Market Overview - Page 10

October 24, 2025

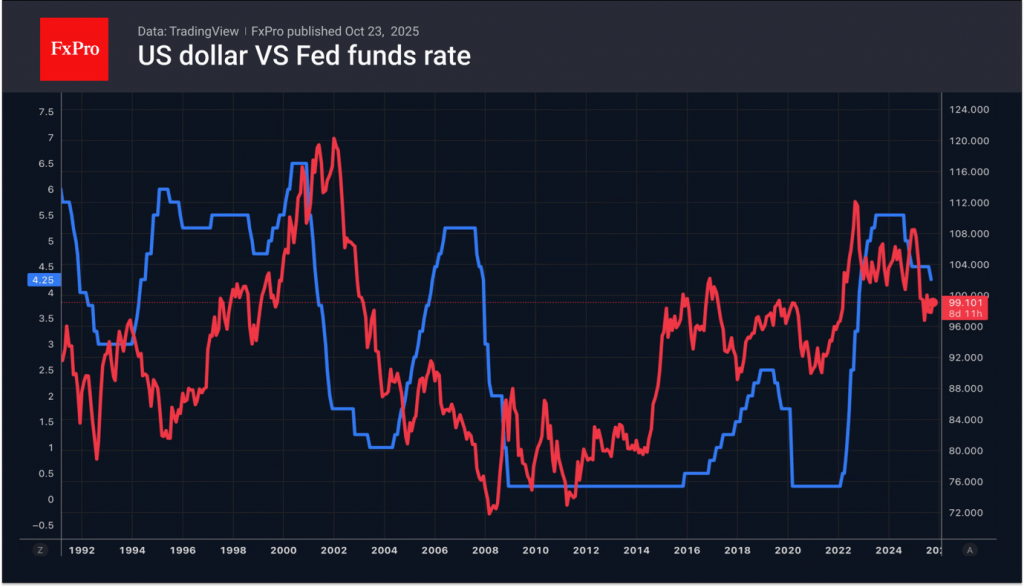

The US dollar rises as rates are reassessed and rivals weaken; the S&P 500 remains volatile, with strong earnings but cautious investor sentiment.

