Market Overview - Page 103

June 23, 2022

• EURJPY reversed from resistance level 144.00• Likely to fall to support level 140.00 EURJPY currency pair earlier reversed down from the pivotal resistance level 144.00 (top of wave (i) from the start of June), standing close to the upper.

June 23, 2022

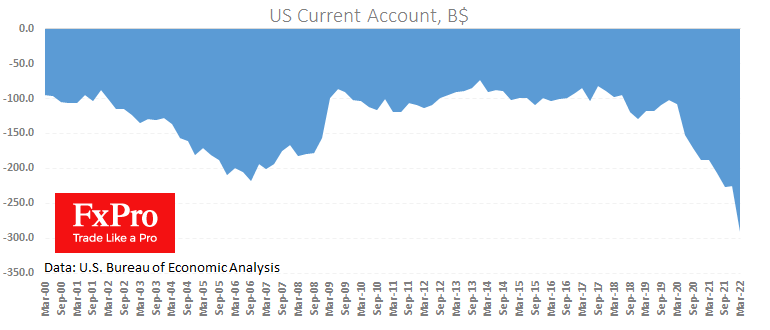

The US Current Account deficit hit a new record of $291.4bn in the first quarter. America is benefiting from higher oil prices, which helped exports rise by $13.9bn to $487.4bn. But the gain in imports was more than five times.

June 23, 2022

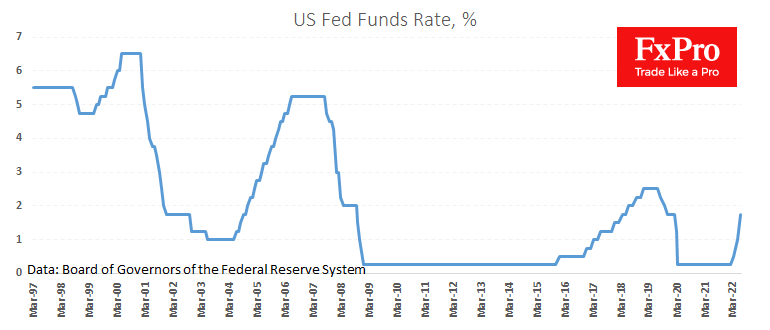

The stock market failed to remain positive for the day, closing Wednesday with a slight decline. Stocks, commodities, and currencies dynamics since the start of the day on Thursday indicate the potential for further downside. Investors are getting more signs.

June 22, 2022

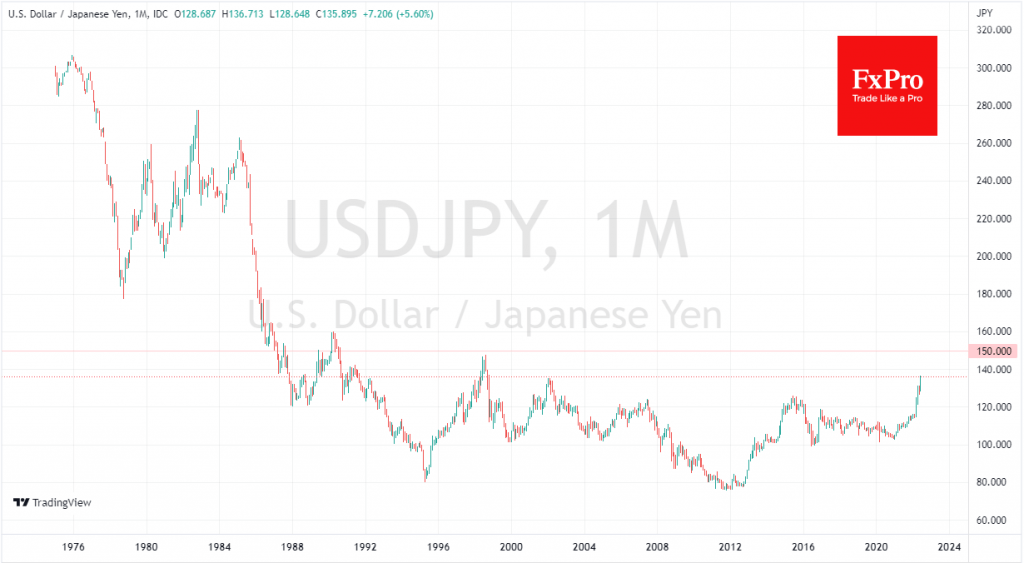

The Japanese yen leads in losses against the dollar amongst the G10 currencies. And so far, there are indications that the USDJPY’s rising trend will only be interrupted by technical corrections in the coming weeks or months. The main fundamental.

