Oil intensifies decline, aiming for $65 by the end of year

December 20, 2021 @ 15:27 +03:00

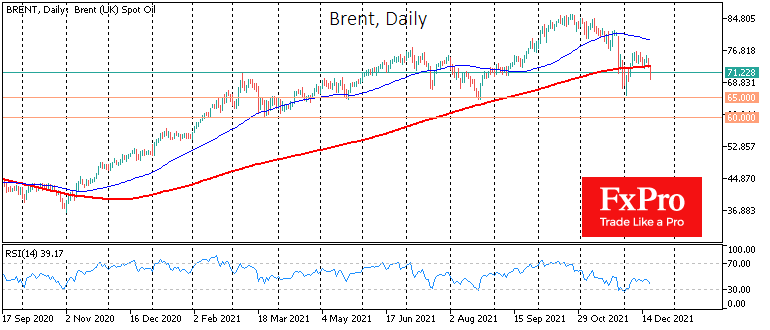

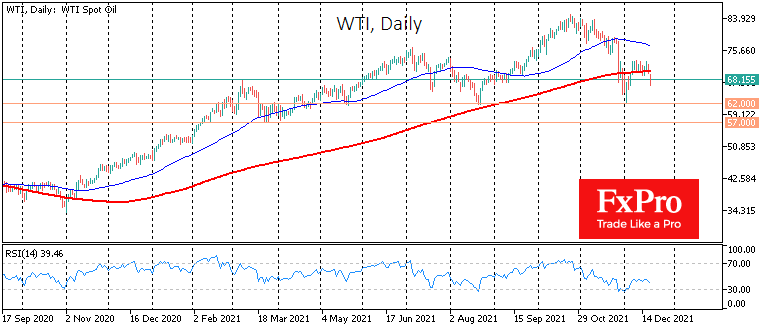

Oil came under pressure at the start of trading on Monday on news of lockdowns in Europe, but also oil broke significant technical levels, which opens the prospect of further price declines.

WTI ended last week close to $70, but pressure from reports of rising contagion in Europe and fears of a drop in demand due to lockdowns are causing a 4% dip so far on Monday to $66.5.

Brent fell close to $70, the level was last seen in early December. Earlier oil had bounced out of that area on hopes that Omicron would not be as dangerous as previous strains and its spread would not lead to new lockdowns. So far, these hopes have not been fulfilled, causing the capitulation of buyers betted on an easing of the pandemic.

But apart from Omicron, oil is under pressure from the technical picture. A sharp decline on Monday morning sent WTI and Brent below their 200-day moving averages. A consolidation below that line means that the current price is below the annual average, which often triggers exits from funds pursuing factor strategies.

It could well be that we saw the end of the price momentum that started last November at the end of October. For most of that rally, oil ignored negative news and reacted strongly to its positive news. Now we might well be witnessing a switch to a different mode and an emphatically strong reaction to the negative.

In addition, traders should not write off the continuing rise in production, both agreed by OPEC+ and caused by the US, where we see both production increases and the sale of reserves from reserves at the same time. Brent could potentially correct towards $65 before the end of the year, aiming for $60 in the early months of the new year. For WTI, that would be $62 and $57.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks