The Nasdaq index, composed mainly of high-tech companies, ended trading yesterday 11% below the maximum close of February 12th. Such a drop is considered as having entered correction territory. On Tuesday morning, Nasdaq futures showed little signs of a rebound, hovering near three-month lows.

It is remarkable how varied the market has become. Strengthened losses in some stocks and sectors stand in stark contrast to the highs in others.

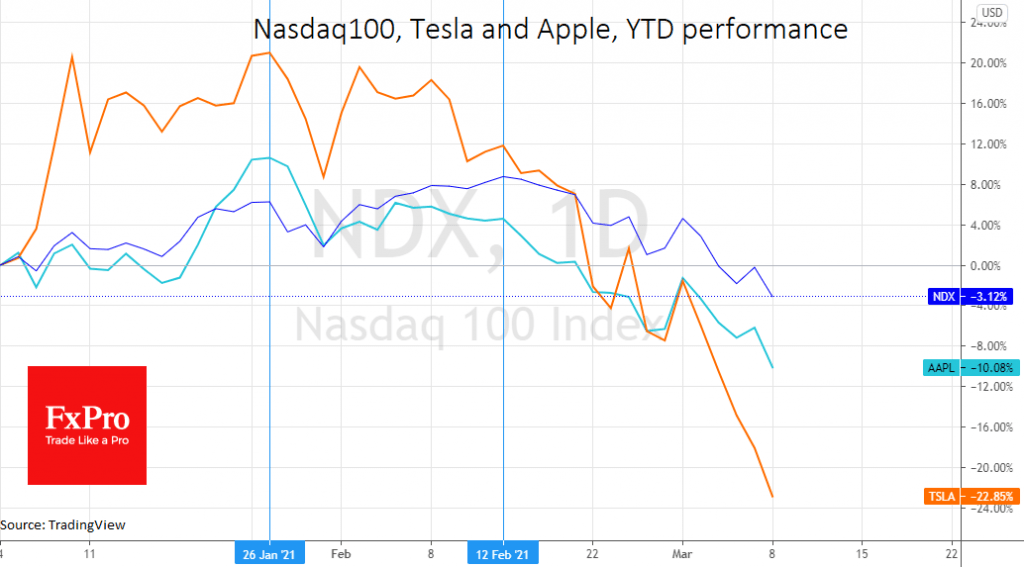

During the 10% drop in the Nasdaq, Tesla shares lost 31%, and Apple lost 14%. These two have proven to be excellent barometers of market sentiment. They peaked as early as January 26th, two weeks before the high of the index they are part of. From those peaks, the losses have already exceeded 36% and 19%, respectively. Tesla has long since plunged into a bear market (20% losses from the peak closing), while Apple is on the verge of doing so.

In contrast to the Nasdaq, the industrial Dow Jones closed near historical highs and rewrote them intraday, at one point going above 32100.

Outside America, similar trends are emerging. The German DAX30 soared 2% yesterday, making an important break above 14,000, a strong resistance since January. This morning the index once again rewrote the all-time highs.

Meantime, China A50 blue-chip index is losing 2% today, down 17.6% from its peak on February 15th.

In general, the DAX30 and continental European markets, with the Dow Jones outperforming among the US indices, show investors shifting from growth to value stocks. This is primarily due to stricter financial markets conditions, which is visible in rising inflation expectations and long-term interest rates.

We have mentioned this global reversal of the market cycle several times. It is characterised by outperformance in commodities and dividend stocks. Investors look for insurance against asset losses due to inflation (commodities and commodity currencies) and try to get higher returns than bonds (dividend stocks). However, this strategy has its limits.

As soon as (and if) central banks concentrate on containing yields on long-term securities and with a growing economy, growth companies will be back in the driver’s seat. The simultaneous decline of the economy and lowering bond yields will stimulate a synchronised sell-off across the markets. For those investors who will “sit it out” in Dow Jones and commodities, it could be just as costly as waiting for growth stocks to recover now.

The FxPro Analyst Team