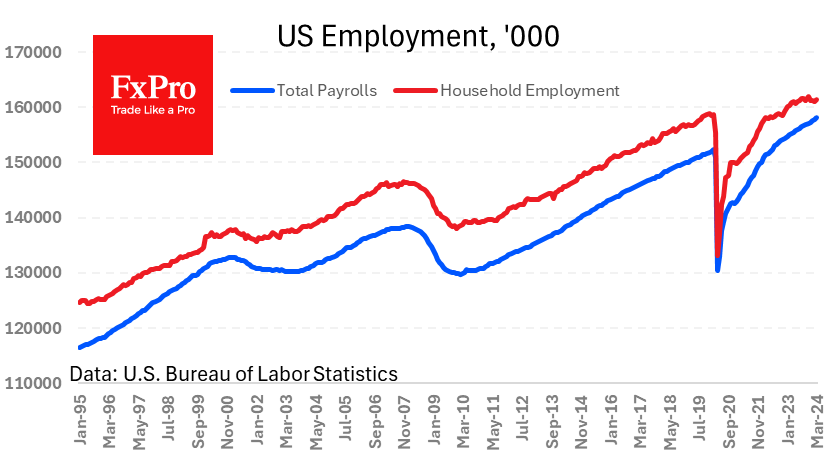

The US economy continues to create jobs above expectations. Employment grew by 303k in March versus 270k previously, and 200K expected. Over ten years, the average monthly gain is 170k, and a gain of 190-200k per month is associated with healthy growth in an economy that is not overheating. In other words, the labour market is creating jobs too fast.

Surprisingly, at the same time, there has been no acceleration in wage growth. Average hourly wages in March were 4.1% higher than a year earlier – the lowest since mid-2021.

This is a perfect report from a risk perspective for financial markets. We see strong employment gains, which promises a pickup in household spending. However, wage growth is slowing, ruling out inflation getting out of control again.

It is likely that in the coming weeks, markets will gently price in 1-2 rate cuts before the end of the year instead of the three currently forecast. There is likely to be a reassessment of the odds of a rate cut on 12 June from the current 58% to 10-20%, which is moderately positive for the dollar and does not bring drama to the stock market.

The FxPro Analyst Team