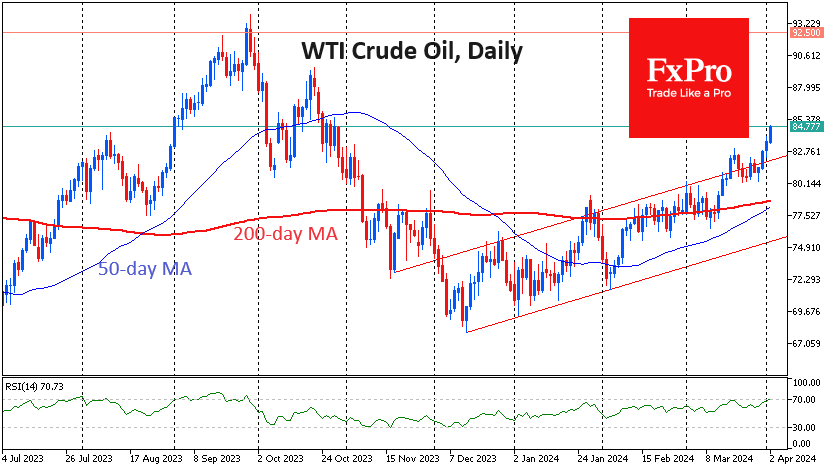

Oil prices have been hitting five-month highs, and every trading session has been rising since 27 March. The price of a barrel of WTI reached $84.6 at the start of the day on Tuesday before retreating slightly by midday in Europe.

To some extent, oil is managing to copy gold, which has also seen a steady increase in buying since the beginning of last week. The latest rally can also be attributed to signs of acceleration in China and continued strong manufacturing data from the US, which promises energy demand.

Contrary to common logic, oil prices are rising simultaneously with the dollar despite historically having a negative correlation. But America has commonly been the largest energy importer, consuming a quarter of all Crude in the early 2000s. In recent years, however, the US has become a net Crude exporter. Last year, it reclaimed the title of largest oil producer. Recently, it became the largest exporter of LNG, a formidable competitor to the OPEC+ countries.

Meanwhile, the states have maintained production at 13.1 million bpd since October last year. Drilling activity has also stagnated for all these months, barring any supply spikes in the coming quarters.

All of this argues for further price growth and methodical, albeit small, additions to the strategic reserve.

The price chart clearly shows the acceleration in growth since the second half of March, when the previous upper boundary of the rising channel turned into support last week. We are also watching for the formation of a “golden cross”, which could attract additional speculative buying in the coming days.

From a technical point of view, the only barrier for oil is the area of previous highs at $92.5. Approaching this area may require significant profit-taking and prolonged consolidation before the next breakout, but success is by no means guaranteed.

The FxPro Analyst Team