October 22, 2025

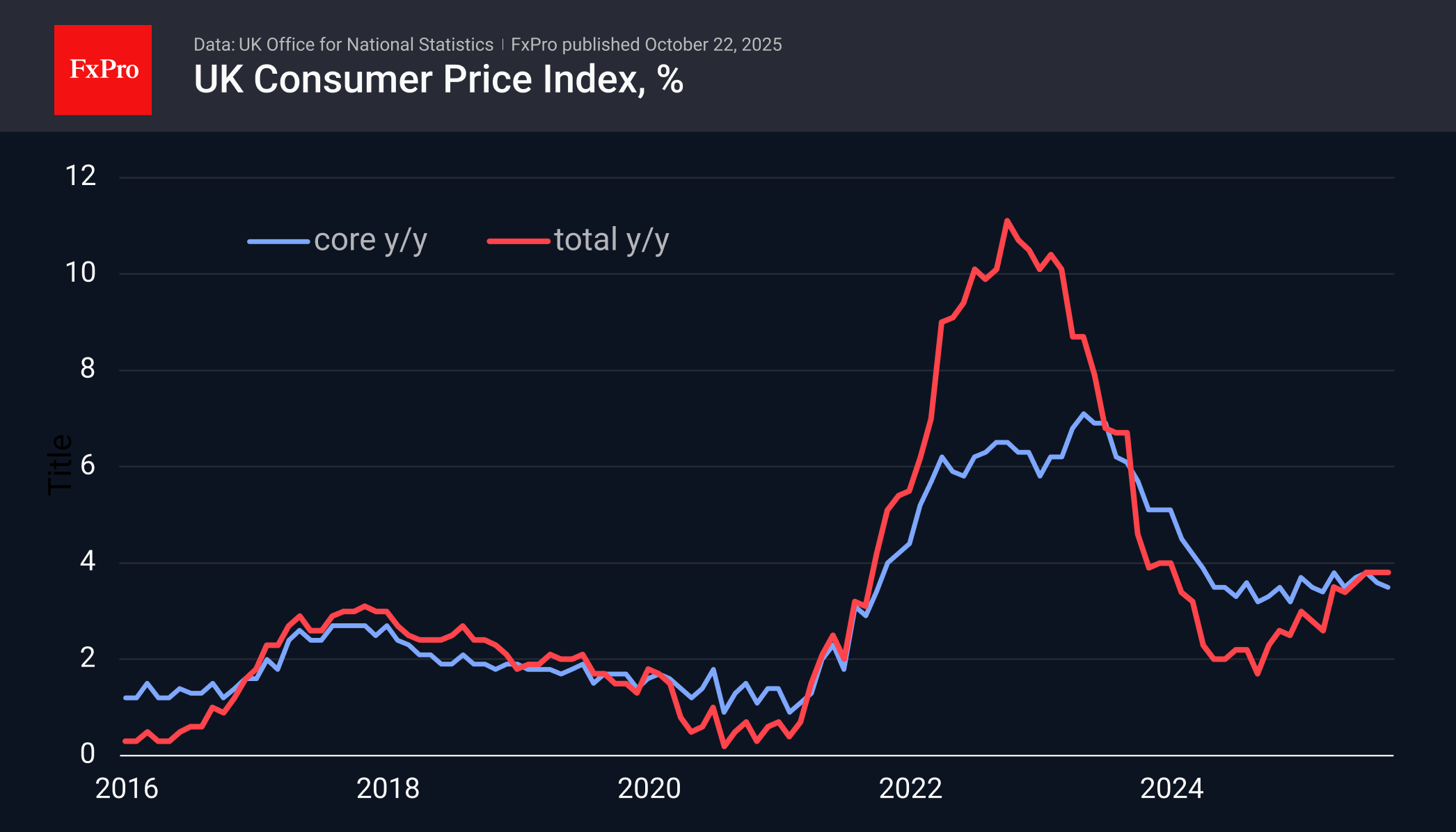

Weaker UK inflation pressured GBP, boosting the FTSE 100, which nears record highs amid expectations of monetary policy easing.

October 21, 2025

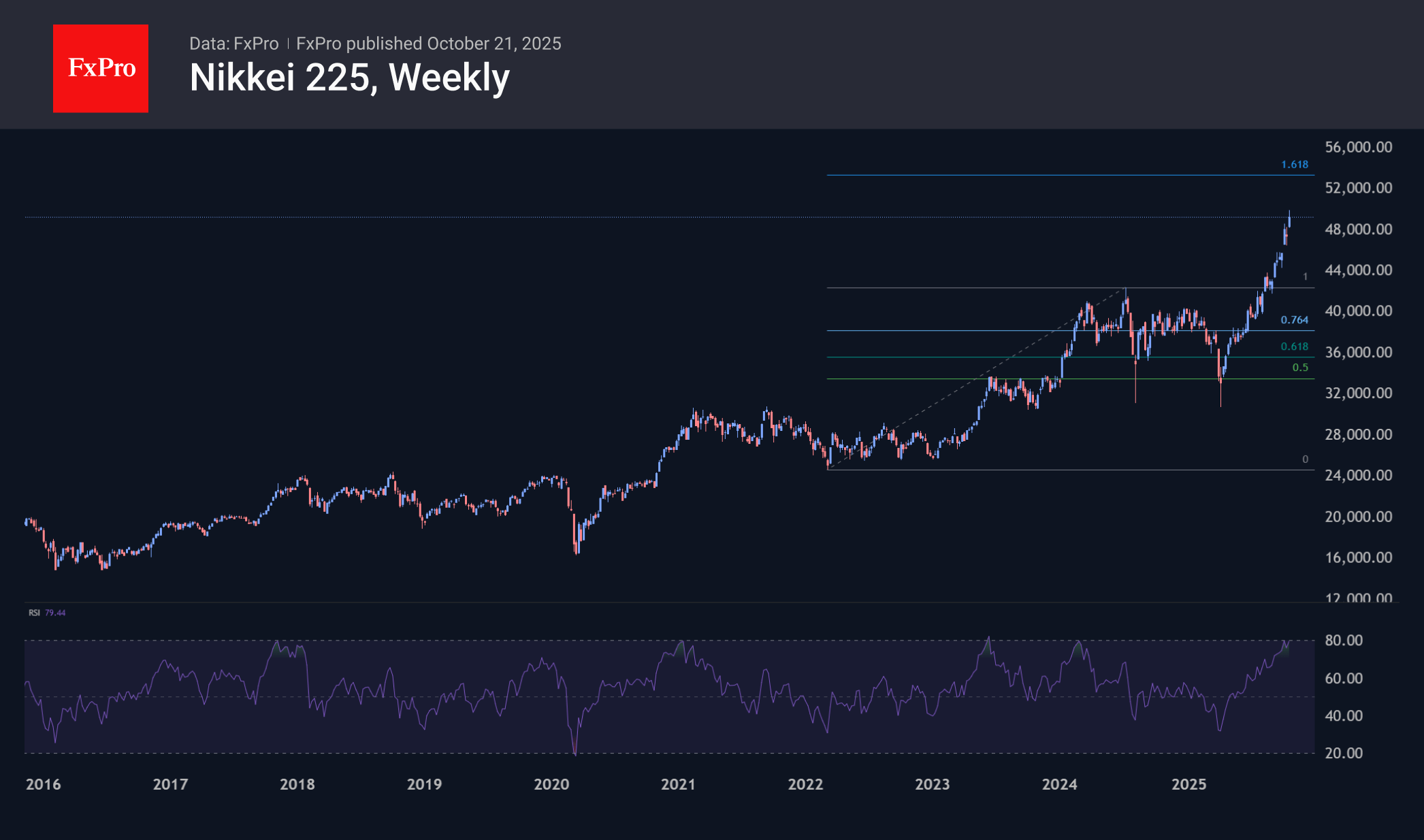

Anticipation of Japan’s new female PM boosts stocks, yen weakens, Nikkei rallies; after short recharge, USDJPY eyes 158–160, Nikkei 225 – 52000-53000.

