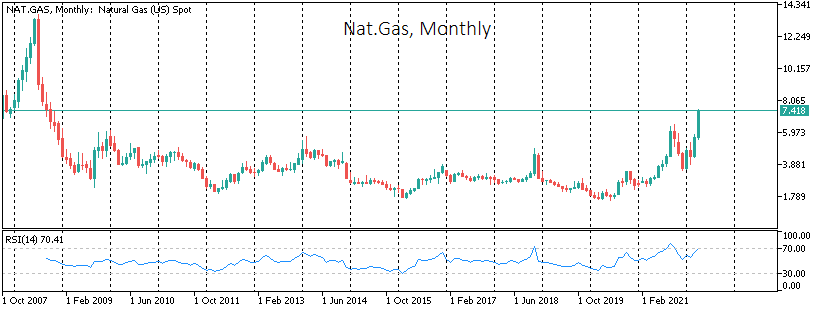

Gas prices on the NYMEX are adding for the 11th trading session of the last 12, renewing their highs since October 2008. US gas exchange prices have risen by a third since the beginning of the month and more than.

April 18, 2022

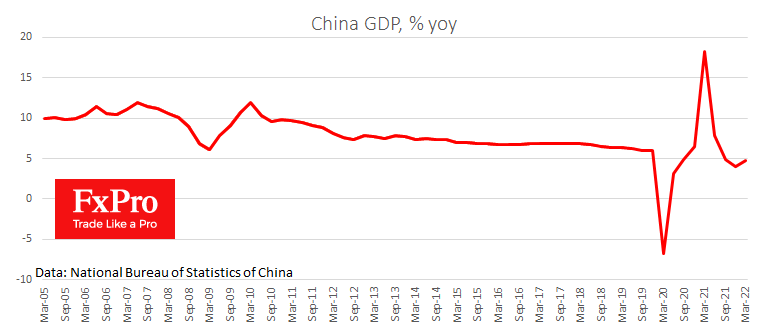

The Easter holiday in Europe and a lack of scheduled publications in the US ensure a quiet trading session this Monday. Only a batch of data from China provides some volatility. Chinese stocks were under moderate pressure on Monday, and.

April 15, 2022

Energy prices continue to fly into the stratosphere, adding 30% since the start of April, strengthening at twice the rate of March. The last time US gas was this expensive was in October 2008. Demand for American gas has surged.