June 22, 2022

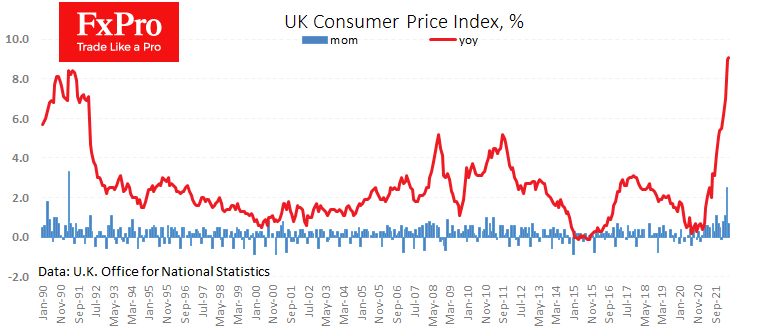

Consumer inflation continues to gain momentum in the UK. Data for May showed that CPI accelerated to 9.1% y/y – a record among the G7 and a 40-year high. The monthly price growth rate was 0.7% compared to 2.5% and.

June 21, 2022

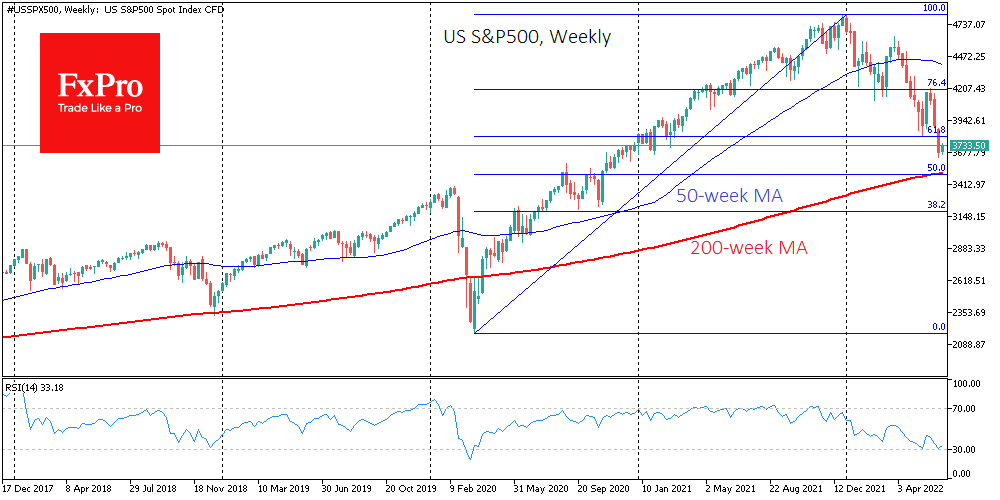

The US market opens later today after a long weekend. S&P500 futures indicate a 1.5% gain to Friday’s closing level, playing off the positive outperformance on the outside. The currency market has also swung towards buying risky assets, reinforcing hopes.

