Market Overview - Page 107

May 20, 2022

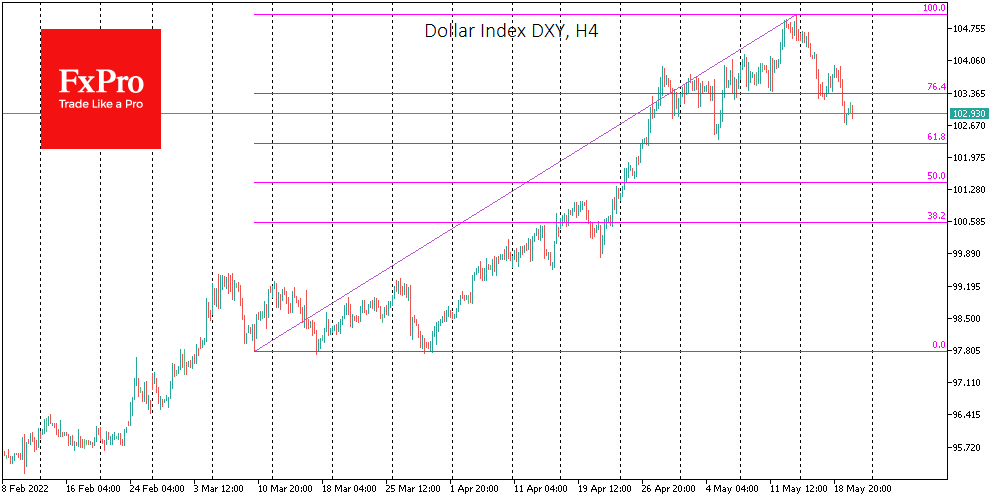

The dollar in the foreign exchange market is correcting some of the gains of the past three months. The dollar index has retreated below 103 after touching 105 a week ago. The retreat of the US currency goes against a.

May 19, 2022

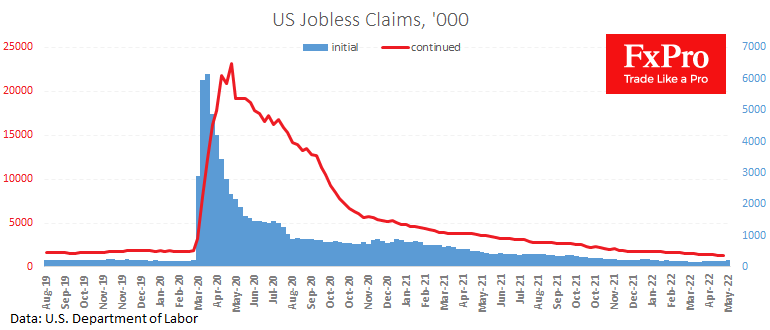

The US labour market is becoming increasingly tight, but at the same time, the rate of job alternation is increasing steadily. The latest weekly data shows that the number of new jobless claims is dropping further to 1.317M, a new.