October 20, 2025

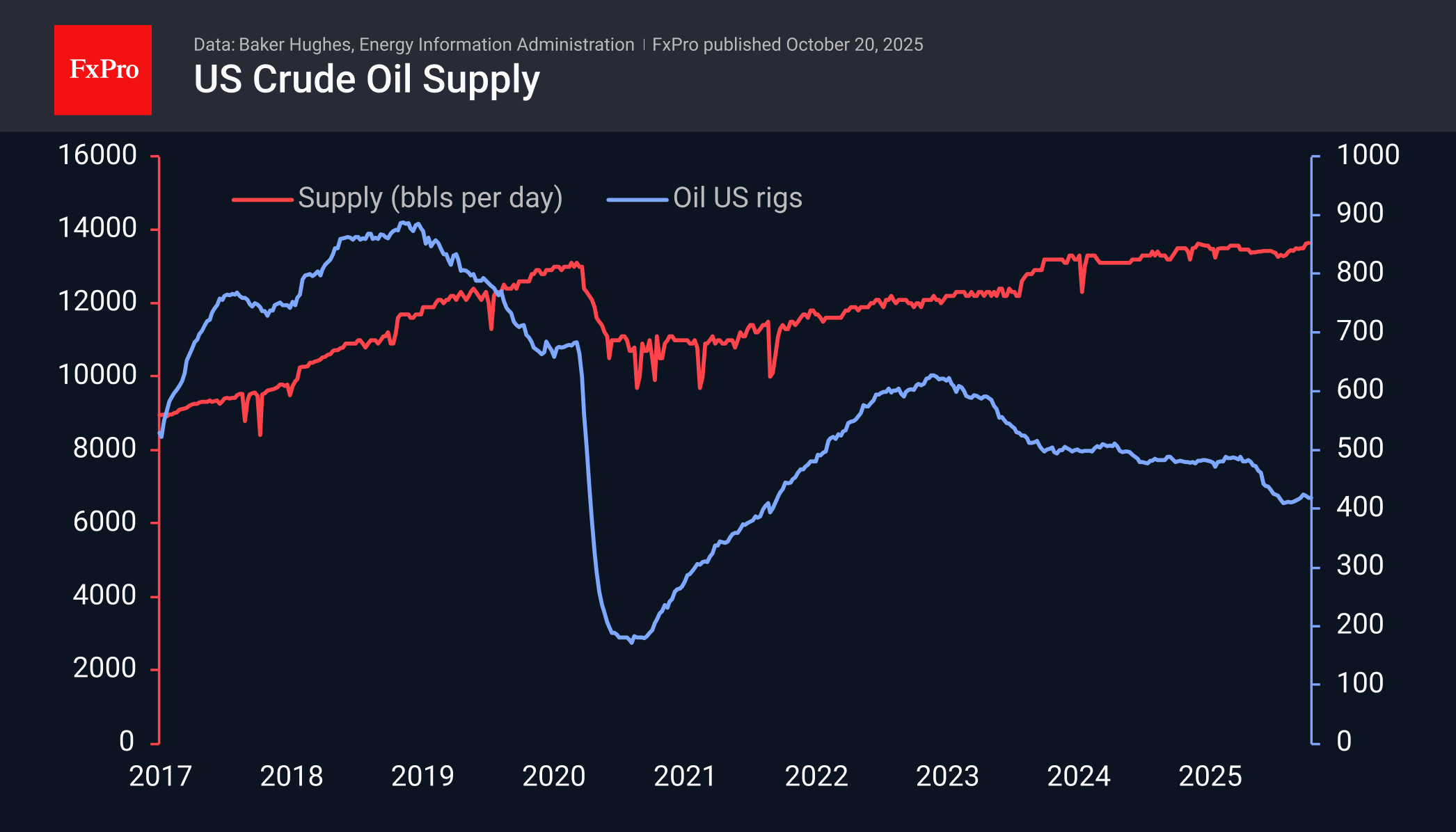

Oil prices could drop 15% by year-end due to rising supply, slowing demand and shrinking risk premiums, with Brent possibly nearing $50.

