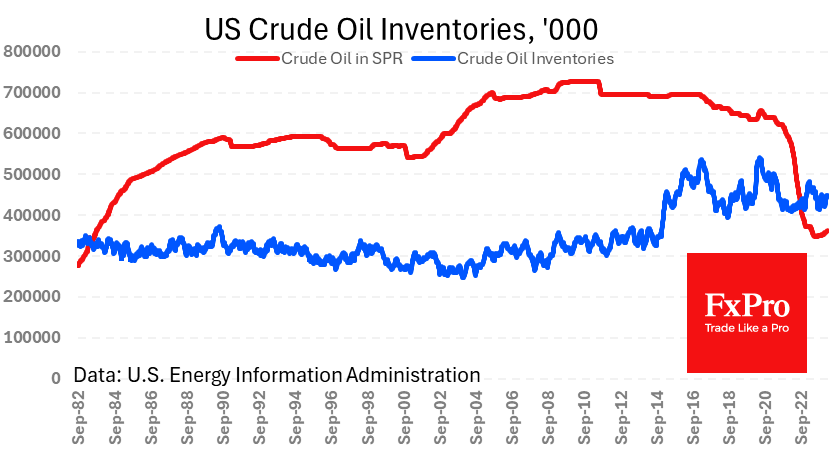

US commercial oil inventories rose by 3.2m barrels last week, against expectations for a decline of 0.7m. At the same time, the Strategic Petroleum Reserve rose by 0.74m barrels, maintaining the pace of recovery since mid-December.

Oil production maintained its pace of 13.1 mb/d for the third week in a row. At current supply levels, commercial inventories are 5.5% lower than a year ago and remain near the lower end of the range over the past nine years. But before 2015, the 400M barrels level was a historical upper bound.

At the current rate, it will take almost seven years to replenish the SPR to the June 2021 start of sales. It would take almost 9.5 years to recover to the 2011 highs.

But we are unlikely to see commercial or strategic stocks recover to the highs any time soon. This is not feasible given the more than doubling of production over the past 15 years, reduced US dependence on imports and the development of “new energy”.

Higher-than-expected inventories have not put pressure on prices. The price of a barrel of WTI remains close to $81, holding on to the former upper boundary of the upward range that has been in place since December.

The FxPro Analyst Team