May 19, 2022

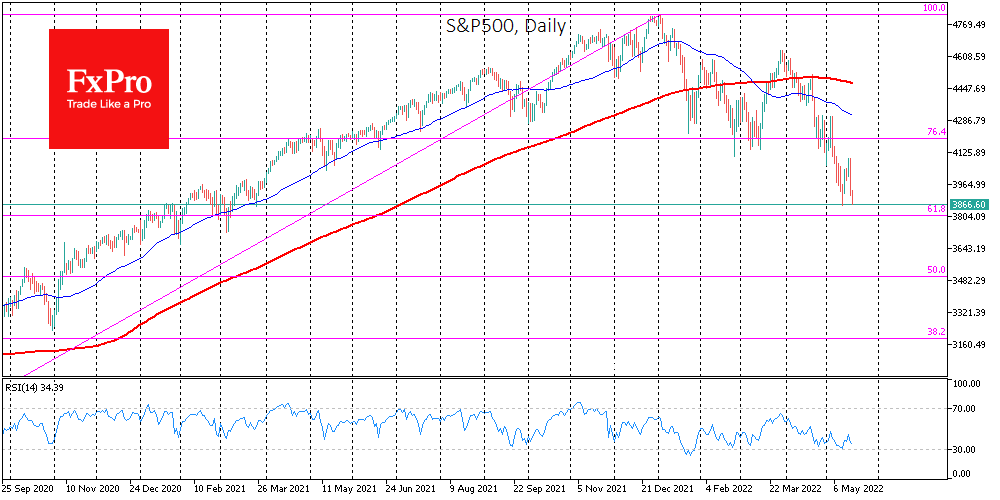

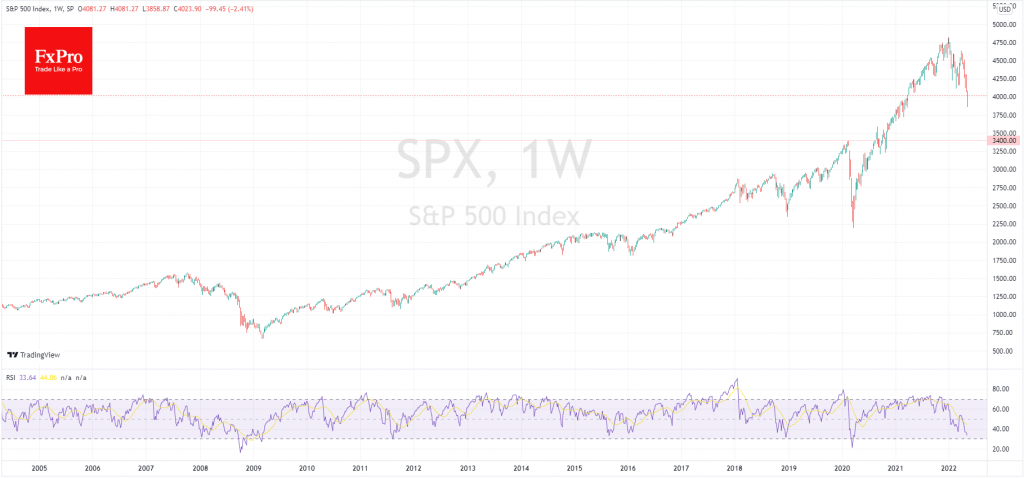

The US market crashed significantly in Wednesday’s trading, with echoes of the fall reverberating across Asian exchanges on Thursday morning. The US S&P500 is down more than 4 per cent for the day, the biggest fall since June 2020. The.

May 18, 2022

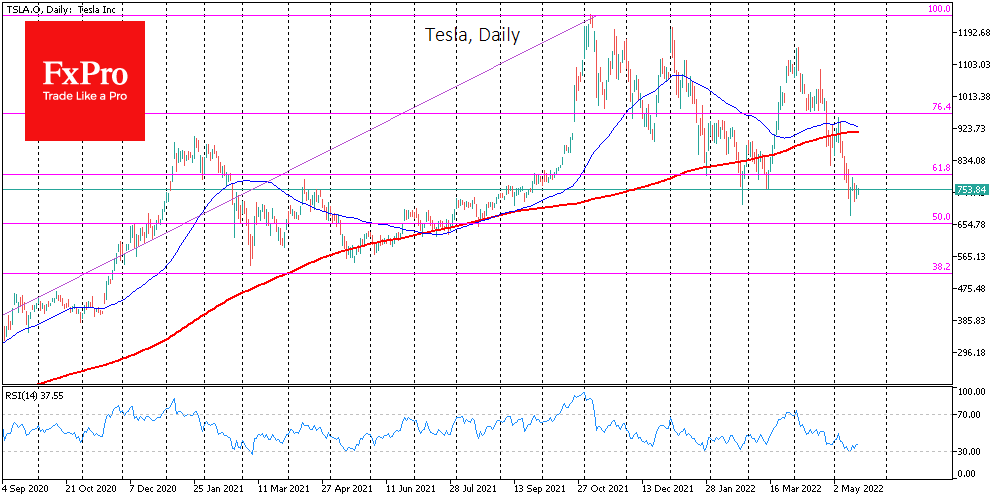

Tesla stock has always been more volatile than the stock market. The list of variables in this stock ranks from the outlook for demand for electric cars (i.e., oil prices) and interest in the ESG agenda, including the economic outlook.