June 21, 2022

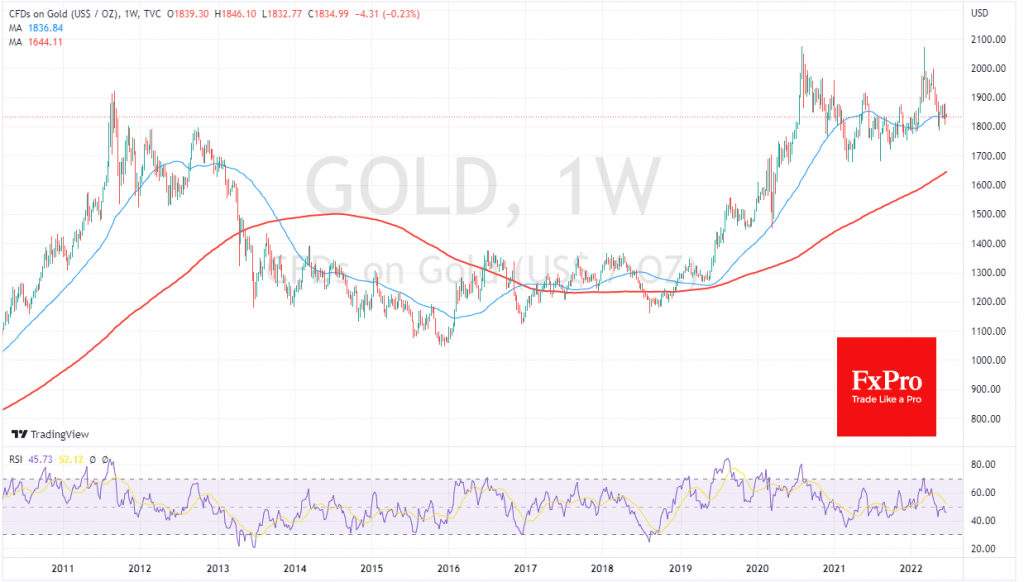

Despite attempts at rebounding equity markets, moderate pressure on gold has persisted for the third consecutive trading session. This pressure is directly linked to rising long-term bond yields on US debt and several other developed countries. Bonds and gold work.

June 20, 2022

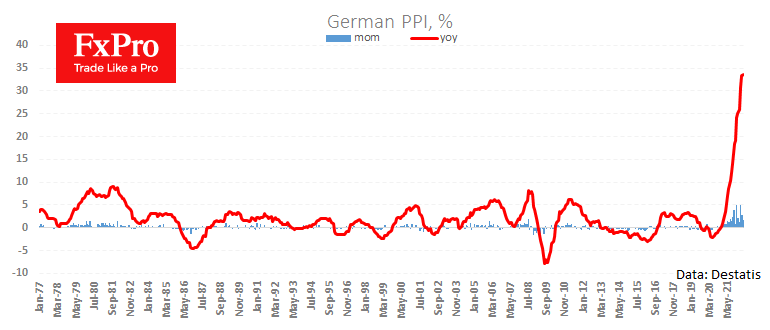

Still no sign of a slowdown in German inflation. Fresh data marked a 1.6% rise in producer prices for May and an acceleration to 33.6% y/y, suggesting further upward pressure on consumer inflation in the coming months. The fresh batch.

June 20, 2022

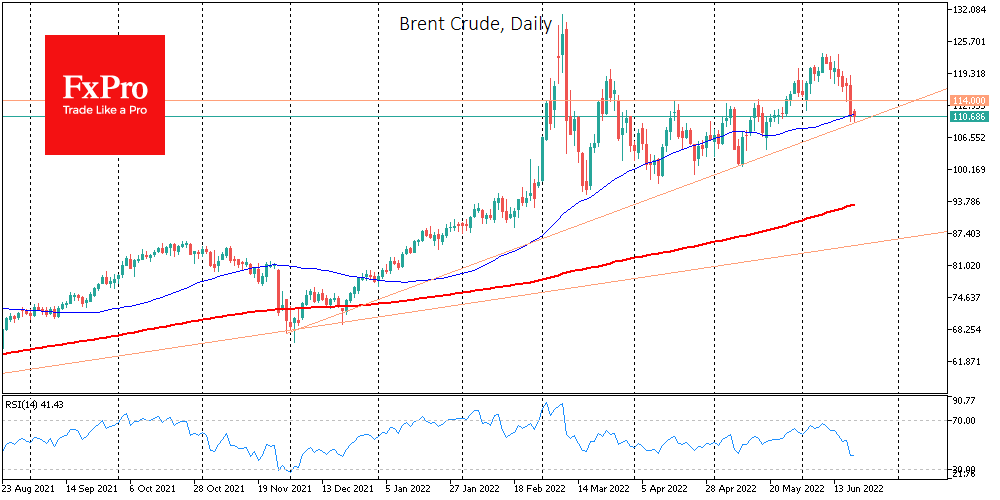

Friday’s collapse added signs of oil’s reversal to a bear market. Brent losses exceeded 5% over Friday, and the pressure continued into Monday morning. Brent dropped more than 11% from the highs of June 8 to around $110, which was.

