The US “Big Oil” has picked up recently, with both production growth and mergers and acquisitions.

At the end of last week, the number of active drilling rigs in the US rose to 502 oil rigs and 122 gas rigs, according to Baker Hughes estimates. This is the second week in a row with some increase. It is minimal, but it could start a trend if it is reinforced by other news.

The last two weekly EIA reports show a jump in average daily oil production to 13.2 million bpd, a record high. And the rising rig count suggests that companies in America are finally seeing the potential in investing in expanding oil production.

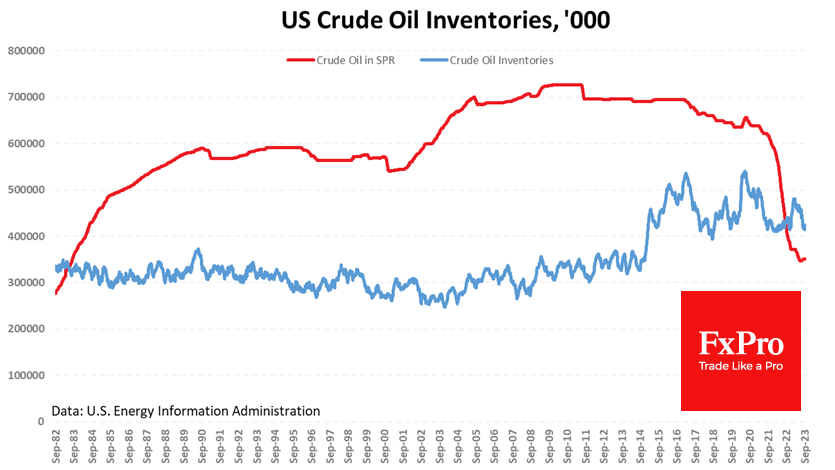

They may have been spurred on by the fact that crude oil inventories are now 4% lower than a year ago and close to their lowest levels since 2015 when the shale boom was in full swing.

Oil producers may have been encouraged by the US government’s move to buy oil for the Strategic Petroleum Reserve.

Chevron agreed to buy Hess for $60bn. About two weeks earlier, Exxon Mobil announced it was buying Pioneer Natural Resources for $58bn. Now it’s clear what the US oil majors have been saving up for.

The easing of sanctions on Venezuela could also be a boon for US oil producers, which have significant capacity there.

The war in the Middle East and the risk of supply disruptions are long-term factors favouring investment in US oil production.

Perhaps the OPEC+ countries, which have spare capacity but artificially limit production to support the price, also see this trend. So far, however, there has been no response from the Islamic world to Iran’s calls for an oil blockade of the West.

This could be the prologue to a shift in focus from the battle for profits and the final price of crude to a war for market share. Given years of record interest rates, it won’t be easy for US companies. But it is also worth noting that the biggest players are now in business, with impressive capital reserves and strong lobbies in government.

All of this promises an interesting play in oil in the months ahead.

The FxPro Analyst Team