May 18, 2022

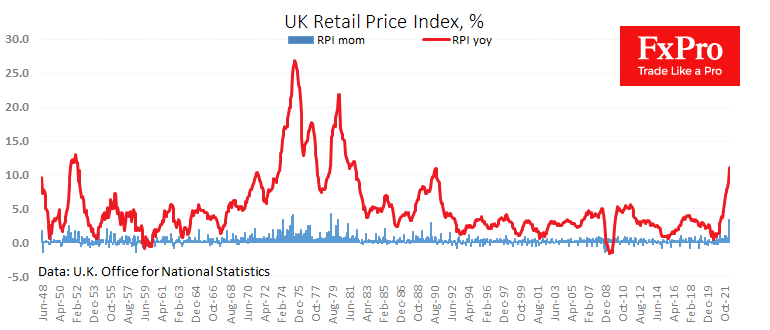

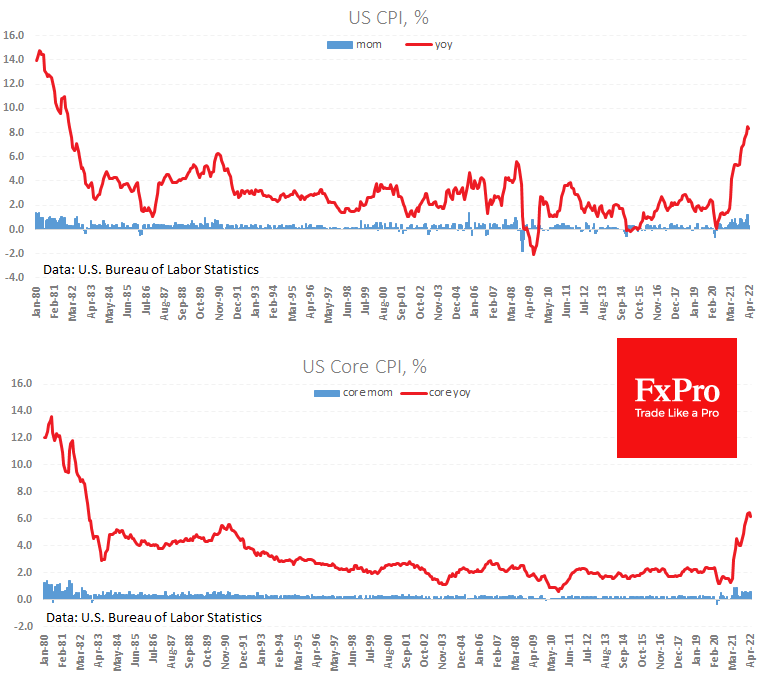

UK consumer prices rose by 2.5% in April, the second-biggest monthly gain in the indicator’s history since 1988. Annual inflation jumped from 7% to 9%, unseen in the indicator’s history. The longer-established retail price index last saw a high annual.

May 17, 2022

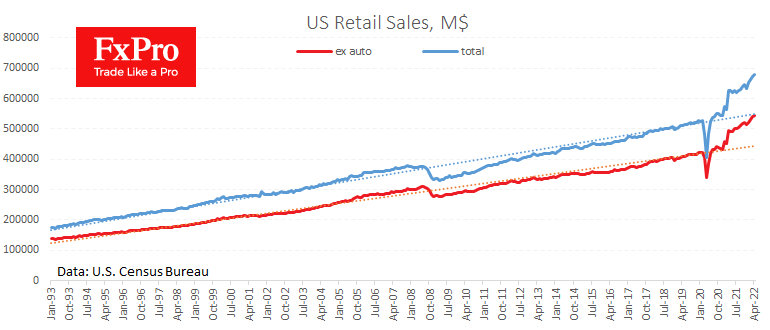

US retail sales continue to grow strongly, adding 0.9% in April after 1.4% a month earlier and slightly weaker than the expected 1.0%. Sales excluding autos and gasoline rose 0.6% after 2.1% a month earlier and against an expected 0.4%.