June 17, 2022

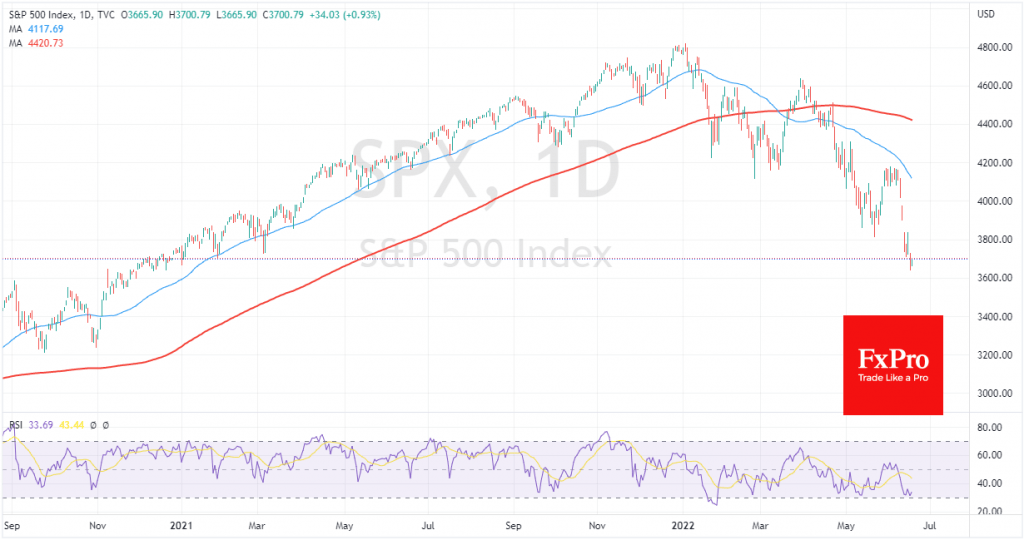

US stock markets updated multi-month lows on Thursday, pushing the S&P500 back to December 2020 and the Nasdaq back to November 2020 at one point. On Friday, before active US trading starts, we see the market attempting to form Friday’s.

June 17, 2022

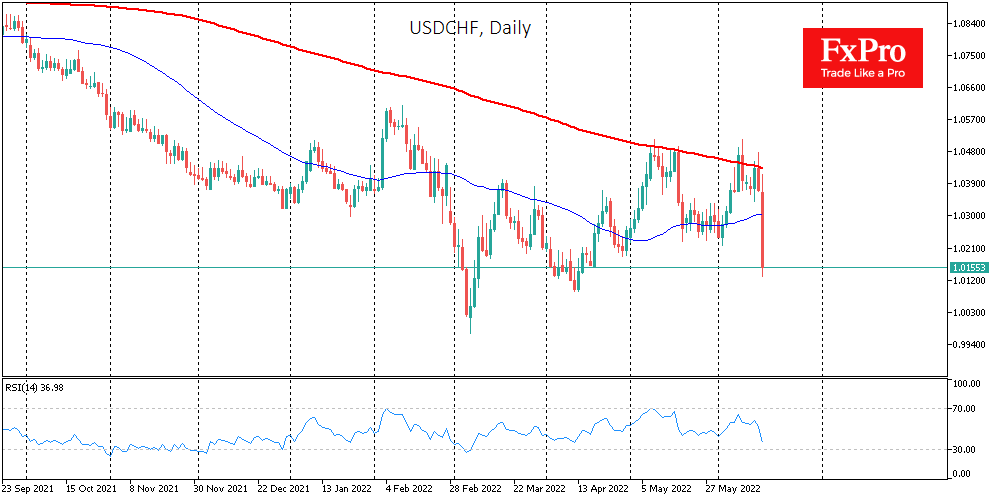

In a surprise decision, the Swiss National Bank raised its key rate by 50 points to -0.25%, the first increase in the country in 15 years. The SNB commented on the decision that it does not rule out further rises..