October 17, 2025

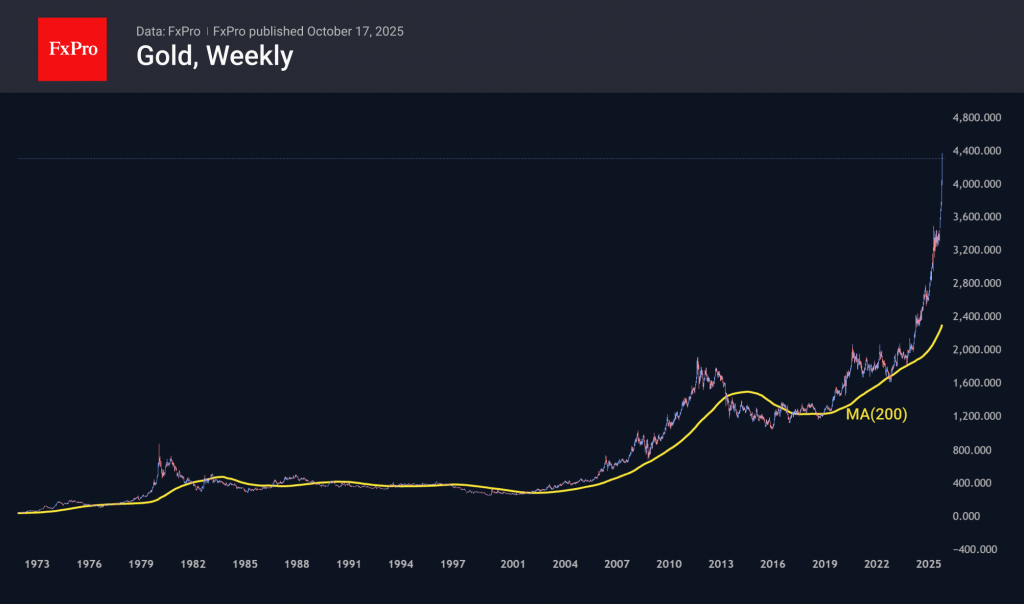

Gold's price has surged above $4,300 due to government debt issues and low interest rates, driving investors toward precious metals. Despite a strong rally, a technical pause may be near

October 17, 2025

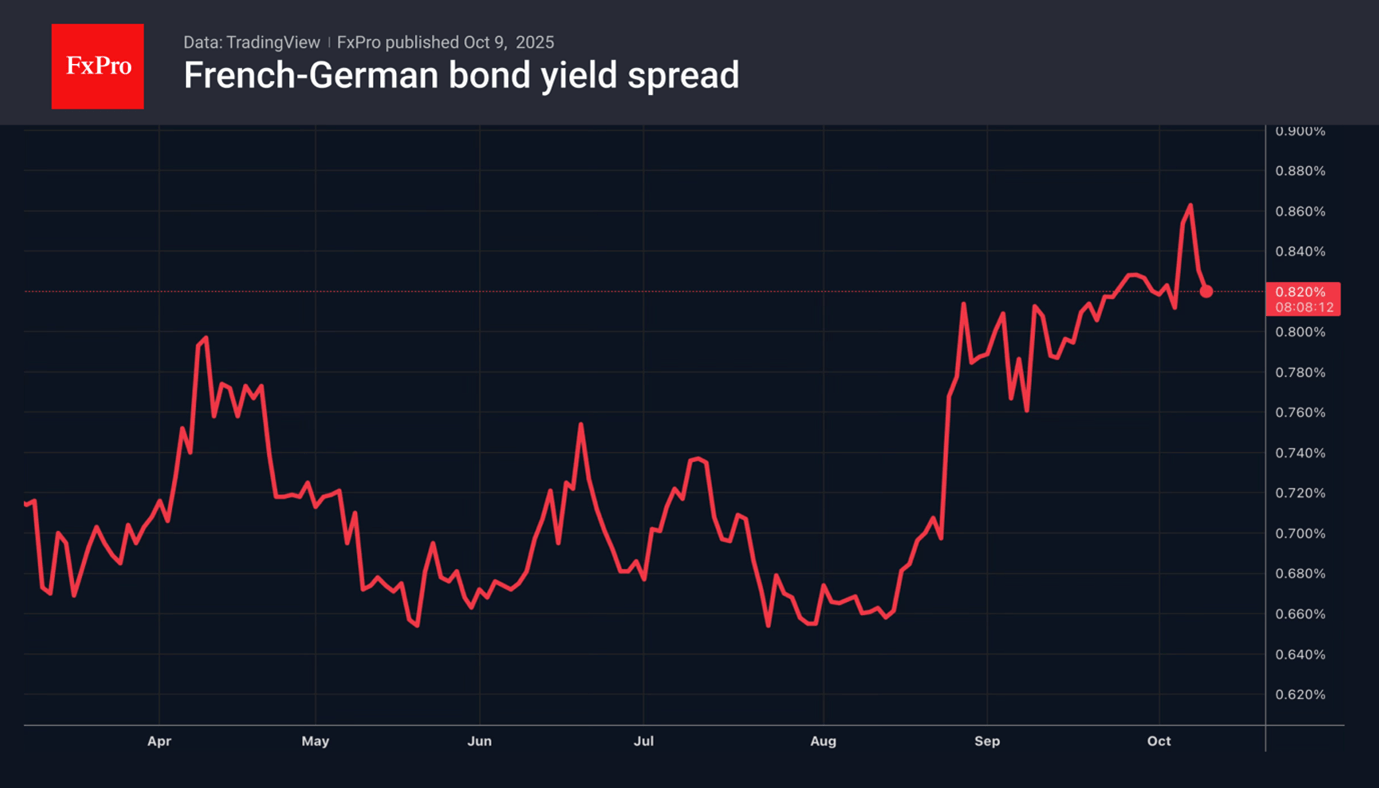

The escalation of the trade conflict between the US and China brought the American dollar back down and pressing stock indices

