Oil has risen since last Thursday and regained momentum on Monday on news of new production cuts from Russia and Saudi Arabia.

Russia announced on Monday that it would cut oil exports by an additional 500K BPD from August, on top of the same move in March. Saudi Arabia said it would extend its voluntary production cut by 1M BPD for another month. The major OPEC+ players are moving further down the supply cut path to support the price.

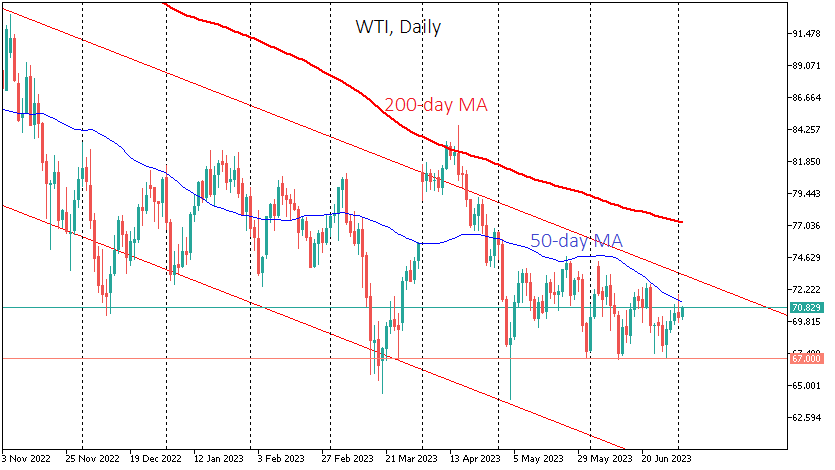

These actions have an effect as they form a solid support line on the charts near $67 per barrel WTI and $72 for Brent. Repeated interventions in the oil market by OPEC+ leaders contribute to a positive feedback loop, with expectations of cartel intervention keeping prices above the desired level.

In addition, reports of a new contract to buy oil into US reserve storage facilities also play into oil’s hands. So, politicians from the biggest oil producers are delivering bullish news for oil.

However, the market is taking a more pragmatic view, and multiple supply cut announcements only have a short-term positive effect on the price but do not change the overall trend. As a result, in addition to the horizontal support since March, the price charts continue to show a downtrend throughout the year. These lines will cross in August, but the market will likely decide on a direction before then.

Given the economic performance and the continued hawkishness of monetary policy, the chances of a bearish breakout are higher.

The short-term technical picture is also bearish, as oil failed to break above its 50-day moving average on Monday, although it was in positive territory early on Tuesday.

The FxPro Analyst Team