May 17, 2022

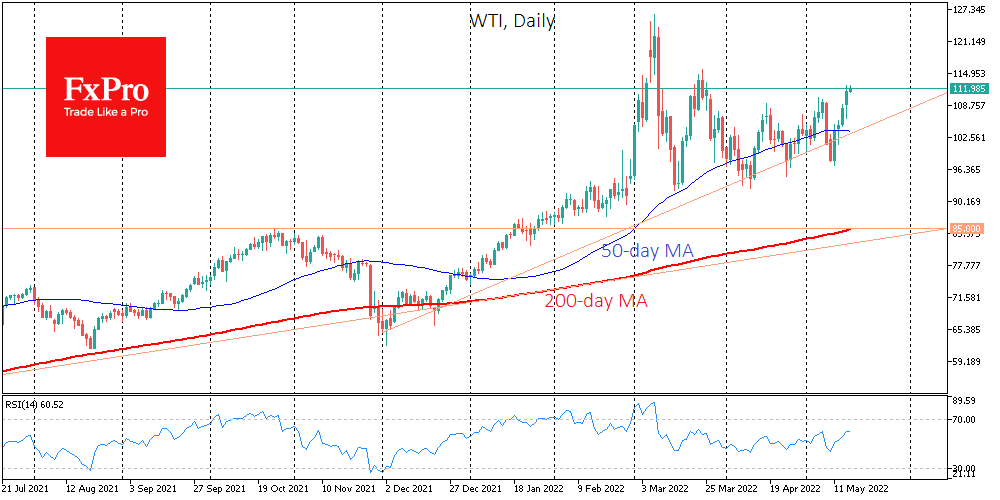

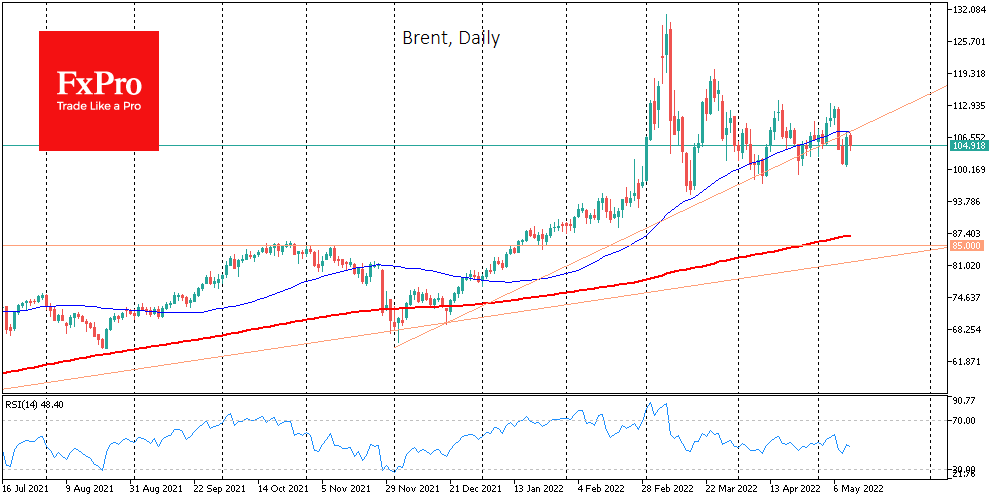

Crude oil has added 15% since last Wednesday, rising to $112/bbl WTI and $113/bbl Brent. Both grades reached new two-month highs on Tuesday morning, despite a decidedly bearish news backdrop. A sharper than previously estimated slowdown in China and not.