October 17, 2025

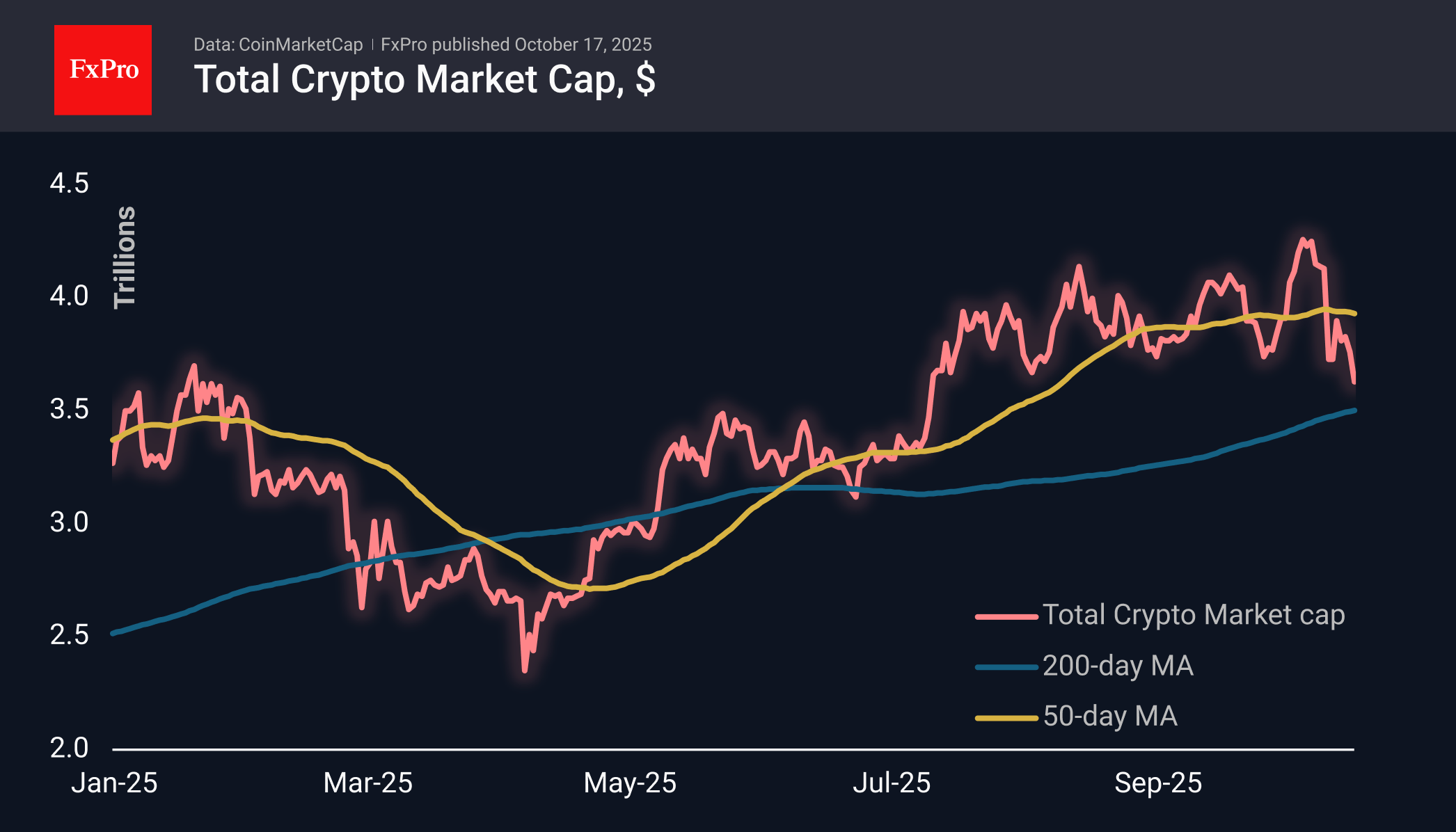

The crypto market losing 5% on Friday and it is dangerous because it is not a queeze on a thin market

