Oil lost its momentum but retained its growth potential

October 13, 2020 @ 12:24 +03:00

The technology giants are pulling the markets up again. However, this time their positive impact has not yet been able to create a broader growth impulse, leaving oil behind.

Slowly but surely, oil is being pressured by news that is undermining the delicate balance of supply and demand. The USA is recovering its production disturbed by Hurricane Delta. Libya is restoring output on its largest oilfield. In Norway, oil workers are back to work following the end of a strike. A formal agreement for a ceasefire between Armenia and Azerbaijan is also favourable for supply. Whilst it is too early to talk about the end of the conflict, progress in this direction removes the risk that gas-rich Azerbaijan will limit its production.

Meanwhile, fears of a tougher lockdown are increasing in the markets as coronavirus is spreading faster. Politicians are still far from repeating the hard spring restrictions and promise to avoid a repeat of these measures. All of this reduces fears of a new collapse in oil consumption to some extent but also prevents growth.

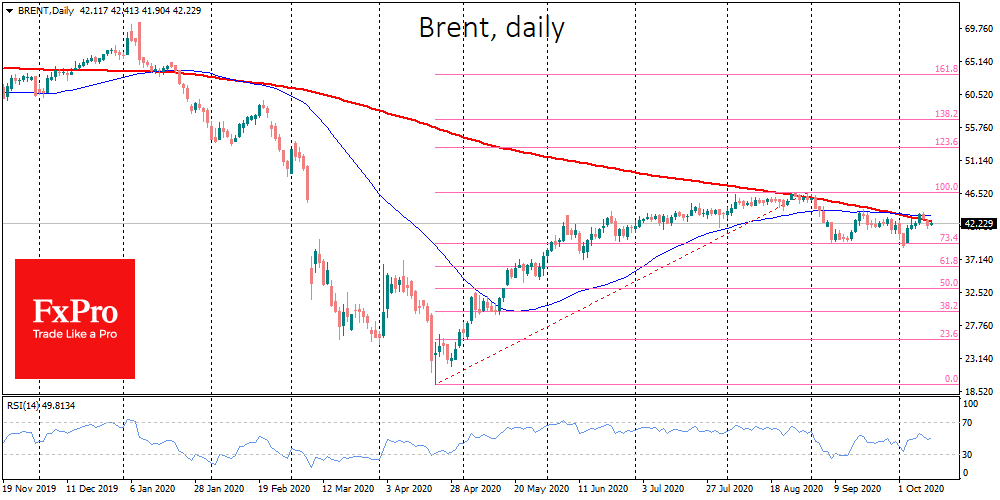

On the technical side, Brent failed to develop growth above the 200-day average by running around it for the fourth trading session in a row. Nearby is also the 50-day average, which last Thursday worked as short-term resistance.

In WTI oil, there is also some bull and bear resistance around the $40 level as a 50-day average.

In an environment of strong demand for growth assets in the stock markets, we can expect to see an increased interest in commodities, particularly oil, among stock market participants.

Besides, a near $2 trillion assistance package is under discussion in the US, including payments to households and support for affected industries.

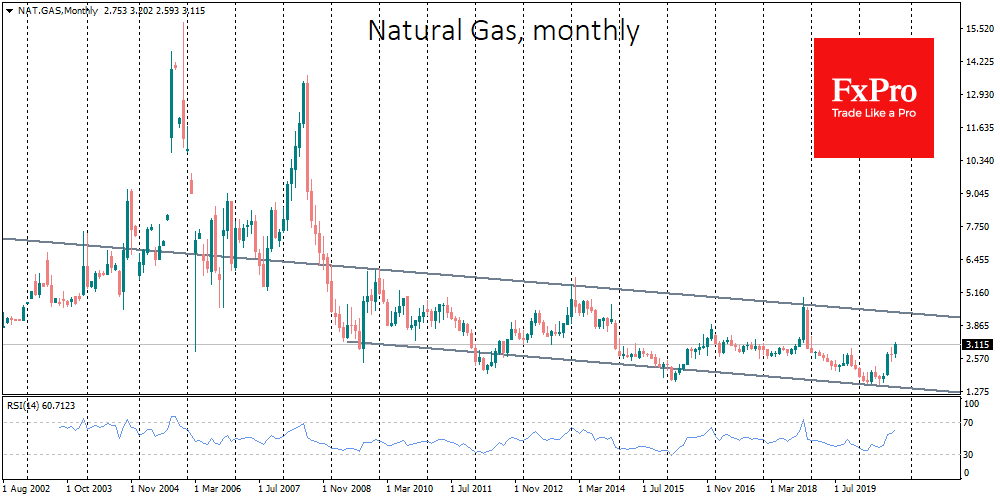

Elsewhere, traders should note positive dynamics of gas, the price of which has more than doubled in the last three months and reached its highest levels since early 2019. The price of gas is less speculative driven than that of oil, which is why it often serves as a guide to what “smart money” thinks about the broader trends and future of the energy market.

In June, gas pushed back from multi-year lows, moving to quite active growth and has already gone more than halfway from bottom to the top of the multi-year trading range. Thus, there is still enough room for growth on the raw materials market, the current hiatus should first be seen as a pause to consolidate the forces of the bulls before a new price spike.

The FxPro Analyst Team