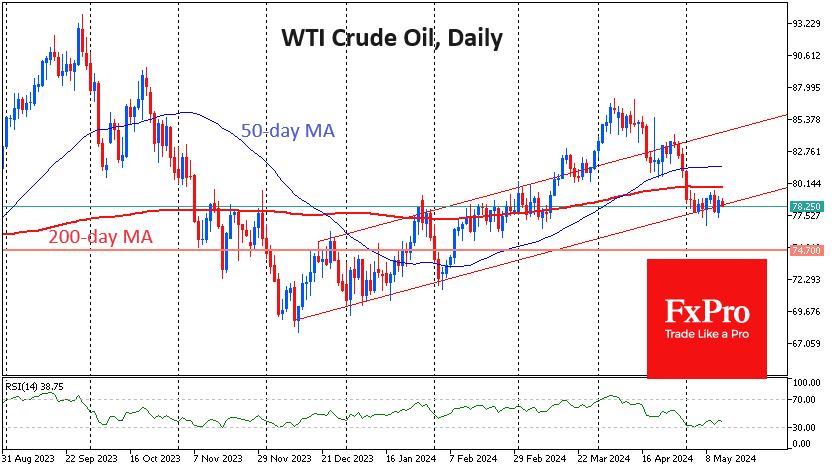

Crude oil has been under pressure over the past four weeks but has been gaining support on the decline to $77 per barrel WTI and $82 per barrel Brent since the beginning of the month. The price has been consolidating in roughly the same area for over a month since the second half of February. Then, there was a prolonged pause in growth to overcome the 200-day average. Now, it could be a pause before a further plunge.

The bears showed their strength a fortnight ago, causing a 4.5% drop in two days and pushing the price immediately below the 50- and 200-day moving averages, which are filters of the medium- and long-term trend, respectively. From this perspective, the subsequent consolidation last week and at the start of this week may be an attempt to remove excessive short-term oversold and build strength and liquidity for a new attack.

Also, the latest consolidation area roughly coincides with the support of the ascending corridor that has been in force for the past five months. A new downside momentum would be a formal prologue to break the uptrend with a potential downside target at $75 for WTI and around $79 for Brent. Near these levels lies the 200-week moving average, a dip below which has intensified discussions on production cuts, resulting in an upward reversal of prices. Impulsive dips below did not exceed 3% for over a year.

The US government’s stance has also changed over the past two years, and we are seeing buying to replenish reserves in downturns, as was the case late last year and early this year.

Of course, OPEC support and purchases into US reserves do not provide infinite support, and the market easily passed it in 2020, 2014 and 2008, and briefly in 2018 if we take the most recent history. Thus, oil’s failure under $72.5 for WTI and $76.3 for Brent could signal that the sellers have the upper hand this time. If this is a repeat of the almost free-fall that we saw in 2020, 2014 or 2008, the price could well plunge back into the $30 area. Near that price, most production becomes unprofitable. However, this has only happened because of a marked dysfunction in the financial markets. So far, there are no signs of this, although the situation may change quickly.

Still, the main scenario, we believe, is that oil returns to growth due to the ease with which OPEC+ can remove 0.5% of global production from the market – enough to reverse the trend. Also, we should not overlook the rise in commodity prices in recent weeks as China has increased steps to stimulate growth.