October 15, 2025

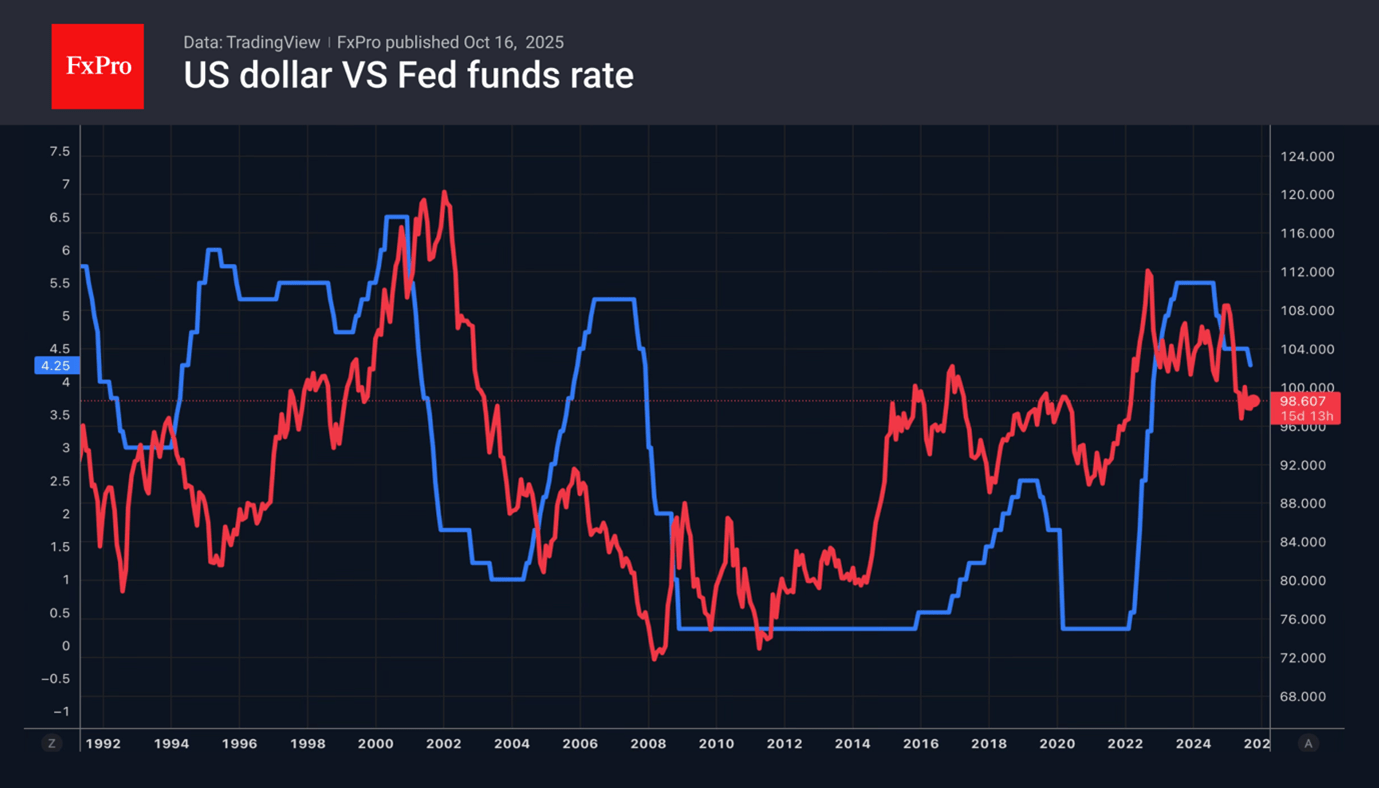

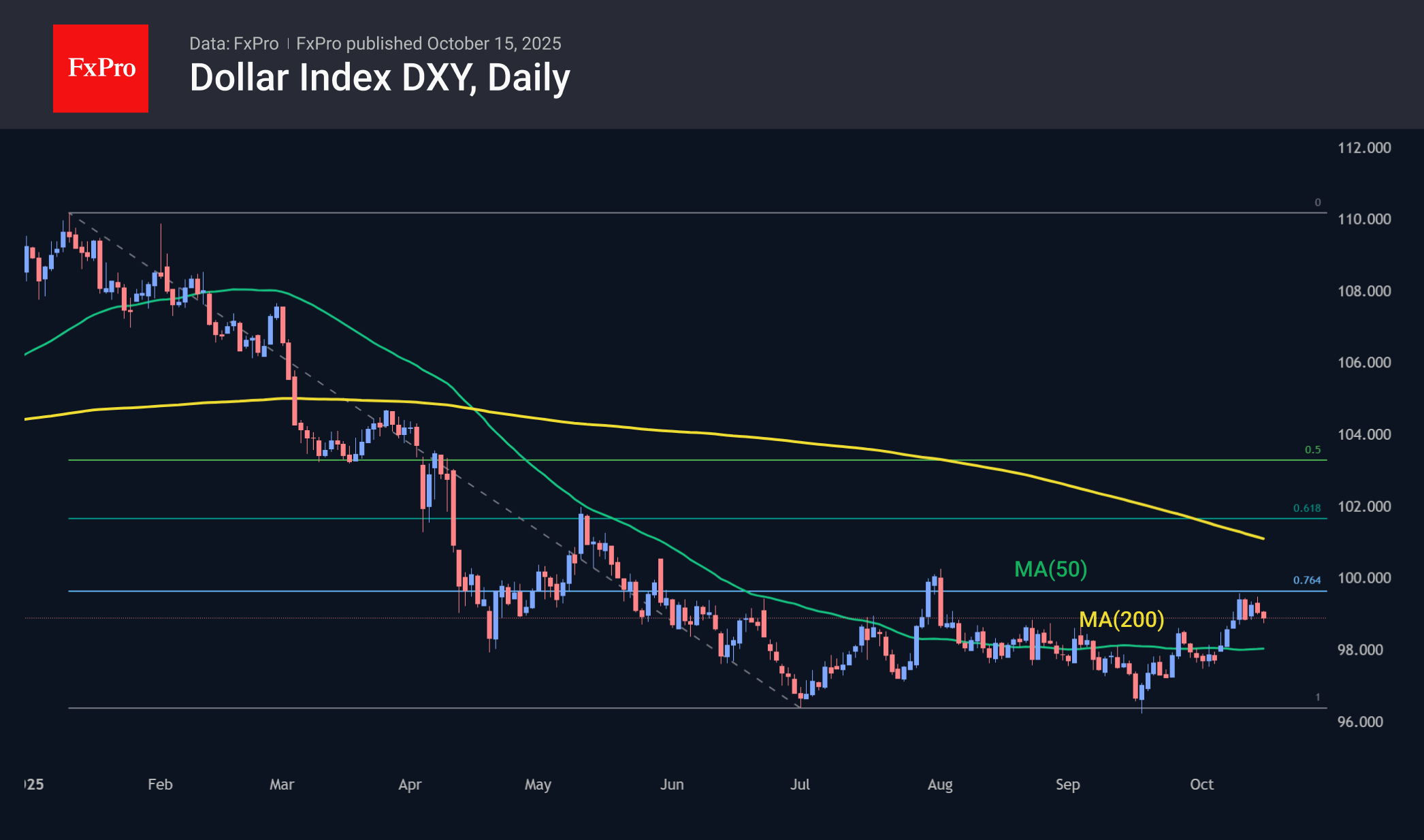

The US dollar faces downward pressure amid market momentum and Fed comments, but remains in a key range, with long-term trends at risk if support breaks.