May 16, 2022

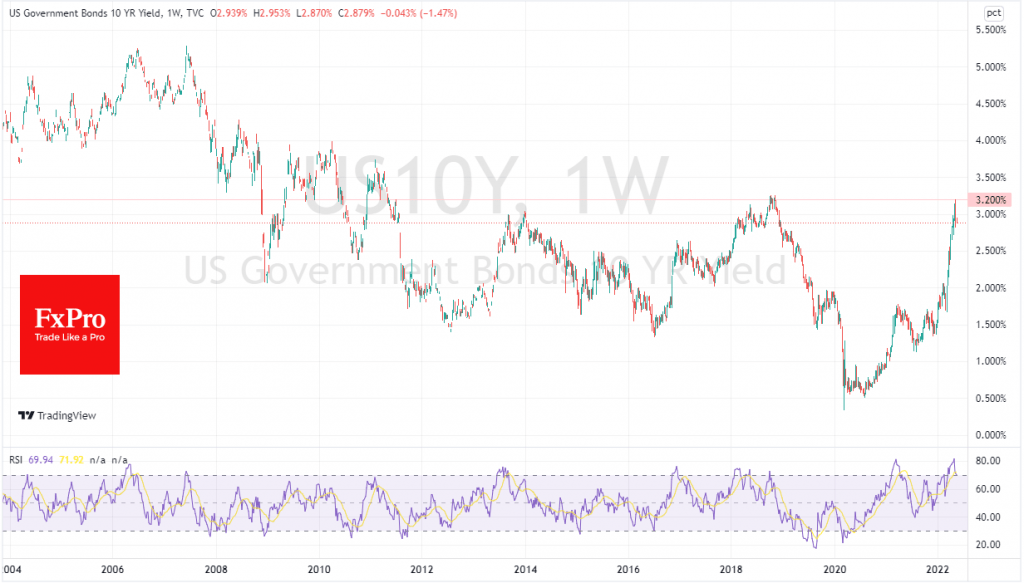

US 10-year bond yields fell last week, retreating from the 3.2% mark. This is one of the most critical levels of the debt market during the previous ten years, so investors and traders should pay increased attention to further developments..

May 16, 2022

US stock markets closed last Friday with a substantial and widespread gain. Do we see a dead cat bounce or the beginning of a recovery? So far, there are more reasons to suspect the former. The CNN Fear & Greed.

May 13, 2022

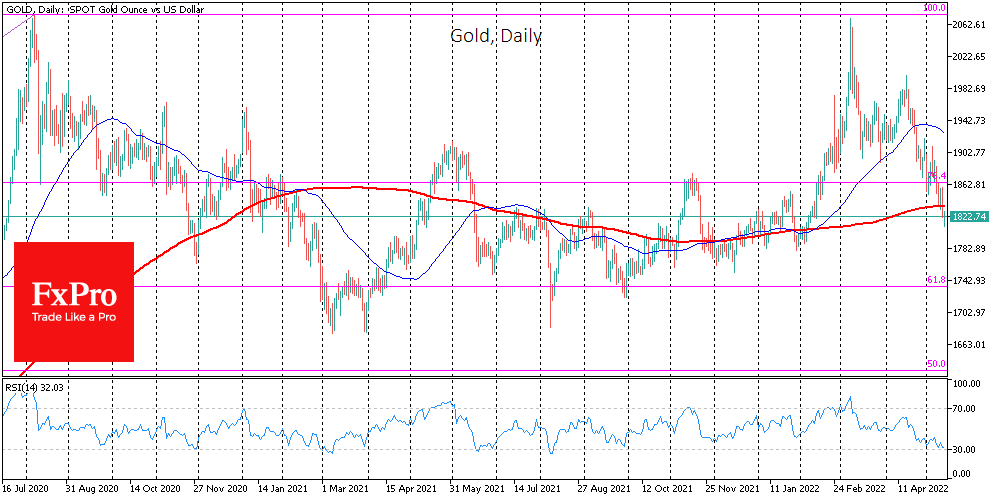

A sell-off in the equity market and a new wave of flight to the dollar on Thursday provided the perfect combination to knock out gold, which slipped to $1810 in thin trading on Friday morning, falling to its lowest level.

May 12, 2022

Crude oil must balance between a strengthening dollar and stock market pressure on the one hand and the problematic energy supply situation on the world markets on the other. In our opinion, this delicate equilibrium has the potential to break.