Oil collapse destabilized world markets

March 09, 2020 @ 13:43 +03:00

It is hard to imagine a more negative combination of factors that are now acting against Oil. No exaggeration, it’s a real perfect storm. No one knows for sure where is the bottom for the Crude Oil, because right now quotes are driven not by supply and demand forecasts, but by a massive triggering of stop orders and derivatives margin calls.

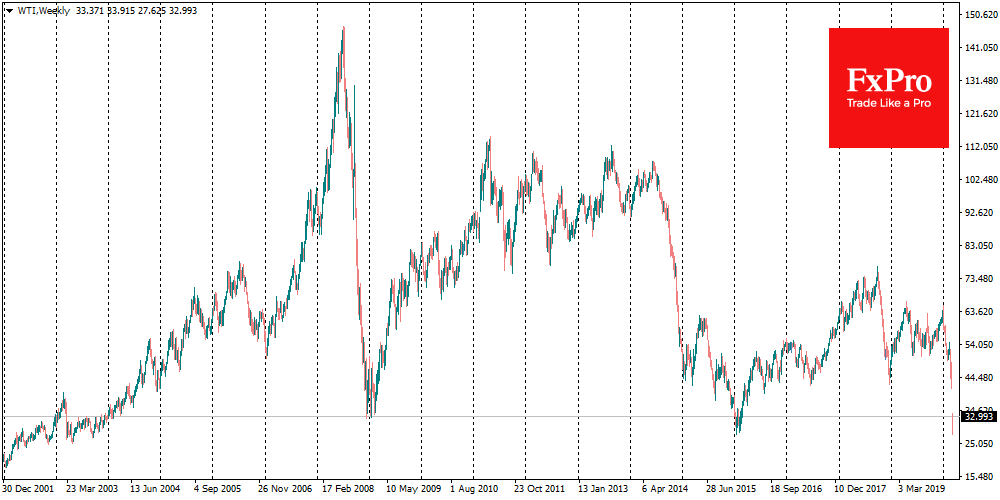

In a matter of several weeks, Brent slipped down from very comfortable levels for OPEC and Russia near $60 per barrel to just over $30, where it declined at the peak of market panic in late 2008 and early 2016.

The sharpest decline in prices since 1991, since the Gulf War, at the start of trading on Monday, was due to a combination of several adverse factors: – demand is plummeting as the world quarantine expands; – additional pressure on strengthened risk aversion; – Russia’s readiness to increase production since April and rejection of the OPEC plans; – Saudi Arabia’s announcement on lowering oil prices for Europe and vows to increase production.

Panic in the commodity market put additional pressure on European indices and stocks. Cheap Oil often fuels economic growth. However, the extreme prices volatility forms an almost mass rejection of risks. In the longer term, when the first shock of oil price collapse passes, the low price of commodities promises to provide support for the world economy. This was the case after the previous two dropdowns in 2008 and 2016, which boosted global economic growth afterwards and helped much of the stock to find the basis for growth.

Traders, who are trying to assess the prospects for entering the market right now, should be careful. The sharp decline of Oil and demand, in general, creates an environment for not only verbal interventions to calm market volatility. In the coming days, there may be more sharp moves in the markets in both directions.

The FxPro Analyst Team