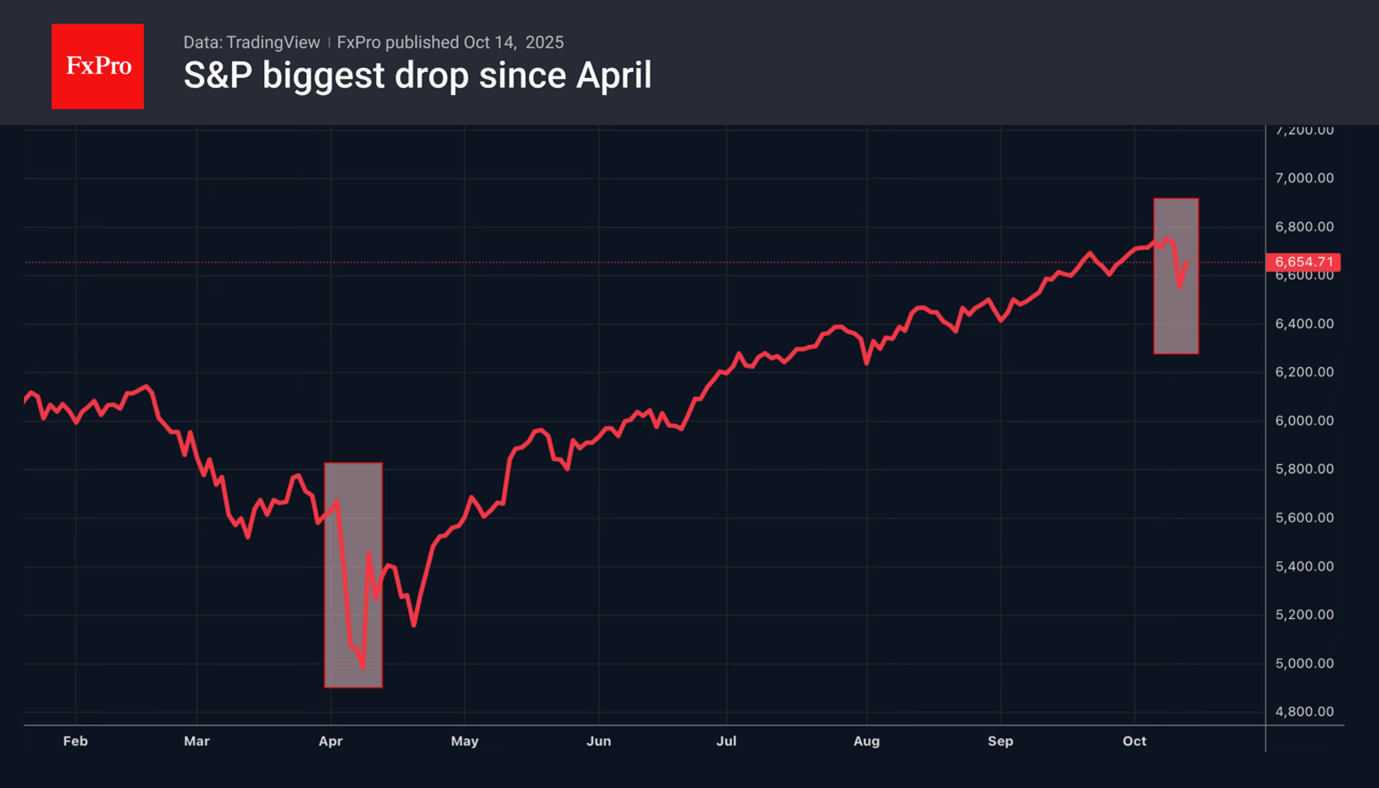

October 14, 2025

Trump's tariff threats shook markets, but optimism returns as talks continue and strong corporate profits fuel S&P 500 resilience.

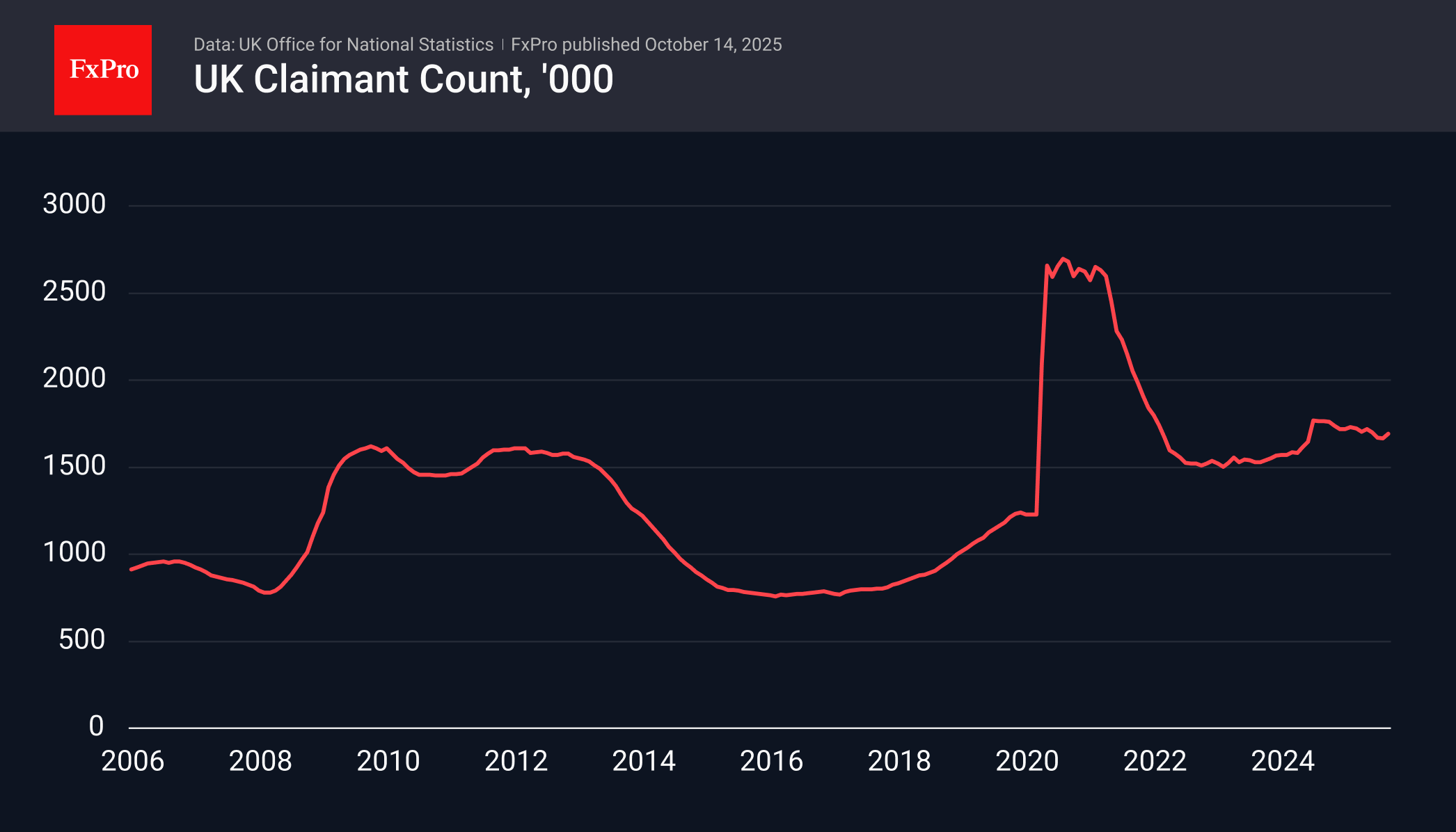

October 14, 2025

The pound weakens as UK jobless claims and unemployment rise, raising pressure on the Bank of England and signalling a possible trend reversal for GBPUSD.

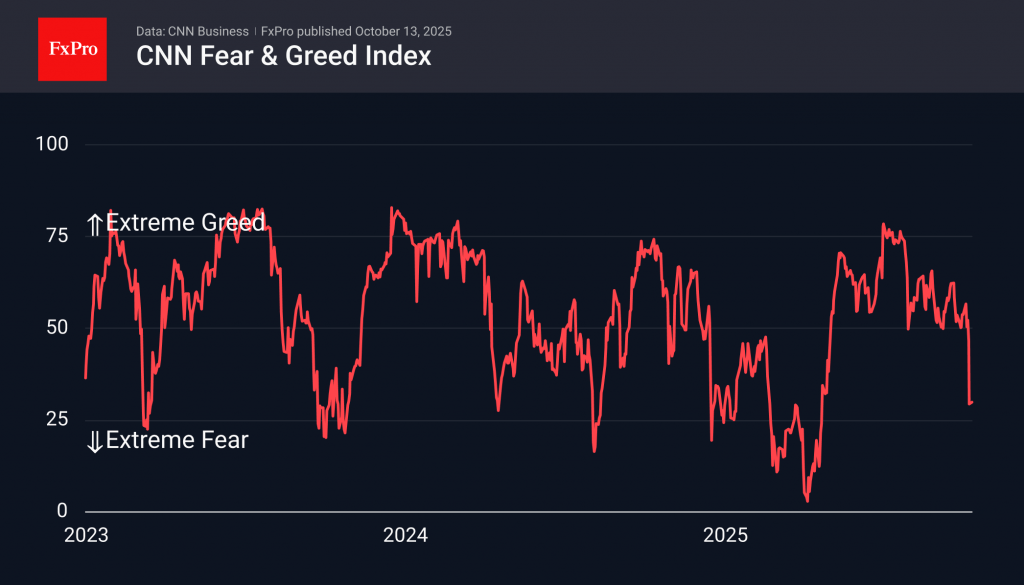

October 13, 2025

US stocks may face more pressure as trade tensions linger, market fear remains high, and correction is likely amid weak economic signals and seasonal bearish trends.